Professional Documents

Culture Documents

Institutionnal Support For Eco Friendly Business

Uploaded by

feno andrianaryOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Institutionnal Support For Eco Friendly Business

Uploaded by

feno andrianaryCopyright:

Available Formats

INSTITUTIONNAL SUPPORT FOR ECO FRIENDLY BUSINESS

The European Union (eu) has proposed to amend the 40-year-old Common Agricultural Policy (cap).

Under the proposal, subsidies will be granted to farmers on the basis of their observing public

health, safety and environmental norms. This is in contrast to the existing system wherein farmers

receive sops on the basis of their produce and farm size.

For countries like India, where subsidies amount to only us $1 billion, the proposal would still lead to

unfair competition from highly subsidised imports from developed countries. Bibek Deb Roy,

director, research, Rajiv Gandhi Institute for Contemporary Studies, a Delhi-based body working on

issues related to sustainable development, too envisages a grim future: "For developing countries

like India, cap will continue to create a market access barrier on the country's agricultural exports.'

Under cap, eu imposes levies on agricultural products from non-eu nations through its external tariff.

http://www.indiaenvironmentportal.org.in/content/19690/ecofriendly-subsidies-proposed/

POLICY MEASURE TO SUPPORT INCLUSIVE AND GREEN BUSINESS MODEL

https://www.enterprise-development.org/wp-

content/uploads/Policy_Measures_to_Support_Inclusive_and_Green_Business_Models.pdf

Tax Benefits and Other Financial Incentives

The U.S. government understands the need for sustainable and renewable energy. In efforts to

support this approach, it offers various tax advantages to businesses that go green. This

includes tax breaks, rebates and other monetary enticements. These financial incentives are

offered on both the state and federal levels. Some examples follow.

Business deductions for installation of HVAC, interior lighting or hot water systems

that significantly reduce power use

Tax credits and grants of 10 and 30 percent for use of alternative energy properties

Tax credits for use of alternative vehicles that meet specific fuel-efficient standards

Bonus depreciation for qualified recycling and reuse of certain equipment or

machinery

Government Subsidy Benefits

Tax breaks are not the only government advantages offered to green businesses. There are a

number of grants, subsidies and financing programs available as well for the company or

entrepreneur who seeks to be eco-friendlier. The Environmental Protection Agency provides

grants for qualified programs that are related to environmentally responsible approaches for a

variety of business operations. The Small Business Administration (SBA) offers financing

solutions to business organizations that support green solutions in new construction,

retrofitting existing structures and the advancement of green technologies. These are but a

few of the many government subsidies available to companies that effect environmentally

friendly practices and solutions.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- DY Centralised Distribution at Nike Centralised An...Document3 pagesDY Centralised Distribution at Nike Centralised An...Daniyal AsifNo ratings yet

- Caracteristicas Reco MedinaDocument40 pagesCaracteristicas Reco MedinaJavier Enrique Gomez RamirezNo ratings yet

- Kelompok 2 Comfort Class StudyDocument16 pagesKelompok 2 Comfort Class Study308 GamerNo ratings yet

- Value Chain Analysis of Tesla MotorsDocument2 pagesValue Chain Analysis of Tesla MotorsMyNo ratings yet

- Cat Logistics: Caterpillar Logistics Services, IncDocument17 pagesCat Logistics: Caterpillar Logistics Services, IncAnirudh VishnubhatlaNo ratings yet

- Assignement Competittion ActDocument6 pagesAssignement Competittion Actfeno andrianaryNo ratings yet

- Competition Act Presentation 1Document3 pagesCompetition Act Presentation 1feno andrianaryNo ratings yet

- Competition ActDocument3 pagesCompetition Actfeno andrianaryNo ratings yet

- Operations Researchers or Management ScientistsDocument1 pageOperations Researchers or Management Scientistsfeno andrianaryNo ratings yet

- Module 1Document80 pagesModule 1feno andrianaryNo ratings yet

- Accounting Principles Financial Accounting Standards BoardDocument5 pagesAccounting Principles Financial Accounting Standards Boardfeno andrianaryNo ratings yet

- Energy Conservation: What Is Energy Conservation? Energy Conservation Is The Effort Made To Reduce TheDocument11 pagesEnergy Conservation: What Is Energy Conservation? Energy Conservation Is The Effort Made To Reduce Thefeno andrianary100% (1)

- Faculty Details: 1 Course Facilitater - Prof - Dr. Siby ZachariasDocument30 pagesFaculty Details: 1 Course Facilitater - Prof - Dr. Siby Zachariasfeno andrianaryNo ratings yet

- The Energy ConservationDocument19 pagesThe Energy Conservationfeno andrianaryNo ratings yet

