Professional Documents

Culture Documents

Quiz # 1: Bahria University (Karachi Campus)

Uploaded by

Aamir MansoorOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quiz # 1: Bahria University (Karachi Campus)

Uploaded by

Aamir MansoorCopyright:

Available Formats

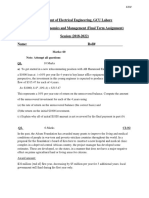

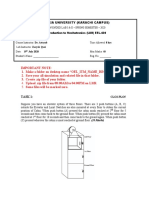

BAHRIA UNIVERSITY (KARACHI CAMPUS)

Department of Electrical Engineering

Engineering Economics and Management – (HSS-411)

Quiz # 1

Class & Section: BEE – 8 (A, B, C & D) Total Marks: 10

Course Instructor: Engr. Asif Raza Given Date: 20/06/2020

Student’s Name: ____________________ Submission Deadline: 26/06/2020

______________

Q.N0.1 [CLO-3(C3)] (02)

You purchase a home with a Rs. 180,000 mortgage at 4% for 30 years with monthly payments. What

will the remaining balance on your mortgage be after 5 years?

Q.N0.2 [CLO-2(C2)] (03)

An electronic testing device is to be DDB depreciated. It has an initial cost of Rs. 25,000 & an

estimated salvage of Rs. 2500 after 12 years.

(a) Calculate the depreciation & book value for years 1 & 4.

(b) Calculate the implied salvage value after 12 years.

Q.N0.3 [CLO-4(C4)] (02)

If the Pakistan Cables has an annual gross income of Rs. 2,750,000 with expenses & depreciation

totaling Rs. 1,950,000.

(a) Calculate the company’s taxable income.

(b) Income taxes?

(c) Average tax rate?

(d) Marginal tax rate?

Q.N0.4 [CLO-3(C3)] (03)

Rastek Technologies is a manufacturer of miniature fittings and valves. Over a 5 year period, the

costs associated with one product line were as follows: Initial cost of Rs. 30,000 & annual costs of

Rs. 18,000. Annual revenue was Rs. 27,000 & the used equipment was salvaged value Rs. 4,000.

What rate of return did the company make on this product?

____________________ Best of Luck ____________________

You might also like

- Engineering Economics - Midterm Exam 2021Document4 pagesEngineering Economics - Midterm Exam 2021Cowo Rasa Alpukat100% (1)

- 7ACCN018W - Exam July 2020 (MODIFIED 19 MAY 2020)Document11 pages7ACCN018W - Exam July 2020 (MODIFIED 19 MAY 2020)hazyhazy9977No ratings yet

- Seem 2440A/B - Engineering Economics First Term (2011 - 2012)Document3 pagesSeem 2440A/B - Engineering Economics First Term (2011 - 2012)Sun KelvinNo ratings yet

- Post - AF3313 - Sem 1 Midterm 2015-16Document9 pagesPost - AF3313 - Sem 1 Midterm 2015-16siuyinxddNo ratings yet

- LAB - 3 - Limit Switches Interfacing Using PLC PDFDocument5 pagesLAB - 3 - Limit Switches Interfacing Using PLC PDFAamir MansoorNo ratings yet

- LAB - 3 - Limit Switches Interfacing Using PLC PDFDocument5 pagesLAB - 3 - Limit Switches Interfacing Using PLC PDFAamir MansoorNo ratings yet

- brdg028 Exam Master 19b2Document19 pagesbrdg028 Exam Master 19b2MatthewNo ratings yet

- Certificate in Advanced Business Calculations: Series 4 Examination 2008Document6 pagesCertificate in Advanced Business Calculations: Series 4 Examination 2008Apollo YapNo ratings yet

- TLS/XII/Accountancy/Oct_P.T_3/2021-22: Periodic Test QuestionsDocument13 pagesTLS/XII/Accountancy/Oct_P.T_3/2021-22: Periodic Test QuestionsPriyank DhadhiNo ratings yet

- Financial Management Assg-1Document6 pagesFinancial Management Assg-1Udhay ShankarNo ratings yet

- ABC L3 Past Paper Series 3 2013Document7 pagesABC L3 Past Paper Series 3 2013b3nzyNo ratings yet

- Model Test PaperDocument112 pagesModel Test PaperTanya Hughes100% (1)

- Business Finance Sample Examination PaperDocument4 pagesBusiness Finance Sample Examination PaperYeshey ChodenNo ratings yet

- AssigmentDocument8 pagesAssigmentnonolashari0% (1)

- B.sc. Engineering 2nd Year 2nd Term Regular Examination, 2015Document15 pagesB.sc. Engineering 2nd Year 2nd Term Regular Examination, 2015MD SHAKIL AHMEDNo ratings yet

- MBA193F3: RamaiahDocument4 pagesMBA193F3: Ramaiahvijay shetNo ratings yet

- Mock Test - 4-2Document16 pagesMock Test - 4-2Deepsikha maitiNo ratings yet

- Project Planning Appraisal and Control AssignmentDocument31 pagesProject Planning Appraisal and Control AssignmentMpho Peloewtse Tau50% (2)

