Professional Documents

Culture Documents

JKSB Weekly - 03.07.20

Uploaded by

TheJOB68Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

JKSB Weekly - 03.07.20

Uploaded by

TheJOB68Copyright:

Available Formats

STOCK MARKET WEEKLY

SRI LANKA

Week Ending, Friday, July 03, 2020

Index Movement & Market Review

Bi Weekly Index Movement Rs. Mn Turnover & Foreign Participation %

5,400 2,700 2,500 100

5,300 2,600 90

5,200 2,500

5,100 2,000 80

2,400

5,000 70

4,900 2,300

1,500 60

4,800 2,200

4,700 2,100 50

4,600 2,000 1,000 40

4,500 30

1,900

4,400

4,300 1,800 500 20

4,200 1,700 10

4,100 1,600 0 0

22/Jun/2020

23/Jun/2020

24/Jun/2020

25/Jun/2020

26/Jun/2020

29/Jun/2020

30/Jun/2020

01/Jul/2020

02/Jul/2020

03/Jul/2020

22/Jun/2020

23/Jun/2020

24/Jun/2020

25/Jun/2020

26/Jun/2020

29/Jun/2020

30/Jun/2020

01/Jul/2020

02/Jul/2020

03/Jul/2020

aspi spsl20 turnover foreign_purchases foreign_sales foreign_percentage

Market Review

"The ASPI ended 2.18% lower for the trading week amid healthy market turnover. Activity centered around the banking and capital goods sectors accounted for a majority of the

week's turnover. Foreign participation resulted in a net outflow of Rs.1.1bn."

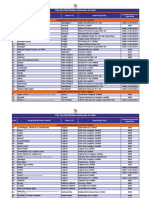

Sector Summary for the Week Market Statistics

Week Close WoW WoW

Sector YTD Change (%) Index % YTD Change (%)

(Rs.) Change (%) Change

Food, Beverage & Tobacco 733.2 (1.3) (13.7) ASPI 5,050.90 (112.5) (2.18) (17.59)

Capital Goods 660.8 (6.2) (22.9) S&P-SL20 2,190.75 (100.1) (4.37) (25.41)

Banks 533.3 (3.1) (26.2)

Diversified Financials 738.1 (1.2) (15.0) Average Daily Turnover - Week (Rs. Mn) 1,527.66

Consumer Services 208.4 (1.0) (22.2) Average Daily Turnover - Month (Rs. Mn) 1,381.36

Telecommunication Services 835.6 (4.5) (12.3) Average Daily Turnover - YTD (Rs. Mn) 1,262.20

Insurance 1,338.5 5.7 (0.6) Net foreign Inflow / (Outflow) - Week (Rs. Mn) (1,130.67)

Food & Staples Retailing 1,097.0 (3.0) (9.5) Net foreign Inflow / (Outflow) - YTD (Rs. Mn) (20,833.09)

Materials 591.2 (1.0) (9.5) Market PER FY19A (JKSB Universe) 7.52

Real Estate 706.7 (0.4) (15.1) Market PER FY20E (JKSB Universe) 8.70

Health Care Equipment & Services 731.4 (3.8) (15.9) Market PER FY21E (JKSB Universe) 13.39

Market PBV (JKSB Universe) 0.79

Top 5 Gainers of the Week Top 5 Losers of the Week

Company Week Close (Rs.) WoW Change (%) Company Week Close (Rs.) WoW Change (%)

BLUE DIAMONDS PLC [X] 0.30 50.00 CEYLINCO INSURANCE PLC [X] 740.40 (16.00)

SMB LEASING PLC 0.40 33.33 AMBEON CAPITAL PLC 3.40 (15.00)

LAKE HOUSE PRINTERS PLC 140.50 22.07 RAIGAM WAYAMBA PLC 2.70 (10.00)

HIKKADUWA BEACH PLC 5.30 20.45 JOHN KEELLS HOLDINGS PLC 115.60 (9.83)

COMMERCIAL CREDIT PLC 24.50 20.10 LAUGFS POWER PLC [X] 2.80 (9.68)

Sector Wise Turnover for the Week Largest Transactions for the Week

WoW Volume (Mn

Sector Turnover (Rs. Mn) % of Turnover Company Price (Rs.)

