Professional Documents

Culture Documents

March, 2006 Q.P.

Uploaded by

M JEEVARATHNAM NAIDUCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

March, 2006 Q.P.

Uploaded by

M JEEVARATHNAM NAIDUCopyright:

Available Formats

1

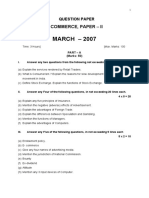

QUESTION PAPER

COMMERCE PAPER – II

MARCH 2006

Time: 3 Hours] [Max. Marks: 100

PART – A

(Marks : 50)

I. Answer any two of the following questions not exceeding 40 lines.

(a) What are the major functions of marketing? Explain

(b) What are the powers of District Forum?

(c) Describe the functions of Stock Exchange.

II. Answer any four of the following questions not exceeding 20 lines.

(a) Explain the differences between life insurance and marine insurance

(b) What are the objectives in levying customs and excise duty? Explain

(c) What are the advantages and disadvantages of outdoor media?

(d) Give an outline of the advantages of computers.

(e) Write the differences between speculator and investor.

(f) Write five functions of managers.

III. Answer any five of the following questions not exceeding 5 lines each.

(a) Average policy

(b) E – Commerce

(c) What are the two advantages and two disadvantages of T.V. advertising?

(d) State any three consumer rights.

2

(e) Certificate of origin

(f) Bull

(g) Attitude

(h) C.P.U. (Central Processing Unit)

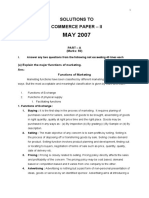

PART – B

(Marks : 50)

IV. Answer the following

X, Y, Z have been partners in a firm. On 31-3-2006 X proposed to retire, the

following was a statement of the position of the firm.

Liabilities Amount Assets Amount

Rs. Rs

Creditors 32,000 Bank Balance 20,000

Reserve Fund 40,000 Plant & Machinery 80,000

Capital Account Furniture 32,000

X 60,000 Debtors 1,00,000

Y 60,000 Less: 8,000

Z 60,000 1,80,000 Bad debts reserve 92,000

Goodwill 24,000

Patents 4,000

2,52,000 2,52,000

For the purpose of ‘X’ s retirement, the following adjustments were agreed upon

(a) The reserve for bad debts was considered unnecessary.

(b) Patents were worthless.

(c) An outstanding liability for Rs.1, 600 for expenses was to be brought in to the

books.

(d) Goodwill is to be taken at the value shown in the balance sheet.

(e) ‘X’ agreed to have the amount due to him as a loan to the firm carrying

interest at 5%p.a.

Show the necessary accounts and draft the balance sheet of the new firm.

V. Answer any one of the following:

(a) Krishna of Hyderabad and Rama of Guntur are in consignment business.

Rama sent goods to Krishna Rs.40, 000. Rama paid freight 2,000, Insurance

3

6,000. Krishna met sales expenses of Rs.3, 600, Krishna sold entire stock for

Rs.80, 000 and is entitled to a commission of 5% on sales. Give accounts in

the books of Rama.

(b) From the following receipts and payments account for the year ending 31-3-

2006. Prepare an income and expenditure account for the period ending 31-

3-06.

Receipts Amount Payments Amount

Rs. Rs.

To Donations 7,000 By Salaries 7,500

To Subscriptions 23,000 By help to poor students 7,400

To Life Membership fee 10,000 By Expenses on free

dispensary 6,900

To Legacy 15,000 By Postage and stationery 700

To Interest received 800 By Furniture 10,000

By Investments 15,000

By Cash in hand 8,300

55,800 55,800

Additional Information:

(1) Subscriptions outstanding for the current year Rs.1, 000

(2) Salaries unpaid Rs.1, 000

(3) Help to poor students promised but unpaid Rs.3, 200

(4) Expenses of dispensary outstanding Rs.600

(5) Postage and Stationery expenses yet to be paid Rs.800

VI. Answer any five of the following

(a) Define “Draft”.

(b) How do you calculate the depreciation under fixed installment method?

(c) Red-Ink Interest

(d) Average due date

(e) Del Credere Commission

(f) Suspense Account

(g) Revenue expenditure

(h) C and D were partners sharing profits and losses in the ratio 3:2. They admit

E, giving him 1/5th share in the future profits. Calculate the new profit sharing

ratio.

