Professional Documents

Culture Documents

April To July MA Assignment Brief 20042020

Uploaded by

Mak PussOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

April To July MA Assignment Brief 20042020

Uploaded by

Mak PussCopyright:

Available Formats

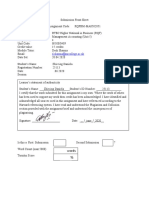

Submission Front Sheet

Assignment Code: RQFBM-MA0502051

Programme: BTEC Higher National in Business (RQF)

Unit Title and Number: Management Accounting (Unit 5)

RFQ Level: 4

Unit Code: H/508/0489

Credit value: 15 credits

Module Tutor: Desh Sharma

Email: d.sharma@mrcollege.ac.uk

Date Set: 20.04.2020

Student’s Name: ………………………………………….

Registration Number: ……………………………………………

Date: ……………………………………………

Session ……………………………………………

Learner’s statement of authenticity

Student’s Name: _______________________Student’s ID Number: ___________________

I certify that the work submitted for this assignment is my own. Where the work of others has been

used to support my work then credit has been acknowledged. I have identified and acknowledged

all sources used in this assignment and have referenced according to the Harvard referencing

system. I have read and understood the Plagiarism and Collusion section provided with the

assignment brief and understood the consequences of plagiarising.

Signature: ___________________ Date: ___/___/_____

Is this a First Submission or Second Submission ?

Word Count (max.5000)

words

Turnitin Score

%

Essential Academic Key Dates

1

Management Accounting (Unit 5) Mont Rose College April 2020

DEADLINES FOR HND’s APR., 2020 SEMESTER

Key Dates

Semester starts 04/05/2020

Semester ends 17/07/2020

Formative assessment Dropbox opens 08/06/2020

Formative assessment Dropbox closes 28/06/2020

FORMATIVE FEEDBACK TO BE COMPLETED BY 10/07/2020

Students will have at least one week to work on teacher’s feedback.

Final SUBMISSION box opens on 11/07/2020

Final SUBMISSION box closes on 19/07/2020

Teacher’s result submission deadline (submission of LARs, observation records, 03/08/2020

exam answer sheets, portfolios etc. with proper comments and grades on

Moodle)

Internal Verification completion date. No more IV of this lot after this date. 20/08/2020

[Those students, whose submissions have been downgraded to referral by the IVs,

have 2 weeks to resubmit their work to their teachers from the day the IV decision

was communicated to them.]

Referral Dropbox will open from: 20/07/2020

As a few students miss the final deadline which they should not, the referral box is

being opened immediately after the final drobox closes, to enable students to make

use of this box. However, this will be treated as their last chance to submit.

Referral Dropbox closes on: 16/08/2020

Referral result deadline for teachers: 30/08/2020

Students to note: No Term Break, maximum 2 chances to clear the modules. If any module is not cleared in the

1st submission (which is to be submitted within the final submission date), it will not be eligible for a Merit or

Distinction. Dates are subject to change depending upon how the current scenario unfolds.

Assignment Title Management Accounting Systems, Techniques and

Planning Tools

Learning Outcomes LO1, LO2, LO3 and LO4

Issue Date TBA

Formative Assessment Date As on 2nd page

Assig Brief NSAB929B5DS/AA Internally Verified as fit for purpose 30 th April2020

Page |2

Management Accounting (Unit 5) Mont Rose College April 2020

Submission Date As on 2nd page

Submission Format

The submission is in the form of a report, submitted as a Microsoft Word document, and

associated portfolio of income statements calculations performed in Microsoft Excel.

You are required to make effective use of headings, bullet points and subsections as

appropriate. Your report should be referenced using the Harvard referencing system.

Please also provide a reference list using the Harvard referencing system.

The recommended word limit is 4000 words, excluding 6 calculations although you will not

be penalised for exceeding the total word limit.

Assignment Brief and Guidance

Scenario and activity:

You have applied for the position of Assistant Management Account with IKEA. You have

successfully passed the telephone interview, which is the first of the 3-stages selection

process.

