Professional Documents

Culture Documents

Affidavit For Purchase - Example - en

Uploaded by

malyousefielct electOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Affidavit For Purchase - Example - en

Uploaded by

malyousefielct electCopyright:

Available Formats

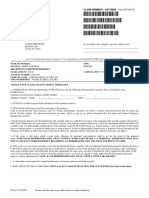

Affidavit for Purchase of Motor Vehicles

MEMBER #: ____________

or Other Vehicles for Resale—Blanket

I HEREBY CERTIFY:

1. I am engaged in the business of selling the following type of tangible personal1.Pick one variant

property:

□ Motor Vehicles/Watercraft/Power Sports and/or Auto Parts

□ Other (please specify) ___________________________________

2. I am purchasing the following property from Copart and its Affiliates for resale:

□ Motor Vehicles 2. Tick the box

3. I will resell the item(s) listed in item 2 in the form of tangible personal property in the regular course of my

business operations, and I will do so prior to making any use of the item(s) other than demonstration and display

while holding the item(s) for sale in the regular course of my business. The specific property listed above is being

purchased for resale in the regular course of my business at the address listed on the sales tax license or dealer

license provided.

4. I intend to resell this/these vehicle(s) or salvage usable parts. If the “other” box is checked in line item 1, I certify

that although my main business may be in another industry, I am purchasing the item(s) listed in item 2 for

resale.

5. I hold a STATE sales tax permit in the following states: 5. If you are eligible for VAT,

state your Country or State

State: ____________ #: __________________________

State: ____________ #: __________________________ and VAT number

State: ____________ #: __________________________

5. If you are NOT eligible for

I do not hold a STATE sales tax permit in any other state because:

□ I do not make sales in any other state and/or a resale permit is notVAT, leave

required in theState

state inand

which#I will

blanksell

this vehicle and/or auto parts. and tick the box here

6. I understand that if I use the item(s) purchased under this affidavit in any manner other than as just described, I

will owe tax based on each item’s purchase price or as otherwise provided by law.

7. I have read and understand the following:

The information below must match the

A PERSON MAY BE GUILTY OF A MISDEMEANOR UNDER THE STATE SALES & USE TAX LAWS IF THE PURCHASER KNOWS

information

AT THE TIME OF PURCHASE THAT in NOT

HE OR SHE WILL theRESELL

notarized translation

THE PURCHASED ITEM PRIOR TO ANY USE (OTHER THAN

RETENTION, DEMONSTRATION,of the company documents that you plan

OR DISPLAY WHILE HOLDING IT FOR RESALE) AND HE OR SHE FURNISHES A RESALE

CERTIFICATE OR OTHER STATEMENT TO AVOID PAYMENT TO THE SELLER OF AN AMOUNT AS TAX. ADDITIONALLY, A

PERSON MISUSING A RESALEto upload FOR PERSONAL GAIN OR TO EVADE THE PAYMENT OF TAX IS LIABLE, FOR

CERTIFICATE

EACH PURCHASE, FOR THE TAX THAT WOULD HAVE BEEN DUE, PLUS A PENALTY MAY APPLY.

I DECLARE UNDER PENALTY OF PERJURY, UNDER THE LAWS OF THE STATE WHERE THIS DOCUMENT WAS EXECUTED,

THAT THE FOREGOING IS TRUE AND CORRECT.

COMPANY NAME IN ENGLISH AS MENTIONED IN THE NOTARIZED TRANSLATION

Company Name

SIGNATURE OF THE OWNER OF THE COMPANY

Signature of Purchaser, Purchaser’s Employee or Authorized Representative

FIRST AND LAST NAME OF THE OWNER TITLE OF THE OWNER OF THE COMPANY

Printed Name of Person Signing Title

TODAY’S DATE (EXAMPLE: APRIL 03, 2018) CITY/STATE WHERE THE DOCUMENT IS SIGNED

Date Executed City/State where signed

BUILDING/OFFICE NUMBER, STREET CONTACT PHONE NUMBER

Purchaser’s Address Purchaser’s Phone Number

CITY, REGION (STATE), COUNTRY AND ZIP CODE

Purchaser’s City, State and ZIP

You might also like

- Affidavit For Purchase of Motor Vehicles 0318Document1 pageAffidavit For Purchase of Motor Vehicles 0318Virnic FarmNo ratings yet

