Professional Documents

Culture Documents

AXIS and KOTAK

Uploaded by

santu0 ratings0% found this document useful (0 votes)

5 views2 pagesAXIS and Kotak Bank ratios

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAXIS and Kotak Bank ratios

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views2 pagesAXIS and KOTAK

Uploaded by

santuAXIS and Kotak Bank ratios

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

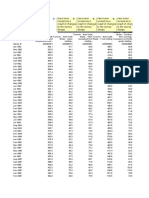

Axis Bank Ratio Analysis

Sr.No Year/Ratio 2019 2018 2017 2016 Sr.No

1 Interest Income 6.86 6.62 7.4 7.8 1

2 Net Interest Income 2.91 2.88 3.21 3.41 2

3 Net Interest Margin 2.71 2.69 3 3.2 3

4 Cost to Income Ratio 44.28 51.64 46.42 35.7 4

5 Net Profit 18.19 1.07 15.36 34.51 5

6 Return on Assets 0.58 0.03 0.61 1.56 6

7 Return on Equity 7.01 0.43 6.59 15.46 7

8 Total advances 75.95 78.44 76.4 78.84 8

9 Total Deposits 7.04 7.64 6.89 6.2 9

10 Loans to deposit ratio 10.52 9.48 9.31 8.6 10

11 CASA Ratio 44.37 53.75 51.41 47.33 11

12 Gross NPA 5.26 6.77 5.04 1.67 12

13 Net NPA 2.06 3.4 2.11 0.7 13

14 Provision coverage Ratio 14

15 Capital Adequacy Ratio 15.84 16.57 14.95 15.29 15

Kotak Mahindra Bank

Year/Ratio 2019 2018 2017 2016

Interest Income 7.66 7.45 8.24 8.52

Net Interest Income 1.47 1.52 1.62 1.35

Net Interest Margin 3.6 3.59 3.78 3.58

Cost to Income Ratio 38.52 39.91 38.68 39.07

Net Profit 25.49 21.43 18.53 11.39

Return on Assets 1.55 1.54 1.58 1.08

Return on Equity 11.47 10.89 12.35 8.72

Total advances 86.44 85.65 80.49 96.23

Total Deposits 4.73 4.69 4.86 5.07

Loans to deposit ratio 6.09 5.81 6.46 6.66

CASA Ratio 52.49 50.75 43.99 38.06

Gross NPA 2.14 2.22 2.59 2.36

Net NPA 0.75 0.98 1.26 1.06

Provision coverage Ratio

Capital Adequacy Ratio 17.45 18.22 16.77 16.34

You might also like

- Historic Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument6 pagesHistoric Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnssantuNo ratings yet

- Historic Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument5 pagesHistoric Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnssantuNo ratings yet

- Arima-X: Things To CheckDocument19 pagesArima-X: Things To ChecksantuNo ratings yet

- IRDA Latest Claim Settlement Ratio 2019 List Best Death Claim Settlement Ratio Life Insurance Companies PicDocument4 pagesIRDA Latest Claim Settlement Ratio 2019 List Best Death Claim Settlement Ratio Life Insurance Companies PicsantuNo ratings yet

- Historic Returns - Elss, Elss Fund Performance Tracker Mutual Funds With Highest ReturnsDocument6 pagesHistoric Returns - Elss, Elss Fund Performance Tracker Mutual Funds With Highest ReturnssantuNo ratings yet

- 12) DCC-GARCH-Hedging-Stocks-Commodity-IndicesDocument20 pages12) DCC-GARCH-Hedging-Stocks-Commodity-IndicessantuNo ratings yet

- RetailDocument224 pagesRetailsantuNo ratings yet

- Worksheet in Credit-Scoring-CASEDocument215 pagesWorksheet in Credit-Scoring-CASEsantuNo ratings yet

- Impact of The Scam:: Sr. No. Psbs Exposure in INR CroresDocument2 pagesImpact of The Scam:: Sr. No. Psbs Exposure in INR CroressantuNo ratings yet

- SBI and BOBDocument4 pagesSBI and BOBsantuNo ratings yet

- Particulars Bank 2016 2017Document4 pagesParticulars Bank 2016 2017santuNo ratings yet

- 15 Ratios For Fundamental Analysis of Banking Sector Ratios HDFC BankDocument2 pages15 Ratios For Fundamental Analysis of Banking Sector Ratios HDFC BanksantuNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Ecotourism Travel EssentialsDocument1 pageEcotourism Travel EssentialsfrancartaNo ratings yet

