Professional Documents

Culture Documents

HLA Beyond Cancer Plan: Wong Evis No 674 Pt4898 Wakaf Delima Wakaf Bharu 16250 Wakaf Bharu Kelantan, Malaysia

Uploaded by

nadiaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HLA Beyond Cancer Plan: Wong Evis No 674 Pt4898 Wakaf Delima Wakaf Bharu 16250 Wakaf Bharu Kelantan, Malaysia

Uploaded by

nadiaCopyright:

Available Formats

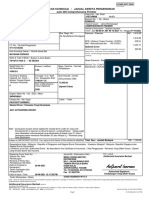

Detail1: A0078131_TL201716510704_N_N_N_Y_N_1_I Doc: TLS

Detail2: WONG EVIS_NO 674 PT4898 WAKAF DELIMA_WONG EVIS_16250

22/01/2020

PL11100000

PL11100000

A0078131_TL201716510704

WONG EVIS

NO 674 PT4898 WAKAF DELIMA

WAKAF BHARU

16250 WAKAF BHARU

KELANTAN, MALAYSIA

TL201716510704/TLAS/KG/A0078131/A0068603/A0019903

YEAR 2019 LIFE INSURANCE PREMIUM STATEMENT

PENYATA PREMIUM INSURANS HAYAT TAHUN 2019

Life Policy No. / No. Polisi TL201716510704 Status / Status IN-FORCE

Commencement Date / Tarikh Permulaan 15/05/2017 Maturity Date / Tarikh Matang 14/05/2047

Payment Mode / Frekuensi Pembayaran YEARLY

Policy Owner / Pemunya polisi WONG EVIS

Assignor / Penyerah Hak NOT APPLICABLE

Life Assured / Hayat Diinsuranskan WONG EVIS

PREMIUM PAID / JUMLAH PREMIUM DIBAYAR ( 01/01/2019 - 31/12/2019 )

Life / Insurans hayat RM 10,000.00

Medical / Perubatan RM 0.00

Education / Pendidikan RM 0.00

Annuity / Anuiti RM 0.00

Total Premium Paid / RM 10,000.00

Jumlah Premium Dibayar

*Total Automatic Premium Loan / *Jumlah Pinjaman Premium Automatik RM 0.00

Service Tax (if any) / Cukai Perkhidmatan (jika ada) RM 0.00

Note: This statement is issued for the PURPOSE OF SUBMISSION TO THE INLAND REVENUE BOARD. Eligibility for deductions which may be claimed is subject to the approval of Inland

Revenue Board.

Nota: Penyata ini dikeluarkan untuk TUJUAN PELEPASAN CUKAI. Kelayakan tuntutan pelepasan cukai pendapatan adalah tertakluk kepada keputusan Jabatan Hasil Dalam Negeri.

* Deduction is not allowable for premiums which are not in fact paid although treated by the insurance company as having paid because of a non-forfeiture clause in the policy ie. Automatic

Premium Loan (APL). Please refer to www.hasil.com.my for further information.

* Potongan tidak dibenarkan bagi premium yang belum dibayar walaupun dianggap oleh syarikat insurans sebagai telah dibayar dengan adanya klausa non-forfeiture dalam polisi seperti

Pinjaman Premium Automatik dan sebagainya. Sila melanggani www.hasil.com.my untuk maklumat lanjutan.

HLA Beyond Cancer Plan

A Fresh Start To Your Life

Getting life insurance was previously impossible for cancer survivors,

but not anymore with the HLA Beyond Cancer Plan. The plan provides

protection against 10 critical illnesses, namely heart disease, stroke and

kidney failure, while enabling them to leave a meaningful legacy for

their family.

For more information, please visit any of our Hong Leong Assurance

branches, call 03-7650 1288 or log on to www.hla.com.my

This is a computer generated letter, no signature is required.

Ini adalah cetakan komputer, tandatangan tidak diperlukan.

Hong Leong Assurance Berhad (94613-X)

Level 3, Tower B, PJ City Development, No. 15A, Jalan 219, Seksyen 51A, 46100 Petaling Jaya, Selangor. CERTIFIED TO ISO 9001:2015

CERT. NO. : QMS 00355

P.O. Box 120, 46710 Petaling Jaya.

Telephone 03-7650 1818 Fascimile 03-7650 1991

Customer Service Hotline 03-7650 1288 Customer Service Hotfax 03-7650 1299 www.hla.com.my

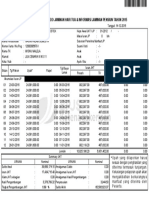

ANNUAL STATEMENT FOR POLICY / PENYATA TAHUNAN UNTUK POLISI ( TL201716510704 ) @ 31/12/2019

Plan Sum Assured / Benefits (RM) / Basic Annuity Premium (RM)

Pelan Jumlah Diinsuranskan / Faedah (RM) / Anuiti Asas Premium (RM)

Basic / Asas

HLA WEALTH INVEST (YEARLY) 10,000.00 10,000.00

Riders / Rider

NIL 0.00 0.00

Total Relevant Amount / Jumlah Amaun Relevan 10,000.00

Bonus Type Previous Accumulation (RM) Current**(RM) Total / Jumlah (RM)

Jenis Bonus Jumlah Terdahulu (RM) Semasa**(RM) @ 31/12/2019

Compound Reversionary Bonus / Annuity Bonus

NA NA NA

Bonus Berbalik Majmuk / Anuiti

Amount Declared Preceding Last 5 Years Amaun

2018 2017 2016 2015 2014

Dideklarasi 5 Tahun Sebelumnya

Compound Reversionary Bonus / Annuity Bonus

NA NA NA NA NA

Bonus Berbalik Majmuk / Anuiti

Cash Dividend (excluding interest)

300.00 0.00 0.00 0.00 0.00

Dividen Tunai (tidak termasuk faedah)

Cash Payment / Guaranteed Monthly or Yearly Income

/ Guaranteed Monthly or Yearly Cash Coupons

(excluding interest)

Deposit Bayaran Tunai / Pendapatan Bulanan atau Tahunan 2,000.00 0.00 0.00 0.00 0.00

Terjamin / Kupon Tunai Bulanan atau Tahunan Terjamin

(tidak termasuk faedah)

Policy Benefits / Polisi Faedah

Current Year (excluding interest)** Total / Jumlah (RM)

Cash Dividend / Dividen Tunai 300.00

Cash Payment / Guaranteed Monthly or Yearly Income / Guaranteed Monthly or Yearly Cash Coupons /

2,000.00

Bayaran Tunai / Pendapatan Bulanan atau Tahunan Terjamin / Kupon Tunai Bulanan atau Tahunan Terjamin

Total / Jumlah (RM)

Accumulated (inclusive of interest)

@ 31/12/2019

Deposited Cash Dividend / Deposit Dividen Tunai A 633.21

Deposited Cash Payment / Guaranteed Monthly or Yearly Income / Guaranteed Monthly or Yearly Cash Coupons /

