Professional Documents

Culture Documents

Competition Commission Directs Investigation into Radio Taxi Services in Delhi NCR

Uploaded by

pb0 ratings0% found this document useful (0 votes)

35 views11 pagesOriginal Title

Meru_Travels_Solutions_Private_Limited_vs_CompetitTA2016161216160236130COM706534

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

35 views11 pagesCompetition Commission Directs Investigation into Radio Taxi Services in Delhi NCR

Uploaded by

pbCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 11

MANU/TA/0061/2016

Equivalent Citation: 2017C ompLR43(C ompAT), I(2017)C PJ1(TA)

IN THE COMPETITION APPELLATE TRIBUNAL

NEW DELHI

Appeal No. 31/2016

Decided On: 07.12.2016

Appellants: Meru Travels Solutions Private Limited

Vs.

Respondent: Competition Commission of India and Ors.

Hon'ble Judges/Coram:

G.S. Singhvi, J. (Chairman), Rajeev Kher and Anita Kapur, Members

Counsels:

For Appellant/Petitioner/Plaintiff: A.N. Haksar, Senior Advocate assisted by Udayan

Jain, Sonal Jain, Akshay Nanda, Rudra Dutta, Manas Gaur, Khyati Dhupar and Anju

Thomas, Advocates

Case Note:

Abuse of dominant position - Denial to direct investigation - Sections 4, 19

and 26 of Competition Act, 2002 - Whether Commission erred in deciding to

close information under Section 26(2) of Act? Held, in a matter where

abuse of dominance has been alleged, the most crucial exercise is to form

an opinion about dominance of relevant entity in relevant market. In order

to form an opinion on dominance, first step is to delineate a relevant

market. At the stage of Section 26(1) of Act, a determination on relevant

market is only prima facie and deeper determinative exercise is not

required. It is a matter of common knowledge that customers can move

from one point in NCR to another point calling taxis on telephone/internet

platforms. According to Motor Vehicle Act, taxis which operate under a

tourist agency permit are not constrained to operate within municipal limits

and taxis such as Uber and Ola use tourist taxi permits. Therefore, on all

counts, restricting relevant geographic market to Delhi NCT was an error.

Relevant geographic market on a prima facie basis should have been radio

taxi service in Delhi NCR. Since two research reports in question showed

contrary results, Commission decided to ignore both of them but then in

subsequent paragraph alluded to a combined reading of two reports.

Commission's approach was not consistent in this respect. Tech Sci Report

had made certain statistical reporting which had not been challenged in

substantive terms by Respondents except by raising doubts about credibility

of report. Even an affidavit was not placed on their behalf. Since objective

of Section 26(1) of Act, is to formulate a prima facie view, information

along with material and facts made available should have been enough for

Commission to formulate an opinion. While 6Wresearch report was not

accepted by Commission in Mega Cabs, Tech Sci report on Bangalore had

been accepted by it in Fast Track. Further the fact that two reports being

referred, which had contrary results to show, could have been a good

reason for Commission to order an investigation to reach a decision on a

matter which has attained significant interest in Indian market place.

Explanation a to Section 4 of Act, explains that dominant position means a

'position of strength'. It does not say that this position of strength

16-02-2020 (Page 1 of 11) www.manupatra.com CNLU STUDENT

necessarily has to come out of market share in statistical terms.

Commission would not be constrained to look at only the market share of

enterprise but it will have to look at other Sub-clauses of Section 19(4) of

Act, particularly Sub-section (b), (c), (d) and (e). Further, availability of

financial resources and existence of discounts and incentives associated

with model of business adopted by Respondents are good supporting

reasons to suggest that issue of dominance needs to be seen from a

perspective that does not limit to market share of enterprise alone. If

necessary, figures on financial flows by ways of investment in India could

have been verified through appropriate measures. It could not be said

definitively that there is an abuse inherent in business practices adopted by

operator such as Respondents but size of discounts and incentives show

that there are either phenomenal efficiency improvements which are

replacing existing business models with new business models or there

could be an anti-competitive stance to it. Whichever is true, the

investigations would show. There was a good enough reason for Director

General to investigate this matter. Facts on record were enough to trigger

an investigation by DG. DG was directed to conduct an investigation into

allegations contained in information filed by Appellant and submit report to

Commission. Appeal allowed.

ORDER

1. Having failed to satisfy the Competition Commission of India (the Commission) in

forming prima facie opinion under Section 26(1) of the Competition Act (the Act), to

order an investigation against alleged abuse of dominance by the respondent, the

appellant has filed this appeal on 18.04.2016 against the order of the Commission

dated 10.02.2016 in Case No. 96 of 2015.

2 . The appellant, M/s. Meru Travels Solutions Private Limited is a group holding

company which provides radio taxi services through its fully owned subsidiaries

namely, Meru Travels Solutions Private Limited and V - Link Automotive Services

Private Limited. Both these subsidiaries are engaged in business of providing radio

taxi services under the brand names, Meru, Meru Genie and Meru Flexi respectively in

21 major cities across India. The appellant started its Delhi operations in March

2008. Since 2012, appellant revised its business model and started providing radio

taxi services through an aggregation model.

3 . Respondent No. 2, M/s. Uber India Systems Private Limited is a company

registered in India whereas Respondent Nos. 3 to 5, M/s. Uber BV, M/s. Uber

International Holding BV (which holds 90% shares of Respondent No. 2 besides 10%

shares of Respondent No. 2 are held by Respondent No. 5 M/s. Uber International

BV) are other associated companies. Respondent No. 6 M/s. Uber International

Technologies Inc. is the ultimate holding company of the Uber Group companies.