The second stage will be the production of a report that you will send to the hiring

manager. The report should cover a critical evaluation of management accounting systems

and their benefits, management accounting reporting and their integration within

organizations. The report should also contain an analysis of the application of different

planning tools for preparing budgets; as well as an evaluation of how these planning tools

and management accounting systems are used to respond to financial problems. You

should make use of at least two examples to compare how real world organisations are

adapting management accounting systems when faced with financial problems.

The third and final stage will be an assessment centre in which you will be required to

perform various calculations using Microsoft Excel for a given scenario.

Your tutor has agreed to help you prepare for the second and third stages.

You are required to

produce the report for review by your tutor, and

complete the test set by your tutor (see below) in preparation for the third and final

stage of the selection process. You should include your answers to the test,

including calculations in the appendix of your report)

Assig Brief NSAB929B5DS/AA Internally Verified as fit for purpose 30 th April2020

Page |3

TEST

Marwa Limited and Aarwa Limited in the same town and both started operations 3 years ago

Management Accounting (Unit 5) Mont Rose College April 2020

on the same day. They have same pattern of costs and revenue and both use FIFO (First in

First Out) when valuing their stock. But, while Marwa Ltd. uses a Marginal costing approach

to the valuation of stock in their financial statements, Aarwa Ltd. uses Absorption costing.

Calculate the Gross Profit and Net Profit for each company for each year of their first three

years in business from the following information:

Total fixed indirect production cost is £84,000 per year.

Direct labour costs over each of the three years were £11 per unit.

Direct material costs over each of the three years were £17 per unit.

Variable expenses which vary in direct ratio to production were £7 per unit.

Sales were: Year 1: 3,000 units; Year 2: 4,000 units; Year 3: 3,500 units. The selling price

remained constant at £92 per unit.

Production is at the rate of: Year 1: 3,600 units; Year 2: 4,100 units; Year 3: 3,400 units.

Other overheads are as follows:

Selling and Distribution overheads are: Year 1: £5,700; Year 2: £7,500; Year 3: £7,100

Administrative overheads £10,500 for each year

Interest expense: Year 1: £1,200; Year 2: £1,450; Year 3: £1,700

Required: Prepare the income statements of these 2 companies for last 3 years.

Please keep in mind that while Marwa uses marginal costing method, Aarwa uses

absorption costing. (6 income statements in total: 3 under marginal and 3 under

absorption. Also show workings of closing stock). After the calculations, please

comment on the followings:

Your understanding of the marginal and absorption costing methods;

Learning Outcomes and Assessment Criteria

Use of Marginal costing in a business;

Pass for the difference in profitMerit

The reason/s figures of 2 companies; Distinction

LO1You

Demonstrate an understanding

have calculated the closing stockofformanagement accounting

these 2 Businesses systems

in applying different formulae.

P1 What

Explain management

is the M1 Evaluate the benefits

reason for doing this? D1 Critically evaluate how

accounting and give the of management management accounting

essential requirements of accounting systems and systems and management

different types of their application within an accounting reporting is

management accounting organisational context. integrated within

systems. organisational processes.

P2 Explain different

methods used for

management accounting

reporting.

LO2 Apply a range of management accounting techniques

P3 Calculate costs using M2 Accurately apply a D2 Produce financial

appropriate techniques of range of management reports that accurately

cost analysis to prepare accounting techniques and apply and interpret data

an income statement produce appropriate for a range of business

using marginal and financial reporting activities.

absorption costs. documents.

Assig Brief NSAB929B5DS/AA Internally Verified as fit for purpose 30 th April2020

Page |4

Management Accounting (Unit 5) Mont Rose College April 2020

LO3 Explain the use of planning tools used in management accounting

P4 Explain the advantages M3 Analyse the use of D3 Evaluate how planning

and disadvantages of different different planning tools tools for accounting

types of planning tools used and their application for respond appropriately to

for budgetary control. preparing and forecasting solving financial problems

budgets. to lead organisations to

sustainable success.