- Sample Resale Certificate, From Regulation 1 6 6 8 (May Be Reproduced)Document1 pageSample Resale Certificate, From Regulation 1 6 6 8 (May Be Reproduced)Phillip FranklinNo ratings yet

- Reseale Certificate SageonemDocument1 pageReseale Certificate SageonemLisa YuNo ratings yet

- 01-909 Formato TaxsDocument4 pages01-909 Formato Taxsconstructora y representaciones del norteNo ratings yet

- Form ST-105: Indiana Department of RevenueDocument2 pagesForm ST-105: Indiana Department of RevenueRenn DallahNo ratings yet

- Affidavit of Exempt Sale StandardDocument2 pagesAffidavit of Exempt Sale StandardAnna AtienzaNo ratings yet

- Customers Resale Certificate 2022Document1 pageCustomers Resale Certificate 2022John MorrisonNo ratings yet

- Scribed - DEED OF SALE OF MOTOR VEHICLEDocument2 pagesScribed - DEED OF SALE OF MOTOR VEHICLEtrakimi88_414070924No ratings yet

- Vehicle Bill of Sale 1Document4 pagesVehicle Bill of Sale 1funky good100% (1)

- JEFF Affidavit-of-Loss-PlateDocument1 pageJEFF Affidavit-of-Loss-PlateRaysunArellano100% (1)

- NC - Certificate of ResaleDocument2 pagesNC - Certificate of ResaleChr FedNo ratings yet

- Registration of Dealers: Tax Law Project OnDocument23 pagesRegistration of Dealers: Tax Law Project OnSushant NainNo ratings yet

- VA Tax Exemption FormDocument1 pageVA Tax Exemption Formkristingreen2011No ratings yet

- E595E Tax Exempt FormDocument4 pagesE595E Tax Exempt FormstockfaceNo ratings yet

- Affidavit Discrepancy SignatureDocument1 pageAffidavit Discrepancy SignatureITVNo ratings yet

- WV TEC InstructionsDocument4 pagesWV TEC InstructionsnareshkumharNo ratings yet

- Bid Form Buena ManoDocument2 pagesBid Form Buena ManoRenzel TamayoNo ratings yet

- Affidavit of Warranty/ Undertaking: Picon DitablanDocument1 pageAffidavit of Warranty/ Undertaking: Picon Ditablandaisy mae mendozaNo ratings yet

- California Resale CertificateDocument1 pageCalifornia Resale CertificatejesbmnNo ratings yet

- W 8ben With AffidavitDocument1 pageW 8ben With AffidavitFelipeNo ratings yet

- Certificate For Exempt Purchases: Form AS 2916.1Document2 pagesCertificate For Exempt Purchases: Form AS 2916.1nareshkumharNo ratings yet

- Resale Certificate: Purchaser InformationDocument2 pagesResale Certificate: Purchaser InformationGlendaNo ratings yet

- SSA Anand Common Application Form - 11.11.09 - 11.12.09Document10 pagesSSA Anand Common Application Form - 11.11.09 - 11.12.09Ashish Jain0% (1)

- Form (Revised 03/15) : - Please Check: NEW RenewalDocument7 pagesForm (Revised 03/15) : - Please Check: NEW RenewalDoirNo ratings yet

- Outside Resale Certificate-OhioDocument8 pagesOutside Resale Certificate-OhioS S AliNo ratings yet

- Affidavit of SurrenderDocument1 pageAffidavit of SurrenderAivy GaudicosNo ratings yet

- EstateAgentSD (Jan 2011)Document1 pageEstateAgentSD (Jan 2011)natamon123No ratings yet

- HDFC Buyer AffidavitDocument2 pagesHDFC Buyer Affidavitprateek.pandeyNo ratings yet

- Offer To Purchase Immovable Property Final Mar 2022Document2 pagesOffer To Purchase Immovable Property Final Mar 2022Lesley munikwaNo ratings yet

