Professional Documents

Culture Documents

Tax Invoice #29Q72Z: Date Ref Tour Pax Gross Nett

Uploaded by

Kiran POriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Invoice #29Q72Z: Date Ref Tour Pax Gross Nett

Uploaded by

Kiran PCopyright:

Available Formats

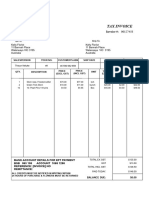

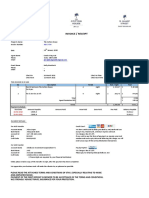

CAPTAIN COOK CRUISES PTY LTD

POSTAL ONLY: Circular Quay, Wharf 6, Sydney NSW 2000, Australia. ABN 17 008 272

302

www.captaincook.com.au

T +61-2-9206 1111

reservations@captaincook.com.au

Tax Invoice #29Q72Z

Issued: 31 Dec 2019 Booking Number: 29Q72Z

Booking Name: Ram Kiran Pratap Passengers: 1

Voucher Number: First Travel Date: 31 Dec 2019

Date Ref Tour Pax Gross* Nett

31 Dec 2019 29Q72Z NYE NANCY WAKE 1 Ad $450.00 $450.00

TOTALS $450.00 $450.00

FARES AND PAYMENTS

Total Nett: $450.00 AUD

(Including GST)

Includes Surcharge of $0.00

Summary of payments

Date of Payment Payment Method Amount

31-12-2019 PayPal $450.00

All amounts in Australian Dollars and inclusive of GST.

* Where special nett rates or discounts apply, gross rate may reflect nett rate and no further commissions apply. Please adjust your

sell rate accordingly

Payments

· Credit Card Surcharges: Visa 1.25% Mastercard 1.25%, American Express 1.25%, JCB 3%, Diners 3%

· International Telegraphic Transfer: please add $25 AUD to the total

· Bank Direct Deposit: Important please visit www.captaincook.com.au/more-info/payments for conditions of use. Account

Name Captain Cook Cruises Pty Ltd. BSB 015056 Account Number 841669104. Reference: The booking number as shown

above.

All bookings are subject to the terms and conditions of the Passenger Cruise Contract and/or Conditions of Carriage. If payment has

not been made and is not received by the due date, the reservation may be automatically cancelled (refer Cruise Conditions). Date

changes and cancellations are not permitted on special event and discounted tickets unless otherwise stated. Public dining cruises

usually operate on Sydney 2000, or alternatively the relaunched John Cadman 2. Vessels are subject to change without notice.

AGENTS ONLY – WITH RESPECT TO GST TREATMENT ON COMMISSION

The recipient and the supplier declare that this agreement applies to supplies to which this tax invoice relates. The recipient can

issue tax invoices in respect to these supplies. The supplier will not issue tax invoices in respect to these supplies. The supplier

acknowledges that it is registered for GST and that it will notify the recipient if it ceases to be registered. The recipient acknowledges

that it is registered for GST and that it will notify the supplier if it ceases to be registered for GST. Acceptance of this RCTI constitutes

acceptance of the terms of this written agreement. Both parties to this supply agree that they are parties to an RCTI agreement. The

supplier agrees to notify the recipient if the supplier does not wish to accept the proposed agreement within 21 days of receiving this

document.

Tax Invoice #29Q72Z 1/1

You might also like

- Att-Usa-Iphone XR - 1-PGDocument1 pageAtt-Usa-Iphone XR - 1-PGBMB-PROD Officiel100% (4)

- Impact of Flexible Working Conditions On Employee Job SatisfactionDocument84 pagesImpact of Flexible Working Conditions On Employee Job SatisfactionDimpu Sarath Kumar100% (1)

- Invoice Att Ip 12 Pro MaxDocument1 pageInvoice Att Ip 12 Pro MaxNamario EtienneNo ratings yet

- Att Usa New Edited 1 PGDocument1 pageAtt Usa New Edited 1 PGKenneth GonzalesNo ratings yet

- 3295 S Tamarac DR DENVER, CO, 80231 Liza ScoobiDocument1 page3295 S Tamarac DR DENVER, CO, 80231 Liza Scoobisimo100% (2)

