Professional Documents

Culture Documents

15 Ratios For Fundamental Analysis of Banking Sector Ratios HDFC Bank

Uploaded by

santu0 ratings0% found this document useful (0 votes)

9 views2 pagesHDFC ICICI ratio analysis

Original Title

HDFC ICICI

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentHDFC ICICI ratio analysis

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views2 pages15 Ratios For Fundamental Analysis of Banking Sector Ratios HDFC Bank

Uploaded by

santuHDFC ICICI ratio analysis

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

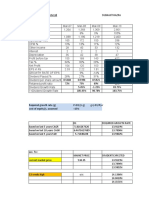

15 RATIOS FOR FUNDAMENTAL ANALYSIS OF BANKING SECTOR

RATIOS HDFC BANK

2016 2017 2018 2019 2020

Interest Income 63,161.56 73,271.35 85,287.84 105,160.74 122,189.30

Net Interest Income 29,165.09 38,435.52 51,025.79 65,983.20 77,523.78

Net Interest Margin 3.98% 3.94% 3.88% 3.97% 3.79%

Cost to Income Ratio 37% 38% 40% 38% 39%

Net Profit 12,817.33 15,287.40 18,560.84 22,445.61 27,296.27

Return On Assets (ROA) 1.75% 1.70% 1.67% 1.72% 1.72%

Return On Equity (ROE) 17.22% 16.61% 16.88% 14.53% 15.40%

Total Advances 464,593.96 554,568.20 658,333.09 819,401.22 993,702.88

Total Deposits 545,873.29 643,134.25 788,375.14 922,502.68 1,146,207.14

Loans to Deposit Ratio or Credit

to Deposit Ratio 10% 10% 12% 16% 13%

CASA Ratio 43% 48% 43% 42% 42%

Gross NPAs 1% 1% 1% 1% 1%

Net NPAs 0% 0% 0% 0% 0%

Provision Coverage Ratio (PCR)

Capital Adequacy Ratio (CAR) 16% 15% 15% 17% 19%

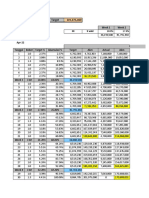

OF BANKING SECTOR

ICICI BANK

2016 2017 2018 2019 2020

59,293.71 60,939.98 62,162.35 71,981.65 84,835.77

25,224.14 22,898.40 19,780.87 18,268.96 22,698.34

2.75% 2.64% 2.48% 2.64% 2.91%

39% 43% 47% 49% 46%

10,926.89 11,340.33 9,099.54 5,689.16 11,050.25

1.10% 1.03% 0.68% 0.34% 0.69%

11.15% 10.03% 7.16% 3.72% 7.78%

435,263.94 464,232.08 512,395.29 586,646.58 -

451,077.39 512,587.26 585,796.11 681,316.94 800,784.46

48% 41% 30% 33% 25%

45% 50% 51% 51% 45%

6% 9% 0% 7% 6%

3% 5% 5% 2% 1%

17% 17% 18% 17% 16%

You might also like

- 2022.07.24 - DCF Tutorial Answer KeyDocument18 pages2022.07.24 - DCF Tutorial Answer KeySrikanth ReddyNo ratings yet

- Petron vs Shell Financial AnalysisDocument5 pagesPetron vs Shell Financial AnalysisFRANCIS IMMANUEL TAYAGNo ratings yet

- DR Lal Path Labs Financial Model - Ayushi JainDocument45 pagesDR Lal Path Labs Financial Model - Ayushi JainTanya SinghNo ratings yet

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachFrom EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachRating: 3 out of 5 stars3/5 (3)

- F9FM RQB Qs - j09kj NDocument64 pagesF9FM RQB Qs - j09kj NErclan0% (1)

- Securities Regulation Code (RA 8799)Document2 pagesSecurities Regulation Code (RA 8799)Sheila Mae BenedictoNo ratings yet

- 3 Methods Calculate Firm Goodwill Under 40 CharactersDocument4 pages3 Methods Calculate Firm Goodwill Under 40 CharactersJosé Edson Jr.No ratings yet