- Authority To SellDocument6 pagesAuthority To SellJENNY CRUZNo ratings yet

- GCAAR Form 1316Document2 pagesGCAAR Form 1316Federal Title & Escrow CompanyNo ratings yet

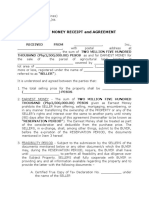

- Earnest Money Receipt and AgreementDocument4 pagesEarnest Money Receipt and Agreementmykel_aaronNo ratings yet

- Resale Certificate: Form St-3Document2 pagesResale Certificate: Form St-3jesbmnNo ratings yet

- Sales Tax FormDocument1 pageSales Tax FormLuna JavNo ratings yet

- Authority To Sell (ATS)Document1 pageAuthority To Sell (ATS)Ph Broker Appraiser100% (1)

- Certificate of Indian Exemption For Certain Property or Services Delivered On A ReservationDocument2 pagesCertificate of Indian Exemption For Certain Property or Services Delivered On A Reservationvikas_ojha54706No ratings yet

- General Resale Certificate FormDocument2 pagesGeneral Resale Certificate Formm4r4nzn0No ratings yet

- Sole Mandate AgreementDocument1 pageSole Mandate AgreementAnoush33% (3)

- Oklahoma Motor Vehicle Bill of Sale: DATEDocument5 pagesOklahoma Motor Vehicle Bill of Sale: DATECem's ChannelNo ratings yet

- PDFDocument2 pagesPDFAntonio BrookinsNo ratings yet

- Sole ProprietorshipDocument6 pagesSole ProprietorshipMuhammad Moiz HasanNo ratings yet

- Affidavit of Warranty/Undertaking: AffiantDocument1 pageAffidavit of Warranty/Undertaking: AffiantAJ SantosNo ratings yet

- Affidavit of Loss ORCRDocument2 pagesAffidavit of Loss ORCRTheodore Dolar100% (1)

- Power of AttorneyDocument2 pagesPower of Attorneymanjinderjodhka8903No ratings yet

- Deed of Sale of Motor VehicleDocument3 pagesDeed of Sale of Motor VehicleCoco NavarroNo ratings yet

- Deed of Sale of Car (Special Conditions)Document3 pagesDeed of Sale of Car (Special Conditions)Coco NavarroNo ratings yet

- Authority To SellDocument3 pagesAuthority To SellRamon Chito Pudelanan100% (2)

- St120 Fill inDocument2 pagesSt120 Fill inUber NewNo ratings yet

- SPECIAL POWER OF ATTORNEY (Filigree)Document4 pagesSPECIAL POWER OF ATTORNEY (Filigree)Angelo Miguel Aquino100% (1)

- 01 339 PDFDocument2 pages01 339 PDFvanderbrley100% (1)

- FL DMVDocument2 pagesFL DMVshameem_ficsNo ratings yet

- Deed of Assignment of Draft TR ReceiptDocument2 pagesDeed of Assignment of Draft TR ReceiptKawaii YoshinoNo ratings yet

- Registration Procedure Under Central Sales Act (SectionDocument23 pagesRegistration Procedure Under Central Sales Act (SectionkgudiyaNo ratings yet

- Power of Attorney-TemplateDocument2 pagesPower of Attorney-Templatemanjinderjodhka8903No ratings yet

- Reservation Agreement Form 2019 v1Document3 pagesReservation Agreement Form 2019 v1mbriones.axaNo ratings yet

- TFS - Affidavit of UndertakingDocument1 pageTFS - Affidavit of UndertakingMary Rose LealNo ratings yet

- Resale CertificateDocument1 pageResale CertificateplayerwheelNo ratings yet

- Tax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesFrom EverandTax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesNo ratings yet

- Tax 1Document351 pagesTax 1AbbyNo ratings yet

- Conducting A Privacy AuditDocument3 pagesConducting A Privacy AuditMichael L WhitenerNo ratings yet

