Professional Documents

Culture Documents

6 Service Concession Arrangements PDF

Uploaded by

Gayle LalloOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

6 Service Concession Arrangements PDF

Uploaded by

Gayle LalloCopyright:

Available Formats

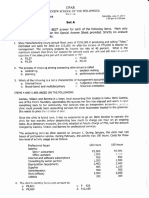

Accounting for Government, Not-for-Profit Entities and Specialized Industries

Hand-out no. 6 – Accounting for Service Concession Arrangements

INTRODUCTION

IFRIC 12 Service Concession Arrangements gives guidance on the accounting by operators for public‑to‑private

service concession arrangements. This Interpretation applies to public‑to‑private service concession arrangements

if:

(a) the grantor controls or regulates what services the operator must provide with the infrastructure, to whom

it must provide them, and at what price; and

(b) the grantor controls—through ownership, beneficial entitlement or otherwise—any significant residual

interest in the infrastructure at the end of the term of the arrangement.

SERVICE CONCESSION ARRANGEMENTS

An arrangement of this type typically involves a private sector entity (an operator) constructing the infrastructure

used to provide the public service or upgrading it and operating and maintaining that infrastructure for a specified

period of time. The operator is paid for its services over the period of the arrangement. Such an arrangement is

often described as a ‘build‑operate‑transfer’, a ‘rehabilitate‑operate‑transfer’ or a ‘public‑to‑private’ service

concession arrangement.

A feature of these service arrangements is the public service nature of the obligation undertaken by the operator.

Public policy is for the services related to the infrastructure to be provided to the public, irrespective of the identity

of the party that operates the services. The service arrangement contractually obliges the operator to provide the

services to the public on behalf of the public sector entity. Other common features are:

(a) the party that grants the service arrangement (the grantor) is a public sector entity, including a

governmental body, or a private sector entity to which the responsibility for the service has been devolved.

(b) the operator is responsible for at least some of the management of the infrastructure and related services

and does not merely act as an agent on behalf of the grantor.

(c) the contract sets the initial prices to be levied by the operator and regulates price revisions over the period

of the service arrangement.

(d) the operator is obliged to hand over the infrastructure to the grantor in a specified condition at the end of

the period of the arrangement, for little or no incremental consideration, irrespective of which party initially

financed it.

Treatment of the operator’s rights over the infrastructure

Infrastructure within the scope IFRIC 12 shall not be recognized as property, plant and equipment of the operator

because the contractual service arrangement does not convey the right to control the use of the public service

infrastructure to the operator. The operator has access to operate the infrastructure to provide the public service

on behalf of the grantor in accordance with the terms specified in the contract.

Consideration given by the grantor to the operator

If the operator provides construction or upgrade services, the consideration received or receivable by the operator

shall be recognized as:

(a) a financial asset, or

(b) an intangible asset.

The operator shall recognize a financial asset to the extent that it has an unconditional contractual right to receive

cash or another financial asset from or at the direction of the grantor for the construction services; the grantor has

little, if any, discretion to avoid payment, usually because the agreement is enforceable by law. The operator has

an unconditional right to receive cash if the grantor contractually guarantees to pay the operator

(a) specified or determinable amounts or

(b) the shortfall, if any, between amounts received from users of the public service and specified or

determinable amounts, even if payment is contingent on the operator ensuring that the infrastructure

meets specified quality or efficiency requirements.

The amount due from or at the direction of the grantor is accounted for in accordance with IFRS 9 as measured at:

(a) amortized cost; or

(b) fair value through other comprehensive income; or

(c) fair value through profit or loss.

If the amount due from the grantor is measured at amortized cost or fair value through other comprehensive income,

IFRS 9 requires interest calculated using the effective interest method to be recognized in profit or loss.

The operator shall recognize an intangible asset to the extent that it receives a right (a license) to charge users of

the public service. A right to charge users of the public service is not an unconditional right to receive cash because

the amounts are contingent on the extent that the public uses the service.