VII. Answer any two of the following:

4

(a) Explain the various kinds of errors.

(b) Sudheer purchased goods worth Rs.20, 000 from Vaheed on 1st April 2006.

Vaheed drafted a bill for the same amount on the same day for 4 months.

Sudheer accepted the bill and returned it to Vaheed. Vaheed discounted the

bill with his bank @ 6%p.a on the same day, On the due date the bill was

dishonoured.

Pass the necessary entries in the books of Vaheed.

(c) An asset was purchased for Rs.48, 000 on 1-5-2002 and was sold on 1-7-

2005 for Rs.36, 000. Calculate the profit or loss assuming depreciation is

charged @ 10%p.a. on straight-line method.

(d) Calculate the average due date of the following particulars.

Date of Bill Period Bill amount

11-1-2006 2 months 800

16-2-2006 1 month 400

19-3-2006 2 months 200

10-4-2006 1 month 400

*****

You might also like

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Commerce Paper II Questions and Ledger AccountsDocument5 pagesCommerce Paper II Questions and Ledger AccountsM JEEVARATHNAM NAIDUNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- May, 2005 Q.P.Document4 pagesMay, 2005 Q.P.M JEEVARATHNAM NAIDUNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Inter May, 2008Document4 pagesInter May, 2008M JEEVARATHNAM NAIDUNo ratings yet

- March, 2007 QuestionssDocument4 pagesMarch, 2007 QuestionssM JEEVARATHNAM NAIDUNo ratings yet

- May. 2007 Q.P.Document4 pagesMay. 2007 Q.P.M JEEVARATHNAM NAIDUNo ratings yet

- Accountancy Assignment Grade 12Document4 pagesAccountancy Assignment Grade 12sharu SKNo ratings yet

- Corporate Accounting Exam Questions PaperDocument7 pagesCorporate Accounting Exam Questions PaperAmmar Bin NasirNo ratings yet

- Inter-II QP 2008Document4 pagesInter-II QP 2008M JEEVARATHNAM NAIDUNo ratings yet

- Syjc - B. K. - Prelim Exam No. 7Document4 pagesSyjc - B. K. - Prelim Exam No. 7karkeraadiyaNo ratings yet

- 1Document5 pages1firoozdasmanNo ratings yet

- 2020-21 - HYE - QP - Accountancy - SET A - XII - PDFDocument3 pages2020-21 - HYE - QP - Accountancy - SET A - XII - PDFLakshay SethNo ratings yet

- March, 2004, Q.P.Document4 pagesMarch, 2004, Q.P.M JEEVARATHNAM NAIDUNo ratings yet

- COMMERCE PAPER EXAMDocument4 pagesCOMMERCE PAPER EXAMM JEEVARATHNAM NAIDUNo ratings yet

- Paper 1Document19 pagesPaper 1GianNo ratings yet

- Accountancy June 2008 EngDocument8 pagesAccountancy June 2008 EngPrasad C MNo ratings yet

- PT 06 (Partnership) (5 Dec)Document8 pagesPT 06 (Partnership) (5 Dec)Rajesh Kumar100% (1)

- CBSE Class 12 Accountancy Sample Papers 2014 - 15Document7 pagesCBSE Class 12 Accountancy Sample Papers 2014 - 15Karthick KarthickNo ratings yet

- Retirement Collage SPCC Term 2..Document5 pagesRetirement Collage SPCC Term 2..Taaran ReddyNo ratings yet

- 1e710c6f-4b3e-4b03-943f-11430d867f0e-Document30 pages1e710c6f-4b3e-4b03-943f-11430d867f0e-angela antoniaNo ratings yet

- Time Allowed: 3 Hours Max Marks: 100: Paper A1Document3 pagesTime Allowed: 3 Hours Max Marks: 100: Paper A1KashifNo ratings yet

- Book Keeping & Accountancy March 2019 STD 12th Commerce HSC Maharashtra Board Question PaperDocument5 pagesBook Keeping & Accountancy March 2019 STD 12th Commerce HSC Maharashtra Board Question PaperBhavin MamtoraNo ratings yet

