Professional Documents

Culture Documents

Revisiting the Satyam Accounting Scam Case Study

Uploaded by

Irisha AnandOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Revisiting the Satyam Accounting Scam Case Study

Uploaded by

Irisha AnandCopyright:

Available Formats

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/304441053

Revisiting the Satyam Accounting Scam: A Case Study

Article · June 2016

CITATIONS READS

2 15,027

2 authors, including:

Madan Bhasin

Universiti Utara Malaysia

121 PUBLICATIONS 1,309 CITATIONS

SEE PROFILE

Some of the authors of this publication are also working on these related projects:

Integrated Reporting and EVA Disclosures. Collaboration Proposala View project

Scientific Journal "Economics, Management and Sustainability" View project

All content following this page was uploaded by Madan Bhasin on 26 June 2016.

The user has requested enhancement of the downloaded file.

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 31

Volume 5, No. 6, June 2016

Revisiting the Satyam Accounting Scam: A Case Study

Dr. Madan Lal Bhasin, Professor, School of Accountancy, College of Business, Universiti Utara Malaysia, Sintok, Kedah

Darul Aman, Malaysia

ABSTRACT punishments, and effective enforcement of law with the

right spirit.”

Satyam Computers were once the crown jewel of Indian IT

industry, but were brought to the ground by its founders in Keywords

2009 as a result of financial crime. The untimely demise of Satyam, accounting scandal, case study, India, Enron,

Satyam raised a debate about the role of CEO in driving a corporate governance, accounting and auditing standards.

company to the heights of success and its relation with the

board members and core committees. The scam brought to 1. INTRODUCTION

the light the role of corporate governance (CG) in shaping

the protocols related to the working of audit committees Fraud is a worldwide phenomenon that affects all

and duties of board members. The Satyam scam was a jolt continents and all sectors of the economy. Organizations

to the market, especially to Satyam stockholders, which of all types and sizes are subject to fraud. Fraudulent

tarnished the reputation of India. An attempt is made in financial reporting can have significant consequences for

this paper to examine in-depth and analyze India‟s Enron, the organization and its stakeholders, as well as for public

Satyam Computer‟s “accounting” scandal. Unlike Enron, confidence in the capital markets. As Bhasin (2013)

which sank due to agency problem, Satyam was brought to reiterated, ―Corporate accounting fraud is not a new thing

its knee due to tunneling effect. In public companies, this in this world after the debacle of Enron, which proved to

type of accounting leading to fraud and investigations are, be a stimulus for others to fancy their own Enron in their

therefore, launched by the various governmental oversight respective organizations.‖ With increasing trend in

agencies. financial crimes across the globe, investors lost their

The accounting fraud committed by the founders of confidence, the credibility of financial disclosures were

Satyam in 2009 is a testament to the fact that “the science being questioned and companies were facing huge

of conduct is swayed in large by human greed, ambition, financial losses. Satyam Computer Services Limited

and hunger for power, money, fame and glory.” Scandals (henceforth ‗Satyam‘) was just another case featuring

have proved that “there is an urgent need for good almost same causes like that of Enron and others including

conduct based on strong corporate governance, ethics and WorldCom (Vasudev, 2010). Satyam computers were once

accounting & auditing standards.” The Satyam scandal the crown jewel of Indian IT industry, but were brought to

highlights the importance of securities laws and CG in the ground by its founders in 2009 as a result of financial

emerging markets. Indeed, Satyam fraud “spurred the crime. ―The debacle of Satyam raised a debate about the

government of India to tighten the CG norms to prevent role of CEO in driving an organization to the heights of

recurrence of similar frauds in future.” Thus, major success and its relation with the board members and core

financial reporting frauds need to be studied for committees,‖ concludes Bhasin (2016) The scam at

„lessons-learned‟ and „strategies-to-follow‟ to reduce the Satyam brought to the light the role of corporate

incidents of such frauds in the future. The increasing rate governance in shaping the protocols related to the working

of white-collar crimes “demands stiff penalties, exemplary of audit committee and duties of board members. Thus, an

i-Explore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 32

Volume 5, No. 6, June 2016

in depth study is conducted to analyze the financial scam Indian scandal that analysts have called ―India's Enron.‖ It

from a management‘s perspective. covered the areas of corporate history of Satyam and also

provided an insight into how the $2.7 billion scandal

No doubt, recent corporate accounting frauds and scandals, evaded regulators, investors, and the board of directors. He

and the resultant outcry for transparency and honesty in also provided a discussion of who was responsible for the

reporting, have given rise to two disparate yet logical fraud, and also explained the scandal‘s effect in India and

outcomes. Recently, Bhasin (2016a) stated, ―First, the implications for dealing with future obstacles. Finally,

‗forensic‘ accounting skills have become crucial in the author discussed the regulatory reform following

untangling the complicated accounting maneuver‘s that Satyam and the current status of Indian securities markets.

have obfuscated financial statement frauds. Second, public

demand for change and subsequent regulatory action has In another research study performed by Bhasin (2013),

transformed ‗corporate governance‘ (henceforth, CG) ―the main objectives of this study were to: (a) identify the

scenario.‖ In fact, both these trends have the common goal prominent companies involved in fraudulent financial

of addressing the investors‘ concerns about the transparent reporting practices, and the nature of accounting

financial reporting system. The failure of the corporate irregularities they committed; (b) highlighted the Satyam

communication structure has made the financial Computer Limited‘s accounting scandal by portraying the

community realize that there is a great need for ‗skilled‘ sequence of events, the aftermath of events, the key parties

professionals that can identify, expose, and prevent involved, and major follow-up actions undertaken in India;

‗structural‘ weaknesses in three key areas: poor CG, and (c) what lesions can be learned from Satyam scam?‖

flawed internal controls, and fraudulent financial To attain the above stated research objectives we applied a

statements. ―Forensic accounting skills are becoming ―content‖ analysis to the ―press‖ articles. Niazi and Ali‘s

increasingly relied upon within a corporate reporting (2015) paper unfolds Satyam‘s corporate scandal of

system that emphasizes its accountability and inflated financial health, the aroused concerns of investors

responsibility to stakeholders.‖ about the effectiveness of CG framework in India, the

long-term effects over Indian stock market resulting from

2. LITERATURE REVIEW Satyam‘s scam, and several suggestions from the CG

theory and practice that could have helped in preventing

Several analytical studies, from time to time, have been this debacle. Thus, an in depth study is conducted to

reported in the media. Unfortunately, majority of them analyze the financial scam from a management‘s

were performed in developed, Western countries. The perspective.

nature of the present study is ―primarily qualitative,

descriptive and analytical, with latest evidence and Another descriptive study by Pai and Tolleson (2015)

updates.‖ Hence, the present study seeks to fill this gap examined the capture of government regulators using the

and contributes to the literature. case of Satyam Computer Services Ltd., one of India‘s

largest software and services companies, which disclosed a

Bhasin (2008) examined the reasons for ‗check‘ frauds, the $1.47 billion fraud on its balance sheet on January 7, 2009.

magnitude of frauds in Indian banks, and the manner, in The authors reviewed the Satyam fraud and PWC‘s failure

which the expertise of internal auditors can be integrated, to detect Satyam‘s accounting shenanigans, and also

in order to detect and prevent frauds in banks. In addition discussed the societal implications associated with a ―too

to considering the common types of fraud signals, auditors big to fail‖ mentality and the moral hazard of such a

can take several ‗proactive‘ steps to combat frauds. mindset. In addition, the paper provides suggestions to

Winkler, D. (2010), paper provided an analysis of the protect the public interest while citing lessons learned

i-Explore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 33

Volume 5, No. 6, June 2016

from this scandal. than six years later, the first decision in the Satyam scam

has been made. Of course, we have not seen the last of this

3. MATERIALS AND METHODS case, given the slow pace at which our judicial system

works.