- A Glossary of Kumarajiva's Translation of The Lotus SutraDocument580 pagesA Glossary of Kumarajiva's Translation of The Lotus SutraSammacittaNo ratings yet

- The Flight To Intimacy - The Flight From IntimacyDocument5 pagesThe Flight To Intimacy - The Flight From IntimacyRatna Bhūṣaṇa Bhūṣaṇā Dāsa100% (2)

- Alphabets, Letters and Diacritics in European Languages: AlbanianDocument8 pagesAlphabets, Letters and Diacritics in European Languages: AlbanianNilmalvila Blue Lilies PondNo ratings yet

- Agent Causation and Agential ControlDocument309 pagesAgent Causation and Agential Controlorj78No ratings yet

- Crazy Eddie Fraud Case-02!19!2015Document7 pagesCrazy Eddie Fraud Case-02!19!2015Yang SongNo ratings yet

- Social Determinants of Health Concept Tool Kit 4Document31 pagesSocial Determinants of Health Concept Tool Kit 4bromberg.alexaNo ratings yet

- Winter Project Report NilojjalDocument26 pagesWinter Project Report NilojjalAbhijit PhoenixNo ratings yet

- An Overview of Organic ReactionsDocument80 pagesAn Overview of Organic Reactions110003551 110ANo ratings yet

- Beginning Theory StudyguideDocument29 pagesBeginning Theory StudyguideSuhad Jameel Jabak80% (5)

- Fees To Be Submitted by The Candidate: Rs. 8065/-Provisional Admission List of M.A. Geography 1 Semester For The Session 2020-21Document6 pagesFees To Be Submitted by The Candidate: Rs. 8065/-Provisional Admission List of M.A. Geography 1 Semester For The Session 2020-21Aequitas RegistrationNo ratings yet

- Ent 121 - 97-102Document6 pagesEnt 121 - 97-102Joseph OndariNo ratings yet

- Financial Statement Analysis Of: Asian Paints LimitedDocument20 pagesFinancial Statement Analysis Of: Asian Paints LimitedPreetiNo ratings yet

- (16610) UmemeDocument1 page(16610) UmemeDAMBA GRAHAM ALEX100% (1)

- Welfare: The Social-Welfare Function: MicroeconomicsDocument34 pagesWelfare: The Social-Welfare Function: MicroeconomicsKartika HandayaniNo ratings yet

- Ben SdgeDocument1 pageBen SdgeCandy ValentineNo ratings yet

- Sun Ray: The Train Solar PanelsDocument2 pagesSun Ray: The Train Solar PanelsGeraldine De La CruzNo ratings yet

- How Age Affects Survey Interaction - The Case of Intelligence StudiesDocument10 pagesHow Age Affects Survey Interaction - The Case of Intelligence StudiesJanlloyd DugoNo ratings yet

- People vs. Hatani, 227 SCRA 497, November 08, 1993Document14 pagesPeople vs. Hatani, 227 SCRA 497, November 08, 1993Catherine DimailigNo ratings yet

- Chapter 12Document25 pagesChapter 12varunjajooNo ratings yet

- Rumusan Kursus Permohonan Reman Dan Permohonan Pelbagai Kes JenayahDocument34 pagesRumusan Kursus Permohonan Reman Dan Permohonan Pelbagai Kes JenayahApulNo ratings yet

- Teachers Education Campus Temenggong Ibrahim - Google SearchDocument1 pageTeachers Education Campus Temenggong Ibrahim - Google Searchnurqaleesyad07No ratings yet

- Connecticut - Federal Rental Assistance FactsDocument1 pageConnecticut - Federal Rental Assistance FactsPatricia DillonNo ratings yet

- Sub Contract AggrementDocument2 pagesSub Contract Aggrementravi kumarNo ratings yet

- Inca PowerpointDocument41 pagesInca PowerpointemmaniauntyNo ratings yet

- Rules of Phonology 1Document21 pagesRules of Phonology 1aqilah atiqah100% (1)

- Tibet Journal IndexDocument99 pagesTibet Journal Indexninfola100% (2)

- ListDocument16 pagesListAnonymous mcCJYBoNo ratings yet