(Respondent Nos. 2 to 6 for short are termed 'Uber' hereinafter). According to the

appeal memo, Uber provides radio taxi services under the brand name Uber. It

entered the Indian market in 2013 and started its operations in Delhi NCR in

December 2013. In Delhi NCR, they offer their services through three different brands

which are Uber XL, Uber X and Uber Go.

4. The Appellant filed information under Section 19 of the Act before the Commission

on 9th October, 2015. The main elements of the information were as follows:

i) It was stated that Respondent No. 6 was founded by Travis Kalanick and

Garett Camp in 2009 in the United States of America through various venture

16-02-2020 (Page 2 of 11) www.manupatra.com CNLU STUDENT

capital funds and private equity investors. Respondent No. 6 routes the

financial resources for India operations through Respondent No. 3.

ii) The Appellant has given a table showing significant investments made in

Respondent No. 6. The primary reasons according to appellant for Uber's

phenomenal growth is large global funding and anti-competitive business

model allowing it to unleash a series of abusive practices prohibited under

the Act.

iii) Quoting certain newspaper reports, it has been stated that the company

has earmarked US$ one billion for its Indian operations to be spent within 6

to 9 months to reach a target figure of one million trips per day. Appellant

has quoted several newspaper reports to establish the large financial backup

available to Uber.

iv) Since starting business in the Delhi NCR in December 2013, Uber has

resorted to many abusive practices with the sole intent to establish its

monopoly and eliminate otherwise equally efficient competitors from the

market.

v) Uber and Meru operate in the same line of business, i.e. radio taxi

services.

vi) It has been stated that average market price of radio taxis existing in

Delhi NCR before the launch of Uber were in the range of about Rs. 23 per

km. Uber launched its services @ Rs. 20 per km. and, thereafter,

successively brought down its per kilometer price to Rs. 7/- per km, Rs. 12/-

per km. and Rs. 9/- per km. for different categories of services. At the time

of dropping its prices to Rs. 12/- per km. in November 2014, it offered

incentives to first time customers and discounts of subsequent trips.

Appellant has quoted the relevant advertisements given out by Uber on that

occasion. This price was further brought down from Rs. 12/- to Rs. 7/- per

km. for one of the services. Relevant advertisement has been provided in the

information. A list of further discounts and incentives offered by Uber from

time to time has been given in para 22 of the information.

vii) It has been further informed that Uber pays its drivers/car owners

attached on its network unreasonably high incentives over and above and in

addition to the trip fair received from the passengers. Para 23 of the

information provides one such calculation indicating per trip net loss of Rs.

204/- to Uber.

viii) It was informed that as a consequence of these practices, the appellant's

market share from 18% in December 2013 came to 11% in September 2015

by number of trips and it lost Rs. 107 crores during this period. Uber in this

short span increased, from nowhere to a market share of about 50% by the

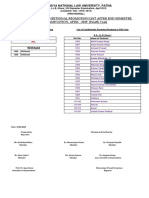

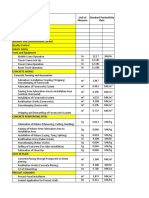

number of trips done on its radio taxi service network. A chart showing

respective market share of competing taxi services is reproduced below:

16-02-2020 (Page 3 of 11) www.manupatra.com CNLU STUDENT

ix) It was alleged that Uber which is valued at US $ 51 billion with an

allocation of US$ one billion for Indian operations has around 6,000 active

cars in its fleet of radio taxi doing about 33 thousand trips per day in Delhi

NCR. It was informed that Uber is spending about US $ 885 million to

generate a revenue of US $ 415 million.

x) The information then went on to give details of the radio taxi service

business, evolution of technology, role of GPS based platform, etc. On the

issue of market share informant relied upon a market research report

produced by New Age Tech Sci Research Private Limited (Tech Sci) which

analyzed radio taxi service in Delhi NCR region as on 30th September 2015.

A summary of market share in terms of fleet size, active fleet size and total

trips per day in tabular form extracted from the report is reproduced below:

"Cabs registered with Radio Taxi Service providers and their related

trips as extracted out of the afore-mentioned report."

16-02-2020 (Page 4 of 11) www.manupatra.com CNLU STUDENT

xi) It has been concluded in the report that on a per trip basis, Uber has

50.1% of the market in Delhi NCR. The information then went on to comment

upon the size and resources of the enterprise in terms of Section 19(4) of the

Act, size and importance of the competitors and economic power of the

enterprise including commercial advantages over competitors, dependence of

customers on the enterprise and countervailing buying power.

xii) The informant alleged that Uber has abused its dominance by alluding to

predatory pricing and following unfair conditions by virtue of its dominance

in the relevant market . In paragraph 64 and 65, the information contains

allegations relating to the kinds of incentives being offered by Uber to its

drivers/partners to build a network effect, the gains that drivers make out of

their engagement with Uber, the losses that Uber makes out of every trip and

the kind of discounts that Uber offers to its customers.

xiii) Finally, it was informed that in view of Uber's exiting from China,

strategically, India has been considered as the most important market. Since

it is flush with resources, Uber is in a position to offer deep pockets to its

partners in order to grab a large part of the market and eliminate competition

from the market."

5. The Commission considered the facts and allegations given in the information and

heard both the parties on 17th November 2015. Subsequently, informant made

additional written submissions on 30th November 2015. Notably no written

submissions/affidavits/material was submitted on behalf of Respondent Nos. 2 to 6.