The main objective of this study is to highlight the Satyam

Computer Services Limited‘s accounting scandal by The case of Satyam accounting fraud has been dubbed by

portraying the emergence of Satyam, sequence of events, the media as ―India‘s Enron‖. Ironically, Satyam means

key players involved in the scam process, anatomy of ―truth‖ in the ancient Indian language ―Sanskrit‖ (Basilico

Satyam fraud, the aftermath of events, auditors role, major et al., 2012). Satyam won the ―Golden Peacock Award‖ for

follow-up actions, regulatory reforms undertaken in India, the best governed company in 2007 and in 2009. From

etc. This study is primarily based on ―secondary‖ sources being India‘s IT ―crown jewel‖ and the country‘s ―fourth

of data, and the nature of the study is ―primarily largest‖ company with high-profile customers, the

qualitative, descriptive and analytical.‖ Best possible outsourcing firm Satyam Computers has become

efforts have made by the author to provide the latest embroiled in the nation‘s biggest corporate scam in living

evidence supporting the case. memory (Ahmad, et al., 2010). Mr. Ramalinga Raju

(Chairman and Founder of Satyam; henceforth called

4. REVISITING THE SATYAM SCAM: A ‗Raju‘), who has been arrested and has confessed to a

CASE STUDY $1.47 billion (or Rs. 7,800 crore) fraud, admitted that he

had made up profits for years. According to reports, Raju

4.1 Introduction and his brother, Mr. B. Rama Raju, who was the Managing

The Satyam Computer Services Limited (hereinafter, Director, ―hid the deception from the company‘s board,

‗Satyam‘), a global IT company based in India, has just senior managers, and auditors.‖

been added to a notorious list of companies involved in

fraudulent financial activities. Satyam‘s CEO, Mr. 4.2 Emergence of Satyam Computer Services Ltd.

Ramalingam Raju (hereinafter, ‗Raju‘), took responsibility Satyam Computer Services Limited was a ‗rising-star‘ in

for all the accounting improprieties that overstated the the Indian ‗outsourced‘ IT-services industry (Fernando,

company‘s revenues and profits, and reported a cash 2010). The company was formed in 1987 in Hyderabad

holding of approximately $1.04 billion that simply did not (India) by Mr. Ramalinga Raju. The firm began with 20

exist. This leads one to ask a simple question: How does employees, grew rapidly as a ‗global‘ business, which

this keep on happening for five years, without any operated in 65 countries around the world. Satyam was the

suspicions? So, while Raju ran his fraud, the auditor slept, first Indian company to be registered with three

the analysts slept, and so did the media. To be fair, the International Exchanges (NYSE, DOW Jones and

media did an excellent job of exposing Raju and his many EURONEXT).

other ―shenanigans‖ after he had confessed (Kaul, 2015;

Miller 2006). In his letter (of Jan.7, 2009) addressed to Satyam was as an example of India‘s growing success; it

board of directors of Satyam, Raju showed the markers of won numerous awards for innovation, governance, and

this fraud ‗pathology‘. He stated, ―What started as a corporate accountability. As Agrawal and Sharma (2009)

marginal gap between actual operating profits and ones stated, ―In 2007, Ernst & Young awarded Mr. Raju with

reflected in the books of accounts continued to grow over the ‗Entrepreneur of the Year‘ award. On April 14, 2008,

the years. It has attained unmanageable proportions.‖ Later, Satyam won awards from MZ Consult‘s for being a ‗leader

he described the process as ―like riding a tiger, not in India in CG and accountability‘. In September 2008, the

knowing how to get off without being eaten.‖ Now, more ―World Council for Corporate Governance‖ awarded the

i-Explore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 34

Volume 5, No. 6, June 2016

Satyam with the ‗Global Peacock Award‘ for global Satyam became the centre-piece of a ‗massive‘ accounting

excellence in corporate accountability.‖ Unfortunately, less fraud.

than five months after winning the Global Peacock Award,

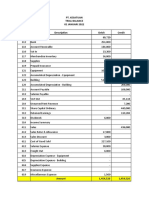

Table-1: Operating Performance of Satyam

(Rs. in millions)

Particulars 2003-04 2004-05 2005-06 2006-07 2007-08 Average Growth

Rate (%)

Net Sales 25,415.4 34,642.2 46,343.1 62,284.7 81,372.8 38

Operating Profit 7,743 9,717 15,714.2 17,107.3 20,857.4 28

Net Profit 5,557.9 7,502.6 12,397.5 14,232.3 17,157.4 33

Operating Cash Flow 4,165.5 6,386.6 7,868.1 10,390.6 13,708.7 35

ROCE (%) 27.95 29.85 31.34 31.18 29.57 30

ROE (%) 23.57 25.88 26.85 28.14 26.12 26

(Source: www.geogit.com)

From 2003-2008, in nearly all financial metrics of interest sheet by $1.47 billion. Nearly $1.04 billion in bank loans

to investors, the company grew measurably, as and cash that the company claimed to own was

summarized in Table-1. Satyam generated Rs. 25,415.4 non-existent. Satyam also underreported liabilities on its

million in total sales in 2003-04. By March 2008, the balance sheet and overstated its income nearly every

company sales revenue had grown by over three times. quarter over the course of several years in order to meet

The company demonstrated ―an annual compound growth analyst expectations. For example, the results announced

rate of 38% over that period.‖ Operating profits, net profit on October 17, 2009 overstated quarterly revenues by 75%

and operating cash flows averaged 28, 33 and 35%, and profits by 97%. Mr. Raju and the company‘s global

respectively. In addition, earnings per share (EPS) head of internal audit used a number of different

similarly grew, from $0.12 to $0.62, at a compound annual techniques to perpetrate the fraud (Willison, 2006). As

growth rate of 40%. Over the same period (2003‐ 2009), Ramachandran (2009) pointed out, ―Using his personal

the company was trading at an average trailing EBITDA computer, Mr. Raju created numerous bank statements to

multiple of 15.36. Finally, beginning in January 2003, at a advance the fraud. He falsified the bank accounts to inflate

share price of Rs. 138.08, Satyam‘s stock would peak at the balance sheet with balances that did not exist. He also

Rs. 526.25: a 300% improvement in share price after inflated the income statement by claiming interest income

nearly five years. Satyam clearly generated significant from the fake bank accounts. Mr. Raju also revealed that

corporate growth and shareholder value. The company was He created 6,000 fake salary accounts over the past few

a leading star (and a recognizable name) in a global IT years and appropriated the money after the company

marketplace. deposited it. The company‘s global head of internal audit

created fake customer identities and generated fake

4.3 Mr. Ramalinga Raju and the Satyam Scandal invoices against their names to inflate revenue. The global

On January 7, 2009, Mr. Raju disclosed in a letter (as head of internal audit also forged board resolutions and

shown in Exhibit-1) to Satyam Computers Services illegally obtained loans for the company.‖ It also appeared

Limited Board of Directors, ―He had been manipulating that the cash that the company raised through American

the company‘s accounting numbers for years.‖ Mr. Raju Depository Receipts in the United States never made it to

claimed that He overstated assets on Satyam‘s balance the balance sheets (Wharton, 2009).

i-Explore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 35

Volume 5, No. 6, June 2016

Exhibit-1: Satyam’s Founder, Chairman and CEO, Mr. be. What followed in the last several days is common

knowledge.

Raju’s Letter to his Board of Directors I would like the Board to know:

1. That neither myself, nor the Managing Director

To The Board of Directors, January 7, 2009 (including our spouses) sold any shares in the last

Satyam Computer Services Ltd. eight years—excepting for a small proportion

From: B. Ramalinga Raju declared and sold for philanthropic purposes.

Chairman, Satyam Computer Services Ltd. 2. That in the last two years a net amount of Rs. 1,230

crore was arranged to Satyam (not reflected in the

Dear Board Members, books of Satyam) to keep the operations going by

It is with deep regret, and tremendous burden that I am resorting to pledging all the promoter shares and

carrying on my conscience, that I would like to bring the raising funds from known sources by giving all kinds

following facts to your notice: of assurances (Statement enclosed, only to the

1. The Balance Sheet carries as of September 30, 2008: members of the board). Significant dividend payments,

(a) Inflated (non-existent) cash and bank balances of acquisitions, capital expenditure to provide for growth

Rs.5,040 crore (as against Rs. 5,361 crore reflected in did not help matters. Every attempt was made to keep

the books); (b) An accrued interest of Rs. 376 crore the wheel moving and to ensure prompt payment of

which is non-existent; (c) An understated liability of salaries to the associates. The last straw was the

Rs. 1,230 crore on account of funds arranged by me; selling of most of the pledged share by the lenders on

and (d) An over stated debtors position of Rs. 490 account of margin triggers.

crore (as against Rs. 2,651 reflected in the books). 3. That neither me, nor the Managing Director took even

2. For the September quarter (Q2), we reported a one rupee/dollar from the company and have not

revenue of Rs.2,700 crore and an operating margin benefitted in financial terms on account of the inflated

of Rs. 649 crore (24% of revenues) as against the results.

actual revenues of Rs. 2,112 crore and an actual 4. None of the board members, past or present, had any

operating margin of Rs. 61 Crore (3% of revenues). knowledge of the situation in which the company is

This has resulted in artificial cash and bank balances placed. Even business leaders and senior executives in

going up by Rs. 588 crore in Q2 alone. the company, such as, Ram Mynampati, Subu D, T.R.