Change (%) Shares)

Banks 3,688.82 48.29 JOHN KEELLS HOLDINGS PLC 115.60 (9.83) 13.62

Capital Goods 2,432.38 31.84 COMMERCIAL BANK OF CEYLON PLC 76.50 (0.26) 18.26

Materials 578.05 7.57 HATTON NATIONAL BANK PLC 110.70 (3.32) 10.23

Diversified Financials 374.46 4.90 NATIONS TRUST BANK PLC 61.00 (3.17) 7.03

Food, Beverage & Tobacco 135.76 1.78 SAMPATH BANK PLC 122.10 (2.94) 3.27

Source : Colombo Stock Exchange Data Feed, JKSB Estimates

# John Keells Group - Confidential

JOHN KEELLS STOCK BROKERS (PVT) LIMITED Fax : +94 11 234 2068

Company No. PV 89 E-Mail : jkstock@keells.com

Website : www.jksb.com

JKSB Mobile : www.jksbmobile.keells.lk

Market Relative Change Against (x)**

Closing PER WoW YTD ROE % Dividend

Stock Cap (USD PER 20E(x) PBV (x) ASPI Sector Index

Price (Rs.) 21E (x) Change % Change % WoW YTD WoW YTD FY19A Yield % *

Mn)

BANKS & FINANCE

COMB 76.50 423 4.55 7.01 0.58 (0.26) (19.47) 1.92 (1.88) 0.74 (10.02) 15.60 8.50

DFCC 63.50 104 8.78 13.50 0.39 (6.20) (30.90) (4.03) (13.31) (5.20) (21.45) 6.37 4.78

HNB 110.70 305 3.86 5.94 0.38 (3.32) (35.71) (1.14) (18.12) (2.31) (26.26) 13.85 7.41

NDB 74.20 93 3.51 5.40 0.39 (4.26) (25.80) (2.08) (8.21) (3.25) (16.35) 14.53 9.75

NTB 61.00 93 4.66 7.52 0.54 (3.17) (23.75) (1.00) (6.16) (2.17) (14.30) 15.26 3.44

SAMP 122.10 250 3.99 6.54 0.41 (2.94) (24.82) (0.76) (7.22) (1.94) (15.36) 15.86 9.80

SEYB 45.30 126 6.27 9.23 0.49 (7.36) (13.71) (5.18) 3.88 (6.36) (4.26) 8.71 3.91

CFIN 77.80 92 3.84 5.90 0.39 (4.07) (25.19) (1.89) (7.60) (3.06) (15.74) 13.25 4.63

PLC 12.70 111 6.07 8.42 0.63 (3.05) (29.05) (0.88) (11.46) (2.05) (19.60) 15.60 9.55

Sector 4.43 7.08 0.47 15.59

INSURANCE

CINS 2,098.00 298 6.49 8.11 1.04 16.55 5.59 18.73 23.18 17.55 15.04 20.97 1.67

HASU 117.30 32 5.81 7.26 0.84 2.00 (15.00) 4.18 2.59 3.00 (5.55) 56.71 5.97

Sector 7.29 9.11 1.07 33.13

BEVERAGE, FOOD & TOBACCO

CTC 950.20 957 10.31 12.89 20.76 (1.02) (13.64) 1.16 3.95 5.22 9.21 342.50 9.55

CCS 690.10 353 30.72 61.07 4.15 (2.32) (13.19) (0.14) 4.40 3.92 9.66 9.01 2.17

NEST 1,082.00 312 22.65 28.32 12.54 (1.40) (16.76) 0.77 0.84 4.84 6.10 66.73 4.62

Sector 11.99 15.66 2.78 25.02

CHEMICALS & PHARMACEUTICALS

HAYC 210.10 34 4.01 4.74 0.67 1.55 10.58 3.72 28.17 2.53 32.79 12.19 3.81

CIC 56.10 29 6.46 5.00 0.56 (2.26) (6.50) (0.09) 11.09 (1.28) 15.71 5.44 1.78

Sector 4.85 4.86 0.61 9.01

CONSTRUCTION & ENGINEERING

DOCK 45.40 18 N/A N/A 0.38 (1.09) (26.77) 1.09 (9.18) 1.88 (17.24) N/A 3.30

AEL 18.40 99 12.14 18.67 0.82 (0.54) (15.60) 1.64 2.00 2.43 (6.07) 10.97 2.72

Sector N/A 49.17 0.70 8.54

TELECOMMUNICATIONS

DIAL 11.20 490 8.46 12.09 1.20 (6.67) (8.94) (4.49) 8.65 (5.32) 4.76 11.63 3.30

SLTL 28.70 278 8.19 12.41 0.65 (0.35) (10.03) 1.83 7.56 1.00 3.67 6.82 3.10

Sector 8.36 12.21 0.92 9.36

MANUFACTURING

