Professional Documents

Culture Documents

10 Aggregate Expenditures Model

Uploaded by

catherine tucayCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

10 Aggregate Expenditures Model

Uploaded by

catherine tucayCopyright:

Available Formats

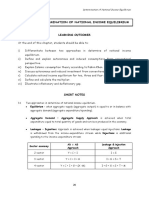

ECON 2 PRINCIPLES OF ECONOMICS 2

THE AGGREGATE EXPENDITURES MODEL

Lesson 10

Aggregate Expenditures (AE) Model At GDP levels above equilibrium, AE will be less

Also known as Keynesian Cross model than GDP; businesses will have unsold, unplanned

Keynes developed this model during the Great inventory investment and will cut back rates of

Depression of the 1930s and it can help explain how production. As GDP declines, the number of jobs

modern economies adjust to economic shocks and total income will also decline until equilibrium is

Helps address 2 questions: (1) What determines the reached

level of GDP? (2) What causes GDP to rise and Other Features of Equilibrium GDP

fall? 1) Savings and planned investment are equal

Assumptions and Simplifications Saving is a “leakage” or withdrawal of spending

1) Not at full employment from the circular flow of income and

2) Prices are fixed expenditures

3) GDP = DI Some output is planned for business

4) Begin with private, closed economy (no investment, not consumer consumption, so this

government, no trade) investment spending (or “injection” of spending

into the circular flow) can replace the leakage

Tools for Aggregate Expenditures Theory:

due to saving

Consumption and Investment Schedules

2) In equilibrium, there are no unplanned changes in

In a closed private economy, there are two inventory

components of aggregate expenditures (AE):

Changes in Equilibrium GDP and the Multiplier

Consumption (C) and Gross Private Investment (Ig).

Consumption Schedule (C) - refer to previous lesson

Investment Schedule (Ig)

Shows the amount that businesses plan to invest at

different levels of GDP

Assume investment is independent of GDP;

investment is constant at all GDP levels

Equilibrium GDP in a Closed Private Economy = C + Ig

In a closed private economy, the equilibrium GDP

will change in response to changes in either the

investment schedule or the consumption schedule

If the expected rate of return on investment rises or

that the interest rate falls such that investment

spending increases, the investment schedule will

shift upward, which in turn increases AE and raises

equilibrium GDP

If the expected rate of return on investment

decreases, or if the interest rate rises, investment

The level of output whose production will create spending will decline, which will show as a

total spending just sufficient to purchase that output downward shift in the investment schedule, and a

At GDP levels below equilibrium, businesses will downward shift of the AE schedule; as a result,

adjust to excess demand revealed by declining equilibrium GDP will fall

inventories by expanding production

Adding Net Exports and International Trade

INSTRUCTOR: NIÑA MAE BIANCA J. MARTIN LESSON 10

PAGE 1

ECON 2 PRINCIPLES OF ECONOMICS 2

Net exports (Xn = X – M) affect aggregate Adding the Public Sector: Government Purchases

expenditures in an open private economy Increases in government spending boost aggregate

Exports expand and imports contract aggregate expenditures

spending on domestic output Government spending is subject to the multiplier

Exports (X) create domestic production, income,

and employment due to foreign spending on

domestically produced goods & services

Imports (M) reduce the sum of consumption &

investment expenditures by the amount expended

on imported goods, so this figure must be

subtracted so as not to overstate aggregate

expenditures on domestically produced goods &

services

Impact of Net Exports on Equilibrium GDP

Taxes reduce DI and, therefore, consumption &

saving at each level of GDP

An increase in taxes will lower the aggregate

expenditures schedule & reduce the equilibrium

GDP

At equilibrium GDP, the sum of leakages equals the

sum of injections

o Saving (SA) + Import (M) + Taxes (T) =

Investment (IG)+ Exports (X) + Government

Purchases (G)

If G & T are each increased by a particular amount,

Positive net exports increase aggregate

the equilibrium level of real output will rise by the

expenditures beyond what they would be in a closed

same amount

economy & thus have the effect of expansion

Negative net exports decrease aggregate

expenditures beyond what they would be in a closed

economy & thus have the effect of contraction

The multiplier effect is also at work in both

scenarios

International Economic Linkages

Prosperity abroad generally raises our exports &

transfers some of their prosperity to us (Recession

abroad has the reverse effect)