The gap in the Balance Sheet has arisen purely on Anand, Keshab Panda, Virender Agarwal, A.S.

account of inflated profits over a period of last several Murthy, Hari T, SV Krishnan, Vijay Prasad, Manish

years (limited only to Satyam standalone, books of Mehta, Murali V, Sriram Papani, Kiran Kavale, Joe

subsidiaries reflecting true performance). What started Lagioia, Ravindra Penumetsa, Jayaraman and

as a marginal gap between actual operating profit and Prabhakar Gupta are unaware of the real situation as

the one reflected in the books of accounts continued against the books of accounts. None of my or

to grow over the years. It has attained unmanageable Managing Director‘s immediate or extended family

proportions as the size of company operations grew members has any idea about these issues.

significantly (annualized revenue run rate of Rs. Having put these facts before you, I leave it to the wisdom

11,276 crore in the September quarter, 2008 and of the board to take the matters forward. However, I am

official reserves of Rs. 8,392 crore). The differential also taking the liberty to recommend the following steps:

in the real profits and the one reflected in the books 1. A Task Force has been formed in the last few days to

was further accentuated by the fact that the company address the situation arising out of the failed Maytas

had to carry additional resources and assets to justify acquisition attempt. This consists of some of the most

higher level of operations —thereby significantly accomplished leaders of Satyam: Subu D, T.R. Anand,

increasing the costs. Keshab Panda and Virender Agarwal, representing

Every attempt made to eliminate the gap failed. As the business functions, and A.S. Murthy, Hari T and

promoters held a small percentage of equity, the Murali V representing support functions. I suggest

concern was that poor performance would result in a that Ram Mynampati be made the Chairman of this

take-over, thereby exposing the gap. It was like riding Task Force to immediately address some of the

a tiger, not knowing how to get off without being operational matters on hand. Ram can also act as an

eaten. interim CEO reporting to the board.

The aborted Maytas acquisition deal was the last 2. Merrill Lynch can be entrusted with the task of

attempt to fill the fictitious assets with real ones. quickly exploring some Merger opportunities.

Maytas‘ investors were convinced that this is a good 3. You may have a ‗restatement of accounts‘ prepared

divestment opportunity and a strategic fit. Once by the auditors in light of the facts that I have placed

Satyam‘s problem was solved, it was hoped that before you. I have promoted and have been associated

Maytas‘ payments can be delayed. But that was not to with Satyam for well over twenty years now. I have

seen it grow from few people to 53,000 people, with

i-Explore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 36

Volume 5, No. 6, June 2016

185 Fortune 500 companies as customers and through, as Satyam would have been able to use Maytas‘

operations in 66 countries. Satyam has established an

assets to shore up its own books.‖ Raju, who showed

excellent leadership and competency base at all levels.

I sincerely apologize to all Satyamites and ‗artificial‘ cash on his books, had planned to use this

stakeholders, who have made Satyam a special ‗non-existent‘ cash to acquire the two Maytas companies

organization, for the current situation. I am confident

they will stand by the company in this hour of crisis. (Ahmad et al., 2010). Table-2 depicts some parts of the

In light of the above, I fervently appeal to the board to Satyam‘s fabricated ‗Balance Sheet and Income Statement‘

hold together to take some important steps. Mr. T.R. and shows the ‗difference‘ between ‗actual‘ and ‗reported‘

Prasad is well placed to mobilize support from the

government at this crucial time. With the hope that finances.

members of the Task Force and the financial advisor, Table-2: Fabricated Balance Sheet and Income

Merrill Lynch (now Bank of America) will stand by Statement of Satyam: As of September 30, 2008

the company at this crucial hour, I am marking copies

of this statement to them as well. Actual Reported Difference

Under the circumstances, I am tendering my resignation as Cash and Bank Balances 321 5,361 5,040

the chairman of Satyam and shall continue in this position

only till such time the current board is expanded. My Accrued Interest on bank FDs Nil 376.5 376

continuance is just to ensure enhancement of the board Understated Liability 1,230 None 1,230

over the next several days or as early as possible. Overstated Debtors 2,161 2,651 490

I am now prepared to subject myself to the laws of the

land and face consequences thereof. Total Nil Nil 7,136

Revenues (Q2 FY 2009) 2,112 2,700 588

Signature

(B. Ramalinga Raju) Operating Profits 61 649 588

(Source: Letter distributed by the Bombay Stock Exchange

and Security and Exchange Board of India, available at Greed for money, power, competition, success and prestige

www.sebi.gov.in) compelled Mr. Raju to ―ride the tiger,‖ which led to

violation of all duties imposed on them as fiduciaries: the

The fraud took place to divert company funds into duty of care, the duty of negligence, the duty of loyalty,

real-estate investment, keep high earnings per share, raise and the duty of disclosure towards the stakeholders

executive compensation, and make huge profits by selling (Bhasin, 2016b). According to Damodaran (2012), ―The

stake at inflated price. In this context, Kripalani (2009) Satyam scandal is a classic case of negligence of fiduciary

stated, ―The gap in the balance sheet had arisen purely on duties, total collapse of ethical standards, and a lack of

account of inflated profits over a period that lasted several corporate social responsibility.‖ Indeed, the Satyam fraud

years starting in April 1999.‖ ―What accounted as a activity dates back from April 1999, when the company

marginal gap between actual operating profit and the one embarked on a road to double‐ digit annual growth. As of

reflected in the books of accounts continued to grow over December 2008, Satyam had a total market capitalization

the years. This gap reached unmanageable proportions as of $3.2 billion dollars (Dixit, 2009).

company operations grew significantly,‖ Ragu explained

in his letter to the board and shareholders. He went on to On 7 January 2009, the Indian stock market regulator, the

explain, ―Every attempt to eliminate the gap failed, and the SEBI commenced investigations under various SEBI

aborted Maytas acquisition deal was the last attempt to fill regulations. The Ministry of Corporate Affairs (MCA) of

the fictitious assets with real ones. But the investors the Central Government separately initiated a fraud

thought it was a brazen attempt to siphon cash out of investigation through its Serious Fraud Investigation

Satyam, in which the Raju family held a small stake, into Office (SFIO). In addition, the MCA filed a petition

firms the family held tightly (D‘Monte, 2008). Fortunately, before the Company Law Board (CLB) to prevent the

the Satyam deal with Maytas was ‗salvageable‘. It could existing directors from acting on the Board and to appoint

have been saved only if ―the deal had been allowed to go new directors. On 9 January 2009, the CLB suspended the

i-Explore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 37

Volume 5, No. 6, June 2016

current directors of Satyam and allowed the Government filled, processing of the order does not go ahead. So,

to appoint up to 10 new nominee directors. Subsequently, what Raju & Company did was to use two alphabets

the new, six-member Board had appointed a chief ‗H‘ (Home) or ‗S‘ (Super) in the Invoice Field Status

executive officer and external advisors, including the to process the entry. The invoices, thus created were

accounting firms KPMG and Deloitte to restate the ‗hidden‘ from the view of those who ran the finance

accounts of Satyam. units. There were about 74,625 invoices generated in

the IMS between April 2003 and December 2008.

4.4 The Anatomy of Satyam Fraud About 7,561 invoices out of 74,625 had ‗S‘ marked in

In its recent indictment of the former promoters and top their invoice field status. Out of this, 6,603 were also

managers of Satyam, the Securities and Exchange Board found on the company‘s Oracle Financials software

of India (SEBI) had provided minute and fascinating system, to make it seem like these were actual sales.

details about how India‘s largest corporate scam was Entries into this system get reflected straight in the

committed. But SEBI‘s account also revealed ―how Profit and Loss Statement. The balance of 958

stupendously easy it is to pull off financial fraud on a invoices remained in the invoice state, and therefore,

grand scale, even in publicly listed companies.‖ The within the IMS system—they were not keyed into the

following is a brief description about the methodology Oracle enterprise-ware. The total revenues shown

used by the Satyam to commit the accounting fraud: against these 7,561 fake invoices were Rs. 5,117 crore.

