Professional Documents

Culture Documents

A Level Accounting Work 25-May-20

Uploaded by

Cephas Panguisa0 ratings0% found this document useful (0 votes)

13 views3 pagesThis document provides an accounting example and exercise about a partnership between X and Y. X and Y share profits and losses in a 3:2 ratio after accounting for 5% interest on their capital accounts of $50,000 and $40,000 respectively and salaries of $9,000 and $6,000. In their first year of trading, the partnership incurred a $44,500 loss. Students are required to prepare the partners' capital accounts and a statement of changes in equity.

Original Description:

Original Title

A level Accounting work 25-May-20

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides an accounting example and exercise about a partnership between X and Y. X and Y share profits and losses in a 3:2 ratio after accounting for 5% interest on their capital accounts of $50,000 and $40,000 respectively and salaries of $9,000 and $6,000. In their first year of trading, the partnership incurred a $44,500 loss. Students are required to prepare the partners' capital accounts and a statement of changes in equity.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views3 pagesA Level Accounting Work 25-May-20

Uploaded by

Cephas PanguisaThis document provides an accounting example and exercise about a partnership between X and Y. X and Y share profits and losses in a 3:2 ratio after accounting for 5% interest on their capital accounts of $50,000 and $40,000 respectively and salaries of $9,000 and $6,000. In their first year of trading, the partnership incurred a $44,500 loss. Students are required to prepare the partners' capital accounts and a statement of changes in equity.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

Subject: Accounting

CLASS A-Leve1

TOPIC Partnership accounting

DATE Monday, 25 May 2020

DUE Wednesday, 27 May 2020

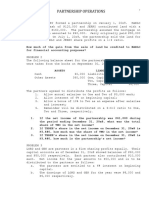

Example 1

X and Y are in a partnership sharing profits and losses in the ratio 3:2 after charging interest on

capital accounts at the rate of 5% per annum and salaries of $9 000 and $6 000 per annum

respectively. The capital balances at the beginning of the year X: $50 000, Y: $40 000. In their first

year of trading the partnership made a loss amounting to $44 500. The partners do not maintain a

separate current a/c.

Required: - Prepare: a) Partners’ Capital Accounts

b) Statement of changes in equity

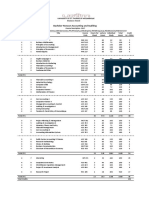

Exercise:

You might also like

- Partnership OperationDocument3 pagesPartnership OperationBianca Iyiyi0% (1)

- Introduction To: Corporate FinanceDocument85 pagesIntroduction To: Corporate FinanceCephas PanguisaNo ratings yet

- Quiz - Chapter 2 - Partnership OperationsDocument5 pagesQuiz - Chapter 2 - Partnership OperationsChristian Arnel Jumpay LopezNo ratings yet

- Lyceum-Northwestern University: Income Statement Balance Sheet Debit Credit Debit CreditDocument12 pagesLyceum-Northwestern University: Income Statement Balance Sheet Debit Credit Debit CreditAmie Jane Miranda0% (1)

- Partnership MyDocument13 pagesPartnership MyHoneylyne PlazaNo ratings yet

- Question 1Document15 pagesQuestion 1Cale HenituseNo ratings yet

- Financial Accounting and ReportingDocument8 pagesFinancial Accounting and ReportingPauline Idra100% (1)

- Partnership HCC CttoDocument7 pagesPartnership HCC CttoKenncy100% (1)

- 'A' Level Accounting Study Pack Volume 1 PDFDocument376 pages'A' Level Accounting Study Pack Volume 1 PDFCephas Panguisa100% (2)

- Mock Aqe 1Document17 pagesMock Aqe 1Albert Ocno Almine100% (4)

- 9 Partnership Question 21Document11 pages9 Partnership Question 21kautiNo ratings yet

- Orquia Quiz-Partnership - OperationsDocument9 pagesOrquia Quiz-Partnership - OperationsClint Agustin M. RoblesNo ratings yet

- ACC 1802 Partneship OperationsDocument3 pagesACC 1802 Partneship OperationsronnelNo ratings yet

- Midterm Exams - 1ST YrDocument7 pagesMidterm Exams - 1ST YrMark Domingo MendozaNo ratings yet

- 2122 1st AC - FAR Act. 05Document2 pages2122 1st AC - FAR Act. 05Airish GeronimoNo ratings yet

- PS - 1 and 2Document6 pagesPS - 1 and 2Rey Joyce AbuelNo ratings yet

- Quiz 1Document5 pagesQuiz 1cpacpacpa100% (2)

- SATURDAYDocument20 pagesSATURDAYkristine bandaviaNo ratings yet

- Practice Sets 3 & 4: Accounting For PartnershipDocument4 pagesPractice Sets 3 & 4: Accounting For PartnershipRey Joyce AbuelNo ratings yet

- CMPC 131 2-Partneship-OperationsDocument4 pagesCMPC 131 2-Partneship-OperationsGab IgnacioNo ratings yet

- Integ02 A QuestionsDocument20 pagesInteg02 A QuestionsRonald CorunoNo ratings yet

- Partnership OperationsDocument4 pagesPartnership Operationsdaniella tagikNo ratings yet

- CAE 2 Financial Accounting and Reporting: Lyceum-Northwestern UniversityDocument15 pagesCAE 2 Financial Accounting and Reporting: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- Xii CommerceDocument7 pagesXii CommerceJatinNo ratings yet

