Professional Documents

Culture Documents

cmd18 Civil Engines cfm56 Leap Transition and Aftermarket PDF

cmd18 Civil Engines cfm56 Leap Transition and Aftermarket PDF

Uploaded by

Diego MartínezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

cmd18 Civil Engines cfm56 Leap Transition and Aftermarket PDF

cmd18 Civil Engines cfm56 Leap Transition and Aftermarket PDF

Uploaded by

Diego MartínezCopyright:

Available Formats

C2 - Restricted

CFM56 / LEAP TRANSITION

AND AFTERMARKET

Olivier ANDRIÈS, SAE CEO

François BASTIN, SAE Commercial

Engines

François PLANAUD, SAE Services

& MRO

54 Safran - Capital Markets Day 2018 / November 29, 2018

This document and the information therein are the property of Safran. They must not be copied or communicated to a third party without the prior written authorization of Safran

C2 - Restricted

1

CFM56 / LEAP TRANSITION

François BASTIN,

SAE Commercial Engines

55 Safran - Capital Markets Day 2018 / November 29, 2018

This document and the information therein are the property of Safran. They must not be copied or communicated to a third party without the prior written authorization of Safran

C2 - Restricted

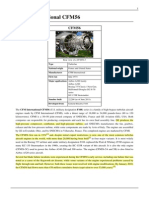

LEAP: Technology, Experience & Execution

2018

COMPOSITE ADVANCED 3D AERO

FAN BLADES & CASE Performance Reliability

Lightweight & durable

Life cycle

maint. cost

ADVANCED COOLING Same as CFM56

Lightweight &

temperature resistant

LEAN COMBUSTOR -15%

lower fuel

Low NOx, durable consumption

and reduction

in CO2 emissions

DEBRIS

FAN MOUNTED AGB Noise

REJECTION SYSTEM

Reliability, Maintainability & NOx

Protection against erosion

-50% vs CAEP6,

margin to new

It takes a suite of technologies to make a great engine regulations (Chap 14)

56 Safran - Capital Markets Day 2018 / November 29, 2018

This document and the information therein are the property of Safran. They must not be copied or communicated to a third party without the prior written authorization of Safran

C2 - Restricted

LEAP: since CMD 2016

2018

All performance,

noise and emissions

A320neo 737 MAX C919

reduction objectives

met

73 LEAP customers

have accumulated more than

LEAP-1A LEAP-1B LEAP-1C 2.5 million

Entry into service Entry into service First Flight engine flight hours

in August 2016 in May 2017 in May 2017

57 Safran - Capital Markets Day 2018 / November 29, 2018

This document and the information therein are the property of Safran. They must not be copied or communicated to a third party without the prior written authorization of Safran

C2 - Restricted

LEAP: the customer’s choice

2018

Market shares, as of October 31, 2018 Based on announced orders and selections

CFM LEAP

737MAX 100%

Single

CFM LEAP

737 MAX 8,171 AC

source 5,008 (o/w ~7,500 AC to be

delivered)

77%

Comac

725

A220

580

PW MC-21

A320neo

A320neo CFM

1000G

42%

2,438 A320neo

197 PW1000G

LEAP

1,732 2,509 AC

58% 23%

Investor’s choice: LEAP market share for A320neo lessors is 67%

58 Safran - Capital Markets Day 2018 / November 29, 2018

This document and the information therein are the property of Safran. They must not be copied or communicated to a third party without the prior written authorization of Safran

C2 - Restricted

LEAP in service: supporting a fleet of more than 500 aircraft…

2018

As of October 31, 2018

A320neo 737 MAX

288 aircraft 231 aircraft

59 Safran - Capital Markets Day 2018 / November 29, 2018

This document and the information therein are the property of Safran. They must not be copied or communicated to a third party without the prior written authorization of Safran

C2 - Restricted

…with unrivalled utilization

2018

Already 99.9% dispatch

Cornerstone

reliability and still improving!

● Engine designed for reliability

World Class Utilization, matching CFM56 standard

Aircraft not flying Flight hours (h)

Levers

(in % of fleet in service)

Source: Flightradar24

/ Average daily utilization

Source: Flightradar24

● Digital advanced monitoring

40%

12

● 3 call centers, 250+ field

Competition LEAP engineers

30%

10

20% ● On site support force operating

10%

8 24/7 from 15 locations over

the world

0%

LEAP 6 Competition

● 7 MRO shops up and running

May 2017 October 2018 May 2017 October 2018

60 Safran - Capital Markets Day 2018 / November 29, 2018

This document and the information therein are the property of Safran. They must not be copied or communicated to a third party without the prior written authorization of Safran