- Tally PaperDocument3 pagesTally Papergitu219No ratings yet

- Book-Keeping Form Three PDFDocument4 pagesBook-Keeping Form Three PDFdesa ntosNo ratings yet

- TP 4 Pa 18 JuneDocument2 pagesTP 4 Pa 18 JuneAditya srivastavaNo ratings yet

- Balance Sheet As On 31-12-2013: Liabilities Rs. Assets RsDocument1 pageBalance Sheet As On 31-12-2013: Liabilities Rs. Assets RsM JEEVARATHNAM NAIDUNo ratings yet

- Additional Questions 8Document8 pagesAdditional Questions 8Neel DudhatNo ratings yet

- Answer The Following: 4 Marks) 3 Marks) 3 Marks) 3.75 Marks) (Note: Detailed Ledger Accounts Are Not Required)Document15 pagesAnswer The Following: 4 Marks) 3 Marks) 3 Marks) 3.75 Marks) (Note: Detailed Ledger Accounts Are Not Required)shashank saxenaNo ratings yet

- Sem I Acc - NEP-UGCF 2022Document8 pagesSem I Acc - NEP-UGCF 2022Raj AbhishekNo ratings yet

- Shares & Debentures TestDocument10 pagesShares & Debentures TestAthul Krishna KNo ratings yet

- RAGHU-33: 506-A Advance Accounting-I (835061) Total Pages: 5) Time: 2 Hours Max. Marks: 60 NoteDocument5 pagesRAGHU-33: 506-A Advance Accounting-I (835061) Total Pages: 5) Time: 2 Hours Max. Marks: 60 NoteRishikesh KalantriNo ratings yet

- MKGM Accounts Question Papers ModelDocument101 pagesMKGM Accounts Question Papers ModelSantvana ChaturvediNo ratings yet

- Part - A (: Time Allowed: 3 Hours Maximum Marks: 90Document4 pagesPart - A (: Time Allowed: 3 Hours Maximum Marks: 90NameNo ratings yet

- 12 C BK Mock Board PraveenaDocument4 pages12 C BK Mock Board PraveenaAdvanced AcademyNo ratings yet

- Retirement of Partners - Updated WorksheetDocument8 pagesRetirement of Partners - Updated WorksheetMisri SoniNo ratings yet

- Model Question Paper - 2011 Class - XII Subject - AccountancyDocument6 pagesModel Question Paper - 2011 Class - XII Subject - AccountancyKunal AggarwalNo ratings yet

- 21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23Document5 pages21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23RohitNo ratings yet

- CLASS TEST-I ACCOUNTANCY EXAM REVIEWDocument4 pagesCLASS TEST-I ACCOUNTANCY EXAM REVIEWshaurya kapoorNo ratings yet

- Sample Paper Class XII Subject-Accountancy Part ADocument5 pagesSample Paper Class XII Subject-Accountancy Part AKaran BhatnagarNo ratings yet

- MQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Document5 pagesMQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Rohit SoodNo ratings yet

- Section A - Accounting questions and answersTITLE Section B - Partnership accounts problems and journal entriesTITLE Section C - Statement of profit or loss and final accounts for single entry systemDocument6 pagesSection A - Accounting questions and answersTITLE Section B - Partnership accounts problems and journal entriesTITLE Section C - Statement of profit or loss and final accounts for single entry systemGSNo ratings yet

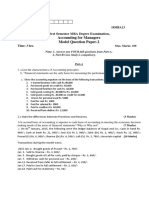

- Accounting For Managers Model Question Paper-2: First Semester MBA Degree ExaminationDocument5 pagesAccounting For Managers Model Question Paper-2: First Semester MBA Degree ExaminationRohan Chaugule0% (1)

- S.6 Ent 2Document5 pagesS.6 Ent 2danielzashleybobNo ratings yet

- Monthly Test - Acc. Aug 2020Document5 pagesMonthly Test - Acc. Aug 2020akash debbarmaNo ratings yet

- Accountancy - XII - QPDocument5 pagesAccountancy - XII - QPKulvirkuljitharmeet singhNo ratings yet