B 4,221.44

Deposit Bayaran Tunai / Pendapatan Bulanan atau Tahunan Terjamin / Kupon Tunai Bulanan atau Tahunan Terjamin

Guaranteed Cash Surrender Value*** / Nilai Serahan Yang Dijamin*** C 0.00

Terminal Dividend (Value based on condition there are no changes to Policy 2 months before 31/12/2019

D 14,563.27

Dividen Terminal / (Nilai berdasarkan andaian tidak terdapat sebarang perubahan kepada Polisi 2 bulan sebelum 31/12/2019

Total Automatic Premium Loan / Jumlah Pinjaman Premium Automatik E 0.00

Total Policy Loan / Jumlah Pinjaman Polisi F 0.00

Projected Total Cash Surrender Value G = (A+B+C+D) - E - F

G 19,417.92

Anggaran Jumlah Nilai Serahan

Assignment, Nomination and Contingent Owner Details/Butir-butir Penyerahan Hak, Penamaan dan Pemunya Kotinjen

KOH CHHEW LAN ( Nominee / Penama )

NO 674, PT4898, WAKAF DELIMA, 16250, WAKAF BHARU, KELANTAN, MALAYSIA

Note / Nota :

1. The current interest rate for Policy Loan and Automatic Premium Loan is 8.00% per annum. The company will review this rate periodically based on prevailing interest rate and

this rate can be revised at the Company's discretion.

Kadar faedah semasa untuk Pinjaman Polisi dan Pinjaman Premium Automatik ialah 8.00% setahun. Syarikat akan menyemak kadar ini secara berkala berdasarkan kadar

faedah lazim dan kadar ini boleh disemak semula pada budi bicara Syarikat.

2. Terminal Dividend would be payable only upon Surrender from first year anniversary onwards or Maturity of the Policy (if applicable).

Dividend Terminal hanya akan dibayar atas syarat Penyerahan Nilai dari ulang tahun pertama atau Kematangan Polisi (jika berkenaan).

This is a computer generated letter, no signature is required.

Ini adalah cetakan komputer, tandatangan tidak diperlukan.

Hong Leong Assurance Berhad (94613-X)

Level 3, Tower B, PJ City Development, No. 15A, Jalan 219, Seksyen 51A, 46100 Petaling Jaya, Selangor. CERTIFIED TO ISO 9001:2015

CERT. NO. : QMS 00355

P.O. Box 120, 46710 Petaling Jaya.

Telephone 03-7650 1818 Fascimile 03-7650 1991

Customer Service Hotline 03-7650 1288 Customer Service Hotfax 03-7650 1299 www.hla.com.my

3. Critical Year (CY) option is an option to utilize the accumulated Cash Dividends to offset premium due. In the event that the accumulated dividends are exhausted, take up an

Automatic Premium Loan (APL) to offset premium due (if applicable).

Opsyen Tahun Kritikal (CY) merupakan satu pilihan untuk menggunakan Dividen Tunai terkumpul untuk mengimbangi premium yang perlu dibayar. Sekiranya dividen terkumpul

habis, Pinjaman Premium Automatik (APL) akan digunakan untuk mengimbangi premium yang perlu dibayar (jika berkenaan).

4. With effect from 1st September 2018, the premium charged* on the provision of all types of insurance policy to all business organization inclusive of life policy assigned to a

business organization is subject to 6% service tax. However, provision of insurance policy to educational institution and religious organization registered under any written law

are excluded from service tax.

Please take note that HLA reserves the right to collect from policyholders an amount equivalent to the Service Tax payable on the applicable premium for the policy period. In the

event that the policy period commences before but expires after 1st September 2018, HLA may collect from the policyholders an amount equivalent to the Service Tax payable

on the applicable premium calculated from 1st September 2018 on a pro-rated basis.

If the organization is exempted from 6% service tax, please provide us with a Service Tax Exemption Letter issued by the relevant authorities (e.g. Royal Malaysia Customs

Department or Ministry of Finance). The exemption from service tax will only take effect at next premium due date after HLA receives the Service Tax Exemption Letter.

*Top up premium (single/ regular top up) and reinvestment of claims/benefit paid (if applicable) forms part of the premium mentioned above

** Current Reversionary Bonus / Annuity Bonus /Cash Dividend / Yearly or Monthly Cash Payment Declared

** Semasa Bonus Berbalik Majmuk / Bonus Anuiti /Dividen Tunai / Bayaran Tunai tahunan atau bulanan

** Bonus to be declared in future (if any) is not guaranteed and will depend on the investment and operating results of the company

** Bonus yang akan dideklarasikan (jika ada) untuk pada masa akan datang adalah tidak terjamin dan bergantung kepada pelaburan dan keputusan operasi

*** Subject to deduction of any indebtedness in the policy i.e APL including interest, Policy Loan including interest and etc.

*** Potongan akan diambil kira dari segala tunggakan seperti Pinjaman Premium Automatik termasuk faedah, Pinjaman Polisi termasuk faedah and sebagainya.

*** Guaranteed Cash Surrender Value is inclusive of the Cash Surrender Values of Basic Plan, Rider(s) (if any) and Reversionary Bonus (if any) and Annuity Bonus (if any) as at the date of

extraction.

*** Jaminan Nilai Serahan Yang Dijamin adalah termasuk Nilai Serahan Pelan Asas Polisi, Rider (jika ada) dan Bonus Berbalik Majmuk (jika ada) Bonus Anuiti (jika ada) pada tarikh diekstrak.

This is a computer generated letter, no signature is required.

Ini adalah cetakan komputer, tandatangan tidak diperlukan.

Hong Leong Assurance Berhad (94613-X)

Level 3, Tower B, PJ City Development, No. 15A, Jalan 219, Seksyen 51A, 46100 Petaling Jaya, Selangor. CERTIFIED TO ISO 9001:2015

CERT. NO. : QMS 00355

P.O. Box 120, 46710 Petaling Jaya.

Telephone 03-7650 1818 Fascimile 03-7650 1991

Customer Service Hotline 03-7650 1288 Customer Service Hotfax 03-7650 1299 www.hla.com.my

Detail1: A0078131_TL201716510704_N_N_N_Y_N_1_I Doc: TX1

Detail2: WONG EVIS_NO 674 PT4898 WAKAF DELIMA_WONG EVIS_16250

Bonus and Cash Dividend

If your policy shares in the profits of the Participating Fund managed by the company, by way of Compound Reversionary

Bonuses (CRB) or Cash Dividends (CD), please note that actual CRB or CD may vary from year to year depending on the

investment returns and operating results of the Fund. Thus CRB or CD declared may be higher or lower from that shown in the

sales illustration given previously to you. Once annual CRB or CD is declared, they are guaranteed and are not affected by

subsequent year's declarations. If you have elected a Critical Year option, please note that as it depends on the amount of CRB

or CD declared, and the interest rates applied,it is thus not guaranteed. A reduction of the CRB or CD declared may require you

to make premium payments after the Critical Year.