LLUB 66.10 85 7.56 11.99 3.80 (2.65) (11.75) (0.47) 5.84 1.17 4.19 50.26 13.24

ACL 42.50 27 6.17 14.81 0.45 (6.18) (26.09) (4.00) (8.49) (2.36) (10.14) 5.31 3.53

DIPD 108.20 35 8.66 7.65 0.58 11.43 28.81 13.61 46.40 15.26 44.75 8.61 4.16

TILE 67.90 19 6.19 16.37 0.46 3.98 (11.47) 6.16 6.12 7.81 4.47 7.43 4.64

RCL 69.20 41 2.96 5.60 0.31 (3.35) (21.81) (1.17) (4.21) 0.47 (5.87) 12.15 5.78

TKYO 32.20 69 6.14 13.65 0.78 (4.45) (32.92) (2.27) (15.32) (0.63) (16.97) (3.06) 0.93

GLAS 3.50 18 8.55 13.30 0.71 (2.78) (22.22) (0.60) (4.63) 1.05 (6.28) 7.95 5.14

TJL 29.00 109 8.56 12.96 1.30 (8.81) (28.92) (6.63) (11.33) (4.98) (12.98) 14.54 6.72

Sector 6.24 10.49 0.76 10.04

DIVERSIFIED HOLDINGS

SPEN 34.20 75 5.84 N/A 0.27 (7.57) (26.45) (5.39) (8.86) (4.50) (0.27) 8.65 7.31

HAYL 132.00 53 26.58 N/A 0.25 (4.83) (24.53) (2.65) (6.94) (1.76) 1.65 0.66 3.79

HHL 60.60 194 29.23 34.39 1.29 (2.73) (24.25) (0.55) (6.66) 0.34 1.93 12.32 7.85

JKH 115.60 819 16.19 23.41 0.70 (9.83) (31.03) (7.65) (13.43) (6.76) (4.85) 7.55 5.37

EXPO 3.20 34 N/A N/A 0.49 (3.03) (37.25) (0.85) (19.66) 0.04 (11.08) 10.71 4.69

SHL 10.80 69 N/A N/A 1.05 (1.82) (32.08) 0.36 (14.48) 1.25 (5.90) 0.81 4.63

Sector 17.21 42.03 0.65 7.19

PLANTATIONS

KOTA 5.70 2 N/A N/A 0.50 (3.39) (20.83) (1.21) (3.2) (2.18) (5.83) N/A 0.00

WATA 27.60 30 6.75 6.72 1.22 (7.69) 6.15 (5.51) 23.75 (6.48) 21.15 23.57 8.06

KGAL 56.70 8 11.81 13.13 0.40 1.25 (4.71) 3.43 12.89 2.46 10.29 12.29 8.82

KVAL 69.50 13 N/A N/A 0.69 (0.57) (21.91) 1.61 (4.32) 0.64 (6.91) N/A 0.00

Sector N/A N/A 0.84 5.64

HOTELS & TRAVELS

AHUN 18.10 33 N/A N/A 0.30 (4.74) (33.21) (2.56) (15.62) (10.41) (32.59) 3.94 5.52

AHPL 27.60 66 N/A N/A 0.37 (9.51) (31.85) (7.33) (14.26) (15.19) (31.23) 2.51 7.25

TRAN 59.00 63 42.87 N/A 1.78 0.00 (15.35) 2.18 2.24 (5.68) (14.73) 7.47 1.69

CONN 29.40 9 N/A N/A 0.45 1.38 (19.89) 3.56 (2.30) (4.30) (19.27) 8.34 18.31

EDEN 13.00 7 N/A N/A 0.29 4.00 (29.35) 6.18 (11.75) (1.68) (28.73) N/A 0.00

KHL 7.80 61 N/A N/A 0.40 (2.50) (32.76) (0.32) (15.17) (8.18) (32.14) 2.97 1.92

Sector N/A N/A 0.46 1.87

18A: Year ending Dec. '17/ Mar '18, 19E : Year ending Dec. '18/ Mar '19 PERs exclude exceptional items 1 USD = Rs. 186.03

* Dividend Yield is calculated based on dividends announced for FY18A N/A = Not Applicable due to negative EPS Source : Colombo Stock Exchange Data Feed, JKSB Estimates

** Measures the relative change in YTD against WoW

This document is published by John Keells Stock Brokers (Pvt) Ltd for the exclusive use of their clients. All information has been compiled from available documentation and JKSB’s own

research material. Whilst all reasonable care has been taken to ensure the accuracy of the contents of this document, neither JKSB nor its employees can accept responsibility for any

decisions made by investors based on information herein.