1. Maintaining Records: Raju maintained thorough Of this, sales through the ‗reconciled‘ 6,603 invoices

details of the Satyam‘s accounts and minutes of were about Rs. 4,746 crore. The CBI has also found

meetings since 2002. He stored records of accounts that ―sales were inflated every quarter and the average

for the latest year (2008-09) in a computer server inflation in sales was about 18%. After generating

called ―My Home Hub.‖ Details of accounts from fake invoices in IMS, a senior manager of the finance

2002 till January 7, 2009 – the day Mr. Raju came out department (named Srisailam), entered the 6,603 fake

with his dramatic (5-page confession) were stored in invoices into Oracle Financials with the objective of

two separate Internet Protocol (IP) addresses. inflating sales by Rs. 4,746 crore. By reconciling the

2. Fake Invoices and Bills: The investigators had used receipts of these invoices, the cash balances in the

cyber forensics to uncover how in-house computer company‘s account were shown at Rs. 3,983 crore.‖

systems were exploited to generate fake invoices. The CBI officers have concluded that ―the scandal

Regular Satyam bills were created by a computer involved this system structure being bypassed by the

application called ‗Operational Real Time abuse of an emergency ‗Excel Porting System‘, which

Management (OPTIMA)‘, which created and allows invoices to be generated directly in IMS…by

maintained information on all company projects. The porting the data into the IMS.‖ This system was

‗Satyam Project Repository (SRP)‘ system then subverted by the creation of a user ID called ‗Super

generated project IDs; there is also an ‗Ontime‘ User‘ with ―the power to hide/unhide the invoices

application for entering the hours worked by Satyam generated in IMS.‖ By logging in, as Super User, the

employees; and a ‗Project Bill Management System accused were hiding some of the invoices that were

(PBMS)‘ for billing. An ‗Invoice Management System generated through Excel Porting. Once an invoice is

(IMS)‘ generated the final invoices. hidden the same will not be visible to the other

From the above, an intriguing question that arises here divisions within the company but will only be visible

is: ―how were the fake invoices created by subverting to the company‘s finance division sales team. As a

the IMS?‖ In the IMS system, there is a mandatory result, concerned business circles would not be aware

field earmarked ‗Invoice Field Status‘. Unless this is of the invoices, which were also not dispatched to the

i-Explore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 38

Volume 5, No. 6, June 2016

customers. Investigation revealed that all the invoices invoices into the company‘s computer systems to

that were hidden using the Super User ID in the IMS record sales that simply did not exist. For good

server were found to be false and fabricated. The face measure, profits too were padded up to show healthy

values of these fake invoices were shown as margins. Over the years, these ghostly clients

receivables in the books of accounts of Satyam, understandably never paid their bills, leading to a‖

thereby dishonestly inflating the total revenues of the big-hole‖ in Satyam‘s balance sheet. The hole was

company. plugged by inflating the debtors (dues from clients) in

3. Web of Companies: A web of 356 investment the balance sheet and forging bank statements to show

companies was used to allegedly divert funds from a mountain of cash and bank balances (Ingam, 2015).

Satyam. All these companies had several transactions After several years of such manipulation, Satyam was

in the form of inter-corporate investments, advances reporting sales of over Rs. 5,200 crore in 2008-09,

and loans within and among them. One such ‗sister‘ when it was in reality making about Rs. 4,100 crore. Its

company, with a paid-up capital of Rs. 5 lakh, had operating profit margins were shown at 24% when they

made an investment of Rs. 90.25 crore, and received were actually at 3% and its handsome profits on paper

unsecured loans of Rs. 600 crore. covered up for real-life losses. It was when the

4. Why did he need the Money?: The cash so raised company ran out of cash (of the real variety) to pay

was used to purchase several thousands of acres of salaries that Ramalinga Raju decided that ―he could not

land, across Andhra Pradesh, to ride a booming realty ride the tiger any longer and made his confession.‖

market. It presented a growing problem as facts had to 6. Riding a Tiger: Raju was compelled to admit to the

be doctored illegally to keep showing healthy profits fraud following an aborted attempt to have Satyam

for Satyam that was growing rapidly both in size and invest $1.6 billion in Maytas Properties and Maytas

scale. Every attempt made to eliminate the gap failed. Infrastructure, two firms promoted and controlled by

As Raju put it, ―it was like riding a tiger, not knowing his close family members. On December 16, Satyam‘s

how to get off without being eaten.‖ Cashing out by board cleared the investment, sparking a negative

selling Maytas Infrastructure and Maytas Properties to reaction by investors, which pummeled its stock on

Satyam for an estimated Rs. 7,800 crore was the last the New York Stock Exchange and Nasdaq. The board

straw. hurriedly reconvened the same day a meeting and

5. The Modus Operandi of Accounting Fraud: As called off the proposed investment. Unfortunately, the

financial frauds go, the one perpetrated by Raju and his matter did not die there, as Raju may have hoped. In

team from Satyam Company was quite uncomplicated. the next 48 hours, resignations streamed in from

Satyam‘s top management simply cooked the Satyam‘s non-executive director, Krishna Palepu, and

company‘s books by overstating its revenues, profit three independent directors. The trigger was obviously

margins, and profits for every single quarter over a the failed attempt to merge Maytas with Satyam. The

period of 5-years, from 2003 to 2008. Not for them, effort failed and in January 2009 Raju confessed to

complex methods like derivatives accounting or irregularity on his own, and was arrested two days

off-balance sheet transactions that were used by later. The attempt finally failed, and Raju made the

Enron‘s executives (Krishnan, 2014). stunning confessions three weeks later on Jan. 7,

Keen to project a perpetually rosy picture of the 2009.

company to investors, employees and analysts, the 7. Truth in Numbers: Satyam‘s finances were a

Rajus manipulated Satyam‘s books, as already black-box with an access card so rare that only Raju

described above. To achieve this, they sewed up deals and his confidants knew what exactly was going on in

with fictitious clients, and introduced over 7,000 fake the company. Ganesh Natarajan of Zensar

i-Explore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 39

Volume 5, No. 6, June 2016

Technologies famously said, ―If anybody in the Mr. Raju‘s brothers and his mother to buy thousands

industry is capable of pulling off a scam like this, it of acres of land. Making up ghost employees might

would be Ramalinga Raju…the capability, the sound complicated, but investigators said it was not

thinking through, the planning of such a large that difficult. ―Employees are just code numbers in

operation….only he had the ability to pull it off‖ your system; you can create any amount of them by

(Shubhashish, 2015). creating bogus employee IDs with false address,

Notwithstanding Raju‘s confession, the Satyam time-sheets, opening salary accounts with banks, and

episode has brought into sharp relief the role and collecting payments through an accomplice.‖

efficacy of ―independent‖ directors. The SEBI Interestingly, the charge-sheet filed by the

requires the Indian publicly held companies to ensure investigators is of the view that Satyam employees

that independent directors make up at least half of remained underutilized. For instance, the utilization

their board strength. The knowledge available to level shown in the latest investor update by the

independent directors and even audit committee company is about 74.88% for offshore employees.

members was inherently limited to prevent willful However, the actual utilization was 62.02%. This

withholding of crucial information. The reality was, at clearly shows that the bench strength was as high as

the end of the day, even as an audit committee 40% in the offshore category. Further, as a result of

member or as an independent director, I would have to underutilization, the company was forced to pay

rely on what the management was presenting to me, salaries to associates without jobs on hand, which

drawing upon his experience as an independent increased the burden on company‘s finances. Even in

director and audit committee member. As Bhasin the onshore category, the bench strength was around

(2008, 2011) pointed out, ―It is the auditors‘ job to see 5% (of total staff).

if the numbers presented are accurate. That is what the 9. Punishment by the Court: All the accused involved

directors should have been asking… Like the dog that in the Satyam fraud case, including Raju, were

didn‘t bark in the Sherlock Holmes story, the matter charged with cheating, criminal conspiracy, forgery,

was allowed to slide. Even if outside directors were breach of trust, inflating invoices, profits, faking

unaware of the true state of Satyam‘s finances, some accounts and violating number of income tax laws.

‗red‘ flags should have been obvious. The CBI had filed three charge-sheets in the case,

8. Showing Fake and Underutilized Employees: To which were later clubbed into one massive

quote Bhasin (2012a), ―One of the biggest sources of charge-sheet running over 55,000 pages. Over 3000

defalcation at Satyam was the inflation of the number documents and 250 witnesses were parsed over the

of employees. Founder chairman of Satyam, Raju past 6 years.

claimed that the company had 53,000 employees on A special CBI court on April 9, 2015 finally,

its payroll. But according to investigators, the real sentenced Mr. B. Ramalinga Raju, his two brothers

number was around 43,000. The fictitious/ghost and seven others to seven years in prison in the

number of employees could be fabricated because Satyam fraud case. The court also imposed a fine of

payment to the remaining 13,000 employees was Rs. 5 crore on Ramalinga Raju, the Satyam Computer

faked year-after-year: an operation that evidently Services Ltd‘s founder and former chairman, and his

involved the creation of bogus companies with a large brother B Rama Raju, and Rs. 20-25 lakh each on the

number of employees.‖ The money, in the form of remaining accused. The 10 people found guilty in the

salaries paid to ghost employees, came to around $4 case are: B. Ramalinga Raju; his brother and Satyam‘s

million a month, which was diverted through front former managing director B. Rama Raju; former chief

companies and through accounts belonging to one of financial officer Vadlamani Srinivas; former PwC

i-Explore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 40

Volume 5, No. 6, June 2016

auditors Subramani Gopalakrishnan and T. Srinivas; U.S. contesting Maytas deal.‖ Four independent directors

Raju‘s another brother, B Suryanarayana Raju; former quit the Satyam board and SEBI ordered promoters to

employees (G. Ramakrishna, D. Venkatpathi Raju and disclose pledged shares to stock exchanges.