C2 - Restricted

Unprecedented ramp-up underway

2018

In 2016, 77 LEAP deliveries,

1,000+

on top of 1,693 CFM56’s

In 2017, 459 LEAP deliveries,

2,000+

1,800+

on top of 1,444 CFM56’s

1,100+

In 2018 on track to beat 1,100

LEAP engines deliveries, on top

2016

'16 2017

'17 2018e

'18 2019e

'19 2020e

'20 2021e

'21 2022e

'22 of more than 1,000 CFM56’s

LEAP CFM56

LEAP weekly rate already hit CFM56 historical peak level

61 Safran - Capital Markets Day 2018 / November 29, 2018

This document and the information therein are the property of Safran. They must not be copied or communicated to a third party without the prior written authorization of Safran

C2 - Restricted

Leveraging our Production Management System

2018

Extensive investment: added 3 new

plants and pulled in a 3rd pulse line Route to Serial Mode

in 2018 alone ● Systematic risk analysis & abatement

Fully active dual sourcing, adding 3rd or

4th when necessary (forged parts, frames) Watch item

● Examples: turbine disks, turbine rear vane ● Forgings and Castings

Winning the First Time Yield battle:

● Through design updates & process improvements

150 suppliers 14 countries

● Examples (2016 to now): OGVs (20 to 93%),

fan blade leading edge (70 to 97%)

SWAT teams to tackle emerging issues

at suppliers

62 Safran - Capital Markets Day 2018 / November 29, 2018

This document and the information therein are the property of Safran. They must not be copied or communicated to a third party without the prior written authorization of Safran

C2 - Restricted

A steadily extending footprint

2018

Safran plant development

Location Size Country Specialisation Status

Queretaro 6,000 m2 Mexico Assembly 2019

Queretaro 31,000 m2 Mexico 3D composites RTM and OGV 2018

Rzeszow 5,000 m2 Poland Compressor Blade machining 2018

Rzeszow 9,300 m2 Poland Turbine blade machining 2018

Suzhou 19,000 m2 China Machining and assembly 2018

Villaroche 40,000 m2 France Logistics for assembly and spares 2017

Gennevilliers 1,500 m2 France Precision forging 2016

Le Creusot 4,000 m2 France Turbine disk machining 2015

Rochester 31,000 m2 USA 3D composites RTM 2014

Commercy 27,000 m2 France 3D composites RTM 2014

In production

Over 173,000 m2 of extensions and new plants in Europe, Asia and the Americas since 2013

63 Safran - Capital Markets Day 2018 / November 29, 2018

This document and the information therein are the property of Safran. They must not be copied or communicated to a third party without the prior written authorization of Safran

C2 - Restricted

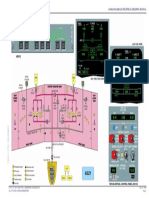

Defining the state of the art of engine assembly

2018

2016 2017 2018 All effective today… and more coming!

● 3 LEAP engine pulse lines, 3 fan module rolling lines

● Friendly engine cradles

(4 axes, including +/- 110° engine axis rotation)

Engine pulse lines Fan rolling lines ● Augmented reality

● Smart tooling

● Generalizing the Pulse line concept ● In line image recognition control

● Combining it with relentless innovation ● Collaborative automation (cobots)

● Zero-G handling

1 2 3

Takt time

64 Safran - Capital Markets Day 2018 / November 29, 2018

This document and the information therein are the property of Safran. They must not be copied or communicated to a third party without the prior written authorization of Safran

C2 - Restricted

Cost reduction: right on track

2018

Before 1st engine delivery, CMD16

-30%

learning curve was expressed

in terms of Cost of Production

-25% As serial production has started,

Cost of Sales metrics becomes

more relevant

2016 2017 2018e 2019e 2020e

Average cost of sales

The achievement to date is in line

with the 2020 objective

65 Safran - Capital Markets Day 2018 / November 29, 2018

This document and the information therein are the property of Safran. They must not be copied or communicated to a third party without the prior written authorization of Safran

C2 - Restricted

LEAP Cost reduction: within our plants

2018

Levers Examples

● 1B Turbine rear vane

Design updates for cost ● Removal of EEC blowers $90k / engine

● 1B Fan frame shroud

● Closed door machining

Process Optimization ● Optimization of inspection times

● Rework elimination

Leveraging our low cost ● China: turbine shafts, disks & module assembly

footprint ● Mexico: fan disks, blades, OGVs & module assembly

66 Safran - Capital Markets Day 2018 / November 29, 2018

This document and the information therein are the property of Safran. They must not be copied or communicated to a third party without the prior written authorization of Safran

C2 - Restricted

Closed door machining: Le Creusot (France)

2018

Traditional Flexible assisted Flexible automated

turbine disk manufacturing manufacturing

machining system system

● One piece flow ● 3 machines for one operator

● Batch flow

● 2 machines for one operator ● Automated loading

● One machine for one operator

● Centralized retooling ● Closed Door Machining

● Manual on line machine set up

● Off line machine set up ● Digital data collection

Labor efficiency: X2.5

Machining time: -50%

67 Safran - Capital Markets Day 2018 / November 29, 2018

This document and the information therein are the property of Safran. They must not be copied or communicated to a third party without the prior written authorization of Safran

