Professional Documents

Culture Documents

ITR-1 Notified Form PDF

Uploaded by

Rutul GandhiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ITR-1 Notified Form PDF

Uploaded by

Rutul GandhiCopyright:

Available Formats

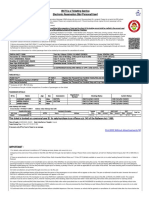

[भाग II—खण्ड 3(i)] भारतकाराजपत्र:असाधारण 3

INDIAN INCOME TAX RETURN Assessment Year

FORM

ITR-1 [For individuals being a resident (other than not ordinarily resident) having total income upto Rs.50 lakh, having

Income from Salaries, one house property, other sources (Interest etc.), and agricultural income upto Rs.5 thousand]

SAHAJ [Not for an individual who is either Director in a company or has invested in unlisted equity shares]

2020 - 2 1

(Refer instructions for eligibility)

PART A GENERAL INFORMATION

Name Date of Birth Aadhaar Number (12 digits)/Aadhaar Enrolment Id (28 digits) (If eligible for

PAN Aadhaar No.)

D D M M Y Y Y Y

Mobile No. Email Address Address: Flat/Door/Block No. Name of Premises/Building/Village Road/Street/Post

Office Area/Locality Town/City/District State Country PIN code

Filed u/s (Tick) 139(1)-On or before due date, 139(4)-Belated, 139(5)-Revised, Nature of employment-

[Please see instruction] 119(2)(b)- After Condonation of delay. Central Govt. State Govt. Public

Or Filed in response to notice u/s 139(9), 142(1), 148, 153A 153C Sector Undertaking Pensioners

Others Not Applicable (e.g. Family

Pension etc.)

If revised/defective, then enter Receipt No. and Date of filing original return (DD/MM/YYYY) / /

If filed in response to notice u/s 139(9)/142(1)/148/153A/153C or order u/s 119(2)(b)- enter Unique Number/Document

/ /

Identification Number (DIN) & Date of such Notice or Order

Are you filing return of income under Seventh proviso to section 139(1) but otherwise not required to furnish return of income? - (Tick) Yes No

If yes, please furnish following information

[Note: To be filled only if a person is not required to furnish a return of income under section 139(1) but filing return of income due to fulfilling one or

more conditions mentioned in the seventh proviso to section 139(1)]

Have you deposited amount or aggregate of amounts exceeding Rs. 1 Crore in one or more current account during

Amount (Rs) (If Yes)

the previous year? (Yes/No)

Have you incurred expenditure of an amount or aggregate of amount exceeding Rs. 2 lakhs for travel to a foreign

Amount (Rs) (If Yes)

country for yourself or for any other person? (Yes/ No)

Have you incurred expenditure of amount or aggregate of amount exceeding Rs. 1 lakh on consumption of

Amount (Rs) (If Yes)

electricity during the previous year? (Yes/No)

PART B GROSS TOTAL INCOME Whole- Rupee( ) only

B1 i Gross Salary (ia + ib + ic) i

a Salary as per section 17(1) ia

b Value of perquisites as per section 17(2) ib

SALARY / PENSION

c Profit in lieu of salary as per section 17(3) ic

Less allowances to the extent exempt u/s 10 (drop down to be provided in e-filing utility)

ii ii

(Ensure that it is included in salary income u/s 17(1)/17(2)/17(3) )

iii Net Salary (i – ii) iii

iv Deductions u/s 16 (iva + ivb + ivc) iv

a Standard deduction u/s 16(ia) iva

b Entertainment allowance u/s 16(ii) ivb

c Professional tax u/s 16(iii) ivc

v Income chargeable under the head ‘Salaries’ (iii – iv) B1

B2 Tick applicable option Self-Occupied Let Out Deemed Let Out

i Gross rent received/ receivable/ lettable value during the year i

HOUSE PROPERTY

ii Tax paid to local authorities ii

iii Annual Value (i – ii) iii

iv 30% of Annual Value iv

v Interest payable on borrowed capital v

vi Arrears/Unrealised rent received during the year less 30% vi

vii Income chargeable under the head ‘House Property’ (iii – iv – v) + vi (If loss, put the figure in negative)

Note: - Maximum loss from House Property that can be set-off is INR 2, 00,000. To avail the benefit of carry B2

forward and set of loss, please use ITR -2

B3 Income from Other Sources (drop down to be provided in e-filing utility specifying nature of income) B3

Less: Deduction u/s 57(iia) (in case of family pension only)

B4

Gross Total Income (B1+B2+B3) (If loss, put the figure in negative) B4

Note: To avail the benefit of carry forward and set of loss, please use ITR -2

PART C – DEDUCTIONS AND TAXABLE TOTAL INCOME (Refer instructions for Deduction limit as per Income-tax Act)

Whether, you have made any investment/ deposit/ payments between 01.04.2020 to 30.06.2020 for the purpose of claiming any deduction under Part B of

Chapter VIA? [Yes/No]

(If yes, please fill schedule DI)