Tariffs on products may reduce our exports &

depress our economy, causing us to retaliate and

worsen the situation. Trade barriers in the 1930s

contributed to the Great Depression

Depreciation of the dollar lowers the cost of

American goods to foreigners and encourages

exports from the U.S. while discouraging the Equilibrium versus Full-Employment GDP

purchase of imports in the U.S. This could lead to a A recessionary expenditure gap exists when

higher real GDP or to inflation, depending on the equilibrium GDP is below full-employment

domestic employment situation. Appreciation of the

dollar could have the opposite impact.

INSTRUCTOR: NIÑA MAE BIANCA J. MARTIN LESSON 10

PAGE 2

ECON 2 PRINCIPLES OF ECONOMICS 2

An inflationary expenditure gap exists when

aggregate expenditures exceed full-employment

GDP

INSTRUCTOR: NIÑA MAE BIANCA J. MARTIN LESSON 10

PAGE 3

You might also like

- Answer:: The Aggregate Expenditures Model QuestionsDocument19 pagesAnswer:: The Aggregate Expenditures Model Questions张敏然No ratings yet

- Parkinmacro11 (28) 1200Document19 pagesParkinmacro11 (28) 1200nikowawa100% (1)

- Chapter Nine The Aggregate Expenditures ModelDocument9 pagesChapter Nine The Aggregate Expenditures Modelspectrum_484372No ratings yet

- Econ102 - Ch27Document50 pagesEcon102 - Ch27janeNo ratings yet

- Macroeconomics 13th Edition Parkin Solutions ManualDocument19 pagesMacroeconomics 13th Edition Parkin Solutions Manualdencuongpow5100% (27)

- Content Note H1 (SC) - ADAS Model & DeterminantsDocument9 pagesContent Note H1 (SC) - ADAS Model & DeterminantsDavid LimNo ratings yet

- Week 4 Economics Graded AssignmentDocument14 pagesWeek 4 Economics Graded AssignmentJackie TaylorNo ratings yet

- Chapter 8 Notes Aggregate Expenditure ModelDocument14 pagesChapter 8 Notes Aggregate Expenditure ModelBeatriz CanchilaNo ratings yet

- Expenditure Multipliers: The Keynesian Model: Economics 102 Jack WuDocument25 pagesExpenditure Multipliers: The Keynesian Model: Economics 102 Jack WuhongphakdeyNo ratings yet

- CH 28 Expenditure Multipliers The Keynesian ModelDocument58 pagesCH 28 Expenditure Multipliers The Keynesian Modelanamshirjeel100% (2)

- Chapter 14Document8 pagesChapter 14bellavdbergNo ratings yet

- Parkinmacro11 1300Document19 pagesParkinmacro11 1300Mr. JahirNo ratings yet

- Shaivi Shah - 203 - Fybaf - EconomicsDocument10 pagesShaivi Shah - 203 - Fybaf - EconomicsJamia MilaNo ratings yet

- SUPPLY AND DEMANd + APPLICATIONSDocument35 pagesSUPPLY AND DEMANd + APPLICATIONSannsaralondeNo ratings yet

- Solution Manual Macroeconomics Robert J Gordon The Answers From The Book On Both The Questions and The Problems Chapter 3Document6 pagesSolution Manual Macroeconomics Robert J Gordon The Answers From The Book On Both The Questions and The Problems Chapter 3Eng Hinji RudgeNo ratings yet

- Session 2Document17 pagesSession 2ZHANG EmilyNo ratings yet

- Prepared By: RSEL Samuelson & Nordhaus. Economics. 17 Ed. Chapter 24Document35 pagesPrepared By: RSEL Samuelson & Nordhaus. Economics. 17 Ed. Chapter 24annsaralondeNo ratings yet

- EconomicsDocument17 pagesEconomicschiaraghezNo ratings yet

- How Change in Income Will Affect Total SpendingDocument40 pagesHow Change in Income Will Affect Total SpendingDeepak DogupartiNo ratings yet

- Income and Expenditure: Topic 2: NMPDocument42 pagesIncome and Expenditure: Topic 2: NMPvsyoiNo ratings yet

- Theme 8 MultiplierDocument18 pagesTheme 8 MultiplierNadineNo ratings yet

- Tme 8ed WB Ch02 AnswersDocument4 pagesTme 8ed WB Ch02 AnswersKadbury ChocolateNo ratings yet

- Felicia Irene - Week 3Document16 pagesFelicia Irene - Week 3felicia ireneNo ratings yet

- Determination of GDP in The Short RunDocument38 pagesDetermination of GDP in The Short Runhhhhhhhuuuuuyyuyyyyy0% (1)

- Acroeconomic IMS: U NY SDocument11 pagesAcroeconomic IMS: U NY SHitisha agrawalNo ratings yet

- Expenditure Multipliers: ("Notes 7" - Comes After Chapter 6)Document57 pagesExpenditure Multipliers: ("Notes 7" - Comes After Chapter 6)hongphakdeyNo ratings yet

- CH - 13, 14 and 15 (Solved Booklet Page)Document14 pagesCH - 13, 14 and 15 (Solved Booklet Page)Rumana AliNo ratings yet

- Econ6049 Economic Analysis, S1 2021: Week 8: Unit 13 - Economic Fluctuations and UnemploymentDocument27 pagesEcon6049 Economic Analysis, S1 2021: Week 8: Unit 13 - Economic Fluctuations and UnemploymentTom WongNo ratings yet

- Overview of Economic DevelopmentDocument35 pagesOverview of Economic Developmentmiggyespinonoza12345No ratings yet

- Copia de Principles of Economics, Chapter 22 SummaryDocument5 pagesCopia de Principles of Economics, Chapter 22 SummaryMariaDeLosAngelesPachecoRuizNo ratings yet

- Chap 010Document12 pagesChap 010Nagah SalmanNo ratings yet

- l1 Ec Rsheets b2Document1 pagel1 Ec Rsheets b2eloise.vernierNo ratings yet

- Income and Expenditure: Krugman/WellsDocument43 pagesIncome and Expenditure: Krugman/WellsSumair S.No ratings yet

- Lec 4 (Expenditure Multipliers and Keynesian Model - CH 28)Document58 pagesLec 4 (Expenditure Multipliers and Keynesian Model - CH 28)AbdulNo ratings yet

- Investopedia Gross Domestic Product (GDP) DefinitionDocument20 pagesInvestopedia Gross Domestic Product (GDP) DefinitionAllenNo ratings yet

- 2.2.1 The Characteristics of ADDocument25 pages2.2.1 The Characteristics of AD18kchohanNo ratings yet

- CHAPTER 3pdf - 211118 - 130431Document21 pagesCHAPTER 3pdf - 211118 - 130431Amalin IlyanaNo ratings yet

- Unit 13 - Economic Fluctuations and Unemployment - 1.0Document35 pagesUnit 13 - Economic Fluctuations and Unemployment - 1.0Georgius Yeremia CandraNo ratings yet

- Ational Ncome Ccounting: Focus of The ChapterDocument14 pagesAtional Ncome Ccounting: Focus of The ChapterJITIN ARORANo ratings yet

- Summary Moneter CH 5Document10 pagesSummary Moneter CH 5Kadek Indah Dwi CahyaniNo ratings yet

- Economics: 6 Edition, Global EditionDocument52 pagesEconomics: 6 Edition, Global Editionhk nutrintentNo ratings yet

- Econotes 8 - Measuring Economic ActivityDocument4 pagesEconotes 8 - Measuring Economic ActivityTumblr_userNo ratings yet

- Econ ch31 NotesDocument2 pagesEcon ch31 NotesPaige BurgosNo ratings yet

- Gross Domestic Product (GDP) Is The: 1 Chapter TwoDocument15 pagesGross Domestic Product (GDP) Is The: 1 Chapter TwoAnikNo ratings yet

- Guided Notes Unit 5 - Macroeconomics - Economic Challenges, GDP and Growth, and LaborDocument4 pagesGuided Notes Unit 5 - Macroeconomics - Economic Challenges, GDP and Growth, and LaborNicols FleurismaNo ratings yet

- Microsoft Word Solution Chapter 28Document18 pagesMicrosoft Word Solution Chapter 28groniganNo ratings yet

- Chapter 10 Final PDFDocument39 pagesChapter 10 Final PDFJohn Vincent GaligaoNo ratings yet

- How The Macroeconomy Works The Circular Flow of Income Aggregate Demandaggregate Supply Analysis and Related ConceptsDocument21 pagesHow The Macroeconomy Works The Circular Flow of Income Aggregate Demandaggregate Supply Analysis and Related Conceptsamjad sittarNo ratings yet

- Macroeconomics NotesDocument5 pagesMacroeconomics NotesJulian SerhanNo ratings yet

- CH 8 Lecture and Textbook NotesDocument9 pagesCH 8 Lecture and Textbook Notes47fwhvhc6kNo ratings yet

- Inflationary GapDocument2 pagesInflationary GapJaycel BayronNo ratings yet

- Chap 2.newDocument25 pagesChap 2.newM Hassan MasoodNo ratings yet

- Intro To Macroeconomics and GDP Problem Set Answer KeyDocument5 pagesIntro To Macroeconomics and GDP Problem Set Answer KeySid JhaNo ratings yet

- 04 Business Cycles2Document13 pages04 Business Cycles2Zhi HaoNo ratings yet

- What Is Aggregate DemandqwertDocument8 pagesWhat Is Aggregate DemandqwertShahana KhanNo ratings yet

- UNIT 4 Short Run FluctuationsDocument81 pagesUNIT 4 Short Run Fluctuationsvaishushukla16No ratings yet

- Ma Econ Pol 2Document81 pagesMa Econ Pol 2Edimarf SatumboNo ratings yet

- What Is Aggregate DemandqwertDocument9 pagesWhat Is Aggregate DemandqwertShahana KhanNo ratings yet

- Summary of David A. Moss's A Concise Guide to Macroeconomics, Second EditionFrom EverandSummary of David A. Moss's A Concise Guide to Macroeconomics, Second EditionNo ratings yet

- Body Systems Interactions ChartDocument5 pagesBody Systems Interactions Chartapi-293216402100% (1)

- Permutation and CombinationDocument2 pagesPermutation and Combinationcatherine tucayNo ratings yet

- Example: Probability Is The Measure of How Likely An Event IsDocument5 pagesExample: Probability Is The Measure of How Likely An Event Iscatherine tucayNo ratings yet

- FUNDAMENTAL COUNTING PRINCIPLE: Multiplication RuleDocument2 pagesFUNDAMENTAL COUNTING PRINCIPLE: Multiplication Rulecatherine tucayNo ratings yet

- Lit in The Spanish PeriodDocument3 pagesLit in The Spanish Periodcatherine tucayNo ratings yet

- At 107 Audit ReportDocument10 pagesAt 107 Audit Reportcatherine tucayNo ratings yet

- Relation As Any Set of Ordered Pairs. in The Context of Algebra, The Relations of Interest Are Sets ofDocument15 pagesRelation As Any Set of Ordered Pairs. in The Context of Algebra, The Relations of Interest Are Sets ofcatherine tucayNo ratings yet

- Lit in The Spanish PeriodDocument3 pagesLit in The Spanish Periodcatherine tucayNo ratings yet

- Math 4 Overview of StatisticsDocument2 pagesMath 4 Overview of Statisticscatherine tucayNo ratings yet

- The Management of OrganizationDocument4 pagesThe Management of Organizationcatherine tucayNo ratings yet

- Philippine Literature (Lit 1) Lesson 1. Introduction To The Study of Literature LiteratureDocument6 pagesPhilippine Literature (Lit 1) Lesson 1. Introduction To The Study of Literature Literaturecatherine tucayNo ratings yet

- Economic Growth: Econ 2 Principles of Economics 2Document2 pagesEconomic Growth: Econ 2 Principles of Economics 2catherine tucayNo ratings yet

- 08 Business Cycles, Unemployment, InflationDocument3 pages08 Business Cycles, Unemployment, Inflationcatherine tucayNo ratings yet

- A Priori and A Posteriori Knowledge: A Priori Knowledge Is Knowledge That Is Known Independently of Experience (That IsDocument7 pagesA Priori and A Posteriori Knowledge: A Priori Knowledge Is Knowledge That Is Known Independently of Experience (That Ispiyush_maheshwari22No ratings yet