- Cma CGM-FRT Inv Idim0279701Document1 pageCma CGM-FRT Inv Idim0279701BERITA TERKININo ratings yet

- Signature RBC Rewards Visa: Previous Account Balance $2,646.15Document5 pagesSignature RBC Rewards Visa: Previous Account Balance $2,646.15Hoang DucNo ratings yet

- What To Include in Financial AnalysisDocument12 pagesWhat To Include in Financial Analysisayushi kapoorNo ratings yet

- 033129Document1 page033129vinsensius rasaNo ratings yet

- Iphone 11 Na 64GB RedDocument1 pageIphone 11 Na 64GB RedClaudensky Succes2022No ratings yet

- Ups FormDocument2 pagesUps FormAchmad Nur Fajri100% (1)

- Original Invoice: NGIM1006637Document1 pageOriginal Invoice: NGIM1006637Imoleayo0% (1)

- ItineraryDocument2 pagesItineraryreddyredNo ratings yet

- Invoice 1Document1 pageInvoice 1ramos.jeffNo ratings yet

- Invoice Original: NGIM1006633Document1 pageInvoice Original: NGIM1006633ImoleayoNo ratings yet

- Our FeeDocument1 pageOur FeeSyafira AmadeaNo ratings yet

- DD Inv Idcia228220 1Document1 pageDD Inv Idcia228220 1GeryNo ratings yet

- Invoice #: Payment OptionsDocument1 pageInvoice #: Payment OptionsAustin SalsburyNo ratings yet

- Payslis PaulaDocument3 pagesPayslis PaulaPaula OcoroNo ratings yet

- Virgin Blue Tax Invoice and Travel Plan: Guest NameDocument3 pagesVirgin Blue Tax Invoice and Travel Plan: Guest Nameapi-26016207No ratings yet

- 10 TD5440RLSC1AC Thermal Direct Label 54mm X 40mm Permanent (1000 Per Roll) $22.00 $220.00Document1 page10 TD5440RLSC1AC Thermal Direct Label 54mm X 40mm Permanent (1000 Per Roll) $22.00 $220.00Bella Grace CollectionsNo ratings yet

- Tax Invoice: PaymentsDocument1 pageTax Invoice: Paymentsramos.jeffNo ratings yet

- Iphone 11 Na 64gb RedDocument1 pageIphone 11 Na 64gb RedClaudensky Succes2022No ratings yet

- WPS NORTH AMERICA INC (Invoice 1)Document1 pageWPS NORTH AMERICA INC (Invoice 1)usmanNo ratings yet

- TRLJEADJKT982120A Inv 2 PDFDocument1 pageTRLJEADJKT982120A Inv 2 PDFHeru WicaksonoNo ratings yet

- PaySlip (4734)Document1 pagePaySlip (4734)Jose Antonio IrazustaNo ratings yet

- Sez / Chennai Y RoadDocument1 pageSez / Chennai Y RoadKumaresan KumaresanNo ratings yet

- World of Titan: Invoice #Document1 pageWorld of Titan: Invoice #Dhânušh ČhîkûNo ratings yet

- Billing Address:: Phone# Qty Ord Qty SHPD Qty B/Ord Taxable Unit Value Unit Price Total PriceDocument1 pageBilling Address:: Phone# Qty Ord Qty SHPD Qty B/Ord Taxable Unit Value Unit Price Total PriceSangeeth AppleNo ratings yet

- Tax Invoice: Charges & Service SummaryDocument1 pageTax Invoice: Charges & Service SummaryPeter ThomsonNo ratings yet

- Auprecedadata PAY1 TOLF80 Payslips 9455479904493 Sessionid PG0 V1 D5 T8Document1 pageAuprecedadata PAY1 TOLF80 Payslips 9455479904493 Sessionid PG0 V1 D5 T8Eggy PalangatNo ratings yet

- Payment Date: 10/15/2020 Payment #: Payment Amt: $0.00 Home State Health 11720 Borman Drive St. Louis, MO 63146 1-855-694-4663Document2 pagesPayment Date: 10/15/2020 Payment #: Payment Amt: $0.00 Home State Health 11720 Borman Drive St. Louis, MO 63146 1-855-694-4663Daya AnandaNo ratings yet

- Tax Point Date Description Qty GST GST Amount Net AmountDocument1 pageTax Point Date Description Qty GST GST Amount Net AmountDeepak JainNo ratings yet

- Iphone 11Document1 pageIphone 11computerphone13No ratings yet

- Invoice: Charge DetailsDocument3 pagesInvoice: Charge Detailstammy suryanaNo ratings yet

- Gross Invoice CAD PDFDocument1 pageGross Invoice CAD PDFGISSEL ANGARITANo ratings yet

- JOB-32465aDocument1 pageJOB-32465aJan Ray Oviedo EscotoNo ratings yet

- Royal Caribbean InternationalDocument4 pagesRoyal Caribbean InternationalVitaliy FedchenkoNo ratings yet

- Heinzay Att 6 PlusDocument1 pageHeinzay Att 6 PlusRONALD YUNo ratings yet

- Tax InvoiceDocument1 pageTax Invoicepradavu83No ratings yet

- Epda Mv. Tbn. Paria. Bombana Port. Sul-Tra. Sulawesi. 14 April 2020Document1 pageEpda Mv. Tbn. Paria. Bombana Port. Sul-Tra. Sulawesi. 14 April 2020Agus Shofyan TauryNo ratings yet

- Statement 2023 07 09Document4 pagesStatement 2023 07 09blackson knightsonNo ratings yet

- Billy Wong 1933 E Desert Rose TRL Queen Creek, Az 85143Document1 pageBilly Wong 1933 E Desert Rose TRL Queen Creek, Az 85143Sangeeth AppleNo ratings yet

- Invoice UBERAUSEATS DEXDOGUO 01 2020 0000028 PDFDocument1 pageInvoice UBERAUSEATS DEXDOGUO 01 2020 0000028 PDFXiomara EscobarNo ratings yet

- Job-32427Document1 pageJob-32427Jan Ray Oviedo EscotoNo ratings yet

- Avtex W270TSDocument1 pageAvtex W270TSAre GeeNo ratings yet

- Tax Invoice: Item QTY Rate TAX AmountDocument2 pagesTax Invoice: Item QTY Rate TAX AmountAkshay SinghNo ratings yet

- AT&TDocument1 pageAT&TGh UnlockersNo ratings yet

- Emissao - CTRB - Ciot - GT 160485Document1 pageEmissao - CTRB - Ciot - GT 160485Petsley AdrianoNo ratings yet

- Original Invoice: IDCIA087226Document1 pageOriginal Invoice: IDCIA087226ASC Tempest-128No ratings yet

- Iphone 6 64GB Gold MeDocument1 pageIphone 6 64GB Gold MeRONALD YUNo ratings yet

- INV 365 - Kelly Woolcock - by Agent Good Living AsiaDocument2 pagesINV 365 - Kelly Woolcock - by Agent Good Living AsiahenryNo ratings yet

- Lucidchart 2022.11 12182086Document2 pagesLucidchart 2022.11 12182086Oladayo OmisopeNo ratings yet

- BankDocument1 pageBankIPTV NumberOneNo ratings yet

- E-Recipit For JadaDocument1 pageE-Recipit For JadaychaohNo ratings yet

- Tickets PDFDocument3 pagesTickets PDFYamile CaldasNo ratings yet

- SW223987 - Lunary - Charlton Flights - 04mar23Document1 pageSW223987 - Lunary - Charlton Flights - 04mar23Santiago VelasquezNo ratings yet

- DJ21221110810Document2 pagesDJ21221110810swami aaiNo ratings yet

- Iphone 6 Plus 128GB Silver Min Khant SiDocument1 pageIphone 6 Plus 128GB Silver Min Khant SiRONALD YUNo ratings yet

- Yuen, Kinsey CoiDocument3 pagesYuen, Kinsey CoiEdi SolihinNo ratings yet

- A Complete Document For Dunning Procedure With Smartform - SAP BlogsDocument11 pagesA Complete Document For Dunning Procedure With Smartform - SAP BlogsRamki P0% (1)