Period of Grace

A thirty (30) days' grace period from the due date shall be allowed for the payment of renewal premiums. A payment for premium

made after grace period is subject to interest on late payment at a rate, which the Company may prescribe from time to time. The

policy shall remain in force during the grace period. In the event of the premium not being paid within the period of grace, the

Policy shall be automatically converted to an Automatic Non-Forfeiture Privilege or Extended Term Insurance after the expiry of

the grace period.

Automatic Extended Term Assurance Privilege

To use the cash value available less any indebtedness due to us (if any) to continue this Policy as a non-participating extended

term insurance for such period as the cash value less any indebtedness due to us (if any) could purchase at the Life Assured's

age at the time this Policy is continued. If the cash value is more than sufficient to purchase Extended Term Insurance to the

expiry date, the excess shall be refunded to the Policy Owner.

Bonus dan Dividen

Jika polisi anda ialah polisi hayat sertaan, secara bonus berbalik majmuk (CRB) atau Dividen Tunai (CD), sila ambil perhatian

bahawa CRB atau CD yang diagihkan setiap tahun akan berbeza dari tahun ke tahun mengikut pulangan pelaburan dan

pengurusan dana. Oleh yang demikian, CRB atau CD yang diisytiharkan berkemungkinan berbeza dengan illustrasi yang

ditunjukkan kepada anda sebelum ini. Apabila CRB atau CD telah diperuntukan, ianya adalah dijamin dan tidak akan terjejas

oleh pengisytiharan yang berikutnya. Jika anda memilih opsyen tahun kritikal, ianya adalah bergantung kepada jumlah dari CRB

atau CD yang diisytiharkan dan kadar faedah yang dikenakan. Oleh yang demikian, ia adalah tidak dijamin. Pengurangan ke

atas CRB atau CD yang bakal diisytiharkan mungkin memerlukan pembayaran premium seterusnya selepas tahun kritikal.

Tempoh Tenggang

Suatu tempoh tenggang selama tiga puluh (30) hari akan dibenarkan untuk pembayaran pembaharuan premium. Dalam

keadaan premium tidak dibayar dalam tempoh tenggang, polisi akan berakhir dan semua premium yang tidak dibayar akan

dilucut oleh Syarikat kecuali dimana premium boleh dibayar dengan permohonan Keistimewaan Tiada Lucut Automatik ataupun

Keistimewaan Insurans Sementara Automatik.

Keistimewaan Insurans Sementara Automatik

Selepas polisi anda memperoleh nilai serahan tunai, anda boleh menggunakan nilai tunai anda yang ada selepas ditolak

apa-apa keterhutangan yang patut dibayar kepada kami (jika ada) untuk meneruskan Polisi ini sebagai insurans bertempoh

lanjutan tanpa penyertaan untuk selama tempoh yang boleh dibeli dengan nilai tunai selepas ditolak apa keterhutangan yang

patut dibayar kepada kami (jika ada) pada umur Hayat Diinsuranskan pada Polisi ini diteruskan. Jika nilai tunai adalah lebih

daripada cukup untuk membeli insurans Bertempoh Lanjutan hingga tarikh tamat tempoh, maka lebihnya akan dibayar balik

kepada pemunya Polisi.

This is a computer generated letter, no signature is required.

Ini adalah cetakan komputer, tandatangan tidak diperlukan.

Hong Leong Assurance Berhad (94613-X)

Level 3, Tower B, PJ City Development, No. 15A, Jalan 219, Seksyen 51A, 46100 Petaling Jaya, Selangor. CERTIFIED TO ISO 9001:2015

CERT. NO. : QMS 00355

P.O. Box 120, 46710 Petaling Jaya.

Telephone 03-7650 1818 Fascimile 03-7650 1991

Customer Service Hotline 03-7650 1288 Customer Service Hotfax 03-7650 1299 www.hla.com.my

PERFORMANCE OF THE PAR FUND

The Par Fund achieved a gross of tax investment return of 11.42% for the financial year ended 30 June

2019. The gross of tax investment return over the past 5 years are as follows:

Investment Returns for Par Fund Gross of Tax

Financial Year 1-year return

2015 5.00%

2016 4.69%

2017 6.66%

2018 3.04%

2019 11.42%*

* Includes unrealized gains. Due to changes to the accounting basis under the new Malaysian accounting

standard MFRS9 effective 1 July 2018, investment returns reported with effect from 1 July 2018 include

unrealized gains. Unrealized gains represent changes in asset values of the investments held purely due

to market movements. These changes in asset values have not been realized and are temporary in nature.

The continual market movements may change unrealized gains into unrealized losses.

The level of bonuses is determined based on the actual experience and future outlook of key factors

affecting the performance of the fund. The key factors include investment performance and future

investment outlook of the fund, operating expenses, insurance claims and surrender experiences.

Bonus allocations are smoothed over a period of time to avoid significant short-term fluctuation in the

bonus declared. As investment performance fluctuates over time, some of the investment returns in good

years may not be distributed immediately so as to smooth out the returns in years where the investment

return is low. However, if the investment performance is poor for several years, bonus rates may be

reduced to reflect the poor results.

Investment Performance in FY 2019

Equities

For the first half of the period under review, the Malaysian market was generally on a downtrend as it

was adjusting to the new government’s policies following the 14th General Elections in May 2018 and

more so with markets digesting the official breakout of trade war between US and China in July 2018.

Continued policy uncertainties on mega projects and regulatory risks caused investors to shy away from

the market. However, at the start of 2019, the Malaysian market saw a turn for the better following the

90-day trade truce made at the G20 summit in Buenos Aires and with crude oil prices rallying from the

bottom on signs that major oil producers have been cutting back on production. This rally was, however,

short-lived when Bank Negara Malaysia made a pre-emptive overnight policy rate cut of 25bps to 3% in

May to address the potential downside risk to growth which had an impact on heavy weighted sectors

such as financials. On the positive side, lackluster valuations in certain sectors and stiff competition have

pushed consolidation and revived M&A activity. In addition, better regulatory clarity for selected counters

This is a computer generated letter, no signature is required.

Ini adalah cetakan komputer, tandatangan tidak diperlukan.

Hong Leong Assurance Berhad (94613-X)

Level 3, Tower B, PJ City Development, No. 15A, Jalan 219, Seksyen 51A, 46100 Petaling Jaya, Selangor. CERTIFIED TO ISO 9001:2015

CERT. NO. : QMS 00355

P.O. Box 120, 46710 Petaling Jaya.

Telephone 03-7650 1818 Fascimile 03-7650 1991

Customer Service Hotline 03-7650 1288 Customer Service Hotfax 03-7650 1299 www.hla.com.my

such as MAHB and TNB sent the stocks rallying in view of less bearish outcomes as previously postulated

by analysts. With that, the KLCI recovered some of its losses but still posted a decline of 1.15% during the

period under review to close at 1672.13 points.