- Contentitemfile Clakzwt9mx9sk0a212lma0ytv PDFDocument4 pagesContentitemfile Clakzwt9mx9sk0a212lma0ytv PDFJoseph OndariNo ratings yet

- Revision Sheet - 2022-23Document27 pagesRevision Sheet - 2022-23addityawritesNo ratings yet

- Class 12 Accounts SC Sample Paper Dissolution 25.12.20 Que and AnsDocument6 pagesClass 12 Accounts SC Sample Paper Dissolution 25.12.20 Que and AnsvidhifalodiaNo ratings yet

- FinancialManagement October2019 B B A WithCredits RegularJune-2017PatternSecondYearB B A 386E9789Document3 pagesFinancialManagement October2019 B B A WithCredits RegularJune-2017PatternSecondYearB B A 386E9789Mubin Shaikh NooruNo ratings yet

- Board Paper 2018Document14 pagesBoard Paper 2018zaraniyaz14No ratings yet

- 15-Mca-Nr-Accounting and Financial ManagementDocument4 pages15-Mca-Nr-Accounting and Financial ManagementSRINIVASA RAO GANTA0% (2)

- Mock TestDocument7 pagesMock TestShivaji hariNo ratings yet

- Sample Paper - Accountancy XI Term 2Document3 pagesSample Paper - Accountancy XI Term 2Manaswi WareNo ratings yet

- BCA DEGREE EXAM ACCOUNTING EXAMDocument11 pagesBCA DEGREE EXAM ACCOUNTING EXAMStudents Xerox ChidambaramNo ratings yet

- RE Exam FA Sem I MFM MMM MHRDMDocument4 pagesRE Exam FA Sem I MFM MMM MHRDMPARAM CLOTHINGNo ratings yet

- Class 12 Cbse Accountancy Sample Paper 2012 Model 2Document20 pagesClass 12 Cbse Accountancy Sample Paper 2012 Model 2Sunaina RawatNo ratings yet

- Nov - 19 - Question and AnswersDocument15 pagesNov - 19 - Question and AnswersVidhi AgrawalNo ratings yet

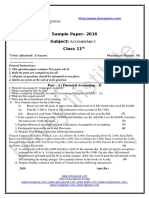

- Sample Paper-2016 Subject: Class 11: Part - A (Financial Accounting - I)Document4 pagesSample Paper-2016 Subject: Class 11: Part - A (Financial Accounting - I)Šhûbh Šhôûřyâ KâšhyâpNo ratings yet

- Public SectorDocument12 pagesPublic SectorM JEEVARATHNAM NAIDUNo ratings yet

- Private Sector Definition and RoleDocument4 pagesPrivate Sector Definition and RoleM JEEVARATHNAM NAIDUNo ratings yet

- May, 2007 AnswersDocument20 pagesMay, 2007 AnswersM JEEVARATHNAM NAIDUNo ratings yet

- Multinational Corporations (MNC'S) : Meaning and DefinitionDocument5 pagesMultinational Corporations (MNC'S) : Meaning and DefinitionM JEEVARATHNAM NAIDUNo ratings yet

- May, 2006 AnswerDocument17 pagesMay, 2006 AnswerM JEEVARATHNAM NAIDUNo ratings yet

- March, 2007 AnswersDocument18 pagesMarch, 2007 AnswersM JEEVARATHNAM NAIDUNo ratings yet

- CD Contents: S.No. Particulars PagesDocument2 pagesCD Contents: S.No. Particulars PagesM JEEVARATHNAM NAIDUNo ratings yet

- March, 2005 AnswersDocument25 pagesMarch, 2005 AnswersM JEEVARATHNAM NAIDUNo ratings yet

- May, 2005 AnswersDocument21 pagesMay, 2005 AnswersM JEEVARATHNAM NAIDUNo ratings yet

- Vijayam Junior College::Chittoor I: Year Mec Ii Terminal ExaminatiuonDocument2 pagesVijayam Junior College::Chittoor I: Year Mec Ii Terminal ExaminatiuonM JEEVARATHNAM NAIDUNo ratings yet

- March, 2004 AnswersDocument22 pagesMarch, 2004 AnswersM JEEVARATHNAM NAIDUNo ratings yet

