Professional Documents

Culture Documents

Pacific Yatco Digest

Uploaded by

Ven BuenaobraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pacific Yatco Digest

Uploaded by

Ven BuenaobraCopyright:

Available Formats

[46] Pacific Commercial Co. v.

Yatco

(Commission merchant, Commercial broker)

G.R. No. L-45976 July 20, 1939

AVANCEÑA, C.J.:

FACTS: Pacific sold refined sugar for the account of Victorias Milling Co. up to the total amount of

P1,126,135.96, having received by way of commission for this sale the amount of P29,534.29. Victorias

Milling Co. paid to the Collector of Internal Revenue of P16,944.90 as merchant sales tax in its capacity

as manufacturer and owner of the sugar sold. Notwithstanding this payment made by Victorias Milling

Co., the Collector of Internal Revenue also collected from the Pacific Commercial the same tax for the

same amount.There were two ways in which Pacific made the sales of sugar after looking for purchasers

and sending the purchase order to Victoria Milling. The purchases were made for the delivery of the sugar

ex-warehouse and delivery ex-ship. If the sugar was to be delivered ex-ship, all that Pacific did was to

hand over the bill of lading to the purchaser and collect the price. If it was for delivery ex-warehouse, the

sugar is first deposited in the warehouse of Pacific before delivery to the purchaser.The court found that

of the price of sugar sold by Pacific, the amount of P558,550.41 corresponds to sugar sold for delivery ex-

warehouse and that of P567,585.55 corresponds to sugar sold for delivery ex-ship, and considering that in

the first case Pacific acted as a commission merchant, and in the second case a broker, it ordered the

Yatco to return to Pacific the amount collected from it, by way of tax on the sale of sugar to be delivered

ex-ship, and denied the prayer in the complaint for the return of the amount paid for the sales of sugar to

be delivered ex-warehouse.

ISSUE/s:

1. WON Pacific acted as a commission merchant as to the sugar delivered ex- warehouse? -YES

2. WON Pacific acted as a mere commercial broker as to the sugar delivered ex- ship? -YES

RULING: 1. YES. Pacific acted as a commission merchant as to the sugar delivered ex-warehouse. A

commission merchant is one engaged in the purchase or sale for another of

personal property which, for this purpose, is placed in his possession and at his disposal. He maintains a

relation not only with his principal and the purchasers or vendors, but also with the property which is the

subject matter of the transaction. In the present case, the sugar was shipped by Victoria., and upon arrival

at the port of destination, Pacific received and transferred it for deposit in its warehouses until the

purchaser called for it. The deposit of the sugar in the warehouses of Pacific was made upon its own

account and at its own risk until it was sold and taken by the purchaser.

2. YES. Pacific also acted as a mere commercial broker as to the sugar deliver ex-ship. The broker has no

relation with the thing he sells or buys. He is merely an intermediary between the purchaser and the

vendor. He acquires neither the possession nor the custody of the things sold. His only office is to bring

together the parties to the transaction. These circumstances are present in connection with the plaintiff's

sale of the sugar which was delivered to the purchaser's ex-ship. The sugar sold under these conditions

was shipped by the plaintiff at its expense and risk until it reached its destination, where it was later taken

ex-ship by the purchaser. The plaintiff never had possession of the sugar at any time. The circumstance

that the bill of lading was sent to the plaintiff does not alter its character of being merely a broker, or

constitute possession by it of the sugar shipped , inasmuch as the same was sent to it for the sole purpose

of turning it over to the purchaser for the collection of the price. The sugar did not come to its possession

in any sense.

You might also like

- Personal Styling Service-Contract - No WatermarkDocument5 pagesPersonal Styling Service-Contract - No WatermarkLexine Emille100% (1)

- Bulk Solids HandlingDocument303 pagesBulk Solids HandlingDr_M_Soliman100% (12)

- Pacific Commercial Co. v. Yatco, 68 Phil. 1939Document1 pagePacific Commercial Co. v. Yatco, 68 Phil. 1939Kent UgaldeNo ratings yet

- Tecnogas Vs PNB Consent in DacionDocument1 pageTecnogas Vs PNB Consent in DacionVen BuenaobraNo ratings yet

- Quiz 1 Answers Fusionné CompresséDocument161 pagesQuiz 1 Answers Fusionné CompresséSlim Charni100% (1)

- 17 Pacific Commercial Co V YatcoDocument2 pages17 Pacific Commercial Co V YatcoVic RabayaNo ratings yet