LO4 Compare ways in which organisations could use management accounting to respond to

financial problems

P5 Compare how M4 Analyse how, in D3 Evaluate how planning

organisations are adapting responding to financial tools for accounting

management accounting problems, management respond appropriately to

systems to respond to accounting can lead solving financial problems

financial problems. organisations to sustainable to lead organisations to

success. sustainable success.

Assig Brief NSAB929B5DS/AA Internally Verified as fit for purpose 30 th April2020

Page |5

Management Accounting (Unit 5) Mont Rose College April 2020

GRADING DETAILS

Achievement of a Pass grade

a student must have satisfied all the Pass criteria for the learning outcomes, showing coverage

of the unit content and therefore attainment at Level 4 or 5 of the national framework.

Achievement of a Merit grade

a student must have satisfied all the Merit criteria (as well as the Pass criteria) through high

performance in each learning outcome.

Achievement of a Distinction grade

a student must have satisfied all the Distinction criteria (as well as the Pass and Merit criteria),

and these define outstanding performance across the unit as a whole.

Specification of Assessment

Present your work in one business report style which should include table of contents,

reference list, foot or end notes and appendices if any

Include the reference code of this assignment on your assignment submission

front page.

Each page must be numbered at the bottom right hand side.

Ensure the following information is in the footer on every page:

o Your name

o The production date of your submission

o The code number of your assignment brief

o The page number

Spell-check the document and make sure there are no grammatical errors.

Complete all the tasks.

Produce clear specific reasoning and arguments in support of your answers.

Submit your work in a single work processed document of not more than 4000 words for

all learning Outcomes excluding the 6 calculations. This word limit is only for guidelines,

and is not applied to grading.

You must include a bibliography at the end to show where your information was

sourced.

Your sources must be identified using the Harvard referencing system. The words

used in your bibliography will not be included in your word count.

As per Pearson policy, you are only allowed two submissions per module. One

for final submission and another one for referral. Failure to achieve a pass grade

after a second submission will result in you having to repeat the module in the

next term.

Any re-submission or late submission (unless authorised due to mitigating

circumstances) will be capped at a PASS grade only.

Assig Brief NSAB929B5DS/AA Internally Verified as fit for purpose 30 th April2020

Page |6

Management Accounting (Unit 5) Mont Rose College April 2020

Extension and Late Submission

If an extension is necessary for a valid reason, requests must be made in writing using a

course work extension request form to the head of department. Please note that the lecturers

do not have the authority to extend the coursework deadlines and therefore do not ask them to

award a coursework extension.

The completed form must be accompanied by evidence such as a medical certificate in the

event of you being sick.

Plagiarism and Collusion

Any act of plagiarism and collusion will be seriously dealt with according to the regulations. In

this context, the definition and scope of plagiarism are presented below:

‘Plagiarism occurs when a student misrepresents, as his/her own work, the work, written or

otherwise, of any other person (including another student) or of any institution. Examples of

forms of plagiarism include1:

the verbatim (word for word) copying of another’s work without appropriate and correctly

presented acknowledgement;

the close paraphrasing of another’s work by simply changing a few words or altering the

order of presentation, without appropriate and correctly presented acknowledgement;

unacknowledged quotation of phrases from another’s work;

The deliberate and detailed presentation of another’s concept as one’s own.’

All types of work submitted by students are covered by this definition, including, written work,

diagrams, designs, engineering drawings and pictures.

‘Collusion occurs when, unless with official approval (e.g. in the case of group projects), two or

more students consciously collaborate in the preparation and production of work which is

ultimately submitted by each in an identical, or substantially similar, form and/or is represented

by each to be the product of his or her individual efforts. Collusion also occurs where there is

unauthorised co-operation between a student and another person in the preparation and

production of work which is presented as the student’s own.’ (’Carroll, J and Appleton, J. (2001)

Plagiarism – A Good Practice Guide. Oxford Brookes University/JISC, Oxford)

All work for assessment must be submitted with a Turnitin Report on plagiarism. The

Maximum Turnitin score admissible is 15%. Assignments with more than this 15% score

will be automatically referred for reworking and resubmission.

