Professional Documents

Culture Documents

B.A.L. Degree Examination, May 2015: 350: Law of Taxation

B.A.L. Degree Examination, May 2015: 350: Law of Taxation

Uploaded by

siva prasadOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

B.A.L. Degree Examination, May 2015: 350: Law of Taxation

B.A.L. Degree Examination, May 2015: 350: Law of Taxation

Uploaded by

siva prasadCopyright:

Available Formats

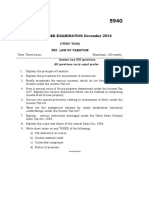

Total No.

of Pages: 1

5940

Register Number:

Name of the Candidate:

B.A.L. DEGREE EXAMINATION, May 2015

(THIRD YEAR)

350: LAW OF TAXATION

Time: Three hours Maximum: 100 marks

Answer any SIX questions

1. Define Tax. Explain the nature and characteristics of Tax. Distinguish

between direct and indirect taxes.

2. What are the provisions of Income Tax Act, 1961 relating to the set off and

carry forward of losses.

3. State the circumstance in which income of other persons are included in the

total income of an assessee.

4. Define the term sale under the Tamil Nadu General Sales Tax Act, 1959.

5. Describe the revisional and appellate powers of High court under the Tamil Nadu

general Sales Tax Act, 1959.

6. Explain the provisions relating to income which do not form part of the total

income.

7. What are the exemption of income from property held for religious and

charitable purposes?

8. In computing income under the head salaries what are the exemption

allowed?

9. W rite short notes on any TW O of the following:

a) Long term capital gains.

b) Valuation date.

c) Speculative business.

d) Turnover under the Tamil Nadu General sales Tax Act, 1959.

$$$$$$$

You might also like

- Taxation Law Review SyllabusDocument14 pagesTaxation Law Review SyllabusRoxanne Peña100% (2)

- B.A.L. DEGREE EXAMINATION December 2014: 350. Law of TaxationDocument1 pageB.A.L. DEGREE EXAMINATION December 2014: 350. Law of Taxationsiva prasadNo ratings yet

- Notes On Taxation LawDocument93 pagesNotes On Taxation Lawram patilNo ratings yet

- Unit 1Document8 pagesUnit 1Diksha ReddyNo ratings yet

- B.A.L. Degree Examination, May 2015: 330: Labour Law SDocument1 pageB.A.L. Degree Examination, May 2015: 330: Labour Law Ssiva prasadNo ratings yet

- Symbiosis International University: SemesterDocument2 pagesSymbiosis International University: SemesterMohit ChawlaNo ratings yet

- Q.May19 Sem ExamDocument9 pagesQ.May19 Sem ExamSanvi NarayanNo ratings yet

- Business TaxationDocument1 pageBusiness TaxationOPTIMA ConsultingNo ratings yet

- B.A.LL.B. V Sem.2015-16Document7 pagesB.A.LL.B. V Sem.2015-16Shubham RawatNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Fall (Winter) 2009 ExaminationsDocument2 pagesInstitute of Cost and Management Accountants of Pakistan Fall (Winter) 2009 ExaminationsSyed Mohammad Ali Zaidi KarbalaiNo ratings yet

- B.A.L. Degree Examination, May 2015: 310: Com Pany LawDocument1 pageB.A.L. Degree Examination, May 2015: 310: Com Pany Lawsiva prasadNo ratings yet

- Income Tax Introduction FinalDocument39 pagesIncome Tax Introduction FinalSammar EllahiNo ratings yet

- Taxation 1 Case Analysis No. 1Document2 pagesTaxation 1 Case Analysis No. 1regine rose bantilanNo ratings yet

- 06-Spring 2014 - BTDocument4 pages06-Spring 2014 - BTpabloescobar11yNo ratings yet

- D.T.L (2006 Pattern)Document14 pagesD.T.L (2006 Pattern)KuNdAn DeOrENo ratings yet

- 2015@public Finance AssignmentDocument1 page2015@public Finance Assignmentgenenegetachew64No ratings yet

- 2010 Taxation Review by Domondon 1Document13 pages2010 Taxation Review by Domondon 1Aldus31100% (1)

- 6 Ball.b Vi SemDocument7 pages6 Ball.b Vi SemAfzal MohhamadNo ratings yet

- Unit I Part-ADocument2 pagesUnit I Part-AsaravmbaNo ratings yet

- Code No: MB164G/R16: MBA IV Semester Regular Examinations, April-2018Document1 pageCode No: MB164G/R16: MBA IV Semester Regular Examinations, April-2018LakshmirajuNo ratings yet

- Lecture Notes On Tax by Domondon PDFDocument43 pagesLecture Notes On Tax by Domondon PDFKristoff Simon75% (4)

- Asres Yenesew - Teqami Mikir (1953)Document1 pageAsres Yenesew - Teqami Mikir (1953)firaolmosisabonkeNo ratings yet

- B.A.L. DEGREE EXAMINATION December 2014: 330. Labour LawsDocument1 pageB.A.L. DEGREE EXAMINATION December 2014: 330. Labour Lawssiva prasadNo ratings yet

- CCIT Module 2 - TAXES, TAX LAWS and TAX ADMINISTRATIONDocument15 pagesCCIT Module 2 - TAXES, TAX LAWS and TAX ADMINISTRATIONAngelo OñedoNo ratings yet