- Senior SAP EPM Systems Functional Analyst New1Document1 pageSenior SAP EPM Systems Functional Analyst New1Kiran PNo ratings yet

- Sap Trainer: Asseton Group Pty LTDDocument1 pageSap Trainer: Asseton Group Pty LTDKiran PNo ratings yet

- Senior Test Analyst: You Will Be Responsible ForDocument1 pageSenior Test Analyst: You Will Be Responsible ForKiran PNo ratings yet

- Senior SAP EPM Systems Functional Analyst New1Document1 pageSenior SAP EPM Systems Functional Analyst New1Kiran PNo ratings yet

- Enter These Verification Codes:: Rjuhuhxo YttvzqoqDocument1 pageEnter These Verification Codes:: Rjuhuhxo YttvzqoqKiran PNo ratings yet

- 171 - October v2Document26 pages171 - October v2Kiran PNo ratings yet

- Role Description: Senior Application Developer - EamDocument6 pagesRole Description: Senior Application Developer - EamKiran PNo ratings yet

- New Plant Config Steps 007 PDFDocument28 pagesNew Plant Config Steps 007 PDFKiran PNo ratings yet

- Technical Object Restructure WM MD Process and Standards AlignmentDocument9 pagesTechnical Object Restructure WM MD Process and Standards AlignmentKiran PNo ratings yet

- SAP Training Specialist TransportDocument2 pagesSAP Training Specialist TransportKiran PNo ratings yet

- Fielder Budget & Forecasting - TechnicalDocument74 pagesFielder Budget & Forecasting - TechnicalKiran PNo ratings yet

- New Plant Config Steps 007Document28 pagesNew Plant Config Steps 007Kiran PNo ratings yet

- Business Request 100002145 Equity AccountingDocument3 pagesBusiness Request 100002145 Equity AccountingKiran PNo ratings yet

- GBIS Senior Mgrs Project MinutesDocument1 pageGBIS Senior Mgrs Project MinutesKiran PNo ratings yet

- GOF006 - Single Instance-V1Document13 pagesGOF006 - Single Instance-V1Kiran PNo ratings yet

- GOF006 - Single Instance-V1Document13 pagesGOF006 - Single Instance-V1Kiran PNo ratings yet

- Accountreceivablearincomingpaymentprocessinsap 140202123003 Phpapp02Document3 pagesAccountreceivablearincomingpaymentprocessinsap 140202123003 Phpapp02Talha KhalidNo ratings yet

- Vishal Patel: Accounts Payable Officer (SAP) - NSW-Fire & RescueDocument3 pagesVishal Patel: Accounts Payable Officer (SAP) - NSW-Fire & RescueRam PNo ratings yet

- Fielder Budget & Forecasting - TechnicalDocument74 pagesFielder Budget & Forecasting - TechnicalKiran PNo ratings yet

- Chem Assets and Capex Data StrategyDocument1 pageChem Assets and Capex Data StrategyKiran PNo ratings yet

- Goodmanr Consol - PlautDocument18 pagesGoodmanr Consol - PlautKiran PNo ratings yet

- Overseas - Payment - ProcessingDocument20 pagesOverseas - Payment - ProcessingKiran PNo ratings yet

- Pratap - IPro Agreements - ICA - 01 - 655830Document13 pagesPratap - IPro Agreements - ICA - 01 - 655830Kiran PNo ratings yet

- 17 Memorand Inside InformationDocument3 pages17 Memorand Inside InformationKiran PNo ratings yet

- Adam Rizk Tenancy Application FormDocument2 pagesAdam Rizk Tenancy Application FormRam PNo ratings yet

- Vishal Patel: Accounts Payable Officer (SAP) - NSW-Fire & RescueDocument3 pagesVishal Patel: Accounts Payable Officer (SAP) - NSW-Fire & RescueRam PNo ratings yet

- GOF006 - Single Instance-V1Document13 pagesGOF006 - Single Instance-V1Kiran PNo ratings yet

- HR Manager Digital Technology & Innovation 1 Charles ST, Level 3A ParramattaDocument3 pagesHR Manager Digital Technology & Innovation 1 Charles ST, Level 3A ParramattaKiran PNo ratings yet