- Understanding Private Bank Fundamentals and RatiosDocument19 pagesUnderstanding Private Bank Fundamentals and RatiosAbhishekNo ratings yet

- PSU Banks Comparative Analysis FY21Document10 pagesPSU Banks Comparative Analysis FY21Ganesh V0% (1)

- Public Sector Banks Comparative Analysis 3QFY24Document10 pagesPublic Sector Banks Comparative Analysis 3QFY24Sujay AnanthakrishnaNo ratings yet

- FY 13-14 FY 14-15 FY 70-71 FY 71-72 FY 72-73 ActualDocument7 pagesFY 13-14 FY 14-15 FY 70-71 FY 71-72 FY 72-73 ActualramNo ratings yet

- Imf CDocument12 pagesImf Cerich canaviriNo ratings yet

- Private Sector Banks Comparative Analysis 1HFY22Document12 pagesPrivate Sector Banks Comparative Analysis 1HFY22Tushar Mohan0% (1)

- Bankmanagement AssignmentDocument4 pagesBankmanagement AssignmentHasan Motiur RahmanNo ratings yet

- Business FinanceDocument6 pagesBusiness Financejeonlei02No ratings yet

- Business Valuation - ROTIDocument21 pagesBusiness Valuation - ROTITEDY TEDYNo ratings yet

- Elisabeth Xaveria Quinn - Lembar Kerja Manajemen Kredit Dan Analisis Kinerja PerbankanDocument4 pagesElisabeth Xaveria Quinn - Lembar Kerja Manajemen Kredit Dan Analisis Kinerja PerbankanRony Adi NugrahaNo ratings yet

- Session 7 Valuation of ITC Using DDMDocument24 pagesSession 7 Valuation of ITC Using DDMSnehil BajpaiNo ratings yet

- Description 2019 2018 2017 2016: Statement of Consolidated Cash FloDocument1 pageDescription 2019 2018 2017 2016: Statement of Consolidated Cash FloAspan FLNo ratings yet

- Ratio CalculationDocument105 pagesRatio Calculationfauziah06No ratings yet

- GCB Bank's profitability and liquidity ratios over 2010-2015Document4 pagesGCB Bank's profitability and liquidity ratios over 2010-2015YAKUBU ISSAHAKU SAIDNo ratings yet

- FedEx (FDX) Financial Ratios and Metrics - Stock AnalysisDocument2 pagesFedEx (FDX) Financial Ratios and Metrics - Stock AnalysisPilly PhamNo ratings yet

- Corporate Finance ReportDocument6 pagesCorporate Finance ReportParbon AcharjeeNo ratings yet

- BMP Bav ReportDocument79 pagesBMP Bav ReportThu ThuNo ratings yet

- Marico Financial Model (Final) (Final-1Document22 pagesMarico Financial Model (Final) (Final-1Jayant JainNo ratings yet

- BMP Bav Report FinalDocument93 pagesBMP Bav Report FinalThu ThuNo ratings yet

- BFS Du Point Analysis BR6 Axis BankDocument27 pagesBFS Du Point Analysis BR6 Axis BankMadhusudhanan RameshkumarNo ratings yet

- Federal Bank Ltd. ICICI Bank CSB Bank Ltd. key financial dataDocument2 pagesFederal Bank Ltd. ICICI Bank CSB Bank Ltd. key financial dataanish mahtoNo ratings yet

- Tata Motors ForetradersDocument18 pagesTata Motors Foretradersguptaasoham24No ratings yet

- Pepper FryDocument13 pagesPepper FryMukesh KumarNo ratings yet

- 04 02 BeginDocument2 pages04 02 BeginnehaNo ratings yet

- Fullerton AnalysisDocument8 pagesFullerton AnalysisSuman MandalNo ratings yet

- DuPont Analysis and Key Financial Ratios of CompanyDocument7 pagesDuPont Analysis and Key Financial Ratios of CompanyVasavi MendaNo ratings yet