- List of ProjectDocument6 pagesList of ProjectPradeep BiradarNo ratings yet

- Vault Guide To Private Equity and Hedge Fund PDFDocument155 pagesVault Guide To Private Equity and Hedge Fund PDFTian Zhong100% (1)

- EkonomiDocument5 pagesEkonomiPirathiksha Prem kumarNo ratings yet

- PhonePe CreditKartDocument12 pagesPhonePe CreditKartGitanjoli BorahNo ratings yet

- Membership Savings Remittance Form (MSRF) : HQP-PFF-053Document2 pagesMembership Savings Remittance Form (MSRF) : HQP-PFF-053OSCI PortovitaNo ratings yet

- An Annuity Is A Series of Equal Payments Occurring at Equal Periods of Time Annuities Occur in The Following InstancesDocument20 pagesAn Annuity Is A Series of Equal Payments Occurring at Equal Periods of Time Annuities Occur in The Following InstancesBolocon, Harvey Jon DelfinNo ratings yet

- Efficient Logistics - A Key To Vietnam's Competitiveness PDFDocument203 pagesEfficient Logistics - A Key To Vietnam's Competitiveness PDFTan LeNo ratings yet

- Purchasing Power Parity & The Big Mac IndexDocument9 pagesPurchasing Power Parity & The Big Mac Indexpriyankshah_bkNo ratings yet

- OU 24 Ppts PRADHANODocument21 pagesOU 24 Ppts PRADHANOapi-3774915No ratings yet

- New Product DevelopmentDocument3 pagesNew Product Developmentविशाल गुप्ताNo ratings yet

- Company Profile: Procuerment Manual, 6.1Document28 pagesCompany Profile: Procuerment Manual, 6.1Noli CorralNo ratings yet

- Case Studies Topic: First First DraftdraftDocument131 pagesCase Studies Topic: First First DraftdraftJosef AgyemanNo ratings yet

- Leading in The Digital Age: 13 June 2019 (Thursday)Document4 pagesLeading in The Digital Age: 13 June 2019 (Thursday)Dexie Cabañelez ManahanNo ratings yet

- Sec of Finance v. LazatinDocument10 pagesSec of Finance v. Lazatinana abayaNo ratings yet

- Organizing For Advertising and Promotion The Role of Ad AgenciesDocument20 pagesOrganizing For Advertising and Promotion The Role of Ad AgenciesMichelle EaktavewutNo ratings yet

- Flour Factory - Proposal - Study11Document33 pagesFlour Factory - Proposal - Study11Sileshi Angerasa92% (71)

- CFSP 2023-24 ApprovedDocument65 pagesCFSP 2023-24 ApprovedNyaoko OmbuyaNo ratings yet

- Case Studies AssignmentDocument4 pagesCase Studies Assignment9xy42xfqgcNo ratings yet

- Study Guide Chap 1 - The Nature of EconomicsDocument8 pagesStudy Guide Chap 1 - The Nature of EconomicsMaría José CarrilloNo ratings yet

- Chapter 7 Audit of The Purchases and Payment CycleDocument34 pagesChapter 7 Audit of The Purchases and Payment CycleRishika RapoleNo ratings yet

- Apple Best Fit ApproachDocument8 pagesApple Best Fit ApproachDivyamol100% (1)

- Final Project Report On Fianacial AnaysisDocument44 pagesFinal Project Report On Fianacial AnaysisMohammed RafiNo ratings yet

- Project Execution in EPC:Turnkeys Contracts and The PM Roles and ResponsibilitiesDocument13 pagesProject Execution in EPC:Turnkeys Contracts and The PM Roles and Responsibilitiesmyself100% (2)

- Thesis Presentation 1Document13 pagesThesis Presentation 1SreejithNo ratings yet

- Chapter 14 SolutionsDocument90 pagesChapter 14 SolutionsAshwin Anil Kumar100% (6)

- Haier LogisticsDocument58 pagesHaier LogisticsVikram Fernandez100% (1)

- Marketing Segmentation Targeting and PositioningDocument100 pagesMarketing Segmentation Targeting and Positioningchandana thimmayaNo ratings yet

- Tutorial 9 SolutionsDocument4 pagesTutorial 9 Solutionsmerita homasiNo ratings yet

- 12 Shopping CentreDocument42 pages12 Shopping CentreFendy TnNo ratings yet