- Baring Bank CaseDocument3 pagesBaring Bank Casefeno andrianaryNo ratings yet

- Pioneers in Good Governance PracticesDocument25 pagesPioneers in Good Governance Practicesfeno andrianary100% (4)

- OS GuidelinesDocument11 pagesOS Guidelinesfeno andrianaryNo ratings yet

- The Role of Quantitative Techniques in Business and ManagementDocument3 pagesThe Role of Quantitative Techniques in Business and Managementfeno andrianaryNo ratings yet

- Case Drill MasterDocument1 pageCase Drill Masterfeno andrianaryNo ratings yet

- The Blossoms Last Only One DayDocument1 pageThe Blossoms Last Only One Dayfeno andrianaryNo ratings yet

- Book ReviewDocument2 pagesBook Reviewfeno andrianaryNo ratings yet

- Jamsetji Tata: / Tɑ Tɑ / Conglomerate Holding Company Mumbai Maharashtra Jamsetji Tata Tata SonsDocument12 pagesJamsetji Tata: / Tɑ Tɑ / Conglomerate Holding Company Mumbai Maharashtra Jamsetji Tata Tata Sonsfeno andrianaryNo ratings yet

- Entrepreneurship Final Exam (Freshman Program 2021)Document9 pagesEntrepreneurship Final Exam (Freshman Program 2021)Tofik Mohammed100% (5)

- Strategic Management Accounting Unit - I Marginal Costing: PGDM 3.5Document32 pagesStrategic Management Accounting Unit - I Marginal Costing: PGDM 3.5Rajat TyagiNo ratings yet

- Lect 16123Document4 pagesLect 16123filmon dissanNo ratings yet

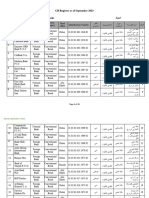

- CB Register September 2023Document25 pagesCB Register September 2023Shiva KathiresanNo ratings yet

- Upper Intermediate Business WritingDocument3 pagesUpper Intermediate Business WritingDelva RyantiNo ratings yet

- Wood Control PolicyDocument3 pagesWood Control PolicySinthia Akter SnigdhaNo ratings yet

- Assignment-02 Truongthienthaohanh HS140396Document4 pagesAssignment-02 Truongthienthaohanh HS140396Ngọc Hiệp LêNo ratings yet

- Actual Garment Production Cost of A Garments CompanyDocument26 pagesActual Garment Production Cost of A Garments CompanySOUMANLALA50% (2)

- GE01 - Online Free Class Lecture Sheet PDFDocument40 pagesGE01 - Online Free Class Lecture Sheet PDFRefa- E- Alam 1110884030No ratings yet

- Constellation Software IncDocument6 pagesConstellation Software IncSugar RayNo ratings yet

- Complaint Handling Policy and ProceduresDocument2 pagesComplaint Handling Policy and ProceduresRamesh AdhikariNo ratings yet

- Mintirho Adverts of SuppliersDocument138 pagesMintirho Adverts of SuppliersEdmund Stokes-WallerNo ratings yet

- Bank AL Habib Limited: Account Opening FormDocument4 pagesBank AL Habib Limited: Account Opening FormArman KhanNo ratings yet

- SIS/BSRS Orientation Session: 2023 TVI Absorptive Capacity InventoryDocument8 pagesSIS/BSRS Orientation Session: 2023 TVI Absorptive Capacity Inventorymarygrace hamblosaNo ratings yet

- BST Notes 2023Document132 pagesBST Notes 2023Blablabla100% (1)

- Nestle India Annual Report 2019 PDFDocument144 pagesNestle India Annual Report 2019 PDFAyush SatyamNo ratings yet

- Group 6 - Boston CreameryDocument7 pagesGroup 6 - Boston CreameryYAKSH DODIANo ratings yet

- Ias 2 Test Bank PDFDocument11 pagesIas 2 Test Bank PDFAB Cloyd100% (1)

- Line ItemsDocument6 pagesLine ItemsFrancis DedumoNo ratings yet

- Business Ethics and Social ResponsibilitiesDocument17 pagesBusiness Ethics and Social Responsibilitiesangel caoNo ratings yet

- Fundamentals of Capital StructureDocument42 pagesFundamentals of Capital StructureSona Singh pgpmx 2017 batch-2No ratings yet

- 061 SVN National Project Officer (CRP) - 2023 - PembaDocument5 pages061 SVN National Project Officer (CRP) - 2023 - PembaErasmo NotaNo ratings yet

- Profit and Loss - 1604512744369Document31 pagesProfit and Loss - 1604512744369Gunjan RawatNo ratings yet

- Class Presentation Course: Analysis of Pakistani IndustriesDocument39 pagesClass Presentation Course: Analysis of Pakistani Industrieshuzaifa anwarNo ratings yet

- 7383736Document88 pages7383736Trisha Mae Mendoza MacalinoNo ratings yet