Any student might be called to go through a viva with the lecturer to confirm any parts

of the module through an interview which will then form part of the summative

assessment.

Assig Brief NSAB929B5DS/AA Internally Verified as fit for purpose 30 th April2020

Page |7

Management Accounting (Unit 5) Mont Rose College April 2020

To access any feedback (formative/summative) you will have to access Moodle and open

your assignment. You will have to click on the blue comment box in the righthand side

and the feedback will appear within the text. You might have to click on the blue bubbles

to see the feedback.

Resubmissions:

As per the Pearson policy under RQF, the learner needs to clear the module within

2 submissions, maximum. If that is not achieved, the learner will have to repeat the

module.

Textbooks

Dyson, J.R. (2010). Accounting for Non-Accounting Students. 8th edition. Harlow: Pearson Education

Ltd

Drury, C. (2009). Management Accounting for Business. London: Cengage Learning

Wood, F. and Sangster, A. (2005). Business Accounting 2. 10th edition. Harlow: Pearson Education Ltd.

Horngren, C.T., Sundem, G.L., Burgstahler, D., Schatzberg, J. (2014) Introduction to Management

Accounting. 16th Edition. Harlow: Pearson

Assig Brief NSAB929B5DS/AA Internally Verified as fit for purpose 30 th April2020

Page |8

You might also like

- MBA 7003 Marketing Assignment 1Document6 pagesMBA 7003 Marketing Assignment 1jNo ratings yet

- Formative Assessment Brief - Driven Decisions For Business - 221118 - 152051Document11 pagesFormative Assessment Brief - Driven Decisions For Business - 221118 - 152051Sana FaizNo ratings yet

- WRlEb Assignment BriefDocument9 pagesWRlEb Assignment BriefLoice WanjalaNo ratings yet

- 1 Course Outline - Accounting For Managers - AY - 2022 - 2023Document7 pages1 Course Outline - Accounting For Managers - AY - 2022 - 2023Mansi GoelNo ratings yet

- BAAC Managerial AccountingDocument2 pagesBAAC Managerial AccountingAmna NoorNo ratings yet

- 5038 - Assignment 2 Brief - Updated (With Numbers)Document7 pages5038 - Assignment 2 Brief - Updated (With Numbers)Minh Thu Nguyen TranNo ratings yet

- International School of Management and EconomicsDocument28 pagesInternational School of Management and EconomicsLê Thái HàNo ratings yet

- Group Assignment (20%) : Any Question Related To Group Assignment Should Be Directed To Lead LecturerDocument7 pagesGroup Assignment (20%) : Any Question Related To Group Assignment Should Be Directed To Lead LecturerEsther Lueh100% (1)

- Luminus Education: - Assignment Brief (RQF)Document15 pagesLuminus Education: - Assignment Brief (RQF)Tawfiq Nassoura0% (1)

- International Financial ManagementDocument5 pagesInternational Financial ManagementKanza KhursheedNo ratings yet

- Acctg. Ed 6 Strategic Cost Mngt.Document20 pagesAcctg. Ed 6 Strategic Cost Mngt.Kim MasapolNo ratings yet

- UT Dallas Syllabus For Acct6201.mbc.11f Taught by Suresh Radhakrishnan (Sradhakr)Document7 pagesUT Dallas Syllabus For Acct6201.mbc.11f Taught by Suresh Radhakrishnan (Sradhakr)UT Dallas Provost's Technology GroupNo ratings yet

- 5038 Assignment 2 Brief UpdatedDocument7 pages5038 Assignment 2 Brief Updated1108nguyenphanthaomyNo ratings yet

- Talal - ICF - ASSIGNMENT - SUMMER 2021Document8 pagesTalal - ICF - ASSIGNMENT - SUMMER 2021Tuba AkbarNo ratings yet

- Course Guide: RICS School of Built EnvironmentDocument14 pagesCourse Guide: RICS School of Built EnvironmentManglam AgarwalNo ratings yet