Borrowing costs incurred by the operator

In accordance with IAS 23, borrowing costs attributable to the arrangement shall be recognized as an expense in

the period in which they are incurred unless the operator has a contractual right to receive an intangible asset (a

right to charge users of the public service). In this case borrowing costs attributable to the arrangement shall be

capitalized during the construction phase of the arrangement in accordance with that Standard.

Items provided to the operator by the grantor

BRIAN CHRISTIAN S. VILLALUZ, CPA

LEarning ADvancement Review Center (LEAD)

CPA Reviewer in Advanced Financial Accounting & Reporting (AFAR)

CPA Reviewer in Financial Accounting & Reporting (FAR)

CPA Reviewer in Auditing (Theory & Problems) Page 1 of 2

In accordance with paragraph 11, infrastructure items to which the operator is given access by the grantor for the

purposes of the service arrangement are not recognized as property, plant and equipment of the operator.

-END-

BRIAN CHRISTIAN S. VILLALUZ, CPA

LEarning ADvancement Review Center (LEAD)

CPA Reviewer in Advanced Financial Accounting & Reporting (AFAR)

CPA Reviewer in Financial Accounting & Reporting (FAR)

CPA Reviewer in Auditing (Theory & Problems) Page 2 of 2

You might also like

- Auditing TheoDocument27 pagesAuditing TheoSherri BonquinNo ratings yet

- Tax MockboardDocument8 pagesTax MockboardJaneNo ratings yet

- Financial Accounting: Share-Based Compensation Share-Based Compensation Book Value Per ShareDocument11 pagesFinancial Accounting: Share-Based Compensation Share-Based Compensation Book Value Per ShareairaNo ratings yet

- Final 2 2Document3 pagesFinal 2 2RonieOlarteNo ratings yet

- Enrichment Class Tax On CorporationDocument4 pagesEnrichment Class Tax On CorporationEmersonNo ratings yet

- Corporate LiquidationDocument7 pagesCorporate LiquidationAcads PurposesNo ratings yet

- Govt Acctg 1234Document5 pagesGovt Acctg 1234taylor swiftyyyNo ratings yet

- Fischer - Pship LiquiDocument7 pagesFischer - Pship LiquiShawn Michael DoluntapNo ratings yet

- LEASE1Document3 pagesLEASE1Ana Leah DelfinNo ratings yet

- Lecture 7 - Other Percentage TaxDocument3 pagesLecture 7 - Other Percentage TaxJeffrey BionaNo ratings yet

- Chapter 11 AISDocument4 pagesChapter 11 AISMyka ManalotoNo ratings yet

- Chapter 28 AnsDocument9 pagesChapter 28 AnsDave ManaloNo ratings yet

- Quiz 1Document11 pagesQuiz 1VIRGIL KIT AUGUSTIN ABANILLANo ratings yet

- Lump Sum LiquidationDocument3 pagesLump Sum LiquidationJose Mariano MelendezNo ratings yet

- Allowable Deductions Part 1Document3 pagesAllowable Deductions Part 1John Rich GamasNo ratings yet

- MOD2 Corporate LiquidationDocument4 pagesMOD2 Corporate LiquidationJasper Andrew AdjaraniNo ratings yet

- Corporate Liquidation (Integration) PDFDocument5 pagesCorporate Liquidation (Integration) PDFCatherine Simeon100% (1)

- Preferential TaxationDocument9 pagesPreferential TaxationMNo ratings yet

- Problems: Problem 4 - 1Document4 pagesProblems: Problem 4 - 1KioNo ratings yet

- Accounting for Governmental Entities ExamDocument4 pagesAccounting for Governmental Entities ExamKarla OñasNo ratings yet

- Answers To Assignement 1 Period 3Document16 pagesAnswers To Assignement 1 Period 3trishaNo ratings yet

- Banking Assignment No. 4Document3 pagesBanking Assignment No. 4Rossette AnasarioNo ratings yet