Ch. Srisailam); and Satyam‘s former internal chief

auditor V.S. Prabhakar Gupta. 4.6 Tunneling Strategy Used by Satyam

As part of their ―tunneling‖ strategy, the Satyam promoters

4.5 Failed Attempt to Acquire Maytas Infrastructure had substantially reduced their holdings in company from

Limited 25.6% in March 2001 to 8.74% in March 2008.

It all started with Raju‘s love for land and that Furthermore, as the promoters held a very small

unquenchable thirst to own more and more of it. Satyam percentage of equity (mere 2.18%) on December 2008, as

planned to acquire a 51% stake in ―Maytas Infrastructure shown in Table-3, the concern was that poor performance

Limited,‖ for $300 million. The trigger was obviously the would result in a takeover bid, thereby exposing the gap.

failed attempt to merge Maytas with Satyam. Satyam had The aborted Maytas acquisition deal was the final,

tried to buy two infrastructure company run by his sons, desperate effort to cover up the accounting fraud by

including Maytas, in December 2008. As Bhasin stated bringing some real assets into the business. When that

(2016c), ―The effort failed and in January 2009 Raju failed, Raju confessed the fraud. Given the stake the Rajus

confessed to irregularity on his own, and was arrested two held in Matyas, pursuing the deal would not have been

days later. This was followed by the law-suits filed in the terribly difficult from the perspective of the Raju family.

Table-3: Promoter’s Shareholding pattern in Satyam

Particulars March March March March March March March March Dec.

2001 2002 2003 2004 2005 2006 2007 2008 2008

Promoter‘s holding in

Percentage 25.6 22.26 20.74 17.35 15.67 14.02 8.79 8.74 2.18

As pointed out by Shirur (2011), ―Unlike Enron, which

sank due to agency problem, Satyam was brought to its 4.7 The Insider Trading Activities at Satyam

knee due to tunneling. The company with a huge cash pile, Investigations into Satyam scam by the CID of the State

with promoters still controlling it with a small per cent of Police and Central agencies have established that the

shares (less than 3%), and trying to absorb a real-estate promoters indulged in nastiest kind of insider trading of

company in which they have a majority stake is a deadly the company‘s shares to raise money for building a large

combination pointing prima facie to tunneling.‖ The land bank. According to the SFIO Report (2009) findings,

reason why Ramalinga Raju claims that he did it was ―promoters of Satyam and their family members during

because every year he was fudging revenue figures and April 2000 to January 7, 2009 sold almost 3.9 crore shares

since expenditure figures could not be fudged so easily, collecting in Rs. 3029.67 crore. During this course, the

the gap between ‗actual‘ profit and ‗book‘ profit got founder ex-chairman Ramalinga Raju sold 98 lakh shares

widened every year. In order to close this gap, he had to collecting in Rs. 773.42 crores, whereas, his brother Rama

buy Maytas Infrastructure and Maytas Properties. In this Raju, sold 1.1 crore shares pocketing Rs. 894.32 crores.‖

way, ‗fictitious‘ profits could be absorbed through a Table-4 provides details of sale of shares by the promoters

‗self-dealing‘ process. Bhasin, (2013a) concludes, ―The and their family. Finding these top managers guilty of

auditors, bankers, and SEBI, the market watchdog, were unfair manipulation of stock prices and insider trading,

all blamed for their role in the accounting fraud.‖ SEBI has asked them to deposit their ‗unlawful gains‘ of

i-Explore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 41

Volume 5, No. 6, June 2016

Rs. 1850 crore, with 12% interest, with the regulator within from operations. But now, we can see there is no real

45 days. They have also been barred from associating with difference in the trends in Satyam‘s net income and its cash

the securities markets in any manner for the next 14 years. flow from operations during 2004 and 2005, as shown in

Figure 1 below. Both net income and cash flow lines were

Table-4: Stake Sold by the Promoters oef Satyam almost overlapping each other for 2004 and 2005. That is

Computers Limited not because the earnings were genuine; it is because the

Name of Promoter No. of Money cash flows were manipulated too. To do that, Raju had to

Shares Sold Earned Rs. forge several big amount accounts receivables, and

in Crore simultaneously falsify about their cash collections. Thus,

B. Ramalinga Raju 98,25,000 773.42 the fake cash flows had led to the bogus bank balances. To

B. Rama Raju 1,13,18,500 894.32 keep from tripping the income-cash flow alarms, Raju had

B. Suryanarayana Raju 1,11,000 12.81 to manipulate almost every account related to operations.

B. Nandini Raju 40,47,000 327.59 However, wide gaps can be noticed in net income and cash

B. Radha 38,73,500 313.55 flow from operation during 2006, 2007 and 2008,

B. Jhansi Rani 1,00,000 11.25 respectively. During 2006 to 2008, cash flows were far less

B. Pritam Teja 9,42,250 49.01 than net income due to accounting manipulations. Indeed,

B. Rama Raju (Jr.) 9,34,250 48.59 Satyam fraud was a stunningly and very cleverly articulated

comprehensive fraud, likely to be far more extensive than

Maytas Infra Ltd (Satyam 0 0.00

what happened at Enron (Bhasin, 2015a). The independent

Construction Ltd.)

board members of Satyam, the institutional investor

B. Satyanarayana Raju 0 0.00

community, the SEBI, retail investors, and the external

B. Appal Anarsamma 0 0.00

auditor—none of them, including professional investors

Elem Investments Pvt. Ltd. 25,47,708 181.29

with detailed information and models available to them,

Fincity Investments Pvt. Ltd. 25,30,400 180.41

detected the malfeasance.

Highgrace Investments Pvt. 25,30,332 170.83

Ltd.

Veeyes Investments Pvt. Ltd. 57,500 71.79

Other Individuals connected 68,000 515.58

to investment co‘s

Off-market transfers by 1,90,000 78.29

investment co‘s in the year

2001 (value estimated)

Promoters Group Total 3,90,75,440 3,029.67

4.8 Satyam’s Earnings and Cash Flows

4.9 The Auditor’s Role and Factors Contributing to

Through long and bitter past experience, some investors

Fraud

have developed a set of early warning signs of financial

Global auditing firm, PricewaterhouseCoopers (PwC),

reporting fraud. One of the strongest is ―the difference

audited Satyam‘s books from June 2000 until the

between income and cash flow.‖ Because overstated

discovery of the fraud in 2009. Several commentators

revenues cannot be collected and understated expenses still

criticized PwC harshly for failing to detect the fraud

must be paid, companies that misreport income often show

(Winkler, 2010). Indeed, PwC signed Satyam‘s financial

a much stronger trend in earnings than they do in cash flow

statements and was responsible for the numbers under the

i-Explore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 42

Volume 5, No. 6, June 2016

Indian law. One particularly troubling item concerned the strange reason, everyone, from the internal auditor to the

$1.04 billion that Satyam claimed to have on its balance statutory auditors, chose to place their faith in the

sheet in ―non-interest-bearing‖ deposits. The large amount ‗Chairman‘s office‘ rather than the company‘s information

of cash thus should have been a ‗red-flag‘ for the auditors systems (Bhasin, 2015). Furthermore, it appears that the

that further verification and testing was necessary. As to auditors did not independently verify with the banks in

the external auditors, who are supposed to look out for which Satyam claimed to have deposits‖ (Kahn, 2009).

investors, they seem to have been quite a trusting lot Furthermore, PwC audited the company for nearly 9 years

(Bhasin, 2016d). While verifying bank balances, they and did not uncover the fraud, whereas Merrill Lynch

relied wholly on the (forged) fixed deposit receipts and discovered the fraud as part of its due diligence in merely

bank statements provided by the ‗Chairman‘s office‘. The 10 days. Missing these ―red-flags‖ implied either that the

forensic audit reveals differences running into hundreds of auditors were grossly inept or in collusion with the

crores between the fake and real statements as captured by company in committing the fraud.

the computerised accounting systems. But for some

Table-5: Satyam’s Total Income and Audit Fees (Rs. in Millions)

Year 2004-05 2005-06 2006-07 2007-08

Total Income (A) 35,468 50,122.2 64,100.8 83,944.8

Audit Fees (B) 6.537 11.5 36.7 37.3

% of B to A 0.0184 0.0229 0.0573 0.0444

(Source: Annual Reports of Satyam, Percentage computed)

A point has also been raised about the increase in audit fee. and charged them with selling the company in the shortest

A reference to the figures of audit fee in comparison with time possible.

total income over a period of time may be pertinent.