# John Keells Group - Confidential

You might also like

- Client: Pro Abdikadir Khayre Project: Residentail BuilidngDocument9 pagesClient: Pro Abdikadir Khayre Project: Residentail BuilidngMukhtar Case2022No ratings yet

- Doors 02Document1 pageDoors 02Nehemiah KoechNo ratings yet

- Update Solo 22.09.2017Document1 pageUpdate Solo 22.09.2017aldi rachmadNo ratings yet

- Cost Estimate PM 320 NGDocument2 pagesCost Estimate PM 320 NGFulkan HadiyanNo ratings yet

- Mavoko Draft 03Document1 pageMavoko Draft 03STEPHEN ODHIAMBONo ratings yet

- Office 2 Office 3: Renovation of Unit 1908Document1 pageOffice 2 Office 3: Renovation of Unit 1908james bubanNo ratings yet

- Loop System PDFDocument1 pageLoop System PDFAkash DesaiNo ratings yet

- Pdf24 MergedDocument6 pagesPdf24 Mergedmursa4mNo ratings yet

- A-A A-A: Kitchenette Open Plan OfficeDocument1 pageA-A A-A: Kitchenette Open Plan OfficeAdams BrunoNo ratings yet

- The Financial Waves Momentum DIVISLAB 20200408Document4 pagesThe Financial Waves Momentum DIVISLAB 20200408Finogent AdvisoryNo ratings yet

- A2Document1 pageA2johnalfred051801No ratings yet

- W-01 Construction Grids PDFDocument1 pageW-01 Construction Grids PDFcharicjacquesNo ratings yet

- Columbus City Schools Facilities Master PlanDocument17 pagesColumbus City Schools Facilities Master PlanWSYX/WTTENo ratings yet

- Manpower (Direct) Histogram & S CurveDocument1 pageManpower (Direct) Histogram & S CurveburereyNo ratings yet

- LSTAR Residential Market Activity March 2018Document28 pagesLSTAR Residential Market Activity March 2018matthewtrevithickNo ratings yet

- Kitchen Library: 25,000 200 8,700 200 4,000 200 2,000 200 2,000 200 1,100 200 800 200 4,550 450 Rare ElevationDocument1 pageKitchen Library: 25,000 200 8,700 200 4,000 200 2,000 200 2,000 200 1,100 200 800 200 4,550 450 Rare ElevationBrian LubangakeneNo ratings yet

- Church of Uganda Nabilatuk 001 PDFDocument1 pageChurch of Uganda Nabilatuk 001 PDFAthiyo MartinNo ratings yet

- Page 3Document1 pagePage 3Kristine MaigueNo ratings yet

- General Notes: All Dimensions Are in MMDocument1 pageGeneral Notes: All Dimensions Are in MMLenny ErastoNo ratings yet

- Fuk SecDocument1 pageFuk SecHirushan MenukaNo ratings yet

- V Series SDocument18 pagesV Series SAbdul KarimNo ratings yet

- Kaigunji Irrigation SchemeDocument4 pagesKaigunji Irrigation SchemeMUKABWA DEONE LUKASINo ratings yet

- AssignmentDocument1 pageAssignmentSamadhi KatagodaNo ratings yet

- General Notes: Site Development Plan Vicinity MapDocument1 pageGeneral Notes: Site Development Plan Vicinity Mapjohnalfred051801No ratings yet

- FloorDocument1 pageFloorconcept coderNo ratings yet

- EnockDocument1 pageEnock2021acek1407fNo ratings yet

- Materiales Cerdanya IndividualDocument4 pagesMateriales Cerdanya IndividualSofía MargaritaNo ratings yet