Fixed Income

The fixed income market for the financial year under review was dominated by episodes of surprises and

its ensuing volatility. In the first half of the financial year, the US Federal Reserve went on a tightening

spree on the back of stronger economic metrics which gave rise to two rounds of hikes in the Fed fund

rates. Following the aforesaid hikes, market players were also guided to position for 3 to 4 hikes in the

second half of the financial year.

From a cautiously optimistic tone, market sentiment took a drastic turn with the unexpected escalation

of trade tension between US and China. On top of that, persistent backlogs in the negotiation surrounding

a Brexit deal, sluggish growth in Europe and other geopolitical stresses globally, started to simultaneously

weigh on global growth. As such, bond yields started to trend lower and went into a free fall in the second

half of the financial year. Sovereign yields for some of the developed nations have plunged into the sub-

zero territory and have seen little signs of a reversion in the near term. Locally, persistent market volatility

and external risks had prompted Bank Negara Malaysia (“BNM”) to take a preemptive cut in its overnight

policy rate by 25 bps to 3.00% in May 2019. The Malaysian fixed income market, surprised by an

announcement on the potential exclusion of Malaysian Government Securities (“MGS”) from the FTSE

Russell’s World Government Bond Index, sparked a knee-jerk selloff which turned out to be relatively

short-lived in the bond market as active foreign bondholders offloaded some positions in anticipation of

the eventual decision by FTSE Russell to remove the MGS from its flagship index. Nonetheless, as domestic

liquidity remains flushed and supply of private debt securities continued to be scarce, local institutions

stepped in to cushion the selloff by the foreign investors.

Investment Outlook

Equity

For the rest of 2019, we expect global equity markets to remain choppy even after the trade truce pact

was made in the G20 summit in Japan as core issues of the trade war – dispute over intellectual property

and transfer of technology - have not been resolved. The trade tensions between the US and China has

resulted in higher volatility with the markets getting more nervous on the negative economic impact

under a prolonged trade friction which will invariably hurt the global supply chain. Major global central

banks have therefore signaled easing - marking the turn of the policy rate cycle as the dovish stance by

central banks is in the hope of using monetary easing to cushion downside risks stemming from

geopolitical factors and the protracted trade war.

On the domestic front, the revival of some key infrastructure projects, resilient crude oil prices and

corporate mergers have lent some support to the market. However, heavy weighted sectors such as banks

This is a computer generated letter, no signature is required.

Ini adalah cetakan komputer, tandatangan tidak diperlukan.

Hong Leong Assurance Berhad (94613-X)

Level 3, Tower B, PJ City Development, No. 15A, Jalan 219, Seksyen 51A, 46100 Petaling Jaya, Selangor. CERTIFIED TO ISO 9001:2015

CERT. NO. : QMS 00355

P.O. Box 120, 46710 Petaling Jaya.

Telephone 03-7650 1818 Fascimile 03-7650 1991

Customer Service Hotline 03-7650 1288 Customer Service Hotfax 03-7650 1299 www.hla.com.my

and plantations have registered minimal to negative earnings growth following tepid demand due to low

consumer sentiment and low crude palm oil prices. Whilst the Malaysian equity market is trading at fair

valuations, corporate earnings’ growth is subdued against the current economic backdrop. However, we

have turned less bearish on the market as foreign investors have been net sellers of our market for two

consecutive years and expectations for corporate earnings are already low. Any significant pullback on

the Malaysian equity market will be a good entry point as we remain positive on the Malaysian economy

in the longer term.

Fixed Income

We opine that the lingering uncertainties from the ongoing trade tension and the spillover effect on the

various global supply chains are likely to have adverse consequences on global growth and inflation. As

such, central banks across the globe are likely to play the accommodative card in the near term. Hence,

we expect investors to maintain an overweight stance on bonds relative to equities until further clarity

surfaces from the trade negotiations between US and China. Domestically, we take the view that the

aforementioned external pressures would prompt BNM to initiate another rate cut in the next 6 to 12

months. In view of that, the low interest rate environment should be conducive for fundraising

opportunities in the corporate space. We expect investors to start to favour investment-grade corporate

papers for yield pick-up over the MGS. As domestic liquidity remains ample and supply of private debt

securities continues to be scarce, we think that bond market yields will remain depressed. That said we

are keeping a close eye on the developments surrounding FTSE Russell’s contemplation to remove

Malaysia from its flagship World Government Bond Index by September 2019. Although BNM had recently

initiated some measures to enhance market liquidity and accessibility, we do not rule out the possibility

of an outright exclusion. Hence, we are positioning for investment opportunities from any selloff by

foreign investors should the risk-reward be favorable.

This is a computer generated letter, no signature is required.

Ini adalah cetakan komputer, tandatangan tidak diperlukan.

Hong Leong Assurance Berhad (94613-X)

Level 3, Tower B, PJ City Development, No. 15A, Jalan 219, Seksyen 51A, 46100 Petaling Jaya, Selangor. CERTIFIED TO ISO 9001:2015

CERT. NO. : QMS 00355

P.O. Box 120, 46710 Petaling Jaya.

Telephone 03-7650 1818 Fascimile 03-7650 1991

Customer Service Hotline 03-7650 1288 Customer Service Hotfax 03-7650 1299 www.hla.com.my

Detail1: A0078131_TL201716510704_N_N_N_Y_N_1_I Doc: ANO

Detail2: WONG EVIS_NO 674 PT4898 WAKAF DELIMA_WONG EVIS_16250

ANNOUNCEMENT

TL201716510704

What is JomPAY?

JomPAY is a service that allows banks' customer to easily pay insurance bills using their credit cards or from their

banking accounts.

Why JomPAY?

Fast, convenient and secure.

How to Make Payment with JomPAY?

1. Spot

Look for JomPAY logo and Biller Code on your insurance premium statement.

2. Go Online

Log on to your preferred Internet or Mobile Banking and look for JomPAY

3. Pay

Enter the policy no from the insurance premium statement and proceed to submit

PERSONAL DATA

Hong Leong Assurance Berhad (“HLA”) safeguards your personal data in accordance with applicable laws in M alaysia. HLA uses personal

data in accordance with the HLA Notice On Personal Data as may be amended from time to time (“Notice on Personal Data”). The Notice on

Personal Data explains the data collection purposes, the persons to whom HLA may transfer data, your data access and correction rights

and how you may contact HLA’s Data Protection Officer. Copies of the Notice on Personal Data are available upon request or from the HLA

website (www.hla.com.my) and you are advised to read the Notice on Personal Data. All personal data provided to HLA by yourself and/or

acquired by HLA from the public domain, as well as personal data that arises as a result of the provision of services to yourself will be subject

to such Notice on Personal Data. If you have any queries, please contact HLA Data Protection Officer at 03-76501817 (fax number), 03-

76501660 (telephone number) or by way of email to customerservice@hla.hongleong.com.my.

