Professional Documents

Culture Documents

Annex A PDF

Annex A PDF

Uploaded by

Joseph Torda0 ratings0% found this document useful (0 votes)

6 views1 pageOriginal Title

annex a.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageAnnex A PDF

Annex A PDF

Uploaded by

Joseph TordaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

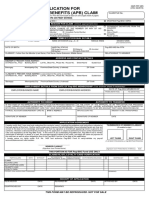

ANNEX “A”

BIR FORM NO.__________

Republic of the Philippines

Department of Finance

BUREAU OF INTERNAL REVENUE

Revenue Region No. ___

Revenue District Office No. ___

__________________________

NOTICE OF AVAILMENT OF THE SUBSTITUTED FILING OF

PERCENTAGE TAX RETURN

Date __________________

Name of Taxpayer ______________________________________________________

Address _______________________________________________________________

Taxpayer Identification Number __________________________________________

Class of Profession or Calling/Business _____________________________________

CERTIFICATION

This is to certify that I am a NON-VAT registered person pursuant to the

provisions of REVENUE REGULATIONS NO. ____; that, in accordance with the

said Regulations, I have availed of the “Optional Registration under the 3% Final

Percentage Tax Withholding, in lieu of the 3% Creditable Percentage Tax

Withholding” System, in order to be entitled to the privileges accorded by the

“Substituted Percentage Tax Return System” prescribed thereunder; that, this

Declaration is sufficient authority of the Withholding Agent to withhold 3%

Percentage Tax from payments to me on my sale of goods and/or services, in lieu of

the said 3% Creditable Percentage Tax Withholding; and that, I have executed this

Declaration under penalty of perjury pursuant to the provisions of Section 267,

National Internal Revenue Code of 1997.

____________________________

Taxpayer’s Name and Signature

You might also like

- BDO Requirements For Claim To Account of Deceased DepositorDocument2 pagesBDO Requirements For Claim To Account of Deceased DepositorANDI CastroNo ratings yet

- Self-Declaration Form of Survivor Pensioner On Non-Remarriage/Non-CohabitationDocument1 pageSelf-Declaration Form of Survivor Pensioner On Non-Remarriage/Non-CohabitationCamille Francisco100% (3)

- Secretary's Certificate Authority To PrintDocument1 pageSecretary's Certificate Authority To PrintImelda PurificacionNo ratings yet

- Authorization Form For Querying FinalDocument1 pageAuthorization Form For Querying FinalApril NNo ratings yet

- Bir Form No. 1702Document6 pagesBir Form No. 1702Mary Monique Llacuna Lagan100% (1)

- COA - R2016-024 - Deferment of Implementation of COA Circular No. 2015-011 Dated December 1, 2015 - Prescribing The Use of The Manual On Financial Management For BarangaysDocument1 pageCOA - R2016-024 - Deferment of Implementation of COA Circular No. 2015-011 Dated December 1, 2015 - Prescribing The Use of The Manual On Financial Management For BarangaysJoseph Paguio100% (1)

- New Application Form Importer Non-Individual RMO 56-2016 - CopyDocument1 pageNew Application Form Importer Non-Individual RMO 56-2016 - CopyKhay-Ar PagdilaoNo ratings yet

- Sworn Application For Tax Clearance For General Purposes Individual TaxpayersDocument1 pageSworn Application For Tax Clearance For General Purposes Individual Taxpayersjdsindustrial23No ratings yet

- Sworn Statement-Bir - Loose LeafDocument1 pageSworn Statement-Bir - Loose LeafEkeena LimNo ratings yet

- Annex B-2Document1 pageAnnex B-2Von Virchel VallesNo ratings yet

- NOTICE ChecklistDocument2 pagesNOTICE ChecklistAdrian50% (2)

- PFF053 MembersContributionRemittanceForm V02-FillableDocument2 pagesPFF053 MembersContributionRemittanceForm V02-FillableCYvelle TorefielNo ratings yet

- Annex B-1 RR 11-2018Document1 pageAnnex B-1 RR 11-2018Vincent AmomonponNo ratings yet

- RA 7160 Situs of The Tax - IRRDocument71 pagesRA 7160 Situs of The Tax - IRRErnie F. CanjaNo ratings yet

- Cash Count Form PDFDocument2 pagesCash Count Form PDFHasbi AsidikiNo ratings yet

- Annex C.1Document1 pageAnnex C.1Eric OlayNo ratings yet

- Letter To BirDocument1 pageLetter To Birjoy buedoNo ratings yet

- Open DOAS ASSUMPTION Princess RachelDocument2 pagesOpen DOAS ASSUMPTION Princess RachelRoyal DragonNo ratings yet