- Joshua OgatoDocument4 pagesJoshua Ogatoogongorichard82No ratings yet

- Polyclinic LayoutDocument3 pagesPolyclinic LayoutAudri NzizaNo ratings yet

- Warehouse 4Document1 pageWarehouse 4Rhome OstonalNo ratings yet

- KPI'sDocument7 pagesKPI'sMohab ZahranNo ratings yet

- VP1-0-L4-A-UYC-35103 - B-MATERIAL STORAGE - Roof PlanDocument2 pagesVP1-0-L4-A-UYC-35103 - B-MATERIAL STORAGE - Roof PlanLê Minh HiếuNo ratings yet

- Abizardi As BuiltDocument1 pageAbizardi As BuiltAdriko NormanNo ratings yet

- (BacePanel) - R4-5Document1 page(BacePanel) - R4-5Ahmad FaizalNo ratings yet

- G.F PLN Bar UbaxDocument1 pageG.F PLN Bar UbaxabdiazizNo ratings yet

- ECI 2080lumbang UtilKit and Driveway Key Plan 04082024 LAYOUTDocument1 pageECI 2080lumbang UtilKit and Driveway Key Plan 04082024 LAYOUTjosh cuaNo ratings yet

- First Floor-1Document1 pageFirst Floor-1Lyton TamanyiirwaNo ratings yet

- Two Storey House Plan 1Document1 pageTwo Storey House Plan 1Edmar InietoNo ratings yet

- Plan PDFDocument14 pagesPlan PDFIpan DibaynNo ratings yet

- Hoima Two 222Document1 pageHoima Two 222Kennie Ntege LubwamaNo ratings yet

- Cross Section: Pier Segment: Jurusan Teknik Sipil Fakultas Teknik Sipil Dan PerencanaanDocument1 pageCross Section: Pier Segment: Jurusan Teknik Sipil Fakultas Teknik Sipil Dan PerencanaanNessa NesschtNo ratings yet

- Abraaj Final Drawing - Mixed PlanDocument33 pagesAbraaj Final Drawing - Mixed PlanpartoneinvestmentNo ratings yet

- Ground Floor Plan Second Floor Plan: Kitchen Service Area Laundry and Drying AreaDocument1 pageGround Floor Plan Second Floor Plan: Kitchen Service Area Laundry and Drying AreaJanine PalecNo ratings yet

- Page01 PSEWeeklyReport2019 wk43Document1 pagePage01 PSEWeeklyReport2019 wk43craftersxNo ratings yet

- Update On COVID-19 in Canada - Epidemiology and Preparedness April 1, 2022Document10 pagesUpdate On COVID-19 in Canada - Epidemiology and Preparedness April 1, 2022Andy RigaNo ratings yet

- #Contact Company: Revision HistoryDocument1 page#Contact Company: Revision HistoryFRANKLYN SPENCERNo ratings yet

- OORO Ndeda SeptDocument1 pageOORO Ndeda SeptJoshua Ng'wonoNo ratings yet

- Corridor Corridor: BedroomDocument1 pageCorridor Corridor: BedroomSuparman SaidNo ratings yet

- Proposed Structural Detached Dwelling House 3Document1 pageProposed Structural Detached Dwelling House 3Norman Mendoza AustriaNo ratings yet

- Geo 9f LW RecDocument1 pageGeo 9f LW RecAnonymous ttvFQFoNo ratings yet

- Nov Dez: VALORES (Em R$ Milhão)Document2 pagesNov Dez: VALORES (Em R$ Milhão)Alessandro AlvesNo ratings yet

- Sustainable Earnings Growth: Snapshot Value of Stock Based OnDocument28 pagesSustainable Earnings Growth: Snapshot Value of Stock Based Onravi.youNo ratings yet

- Revit Domoty 1Document1 pageRevit Domoty 1SAN RAKSANo ratings yet

- VIEW/ Izvietojuma Plāns/ Virsskats ADocument2 pagesVIEW/ Izvietojuma Plāns/ Virsskats ArajuNo ratings yet

- FloorplanDocument1 pageFloorplanBrown Justin NzNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueGayeong KimNo ratings yet

- Final Foundational PlanDocument1 pageFinal Foundational Planmuthomidun001No ratings yet

- 18-Tipikal Tower CC and DD, DDR-Layout1Document1 page18-Tipikal Tower CC and DD, DDR-Layout1randi wirdanaNo ratings yet

- ElectroMechanical LayoutDocument1 pageElectroMechanical LayoutDeksan GroupNo ratings yet