C2 - Restricted

LEAP Cost reduction: with our suppliers

2018

Levers Examples

150

3,000 suppliers ● Cone torque metal coating

part numbers Design to cost removal, LPT shaft heat

treatment optimization

Lean manufacturing, ● Turbine disk machining

value chain analysis, cycle time reduced

4 process reengineering from 120 to 43 days

levers

Supply base footprint ● Extension of cost share

optimization including in Morocco, Mexico,

best cost country Portugal, Poland

215 13,000

workshops Actions ● Contract renewal, market

items Rolling negociations share or volume change,

dual sourcing benchmarking

68 Safran - Capital Markets Day 2018 / November 29, 2018

This document and the information therein are the property of Safran. They must not be copied or communicated to a third party without the prior written authorization of Safran

C2 - Restricted

CFM56 / LEAP Transition: the first steps of a success story

2018

Looking back on 2.5 years

and 2.5 million hours

of operations, LEAP

is already delivering

Historic ramp up

on all its promises Cost reduction

is underway, supported

Performance by a strong production is right on target

(fuel, noise, emissions) management system

Reliability

Utilization

69 Safran - Capital Markets Day 2018 / November 29, 2018

This document and the information therein are the property of Safran. They must not be copied or communicated to a third party without the prior written authorization of Safran

C2 - Restricted

2

CFM56 / LEAP AFTERMARKET

François PLANAUD,

SAE Services and MRO

70 Safran - Capital Markets Day 2018 / November 29, 2018

This document and the information therein are the property of Safran. They must not be copied or communicated to a third party without the prior written authorization of Safran

C2 - Restricted

CFM56 / LEAP installed base growing

2018

CFM Fleet in service

CFM56 / LEAP fleet in service to grow Source: CFM fleet data, agreed airframer LEAP rates

50,000

by 4.5% CAGR until 2025

● More than 38,000 CFM56 / LEAP engines 40,000

will be in operation in 2025

30,000

Strong CFM56 installed base

over the horizon

● 28,000 CFM56 engines (all models) 20,000

in operation today

● 22,000+ in 2025 10,000

0

Sustained CFM fleet growth 2015 2017 2019e 2021e 2023e 2025e 2027e 2029e

driven by LEAP deliveries

CFM56 Legacy Models CFM56 -5B/-7B (Gen 2) LEAP

71 Safran - Capital Markets Day 2018 / November 29, 2018

This document and the information therein are the property of Safran. They must not be copied or communicated to a third party without the prior written authorization of Safran

C2 - Restricted

CFM56 / LEAP different aftermarket dynamics

2018

CFM56 LEAP

● Aftermarket business essentially driven ● Increased customer demand for long term,

by spare parts sales rate per flight hour agreements

> Large choice of Maintenance, > Provides airlines for maintenance cost

Repair and Overhaul (MRO) providers predictability

for Airlines > 3rd party MRO network will develop over time

● Revenue drivers: shop visit volumes, ● Profitability drivers: engine reliability, fleet

workscopes (content), pricing management & maintenance cost optimization,

additional services

Transitioning from spare parts model to long term contracts

72 Safran - Capital Markets Day 2018 / November 29, 2018

This document and the information therein are the property of Safran. They must not be copied or communicated to a third party without the prior written authorization of Safran

C2 - Restricted

CFM56: -5B/-7B fleet is still a young fleet

2018

As of 2018 60% of CFM56 -5B/-7B in service have had 0 shop visit

CFM56 -5B/-7B fleet split by number of shop visits performed

Source: CFM fleet data

60% ~45% ~20%

with no SV with no SV with no SV

2018e 2020e 2025e

22,800 ~23,000 ~20,000

30% Engines Engines Engines

with 1 SV ~50%

~40%

with 1 SV

with 1 SV

No shop visit performed 1 shop visit performed 2+ shop visits performed

Large maintenance activity ahead for CFM56-5B/-7B fleet

73 Safran - Capital Markets Day 2018 / November 29, 2018

This document and the information therein are the property of Safran. They must not be copied or communicated to a third party without the prior written authorization of Safran

C2 - Restricted

CFM56: Spare parts consumption model

2018

Shop visit forecast Spare parts usage at shop visit

Long term trend

Fleet in service Workscope

● Engines in service

● Module exposure

● Utilization, area of operation

● Rebuild standards, Life Limited Parts (LLP) replacement

Technical parameters

● Operating data (Flight leg, temperatures…)