- Pacific Commercial v. YatcoDocument1 pagePacific Commercial v. YatcoAices SalvadorNo ratings yet

- Agency 42. Pacific Mommercial Vs YatcoDocument2 pagesAgency 42. Pacific Mommercial Vs YatcoXing Keet LuNo ratings yet

- Agency - Broker - Ferdinand O. BasasDocument1 pageAgency - Broker - Ferdinand O. BasasgongsilogNo ratings yet

- Pacific Commercial Company vs. YatcoDocument1 pagePacific Commercial Company vs. YatcoNorie SapantaNo ratings yet

- Pacific Commercial Company acted as broker for ex-ship sugar salesDocument1 pagePacific Commercial Company acted as broker for ex-ship sugar salesAngelicaNo ratings yet

- Pacific Commercial Vs YatcoDocument1 pagePacific Commercial Vs YatcoPatricia SorianoNo ratings yet

- Pacific Commercial Company vs Yatco Sugar Sales DisputeDocument1 pagePacific Commercial Company vs Yatco Sugar Sales DisputeCris TinaNo ratings yet

- 17-Pacific Commercial Co. v. Yatco, 68 Phil. 1939Document2 pages17-Pacific Commercial Co. v. Yatco, 68 Phil. 1939Rogelio BataclanNo ratings yet

- PACIFIC COMMERCIAL COMPANY, Plaintiff-Appellant, vs. ALFREDO L. YATCO, Defendant-AppelleeDocument5 pagesPACIFIC COMMERCIAL COMPANY, Plaintiff-Appellant, vs. ALFREDO L. YATCO, Defendant-AppelleejaneldeveraturdaNo ratings yet

- Pacific Commercial Co. Vs YatcoDocument5 pagesPacific Commercial Co. Vs YatcoZahraMinaNo ratings yet

- Supreme Court Affirms No Double Taxation in Sugar Sales CaseDocument4 pagesSupreme Court Affirms No Double Taxation in Sugar Sales CaseRhona MarasiganNo ratings yet

- Pacific Commercial Co. v. Yatco, 68 Phil. 398Document8 pagesPacific Commercial Co. v. Yatco, 68 Phil. 398Jamaika Ina CruzNo ratings yet

- American Sugar Refiing Co. v. United States, 181 U.S. 610 (1901)Document4 pagesAmerican Sugar Refiing Co. v. United States, 181 U.S. 610 (1901)Scribd Government DocsNo ratings yet

- Supreme Court: Ramon A. Gonzales For Petitioner. The Government Corporate Counsel For RespondentsDocument7 pagesSupreme Court: Ramon A. Gonzales For Petitioner. The Government Corporate Counsel For RespondentsLizzette GuiuntabNo ratings yet

- Court Rules Bureau of Customs Not Liable for Damages in Customs CaseDocument2 pagesCourt Rules Bureau of Customs Not Liable for Damages in Customs CaseMary Louise Balbuena100% (1)

- Handout ASI 2402 ConsignmentDocument7 pagesHandout ASI 2402 ConsignmentRosda DhangNo ratings yet

- Case Law On Warehouse Receipts LawDocument9 pagesCase Law On Warehouse Receipts LawynnaNo ratings yet

- CIR VS. TOKYO SHIPPING. LTD - G.R. No. L-68252 May 26, 1995Document2 pagesCIR VS. TOKYO SHIPPING. LTD - G.R. No. L-68252 May 26, 1995Rizalnino Noble100% (1)

- Online Digests - Warehouse Receipts LawDocument9 pagesOnline Digests - Warehouse Receipts LawMaria Reylan Garcia100% (2)

- Republic vs. BacolodDocument3 pagesRepublic vs. BacolodJing DalaganNo ratings yet

- Warehouse ReceiptsDocument7 pagesWarehouse ReceiptsJuvial Guevarra BostonNo ratings yet

- The United States, in Error v. Horace Southmayd and Stephen C. Southmayd, 50 U.S. 637 (1850)Document11 pagesThe United States, in Error v. Horace Southmayd and Stephen C. Southmayd, 50 U.S. 637 (1850)Scribd Government DocsNo ratings yet

- Alliance Tobacco Corp. Inc. v. PhilippineDocument6 pagesAlliance Tobacco Corp. Inc. v. PhilippineShiela PilarNo ratings yet

- Petitioner vs. vs. Respondents Clarence J. Villanueva The Government Corporate CounselDocument6 pagesPetitioner vs. vs. Respondents Clarence J. Villanueva The Government Corporate CounselLucio GeorgioNo ratings yet