- Series I - QuestionsDocument11 pagesSeries I - QuestionsAlok MishraNo ratings yet

- Bangladesh University exam questions on corporate financeDocument3 pagesBangladesh University exam questions on corporate financeRahman NiloyNo ratings yet

- Final Paper (Online) - Engineering Economics Manaement - Dated 28-06-2021Document2 pagesFinal Paper (Online) - Engineering Economics Manaement - Dated 28-06-2021saran gulNo ratings yet

- Assessment 1 October 2021 POCFDocument2 pagesAssessment 1 October 2021 POCFAakanksha ChughNo ratings yet

- Engineering Economics and Finacial Management (HUM 3051)Document5 pagesEngineering Economics and Finacial Management (HUM 3051)uday KiranNo ratings yet

- B Com 2023 Examination PaperDocument9 pagesB Com 2023 Examination PaperAkshitaNo ratings yet

- PPAC AssignDocument13 pagesPPAC AssignTs'epo MochekeleNo ratings yet

- CC1 A232 - QUESTIONDocument6 pagesCC1 A232 - QUESTIONDAHLIAH AZIZNo ratings yet

- Financial Accounting Problems and SolutionsDocument10 pagesFinancial Accounting Problems and SolutionsThe ShiningNo ratings yet

- Investment Appraisal Questions 2-1Document8 pagesInvestment Appraisal Questions 2-1Olajumoke SanusiNo ratings yet

- CT2-PX-0 - QP-x2-x3Document22 pagesCT2-PX-0 - QP-x2-x3AmitNo ratings yet

- Practice Exam #2Document12 pagesPractice Exam #2Mat MorashNo ratings yet

- R2.TAXM .L December 2020Document6 pagesR2.TAXM .L December 2020Pavel DhakaNo ratings yet

- Taxation - English Question 27.01.2023Document12 pagesTaxation - English Question 27.01.2023harish jangidNo ratings yet

- Eco 11Document4 pagesEco 11Deepak GautamNo ratings yet

- Direct Tax Laws & International Taxation Mock Test Paper SeriesDocument11 pagesDirect Tax Laws & International Taxation Mock Test Paper SeriesDeepsikha maitiNo ratings yet

- 0102 Managerial Economics and Financial AnalysisDocument7 pages0102 Managerial Economics and Financial AnalysisFozia PanhwerNo ratings yet

- Tax (Old) Q Mtp1 Ipc Oct21Document10 pagesTax (Old) Q Mtp1 Ipc Oct21Karan Singh RanaNo ratings yet

- 7ACCN018W - Exam May 2020 (MODIFIED 7 April 2020)Document11 pages7ACCN018W - Exam May 2020 (MODIFIED 7 April 2020)hazyhazy9977No ratings yet

- P1 Question June 2021Document6 pagesP1 Question June 2021S.M.A AwalNo ratings yet

- 11CH8DHSS2Document4 pages11CH8DHSS2Pranit SonthaliaNo ratings yet

- Tutorial 8 ACC POLICIES, ESTIMATES, ERRORSFileDocument9 pagesTutorial 8 ACC POLICIES, ESTIMATES, ERRORSFileAisyah OthmanNo ratings yet

- Project Appraisal MBA-IVDocument11 pagesProject Appraisal MBA-IVnareshbansal130No ratings yet

- Corporate FinanceDocument2 pagesCorporate FinanceMuhammad Atif SheikhNo ratings yet

- Ca-Inter Nov.'21 Batch Test of Taxation Topic Covered: PGBPDocument5 pagesCa-Inter Nov.'21 Batch Test of Taxation Topic Covered: PGBPshettymihir9No ratings yet

- EM Final Paper Assingment EE GCU S18Document4 pagesEM Final Paper Assingment EE GCU S18KhanNo ratings yet

- Paper7 Syl22 Dec23 Set1Document6 pagesPaper7 Syl22 Dec23 Set1rishabhrai676No ratings yet

- Capital Budgeting Techniques for Investment EvaluationDocument5 pagesCapital Budgeting Techniques for Investment EvaluationUday Gowda0% (1)

- Students Engineering EconomyDocument9 pagesStudents Engineering EconomyAlyssa Apolinario100% (1)

- Students Engineering Economy 2 PDFDocument9 pagesStudents Engineering Economy 2 PDFMark Jake RodriguezNo ratings yet

- SFM 6 PDFDocument3 pagesSFM 6 PDFketulNo ratings yet

- Paper 1 FinalDocument2 pagesPaper 1 FinalMaria Jafar KhanNo ratings yet

- ENGR 301 Final Exam CPM Network AnalysisDocument13 pagesENGR 301 Final Exam CPM Network AnalysisSang MangNo ratings yet

- taxation-test-6-ch-4-unit-3-unscheduled-nov-2023-Test-Paper-1689754347 (1)Document11 pagestaxation-test-6-ch-4-unit-3-unscheduled-nov-2023-Test-Paper-1689754347 (1)ashishchafle007No ratings yet

- Management Accounting For Financial ServicesDocument2 pagesManagement Accounting For Financial ServicesJAVEDNo ratings yet