● Hardware durability, Life Limited Parts, EGT…

Spare parts consumption

● Replacement rates

Short term variations ● Used parts availability and demand

Airlines strategy

● Fleet management

● Financial & operational situation

Comprehensive spare parts forecast model

74 Safran - Capital Markets Day 2018 / November 29, 2018

This document and the information therein are the property of Safran. They must not be copied or communicated to a third party without the prior written authorization of Safran

C2 - Restricted

CFM56: -5B/-7B shop visit outlook

2018

CFM56 -5B/-7B Worldwide shop visits

Source: CFM fleet data

3,000

2,000

1,000

CFM56-5B/-7B shop visits to grow

by ~5% CAGR until 2025

0

2015 2020e 2025e

Peak over 3,000 shop visits per year

expected around 2025 Higher peak level than in CMD16,

due to additional CFM56 deliveries

75 Safran - Capital Markets Day 2018 / November 29, 2018

This document and the information therein are the property of Safran. They must not be copied or communicated to a third party without the prior written authorization of Safran

C2 - Restricted

CFM56: -5B/-7B shop visit rank distribution

2018

Fleet-wide average timeline for spare parts revenue

Proportion of shop visits 1 & 2

Revenue within total of -5B/-7B SV/year

2018e 2025e

75% >66%

SV1

SV2

SV3

Entry in service 10 20 Years

Shop visits 1 & 2 are main revenue Large proportion of shop visits

contributors 1&2

76 Safran - Capital Markets Day 2018 / November 29, 2018

This document and the information therein are the property of Safran. They must not be copied or communicated to a third party without the prior written authorization of Safran

C2 - Restricted

CFM56: Spare parts outlook

2018

Expected CFM56 worldwide spare parts 2017/2018 benefiting from tailwinds

consumption profile ($) ● Positive global context:

Source: CFM fleet data > Traffic growth and high fleet utilization

> Airlines financial health

● Strong MRO activity & high-content workscopes

Higher perspective over the horizon

● Main contributor to civil aftermarket growth

● Year to year anticipated variations

Peaking in 2025

2007 2010 2016 2018e 2022e 2028e Stronger outlook for future CFM56

CMD16 CMD18 spare parts

77 Safran - Capital Markets Day 2018 / November 29, 2018

This document and the information therein are the property of Safran. They must not be copied or communicated to a third party without the prior written authorization of Safran

C2 - Restricted

LEAP: moving to Services with different type

2018

of offerings and contracts

Spare parts purchase Rate Per Flight Hour

Time & Material ESPH* / ESPO**

Spot Sales / Short term agreement Long Term agreement

● Spare parts sales to MRO shops or operators ● Typically 8 to 12 years

● T&M overhaul agreements for an engine or a batch ● Agreement covering a defined fleet

● Workscope control by operator ● Additional services (Lease Engines, Engineering…)

● MRO provider manages Time on Wing and maintenance cost

Cash at point of sale Cash per the hour (ESPH) or at shop visit (ESPO)

Increasing scope of services to address customers needs

*ESPH: Engine Service Per Hour **ESPO: Engine Service Per Overhaul

78 Safran - Capital Markets Day 2018 / November 29, 2018

This document and the information therein are the property of Safran. They must not be copied or communicated to a third party without the prior written authorization of Safran

C2 - Restricted

LEAP: Long term contracts performance management

2018

Leveraging on our expertise Bringing digital tools and analytics

OEM expertise Integrated Data Collection

● Wide range of services ● Larger quantity of Engine data

● Engine design knowledge ● Environment (Weather, routes, …)

Predictive maintenance

Fleet management ● Continuous Remote Monitoring & diagnostics

& maintenance optimization (e.g. advanced vibration analytics…)

> Reduces physical interventions on engines

● Shop visit schedule

● Customized maintenance and inspections plans

● On wing/quick turns interventions

(e.g. Waterwash recommendations…)

● Dedicated teams developing advanced analytics

Operational performance

● Optimized workscoping Enhanced fleet management

● State of the art MRO facilities ● Multi-parameters optimized engine removal plans

A wide suite of levers to manage performance

79 Safran - Capital Markets Day 2018 / November 29, 2018

This document and the information therein are the property of Safran. They must not be copied or communicated to a third party without the prior written authorization of Safran

C2 - Restricted

ESPH and ESPO illustrative cash profile

2018

Engine Services Per Hour (ESPH) Engine Services Per Overhaul (ESPO)

Revenue: IFRS15 Sales Cash Flow: Net Billings less Costs

Billings: Cash in Costs: Cash out

Similar revenue patterns in both cases

Improved cash profile for ESPH vs ESPO

80 Safran - Capital Markets Day 2018 / November 29, 2018

This document and the information therein are the property of Safran. They must not be copied or communicated to a third party without the prior written authorization of Safran