80C 80CCC 80CCD(1) 80CCD(1B) 80CCD(2) 80D 80DD 80DDB 80E 80EE

(Details are to be filled (Details are to be (Details are to be filled

in the drop down to be filled in the drop in the drop down to be

provided in e-filing down to be provided in e-filing

utility) provided in e-filing utility)

utility)

80EEA 80EEB 80G 80GG 80GGA 80GGC 80TTA 80TTB 80U

(Details are to (Details are to be (Details are to

be filled in the filled in the drop be filled in the

drop down to down to be drop down to be

be provided in provided in e- provided in e-

e-filing utility) filing utility) filing utility)

Total deductions Total Income

C1 C2

(B4-C1)

Exempt Income: For reporting purpose Drop down to be provided in e-filing utility mentioning nature of exempt income, relevant clause and section

4 THE GAZETTE OF INDIA : EXTRAORDINARY [PART II—SEC. 3(i)]

PART D – COMPUTATION OF TAX PAYABLE

D1 Tax payable on total income D2 Rebate u/s 87A D3 Tax after Rebate

D4 Health and education Cess @ D5 Total Tax and Cess D6 Relief u/s 89 (Please

4% on D3 ensure to submit Form

10E to claim this relief)

D7 Interest u/s 234A D8 Interest u/s 234B D9 Interest u/s 234C

D10 Fee u/s 234F D11 Total Tax, Fee and Interest (D5+D7+D8+D9+D10 – D6)

D12 Total Taxes Paid D13 Amount payable D14 Refund

(D11-D12) (if D11>D12) (D12-D11) (if D12>D11)

PART E – OTHER INFORMATION

Details of all Bank Accounts held in India at any time during the previous year (excluding dormant accounts)

Sl. IFS Code of the Bank Name of the Bank Account Number Select Account for Refund Credit

I

1. Minimum one account should be selected for refund credit.

2. In case of Refund, multiple accounts are selected for refund credit, then refund will be credited to one of the account decided by CPC after processing the return.

Schedule-IT Details of Advance Tax and Self-Assessment Tax payments

BSR Code Date of Deposit (DD/MM/YYYY) Serial Number of Challan Tax paid

Col (1) Col (2) Col (3) Col (4)

R1

R2

Schedule-TDS Details of TDS/TCS [As per Form 16/16A/16C/27D issued by the Deductor(s)/ Employer(s)/ Payer(s)/ Collector(s)]

TAN of Name of the Deductor/ Gross payment/ receipt which is Year of tax Tax Deducted/ TDS/TCS credit out of

deductor/Collector or Collector/Tenant subject to tax deduction /collection deduction/ collection collected (5) claimed this Year

PAN/ Aadhaar No. of the

Tenant

Col (1) Col (2) Col (3) Col (4) Col (5) Col (6)

T1

T2

Schedule DI - Details of Investment

Investment/ Deposit/ Payments for the purpose of claiming deduction under Part B of Chapter VIA

Section Eligible amount of deduction during FY 2019-20 Deduction attributable to investment/expenditure made

(As per Part C- Deductions and taxable total income) between 01.04.2020 to 30.06.2020

(Out of Col No.2)

Col (1) Col (2) Col (3)

(ii)

80C

80CCC

80CCD(1)

80CCD(1B)

80CCD(2)

80D

80DD

80DDB

80E

80EE

80EEA

80EEB

80G

80GG

80GGA

80GGC

Total

VERIFICATION

Stamp Receipt No., Seal, I, son/ daughter of solemnly declare that to the best of my knowledge and belief, the information given

Date & Sign of Receiving in the return is correct and complete and is in accordance with the provisions of the Income-tax Act, 1961. I further declare that I am making this

Official return in my capacity as ___________(drop down to be provided in e-filing utility) and I am also competent to make this return and verify it. I

am holding permanent account number .(Please see instruction).

Date: Signature:

If the return has been prepared by a Tax Return Preparer (TRP) give further details below:

Identification No. of TRP Name of TRP Counter Signature of TRP

If TRP is entitled for any reimbursement from the Government, amount thereof

You might also like

- Amc Requisited Hospital Status 17-06-2020 5.00 OnlineDocument2 pagesAmc Requisited Hospital Status 17-06-2020 5.00 OnlineRutul GandhiNo ratings yet

- Relwood UpbDocument15 pagesRelwood UpbRutul GandhiNo ratings yet

- Gujarat Medical Education and Research Society, "O"-Blok, 4 Floor, Civil Hospital Campus, Opp. Pathikashram, Sector - 12 Gandhinagar-382012Document2 pagesGujarat Medical Education and Research Society, "O"-Blok, 4 Floor, Civil Hospital Campus, Opp. Pathikashram, Sector - 12 Gandhinagar-382012Rutul GandhiNo ratings yet

- ITR-3 Notified Form PDFDocument47 pagesITR-3 Notified Form PDFRutul GandhiNo ratings yet

- ITR-4 Notified Form PDFDocument5 pagesITR-4 Notified Form PDFRutul GandhiNo ratings yet

- NN2914546962898 E-TicketDocument3 pagesNN2914546962898 E-TicketRutul GandhiNo ratings yet