- Philippines Dept of Agriculture vs Noah's Ark Sugar HoldingsDocument2 pagesPhilippines Dept of Agriculture vs Noah's Ark Sugar HoldingsSean ArcillaNo ratings yet

- 1 BARON v. DAVIDDocument6 pages1 BARON v. DAVIDRaven Claire MalacaNo ratings yet

- Able Sales Co., Inc. v. Compania de Azucar, 406 F.3d 56, 1st Cir. (2005)Document12 pagesAble Sales Co., Inc. v. Compania de Azucar, 406 F.3d 56, 1st Cir. (2005)Scribd Government DocsNo ratings yet

- State Immunity from Suit in Customs CaseDocument1 pageState Immunity from Suit in Customs CaseKrishielle AnneNo ratings yet

- Baron V DavidDocument9 pagesBaron V Davidpa0l0sNo ratings yet

- Agency Cases For Sep.10,'22Document30 pagesAgency Cases For Sep.10,'22FuxgdNo ratings yet

- Victorias Milling Vs CADocument12 pagesVictorias Milling Vs CAPierro Niccolo RamosNo ratings yet

- Philippines Supreme Court rules on palay sales disputeDocument4 pagesPhilippines Supreme Court rules on palay sales disputevanessa3333333No ratings yet

- Martinez vs. Philippine National Bank, G.R. No. L-4080, 21 September 1953Document1 pageMartinez vs. Philippine National Bank, G.R. No. L-4080, 21 September 1953Bibi Jumpol100% (1)

- G.R. No. 117356. June 19, 2000Document8 pagesG.R. No. 117356. June 19, 2000Eli JahNo ratings yet

- Carrier liability limited to declared value in bill of ladingDocument1 pageCarrier liability limited to declared value in bill of ladingJolynne Anne GaticaNo ratings yet

- Benedicto v. LacsonDocument2 pagesBenedicto v. LacsonSarah RiveraNo ratings yet

- CIR V Tokyo ShippingDocument2 pagesCIR V Tokyo ShippingJerico GodoyNo ratings yet

- Victorias Milling V CA G.R. No. 117356Document7 pagesVictorias Milling V CA G.R. No. 117356Friendship GoalNo ratings yet

- SPCL Case DigestDocument7 pagesSPCL Case DigestlawYearNo ratings yet

- Citadel Lines Vs CA DigestDocument1 pageCitadel Lines Vs CA DigestVincent Jan TudayanNo ratings yet

- Albaladejo y Cia v. Phil. RefiningDocument10 pagesAlbaladejo y Cia v. Phil. RefiningElle MichNo ratings yet

- Facts:: MACAM vs. COURT OF APPEALS GR No. 125524 August 25, 1999Document27 pagesFacts:: MACAM vs. COURT OF APPEALS GR No. 125524 August 25, 1999PeperoniiNo ratings yet

- Vegetable Oil Corp. V Trinidad, G.R. No. 21475, March 26, 1924, 45 Phil. 822Document2 pagesVegetable Oil Corp. V Trinidad, G.R. No. 21475, March 26, 1924, 45 Phil. 822Maria Fiona Duran MerquitaNo ratings yet

- Importing, Exporting and CountertradeDocument2 pagesImporting, Exporting and Countertradeathena leila bordanNo ratings yet

- Coca Cola Export v. CIRDocument1 pageCoca Cola Export v. CIRJack JacintoNo ratings yet

- Agriex Co. LTD v. VillanuevaDocument2 pagesAgriex Co. LTD v. VillanuevaannedefrancoNo ratings yet

- VICTORIAS MILLING CO. vs. COURT OF APPEALSDocument8 pagesVICTORIAS MILLING CO. vs. COURT OF APPEALSBryanNavarroNo ratings yet

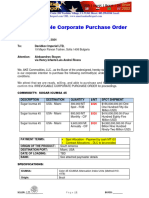

- ICPO AKE DAVIDKOV USSUGAR 010524 Spot-ContDocument6 pagesICPO AKE DAVIDKOV USSUGAR 010524 Spot-Contmarspublicidadymarketing360No ratings yet

- Ocejo v. International Banking Ownership TransferDocument2 pagesOcejo v. International Banking Ownership TransferAmber AncaNo ratings yet

- New Zealand TranspoDocument2 pagesNew Zealand TranspoAyenGaileNo ratings yet

- Albaladejo y CIA v. Phil. Refining CoDocument11 pagesAlbaladejo y CIA v. Phil. Refining CoylessinNo ratings yet