It was argued on behalf of the respondents that the prerequisite for examining the

abuse of dominance is that dominance should be proved. It was stated that the report

(Tech Sci) on which the appellant was relying upon lacked credibility as while

preparing the report, none of the representatives of Uber was interviewed. It was

stated that this made the nature of report dubious and it could not be believed. It

was also stated that the report was made for business up to 30th September 2015

while the information was filed on the 9th October, 2015 raising a doubt on the

nature of the report as it was impossible to file information so soon after the

reporting period was completed.

6 . The Commission has not found a prima facie case to order investigation on the

16-02-2020 (Page 5 of 11) www.manupatra.com CNLU STUDENT

following grounds,

"a) The nature of the report on which the appellant has relied upon is

controversial as Uber was not interviewed and the findings of this research

report were entirely contrary to another report 6W research which had been

presented before the Commission in an earlier case Fast Track Call Cabs Pvt.

Ltd. v. ANI Technologies thereby raising doubt about the credibility of the

report.

b) The Commission held Delhi as the relevant market and not Delhi NCR

region as requested by the appellant/informant on the grounds that the

regulatory framework in relation to taxi services and use of CNG in public

transport were different in both the regions.

c) In view of the Commission, there was a vibrant and dynamic radio taxi

service market in Delhi. The Commission did not consider Uber to be

dominant in the relevant market. Therefore, the Commission decided to close

the information under Section 26(2)."

7 . We have heard the learned counsels from both sides and carefully perused the

relevant pleadings, reports and documents placed before us. Dominance has to be

examined on the benchmark of Section 4 read with Section 19(4) in order to form a

prima facie view in accordance with Section 26(1) of the Act. Section 4 reads as

follows:

"Section 4 -Abuse of dominant position

[(1) No enterprise or group shall abuse its dominant position.]

(2) There shall be an abuse of dominant position 4 [under sub-section (1), if

an enterprise or a group].-

(a) directly or indirectly, imposes unfair or discriminatory-

(i) condition in purchase or sale of goods or service; or

(ii) price in purchase or sale (including predatory price) of

goods or service.

Explanation.- For the purposes of this clause, the unfair or

discriminatory condition in purchase or sale of goods or

service referred to in sub-clause (i) and unfair or

discriminatory price in purchase or sale of goods (including

predatory price) or service referred to in sub-clause (ii) shall

not include such discriminatory condition or price which may

be adopted to meet the competition; or

(b) limits or restricts-

(i) production of goods or provision of services or market

therefor; or

(ii) technical or scientific development relating to goods or

services to the prejudice of consumers; or

(c) indulges in practice or practices resulting in denial of market

access [in any manner]; or

16-02-2020 (Page 6 of 11) www.manupatra.com CNLU STUDENT

(d) makes conclusion of contracts subject to acceptance by other

parties of supplementary obligations which, by their nature or

according to commercial usage, have no connection with the subject

of such contracts; or

(e) uses its dominant position in one relevant market to enter into,

or protect, other relevant market."

Explanation.-For the purposes of this section, the expression-

(a) "dominant position" means a position of strength, enjoyed by an

enterprise, in the relevant market, in India, which enables it to-

(i) operate independently of competitive forces prevailing in

the relevant market; or

(ii) affect its competitors or consumers or the relevant

market in its favour;

(b) "predatory price" means the sale of goods or provision of

services, at a. price which is below the cost, as may be determined

by regulations, of production of the goods or provision of services,

with a view to reduce competition or eliminate the competitors.

[(c) "group" shall have the same meaning as assigned to it in clause

(b) of the Explanation to section 5.]""

8. Section 19(4) relates to the various benchmarks provided under the Act on which

existence of dominance has to be examined. Section 19(4) is quoted below:

"The Commission shall, while inquiring whether an enterprise enjoys a

dominant position or not under section 4, have due regard to all or any of

the following factors, namely:-

(a) market share of the enterprise;

(b) size and resources of the enterprise;

(c) size and importance of the competitors;

( d ) economic power of the enterprise including commercial

advantages over competitors;

(e) vertical integration of the enterprises or sale or service network

of such enterprises;

(f) dependence of consumers on the enterprise;

(g) monopoly or dominant position whether acquired as a result of

any statute or by virtue of being a Government company or a public

sector undertaking or otherwise;

(h) entry barriers including barriers such as regulatory barriers,

financial risk, high capital cost of entry, marketing entry barriers,

technical entry barriers, economies of scale, high cost of

substitutable goods or service for consumers;

(i) countervailing buying power;

16-02-2020 (Page 7 of 11) www.manupatra.com CNLU STUDENT

(j) market structure and size of market;

(k) social obligations and social costs;

(l) relative advantage, by way of the contribution to the economic

development, by the enterprise enjoying a dominant position having

or likely to have an appreciable adverse effect on competition;

(m) any other factor which the Commission may consider relevant

for the inquiry."

Section 26(1) and (2) are also quoted :

(emphasis supplied)

"26. Procedure for inquiry under section 19] -- (1) On receipt of a reference

from the Central Government or a State Government or a statutory authority

or on its own knowledge or information received under section 19, if the

Commission is of the opinion that there exists a prima facie case, it shall

direct the Director General to cause an investigation to be made into the

matter:

Provided that if the subject matter of an information received is, in

the opinion of the Commission, substantially the same as or has

been covered by any previous information received, then the new

information may be clubbed with the previous information.

(2) Where on receipt of a reference from the Central Government or a State

Government or a statutory authority or information received under section 19

the Commission is of the opinion that there exists no prima facie case, it

shall close the matter forthwith and pass such orders as it deems fit and send

a copy of its order to the Central Government or the State Government or the

statutory authority or the parties concerned, as the case may be."