- BE210 TMA Financial AccountingDocument9 pagesBE210 TMA Financial AccountingMuhammad Yaseen LakhaNo ratings yet

- Assignment Based Assessment: Final ExaminationDocument9 pagesAssignment Based Assessment: Final ExaminationMuhammad Raza RafiqNo ratings yet

- Course Overview and AssignmentDocument14 pagesCourse Overview and AssignmentcleophacerevivalNo ratings yet

- Af4s997 CW2 22-23Document5 pagesAf4s997 CW2 22-23Lily BlackNo ratings yet

- 8524Document7 pages8524KhurramRiaz100% (1)

- Ipcc Guess Questions Grp-1Document84 pagesIpcc Guess Questions Grp-1Sai Kumar Sandrala100% (1)

- Unit of Study Outline: Accounting, Business and SocietyDocument6 pagesUnit of Study Outline: Accounting, Business and SocietyNicyKOKNo ratings yet

- Jaipuria Institute of Management PGDM Trimester I Academic Year 2019-21Document14 pagesJaipuria Institute of Management PGDM Trimester I Academic Year 2019-21Utkarsh padiyarNo ratings yet

- MBA Part-II Sem-IV Assignment QuestionsDocument8 pagesMBA Part-II Sem-IV Assignment QuestionsAakriti SahuNo ratings yet

- Ukaf4023 Accounting Theory and Practice: October 2021 Assignment (20%)Document8 pagesUkaf4023 Accounting Theory and Practice: October 2021 Assignment (20%)Esther LuehNo ratings yet

- Bba 3163 International Accounting (Group Assignment) - April 2022 - September 2022Document8 pagesBba 3163 International Accounting (Group Assignment) - April 2022 - September 2022Zale EzekielNo ratings yet

- BSBI422 Final Special Project V3Document11 pagesBSBI422 Final Special Project V3hamzaNo ratings yet

- FAM Assignment Jan 2020Document15 pagesFAM Assignment Jan 2020Anil KumarNo ratings yet

- BUAD 280-Spring 2017Document11 pagesBUAD 280-Spring 2017Alex ChanNo ratings yet

- Taxation 0816 Extra NotesDocument15 pagesTaxation 0816 Extra NotesDani MotaNo ratings yet

- MBA Project Guidelines - 18-1Document17 pagesMBA Project Guidelines - 18-1Vikeel ReddyNo ratings yet

- Syllabus RSM433 2020Document8 pagesSyllabus RSM433 2020Janice JingNo ratings yet

- AF5203 - Course Outline - 2022-23 Sem 2 v0.3Document9 pagesAF5203 - Course Outline - 2022-23 Sem 2 v0.3i YuerukiNo ratings yet

- DC-Tutor Notes - DM Assignment BriefDocument10 pagesDC-Tutor Notes - DM Assignment BriefPalak ShahNo ratings yet

- Chindwin Tu International College: Assignment Front Sheet Qualification Unit Code / Unit Number and TitleDocument7 pagesChindwin Tu International College: Assignment Front Sheet Qualification Unit Code / Unit Number and TitleNaNaNo ratings yet

- Bsib521 FB ProjectDocument8 pagesBsib521 FB ProjectNoor AssignmentsNo ratings yet

- COIT20249 Supplmentary AssessmentDocument12 pagesCOIT20249 Supplmentary AssessmentHarsh Jain0% (1)

- BSBI422 Final Special Project V5Document10 pagesBSBI422 Final Special Project V5hamzaNo ratings yet

- GAC5010 PM Writ1 MidDocument9 pagesGAC5010 PM Writ1 MidArsl331No ratings yet

- SO-D2FIN100-1 - SDocument25 pagesSO-D2FIN100-1 - SThenappan GanesenNo ratings yet

- SEEM 3600 Engineering Entrepreneurship: Course ObjectivesDocument8 pagesSEEM 3600 Engineering Entrepreneurship: Course ObjectivesHamid UllahNo ratings yet

- 212ECN Normal Coursework March 2017Document5 pages212ECN Normal Coursework March 2017phuongfeoNo ratings yet