DATA PERIBADI

Hong Leong Assurance Berhad ("HLA") melindungi data peribadi anda selaras dengan undang-undang di Malaysia. HLA menggunakan

data peribadi mengikut Notis Data Peribadi HLA sebagaimana yang dipinda dari semasa ke semasa ("Notis Data Peribadi"). Notis Data

Peribadi menerangkan tujuan pengumpulan data, orang yang kepadanya HLA boleh memindahkan data, data akses anda dan hak-hak

pembetulan anda dan bagaimana anda boleh menghubungi Pegawai Perlindungan Data HLA . Salinan Notis Data Peribadi boleh didapati

atas permintaan atau daripada laman web HLA (www.hla.com.my) dan anda dinasihatkan supaya membaca Notis Data Peribadi. Semua

data peribadi yang anda berikan kepada HLA dan/atau yang diperoleh oleh HLA daripada domain awam, dan juga data peribadi yang timbul

akibat daripada penyediaan perkhidmatan kepada anda akan tertakluk kepada Notis Data Peribadi. Jika anda mempunyai sebarang

pertanyaan, sila hubungi Pegawai Perlindungan Data HLA di 03-76501817 (nombor faks), 03- 76501660 (nombor telefon) atau melalui e-

mel kepada customerservice@hla.hongleong.com.my.

Minimum Guaranteed Unit Price at Fund Maturity for HLA EverGreen Funds (If Applicable)

We are pleased to append below the minimum unit price at fund maturity for EverGreen Funds updated as of 27/12/2019.

Fund Type Matu rity Da te Min Unit Price at Funds Maturity (before tax)

HLA EVERGREEN 2023 26 /12/2023 1.2358

HLA EVERGREEN 2025 26 /12/2025 1.2670

HLA EVERGREEN 2028 26 /1 2/2028 1.3136

HLA EVERGREEN 2030 26 /1 2/2030 1.3446

HLA EVERGREEN 2035 26 /12/2035 1.4221

The minimum Guaranteed Unit Price at Fund maturity before tax will attract a portion of tax which has yet to be provided

for. The further tax adjustment is the difference of tax payable on the capital gains of the Funds determined at the funds

maturity and tax which has been provided for the Funds through weekly unit pricing.

The unit prices published weekly are on after tax basis.

Publication of Unit Price

The unit prices of investment linked funds are available on www.hla.com.my.

We also publish the unit prices in Berita Harian and The New Straits Times on the last business day of every month.

You might also like

- Annual Life Insurance Premium Statement for Goh Qi ChengDocument6 pagesAnnual Life Insurance Premium Statement for Goh Qi ChengKendrick Goh QichengNo ratings yet

- SampleDocument5 pagesSamplenadiaNo ratings yet

- The Guru’s Guide to Self-Managed Super Funds: The $700 Billion (And Growing) Super Powerhouse ExplainedFrom EverandThe Guru’s Guide to Self-Managed Super Funds: The $700 Billion (And Growing) Super Powerhouse ExplainedNo ratings yet

- Annual investment policy statementDocument13 pagesAnnual investment policy statementLow Kim HoeNo ratings yet

- Belastingboekhouding voor Beginners: Een Toegankelijke HandleidingFrom EverandBelastingboekhouding voor Beginners: Een Toegankelijke HandleidingNo ratings yet

- Statement Ilps 2020Document8 pagesStatement Ilps 2020Faiz RosliNo ratings yet

- Policy Mcd1795Document7 pagesPolicy Mcd1795surya namahaNo ratings yet

- AXA insurance policy detailsDocument9 pagesAXA insurance policy detailssyahmiNo ratings yet

- Cover NoteDocument2 pagesCover Notecalvin tekNo ratings yet

- Motor Insurance Policy for Malaysian Car OwnerDocument7 pagesMotor Insurance Policy for Malaysian Car Ownersurya namahaNo ratings yet

- Nor Hayati Bte IbrahimDocument1 pageNor Hayati Bte Ibrahimyatie9429No ratings yet

- C301149660-Renewal Premium ReceiptDocument1 pageC301149660-Renewal Premium ReceiptsaivenkateswarNo ratings yet

- Syamsul Farizth Bin RemeliDocument1 pageSyamsul Farizth Bin RemeliZarinaKhalidNo ratings yet

- Annual income distribution statement for Amanah Saham Malaysia 2 - WawasanDocument2 pagesAnnual income distribution statement for Amanah Saham Malaysia 2 - Wawasannick1628No ratings yet

- Tagihan / Bill: Rp. 8,100 Credit 18 May 2019Document3 pagesTagihan / Bill: Rp. 8,100 Credit 18 May 2019anon_597994779No ratings yet

- Allianz Life Insurance Policy Sustainability QuoteDocument4 pagesAllianz Life Insurance Policy Sustainability Quotechang muiyunNo ratings yet

- Human Resource Management Division Head Office, Plot No. 4, Sector 10, Dwarka, New Delhi-110 075Document6 pagesHuman Resource Management Division Head Office, Plot No. 4, Sector 10, Dwarka, New Delhi-110 075Srikanth Reddy ChityalaNo ratings yet

- Pacific & Orient Insurance Co BHDDocument1 pagePacific & Orient Insurance Co BHDMuhammad FaizNo ratings yet

- Private Car Schedule / Jadual Kereta Persendirian Auto 365 Comprehensive PremierDocument12 pagesPrivate Car Schedule / Jadual Kereta Persendirian Auto 365 Comprehensive Premiernavindon6No ratings yet

- RP 108,900 01 Nov 2019: Fathul Faruq Golantepus Mejobo Jawa Tengah 50000 GOLANTEPUS 001/006Document2 pagesRP 108,900 01 Nov 2019: Fathul Faruq Golantepus Mejobo Jawa Tengah 50000 GOLANTEPUS 001/006Faruq Naga AlfaNo ratings yet

- Inv Sal Inv 2020 1419066Document2 pagesInv Sal Inv 2020 1419066Mobil Tua EropaNo ratings yet

- LIC Wealth PlusDocument3 pagesLIC Wealth Plussatish kumarNo ratings yet

- RPN 2H765220702 1294 PDFDocument1 pageRPN 2H765220702 1294 PDFManohar ByrisettiNo ratings yet

- Invoice Kuitansi: Pt. Singgasana Unagi IndonesiaDocument1 pageInvoice Kuitansi: Pt. Singgasana Unagi IndonesiaHwang XuxiNo ratings yet

- Payslip 4 2022Document1 pagePayslip 4 2022Sunil B R SunilshettyNo ratings yet

- Rincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2015Document1 pageRincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2015DesiNo ratings yet

- Tax Invoice / Statement of Account: Invois Cukai / Penyata AkaunDocument3 pagesTax Invoice / Statement of Account: Invois Cukai / Penyata AkaunTasaka AmbotangNo ratings yet