- 04.1 S4 VAT PPT AquinoDocument112 pages04.1 S4 VAT PPT Aquinosaeloun hrdNo ratings yet

- Activity 6 - EthicsDocument2 pagesActivity 6 - EthicsGwy HipolitoNo ratings yet

- 1Document6 pages1Marinel FelipeNo ratings yet

- Taxation: Multiple ChoiceDocument16 pagesTaxation: Multiple ChoiceJomar VillenaNo ratings yet

- Liabilities: Legal Obligation Constructive Obligation A. Legal Obligation B. Constructive ObligationDocument40 pagesLiabilities: Legal Obligation Constructive Obligation A. Legal Obligation B. Constructive Obligationmaria isabellaNo ratings yet

- ACC117-CON09 Module 3 ExamDocument16 pagesACC117-CON09 Module 3 ExamMarlon LadesmaNo ratings yet

- Chapter 6 Financial AssetsDocument6 pagesChapter 6 Financial AssetsJoyce Mae D. FloresNo ratings yet

- Nonprofit Organization Cash FlowsDocument6 pagesNonprofit Organization Cash FlowsCresca Cuello CastroNo ratings yet

- Mixed PDFDocument8 pagesMixed PDFChris Tian FlorendoNo ratings yet

- Business TaxesDocument47 pagesBusiness TaxesJoyce MorganNo ratings yet

- LawDocument5 pagesLawJhunnel LangubanNo ratings yet

- Business Law MidtermsDocument16 pagesBusiness Law MidtermsLory McmorryNo ratings yet

- La Consolacion College Manila Managerial Accounting 1 QuizDocument5 pagesLa Consolacion College Manila Managerial Accounting 1 QuizDeniece RonquilloNo ratings yet

- DagohoyDocument6 pagesDagohoylinkin soyNo ratings yet

- Exempt Sale of Goods Properties and Services NotesDocument2 pagesExempt Sale of Goods Properties and Services NotesSelene DimlaNo ratings yet

- Part 2 Oblig and Contracts PDFDocument13 pagesPart 2 Oblig and Contracts PDFMichelle PepitoNo ratings yet

- Assessment Current LiabilitiesDocument6 pagesAssessment Current LiabilitiesEdward Glenn BaguiNo ratings yet

- Donor's TaxDocument25 pagesDonor's TaxMark Erick Acojido RetonelNo ratings yet

- Tax ReviewerDocument22 pagesTax ReviewercrestagNo ratings yet

- Revenues and Other ReceiptsDocument4 pagesRevenues and Other ReceiptsWawex DavisNo ratings yet

- TOA03 04 Leases Income Tax Employee Benefits CharlenesDocument3 pagesTOA03 04 Leases Income Tax Employee Benefits CharlenesMerliza JusayanNo ratings yet

- Afar NotesDocument20 pagesAfar NotesChristian James Umali BrionesNo ratings yet

- Estate Tax Assignment 1Document2 pagesEstate Tax Assignment 1Heavenly Joy CuaresmaNo ratings yet

- Quiz 1 - Business CombiDocument6 pagesQuiz 1 - Business CombiKaguraNo ratings yet

- Handout 1 - Nonprofit Organizations - RevisedDocument10 pagesHandout 1 - Nonprofit Organizations - RevisedPaupauNo ratings yet

- Mostafa Fouda98Document9 pagesMostafa Fouda98deepak1818No ratings yet

- Audit Working Papers TitleDocument1 pageAudit Working Papers TitleJadeNo ratings yet

- Notes On BP22 Atty. DomingoDocument2 pagesNotes On BP22 Atty. Domingothalia alfaroNo ratings yet

- MODULE 2 CVP AnalysisDocument8 pagesMODULE 2 CVP Analysissharielles /No ratings yet

- Cagayan State University Aparri, Cagayan: Preliminary Examination - Transfer and Business Tax IDocument3 pagesCagayan State University Aparri, Cagayan: Preliminary Examination - Transfer and Business Tax IJenelyn BeltranNo ratings yet