- Acco 2033 Income TaxationDocument1 pageAcco 2033 Income TaxationPatrick JaneNo ratings yet

- 09 Tax UstDocument59 pages09 Tax Ustjb13ruizNo ratings yet

- 2010 Taxation Review by DomondonDocument38 pages2010 Taxation Review by DomondonMerghany N JaiyariNo ratings yet

- Taxation Law 2021Document60 pagesTaxation Law 2021eayemeyemieNo ratings yet

- TAX Repeated QuestionsDocument3 pagesTAX Repeated QuestionsAsif PashaNo ratings yet

- Taxation - 6 SemesterDocument28 pagesTaxation - 6 SemesterKhalid123No ratings yet

- Bar+Q+ (Domondon) +TAX (1) PrintedDocument47 pagesBar+Q+ (Domondon) +TAX (1) PrintedJoyce Noreen BagyonNo ratings yet

- Cir Vs Estate of TodaDocument3 pagesCir Vs Estate of TodaPia SottoNo ratings yet

- Sample Memorial RespondentDocument22 pagesSample Memorial RespondentShivani SinghNo ratings yet

- Universiti Teknologi Mara Faculty of Accountancy Tax737: Tax Fraud and Investigation Tutorial Questions: Tax Administration A. General QuestionsDocument1 pageUniversiti Teknologi Mara Faculty of Accountancy Tax737: Tax Fraud and Investigation Tutorial Questions: Tax Administration A. General Questionsiskandar027100% (1)

- Legal Aspects of Business Previous Yearl PapersDocument13 pagesLegal Aspects of Business Previous Yearl PapersRahul CharanNo ratings yet

- Fayaz Hussain Abro, Assistant CommissionerDocument34 pagesFayaz Hussain Abro, Assistant CommissionerInder KeswaniNo ratings yet

- Tax Law SemesterDocument13 pagesTax Law Semesterarfaimteyaz39No ratings yet

- Domondon Based Tax ReviewerDocument77 pagesDomondon Based Tax ReviewerGenevieve Penetrante100% (1)

- Taxation EMDocument2 pagesTaxation EMtadepalli patanjaliNo ratings yet

- Unsolved Question Papers Part-VII Special and Local LawsDocument1 pageUnsolved Question Papers Part-VII Special and Local LawsStormerwikiNo ratings yet

- 2018 19 6 Ball.b Vi Sem Et AprilDocument8 pages2018 19 6 Ball.b Vi Sem Et AprilAlok KumarNo ratings yet

- Domondon Tax Notes PDFDocument79 pagesDomondon Tax Notes PDFMae SalinoNo ratings yet

- Taxation LawDocument12 pagesTaxation LawYassar KhanNo ratings yet

- Department of Accounting: Taxation 200 (Tax2Ab0)Document6 pagesDepartment of Accounting: Taxation 200 (Tax2Ab0)Tawanda NgoweNo ratings yet

- Domondon Tax ReviewerDocument47 pagesDomondon Tax ReviewerHezl Valerie Arzadon100% (1)

- Course Plan of Principle of Taxation Law PDFDocument8 pagesCourse Plan of Principle of Taxation Law PDFMuskan KhatriNo ratings yet

- DBA7107Document21 pagesDBA7107Bhat MerajNo ratings yet

- 2014 15 B.A.LL.B VI SemDocument8 pages2014 15 B.A.LL.B VI SemSumyyaNo ratings yet

- Domondon TAXDocument56 pagesDomondon TAXAnge Buenaventura Salazar100% (1)

- Taxation Law Bar QuestionsDocument54 pagesTaxation Law Bar QuestionsAnthony RoblesNo ratings yet

- Subject: Taxation Laws I (Direct Tax) : Kumail FatimaDocument24 pagesSubject: Taxation Laws I (Direct Tax) : Kumail FatimaVida travel SolutionsNo ratings yet

- Taxation Question BankDocument3 pagesTaxation Question BankRishikesh BhujbalNo ratings yet

- Revenue Law and Taxation IIDocument5 pagesRevenue Law and Taxation IIakomakechNo ratings yet

- LL B 6TH Sem 2023Document11 pagesLL B 6TH Sem 2023himanshu chhokraNo ratings yet

- How to Invest in Real Estate And Pay Little or No Taxes: Use Tax Smart Loopholes to Boost Your Profits By 40%: Use Tax Smart Loopholes to Boost Your Profits By 40%From EverandHow to Invest in Real Estate And Pay Little or No Taxes: Use Tax Smart Loopholes to Boost Your Profits By 40%: Use Tax Smart Loopholes to Boost Your Profits By 40%No ratings yet

- Code 18Document64 pagesCode 18siva prasadNo ratings yet

- Cod 8 All New1Document75 pagesCod 8 All New1siva prasadNo ratings yet

- Code 10Document65 pagesCode 10siva prasadNo ratings yet

- Course: Mba - Executive ManagementDocument2 pagesCourse: Mba - Executive Managementsiva prasadNo ratings yet

- Final Answer KeyDocument13 pagesFinal Answer Keysiva prasadNo ratings yet

- Final Answer KeyDocument13 pagesFinal Answer Keysiva prasadNo ratings yet

- Final Answer KeyDocument13 pagesFinal Answer Keysiva prasadNo ratings yet