- Maryam - 37 - 3726 - 1 - Assignment Based FT Template SUMMER 2021Document3 pagesMaryam - 37 - 3726 - 1 - Assignment Based FT Template SUMMER 2021Hasnain BhuttoNo ratings yet

- Project - GuidlinesSDFSDFSDFSDDocument2 pagesProject - GuidlinesSDFSDFSDFSDMEO lalandNo ratings yet

- Module 4 - Sample AssignmentDocument35 pagesModule 4 - Sample Assignmentaung sanNo ratings yet

- A1.1 Mar2023Document3 pagesA1.1 Mar2023Hạnh Chi NguyễnNo ratings yet

- BMP6033 - Assignment BriefDocument10 pagesBMP6033 - Assignment Brief110302200029No ratings yet

- BMM 3013Document6 pagesBMM 3013Muhammad Talha HassanNo ratings yet

- BU7006 Semester 1 Assessment Brief Sep 2023 - 24Document12 pagesBU7006 Semester 1 Assessment Brief Sep 2023 - 24Safeer khanNo ratings yet

- Acc. Course OutlineDocument5 pagesAcc. Course OutlineNoor DeenNo ratings yet

- MGT 531 1Document4 pagesMGT 531 1rizwan aliNo ratings yet

- MA515 Managerial Accounting Individual AssignmentDocument8 pagesMA515 Managerial Accounting Individual AssignmentnepalsgreatNo ratings yet

- Assignment 1Document6 pagesAssignment 1thevicky94No ratings yet

- Management Accounting - Chapter 00 - Course Introduction - FinalDocument16 pagesManagement Accounting - Chapter 00 - Course Introduction - FinalHuyền MaiNo ratings yet

- FRA Course Outline - PGDM 2021-23Document6 pagesFRA Course Outline - PGDM 2021-23Chetan SaxenaNo ratings yet

- Intermediate Accounting Ii: ADM3340 A Fall 2016Document12 pagesIntermediate Accounting Ii: ADM3340 A Fall 2016divyaNo ratings yet

- E Assignments SotonDocument7 pagesE Assignments Sotoncjd2e6wt100% (1)

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- Fundamentals of Performance Improvement: Optimizing Results through People, Process, and OrganizationsFrom EverandFundamentals of Performance Improvement: Optimizing Results through People, Process, and OrganizationsNo ratings yet

- SF-02 Application For Employment Issue 1Document4 pagesSF-02 Application For Employment Issue 1Mak PussNo ratings yet

- OA-Assignment Managerial Accounting Draft 1 1-1Document13 pagesOA-Assignment Managerial Accounting Draft 1 1-1Mak PussNo ratings yet

- 2G-Management AccountingDocument22 pages2G-Management AccountingMak PussNo ratings yet

- Sk-Unit 3 Human Resource ManagementDocument23 pagesSk-Unit 3 Human Resource ManagementMak PussNo ratings yet

- 32-Unit-3 HRMDocument23 pages32-Unit-3 HRMMak Puss100% (1)

- GV-MANAGEMENT AND OPERATIONS - EditedDocument17 pagesGV-MANAGEMENT AND OPERATIONS - EditedMak PussNo ratings yet

- Income Statement For Year: 1 Using Absorption Costing ApproachDocument5 pagesIncome Statement For Year: 1 Using Absorption Costing ApproachMak PussNo ratings yet

- 5f-Management and OperationsDocument17 pages5f-Management and OperationsMak PussNo ratings yet

- Marwa Year 1 Using Marginal Costing ApproachDocument6 pagesMarwa Year 1 Using Marginal Costing ApproachMak PussNo ratings yet

- 2G-Management AccountingDocument22 pages2G-Management AccountingMak PussNo ratings yet

- LTD Co Reg Form Single WorkerDocument1 pageLTD Co Reg Form Single WorkerMak PussNo ratings yet

- Tot 14517773554785977020Document2 pagesTot 14517773554785977020Mak PussNo ratings yet