- Chapter 1-Managerial EconomicsDocument9 pagesChapter 1-Managerial EconomicsPitel O'shoppeNo ratings yet

- Chapter 2 Partnership Operations and Financial ReportingDocument28 pagesChapter 2 Partnership Operations and Financial Reportingpia guiret0% (2)

- Lahore Commerce Academy: 2 114-Allama Iqbal Road, Ghari Shahu, Lahore. (In-Front of Warid Franchise)Document21 pagesLahore Commerce Academy: 2 114-Allama Iqbal Road, Ghari Shahu, Lahore. (In-Front of Warid Franchise)Waqas AwaisNo ratings yet

- Newmont Barrick JV Term Sheet FINALDocument6 pagesNewmont Barrick JV Term Sheet FINALSakshi AthwaniNo ratings yet

- SUPA Economics Presentation, Fall 2023Document47 pagesSUPA Economics Presentation, Fall 2023bwangNo ratings yet

- ानम् "That which is not different from knowledge which arises spontaneously."Document1 pageानम् "That which is not different from knowledge which arises spontaneously."Ashutosh KumarNo ratings yet

- Cs-Supertrends 22 Eng RGBDocument47 pagesCs-Supertrends 22 Eng RGBWildan AriefNo ratings yet

- Icici Stack Report by Group 2Document14 pagesIcici Stack Report by Group 2Madhav KhuranaNo ratings yet

- Hyderabad Electric Supply Company - Electricity Consumer Bill (Mdi)Document2 pagesHyderabad Electric Supply Company - Electricity Consumer Bill (Mdi)aurang zaibNo ratings yet

- 3.7.2.1 C - Details of Linkages 1Document207 pages3.7.2.1 C - Details of Linkages 1Rai Media TechnologiesNo ratings yet

- Compensation Plan: GlobalDocument24 pagesCompensation Plan: GlobalPándi ÁdámNo ratings yet

- Lecture Notes BSND AccountingDocument4 pagesLecture Notes BSND AccountingCassandra NaragNo ratings yet

- CMA Examination Sample Questions and EssaysDocument12 pagesCMA Examination Sample Questions and Essaysestihdaf استهدافNo ratings yet

- UNIT I Business CombinationDocument22 pagesUNIT I Business CombinationDaisy TañoteNo ratings yet

- Assignment 1: Daniella AlemaniaDocument4 pagesAssignment 1: Daniella AlemaniaDaniella AlemaniaNo ratings yet

- một số câu hỏi bài tập tiếng anhDocument21 pagesmột số câu hỏi bài tập tiếng anhNam chính Chị củaNo ratings yet

- Momentum Trading (Research Paper)Document11 pagesMomentum Trading (Research Paper)Duke NguyenNo ratings yet

- Ruchi Soya Industries LTD.: Growing With Improving Strength in FMCG SpaceDocument3 pagesRuchi Soya Industries LTD.: Growing With Improving Strength in FMCG SpaceYakshit NangiaNo ratings yet

- Intro To Inclusive BuisnessDocument27 pagesIntro To Inclusive BuisnessKhalid AhmedNo ratings yet

- Singapore IncDocument2 pagesSingapore IncBastiaan van de Loo100% (1)

- Task 5 MCQDocument5 pagesTask 5 MCQHamizah KawiNo ratings yet

- Bureau - Veritas - ESMA Service Card - May - 2021Document7 pagesBureau - Veritas - ESMA Service Card - May - 2021Balakrishna GopinathNo ratings yet

- ESG GuidelinesDocument62 pagesESG GuidelinesDTD AgencyNo ratings yet

- Cambridge IELTS 5 Listening Test 1Document4 pagesCambridge IELTS 5 Listening Test 1ggggNo ratings yet

- Concepts of CostsDocument14 pagesConcepts of CostsMughees Ahmed100% (1)

- FD SsssssDocument704 pagesFD Ssssssakashjain19950312No ratings yet

- Inventory ValuationDocument25 pagesInventory ValuationKailas Sree Chandran100% (1)

- Annex B-2 RR 11-2018Document1 pageAnnex B-2 RR 11-2018Kristine JoyceNo ratings yet