- Capital Budgeting Illustrative NumericalsDocument6 pagesCapital Budgeting Illustrative NumericalsPriyanka Dargad100% (1)

- BCA 2nd Sem Assignment 2022-23Document18 pagesBCA 2nd Sem Assignment 2022-23JOJI U.RNo ratings yet

- FAB Assignment 2020-2021 - UpdatedDocument7 pagesFAB Assignment 2020-2021 - UpdatedMuhammad Hamza AminNo ratings yet

- A GCE Accounting 2505 June 2007 Question Paper +ansDocument17 pagesA GCE Accounting 2505 June 2007 Question Paper +ansNaziya BocusNo ratings yet

- Test 1 N 2 Sem Sept - Dec 2018 For StudentDocument7 pagesTest 1 N 2 Sem Sept - Dec 2018 For StudentjohncenaNo ratings yet

- QUESTION PAPER-S4 - Set 2Document3 pagesQUESTION PAPER-S4 - Set 2Titus ClementNo ratings yet

- AFIN209 2018 Semester 1 Final Exam PDFDocument6 pagesAFIN209 2018 Semester 1 Final Exam PDFGeorge MandaNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- LAB - 5 - Electric Actuators and Mechanisms PDFDocument6 pagesLAB - 5 - Electric Actuators and Mechanisms PDFAamir MansoorNo ratings yet

- Bahria University (Karachi Campus) : Task 1Document2 pagesBahria University (Karachi Campus) : Task 1Aamir MansoorNo ratings yet

- LAB - 8 - Sequencing and Cascading Circuits Using FluidSIM PDFDocument4 pagesLAB - 8 - Sequencing and Cascading Circuits Using FluidSIM PDFAamir MansoorNo ratings yet

- LAB - 5 - Electric Actuators and Mechanisms PDFDocument6 pagesLAB - 5 - Electric Actuators and Mechanisms PDFAamir MansoorNo ratings yet

- LAB - 4 - Linear Variable Differential Transformer - LVDT PDFDocument5 pagesLAB - 4 - Linear Variable Differential Transformer - LVDT PDFAamir MansoorNo ratings yet

- LAB - 4 - Linear Variable Differential Transformer - LVDT PDFDocument5 pagesLAB - 4 - Linear Variable Differential Transformer - LVDT PDFAamir MansoorNo ratings yet

- LAB - 4 - Linear Variable Differential Transformer - LVDT PDFDocument5 pagesLAB - 4 - Linear Variable Differential Transformer - LVDT PDFAamir MansoorNo ratings yet

- LAB - 5 - Electric Actuators and Mechanisms PDFDocument6 pagesLAB - 5 - Electric Actuators and Mechanisms PDFAamir MansoorNo ratings yet

- Complex Engineering Task 2 PDFDocument3 pagesComplex Engineering Task 2 PDFAamir MansoorNo ratings yet

- Local Resident Plots ApplicationDocument3 pagesLocal Resident Plots ApplicationAamir MansoorNo ratings yet

- Complex Engineering Task 1 PDFDocument3 pagesComplex Engineering Task 1 PDFAamir MansoorNo ratings yet

- Complex Engineering Task 2 PDFDocument3 pagesComplex Engineering Task 2 PDFAamir MansoorNo ratings yet

- Pneumatic and Hydraulic Actuation SystemsDocument29 pagesPneumatic and Hydraulic Actuation SystemsAamir MansoorNo ratings yet

- Complex Engineering Task 1 PDFDocument3 pagesComplex Engineering Task 1 PDFAamir MansoorNo ratings yet

- Introduction to Mechatronics SensorsDocument18 pagesIntroduction to Mechatronics SensorsAamir MansoorNo ratings yet

- Ch16 Lecture NotesDocument40 pagesCh16 Lecture NotesAhmed TahmidNo ratings yet

- Bahria University: Introduction To MechatronicsDocument4 pagesBahria University: Introduction To MechatronicsAamir MansoorNo ratings yet

- Python Packages 17052020 104702am PDFDocument5 pagesPython Packages 17052020 104702am PDFAamir MansoorNo ratings yet

- Metal Detector Security SystemDocument4 pagesMetal Detector Security SystemAamir MansoorNo ratings yet

- Lecture 19 - 20 10062020 025505pmDocument22 pagesLecture 19 - 20 10062020 025505pmAamir MansoorNo ratings yet

- EEA-430 Introduction To Mechatronics: D R. Abdul Attayyab Khan Email AddressDocument16 pagesEEA-430 Introduction To Mechatronics: D R. Abdul Attayyab Khan Email AddressAamir MansoorNo ratings yet

- Bahria University: Introduction To MechatronicsDocument4 pagesBahria University: Introduction To MechatronicsAamir MansoorNo ratings yet

- Important Instructions (Read Carefully Before Creating Project Report)Document6 pagesImportant Instructions (Read Carefully Before Creating Project Report)Aamir MansoorNo ratings yet

- Exampleproblemsandsolutionsogata Root LocusDocument21 pagesExampleproblemsandsolutionsogata Root LocusAamir MansoorNo ratings yet

- Fourth-order transfer function approximationDocument32 pagesFourth-order transfer function approximationvignesh0617100% (1)