Table-5 shows that over a period of four years, 2004-05 to At its peak market capitalization, Satyam was valued at Rs.

2007-08, the audit fee increased by 5.7 times, whereas 36,600 crore in 2008. Just a year later, the scam-hit

total income increased by 2.47 times during the same Satyam was snapped up by Tech Mahindra for a mere Rs.

period. Nevertheless, it is difficult to draw any conclusion 58 per share—a market cap of a mere Rs. 5600 crore. The

as to whether the increase in audit fee was justified or not. stock that hit its all-time high of Rs. 542 in 2008 crashed

Suspiciously, Satyam also paid PwC twice what other to an unimaginable Rs. 6.30 on the day Raju confessed on

firms would charge for the audit, which raises questions January 9, 2009. Satyam‘s shares fell to 11.50 rupees on

about whether PwC was complicit in the fraud (Bhasin, January 10, 2009, their lowest level since March 1998,

2013). compared to a high of 544 rupees in 2008. In the New

4.10 The Aftermath of Satyam Scandal York Stock Exchange, Satyam shares peaked in 2008 at

The Indian government immediately started an US$ 29.10; by March 2009 they were trading around US

investigation, while at the same time limiting its direct $1.80. Thus, investors lost $2.82 billion in Satyam.

participation. The government appointed a ‗new‘ board of Criminal charges were brought against Mr. Raju, including:

directors for Satyam to try to save the company: goal was criminal conspiracy, breach of trust, and forgery. After the

to sell the company within 100 days. To devise a plan of Satyam fiasco and the role played by PwC, investors

sale, the board met with bankers, accountants, lawyers, became wary of those companies who are clients of PwC

and government officials immediately. To accomplish the (Blakely, 2009), which resulted in fall in share prices of

sale, the board hired Goldman Sachs and Avendus Capital around 100 companies varying between 5 to 15%. The

i-Explore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 43

Volume 5, No. 6, June 2016

news of the scandal (quickly compared with the collapse Satyam fell more than 70%. The graph, ―Fall from Grace,‖

of Enron) sent jitters through the Indian stock market, and shown in Figure 2, depicts the Satyam‘s stock decline

the benchmark Sensex index fell more than 5%. Shares in between December 2008 and January 2009.

Figure 2: Stock Charting of Satyam from December 2008 to January 2009

In the aftermath of Satyam, India‘s markets recovered and Chartered Accountants of India (ICAI 2009) ruled that

Satyam now lives on. India‘s stock market is currently ―the CFO and the auditor were guilty of professional

trading near record highs, as it appears that a global misconduct.‖ The CBI is also in the course of investigating

economic recovery is taking place. Civil litigation and the CEO‘s overseas assets. There were also several civil

criminal charges continue against Satyam. Tech Mahindra charges filed in the U.S. against Satyam by the holders of

purchased 51% of Satyam on April 16, 2009, successfully its ADRs. The investigation also implicated several Indian

saving the firm from a complete collapse. As Winkler politicians. Both civil and criminal litigation cases

states (2010), ―With the right changes, India can minimize continue in India and civil litigation continues in the

the rate and size of accounting fraud in the Indian capital United States.

markets.‖

4.12 Regulatory and Corporate Governance Reforms

4.11 Investigation into the Satyam Case: Criminal, in India

Civil Charges After the Satyam scandal, investors and regulators called

The Satyam fraud has highlighted the multiplicity of for strengthening the regulatory environment in the

regulators, courts and regulations involved in a serious securities markets. In response to the scandal, the SEBI

offence by a listed company in India. The investigation revised CG requirements as well as financial reporting

that followed the revelation of the fraud has led to charges requirements for publicly traded corporations listed in the

against several different groups of people involved with country. The SEBI also strengthened its commitment to

Satyam. Indian authorities arrested Mr. Raju, Mr. Raju‘s the adoption of International Financial Accounting

brother, B. Ramu Raju, its former managing director, Reporting Standards (IFRS). In addition, the Ministry of

Srinivas Vdlamani, the company‘s head of internal audit, Corporate Affairs (MCA) has devised a new Corporate

and its CFO on criminal charges of fraud. Indian Code and is considering changing the securities laws to

authorities also arrested and charged several of the make it easier for shareholders to bring class-action

company‘s auditors (PwC) with fraud. The Institute of lawsuits (Bhasin, 2012). Some of the recent CG reforms

i-Explore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 44

Volume 5, No. 6, June 2016

undertaken in India, as summed up by Sharma (2015), are: organization to the heights of success and its relation with

(a) Appointment of Independent Directors, (b) Disclosure the board members and core committees. The scam at

of Pledged Securities, (c) Increased Financial Accounting Satyam brought to the light the role of CG in shaping the

Disclosures, (d) IFRS (Adoption of International protocols related to the working of audit committee and

Standards), and (e) Creation of New Corporate Code by duties of board members (Niazi, and Ali, 2015).

the Ministry of Corporate Affairs.

The Indian government took very quick actions to protect

Satyam grossly violated all rules of corporate governance the interest of the Satyam investors, safeguard the

(Chakrabarti, 2008). The Satyam scam had been the credibility of India, and the nation‘s image across the

example for following ―poor‖ CG practices. It had failed world. Moreover, Satyam fraud has forced the government

to show good relation with the shareholders and to re‐ write the CG rules and tightened the norms for

employees. As Kahn (2009) stated, ―CG issue at Satyam auditors and accountants (Bhasin, 2013b). The Indian

arose because of non-fulfillment of obligation of the affiliate of PwC ―routinely failed to follow the most basic

company towards the various stakeholders. Of specific audit procedures. The SEC and the PCAOB fined the

interest are the following: distinguishing the roles of board affiliate, PwC India, $7.5 million in what was described as

and management; separation of the roles of the CEO and the largest American penalty ever against a foreign

chairman; appointment to the board; directors and accounting firm‖ (Norris, 2011). According to Mr. Chopra,

executive compensation; protection of shareholders rights President (ICAI), ―The Satyam scam was not an

and their executives.‖ Scandals from Enron to the recent accounting or auditing failure, but one of CG. This apex

financial crisis have time and time again proved that there body had found the two PwC auditors ‗prima-facie‘ guilty

is a need for good conduct based on strong ethics. Not of professional misconduct.‖ The CBI, which investigated

surprising, such frauds can happen, at any time, all over the Satyam fraud case, also charged the two auditors with

the world. Satyam fraud spurred the government of India complicity in the commission of the fraud by consciously

to tighten CG norms to prevent recurrence of similar overlooking the accounting irregularities.

frauds in the near future. The government took prompt Keeping in view the ―modus operandi‖ used by the

actions to protect the interest of the investors and management in Satyam scam, we recommend the

safeguard the credibility of India and the nation‘s image followings: (a) Corporations must uplift the moral, ethical

across the world.

and social values of its executives. (b) Board members

need to feel the importance of the responsibility entrusted

6. CONCLUSION AND

with them: be proactive and watchful in protecting the

RECOMMENDATIONS

interests of owners. (c) There was a lack of proper and

The fraud committed by the founders of Satyam is a timely information in Satyam‘s case. (d) Shareholder

testament to the fact that ―the science of conduct is swayed activism is an excellent mechanism of keeping a check on

in large by human greed, ambition, and hunger for power, the corporation and its executives. (e) Block-holders and

money, fame and glory.‖ The culture at Satyam, especially institutional investors can also serve as an effective means

dominated by the board, symbolized an unethical culture. for board‘s and management‘s accountability. And finally,

Unlike Enron, which sank due to ‗agency‘ problem, CG framework needs to be implemented in letter as well

Satyam was brought to its knee due to ‗tunneling‘ effect.

as spirit.