9 . According to Section 26(1) on receipt of a reference/information, if the

Commission is of the opinion that "there exists a prima facie case, it shall direct the

Director General to cause an investigation to be made into the matter." If in the

opinion of the Commission "there exists no prima facie case", it shall close the matter

forth with. There is a plethora of jurisprudence on the scope of Section 26(1) and

(2). Both sides from their own perspectives relied upon Competition Commission of

India v. SAIL MANU/SC/0690/2010 : (2010) 10 SCC 744. The appellant also drew

our attention to this Tribunal's decision in Appeal No. 51/2014 North East India

Petroleum Dealers Association v. Competition Commission of India and others and a

few other cases decided by the Tribunal on the scope of Section 26(1). The gist of

jurisprudence developed so far on the basis of decisions made by the Commission,

this Tribunal and higher Courts is that on receipt of an information from any of the

sources mentioned in the Act, the Commission on the basis of the information, the

preliminary conference allowed under Regulation 17 of the General Regulations,

using the material and documents placed before it form a prima facie view whether a

case exists for directing an investigation by the Director General. In case the

Commission is not in a position to form a view even after having considered

information, material, documents and listening to the parties by virtue of the

preliminary conference, it will close the matter. We have eschewed the temptation of

quoting from decided cases.

1 0 . In a matter where abuse of dominance has been alleged, the most crucial

16-02-2020 (Page 8 of 11) www.manupatra.com CNLU STUDENT

exercise is to form an opinion about dominance of the relevant entity in the relevant

market. In order to form an opinion on dominance, the first step is to delineate a

relevant market. While the information suggested Delhi NCR region as the relevant

market, the Commission considered Delhi as the relevant market. In order to justify

the Commission's opinion, it has been stated in the impugned order that since

transport is a State subject under the Constitution, the radio taxi services market is

largely regulated by the State Transport authorities. Thus the conditions of

competition appear to be homogenous only in a city/State. According to the

Commission, since the regulatory architecture in Delhi is quite different from that

operating in the NCR, they were persuaded to consider Delhi as the relevant

geographic market. The Commission has further stated as follows:

"The demarcation of Delhi as a separate relevant geographic market is

further corroborated by the fact that the app (i.e. applications) designed by

such aggregators (i.e. OP, OLA etc.) also specifically distinguish between

taxis available for booking within Delhi and those available for booking for

commuting from Delhi to NCR. Therefore, it appears that the radio taxis

operating in Delhi region face homogenous competitive constraints distinct

from those prevailing in other cities/States."

11. As far as the relevant product market is concerned, the Commission has agreed

with the suggestion given by the informant, i.e. radio taxi services to be the relevant

product market. The appellant has argued that the Commission's understanding of the

regulatory framework is not correct and on the practical side also, the Commission

has taken a wrong view by not agreeing to consider Delhi NCR as the relevant

geographic market.

12. We may at this point reiterate that at the stage of Section 26(1), a determination

on relevant market is only prima facie and deeper determinative exercise is not

required. It is a matter of common knowledge that customers can move from one

point in NCR to another point calling taxis on telephone/internet platforms. Neither in

the practical sense nor even in the regulatory sense, the kind of distinction made by

the Commission exists. The Commission had referred to High Court of Delhi order on

the mandate on the use of CNG in public transport within NCT. We were informed by

the appellant that this mandate has been revised by the Supreme Court to cover the

entire NCR of Delhi. A copy of the order has been placed on the file. Further as far as

the consumer is concerned, a seamless movement between two points within the NCR

is a more pragmatic way of looking at any transport regulation as customers are not

affected by political demarcations. Thirdly, according to Motor Vehicle Act, taxis

which operate under a tourist agency permit are not constrained to operate within

municipal limits and taxis such as Uber and Ola use tourist taxi permits. Therefore,

on all of these counts, restricting relevant geographic market to Delhi NCT was an

error. In our opinion, the relevant geographic market on a prima facie basis should

have been radio taxi service in Delhi NCR. However, we must hastily point out that

we do not want to be determinative on this issue as at this stage we are not inclined

to go into the merits of the matter but we are simply responding to the approach the

Commission has adopted in this particular matter.

1 3 . On the issue of dominance, the Commission has stated that respondent had

raised doubt about the credibility of the Tech Sci report on some grounds. The

Commission recalled its consideration of another research report called 6W research

Report which had come before it in an earlier consideration wherein another radio

taxi service, Ola had been reported to be in dominance. Since the two research

reports in question showed contrary results, the Commission decided to ignore both

of them but then in subsequent paragraph alluded to a combined reading of the two

16-02-2020 (Page 9 of 11) www.manupatra.com CNLU STUDENT

reports. If the Commission had ignored both these reports, then there was no reason

for the Commission to give a combined reading to both of them as it was difficult to

say which part was being excluded by the Commission from each report and what

parts were being read. The appellant had argued before the Commission that the 6W

research Report was dated in time and since Uber did not operate in two months of

November and December 2014, due to regulatory restriction this report, which was

dated March 2015, did not have realistic figures for Uber, thereby Ola was shown in

dominance in terms of market share.