- JRF 4597Document4 pagesJRF 4597feigu6598No ratings yet

- Tagihan / Bill: Rp. 8,100 Credit 14 Apr 2019Document2 pagesTagihan / Bill: Rp. 8,100 Credit 14 Apr 2019lefhanNo ratings yet

- Management Fee Info for REKSA DANA SIMAS MAJU BERKEMBANGDocument1 pageManagement Fee Info for REKSA DANA SIMAS MAJU BERKEMBANGOpik TamaNo ratings yet

- Tan Choon MingDocument1 pageTan Choon MingChoon MingNo ratings yet

- NotifyagreementnoDocument2 pagesNotifyagreementnonormahifzanNo ratings yet

- 2 PDFDocument1 page2 PDFyatie9429No ratings yet

- myIM3 6281585160497 201905Document3 pagesmyIM3 6281585160497 201905Yusuf SugiartoNo ratings yet

- 20221231-ANLstat ASB 000013324224Document2 pages20221231-ANLstat ASB 000013324224cd5ws9dvdxNo ratings yet

- Alliance - NOD (Amended 1.0)Document3 pagesAlliance - NOD (Amended 1.0)Daniel OthmanNo ratings yet

- InvalidDocument1 pageInvalidmiss kentalNo ratings yet

- Rincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2015Document2 pagesRincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2015mashudiNo ratings yet

- Unit Trust Investment Holding Statement As at 23/12/2019: Penyata Pegangan Pelaburan Unit Amanah SetakatDocument1 pageUnit Trust Investment Holding Statement As at 23/12/2019: Penyata Pegangan Pelaburan Unit Amanah Setakatdayah87No ratings yet

- myIM3 6285727027131 201906Document3 pagesmyIM3 6285727027131 201906Irfan ArifinNo ratings yet

- Motor Vehicle Policy Schedule RewardsDocument5 pagesMotor Vehicle Policy Schedule RewardsQhazry Bin SulNo ratings yet

- Individual-Txation-FY-2018-19-with - JJDocument64 pagesIndividual-Txation-FY-2018-19-with - JJCOMPLETE ACADEMYNo ratings yet

- ITR Filing for Individual Himmat Singh for AY 2019-20Document3 pagesITR Filing for Individual Himmat Singh for AY 2019-20ashishrpgNo ratings yet

- STATEMENT ILPS 2022ysbDocument10 pagesSTATEMENT ILPS 2022ysbJeremy EliaNo ratings yet

- Invoice Biznet InternetDocument1 pageInvoice Biznet InternetiqsaneNo ratings yet

- AnnualStatementASNB 2Document3 pagesAnnualStatementASNB 2nur alia marissa mohd noor fairusNo ratings yet

- This Bill Is Net of Earlier Adjustment in Previous Advice. This Is A Computer Generated Payment Advice, Hence No Signature Is RequiredDocument1 pageThis Bill Is Net of Earlier Adjustment in Previous Advice. This Is A Computer Generated Payment Advice, Hence No Signature Is Requiredtapas kumar biswalNo ratings yet

- Cover NoteDocument2 pagesCover NoteKirajadi2u ServicesNo ratings yet

- Family Takaful Contribution Statement / Penyata Sumbangan Takaful Keluarga 2018Document1 pageFamily Takaful Contribution Statement / Penyata Sumbangan Takaful Keluarga 2018Ahmad NizamNo ratings yet

- Tax InvoiceDocument18 pagesTax InvoiceSachi AnandNo ratings yet

- Penyata Tahunan 2019: Annual Statement 2019Document6 pagesPenyata Tahunan 2019: Annual Statement 2019Athirah AzizNo ratings yet

- File 20220902164757Document194 pagesFile 20220902164757Faiz FahmiNo ratings yet

- Perbadanan Pengurusan Rumah Pangsa Zon 6D2 (1) (Blok De) : Statement of AccountDocument2 pagesPerbadanan Pengurusan Rumah Pangsa Zon 6D2 (1) (Blok De) : Statement of AccountSu Zana AnumNo ratings yet

- Pacific & Orient Insurance Co online motorcycle insurance quoteDocument2 pagesPacific & Orient Insurance Co online motorcycle insurance quoteMohamad HamidNo ratings yet

- 000005467410Document1 page000005467410qistinaazihanNo ratings yet

- QR-CSH-ORV/Rev. 0/ October 2007 Philam Life Customer ConfidentialDocument2 pagesQR-CSH-ORV/Rev. 0/ October 2007 Philam Life Customer ConfidentialMaybelle Cababat SaclotNo ratings yet

- Basic Savings Account-I: Penyata Akaun & Invois CukaiDocument2 pagesBasic Savings Account-I: Penyata Akaun & Invois CukaiMohd ZainuddinNo ratings yet

- Arun B KadamDocument3 pagesArun B KadamRohit KumardeyNo ratings yet

- Bbgo4103 PDFDocument1 pageBbgo4103 PDFnadiaNo ratings yet

- Bbgo4103 PDFDocument1 pageBbgo4103 PDFnadiaNo ratings yet

- Female Age 54 Life 800kDocument8 pagesFemale Age 54 Life 800knadiaNo ratings yet

- Soalan Assignment - CBMS4303Document8 pagesSoalan Assignment - CBMS4303aku kacakNo ratings yet

- Assignment/ Tugasan - Financial Management IiDocument6 pagesAssignment/ Tugasan - Financial Management IinadiaNo ratings yet

- Assignment 1 / Tugasan 1 - Research MethodologyDocument6 pagesAssignment 1 / Tugasan 1 - Research MethodologynadiaNo ratings yet

- Femele 2Document9 pagesFemele 2nadiaNo ratings yet

- HLA Beyond Cancer Plan: Wong Evis No 674 Pt4898 Wakaf Delima Wakaf Bharu 16250 Wakaf Bharu Kelantan, MalaysiaDocument8 pagesHLA Beyond Cancer Plan: Wong Evis No 674 Pt4898 Wakaf Delima Wakaf Bharu 16250 Wakaf Bharu Kelantan, MalaysianadiaNo ratings yet

- HLA Wealth Booster Plus Savings and Protection Plan ProjectionsDocument1 pageHLA Wealth Booster Plus Savings and Protection Plan ProjectionsnadiaNo ratings yet

- Baby rm6k PdsDocument6 pagesBaby rm6k PdsnadiaNo ratings yet

- Bbgo4103 PDFDocument1 pageBbgo4103 PDFnadiaNo ratings yet

- BBRC4103Document1 pageBBRC4103nadia0% (1)

- Perkembangan Islam Di Turki Menerusi Pendekatan Politik: Satu Sorotan SejarahDocument18 pagesPerkembangan Islam Di Turki Menerusi Pendekatan Politik: Satu Sorotan SejarahnadiaNo ratings yet