- Financial Accounting & Reporting Final Examination: Name: Date: Professor: Section: ScoreDocument17 pagesFinancial Accounting & Reporting Final Examination: Name: Date: Professor: Section: ScoreMaryjoy NemenoNo ratings yet

- Partnership Multiple ChoiceDocument2 pagesPartnership Multiple ChoiceLinda Duvalier-Evans100% (3)

- ACC Assignment Questions Extra PractiseDocument20 pagesACC Assignment Questions Extra Practisesikeee.exeNo ratings yet

- Ast - 3B - Quiz No. 1Document10 pagesAst - 3B - Quiz No. 1Renalyn Paras0% (1)

- Xii Acc WorksheetssDocument55 pagesXii Acc WorksheetssUnknown patelNo ratings yet

- Xii Acc Worksheetss-1-29Document29 pagesXii Acc Worksheetss-1-29Unknown patelNo ratings yet

- 1st Year ExamDocument9 pages1st Year ExamMark Domingo MendozaNo ratings yet

- Partnership Formation AssignmentDocument3 pagesPartnership Formation AssignmentMariella Olympia PanuncialesNo ratings yet

- Activity 1.2.1Document1 pageActivity 1.2.1De Nev OelNo ratings yet

- Partnership Mock ExamDocument4 pagesPartnership Mock ExamCleo Meguel AbogadoNo ratings yet

- Orquiaquiz Partnershipoperationsdocx PDF FreeDocument9 pagesOrquiaquiz Partnershipoperationsdocx PDF FreeLemhar DayaoenNo ratings yet

- Survey of Accounting 5th Edition Edmonds Test BankDocument69 pagesSurvey of Accounting 5th Edition Edmonds Test Bankenochtuyenuydxeq100% (22)

- 02 Partnership OperationDocument4 pages02 Partnership OperationRoland jamesNo ratings yet

- Partnership Operations ( (Exercise No. 1)Document1 pagePartnership Operations ( (Exercise No. 1)Shaira Nicole VasquezNo ratings yet

- Finals ProblemsDocument9 pagesFinals Problemsr3gjc.nfjpia2223No ratings yet

- UntitledDocument1 pageUntitledRdeeeNo ratings yet

- 12 Accountancy 2023-24Document37 pages12 Accountancy 2023-24chiragdahiya0602No ratings yet

- 15 May Accounts TestDocument1 page15 May Accounts TestPrashantu MerNo ratings yet

- Screenshot 2023-03-11 at 12.52.38 PM PDFDocument56 pagesScreenshot 2023-03-11 at 12.52.38 PM PDFpalak sanghviNo ratings yet

- Partnership (Q)Document4 pagesPartnership (Q)amna zamanNo ratings yet

- Partnership Fundamentals WorksheetDocument7 pagesPartnership Fundamentals Worksheetmpsaj1177b9No ratings yet

- Advance Accounting Prelim BSATDocument8 pagesAdvance Accounting Prelim BSATLenie Lyn Pasion TorresNo ratings yet

- PUNZALANDocument16 pagesPUNZALANAngelique Kate Tanding DuguiangNo ratings yet

- 2nd Assign Topic2 AdvaccDocument2 pages2nd Assign Topic2 AdvaccStella SabaoanNo ratings yet

- Afar 1 Sw3 Mle01 PDF FreeDocument9 pagesAfar 1 Sw3 Mle01 PDF FreeBrian TorresNo ratings yet

- Accounting For ST - Activity 2Document8 pagesAccounting For ST - Activity 2Aretha Joi Domingo PrezaNo ratings yet

- Ae100 Partnership Operations Notes and Sample ProblemsDocument3 pagesAe100 Partnership Operations Notes and Sample ProblemsJrm mendesNo ratings yet

- 2 OperationsDocument7 pages2 Operationsmartinfaith958No ratings yet

- 2 Partnership OperationDocument4 pages2 Partnership OperationDacanay, Sean Eigencris G.No ratings yet

- Quiz 3 Fin II - Parte 2Document3 pagesQuiz 3 Fin II - Parte 2RicardoNo ratings yet

- Ac 16 MidtermDocument20 pagesAc 16 MidtermMarjorie AmpongNo ratings yet

- GCL Retirement & Death Practice Paper 1Document2 pagesGCL Retirement & Death Practice Paper 1Ananya BhargavaNo ratings yet

- Indian School Sohar UNIT TEST (2021-22) Accountancy Date: Max Marks:50 Class: XII Duration: 2 HoursDocument5 pagesIndian School Sohar UNIT TEST (2021-22) Accountancy Date: Max Marks:50 Class: XII Duration: 2 HoursRitaNo ratings yet

- IG2 Mathematics - Fractions 08-June-20Document3 pagesIG2 Mathematics - Fractions 08-June-20Cephas PanguisaNo ratings yet

- Payment Methods - Cheques: Clearing SystemDocument2 pagesPayment Methods - Cheques: Clearing SystemCephas PanguisaNo ratings yet

- Bachelor Honours Accounting and AuditingDocument1 pageBachelor Honours Accounting and AuditingCephas PanguisaNo ratings yet

- Accounting A Level 1 Non-Profit Making Exercise 29 Jul 20Document2 pagesAccounting A Level 1 Non-Profit Making Exercise 29 Jul 20Cephas PanguisaNo ratings yet

- Accounting Cash Flow Statement NotesDocument4 pagesAccounting Cash Flow Statement NotesCephas PanguisaNo ratings yet