14. The appellant has, argued that Tech Sci Report had statistics till 30th September,

2015 and was, therefore, updated. It was further argued that the Commission has

relied upon size of the fleet and not the number of trips. It may also be noted that in

an earlier consideration on information filed by M/s. Fast Track in relation to radio

taxi service in Bangalore, the Commission had given credence to a research report

prepared by Tech Sci. It may further be observed that the data presented in the Tech

Sci Report has simply been denied by Uber in the preliminary conference but nothing

in writing or by way of material has been presented by Uber to assist the Commission

in making an assessment about the size and share of the market. They have not

controverted the figures factually. If they did not believe the correctness of the Tech

Sci figures, they had the option of giving their own figures. They offered to do so

under confidentiality but perhaps the matters ended there itself.

15. We, therefore, feel that the Commission's approach was not consistent in this

respect. Tech Sci Report had made certain statistical reporting which had not been

challenged in substantive terms by the respondents except by raising doubts about

the credibility of the report. Even an affidavit was not placed on their behalf. Since

the objective of Section 26(1) is to formulate a prima facie view, the information

along with material and facts made available should have been enough for the

Commission to formulate an opinion. It may be noted that while 6Wresearch report

was not accepted by the Commission in Mega Cabs, the Tech Sci report on Bangalore

had been accepted by it in Fast Track. Further the fact that two reports being

referred, which had contrary results to show, could have been a good reason for the

Commission to order an investigation to reach a decision on a matter which has

attained significant interest in the Indian market place.

16. This examination also needs to look at the provisions of Explanation a to Section

4. It explains that dominant position means a 'position of strength'. It does not say

that this position of strength necessarily has to come out of market share in

statistical terms. The assistance in this respect to the Commission comes from Sub-

Clause (i) and (ii) of Explanation 1 read with Section 19(4). The cumulative effect of

this exercise would be that the Commission would not be constrained to look at only

the market share of the enterprise but it will have to look at other Sub-Clauses of

Section 19(4) particularly Sub-Section (b), (c), (d) and (e). The information made

available by the informant/appellant should be seen in the context of overall picture

as it exists in the radio taxi service market in terms of status of funding, global

developments, statements made by leaders in the business, the fact that aggregator

based radio taxi service is essentially a function of network expansion and there was

adequate indication from the respondent that network expansion was one of the

primary purpose of its business operation. Further, availability of financial resources

and existence of discounts and incentives associated with the model of business

adopted by the respondents are good supporting reasons to suggest that the issue of

dominance needs to be seen from a perspective that does not limit to the market

share of the enterprise alone. If necessary, the figures on financial flows by ways of

investment in India could have been verified through appropriate measures.

16-02-2020 (Page 10 of 11) www.manupatra.com CNLU STUDENT

(emphasis supplied)

17. While discussing as above, we do not intend to say that Uber is necessarily in a

dominant position. The Tech Sci Report shows that Uber's market share in terms of

various parameters is as follows:

"Fleet size 44.42%

Active fleet size 41.38%

Number of trips 50.1%

Thus on all three parameters, the figures were quite close to halfway mark. We

cannot ignore the fact that besides the appellant, there are a few very small players

in the market who can be seriously affected, if any of the bigger players adopts anti-

competitive practices.

1 8 . Aggregator based radio taxi service is a relatively new paradigm of public

transport in Indian cities which has revolutionized the manner in which we commute

and work. Reportedly, it has done wonders to consumer satisfaction in whichever city

it has started. Therefore, it cannot be said definitively that there is an abuse inherent

in the business practices adopted by operator such as respondents but the size of

discounts and incentives show that there are either phenomenal efficiency

improvements which are replacing existing business models with the new business

models or there could be an anti-competitive stance to it. Whichever is true, the

investigations would show.

19. In our view there is a good enough reason for Director General to investigate

this matter. It will also help in settling an issue which has agitated business

discourse for quite some time. In several jurisdictions, it has been done with

different shades of judicial consequences. We, therefore, think that the facts on the

record are enough to trigger an investigation by the DG. If he finds that the

dominance of Uber is not made out, the follow up to that will not happen.

20. In view of our discussion, we accept the appeal and direct the DG to conduct an

investigation into the allegations contained in the information filed by the appellant

and submit report to the Commission within the period prescribed under the Act. If

the Director General is unable to submit report within 60 days and there exists good

reasons for seeking extension of time, then he may approach the Commission for

grant of time to complete the investigation.

2 1 . On receipt of the investigation report, the Commission shall pass appropriate

order after giving opportunity to the parties to file their replies/objections and

affording them opportunity of personal hearing.

© Manupatra Information Solutions Pvt. Ltd.

16-02-2020 (Page 11 of 11) www.manupatra.com CNLU STUDENT

You might also like

- Innovative Infrastructure Financing through Value Capture in IndonesiaFrom EverandInnovative Infrastructure Financing through Value Capture in IndonesiaRating: 5 out of 5 stars5/5 (1)

- Decision Makers' Guide to Road Tolling in CAREC CountriesFrom EverandDecision Makers' Guide to Road Tolling in CAREC CountriesNo ratings yet

- 6 of 2015 Fast Track Call Cab PVT LTD V Ani Technologies PVT LTDDocument20 pages6 of 2015 Fast Track Call Cab PVT LTD V Ani Technologies PVT LTDChirag AgrawalNo ratings yet

- Meru Travel Solutions Private Limited MTSPL Vs UbeCO201618021615570132COM583951Document7 pagesMeru Travel Solutions Private Limited MTSPL Vs UbeCO201618021615570132COM583951pbNo ratings yet

- Merger Control Research Paper-Thrisha RaiDocument15 pagesMerger Control Research Paper-Thrisha RaiRitika SharmaNo ratings yet

- Supreme Court of India Upholds Investigation Against Uber - Kluwer Competition Law BlogDocument5 pagesSupreme Court of India Upholds Investigation Against Uber - Kluwer Competition Law BlogpbNo ratings yet

