0% found this document useful (0 votes)

1K views1 pagePension Calculation

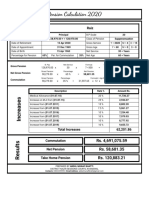

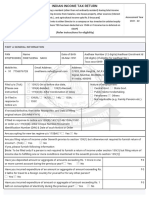

This document contains the pension calculation details for Raiz, who retired as Principal on April 15, 2020 after 30 years of service. His gross pension is calculated to be Rs. 90,279 based on his last pay of Rs. 128,970. After applying the percentage for pension of 65%, his net pension is Rs. 58,681.35. He is also eligible for commutation of Rs. 31,597.65, totaling Rs. 4,691,075.59. Additional allowances including medical allowance and increases total Rs. 62,201.86. Therefore, Raiz's total take home pension is Rs. 120,883.21.

Uploaded by

Ahmad FarhanCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

1K views1 pagePension Calculation

This document contains the pension calculation details for Raiz, who retired as Principal on April 15, 2020 after 30 years of service. His gross pension is calculated to be Rs. 90,279 based on his last pay of Rs. 128,970. After applying the percentage for pension of 65%, his net pension is Rs. 58,681.35. He is also eligible for commutation of Rs. 31,597.65, totaling Rs. 4,691,075.59. Additional allowances including medical allowance and increases total Rs. 62,201.86. Therefore, Raiz's total take home pension is Rs. 120,883.21.

Uploaded by

Ahmad FarhanCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd