Professional Documents

Culture Documents

Revision PDF

Uploaded by

Navin N Meenakshi ChandraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Revision PDF

Uploaded by

Navin N Meenakshi ChandraCopyright:

Available Formats

Part 1

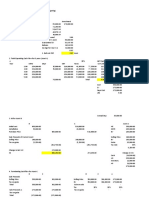

Cost of new oven $ 30,500.00

+ installed cost $ 1,500.00

Total installed cost $ 32,000.00

Proceeds from sale of old oven $ 22,000.00

Less tax on sale of old oven

Sale Price $ 22,000.00

Less BV (1-0.2-0.32-0.192) x $20,000 $ 5,760.00

Gain on sale of existing washer $ 16,240.00

x tax rate 0.40

Tax on sale of existing washer $ 6,496.00

After tax proceeds from sale of existing washer (15,504.00)

INITIAL CASH OUTFLOW $ 16,496.00 *Page 323 the after tax cash inflow from the disposal of the

existing machine is deducted from the installed cost of the

new machine

Depreciation /new Oven

5 year Installed cost Depreciation

20 32,000 $ 6,400.00

32 32,000 $ 10,240.00

19.2 32,000 $ 6,144.00

11.52 32,000 $ 3,686.40

11.52 32,000 $ 3,686.40

5.76 32,000 $ 1,843.20

Total $ 32,000.00

New Oven Year 1 2 3 4 5 6

Sales 300,000 300,000 300,000 300,000 300,000 -

-Expenses (288,000) (288,000) (288,000) (288,000) (288,000) 0

-depreciation (6,400) (10,240) (6,144) (3,686) (3,686) $ (1,843.20)

Taxable Income 5,600.0 1,760.0 5,856.0 8,313.6 8,313.6 (1,843.2)

-taxes (40%) (2,240.0) (704.0) (2,342.4) (3,325.4) (3,325.4) 737.3

Earnings 3,360.00 1,056.00 3,513.60 4,988.16 4,988.16 (1,105.92)

Incremental op. CF's 9,760.0 11,296.0 9,657.6 8,674.6 8,674.6 737.3

Depreciation Old Oven

5 year Installed cost Depreciation

20 $ 20,000.00 $ 4,000.00

32 $ 20,000.00 $ 6,400.00

19.2 $ 20,000.00 $ 3,840.00 Note that the first 3 years of depreciation have already

11.52 $ 20,000.00 $ 2,304.00 been taken on the old oven

11.52 $ 20,000.00 $ 2,304.00

5.76 $ 20,000.00 $ 1,152.00

$ 20,000.00

Old Oven 1 2 3 4 5 6

Sales 270,000 270,000 270,000 270,000 270,000 -

-Expenses (264,000) (264,000) (264,000) (264,000) (264,000) -

-depreciation (2,304) (2,304) (1,152) - - -

Taxable Income 3,696.0 3,696.0 4,848.0 6,000.0 6,000.0 -

-taxes (40%) (1,478.40) (1,478.40) (1,939.20) (2,400.00) (2,400.00) -

Earnings 2,217.60 2,217.60 2,908.80 3,600.00 3,600.00 -

Incremental op. CF's 4,521.60 4,521.60 4,060.80 3,600.00 3,600.00 -

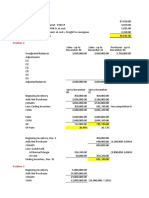

Part D

Year 0 1 2 3 4 5

Initial Outflow $ (16,496.00)

Incremental Cashflow 5,238.40 6,774.40 5,596.80 5,074.56 5,074.56

D/F 1 0.9091 0.8264 0.7513 0.6830 0.6209

PV Cashflow $ (16,496.00) $ 4,762.18 $ 5,598.68 $ 4,204.96 $ 3,465.99 $ 3,150.90

NPV $ 4,686.71

The existing oven should be changed because it increases shareholders wealth or firms wealth by $4,686.71

You might also like

- Ice Cream Shop Feasibility StudyDocument45 pagesIce Cream Shop Feasibility StudyCamille Jane Roan EsporlasNo ratings yet

- Practice Set - Alfresco Marketing WorksheetDocument4 pagesPractice Set - Alfresco Marketing WorksheetAdrian SaplalaNo ratings yet

- Accounting 1 2 PractisetDocument10 pagesAccounting 1 2 PractisetShania MoralesNo ratings yet

- Minicaso Bethesda Mining CompanyDocument8 pagesMinicaso Bethesda Mining CompanySebastián OrtizNo ratings yet

- For Domestic Corporations: 1. Salient Features of The CREATE LawDocument6 pagesFor Domestic Corporations: 1. Salient Features of The CREATE LawJean Tomugdan100% (1)

- Pilsudski Coal Company-Self-correction Problems-Capital Budgeting and Estimating Cash FlowsDocument1 pagePilsudski Coal Company-Self-correction Problems-Capital Budgeting and Estimating Cash FlowsRajib Dahal50% (2)

- ACCTG - Worksheet Quality AutoDocument1 pageACCTG - Worksheet Quality AutoCab Vic100% (1)

- Continental Carriers IncDocument7 pagesContinental Carriers IncYetunde JamesNo ratings yet

- Lasting Impressions CompanyDocument5 pagesLasting Impressions CompanyNadya Azzura100% (1)

- More Cash Flow ExercisesDocument4 pagesMore Cash Flow ExercisesLorenzodeLunaNo ratings yet

- Complete Investment Appraisal - 2Document7 pagesComplete Investment Appraisal - 2Reagan SsebbaaleNo ratings yet

- Cleaners WorksheetDocument1 pageCleaners WorksheetSeijuro Akashi100% (1)

- Cleaners WorksheetDocument1 pageCleaners WorksheetSeijuro AkashiNo ratings yet

- Cleaners WorksheetDocument1 pageCleaners WorksheetCracklings Gacuma100% (3)

- Capital Budgeting Techniques and Cash Flows Class ExerciseDocument6 pagesCapital Budgeting Techniques and Cash Flows Class ExerciseReynaldi DimasNo ratings yet

- Financials Bentu Modified 2021Document31 pagesFinancials Bentu Modified 2021Obakeng SekotoNo ratings yet

- FS 1 1Document4 pagesFS 1 1catzeyeNo ratings yet

- Capital Budgeting Answer KeyDocument31 pagesCapital Budgeting Answer KeyEsel DimapilisNo ratings yet

- Ast Chapter 1 MCPDocument14 pagesAst Chapter 1 MCPElleNo ratings yet

- AACA2 AssignmentsDocument20 pagesAACA2 AssignmentsadieNo ratings yet

- ClassProblemsChapter5 SolutionDocument6 pagesClassProblemsChapter5 SolutionA373728272No ratings yet

- Gyoo 1Document2 pagesGyoo 1Jihane TanogNo ratings yet

- Worksheet - Service - Cotton CompanyDocument7 pagesWorksheet - Service - Cotton CompanyJasmine ActaNo ratings yet

- Sheetband & Halyard Inc The Correct AnswerDocument6 pagesSheetband & Halyard Inc The Correct Answermaran_navNo ratings yet

- Allowable DeductionsDocument9 pagesAllowable DeductionsLyka RoguelNo ratings yet

- DividendsDocument13 pagesDividendsTrixieNo ratings yet

- Allied Sugar CompanyDocument9 pagesAllied Sugar CompanyFurqanTariqNo ratings yet

- Lesson2.1-Chapter 8-Fundamentals of Capital BudgetingDocument6 pagesLesson2.1-Chapter 8-Fundamentals of Capital BudgetingMeriam HaouesNo ratings yet

- Items Cost Cost ( N ) : Cleaners Food Technicians Security Guards Other Total Salary Labor Salary in NairaDocument4 pagesItems Cost Cost ( N ) : Cleaners Food Technicians Security Guards Other Total Salary Labor Salary in NairababatundeNo ratings yet

- Ecsy Cola Question2Document8 pagesEcsy Cola Question2Dhagash SanghaviNo ratings yet

- Windowlux - Case SolutionDocument2 pagesWindowlux - Case SolutionanisaNo ratings yet

- AE 315 FM Sum2021 Week 3 Capital Budgeting Quiz Anserki B FOR DISTRIBDocument7 pagesAE 315 FM Sum2021 Week 3 Capital Budgeting Quiz Anserki B FOR DISTRIBArly Kurt TorresNo ratings yet

- AC - IntAcctg1 Quiz 2 Solution GuideDocument6 pagesAC - IntAcctg1 Quiz 2 Solution Guidejohn hellNo ratings yet

- Cup of Cake Café Notes To Financial StatementsDocument44 pagesCup of Cake Café Notes To Financial StatementsGalgala, Orvil B.No ratings yet

- 6306903Document4 pages6306903maudiNo ratings yet

- Boracay Newcoast - Final Budget - 03!15!21Document226 pagesBoracay Newcoast - Final Budget - 03!15!21Juan Antonio TrinidadNo ratings yet

- CLBS Financial Statement 1Document6 pagesCLBS Financial Statement 1Peter Cranzo MeisterNo ratings yet

- Coffee CubeDocument5 pagesCoffee Cubes3976142No ratings yet

- Maxiclean FinaleDocument36 pagesMaxiclean FinaleAngeline MicuaNo ratings yet

- FARM-PLAN-BUDGET-AGRINEGOSYO-2 (1) FinalDocument19 pagesFARM-PLAN-BUDGET-AGRINEGOSYO-2 (1) FinalJOURLY RANQUENo ratings yet

- Solution Problem On Project EvaluationDocument5 pagesSolution Problem On Project EvaluationHasanNo ratings yet

- Financial Statement Activity W AnswersDocument4 pagesFinancial Statement Activity W AnswersLizlee LaluanNo ratings yet

- FPQ1 - Answer KeyDocument6 pagesFPQ1 - Answer KeyJi YuNo ratings yet

- CashflowDocument3 pagesCashflowMuhammad Amir AmirNo ratings yet

- Cash Flow Statement: Cash Flow Before SSF Cash Flow After SSF 1 Cash Flow After SSF 2Document1 pageCash Flow Statement: Cash Flow Before SSF Cash Flow After SSF 1 Cash Flow After SSF 2JHOMAENo ratings yet

- Calculo Rta 5ta 2020Document12 pagesCalculo Rta 5ta 2020CARLOS DANIEL ARELLANO SOLANONo ratings yet

- 1 Manufacturing Units Cost Saving Versus Unit Purchase CostDocument5 pages1 Manufacturing Units Cost Saving Versus Unit Purchase CostPunkruk McentNo ratings yet

- Is Fishing Non Motorized BangkaDocument4 pagesIs Fishing Non Motorized BangkaAnonymous EvbW4o1U7No ratings yet

- Gross Profit For The Year 2021-2023Document6 pagesGross Profit For The Year 2021-2023Beverly DatuNo ratings yet

- Intax FINAL EXAMDocument20 pagesIntax FINAL EXAMSteph TubuNo ratings yet

- Casos Fep 2020 IDocument18 pagesCasos Fep 2020 ICristhian MancillaNo ratings yet

- SCHEDULE 1 - Revenue 2017 2018 2019 2020 2021Document7 pagesSCHEDULE 1 - Revenue 2017 2018 2019 2020 2021Nathalie PadillaNo ratings yet

- Capital Budgeting Activity 3Document12 pagesCapital Budgeting Activity 3Corporate Accountant Marayo BankNo ratings yet

- Answer: B.: Review Question 1: Traditional Jo PetmaluDocument20 pagesAnswer: B.: Review Question 1: Traditional Jo PetmaluFranchNo ratings yet

- WP - Forex Practice SetDocument8 pagesWP - Forex Practice SetJester LimNo ratings yet

- Coret2 UtsDocument7 pagesCoret2 UtsEgayo PuddingNo ratings yet

- Solutions To Problems AFAR2 Chap3Document39 pagesSolutions To Problems AFAR2 Chap3Jane DizonNo ratings yet

- Chapter 3 Problem 1, 2 and 5 SolutionsDocument30 pagesChapter 3 Problem 1, 2 and 5 SolutionseiaNo ratings yet

- Financial Accounting 3A Assignment 2tendai MakosaDocument5 pagesFinancial Accounting 3A Assignment 2tendai MakosaTendai MakosaNo ratings yet

- Practica Valoracion 1Document3 pagesPractica Valoracion 1Marco Antonio Dco Vega RomanNo ratings yet

- Ing. Economica Pregunta 2Document2 pagesIng. Economica Pregunta 2Sheiler Alvarado SanchezNo ratings yet

- Financial Assumptions: RevenueDocument12 pagesFinancial Assumptions: RevenueKathleeneNo ratings yet

- Executive Summary: S11158164 S11157500 S11157427 S11159403 S11158400Document12 pagesExecutive Summary: S11158164 S11157500 S11157427 S11159403 S11158400Navin N Meenakshi ChandraNo ratings yet

- AF108 Research Assignment 2020Document3 pagesAF108 Research Assignment 2020Navin N Meenakshi ChandraNo ratings yet

- Af208 Assignment 1: Pleass GlobalDocument7 pagesAf208 Assignment 1: Pleass GlobalNavin N Meenakshi ChandraNo ratings yet

- Sample Memorandum of AdviceDocument3 pagesSample Memorandum of AdviceNavin N Meenakshi ChandraNo ratings yet

- Sample Memorandum of AdviceDocument3 pagesSample Memorandum of AdviceNavin N Meenakshi ChandraNo ratings yet

- Af208 Revision PackageDocument11 pagesAf208 Revision PackageNavin N Meenakshi ChandraNo ratings yet

- AF208 Revision Package S2 2019Document30 pagesAF208 Revision Package S2 2019Navin N Meenakshi ChandraNo ratings yet

- AF208 Group AssignmentDocument18 pagesAF208 Group AssignmentNavin N Meenakshi ChandraNo ratings yet

- SIP Report PriyaDocument18 pagesSIP Report Priyarucha gaurkhedeNo ratings yet

- LVMH Consolidated Statements PDFDocument74 pagesLVMH Consolidated Statements PDFThomasNo ratings yet

- Essentials of Investments (BKM 5 Ed.) Answers To Selected Problems - Lecture 6Document3 pagesEssentials of Investments (BKM 5 Ed.) Answers To Selected Problems - Lecture 6Kunal KumudNo ratings yet

- T.y.baf F.A - VLDocument5 pagesT.y.baf F.A - VLStar NxtNo ratings yet

- Cabael-Ae109-Proof of CashDocument4 pagesCabael-Ae109-Proof of CashJanine MadriagaNo ratings yet

- Stayway Homes Private Limited: A. Significant Accounting PoliciesDocument3 pagesStayway Homes Private Limited: A. Significant Accounting PoliciesNikhil TripathiNo ratings yet

- Homework Notes Unit 1 MBA 615Document10 pagesHomework Notes Unit 1 MBA 615Kevin NyasogoNo ratings yet

- Amazon Financial AnalysisDocument6 pagesAmazon Financial Analysisapi-315180958No ratings yet

- Venugopal Gopinatha N Nair: Shoppers Stop LimitedDocument2 pagesVenugopal Gopinatha N Nair: Shoppers Stop LimitedAkchikaNo ratings yet

- Problem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementDocument4 pagesProblem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementRavena ReyesNo ratings yet

- Notes by Chirag Sir-1Document84 pagesNotes by Chirag Sir-1Sujata KanadeNo ratings yet

- Unit 1 - Final Accounts - ProblemsDocument5 pagesUnit 1 - Final Accounts - Problemsxyz1No ratings yet

- Paper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaDocument26 pagesPaper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaYashNo ratings yet

- NPV and XIRR Calculator Excel TemplateDocument7 pagesNPV and XIRR Calculator Excel TemplateAJIT KUMAR PATRANo ratings yet

- Silo (Q4 - 2016)Document91 pagesSilo (Q4 - 2016)Wihelmina DeaNo ratings yet

- Intermediate Accounting Ii McqsDocument7 pagesIntermediate Accounting Ii Mcqsraymart copiarNo ratings yet

- Annual Report 2012 of MJL Bangladesh Limited PDFDocument124 pagesAnnual Report 2012 of MJL Bangladesh Limited PDFTafsir HossainNo ratings yet

- Statement of Financial Position (Reviewer)Document6 pagesStatement of Financial Position (Reviewer)ChinNo ratings yet

- Chap 6 & 7 QuestionsDocument2 pagesChap 6 & 7 QuestionschengNo ratings yet

- Akuntansi Keuangan 2: Pertemuan 1Document72 pagesAkuntansi Keuangan 2: Pertemuan 1Monita nababanNo ratings yet

- Санхүүгийн Тайлангийн МАЯГТ Англи Хэл ДээрDocument13 pagesСанхүүгийн Тайлангийн МАЯГТ Англи Хэл Дээрmunkhtsetseg.tsogooNo ratings yet

- Solution Manual Advanced Financial Accounting 8th Edition Baker Chap012 PDFDocument79 pagesSolution Manual Advanced Financial Accounting 8th Edition Baker Chap012 PDFYopie ChandraNo ratings yet

- C Law Unit II - Securities Exchange Board of India (SEBI ACT)Document5 pagesC Law Unit II - Securities Exchange Board of India (SEBI ACT)Mr. funNo ratings yet

- Payment Details: Email: Investor - Relations@pidilite - Co.inDocument2 pagesPayment Details: Email: Investor - Relations@pidilite - Co.inOpenText DataNo ratings yet

- Answer To Homework QuestionsDocument102 pagesAnswer To Homework QuestionsDhanesh SharmaNo ratings yet

- Test I - Multiple Choice - TheoryDocument6 pagesTest I - Multiple Choice - Theorycute meNo ratings yet

- Pract 1 - Exam2Document2 pagesPract 1 - Exam2Sharmaine Rivera MiguelNo ratings yet