- RN170907113212734 RpuDocument13 pagesRN170907113212734 RpunadiaNo ratings yet

- Perkembangan Islam Di Turki Menerusi Pendekatan Politik: Satu Sorotan SejarahDocument18 pagesPerkembangan Islam Di Turki Menerusi Pendekatan Politik: Satu Sorotan SejarahnadiaNo ratings yet

- Financial Management II BBPW3203 Sept 2019Document1 pageFinancial Management II BBPW3203 Sept 2019nadiaNo ratings yet

- RN190326051031171 SiDocument11 pagesRN190326051031171 SinadiaNo ratings yet

- Bbgo4103 PDFDocument1 pageBbgo4103 PDFnadiaNo ratings yet

- Pending Requirement Letter - UL201919178230Document1 pagePending Requirement Letter - UL201919178230nadiaNo ratings yet

- RN190620050652087 PRDocument18 pagesRN190620050652087 PRnadiaNo ratings yet

- Perkembangan Islam Di Turki Menerusi Pendekatan Politik: Satu Sorotan SejarahDocument18 pagesPerkembangan Islam Di Turki Menerusi Pendekatan Politik: Satu Sorotan SejarahnadiaNo ratings yet

- Topic 5 Business Writing 1Document18 pagesTopic 5 Business Writing 1nadiaNo ratings yet

- New PdsDocument5 pagesNew PdsnadiaNo ratings yet

- Pending Requirement Letter - UL201919114633Document1 pagePending Requirement Letter - UL201919114633nadiaNo ratings yet

- .Document11 pages.nadiaNo ratings yet

- HLA Participating Life Fund Investment ReturnsDocument1 pageHLA Participating Life Fund Investment ReturnsnadiaNo ratings yet

- RN190620050652087 PDSDocument13 pagesRN190620050652087 PDSnadiaNo ratings yet

- ADocument4 pagesAnadiaNo ratings yet

- ResourceDocument2 pagesResourcealkubra313No ratings yet

- ACC501 All Solved Mid Term MCQsDocument31 pagesACC501 All Solved Mid Term MCQsMuhammad aqeeb qureshiNo ratings yet

- Fabozzi Bmas7 Ch23 ImDocument37 pagesFabozzi Bmas7 Ch23 ImSandeep SidanaNo ratings yet

- International FinanceDocument39 pagesInternational FinancesrinivasNo ratings yet

- 7 Steps To Understanding The Stock Market Ebook v3Document62 pages7 Steps To Understanding The Stock Market Ebook v3RiyasNo ratings yet

- Cost of Capital: Concept, Components, Importance, Example, Formula and SignificanceDocument72 pagesCost of Capital: Concept, Components, Importance, Example, Formula and SignificanceRamya GowdaNo ratings yet

- Financial Economics Chapter One Multiple Choice QuestionsDocument8 pagesFinancial Economics Chapter One Multiple Choice QuestionsAsif HossainNo ratings yet

- Paper - 2: Strategic Financial Management Questions Merger and AcquisitionsDocument27 pagesPaper - 2: Strategic Financial Management Questions Merger and AcquisitionsObaid RehmanNo ratings yet

- Finance Interview Questions: Infosys BrigadeDocument13 pagesFinance Interview Questions: Infosys Brigadevivekp987No ratings yet

- Gen Math GR 11Document3 pagesGen Math GR 11Juno HealerNo ratings yet

- Money Demand in The US A Quantitative ReviewDocument35 pagesMoney Demand in The US A Quantitative ReviewManuel Mercy GarciaNo ratings yet

- Agrarian Reform DocumentsDocument32 pagesAgrarian Reform DocumentsJuris PoetNo ratings yet

- FIMMDA Valuation MethodologyDocument13 pagesFIMMDA Valuation MethodologyRajashekhar PujariNo ratings yet

- Comprehensive FAR Part 3 ReviewDocument21 pagesComprehensive FAR Part 3 ReviewLabLab ChattoNo ratings yet

- Accounting for Bonds Payable: Key ConceptsDocument11 pagesAccounting for Bonds Payable: Key ConceptsChrisus Joseph SarchezNo ratings yet

- Financial Domain QuestionsDocument14 pagesFinancial Domain QuestionsNikhil SatavNo ratings yet

- Indian Institute of Quantitative Finance: 2020 FRM Exam Training SyllabusDocument5 pagesIndian Institute of Quantitative Finance: 2020 FRM Exam Training SyllabusSahil KumarNo ratings yet

- Docket Annotation (Superseding Indictment)Document32 pagesDocket Annotation (Superseding Indictment)MouldieParvatiNo ratings yet

- Economy of Argentina - WikipediaDocument20 pagesEconomy of Argentina - WikipediaTomasNo ratings yet

- 4 4Normal-DistributionsDocument24 pages4 4Normal-DistributionsRenalyn Palomeras PerudaNo ratings yet

- Risk Management Beyond Asset Class Diversification (Page, 2013)Document8 pagesRisk Management Beyond Asset Class Diversification (Page, 2013)Francois-Xavier AdamNo ratings yet

- Long-Term Liabilities AnswersDocument15 pagesLong-Term Liabilities AnswersNicoleNo ratings yet

- Appendix C: Time Value of MoneyDocument15 pagesAppendix C: Time Value of MoneyRabie HarounNo ratings yet

- LNWDocument21 pagesLNWchristoofar2190100% (1)

- Forecasting Local Currency Bond Risk Premia of Emerging Markets - The Role of Cross-Country Macro-Financial Linkages, 2019Document61 pagesForecasting Local Currency Bond Risk Premia of Emerging Markets - The Role of Cross-Country Macro-Financial Linkages, 2019Sorin DinuNo ratings yet

- Form 1040A or 1040Document2 pagesForm 1040A or 1040Vita Volunteers WebmasterNo ratings yet

- Paper - 2: Strategic Financial Management Questions Index FuturesDocument26 pagesPaper - 2: Strategic Financial Management Questions Index FutureskaranNo ratings yet

- John Maynard Keynes The General Theory of Employment Interest and Money A Critique by Brett DiDonatoDocument23 pagesJohn Maynard Keynes The General Theory of Employment Interest and Money A Critique by Brett DiDonatosoyouthinkyoucaninvest100% (1)

- Quiz 525Document23 pagesQuiz 525Haris NoonNo ratings yet

- BoostDocument811 pagesBoostVeeranki DavidNo ratings yet

- Treasury Operation in Islamic BanksDocument17 pagesTreasury Operation in Islamic BanksAnonymous f7wV1lQKRNo ratings yet

- Mindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessFrom EverandMindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessRating: 4.5 out of 5 stars4.5/5 (328)

- Summary of The Anxious Generation by Jonathan Haidt: How the Great Rewiring of Childhood Is Causing an Epidemic of Mental IllnessFrom EverandSummary of The Anxious Generation by Jonathan Haidt: How the Great Rewiring of Childhood Is Causing an Epidemic of Mental IllnessNo ratings yet