C2 - Restricted

LEAP: Rate Per Flight Hours agreements portfolio

2018

To date, 28% of LEAP engine orders include a signed CFM Rate Per Flight Hour (RPFH)

long term agreement

● Split between ESPH and ESPO: 25% ESPH /75% ESPO

Within 3/5 years, expected RPFH agreements to represent 60-70% of LEAP installed

fleet as further discussions are on-going with a large panel of LEAP customers

● Anticipated split between ESPH/ESPO to be similar for future contracts

We assume later switch to T&M or spare parts model as fleet matures and worldwide

overhaul demand increases (typically 8/10 years after EIS)

RPFH agreements trending to 60-70% of LEAP installed fleet

81 Safran - Capital Markets Day 2018 / November 29, 2018

This document and the information therein are the property of Safran. They must not be copied or communicated to a third party without the prior written authorization of Safran

C2 - Restricted

LEAP: Shop visits & MRO footprint

2018

Worldwide shop visits LEAP worldwide shop visits

● Expect strong ramp-up of shop visits as a result

3,000

of new engines deliveries profile

● ~1,000 shop visits in 2025

2,000 Maintenance activity for Safran

● Long term Services portfolio will translate into

significantly higher industrial maintenance

volumes (x3 vs CFM56)

1,000

Planned extension of current Safran

maintenance network footprint

0

2019e 2020e 2021e 2022e 2023e 2024e 2025e 2026e 2027e 2028e

Preparing for LEAP MRO ramp-up

82 Safran - Capital Markets Day 2018 / November 29, 2018

This document and the information therein are the property of Safran. They must not be copied or communicated to a third party without the prior written authorization of Safran

C2 - Restricted

CFM56 and LEAP mix of aftermarket revenues

2018

Distribution of CFM56+LEAP aftermarket revenues by nature

88% 12% ~80% ~20% ~70% ~30%

2017 2022e 2025e

Spare parts and T&M RPFH

Smooth and progressive ramp-up of RPFH contracts

Spare parts and T&M will be the main revenue channel up to 2025+

83 Safran - Capital Markets Day 2018 / November 29, 2018

This document and the information therein are the property of Safran. They must not be copied or communicated to a third party without the prior written authorization of Safran

C2 - Restricted

Civil Aftermarket key messages

2018

● CFM56 spare parts keep driving civil aftermarket

growth until 2025

● LEAP Services will progressively ramp up and provide

the relay for growth

High single digit growth for total CFM56 & LEAP

aftermarket revenues

84 Safran - Capital Markets Day 2018 / November 29, 2018

This document and the information therein are the property of Safran. They must not be copied or communicated to a third party without the prior written authorization of Safran

You might also like

- Leap 1a LMDocument149 pagesLeap 1a LMuspaulrusselNo ratings yet

- CFM56-7B Fan Blade Lubrication CESM-005Document2 pagesCFM56-7B Fan Blade Lubrication CESM-005Keith Humphrey0% (2)

- General Familiarization Training For CFM56!3!5 - 7 Engines - Magnetic MRODocument5 pagesGeneral Familiarization Training For CFM56!3!5 - 7 Engines - Magnetic MROArabyAbdel Hamed SadekNo ratings yet

- A330 (GE CF6-80E1) : Engine & Correlated ATA 71 Up 80Document394 pagesA330 (GE CF6-80E1) : Engine & Correlated ATA 71 Up 80Diego Rafael50% (2)

- Q0 ZNNTYuc GRMDocument4 pagesQ0 ZNNTYuc GRMmenosoftNo ratings yet

- 71-00-00-710-002-B - Wet Motoring CheckDocument8 pages71-00-00-710-002-B - Wet Motoring CheckEder Luciano100% (2)

- A330 Eng Run Check ListDocument41 pagesA330 Eng Run Check ListAnh TuanNo ratings yet

- Airbus A320neo Family Project - Docx-1Document54 pagesAirbus A320neo Family Project - Docx-1ashik hussainNo ratings yet

- Engine Change BootstrapDocument5 pagesEngine Change Bootstrapolegprikhodko2809No ratings yet

- CFM56-5A-5B CO-063 Basic Engine Feb2014Document27 pagesCFM56-5A-5B CO-063 Basic Engine Feb2014Kelik Arif100% (1)

- A320 Ata28-00 PDFDocument1 pageA320 Ata28-00 PDFkpilNo ratings yet

- LEAP Engine Design FlawsDocument7 pagesLEAP Engine Design FlawsaliNo ratings yet

- Daniels DMC519 Specification Sheet PDFDocument2 pagesDaniels DMC519 Specification Sheet PDFReksa Karisma YogasmaraNo ratings yet

- The Scarlet Letter - Chapter 2Document5 pagesThe Scarlet Letter - Chapter 2soniasedanoNo ratings yet

- BES 111 - Course SyllabusDocument2 pagesBES 111 - Course SyllabusJayson FranciscoNo ratings yet

- CFM Technology: Realizing The PromiseDocument17 pagesCFM Technology: Realizing The PromiseNikoo100% (1)