All kind of frauds have proven that there is a need for

good conduct based on strong ethics. The debacle of

The Satyam fraud, finally, had to end and the implications

Satyam raised a debate about the role of CEO in driving an

i-Explore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 45

Volume 5, No. 6, June 2016

were having far reaching consequences. With all the 10 International Journal of Contemporary Business

people involved in the multi-crore accounting fraud found Studies, September, Volume 3, No. 9, pp. 6-26.

guilty of cheating, forgery, destruction of evidence and [7] Bhasin, M.L. (2013), Corporate Accounting

Scandal at Satyam: A Case Study of India‘s Enron,

criminal breach of trust, by a special Central Bureau of

European Journal of Business and Social Sciences,

Investigation court in Hyderabad, the six-year-old case has

1(12), March, 25-47.

reached its logical conclusion. This includes the founder

[8] Bhasin, M.L. (2013a), Corporate Accounting Fraud:

and the Chairman of the company B Ramalinga Raju. The

A Case Study of Satyam Computer Limited, Open

court pronounced a seven year-jail term for the founder Journal of Accounting, April, 2(2), 26-38.

and also imposed a Rs. 5 crore fine on Raju. The decision [9] Bhasin, M.L. (2013b), Corporate Governance and

came more than six years after the scam first came to light Role of the Forensic Accountants: An Exploratory

in 2009. Since liberalization, serious efforts have been Study of an Asian Country, International Journal of

directed at overhauling the CG system, with the SEBI Contemporary Business Studies, 4(7), July, 38-59.

instituting the Revised Clause 49 of the Listing [10] Bhasin, M.L. (2015), Menace of Frauds in Banking

Industry: Experience of a Developing Country,

Agreements dealing with CG. With the right changes, India

Australian Journal of Business and Management

can minimize the rate and size of accounting fraud in the

Research, 4(12), April, 21-33.

Indian capital markets.

[11] Bhasin, M.L. (2015a), Creative Accounting

Practices in the Indian Corporate Sector: An

REFERENCES Empirical Study, International Journal of

Management Science and Business Research,

[1] Agrawal, S. & Sharma, R. (2009), Beat this:

Volume 4, Issue 10, October 2015, E-ISSN

Satyam won awards for corporate governance,

2226-8235 published by QS publishers, USA, pp.

internal audit. Available at www.vccircle.com/news.

35-52 (USA).

[2] Ahmad, T., Malawat, T., Kochar, Y. & Roy, A.

[12] Bhasin, M.L. (2016a), Contribution of Forensic

(2010), Satyam Scam in the Contemporary

Accounting to Corporate Governance: An

corporate world: A case study in Indian Perspective,

Exploratory Study of an Asian Country,

IUP Journal. Available at SSRN, 1-48.

International Business Management Journal, 10(4),

[3] Basilico, E., Grove, H, & Patelli, L. (2012), Asia‘s

479-492.

Enron: Satyam (Sanskrit word for truth), Journal of

[13] Bhasin, M.L. (2016b), Survey of Creative

Forensic & Investigative Accounting, 4(2),

Accounting Practices: An Empirical Study,

142-160.

Wulfenia Journal KLAGENFURT, 23(1), January,

[4] Bhasin, M.L. (2008), Corporate Governance and

143-162.

Role of the Forensic Accountant, The Chartered

[14] Bhasin, M.L. (2016), Debacle of Satyam

Secretary Journal, Vol. 38(10), October,

Computers Limited: A Case Study of India‘s Enron,

1361-1368.

Wulfenia Journal KLAGENFURT, 23(3), March,

[5] Bhasin, M.L. (2011), Corporate Governance

124-162.

Disclosure Practices: The Portrait of a Developing

[15] Bhasin, M.L. (2016c), Strengthening Corporate

Country, International Review of Business Research

Governance Through an Audit Committee: An

Papers, 7(1), January, 393-419.

Empirical Study, Wulfenia Journal, Volume 23, No.

[6] Bhasin, M.L. (2012), Voluntary Corporate

2, Feb. pp. 2-27.

Governance Disclosures: An Exploratory Study,

[16] Bhasin, M.L. (2016d), Integration of Technology to

i-Explore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 46

Volume 5, No. 6, June 2016

Combat Bank Frauds: Experience of a Developing Computers Ltd.: A Case Study from Management‘s

Country, Wulfenia Journal, 23, No. 2, Feb. 2016, Perspective, Universal Journal of Industrial and

pp.201-233. Business Management, 3(2), 58-65.

[17] Blakely, R. (2009). ―Investors raise questions over [32] Pai, K. & Tollsen, T.D. (2015), India‘s Satyam

PWC Satyam audit,‖ Times Online. Scandal: Evidence the too large to Indict Mindset of

[18] Chakrabarti, R., Megginson, W., Yadav & Pradeep Accounting Regulators is a Global Phenomenon,

K. (2008). Corporate Governance in India, Journal Review of Business and Financial Studies, 6(2),

of Applied Corporate Finance, 20(1), 59. 35-43.

[19] Chopra, A. (2011), ―Satyam fraud, not an [33] Ramachadran, S. (2009). Raju brings down Satyam,

accounting failure,‖ Business Standard, 25 January. shakes India. Asia Times Online Ltd.

Available at http://www.business-standard.com. [34] SFIO Report published in the Pioneer (New Delhi),

[20] D‘Monte, L. (2008). Satyam: just what went wrong? May 4, 2009, p 10

Rediff India Abroad. [35] Sharma, J.P. (2015), What went wrong with Satyam?

[21] Damodaran, M. (2009), ―Listed firms to get new Paper presented at WCFCG Global Convention, in

conduct code,‖ Financial Chronicle, available at association with Institute of Directors, available at

http://wrd.mydigitalfc.com. www.

[22] Dixit, N. (2009), What Happened at Satyam? [36] Shirur, S. (2011), ―Tunneling vs agency effect: a

March 1, available at Wharton@knowledge.com case study of Enron and Satyam,‖ Vikalpa, 36(3),

[23] Fernando, A.C. (2010), Satyam: Anything but July-September, 9-20.

Satyam, Loyala Institute of Business [37] Shubhashish (2015), ―All that you need to know

Administration. Available at about the Satyam Scam,‖ DNA, April 9.

www.publishingindia.com. [38] Vasudev, P.M. (2010), Satyam and Enron: A Tale of

[24] ICAI (2009). ICIA finds ex Satyam CFO, Price two companies and two countries, Sept. 14, Deccan

Waterhouse auditors guilty. Outlook India.com. Herald, available at

[25] Kripalani, M. (2009). India‘s Madoff Satyam http://www.deccanherald.com/content/96271/satya

scandal rocks outsourcing industry. Business Week. m-amp-enron-tale-two.html.

[26] Kahn, J. (2009). The Crisis exposes all the flaws. [39] Willison, R. (2006) ―Understanding the

Newsweek. offender/environment dynamic for computer

[27] Kaul, V. (2015), Satyam scam: Ramalinga Raju, the crimes‖, Information Technology & People, 19(2),

man who knew too much, gets 7 years in jail, April 170 - 186

10. [40] Winkler, D. (2010), India‘s Satyam Accounting

[28] Krishnan, A. (2014), Finally, the truth about Satyam, Scandal, February 1, The University of Iowa Center

The Hindu Business Line, July 18. for International Finance and Development.

[29] Miller, G.. S. (2006), ―The press as a watchdog for Available online at http://blogs.law.uiowa.edu.

accounting fraud,‖ Journal of Accounting Research, [41] Wharton (2009), Scandal at Satyam: Truth, Lies and

44(5), December, 1001- 1033. Corporate Governance, available at

[30] Norris, F. (2011), ―Indian Accounting Firm is Fined knowledge@wharton.

$7.5 million over fraud at Satyam,‖ The New York

Times, April 5, 2011.

[31] Niazi, A. & Ali, M. (2015), The Debacle of Satyam

i-Explore International Research Journal Consortium www.irjcjournals.org

View publication stats

You might also like

- Bhasin SatyamDemiseCaseStudy IJMSSR May2016Document20 pagesBhasin SatyamDemiseCaseStudy IJMSSR May2016Sultana ChowdhuryNo ratings yet

- Revisiting The Satyam Accounting Scam: A Case StudyDocument16 pagesRevisiting The Satyam Accounting Scam: A Case StudymetopeNo ratings yet

- Fraudulent Reporting Practices: The Inside Story of India's EnronDocument15 pagesFraudulent Reporting Practices: The Inside Story of India's EnronManish ShahNo ratings yet

- Fraudulent Financial Reporting Practices: Case Study of Satyam Computer LimitedDocument13 pagesFraudulent Financial Reporting Practices: Case Study of Satyam Computer LimitedmetopeNo ratings yet

- Bhasin UnethicalCACultureatSatyam IJBSR July2016 PDFDocument26 pagesBhasin UnethicalCACultureatSatyam IJBSR July2016 PDFSeema ChaturvediNo ratings yet

- Indias Satyam Accounting Scandal How The PDFDocument13 pagesIndias Satyam Accounting Scandal How The PDFAmiteshNo ratings yet

- Critical analysis of the Satyam scandalDocument14 pagesCritical analysis of the Satyam scandalBhuvneshwari RathoreNo ratings yet