- Ola and Uber Vs MeruDocument14 pagesOla and Uber Vs MeruAYUSHI GABANo ratings yet

- Fast Track Call Cab Private LimitedDocument5 pagesFast Track Call Cab Private LimitedKopal KhannaNo ratings yet

- Competition Law Assignment 01Document6 pagesCompetition Law Assignment 01Kallis AlphansoNo ratings yet

- Decoding Abuse of Dominance in IndiaDocument9 pagesDecoding Abuse of Dominance in IndiaAstha AgarwalNo ratings yet

- Ola CaseDocument3 pagesOla CaseAkash PatelNo ratings yet

- Competition Commission of India Case No. 96 of 2015Document63 pagesCompetition Commission of India Case No. 96 of 2015EISH MALIKNo ratings yet

- In ReDocument42 pagesIn ReUaba bejaNo ratings yet

- Update: Cci Dismisses Unfair Business Practices Complaint Against UberDocument3 pagesUpdate: Cci Dismisses Unfair Business Practices Complaint Against UberEISH MALIKNo ratings yet

- SHAMSHER KATARIA Case Competition LawDocument8 pagesSHAMSHER KATARIA Case Competition LawShobhit RajNo ratings yet

- CCI Restricts Auto Manufacturers' Aftermarket PracticesDocument11 pagesCCI Restricts Auto Manufacturers' Aftermarket PracticesDisha PathakNo ratings yet

- Ca Final New Syllabus Elective Paper 6D Economic Laws: Summary of Significant Case LawsDocument26 pagesCa Final New Syllabus Elective Paper 6D Economic Laws: Summary of Significant Case LawsMala M PrasannaNo ratings yet

- Abuse of DominaceDocument13 pagesAbuse of DominaceashwaniNo ratings yet

- Edition-6-Analysis of Competition Cases in IndiaDocument12 pagesEdition-6-Analysis of Competition Cases in IndiaMona SNo ratings yet

- Supreme Court of India: BenchDocument14 pagesSupreme Court of India: BenchChirag AgrawalNo ratings yet

- Competition News Bulletin: Inside..Document11 pagesCompetition News Bulletin: Inside..vaibhav4yadav-4No ratings yet

- Evolving Principles of Dominant Position and Predatory Pricing in the Telecommunication Sector (1)Document20 pagesEvolving Principles of Dominant Position and Predatory Pricing in the Telecommunication Sector (1)Aryansh SharmaNo ratings yet

- Case No. 13 of 2020 Page 1 of 6Document6 pagesCase No. 13 of 2020 Page 1 of 6Simran KaurNo ratings yet

- Research Work CCIDocument16 pagesResearch Work CCIrashmi narayanNo ratings yet

- Judgements CCIIDocument3 pagesJudgements CCIISADAF FAIZINo ratings yet

- Uber Taxi Cab - Case StudyDocument9 pagesUber Taxi Cab - Case StudyYolanda DescallarNo ratings yet

- ExtemporeDocument14 pagesExtemporeshivam tiwariNo ratings yet

- MCX Vs NseDocument4 pagesMCX Vs NseRishu SharmaNo ratings yet

- CASE STUDY OF SHAMSHER KATARIA VERSUS HONDA SIEL CARSDocument8 pagesCASE STUDY OF SHAMSHER KATARIA VERSUS HONDA SIEL CARSSiva Ganga SivaNo ratings yet

- Government of India Airport Privatization Process Case StudyDocument4 pagesGovernment of India Airport Privatization Process Case StudyAnant JainNo ratings yet

- Consumer Online Foundation V Tata Sky LTDDocument5 pagesConsumer Online Foundation V Tata Sky LTDPritish Mishra100% (2)

- RFP PDFDocument286 pagesRFP PDFanamika singhNo ratings yet

- India Mergers 0706Document12 pagesIndia Mergers 0706amolmarathe1986No ratings yet

- Ca Final New Syllabus Elective Paper 6D Economic Laws: Summary of Significant Case LawsDocument15 pagesCa Final New Syllabus Elective Paper 6D Economic Laws: Summary of Significant Case Lawsrajat GuptaNo ratings yet

- Issues (Reviewed)Document25 pagesIssues (Reviewed)Mrigank Patel HNLU Batch 2018No ratings yet

- Atlas Honda October 30Document17 pagesAtlas Honda October 30Qaral ShamsNo ratings yet

- Edition-11-Analysis of Competition Cases in IndiaDocument9 pagesEdition-11-Analysis of Competition Cases in IndiaJosepjNo ratings yet

- Conducting Parking & User SurveysDocument8 pagesConducting Parking & User SurveysneerajNo ratings yet

- CompendiumDocument33 pagesCompendiumakshay kharteNo ratings yet

- J 2020 PL CompL February 79 919466513286 20221018 100149 1 4Document4 pagesJ 2020 PL CompL February 79 919466513286 20221018 100149 1 4SHIVAM SHARMANo ratings yet

- Competition Law Project Case Analysis: Meru Travels Solutions Private Limited v. Uber India Systems Private Limited & OrsDocument14 pagesCompetition Law Project Case Analysis: Meru Travels Solutions Private Limited v. Uber India Systems Private Limited & OrsGyana PathakNo ratings yet

- Multix Owners and Users Welfare Society Vs Eicher CODocument3 pagesMultix Owners and Users Welfare Society Vs Eicher CODiksha MittalNo ratings yet