- PW1500G TRM Supplemental Material - Combustion Chamber Borescope Pictures - PWA115622 Rev CDocument2 pagesPW1500G TRM Supplemental Material - Combustion Chamber Borescope Pictures - PWA115622 Rev CaliNo ratings yet

- A318/a319/a320/a321 Technical Training ManualDocument1 pageA318/a319/a320/a321 Technical Training ManualadiNo ratings yet

- A330 Rolls-Royce RB211-Trent 700 Virtual Reality 360Document20 pagesA330 Rolls-Royce RB211-Trent 700 Virtual Reality 360Edison Vianney Cardona Montoya100% (2)

- CFM Flight Ops Support A320Document143 pagesCFM Flight Ops Support A320Marcin100% (1)

- EngineDocument2 pagesEnginesyahirazaihadNo ratings yet

- A320 Ramp and Transit Ata 28 - Fuel Metric UnitsDocument184 pagesA320 Ramp and Transit Ata 28 - Fuel Metric UnitsCassiano CapellassiNo ratings yet

- Vertical Profile Navigation: Mode ReviewDocument48 pagesVertical Profile Navigation: Mode ReviewRepartoNo ratings yet

- 70 Power Plant (V2500-A5)Document296 pages70 Power Plant (V2500-A5)Marcos Filho100% (1)

- Rmoval of NLGDocument6 pagesRmoval of NLGje_carD23100% (1)

- A350 Ata 32Document107 pagesA350 Ata 32Bongyoun Lee100% (1)

- Defueling Procedure Erj 190Document4 pagesDefueling Procedure Erj 190jucamallaNo ratings yet

- A320 Hydraulic Accumulator ServicingDocument9 pagesA320 Hydraulic Accumulator ServicingEdwar ZulmiNo ratings yet

- A330 Ata 79-00-00Document1 pageA330 Ata 79-00-00essid zouhaierNo ratings yet

- E 190 EnginesDocument22 pagesE 190 EnginesHighspeed Flyboy100% (1)

- New CFM Leap1 TestDocument2 pagesNew CFM Leap1 TestLahu KureNo ratings yet

- ATA 71-80 Manual CFM 320Document134 pagesATA 71-80 Manual CFM 320Stefan GergenenovNo ratings yet

- Cataloag (Cfm56-5a)Document2 pagesCataloag (Cfm56-5a)hNo ratings yet

- AIRBUS A320 Operations Circular No. DT / A320 / 816 C. T.E., Hyd Era BadDocument2 pagesAIRBUS A320 Operations Circular No. DT / A320 / 816 C. T.E., Hyd Era BadYogish Katagihallimath100% (2)

- Ceo Neo DifferanceDocument4 pagesCeo Neo Differancerustydfc100% (1)

- B Trent41368ATDocument81 pagesB Trent41368ATArabyAbdel Hamed SadekNo ratings yet

- Powerplant IAE V - 2500Document310 pagesPowerplant IAE V - 2500Sam VencesNo ratings yet

- CFM56 - 7B 2015 PDFDocument9 pagesCFM56 - 7B 2015 PDFferNo ratings yet

- CFM LEAP 1A Run Up ChecksheetDocument30 pagesCFM LEAP 1A Run Up Checksheetjürgen100% (2)

- CFM International CFM56Document17 pagesCFM International CFM56VijayMaradimath100% (1)

- Trent 700 - L & B Maintenance TrainingDocument1 pageTrent 700 - L & B Maintenance TrainingIrfan05No ratings yet

- LEAP Brochure 2013Document15 pagesLEAP Brochure 2013Reparto100% (1)

- CTC-070 Answerbook Oct13Document57 pagesCTC-070 Answerbook Oct13Giovanny Colorado100% (2)

- 19-Workscoping-WTT NashvilleDocument28 pages19-Workscoping-WTT NashvilleFaraz KhanNo ratings yet

- Airbus AC A320 Jun16Document387 pagesAirbus AC A320 Jun16Roman YoyopoNo ratings yet

- Ecu Software - cfm56Document9 pagesEcu Software - cfm56aliNo ratings yet

- a320-A321-Refuel-Defuel System - Task Supporting DataDocument15 pagesa320-A321-Refuel-Defuel System - Task Supporting Data553486151No ratings yet

- V2500 Line and Base Maintenance Engine OverviewDocument24 pagesV2500 Line and Base Maintenance Engine OverviewHENIGUEDRI100% (2)

- AIRBUS A330-200F: European ConsortiumDocument2 pagesAIRBUS A330-200F: European ConsortiumNadeemNo ratings yet

- 00 Engine Bleed Air SupplyDocument14 pages00 Engine Bleed Air SupplyAnas Abandeh100% (1)

- Engine Yearbook 2011Document144 pagesEngine Yearbook 2011jcline88100% (1)