- Check List: For Office Use OnlyDocument1 pageCheck List: For Office Use OnlyRutul GandhiNo ratings yet

- TicketDocument2 pagesTicketRutul GandhiNo ratings yet

- TicketDocument2 pagesTicketRutul GandhiNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Rustom Shams PDFDocument48 pagesRustom Shams PDFmtaha85No ratings yet

- The Joint Force Commander's Guide To Cyberspace Operations: by Brett T. WilliamsDocument8 pagesThe Joint Force Commander's Guide To Cyberspace Operations: by Brett T. Williamsأريزا لويسNo ratings yet

- 3 Manacsa&Tan 2012 Strong Republic SidetrackedDocument41 pages3 Manacsa&Tan 2012 Strong Republic SidetrackedGil Osila JaradalNo ratings yet

- Ch10 Stress in Simple WordsDocument7 pagesCh10 Stress in Simple Wordsmanaar munthirNo ratings yet

- DWDM Route Planning A4 WPDocument3 pagesDWDM Route Planning A4 WPChavara MatekweNo ratings yet

- Surge arrester protects electrical equipmentDocument25 pagesSurge arrester protects electrical equipmentSyed Ahsan Ali Sherazi100% (3)

- Altered Ventilatory Function Assessment at Pamantasan ng CabuyaoDocument27 pagesAltered Ventilatory Function Assessment at Pamantasan ng Cabuyaomirai desuNo ratings yet

- FIL M 216 2nd Yer Panitikan NG PilipinasDocument10 pagesFIL M 216 2nd Yer Panitikan NG PilipinasJunas LopezNo ratings yet

- GMS175CSDocument4 pagesGMS175CScorsini999No ratings yet

- Tugas Bahasa Inggris Analytical Exposition Text: Disusun Oleh: Nama:Hansel Hendrawan Effendy Kelas:XI IPA 1Document4 pagesTugas Bahasa Inggris Analytical Exposition Text: Disusun Oleh: Nama:Hansel Hendrawan Effendy Kelas:XI IPA 1Hansel HendrawanNo ratings yet

- NOV Completion ToolsDocument12 pagesNOV Completion Toolsfffggg777No ratings yet

- IT-02 Residential StatusDocument26 pagesIT-02 Residential StatusAkshat GoyalNo ratings yet

- LESSON 9 Steam Generators 2Document12 pagesLESSON 9 Steam Generators 2Salt PapiNo ratings yet

- Orion C.M. HVAC Case Study-07.25.23Document25 pagesOrion C.M. HVAC Case Study-07.25.23ledmabaya23No ratings yet

- Reporte Corporativo de Louis Dreyfus Company (LDC)Document21 pagesReporte Corporativo de Louis Dreyfus Company (LDC)OjoPúblico Periodismo de InvestigaciónNo ratings yet

- Technical Information System Overview Prosafe-Com 3.00 Prosafe-ComDocument49 pagesTechnical Information System Overview Prosafe-Com 3.00 Prosafe-Comshekoofe danaNo ratings yet

- Mark Wildon - Representation Theory of The Symmetric Group (Lecture Notes) (2015)Document34 pagesMark Wildon - Representation Theory of The Symmetric Group (Lecture Notes) (2015)Satyam Agrahari0% (1)

- Is Iso 2692-1992Document24 pagesIs Iso 2692-1992mwasicNo ratings yet

- Consumer Behavior PP Chapter 4Document36 pagesConsumer Behavior PP Chapter 4tuongvyvyNo ratings yet

- Material Safety Data Sheet Surfacecool© Roof CoatingDocument3 pagesMaterial Safety Data Sheet Surfacecool© Roof CoatingPremfeb27No ratings yet

- 03 Authority To TravelDocument5 pages03 Authority To TravelDiana Marie Vidallon AmanNo ratings yet

- What Is Robotic Process Automation?: ERP SystemDocument5 pagesWhat Is Robotic Process Automation?: ERP SystemAna BoboceaNo ratings yet

- Osda Solar Module - Installation ManualDocument21 pagesOsda Solar Module - Installation ManualIOZEF1No ratings yet

- Inventario de Autoestima de Coopersmith PDFDocument10 pagesInventario de Autoestima de Coopersmith PDFNancy BerduzcoNo ratings yet

- Health Fitness Guide UK 2018 MayDocument100 pagesHealth Fitness Guide UK 2018 MayMitch Yeoh100% (2)

- NST 021 Orientation SASDocument5 pagesNST 021 Orientation SASLady Mae AguilarNo ratings yet

- D41P-6 Kepb002901Document387 pagesD41P-6 Kepb002901LuzioNeto100% (1)

- V14 EngDocument8 pagesV14 EngJamil PavonNo ratings yet

- YlideDocument13 pagesYlidePharaoh talk to youNo ratings yet

- MIZAT PWHT Procedure Ensures Welded Joints Meet StandardsDocument9 pagesMIZAT PWHT Procedure Ensures Welded Joints Meet StandardsM. R. Shahnawaz KhanNo ratings yet