- Ansbacher Cayman Report Appendix 5Document434 pagesAnsbacher Cayman Report Appendix 5thestorydotieNo ratings yet

- AFAR Summary Lecture (10 May 2021)Document30 pagesAFAR Summary Lecture (10 May 2021)Joanna MalubayNo ratings yet

- Limited Liability Partnership (LLP) : An: Alternative Form of Business Introduced in PakistanDocument4 pagesLimited Liability Partnership (LLP) : An: Alternative Form of Business Introduced in PakistanSadaf Ashraf KhanNo ratings yet

- Valeant's Battle For AllerganFile - Case Analysis - Group 11Document21 pagesValeant's Battle For AllerganFile - Case Analysis - Group 11Shashank ShekharNo ratings yet

- Middle Market Investment Banking GuideDocument234 pagesMiddle Market Investment Banking GuideAnonymous MZMEHGHB100% (1)

- Registering A Company in Kenya and Summary of The New ACTDocument22 pagesRegistering A Company in Kenya and Summary of The New ACTmercy kNo ratings yet

- Summer Training Report by Deepak DhingraDocument94 pagesSummer Training Report by Deepak Dhingraashurpt1288% (8)

- CH 15 Equity LanjutanDocument35 pagesCH 15 Equity LanjutanKalyana MittaNo ratings yet

- PSAK 55 Instrumen Keuangan Pengukuran 15122014Document140 pagesPSAK 55 Instrumen Keuangan Pengukuran 15122014LiaNo ratings yet

- Lista Iptv AtualizadaDocument21 pagesLista Iptv AtualizadaNair QzNo ratings yet

- Venture Capitalists of IndiaDocument17 pagesVenture Capitalists of IndiaShaantanu GaurNo ratings yet

- Chapter 15 - Mergers and AcquisitionsDocument18 pagesChapter 15 - Mergers and AcquisitionsManeet TutejaNo ratings yet

- Solman Chapter 3Document6 pagesSolman Chapter 3Kyla RoxasNo ratings yet

- CGD Data For Website 7.10.2016Document3 pagesCGD Data For Website 7.10.2016arbaz khanNo ratings yet

- Solution Final Advanced Acc. First09 10Document6 pagesSolution Final Advanced Acc. First09 10RodNo ratings yet

- Business Organization QuizDocument5 pagesBusiness Organization QuizPooja gopwaniNo ratings yet

- Concepts in A VC TransactionDocument2 pagesConcepts in A VC TransactionStartup Tool KitNo ratings yet

- Managment 12Document8 pagesManagment 12Mae FrancesNo ratings yet

- 36 Theory and Practice of Corporate GovernanceDocument36 pages36 Theory and Practice of Corporate Governancem_dattaias86% (7)

- CD DATA 26 07 2019 (1) .OdsDocument78 pagesCD DATA 26 07 2019 (1) .OdsChaitali Degavkar100% (1)

- BO 100917 Web Full IssueDocument104 pagesBO 100917 Web Full IssueMaja SchwoererNo ratings yet

- 03 Joint ArrangementsxxDocument62 pages03 Joint ArrangementsxxAnaliza OndoyNo ratings yet

- AGULHAS: Unit 3, 99 CompaniesDocument323 pagesAGULHAS: Unit 3, 99 CompaniesThe CompaniesNo ratings yet

- Dividend Policy: Financial Management Theory and PracticeDocument33 pagesDividend Policy: Financial Management Theory and PracticeSamar KhanzadaNo ratings yet

- ACT2111 Fall 2019 Ch1 - Lecture 1&2 - StudentDocument57 pagesACT2111 Fall 2019 Ch1 - Lecture 1&2 - StudentKevinNo ratings yet

- Touch N Buy - Com SunPassDocument1 pageTouch N Buy - Com SunPassnmillan007No ratings yet

- Company Law Solved MCQsDocument29 pagesCompany Law Solved MCQseService HubNo ratings yet

- Maf603-Question Test 2 2021 JulyDocument4 pagesMaf603-Question Test 2 2021 JulyWAN MOHAMAD ANAS WAN MOHAMADNo ratings yet

- RHP IrctcDocument383 pagesRHP IrctcSudhir KulkarniNo ratings yet

- Full-Time Mba Programs: 2019 Employment ReportDocument6 pagesFull-Time Mba Programs: 2019 Employment ReportPiyush MalhotraNo ratings yet