- CB RESET A320 and ProcedureDocument74 pagesCB RESET A320 and ProcedureHasry RitongaNo ratings yet

- v16 - GE-1015 Jane's Aero Engine March 2000Document11 pagesv16 - GE-1015 Jane's Aero Engine March 2000Marcelo Roberti Rocha FantaguzziNo ratings yet

- 2011-Eng Run-Up-Cfm56 5BDocument18 pages2011-Eng Run-Up-Cfm56 5BmarkoNo ratings yet

- 2 Engine GeneralDocument23 pages2 Engine GeneralChabou Rafik100% (1)

- Trent 700 Series Issue 03Document9 pagesTrent 700 Series Issue 03HelloWorldNo ratings yet

- A320 Alpha Call Up N CB LocationDocument20 pagesA320 Alpha Call Up N CB LocationReksa Karisma YogasmaraNo ratings yet

- Breaker A330Document33 pagesBreaker A330Anh TuanNo ratings yet

- TES Engine Datapack (April 10)Document49 pagesTES Engine Datapack (April 10)Ibraheem Sadiq100% (1)

- G5 High Profile Unit Cooler G5HP 205 V3 0Document9 pagesG5 High Profile Unit Cooler G5HP 205 V3 0Nguyễn Hữu HiệpNo ratings yet

- Speed-Controlled Screw Compressors: WWW - Almig.deDocument8 pagesSpeed-Controlled Screw Compressors: WWW - Almig.deAndy ConnersNo ratings yet

- CIMC Guide To Developing Modules For Self Paced Learning 2018Document80 pagesCIMC Guide To Developing Modules For Self Paced Learning 2018RickyNo ratings yet

- Module Handbook: Examination Regulations 2016Document25 pagesModule Handbook: Examination Regulations 2016RickyNo ratings yet

- Importance of Course Module in Academic Performance of Students M.Ranga Reddy (PHD) 49Document12 pagesImportance of Course Module in Academic Performance of Students M.Ranga Reddy (PHD) 49RickyNo ratings yet

- Developing A Science Journalism Course For Developing CountriesDocument44 pagesDeveloping A Science Journalism Course For Developing CountriesRickyNo ratings yet

- Port Reform Toolkit: Second EditionDocument20 pagesPort Reform Toolkit: Second EditionRicky100% (1)

- How To Download Course Content (Files) From Blackboard LearnDocument5 pagesHow To Download Course Content (Files) From Blackboard LearnRickyNo ratings yet

- Introduction and Course Overview: Learning ObjectivesDocument28 pagesIntroduction and Course Overview: Learning ObjectivesRickyNo ratings yet

- Mps Series: Maximum Working Pressure Up To 1.2 Mpa (12 Bar) - Flow Rate Up To 365 L/MinDocument20 pagesMps Series: Maximum Working Pressure Up To 1.2 Mpa (12 Bar) - Flow Rate Up To 365 L/MinRickyNo ratings yet

- Module H Directors Guide PDFDocument116 pagesModule H Directors Guide PDFRickyNo ratings yet

- Reduced Vertical Separation Minima (RVSM) Guidelines: Ata: Fin: Ref: A/C Type: A/C Serie: Topic: First Issue DateDocument14 pagesReduced Vertical Separation Minima (RVSM) Guidelines: Ata: Fin: Ref: A/C Type: A/C Serie: Topic: First Issue DateRickyNo ratings yet

- 04 TOOLKIT Module4Document80 pages04 TOOLKIT Module4RickyNo ratings yet

- 05 TOOLKIT Module5 PDFDocument70 pages05 TOOLKIT Module5 PDFRickyNo ratings yet

- Module 1 - PM AdolescentDocument19 pagesModule 1 - PM AdolescentRickyNo ratings yet

- Port Reform Toolkit: Labor Reform and Related Social IssuesDocument44 pagesPort Reform Toolkit: Labor Reform and Related Social IssuesRickyNo ratings yet

- Npa 2019-05 (B)Document272 pagesNpa 2019-05 (B)RickyNo ratings yet

- Npa 2019-05 (A)Document69 pagesNpa 2019-05 (A)RickyNo ratings yet

- eCSE07-6 Technical ReportDocument30 pageseCSE07-6 Technical ReportRickyNo ratings yet

- Npa 2019-06Document372 pagesNpa 2019-06RickyNo ratings yet

- MPSM Section 11.05 - Chemical/Consumable Products - Specification/CPN Cross Reference List (M20-8)Document43 pagesMPSM Section 11.05 - Chemical/Consumable Products - Specification/CPN Cross Reference List (M20-8)Ricky100% (1)

- PROCEDURE MANUALS - (Materials and Process Specifications Manual) - (07-01)Document15 pagesPROCEDURE MANUALS - (Materials and Process Specifications Manual) - (07-01)RickyNo ratings yet