- @Clawmcq Significant Case Laws SummaryDocument15 pages@Clawmcq Significant Case Laws SummaryAbhishek SharmaNo ratings yet

- INDULGENCE RESULTS DENIAL MARKET ACCESSDocument7 pagesINDULGENCE RESULTS DENIAL MARKET ACCESSPrateek TanmayNo ratings yet

- Jurisdictional Issues of Competition Commission of India A Critical AnalysisDocument5 pagesJurisdictional Issues of Competition Commission of India A Critical AnalysisAnanta ChopraNo ratings yet

- Competition Is A Process of Economic Rivalry Between Market Players To Attract CustomersDocument6 pagesCompetition Is A Process of Economic Rivalry Between Market Players To Attract CustomersAkash LallNo ratings yet

- IssuesDocument24 pagesIssuesMrigank Patel HNLU Batch 2018No ratings yet

- Appellant Moot Court MemorialDocument20 pagesAppellant Moot Court MemorialAbdul MoizNo ratings yet

- Airport Privatiization in IndiaDocument20 pagesAirport Privatiization in IndiaCMUPESNo ratings yet

- CompetitionDocument7 pagesCompetitionGurjeev SinghNo ratings yet

- Anant Investors & Traders PVT LTD CP 42-2020 NCLT On 21.05.2020 FINALDocument15 pagesAnant Investors & Traders PVT LTD CP 42-2020 NCLT On 21.05.2020 FINALKumar KartikNo ratings yet

- Three D Integrated Solutions LTD V/s VerifoneDocument31 pagesThree D Integrated Solutions LTD V/s VerifoneIndianAntitrustNo ratings yet

- Amir Khan V CCIDocument13 pagesAmir Khan V CCIshalwNo ratings yet

- Fa 409350 e 6 F 7Document4 pagesFa 409350 e 6 F 7CoralBridge EngineeringNo ratings yet

- Comparing Business Strategies of Uber and Ola CabsDocument7 pagesComparing Business Strategies of Uber and Ola CabsPuneetGupta50% (6)

- The Curious Case of CBB Cartel: A Sophistic Approach of Indian Competition AuthorityDocument3 pagesThe Curious Case of CBB Cartel: A Sophistic Approach of Indian Competition AuthorityVinayak GuptaNo ratings yet

- Competition Commission of India: (Combination Registration No. C-2017/04/502)Document16 pagesCompetition Commission of India: (Combination Registration No. C-2017/04/502)AMNo ratings yet

- NCLT OrderDocument13 pagesNCLT Orderjainanmol0410No ratings yet

- vehicleTenderNotice-240620Document21 pagesvehicleTenderNotice-240620Ankit RajNo ratings yet

- Miss Madhu Bala: Sumbited By-Rahul Pandey RF6901B-48 REG-10902053 9356501220Document8 pagesMiss Madhu Bala: Sumbited By-Rahul Pandey RF6901B-48 REG-10902053 9356501220Rahul KumarNo ratings yet

- Labour LawsDocument29 pagesLabour LawsAroraYarnPvtLtd A285IGCKharaBikaner334001RAJNo ratings yet

- Examination Notice No. 628Document2 pagesExamination Notice No. 628pbNo ratings yet

- Detained Promoted List 2019Document9 pagesDetained Promoted List 2019pbNo ratings yet

- The Employees' State Insurance Act, 1948 - Arrangement of SectionsDocument54 pagesThe Employees' State Insurance Act, 1948 - Arrangement of SectionsLn mallickNo ratings yet

- Revised Regulation UG 20-21Document12 pagesRevised Regulation UG 20-21pbNo ratings yet

- Syllabus Constitutional Law IDocument2 pagesSyllabus Constitutional Law IpbNo ratings yet

- Intentions MotucsDocument1 pageIntentions MotucspbNo ratings yet

- MSEFC Jurisdiction Over Arbitration DisputeDocument10 pagesMSEFC Jurisdiction Over Arbitration DisputepbNo ratings yet

- Great ParoleDocument5 pagesGreat ParolepbNo ratings yet

- MCX Vs NseDocument170 pagesMCX Vs NsepbNo ratings yet

- International Workshop Socio Legal Writing FINAL PDF Converted 1Document5 pagesInternational Workshop Socio Legal Writing FINAL PDF Converted 1pbNo ratings yet

- Skill Gaming in India: The Changing LandscapeDocument36 pagesSkill Gaming in India: The Changing Landscapedivya_jaiswal_djNo ratings yet

- UN Report On Artistic FreedomDocument25 pagesUN Report On Artistic FreedomncacensorshipNo ratings yet

- Intentions MotucsDocument1 pageIntentions MotucspbNo ratings yet

- Juris RelevantDocument1 pageJuris RelevantpbNo ratings yet

- CCI orders investigation into alleged anti-competitive practices in online sale of SanDisk productsDocument8 pagesCCI orders investigation into alleged anti-competitive practices in online sale of SanDisk productsgauri shyamNo ratings yet

- Dudley JurisDocument1 pageDudley JurispbNo ratings yet

- 7B20N001Document21 pages7B20N001pbNo ratings yet

- Compliance of Companies With Corporate Governance Codes: Case Study On Listed Belgian SmesDocument17 pagesCompliance of Companies With Corporate Governance Codes: Case Study On Listed Belgian SmespbNo ratings yet

- Consent Form - StudentsDocument1 pageConsent Form - StudentspbNo ratings yet

- Esys Vs IntelDocument30 pagesEsys Vs IntelpbNo ratings yet

- BMC Pre Internship Questionnaire2Document3 pagesBMC Pre Internship Questionnaire2HiteshJainNo ratings yet