- Catholic Syrian BankDocument29 pagesCatholic Syrian BanksherwinmitraNo ratings yet

- Cigniti - Group 3 - BFBVDocument24 pagesCigniti - Group 3 - BFBVpgdm22srijanbNo ratings yet

- Pakistan Inflation RATE (%) Exchange Rate (LCU Per USD, Period Avg) Foreign Reserve (Million $) Unemployment RATE (%)Document5 pagesPakistan Inflation RATE (%) Exchange Rate (LCU Per USD, Period Avg) Foreign Reserve (Million $) Unemployment RATE (%)Neelofer GulNo ratings yet

- Valuation Task 20 - SUPRITHA.KDocument14 pagesValuation Task 20 - SUPRITHA.KSupritha HegdeNo ratings yet

- Keterangan 2015 2016 2017: Year To Year Anylisis Analisis Common SizeDocument9 pagesKeterangan 2015 2016 2017: Year To Year Anylisis Analisis Common SizeSahirah Hafizhah TaqiyyahNo ratings yet

- FM Assigment 14 FebDocument6 pagesFM Assigment 14 FebSubhajit HazraNo ratings yet

- Ejercicio 1 AnálisisDocument7 pagesEjercicio 1 AnálisisscawdarkoNo ratings yet

- AnalysisDocument20 pagesAnalysisKoduri Sri HarshaNo ratings yet

- Operator Search 20220419084949Document9 pagesOperator Search 20220419084949beriNo ratings yet

- Vinati Organics Ltd financial analysis and key metrics from 2011 to 2020Document30 pagesVinati Organics Ltd financial analysis and key metrics from 2011 to 2020nhariNo ratings yet

- Fsa 21311030Document12 pagesFsa 21311030Gangothri AsokNo ratings yet

- Axiata Data Financials 4Q21bDocument11 pagesAxiata Data Financials 4Q21bhimu_050918No ratings yet

- DCF Trident 2Document20 pagesDCF Trident 2Jayant JainNo ratings yet

- 077 - UBAID DHANSAY Financial Accounting AasgnDocument15 pages077 - UBAID DHANSAY Financial Accounting Aasgniffu rautNo ratings yet

- Ratios and financial parameters for 14-Aug-19 and 20-Aug-19Document1 pageRatios and financial parameters for 14-Aug-19 and 20-Aug-19Aldo Namora SarumpaetNo ratings yet

- Ratios and financial parameters for 14-Aug-19 and 20-Aug-19Document1 pageRatios and financial parameters for 14-Aug-19 and 20-Aug-19Aldo Namora SarumpaetNo ratings yet

- Lap. Croseling April 2022Document78 pagesLap. Croseling April 2022Fatimah RizkiNo ratings yet

- ACC DCF ValuationDocument7 pagesACC DCF ValuationJitesh ThakurNo ratings yet

- Report Collection Projection at Month EndDocument12 pagesReport Collection Projection at Month EndNazarNo ratings yet

- Horizontal Analysis 0% 6% 6%: As at December 31, 2017 As at December 31, 2016Document7 pagesHorizontal Analysis 0% 6% 6%: As at December 31, 2017 As at December 31, 2016Sathwik HvNo ratings yet

- ST BK of IndiaDocument42 pagesST BK of IndiaSuyaesh SinghaniyaNo ratings yet

- Nvidia DCFDocument28 pagesNvidia DCFibs56225No ratings yet

- Kota Fibres, Ltd. (FIX)Document10 pagesKota Fibres, Ltd. (FIX)Aldo MadonaNo ratings yet

- Key Ratio Analysis: Profitability RatiosDocument27 pagesKey Ratio Analysis: Profitability RatioskritikaNo ratings yet

- December 31 2004 2005 2006 2007 2008 2009Document2 pagesDecember 31 2004 2005 2006 2007 2008 2009adilroseNo ratings yet