- ABC Straniero Inglese PDFDocument24 pagesABC Straniero Inglese PDFRickyNo ratings yet

- Mea Companion Volume Meeting Workplace RequirementsDocument69 pagesMea Companion Volume Meeting Workplace RequirementsRickyNo ratings yet

- or Read: Part 147 Part 66 Regulatory Training and Development of Mtoe PDF EbookDocument4 pagesor Read: Part 147 Part 66 Regulatory Training and Development of Mtoe PDF EbookRicky100% (1)

- Homework 4Document3 pagesHomework 4DavidMuñozNo ratings yet

- Cutler-Hammer ATC400 AG Switch ManualDocument38 pagesCutler-Hammer ATC400 AG Switch ManualTom LeonardNo ratings yet

- Basic ECG Lecture - NewDocument148 pagesBasic ECG Lecture - NewAradhanaRamchandaniNo ratings yet

- Flight Management SystemDocument17 pagesFlight Management SystemBinod BinodNo ratings yet

- Cobem 97 Vol - 1Document922 pagesCobem 97 Vol - 1José Jéferson Rêgo SilvaNo ratings yet

- Ammar YasirDocument303 pagesAmmar YasirShar KhanNo ratings yet

- Erin B. Reaction PaperDocument5 pagesErin B. Reaction PaperMay FakatNo ratings yet

- Bolton 1979 Geotechnique - Considerations in the earthquake-resistant design of earth and rockfill damsDocument49 pagesBolton 1979 Geotechnique - Considerations in the earthquake-resistant design of earth and rockfill damsCharlie YoungNo ratings yet

- Thiopyrylium ReactionsDocument4 pagesThiopyrylium ReactionsTaqdees NadeemNo ratings yet

- IELTS Cause-Problem and Effect-Solution Model EssayDocument17 pagesIELTS Cause-Problem and Effect-Solution Model EssaySayaf RashadNo ratings yet

- Science Final ReviewerDocument25 pagesScience Final ReviewerTantan Fortaleza PingoyNo ratings yet

- Philosophy and Fundamental ConceptsDocument63 pagesPhilosophy and Fundamental ConceptsSarah Wulan SariNo ratings yet

- Water Resources Planning in HP-1 Karnataka Surface WaterDocument48 pagesWater Resources Planning in HP-1 Karnataka Surface WaterHydrologywebsiteNo ratings yet

- Grantmaker Research For Heifer Ecuador 3 September 2009Document36 pagesGrantmaker Research For Heifer Ecuador 3 September 2009Manish MehraNo ratings yet

- Wilderwords: Roll D12 For The Table and D20 For The WordDocument8 pagesWilderwords: Roll D12 For The Table and D20 For The Wordpukunui81No ratings yet

- Liposomes 3Document63 pagesLiposomes 3Rohit SardaNo ratings yet

- MultiTherm FF-1® Tech DataDocument2 pagesMultiTherm FF-1® Tech DataSteranskoNo ratings yet

- Soil-Structure Interaction Analysis For Bridge Caisson FoundationDocument10 pagesSoil-Structure Interaction Analysis For Bridge Caisson FoundationarslanpasaNo ratings yet

- EX-CELL® EBx® PRO-II Serum-Free Medium Without L-Glutamine, Without Sodium BicarbonateDocument2 pagesEX-CELL® EBx® PRO-II Serum-Free Medium Without L-Glutamine, Without Sodium BicarbonateSAFC-GlobalNo ratings yet

- 5.5KVA Generator Manual V4Document18 pages5.5KVA Generator Manual V4adam_nell_1100% (1)

- EL Hombre y El Mundo BiologicoDocument41 pagesEL Hombre y El Mundo BiologicoLitzy Valencia OsorioNo ratings yet

- Domestic Cold Water Pipe Sizing Sheet Project Name: Date: Project No: EngineerDocument1 pageDomestic Cold Water Pipe Sizing Sheet Project Name: Date: Project No: EngineerPeterNo ratings yet

- The Radiation MechanismDocument2 pagesThe Radiation MechanismKote Bhanu PrakashNo ratings yet

- 9660 Ma01 AcDocument35 pages9660 Ma01 Ac965161191No ratings yet

- SAT Problem Solving Practice Test 04Document3 pagesSAT Problem Solving Practice Test 04EszterListárNo ratings yet

- Model Question Paper: Fifth Semester B.E. Degree ExaminationDocument3 pagesModel Question Paper: Fifth Semester B.E. Degree ExaminationPCT 19AE04 Sivakumar. KNo ratings yet

- 10 Tips in Taking The Let ExamDocument14 pages10 Tips in Taking The Let ExamJom Maglente BeltranNo ratings yet

- Managed Aquifer RechargeDocument13 pagesManaged Aquifer RechargeSudharsananPRSNo ratings yet