- Summary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesFrom EverandSummary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesRating: 5 out of 5 stars5/5 (1633)

- The One Thing: The Surprisingly Simple Truth Behind Extraordinary ResultsFrom EverandThe One Thing: The Surprisingly Simple Truth Behind Extraordinary ResultsRating: 4.5 out of 5 stars4.5/5 (708)

- Can't Hurt Me by David Goggins - Book Summary: Master Your Mind and Defy the OddsFrom EverandCan't Hurt Me by David Goggins - Book Summary: Master Your Mind and Defy the OddsRating: 4.5 out of 5 stars4.5/5 (382)

- Book Summary of The Subtle Art of Not Giving a F*ck by Mark MansonFrom EverandBook Summary of The Subtle Art of Not Giving a F*ck by Mark MansonRating: 4.5 out of 5 stars4.5/5 (577)

- The War of Art by Steven Pressfield - Book Summary: Break Through The Blocks And Win Your Inner Creative BattlesFrom EverandThe War of Art by Steven Pressfield - Book Summary: Break Through The Blocks And Win Your Inner Creative BattlesRating: 4.5 out of 5 stars4.5/5 (273)

- The Body Keeps the Score by Bessel Van der Kolk, M.D. - Book Summary: Brain, Mind, and Body in the Healing of TraumaFrom EverandThe Body Keeps the Score by Bessel Van der Kolk, M.D. - Book Summary: Brain, Mind, and Body in the Healing of TraumaRating: 4.5 out of 5 stars4.5/5 (266)

- We Were the Lucky Ones: by Georgia Hunter | Conversation StartersFrom EverandWe Were the Lucky Ones: by Georgia Hunter | Conversation StartersNo ratings yet

- Summary of 12 Rules for Life: An Antidote to ChaosFrom EverandSummary of 12 Rules for Life: An Antidote to ChaosRating: 4.5 out of 5 stars4.5/5 (294)

- Summary of Atomic Habits by James ClearFrom EverandSummary of Atomic Habits by James ClearRating: 5 out of 5 stars5/5 (168)

- The Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessFrom EverandThe Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessRating: 5 out of 5 stars5/5 (456)

- How To Win Friends and Influence People by Dale Carnegie - Book SummaryFrom EverandHow To Win Friends and Influence People by Dale Carnegie - Book SummaryRating: 5 out of 5 stars5/5 (556)

- How Not to Die by Michael Greger MD, Gene Stone - Book Summary: Discover the Foods Scientifically Proven to Prevent and Reverse DiseaseFrom EverandHow Not to Die by Michael Greger MD, Gene Stone - Book Summary: Discover the Foods Scientifically Proven to Prevent and Reverse DiseaseRating: 4.5 out of 5 stars4.5/5 (83)

- Summary of The Compound Effect by Darren HardyFrom EverandSummary of The Compound Effect by Darren HardyRating: 5 out of 5 stars5/5 (70)

- The Whole-Brain Child by Daniel J. Siegel, M.D., and Tina Payne Bryson, PhD. - Book Summary: 12 Revolutionary Strategies to Nurture Your Child’s Developing MindFrom EverandThe Whole-Brain Child by Daniel J. Siegel, M.D., and Tina Payne Bryson, PhD. - Book Summary: 12 Revolutionary Strategies to Nurture Your Child’s Developing MindRating: 4.5 out of 5 stars4.5/5 (57)

- Tiny Habits by BJ Fogg - Book Summary: The Small Changes That Change EverythingFrom EverandTiny Habits by BJ Fogg - Book Summary: The Small Changes That Change EverythingRating: 4.5 out of 5 stars4.5/5 (110)

- Summary of Million Dollar Weekend by Noah Kagan and Tahl Raz: The Surprisingly Simple Way to Launch a 7-Figure Business in 48 HoursFrom EverandSummary of Million Dollar Weekend by Noah Kagan and Tahl Raz: The Surprisingly Simple Way to Launch a 7-Figure Business in 48 HoursNo ratings yet

- Essentialism by Greg McKeown - Book Summary: The Disciplined Pursuit of LessFrom EverandEssentialism by Greg McKeown - Book Summary: The Disciplined Pursuit of LessRating: 4.5 out of 5 stars4.5/5 (187)

- Summary of Supercommunicators by Charles Duhigg: How to Unlock the Secret Language of ConnectionFrom EverandSummary of Supercommunicators by Charles Duhigg: How to Unlock the Secret Language of ConnectionNo ratings yet

- Summary of The Galveston Diet by Mary Claire Haver MD: The Doctor-Developed, Patient-Proven Plan to Burn Fat and Tame Your Hormonal SymptomsFrom EverandSummary of The Galveston Diet by Mary Claire Haver MD: The Doctor-Developed, Patient-Proven Plan to Burn Fat and Tame Your Hormonal SymptomsNo ratings yet

- Psycho-Cybernetics by Maxwell Maltz - Book SummaryFrom EverandPsycho-Cybernetics by Maxwell Maltz - Book SummaryRating: 4.5 out of 5 stars4.5/5 (91)

- Sell or Be Sold by Grant Cardone - Book Summary: How to Get Your Way in Business and in LifeFrom EverandSell or Be Sold by Grant Cardone - Book Summary: How to Get Your Way in Business and in LifeRating: 4.5 out of 5 stars4.5/5 (86)

- Steal Like an Artist by Austin Kleon - Book Summary: 10 Things Nobody Told You About Being CreativeFrom EverandSteal Like an Artist by Austin Kleon - Book Summary: 10 Things Nobody Told You About Being CreativeRating: 4.5 out of 5 stars4.5/5 (128)

- Make It Stick by Peter C. Brown, Henry L. Roediger III, Mark A. McDaniel - Book Summary: The Science of Successful LearningFrom EverandMake It Stick by Peter C. Brown, Henry L. Roediger III, Mark A. McDaniel - Book Summary: The Science of Successful LearningRating: 4.5 out of 5 stars4.5/5 (55)

- Summary, Analysis, and Review of Daniel Kahneman's Thinking, Fast and SlowFrom EverandSummary, Analysis, and Review of Daniel Kahneman's Thinking, Fast and SlowRating: 3.5 out of 5 stars3.5/5 (2)

- SUMMARY: So Good They Can't Ignore You (UNOFFICIAL SUMMARY: Lesson from Cal Newport)From EverandSUMMARY: So Good They Can't Ignore You (UNOFFICIAL SUMMARY: Lesson from Cal Newport)Rating: 4.5 out of 5 stars4.5/5 (14)

- Designing Your Life by Bill Burnett, Dave Evans - Book Summary: How to Build a Well-Lived, Joyful LifeFrom EverandDesigning Your Life by Bill Burnett, Dave Evans - Book Summary: How to Build a Well-Lived, Joyful LifeRating: 4.5 out of 5 stars4.5/5 (61)