- 12 - Chepter 5Document11 pages12 - Chepter 5KhaireddineNo ratings yet

- Music and Yoga Are Complementary To Each OtherDocument9 pagesMusic and Yoga Are Complementary To Each OthersatishNo ratings yet

- Chapter 2 The Development of Evolutionary TheoryDocument5 pagesChapter 2 The Development of Evolutionary TheoryjohnNo ratings yet

- Neonatal HypothermiaDocument8 pagesNeonatal Hypothermiamia liaNo ratings yet

- Physics 715 HW 1Document13 pagesPhysics 715 HW 1Antonildo PereiraNo ratings yet

- Expt Lipid - Influence of Bile in The Action of LipaseDocument3 pagesExpt Lipid - Influence of Bile in The Action of LipaseAngela CaguitlaNo ratings yet

- Discovering JerusalemDocument134 pagesDiscovering JerusalemDzhel DezjayNo ratings yet

- Uber+PM+Prioritisation+Assignment+Submission+File-Shashank KaranthDocument6 pagesUber+PM+Prioritisation+Assignment+Submission+File-Shashank KaranthShashank KaranthNo ratings yet

- But Flee Youthful Lusts - pdf2Document2 pagesBut Flee Youthful Lusts - pdf2emmaboakye2fNo ratings yet

- Cement Grouted Rock BoltsDocument28 pagesCement Grouted Rock BoltsBhaskar ReddyNo ratings yet

- MikroC PRO For DsPIC30Document9 pagesMikroC PRO For DsPIC30ivcal20No ratings yet

- What Is An Aesthetic Experience?Document11 pagesWhat Is An Aesthetic Experience?geoffhockleyNo ratings yet

- B737 AutothrottleDocument103 pagesB737 AutothrottleZaw100% (1)

- Screen 2014 Uricchio 119 27Document9 pagesScreen 2014 Uricchio 119 27NazishTazeemNo ratings yet

- VW 60330 2009 12 eDocument29 pagesVW 60330 2009 12 eAmir Borhanipour100% (1)

- ECON 211: Principles of Macroeconomics-901: Smhussain@vcu - EduDocument6 pagesECON 211: Principles of Macroeconomics-901: Smhussain@vcu - EdusshinnNo ratings yet

- Answerkey Precise ListeningDocument26 pagesAnswerkey Precise ListeningAn LeNo ratings yet

- The Positive and Negative Impact of Inclusive LeadershipDocument9 pagesThe Positive and Negative Impact of Inclusive LeadershipAmbreen ZainebNo ratings yet

- Sociology Internal AssessmentDocument21 pagesSociology Internal AssessmentjavoughnNo ratings yet

- ECN 331 Fall 2018 SyllabusDocument6 pagesECN 331 Fall 2018 SyllabusDat BoiNo ratings yet

- Alien Bestiary PDFDocument450 pagesAlien Bestiary PDFDũng Lê100% (13)

- S.NO. Students Name Contact Number CAP 10TH: Ideal Institute of Pharamacy, Wada SESSION-2020-21Document12 pagesS.NO. Students Name Contact Number CAP 10TH: Ideal Institute of Pharamacy, Wada SESSION-2020-21DAMBALENo ratings yet

- Bubbles in Transformer Oil Dynamic Behavior Internal Discharge and Triggered Liquid BreakdownDocument9 pagesBubbles in Transformer Oil Dynamic Behavior Internal Discharge and Triggered Liquid BreakdownMuhammad Irfan NazhmiNo ratings yet

- If Else ExercisesDocument5 pagesIf Else ExercisesHoney Jean PerezNo ratings yet

- Docs Grails Org 4 0 0 Guide Single HTMLDocument296 pagesDocs Grails Org 4 0 0 Guide Single HTMLlicface13No ratings yet

- Julia Kristeva IntroDocument7 pagesJulia Kristeva IntroShweta SoodNo ratings yet

- Mum LatecityDocument14 pagesMum LatecityGkiniNo ratings yet

- Predicates and ArgumentsDocument4 pagesPredicates and ArgumentsOanh NguyễnNo ratings yet

- Machine Design Key 2014Document15 pagesMachine Design Key 2014SouvikDasNo ratings yet