- Auditing Expenditure Cycle Chapter 10Document12 pagesAuditing Expenditure Cycle Chapter 10Wendelyn TutorNo ratings yet

- tAX FINALSDocument8 pagestAX FINALSAmie Jane MirandaNo ratings yet

- Auditing Theory Answer Key 6Document3 pagesAuditing Theory Answer Key 6Jasper GicaNo ratings yet

- Service Concession Arrangements: IFRIC Interpretation 12Document7 pagesService Concession Arrangements: IFRIC Interpretation 12Tanvir PrantoNo ratings yet

- Ifric 12Document7 pagesIfric 12J Satya SarawanaNo ratings yet

- International AccountingDocument11 pagesInternational AccountingJOLLYBEL ROBLES0% (1)

- Service Concession AgreementDocument31 pagesService Concession AgreementvorapratikNo ratings yet

- Accounting For Build Operate TransferDocument8 pagesAccounting For Build Operate TransferDanielle MarundanNo ratings yet

- 6 Service Concession Arrangements PDFDocument2 pages6 Service Concession Arrangements PDFGayle LalloNo ratings yet

- Knights EndorsementDocument1 pageKnights EndorsementGayle LalloNo ratings yet

- Practicum Training EvaluationDocument2 pagesPracticum Training EvaluationGayle LalloNo ratings yet

- 8 Wasting Assets PDFDocument2 pages8 Wasting Assets PDFGayle LalloNo ratings yet

- 5 Insurance Contracts PDFDocument3 pages5 Insurance Contracts PDFGayle LalloNo ratings yet

- General Principles of Taxation Power of Cir PDFDocument16 pagesGeneral Principles of Taxation Power of Cir PDFGayle LalloNo ratings yet

- 8 Wasting Assets PDFDocument2 pages8 Wasting Assets PDFGayle LalloNo ratings yet

- Handout 2 - Law On Contract RFBT ReviewDocument14 pagesHandout 2 - Law On Contract RFBT ReviewGayle LalloNo ratings yet

- SRO Prospectus 2015 PDFDocument327 pagesSRO Prospectus 2015 PDFGayle LalloNo ratings yet

- 03 Quiz Bee p1 and Toa ClincherDocument2 pages03 Quiz Bee p1 and Toa ClincherHadassahFayNo ratings yet

- 5 Insurance Contracts PDFDocument3 pages5 Insurance Contracts PDFGayle LalloNo ratings yet

- Agriculture Agricultural Produce Biological Asset Bearer PlantDocument2 pagesAgriculture Agricultural Produce Biological Asset Bearer PlantGayle LalloNo ratings yet

- Law On Obligations5632097216615024961 PDFDocument7 pagesLaw On Obligations5632097216615024961 PDFGayle LalloNo ratings yet

- Test Bank Law 1 CparDocument26 pagesTest Bank Law 1 CparJoyce Kay Azucena73% (22)

- CamScanner Scans PDFs QuicklyDocument4 pagesCamScanner Scans PDFs QuicklyGayle LalloNo ratings yet

- Government Accounting Manual AcknowledgementDocument493 pagesGovernment Accounting Manual Acknowledgementnicah100% (1)

- ACCA SBR Notes - AsraDocument69 pagesACCA SBR Notes - AsraReem JavedNo ratings yet

- PFRS for Small Entities at a GlanceDocument49 pagesPFRS for Small Entities at a GlanceJerico CelesteNo ratings yet

- Intermediate AccountingDocument7 pagesIntermediate AccountingMelissa Kayla Maniulit100% (1)

- Legend - Docx 1Document101 pagesLegend - Docx 1Juberlina CerbitoNo ratings yet

- Ata Khan & Co. Chartered Accountants Auditors' Report To The Shareholders of H.R. Textile Mills LimitedDocument19 pagesAta Khan & Co. Chartered Accountants Auditors' Report To The Shareholders of H.R. Textile Mills Limitedkhurshid topuNo ratings yet

- T or F FARDocument5 pagesT or F FARChjxksjsgskNo ratings yet

- Research The Usefulness and Limitations of The THREE (3) Accounting Concepts AboveDocument1 pageResearch The Usefulness and Limitations of The THREE (3) Accounting Concepts AboveCathy limNo ratings yet

- Chapter 2 AccountingDocument71 pagesChapter 2 AccountingBen Soderholm50% (2)

- BAC 200 Accounting For AssetsDocument90 pagesBAC 200 Accounting For AssetsFaith Ondieki100% (3)

- CPA Chapter 4 FAR Notes Inventories & CA/CLDocument5 pagesCPA Chapter 4 FAR Notes Inventories & CA/CLjklein2588No ratings yet

- Tax Faculty - Seminar On Tax Impl of IFRS - Taiwo OyedeleDocument58 pagesTax Faculty - Seminar On Tax Impl of IFRS - Taiwo OyedeleLegogie Moses AnoghenaNo ratings yet

- Financial Reporting Conceptual Framework of Financial Accounting KeyDocument13 pagesFinancial Reporting Conceptual Framework of Financial Accounting KeySteffNo ratings yet

- Discussion QuestionsDocument34 pagesDiscussion QuestionsCarlos arnaldo lavadoNo ratings yet

- Accounting Principles Volume 1 Canadian 7th Edition Geygandt Solutions ManualDocument92 pagesAccounting Principles Volume 1 Canadian 7th Edition Geygandt Solutions Manualchadthedad15No ratings yet

- Ifr-Apc 311Document8 pagesIfr-Apc 311hkndarshanaNo ratings yet

- Consolidation 2Document5 pagesConsolidation 2Tay?No ratings yet

- Patent ValuationDocument11 pagesPatent ValuationAkhil JainNo ratings yet

- GAAP: Generally Accepted Accounting PrinciplesDocument7 pagesGAAP: Generally Accepted Accounting PrinciplesTAI LONGNo ratings yet

- Receivables: Accounts ReceivableDocument2 pagesReceivables: Accounts ReceivableKristalen ArmandoNo ratings yet

- Theory of Accounts Accounting Standards BasicDocument12 pagesTheory of Accounts Accounting Standards BasicKimi No NawaNo ratings yet

- Summative Test Fabm 11Document5 pagesSummative Test Fabm 11Rey Kian Miguel MengulloNo ratings yet

- PROJECT REPORT ON AViva LIFE INSURANCEDocument62 pagesPROJECT REPORT ON AViva LIFE INSURANCEMayank100% (12)

- Market Value Vs Historical CostDocument6 pagesMarket Value Vs Historical Costassime_hNo ratings yet

- Accounting Theory Summary NotesDocument28 pagesAccounting Theory Summary NotesOlly Taina100% (1)

- Scott Financial Accounting Theory Chapter 2Document18 pagesScott Financial Accounting Theory Chapter 2Diny Fariha ZakhirNo ratings yet

- New Introductory Accounting Part 1Document39 pagesNew Introductory Accounting Part 1Aufa HabibieNo ratings yet

- 1575 Tania SultanaDocument34 pages1575 Tania SultanaTania SultanaNo ratings yet

- Test Bank For Financial Reporting Financial Statement Analysis and Valuation A Strategic Perspective 7th Edition Wahlen, Baginski, BradshawDocument33 pagesTest Bank For Financial Reporting Financial Statement Analysis and Valuation A Strategic Perspective 7th Edition Wahlen, Baginski, Bradshawa415878694No ratings yet

- Accounting Standard 5-8Document36 pagesAccounting Standard 5-8Aseem1No ratings yet

- Basic Accounting For BSBA: Chapter 1Document9 pagesBasic Accounting For BSBA: Chapter 1Cyro Kam SaragponNo ratings yet