- CASA growth and robust liquidity drive BCA's strong 1H20 resultsDocument3 pagesCASA growth and robust liquidity drive BCA's strong 1H20 resultsErica ZulianaNo ratings yet

- Sum - Millions (COP) - Annual - Indicators Size Sales / VENTASDocument4 pagesSum - Millions (COP) - Annual - Indicators Size Sales / VENTASAdolfo Silva QuiñonesNo ratings yet

- Industry AveragesDocument5 pagesIndustry AveragesNuwani ManasingheNo ratings yet

- Amazon DCF: Ticker Implied Share Price Date Current Share PriceDocument4 pagesAmazon DCF: Ticker Implied Share Price Date Current Share PriceFrancesco GliraNo ratings yet

- 12) DCC-GARCH-Hedging-Stocks-Commodity-IndicesDocument20 pages12) DCC-GARCH-Hedging-Stocks-Commodity-IndicessantuNo ratings yet

- Best Performing ELSS Mutual Funds Over 1, 2 and 3 YearsDocument6 pagesBest Performing ELSS Mutual Funds Over 1, 2 and 3 YearssantuNo ratings yet

- Historic Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument6 pagesHistoric Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnssantuNo ratings yet

- Historic Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument5 pagesHistoric Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnssantuNo ratings yet

- Arima-X: Things To CheckDocument19 pagesArima-X: Things To ChecksantuNo ratings yet

- IRDA Latest Claim Settlement Ratio 2019 List Best Death Claim Settlement Ratio Life Insurance Companies PicDocument4 pagesIRDA Latest Claim Settlement Ratio 2019 List Best Death Claim Settlement Ratio Life Insurance Companies PicsantuNo ratings yet

- Asian PaintsDocument6 pagesAsian PaintssantuNo ratings yet

- AsdfgDocument1 pageAsdfgsantuNo ratings yet

- GAMEPLAN SEASON 10 Case StudyDocument23 pagesGAMEPLAN SEASON 10 Case StudyAnirudh ParmarNo ratings yet

- Senti NIFTY50Document5 pagesSenti NIFTY50santuNo ratings yet

- Zara ReviewDocument1 pageZara ReviewsantuNo ratings yet

- BookDocument2 pagesBooksantuNo ratings yet

- Impact of The Scam:: Sr. No. Psbs Exposure in INR CroresDocument2 pagesImpact of The Scam:: Sr. No. Psbs Exposure in INR CroressantuNo ratings yet

- RetailDocument224 pagesRetailsantuNo ratings yet

- Cost StructureDocument8 pagesCost StructuresantuNo ratings yet

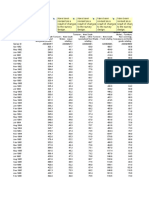

- Bank financial metrics comparison 2016-2019Document4 pagesBank financial metrics comparison 2016-2019santuNo ratings yet

- Particulars Bank 2016 2017Document4 pagesParticulars Bank 2016 2017santuNo ratings yet

- Worksheet in Credit-Scoring-CASEDocument215 pagesWorksheet in Credit-Scoring-CASEsantuNo ratings yet

- Worksheet in Credit-Scoring-CASEDocument215 pagesWorksheet in Credit-Scoring-CASEsantuNo ratings yet

- AXIS and KOTAKDocument2 pagesAXIS and KOTAKsantuNo ratings yet

- 15 Ratios For Fundamental Analysis of Banking Sector Ratios HDFC BankDocument2 pages15 Ratios For Fundamental Analysis of Banking Sector Ratios HDFC BanksantuNo ratings yet

- AbcdDocument1 pageAbcdsantuNo ratings yet

- Worksheet in Credit-Scoring-CASEDocument215 pagesWorksheet in Credit-Scoring-CASEsantuNo ratings yet

- AXIS and KOTAKDocument2 pagesAXIS and KOTAKsantuNo ratings yet

- GDP Chapter 15 GuideDocument8 pagesGDP Chapter 15 GuideTienNo ratings yet

- Undergraduate Story Templates for IBDocument4 pagesUndergraduate Story Templates for IBKerr limNo ratings yet