- UG Course MapDocument3 pagesUG Course MappbNo ratings yet

- Application Form: - Out ofDocument5 pagesApplication Form: - Out ofPriyankaNo ratings yet

- Lis of Ngo in Delhi and NearDocument1 pageLis of Ngo in Delhi and NearpbNo ratings yet

- Krishna Neel Verma v. Federal Republic of Mayeechin III: A Case Pertaining To Accepting Migrants OnDocument9 pagesKrishna Neel Verma v. Federal Republic of Mayeechin III: A Case Pertaining To Accepting Migrants OnpbNo ratings yet

- Internship Opportunities at Advaya Legal Firm Overview: TH ND RDDocument1 pageInternship Opportunities at Advaya Legal Firm Overview: TH ND RDpbNo ratings yet

- Academic Regulations For 5 Year Law Course Leading To The Award of BDocument10 pagesAcademic Regulations For 5 Year Law Course Leading To The Award of BSAURABH SUNNYNo ratings yet

- Chankaya National Law University20210302Document4 pagesChankaya National Law University20210302pbNo ratings yet

- CNLU Family Law IIDocument3 pagesCNLU Family Law IIRishabh SinhaNo ratings yet

- GEKKON GeylDocument12 pagesGEKKON Geylmarcica2100% (2)

- ITTF Advanced Coaching Manual Order FormDocument1 pageITTF Advanced Coaching Manual Order FormRyanNo ratings yet

- Answer To The Question No 1Document2 pagesAnswer To The Question No 1Nafiul haqueNo ratings yet

- Chapter 5: Figures: PreviewDocument3 pagesChapter 5: Figures: PreviewMoli CatNo ratings yet

- EDESIGN Pedro Truck HubDocument8 pagesEDESIGN Pedro Truck HubZane BevsNo ratings yet

- Registered SaccosDocument160 pagesRegistered SaccosEddy Tanui100% (1)

- Discover vendor order detailsDocument1 pageDiscover vendor order detailsDan AndreyNo ratings yet

- Productivity RateDocument5 pagesProductivity RateSarah TolineroNo ratings yet

- Ipao Report Master SubmitDocument49 pagesIpao Report Master SubmitProject 3No ratings yet

- Topic 3 - Types of Construction ContractDocument40 pagesTopic 3 - Types of Construction ContractMUSLIHAH AQILAH MUSAFFENDYNo ratings yet

- Abp2 ReportDocument8 pagesAbp2 Reportapi-545675901No ratings yet

- Barangay Budget Preparation Form No. 1Document5 pagesBarangay Budget Preparation Form No. 1Yza Belle100% (1)

- List of Real Properties and Transportations - TemplateDocument2 pagesList of Real Properties and Transportations - Templatejharel jay pizarro100% (1)

- Dash - The Story of EconophysicsDocument223 pagesDash - The Story of EconophysicsEricNo ratings yet

- Designand Simulationof Natural Gas Liquid Recovery Processfrom Rich Natural GasDocument11 pagesDesignand Simulationof Natural Gas Liquid Recovery Processfrom Rich Natural Gasmindunder36No ratings yet

- Economic Development - Mock ExaminationDocument15 pagesEconomic Development - Mock ExaminationLeilei GalangNo ratings yet

- Ballada - Chapters 2-6Document7 pagesBallada - Chapters 2-6Patricia Camille Austria0% (1)

- Underverk Dunstabzug Zum Einbauen Edelstahl - AA 2039317 9 1Document64 pagesUnderverk Dunstabzug Zum Einbauen Edelstahl - AA 2039317 9 1nemkocicNo ratings yet

- Refund Request FormDocument2 pagesRefund Request FormBinh TranNo ratings yet

- Cartas de ReclamoDocument9 pagesCartas de ReclamoLourdes Sucely Pirir ToxcónNo ratings yet

- Sandvik CH 660-32-33Document2 pagesSandvik CH 660-32-33Damaris OrtizNo ratings yet

- ABM APPLIED ECONOMICS 12 - Q1 - W1 - Mod1EDITED 1 PDFDocument14 pagesABM APPLIED ECONOMICS 12 - Q1 - W1 - Mod1EDITED 1 PDFfeyNo ratings yet

- Zwor Cwievwnzv I E'Y WZK We KølyDocument86 pagesZwor Cwievwnzv I E'Y WZK We KølyKhulna TravelsNo ratings yet

- Technical Data: Vertical and Horizontal Bladder Tanks Model VFT ASME Sec - VIII Div.1 - U-1ADocument11 pagesTechnical Data: Vertical and Horizontal Bladder Tanks Model VFT ASME Sec - VIII Div.1 - U-1AmhmdNo ratings yet

- BBA II Chapter 2 Sale of PartnershipDocument19 pagesBBA II Chapter 2 Sale of PartnershipSiddharth SalgaonkarNo ratings yet

- Choosing The Right Home Furniture For Your Own Home Some Advicedcvsx PDFDocument2 pagesChoosing The Right Home Furniture For Your Own Home Some Advicedcvsx PDFVinsonLaw13No ratings yet

- Lxe10e A36 ADocument62 pagesLxe10e A36 AСергей ПетровNo ratings yet

- Ekoko 55Document11 pagesEkoko 55QS OH OladosuNo ratings yet

- Self Help Complete PDFDocument35 pagesSelf Help Complete PDFSubodh NigamNo ratings yet

- Argus Coal Daily InternationalDocument13 pagesArgus Coal Daily InternationalDaudy MuhlisinNo ratings yet