- March, 2006 AnswerDocument23 pagesMarch, 2006 AnswerM JEEVARATHNAM NAIDUNo ratings yet

- Vijayam Junior College:: Chittoor: Iii Answer The Following. 1X10 10Document1 pageVijayam Junior College:: Chittoor: Iii Answer The Following. 1X10 10M JEEVARATHNAM NAIDUNo ratings yet

- June, 2004 AnswersDocument18 pagesJune, 2004 AnswersM JEEVARATHNAM NAIDUNo ratings yet

- JR Mec Pre Final 2Document1 pageJR Mec Pre Final 2M JEEVARATHNAM NAIDUNo ratings yet

- Vijayam Junior College Commerce Exam QuestionsDocument2 pagesVijayam Junior College Commerce Exam QuestionsM JEEVARATHNAM NAIDUNo ratings yet

- Liabilities Amount Rs. Assets Amount RsDocument2 pagesLiabilities Amount Rs. Assets Amount RsM JEEVARATHNAM NAIDUNo ratings yet

- JR Mec Pre Final 2Document1 pageJR Mec Pre Final 2M JEEVARATHNAM NAIDUNo ratings yet

- Vijayam Junior College terminal exam questionsDocument2 pagesVijayam Junior College terminal exam questionsM JEEVARATHNAM NAIDUNo ratings yet

- I Yr Monthly 24-10-16Document1 pageI Yr Monthly 24-10-16M JEEVARATHNAM NAIDUNo ratings yet

- JR Mec Iii Term 06-12-18Document4 pagesJR Mec Iii Term 06-12-18M JEEVARATHNAM NAIDUNo ratings yet

- JR Mec Monthly 18-9-17Document1 pageJR Mec Monthly 18-9-17M JEEVARATHNAM NAIDUNo ratings yet

- Vijayam Junior College Chittoor Junior MEC Monthly Test Business Organization FormsDocument1 pageVijayam Junior College Chittoor Junior MEC Monthly Test Business Organization FormsM JEEVARATHNAM NAIDUNo ratings yet

- Vijayam Junior College:: Chittoor: Iii Answer The Following. 1X10 10Document1 pageVijayam Junior College:: Chittoor: Iii Answer The Following. 1X10 10M JEEVARATHNAM NAIDUNo ratings yet

- JR Commerce Weekly Three Column Cash BookDocument3 pagesJR Commerce Weekly Three Column Cash BookM JEEVARATHNAM NAIDUNo ratings yet

- JR Mec Monthly Test 15-07-19Document2 pagesJR Mec Monthly Test 15-07-19M JEEVARATHNAM NAIDUNo ratings yet

- JR Commerce Weekly Three Column Cash BookDocument3 pagesJR Commerce Weekly Three Column Cash BookM JEEVARATHNAM NAIDUNo ratings yet

- JR Mec Monthly 30.10.18Document2 pagesJR Mec Monthly 30.10.18M JEEVARATHNAM NAIDUNo ratings yet

- Vijayam Junior College Chittoor Junior MEC Monthly Test Business Organization FormsDocument1 pageVijayam Junior College Chittoor Junior MEC Monthly Test Business Organization FormsM JEEVARATHNAM NAIDUNo ratings yet

- SUB: COMMERCE-I TERMINAL EXAM Date: 18.08.2018 Marks: 100Document3 pagesSUB: COMMERCE-I TERMINAL EXAM Date: 18.08.2018 Marks: 100M JEEVARATHNAM NAIDUNo ratings yet

- Midterm Exam Review for Accounting StudentsDocument5 pagesMidterm Exam Review for Accounting StudentsRuby Amor Doligosa100% (1)

- Ch07 Beams10e TBDocument29 pagesCh07 Beams10e TBjeankoplerNo ratings yet

- Power Sector OutlookDocument5 pagesPower Sector OutlookJade EspirituNo ratings yet

- Contoh 9 Data PanelDocument22 pagesContoh 9 Data Panelnoel_manroeNo ratings yet

- May 2022 PayslipDocument1 pageMay 2022 PayslipJustice Agbeko100% (1)

- Solving Some Numerical QuestionsDocument9 pagesSolving Some Numerical QuestionsVEDANT BASNYATNo ratings yet