- Jiblr 2005 20 10 535-540Document6 pagesJiblr 2005 20 10 535-540Santanu RoyNo ratings yet

- XAT Decision Making - 2: by Gautam Puri (GP)Document43 pagesXAT Decision Making - 2: by Gautam Puri (GP)Lenovo K8noteNo ratings yet

- Tugas-MPSI-P1-P14 - Kelompok 2 - 19.4A.04Document29 pagesTugas-MPSI-P1-P14 - Kelompok 2 - 19.4A.04gilang putraNo ratings yet

- TH THDocument39 pagesTH THPudy BreadNo ratings yet

- Corporate Liquidation Answer SheetDocument4 pagesCorporate Liquidation Answer SheetsatyaNo ratings yet

- RBWM Memory Based Question Jaiib May 2023 4 1 Compressed 1687270033Document25 pagesRBWM Memory Based Question Jaiib May 2023 4 1 Compressed 1687270033NIKHIL ASHOKNo ratings yet

- HDFC Life Insurance (HDFCLIFE) : 2. P/E 58 3. Book Value (RS) 23.57Document5 pagesHDFC Life Insurance (HDFCLIFE) : 2. P/E 58 3. Book Value (RS) 23.57Srini VasanNo ratings yet

- International Financial Markets: An Overview of Key Terms and ConceptsDocument16 pagesInternational Financial Markets: An Overview of Key Terms and ConceptsanshuldceNo ratings yet

- Fit - Tax Table 2Document4 pagesFit - Tax Table 2zipaganermy15No ratings yet

- FIM Chapter 4Document16 pagesFIM Chapter 4Surafel BefekaduNo ratings yet

- Quote Template 2 WordDocument1 pageQuote Template 2 WordMostafa SayedNo ratings yet

- TrustsDocument24 pagesTrustsTiso Blackstar GroupNo ratings yet

- CAIIB Elective Papers Low 032013Document14 pagesCAIIB Elective Papers Low 032013Soumava PaulNo ratings yet

- Fema CDocument5 pagesFema Capi-3712367No ratings yet

- Axial Website - Transitioning CEO Tips - Some Points Here To Use in IOIkDocument6 pagesAxial Website - Transitioning CEO Tips - Some Points Here To Use in IOIkgalindoalfonsoNo ratings yet

- Projections of Investment in Infrastructure During The Eleventh PlanDocument41 pagesProjections of Investment in Infrastructure During The Eleventh PlanJitesh ShahNo ratings yet

- MA Playbook PDFDocument188 pagesMA Playbook PDFdavidlaval79No ratings yet

- FinanceDocument108 pagesFinanceChaitanya DaraNo ratings yet

- Consolidation at Acquisition DateDocument29 pagesConsolidation at Acquisition DateLee DokyeomNo ratings yet

- SENATE HEARING, 113TH CONGRESS - S. Hrg. 113-720 NOMINATIONS OF THE 113TH CONGRESS - SECOND SESSIONDocument874 pagesSENATE HEARING, 113TH CONGRESS - S. Hrg. 113-720 NOMINATIONS OF THE 113TH CONGRESS - SECOND SESSIONScribd Government DocsNo ratings yet

- CHP 13 Testbank 2Document15 pagesCHP 13 Testbank 2judyNo ratings yet

- Stock Report On JSW Steel in India PDFDocument8 pagesStock Report On JSW Steel in India PDFPranavPillaiNo ratings yet

- Answer The Following A Will The Limitation of 20 StocksDocument1 pageAnswer The Following A Will The Limitation of 20 Stockshassan taimourNo ratings yet

- 14239Document89 pages14239maxeytm_839061685No ratings yet

- Manual For SOA Exam FM/CAS Exam 2.: Chapter 7. Derivative Markets. Section 7.3. FuturesDocument15 pagesManual For SOA Exam FM/CAS Exam 2.: Chapter 7. Derivative Markets. Section 7.3. FuturesAlbert ChangNo ratings yet