- New Income Tax Return BIR Form 1702 - November 2011 RevisedDocument6 pagesNew Income Tax Return BIR Form 1702 - November 2011 RevisedBusinessTips.Ph100% (4)

- Affidavit of CancellationDocument2 pagesAffidavit of CancellationAeris Sycamine Garces AquinoNo ratings yet

- Bir Regulations No. 14-2003Document12 pagesBir Regulations No. 14-2003Haryeth CamsolNo ratings yet

- Authority To PrintDocument5 pagesAuthority To PrintKyungsoo PenguinNo ratings yet

- Joint Affidavit-of-Transferor-Transferee-DAR-AO-4-daniel MarzanDocument1 pageJoint Affidavit-of-Transferor-Transferee-DAR-AO-4-daniel MarzanMer Cy100% (1)

- How To Enroll EfpsDocument18 pagesHow To Enroll EfpsAdyNo ratings yet

- Annex B-2 RR 11-2018Document1 pageAnnex B-2 RR 11-2018Kristine JoyceNo ratings yet

- Bir Ruling Da 192-08Document2 pagesBir Ruling Da 192-08norliza albutraNo ratings yet

- Application For Registration: BIR Form NoDocument2 pagesApplication For Registration: BIR Form NoBernardino PacificAceNo ratings yet

- Certification of Travel CompletedDocument2 pagesCertification of Travel CompletedLourdes UrgellesNo ratings yet

- Gmail - Tax Return Receipt ConfirmationDocument1 pageGmail - Tax Return Receipt ConfirmationSERVICES SUB100% (1)

- RMC No. 28-2019Document2 pagesRMC No. 28-2019AmberlyNo ratings yet

- Electronic Payment Payor Enrollment Form: Landbank of The Philippines - BranchDocument1 pageElectronic Payment Payor Enrollment Form: Landbank of The Philippines - BranchKilikili East100% (1)

- Annex D Bir InventoryDocument17 pagesAnnex D Bir InventoryDada SalesNo ratings yet

- SPADocument1 pageSPAPaul CasajeNo ratings yet

- 70534BIR Form 1921 - Annex B PDFDocument1 page70534BIR Form 1921 - Annex B PDFJunar MadaliNo ratings yet

- Engr. Eduardo B. CedoDocument1 pageEngr. Eduardo B. CedoHoward UntalanNo ratings yet

- Withholding Tax Remittance Return: Kawanihan NG Rentas InternasDocument4 pagesWithholding Tax Remittance Return: Kawanihan NG Rentas InternasArlyn De Las AlasNo ratings yet

- Affidavit of Loss - Student IDDocument1 pageAffidavit of Loss - Student IDKen DG CNo ratings yet

- Statement of ManagementDocument31 pagesStatement of ManagementSharmz SalazarNo ratings yet

- SEC Form 17-C Dito CME Re Change in Officers and Directors (11 October 2023)Document3 pagesSEC Form 17-C Dito CME Re Change in Officers and Directors (11 October 2023)judy jace thaddeus AlejoNo ratings yet

- PhilGEPS Sworn StatementDocument2 pagesPhilGEPS Sworn StatementArchie PadillaNo ratings yet

- Application For Tax Compliance Verification Certificate Non-Individual TaxpayersDocument1 pageApplication For Tax Compliance Verification Certificate Non-Individual TaxpayersanabuaNo ratings yet

- Sworn Declaration of Gross Sales (LGU)Document1 pageSworn Declaration of Gross Sales (LGU)Kathyrn Ang-ZarateNo ratings yet

- Affidavit: Republic of The Philippines) - ) - ) S.SDocument1 pageAffidavit: Republic of The Philippines) - ) - ) S.SJerrie Macalam Luib100% (1)

- CMPRS Form2 - Secretarys Certificate CMPRS Oct 17 2017Document2 pagesCMPRS Form2 - Secretarys Certificate CMPRS Oct 17 2017Lariyl de VeraNo ratings yet

- 2307Document16 pages2307Marjorie JotojotNo ratings yet

- Annex B-2 RR 11-2018Document1 pageAnnex B-2 RR 11-2018Princess RegalaNo ratings yet

- Secretary-Certificate LetterDocument2 pagesSecretary-Certificate Letterteresa bautistaNo ratings yet

- Certification of Gross ReceiptsDocument1 pageCertification of Gross ReceiptsRosel RomanticoNo ratings yet

- Deed of Sale Motor VehicleDocument1 pageDeed of Sale Motor Vehiclecris jaluageNo ratings yet