- Lesson 17 PDFDocument36 pagesLesson 17 PDFNelwan NatanaelNo ratings yet

- Laundry InvoiceDocument1 pageLaundry InvoiceprashantkgargNo ratings yet

- Lesson 4 Written Assignment: Every Question)Document8 pagesLesson 4 Written Assignment: Every Question)Uyên Phương Phạm0% (1)

- Cashflow Forecasting Using Montecarlo SimulationDocument111 pagesCashflow Forecasting Using Montecarlo SimulationDavid Esteban Meneses RendicNo ratings yet

- 2009-SEC Form ExA-001-Renewal External AuditorDocument2 pages2009-SEC Form ExA-001-Renewal External AuditorRheneir MoraNo ratings yet

- Pas 21 The Effects of Changes in Foreign Exchange RatesDocument3 pagesPas 21 The Effects of Changes in Foreign Exchange RatesJanaisa BugayongNo ratings yet

- Bank of International Settlements Quarterly Review: Detailed Tables March 2011Document137 pagesBank of International Settlements Quarterly Review: Detailed Tables March 2011creditplumberNo ratings yet

- Wesco Charlie Munger Letters 1983 2009 CollectionDocument286 pagesWesco Charlie Munger Letters 1983 2009 Collectionevolve_usNo ratings yet

- Capital Investment Decision, Project Planning and ControlDocument16 pagesCapital Investment Decision, Project Planning and ControlAnuj JoshiNo ratings yet

- IB PPT-1 (ReplDocument12 pagesIB PPT-1 (ReplKunal M CNo ratings yet

- Askeladden Capital Investor Letter Scars and How We Got ThemDocument23 pagesAskeladden Capital Investor Letter Scars and How We Got ThemMario Di MarcantonioNo ratings yet

- Global Process Systems InvoiceDocument16 pagesGlobal Process Systems InvoiceValiNo ratings yet

- Fabm1 Module 5Document16 pagesFabm1 Module 5Randy Magbudhi50% (4)

- Tata PlanDocument8 pagesTata PlanLIFE HACKNo ratings yet

- INSEAD Master in Finance Curriculum PDFDocument25 pagesINSEAD Master in Finance Curriculum PDFLeslie Cheetah LamNo ratings yet

- Project Report For Spare PartsDocument5 pagesProject Report For Spare Partsrajesh patelNo ratings yet

- FABM 1.module 5 PDFDocument34 pagesFABM 1.module 5 PDFSHIERY MAE FALCONITINNo ratings yet

- Tutorial 4 - QuestionsDocument2 pagesTutorial 4 - QuestionsHuang ZhanyiNo ratings yet

- Work Sheet Computation of Income Under The Head "Capital Gains"Document4 pagesWork Sheet Computation of Income Under The Head "Capital Gains"Vishal SarkarNo ratings yet

- Op Risk MGTDocument64 pagesOp Risk MGTDrAkhilesh TripathiNo ratings yet

- Risk and Return Trade OffDocument14 pagesRisk and Return Trade OffDebabrata SutarNo ratings yet

- Description: S&P/BMV Total Mexico Esg Index (MXN)Document7 pagesDescription: S&P/BMV Total Mexico Esg Index (MXN)tmayur21No ratings yet

- NO. 153/154, GROUND FLOOR,,4TH CROSS,, J P Nagar, 4Th Phase, Bangalore, Karnataka-560078 Phone - 080-40402020Document1 pageNO. 153/154, GROUND FLOOR,,4TH CROSS,, J P Nagar, 4Th Phase, Bangalore, Karnataka-560078 Phone - 080-40402020Ajay Kumar MattupalliNo ratings yet

- Manch 4.0 Project List: For Internal Use OnlyDocument8 pagesManch 4.0 Project List: For Internal Use OnlyHimanshu KumarNo ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesFrom EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesRating: 5 out of 5 stars5/5 (4)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)

- Full Charge Bookkeeping, For the Beginner, Intermediate & Advanced BookkeeperFrom EverandFull Charge Bookkeeping, For the Beginner, Intermediate & Advanced BookkeeperRating: 5 out of 5 stars5/5 (3)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- NLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsFrom EverandNLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsRating: 4.5 out of 5 stars4.5/5 (4)