0% found this document useful (0 votes)

693 views10 pagesChina's Consumer Activity Resumes Post-COVID

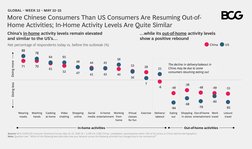

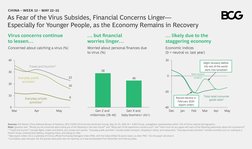

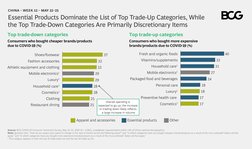

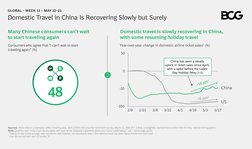

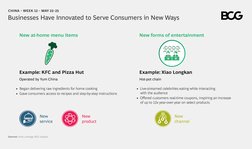

Most daily life activities are resuming in China as new COVID-19 cases have fallen by 80% from peak levels. Wuhan's lockdown has been lifted and 99% of major industrial enterprises have reopened. While in-home activity levels in China and the US remain high, out-of-home activities in China are rebounding with more Chinese consumers resuming eating out and shopping in stores. A majority of Chinese consumers feel their lifestyles have permanently changed due to the pandemic, with nearly half reporting changes that are neither better nor worse but very different, and about 30% seeing the changes as improvements to health and savings.

Uploaded by

Pankaj MehraCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

693 views10 pagesChina's Consumer Activity Resumes Post-COVID

Most daily life activities are resuming in China as new COVID-19 cases have fallen by 80% from peak levels. Wuhan's lockdown has been lifted and 99% of major industrial enterprises have reopened. While in-home activity levels in China and the US remain high, out-of-home activities in China are rebounding with more Chinese consumers resuming eating out and shopping in stores. A majority of Chinese consumers feel their lifestyles have permanently changed due to the pandemic, with nearly half reporting changes that are neither better nor worse but very different, and about 30% seeing the changes as improvements to health and savings.

Uploaded by

Pankaj MehraCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

- Trends and Resumptions in China: Analyzes the resumption of everyday life and activities in China with a focus on COVID-19 case decline and relaxation of restrictions.