- Happy Hookers - Findings From An International Study Exploring The PDFDocument24 pagesHappy Hookers - Findings From An International Study Exploring The PDFNur Amalia MajidNo ratings yet

- Oct 8Document9 pagesOct 8crisNo ratings yet

- Lecture 7 CrosstabsDocument20 pagesLecture 7 CrosstabsibmrNo ratings yet

- PubCorp BookExcerpts 01Document6 pagesPubCorp BookExcerpts 01Roms RoldanNo ratings yet

- IcseDocument11 pagesIcsevikiabi28No ratings yet

- Make Her Make MoveDocument32 pagesMake Her Make MoveAlfredo GomezNo ratings yet

- Art History Research ProjectDocument3 pagesArt History Research Projectapi-245037226No ratings yet

- LAS Q2-WEEK 1-2-TVL-FBS NC II - Grade 12Document15 pagesLAS Q2-WEEK 1-2-TVL-FBS NC II - Grade 12Xian Julz PaezNo ratings yet

- CPM322E CH1 Planning PDFDocument38 pagesCPM322E CH1 Planning PDFRamesh BabuNo ratings yet

- Big 1988Document145 pagesBig 1988Tony EmmerNo ratings yet

- Comparative Study of CNC Controllers Used in CNC Milling MachineDocument9 pagesComparative Study of CNC Controllers Used in CNC Milling MachineAJER JOURNALNo ratings yet

- Metformin Drug StudyDocument2 pagesMetformin Drug StudyArone SebastianNo ratings yet

- SOC 1502 Learning Journal Unit 4Document29 pagesSOC 1502 Learning Journal Unit 4MangalisoNo ratings yet

- Interpretation of Every Stanza and Objectives Dusk by Carlos AngelesDocument2 pagesInterpretation of Every Stanza and Objectives Dusk by Carlos AngelesYaj Gabriel De LeonNo ratings yet

- Exam 3 Practice QuestionsDocument8 pagesExam 3 Practice Questionsphoenix180No ratings yet

- JSPS Application GuidelinesDocument9 pagesJSPS Application GuidelinesNihad AdnanNo ratings yet

- Incentives and BenefitsDocument58 pagesIncentives and Benefitskamaljit kaushikNo ratings yet

- Job or BusinessDocument1 pageJob or Businessabhisek1987No ratings yet

- Basic Circuit Laws: Georg Ohm Kirchhoff's LawsDocument4 pagesBasic Circuit Laws: Georg Ohm Kirchhoff's LawsrezhabloNo ratings yet

- PROM-12395-002 1114007 BRO QIAstat-Dx 0518 SPREAD WWDocument3 pagesPROM-12395-002 1114007 BRO QIAstat-Dx 0518 SPREAD WWTaty ElejaldeNo ratings yet

- Jenova Chen - Flow in Games (And Everything Else) PDFDocument4 pagesJenova Chen - Flow in Games (And Everything Else) PDFKirakirakirakiraNo ratings yet

- Emerging Treatment Options For Prostate CancerDocument8 pagesEmerging Treatment Options For Prostate CancerMax Carrasco SanchezNo ratings yet

- MC Script For The Birthday Company 2021Document7 pagesMC Script For The Birthday Company 2021HR CLVNo ratings yet

- 24941-100-30R-G01-00073 Tunra 6299 Report FinalDocument96 pages24941-100-30R-G01-00073 Tunra 6299 Report FinalcmahendrNo ratings yet

- Tara LagnaDocument10 pagesTara LagnaNarotham Reddy100% (1)

- Chapter 43 The Immune SystemDocument13 pagesChapter 43 The Immune System蔡旻珊No ratings yet

- Title Eight Crimes Against Persons: Article 246. ParricideDocument27 pagesTitle Eight Crimes Against Persons: Article 246. ParricideJeric RealNo ratings yet

- CRPC Bail PresentationDocument8 pagesCRPC Bail PresentationDishant ThakkarNo ratings yet

- Essential Question and Enduring Understanding TutorialDocument28 pagesEssential Question and Enduring Understanding TutorialAureliano BuendiaNo ratings yet