- Application For The New Penalty Condonation Program On Mandatory Monthly Savings (MS) RemittancesDocument2 pagesApplication For The New Penalty Condonation Program On Mandatory Monthly Savings (MS) RemittancesCrizetteTarcena50% (2)

- Trustees CertificateDocument1 pageTrustees Certificatespy sorianoNo ratings yet

- PFF285 ApplicationProvidentBenefitsClaim V03Document2 pagesPFF285 ApplicationProvidentBenefitsClaim V03Carlo Beltran Valerio0% (2)

- BIR Form 2316 UndertakingDocument1 pageBIR Form 2316 UndertakingJan Paolo CruzNo ratings yet

- Rmo 12 2013 List of Unused Expired Orssiscis Annex D Docxdocx PDF FreeDocument2 pagesRmo 12 2013 List of Unused Expired Orssiscis Annex D Docxdocx PDF FreeShitake MitsukiNo ratings yet

- Checklist PcabDocument5 pagesChecklist PcabLyka Amascual ClaridadNo ratings yet

- Deed of Conditional Sale (Sccribed)Document2 pagesDeed of Conditional Sale (Sccribed)Bong RoqueNo ratings yet

- Registration Update Sheet: Taxpayer InformationDocument1 pageRegistration Update Sheet: Taxpayer InformationRCVZ BKNo ratings yet

- APPLICATION FOR REGISTRATION/ACCREDITATION AS AN ECOZONE SERVICE ENTERPRISE (For Customs Broker, Freight Forwarder/Trucker and Security Agency)Document7 pagesAPPLICATION FOR REGISTRATION/ACCREDITATION AS AN ECOZONE SERVICE ENTERPRISE (For Customs Broker, Freight Forwarder/Trucker and Security Agency)Albert YsegNo ratings yet

- Bir Form For Tax ExceptionDocument1 pageBir Form For Tax ExceptionPublic Safety OfficeNo ratings yet

- Notice of Cancellation of Availment of The Substituted Filing of Percentage Tax/Vat ReturnDocument1 pageNotice of Cancellation of Availment of The Substituted Filing of Percentage Tax/Vat ReturnWarlie Zambales DiazNo ratings yet

- Katigbak v. Solicitor General, 180 SCRA 540Document2 pagesKatigbak v. Solicitor General, 180 SCRA 540Jomar Teneza100% (1)

- Froilan R. Montalban, Sr. For Petitioner Sixto B. Dela Victoria. Escalon Law Office For Private RespondentDocument3 pagesFroilan R. Montalban, Sr. For Petitioner Sixto B. Dela Victoria. Escalon Law Office For Private RespondentJomar TenezaNo ratings yet

- People Vs PinedaDocument5 pagesPeople Vs PinedaJomar TenezaNo ratings yet

- People Vs EchegarayDocument16 pagesPeople Vs EchegarayJomar Teneza100% (1)

- Abadia Vs CADocument4 pagesAbadia Vs CAJomar TenezaNo ratings yet

- Robertson Vs BaldwinDocument5 pagesRobertson Vs BaldwinJomar TenezaNo ratings yet

- People Vs EchegarayDocument16 pagesPeople Vs EchegarayJomar TenezaNo ratings yet

- Fonacier Vs CADocument1 pageFonacier Vs CAJomar TenezaNo ratings yet

- Alfredo Calupitan, and Gibbs, Mcdonough & Johnson For Petitioner. Assistant City of Fiscal Felix For RespondentDocument3 pagesAlfredo Calupitan, and Gibbs, Mcdonough & Johnson For Petitioner. Assistant City of Fiscal Felix For RespondentJomar TenezaNo ratings yet

- Soliven Vs MakasiarDocument2 pagesSoliven Vs MakasiarJomar TenezaNo ratings yet

- People Vs IntingDocument4 pagesPeople Vs IntingJomar TenezaNo ratings yet

- The Solicitor General For Plaintiff-Appellee. Public Attorney's Office For Accused-AppellantDocument4 pagesThe Solicitor General For Plaintiff-Appellee. Public Attorney's Office For Accused-AppellantJomar TenezaNo ratings yet

- Regulation of Medical Education (B) The Examination For Registration of Physicians and (C) TheDocument5 pagesRegulation of Medical Education (B) The Examination For Registration of Physicians and (C) TheJomar TenezaNo ratings yet

- People Vs GesmundoDocument5 pagesPeople Vs GesmundoJomar TenezaNo ratings yet

- The Philippine Higher Education System:: Current Trends and DevelopmentsDocument33 pagesThe Philippine Higher Education System:: Current Trends and DevelopmentsJomar TenezaNo ratings yet