- Satyam Scandal Lessons on Corporate GovernanceDocument11 pagesSatyam Scandal Lessons on Corporate GovernanceRakib HasanNo ratings yet

- 2 Bhasin PDFDocument15 pages2 Bhasin PDFpriyaNo ratings yet

- BHASIN DebacleofSatyam Wulfenia 2016Document40 pagesBHASIN DebacleofSatyam Wulfenia 2016P. S. Jhedu & AssociatesNo ratings yet

- India's Satyam accounting scandal case studyDocument40 pagesIndia's Satyam accounting scandal case studySultana ChowdhuryNo ratings yet

- Intro To Forensic Final Project CompilationDocument15 pagesIntro To Forensic Final Project Compilationapi-282483815No ratings yet

- PMJJBYDocument1 pagePMJJBYPEDDER ROADNo ratings yet

- ZERO TO MASTERY IN CORPORATE GOVERNANCE: Become Zero To Hero In Corporate Governance, This Book Covers A-Z Corporate Governance Concepts, 2022 Latest EditionFrom EverandZERO TO MASTERY IN CORPORATE GOVERNANCE: Become Zero To Hero In Corporate Governance, This Book Covers A-Z Corporate Governance Concepts, 2022 Latest EditionNo ratings yet

- Creative Accounting Practices at Satyam Computers Limited: A Case Study of India's EnronDocument25 pagesCreative Accounting Practices at Satyam Computers Limited: A Case Study of India's EnronNurlinaNo ratings yet

- Analysing The Aspects of Corporate Governance Failure in The Light of Satyam Computers FiascoDocument1 pageAnalysing The Aspects of Corporate Governance Failure in The Light of Satyam Computers FiascokullsNo ratings yet

- Corp Scam-DraftDocument22 pagesCorp Scam-DraftArushi SinghNo ratings yet

- Accounting Manipulations in Corporate Financial Reports: Study of An Asian MarketDocument25 pagesAccounting Manipulations in Corporate Financial Reports: Study of An Asian MarketSam SamNo ratings yet

- Final Director Liability Report September 19 2019 PDFDocument50 pagesFinal Director Liability Report September 19 2019 PDFAmitoj KaurNo ratings yet

- Corporate Accounting FraudDocument17 pagesCorporate Accounting Fraudanimes prustyNo ratings yet

- Satyam's Manipulative Accounting Methodology Unveiled: An Experience of An Asian EconomyDocument34 pagesSatyam's Manipulative Accounting Methodology Unveiled: An Experience of An Asian EconomyRakib HasanNo ratings yet

- India'S Satyam Scandal: Evidence The Too Large To Indict Mindset of Accounting Regulators Is A Global PhenomenonDocument10 pagesIndia'S Satyam Scandal: Evidence The Too Large To Indict Mindset of Accounting Regulators Is A Global PhenomenonvinayNo ratings yet

- 4.1. Emergence of Satyam Computer Services LimitedDocument7 pages4.1. Emergence of Satyam Computer Services LimitedYAHOO MAILNo ratings yet

- How the new Act protects investors in the marketDocument9 pagesHow the new Act protects investors in the marketAshutosh MishraNo ratings yet

- Corporate Governance and Financial Crises: What Have We MissedDocument15 pagesCorporate Governance and Financial Crises: What Have We MissedTarun SinghNo ratings yet

- Ejbss 1208 13 Corporateaccountingscandalatsatyam PDFDocument23 pagesEjbss 1208 13 Corporateaccountingscandalatsatyam PDFDebasish SahaNo ratings yet

- Typesreasons ScopusDocument8 pagesTypesreasons Scopus46 Gaurav PawarNo ratings yet

- The Impact of Corporate Governance Characteristics On The of Financial DistressDocument15 pagesThe Impact of Corporate Governance Characteristics On The of Financial DistressFuad Achsan AlviaroNo ratings yet

- Impact of Fraud Preventive Measures On Good Corporate GovernanceDocument25 pagesImpact of Fraud Preventive Measures On Good Corporate Governanceassignmentservices947No ratings yet

- Corporate Governance Failure at SatyamDocument4 pagesCorporate Governance Failure at SatyamPoojaa ShirsatNo ratings yet

- Determinants of Capital Structure in Jordanian BanksDocument14 pagesDeterminants of Capital Structure in Jordanian BanksFaycal BenhalimaNo ratings yet

- Accounts Draft 1Document7 pagesAccounts Draft 1NORZADIAN DOMAINNo ratings yet

- Corporate Governance Index and Its Determinants in Samsung CompanyDocument16 pagesCorporate Governance Index and Its Determinants in Samsung CompanyMonal BagdeNo ratings yet

- Corporate Governance Index and Its Determinants in Samsung CompanyDocument16 pagesCorporate Governance Index and Its Determinants in Samsung CompanyMonal BagdeNo ratings yet

- 401 Contract 1Document7 pages401 Contract 1aswinecebeNo ratings yet

- Jayanth Rama Varma: Sr. No Title Auther Objective Methodology FindingsDocument4 pagesJayanth Rama Varma: Sr. No Title Auther Objective Methodology FindingsChandan KathuriaNo ratings yet

- Financial Statement Fraud Control Audit Testing and Internal Auditing Expectation GapDocument7 pagesFinancial Statement Fraud Control Audit Testing and Internal Auditing Expectation GapRia MeilanNo ratings yet

- Corporate Governance in SatyamDocument6 pagesCorporate Governance in Satyamnishan_patel_3No ratings yet

- SSRN Id2277512Document34 pagesSSRN Id2277512Takhleeq AkhterNo ratings yet

- 909-Dokumen Artikel Utama-3428-1-10-20221225Document14 pages909-Dokumen Artikel Utama-3428-1-10-20221225Adi SatriyaNo ratings yet

- Fraudulent Financial Reporting Based ofDocument16 pagesFraudulent Financial Reporting Based ofadelaoktaviani simbolonNo ratings yet

- Determinants of Integrity of Financial Statements and The Role of Whistleblowing SystemDocument22 pagesDeterminants of Integrity of Financial Statements and The Role of Whistleblowing Systembilal mateenNo ratings yet

- FASA Case Analysis Group 5Document3 pagesFASA Case Analysis Group 5sohilbankar7No ratings yet

- Satyam ComputerDocument17 pagesSatyam ComputerFarah S NoshirwaniNo ratings yet

- SatyamDocument12 pagesSatyamkrrish khemaniNo ratings yet

- Corporate Accounting Fraud: A Case Study of Satyam Computers LimitedDocument14 pagesCorporate Accounting Fraud: A Case Study of Satyam Computers LimitedVidushi Puri0% (1)

- IJAFR CG Vol6Document35 pagesIJAFR CG Vol6assignmentservices947No ratings yet

- Transparency and Accountability in Pakistan's State-Owned EnterprisesDocument18 pagesTransparency and Accountability in Pakistan's State-Owned EnterprisesMuzamil Hussain SoomroNo ratings yet

- Criminal Liability of Auditors For Financial StatementsDocument16 pagesCriminal Liability of Auditors For Financial StatementsS I D D H A N TNo ratings yet

- Satyam Computers Case StudyDocument10 pagesSatyam Computers Case StudyAchlesh MishraNo ratings yet

- Corporate Governance Practices in Indian BanksDocument15 pagesCorporate Governance Practices in Indian BanksSaurabh RajNo ratings yet

- An Analysis On Financial Statement Fraud Detection For Chinese Listed Companies Using Deep LearningDocument17 pagesAn Analysis On Financial Statement Fraud Detection For Chinese Listed Companies Using Deep LearningpvtvinayNo ratings yet

- 5676-Article Text-23061-1-10-20230105Document20 pages5676-Article Text-23061-1-10-20230105Berliana Putri KurniawanNo ratings yet

- Forensic Accounting in India-182 PDFDocument7 pagesForensic Accounting in India-182 PDFAaronNo ratings yet

- Research Paper SampleDocument44 pagesResearch Paper SampleResearch and Publication Center UMTCNo ratings yet

- 30-Article Text-112-1-10-20201223Document20 pages30-Article Text-112-1-10-20201223woubeshet shawellNo ratings yet

- Relationship Between Corporate Social Responsibility and Earnings Management A Systematic Review of Measurement MethodsDocument9 pagesRelationship Between Corporate Social Responsibility and Earnings Management A Systematic Review of Measurement MethodsEditor IJTSRDNo ratings yet

- C G R: W ?: T B.b.a., Ll.b. (H .)Document14 pagesC G R: W ?: T B.b.a., Ll.b. (H .)souravNo ratings yet