- Victorias Milling V CA - GR 117356 - 333 SCRA 663Document8 pagesVictorias Milling V CA - GR 117356 - 333 SCRA 663Jeremiah ReynaldoNo ratings yet

- G.R. No. 117356 June 19, 2000 VICTORIAS MILLING CO., INC., Petitioner, Court of Appeals and Consolidated Sugar Corporation, RespondentsDocument6 pagesG.R. No. 117356 June 19, 2000 VICTORIAS MILLING CO., INC., Petitioner, Court of Appeals and Consolidated Sugar Corporation, RespondentsHBNo ratings yet

- Tax Midterm CasesDocument33 pagesTax Midterm CasesCassey Koi FarmNo ratings yet

- HSBC v Aldanese surety liabilityDocument1 pageHSBC v Aldanese surety liabilityLouie RaotraotNo ratings yet

- FCO Full Corporate Offer for 500kg Gold Dore Bars from Burkina FasoDocument2 pagesFCO Full Corporate Offer for 500kg Gold Dore Bars from Burkina FasoGrigory Vladimirovich TishkinNo ratings yet

- Dacion en Pago Ruling No Transfer Ownership BusesDocument1 pageDacion en Pago Ruling No Transfer Ownership BusesVen BuenaobraNo ratings yet

- Sss Vs Atlantic Gulf. Gab Digest Dacion e PagoDocument2 pagesSss Vs Atlantic Gulf. Gab Digest Dacion e PagoVen Buenaobra0% (1)

- Victoria Milling Vs CaDocument1 pageVictoria Milling Vs CaVen BuenaobraNo ratings yet

- Equatorial Vs MayfairDocument22 pagesEquatorial Vs MayfairVen BuenaobraNo ratings yet

- Engineering and Machinery Corp Vs CA and AlmedaDocument2 pagesEngineering and Machinery Corp Vs CA and AlmedaVen BuenaobraNo ratings yet

- Vda de Jayme Vs CADocument2 pagesVda de Jayme Vs CAVen Buenaobra100% (2)

- Lo Vs KJS Dacion en Pago. Existing CreditDocument1 pageLo Vs KJS Dacion en Pago. Existing CreditVen BuenaobraNo ratings yet

- Austria Vs ReyesDocument2 pagesAustria Vs ReyesVen BuenaobraNo ratings yet

- G.R. No. 213027 Marcos Vs Republic Sereno, Cj.Document8 pagesG.R. No. 213027 Marcos Vs Republic Sereno, Cj.Ven BuenaobraNo ratings yet

- Baritua vs CA (Shares in Intestate SuccessionDocument2 pagesBaritua vs CA (Shares in Intestate SuccessionVen BuenaobraNo ratings yet

- First Global Realy and Dev Vs San AgustinDocument2 pagesFirst Global Realy and Dev Vs San AgustinVen BuenaobraNo ratings yet

- Del Monte Vs Aragones Contract of Piece of OwrkDocument2 pagesDel Monte Vs Aragones Contract of Piece of OwrkVen BuenaobraNo ratings yet

- PNB Vs Pineda Dacion No Transfer of OwnershipDocument1 pagePNB Vs Pineda Dacion No Transfer of OwnershipVen BuenaobraNo ratings yet

- Lo Vs KJS Dacion en Pago. Existing CreditDocument1 pageLo Vs KJS Dacion en Pago. Existing CreditVen BuenaobraNo ratings yet

- Sss Vs Atlantic Gulf. Gab Digest Dacion e PagoDocument2 pagesSss Vs Atlantic Gulf. Gab Digest Dacion e PagoVen Buenaobra0% (1)

- Umali Vs ComelecDocument14 pagesUmali Vs Comelecjo123No ratings yet

- Yuson Vs Atty Vitan Dacion en PagsDocument2 pagesYuson Vs Atty Vitan Dacion en PagsVen BuenaobraNo ratings yet

- Republic Vs PalawanDocument69 pagesRepublic Vs PalawanVen BuenaobraNo ratings yet

- AarDocument2 pagesAarkomar agusNo ratings yet

- Un Authorised Sites Regularisation Within Sept 2009Document2 pagesUn Authorised Sites Regularisation Within Sept 2009Sridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್No ratings yet

- Presentation On Tutorial Question On Promissory EstoppelDocument13 pagesPresentation On Tutorial Question On Promissory EstoppelNaqeeb NexerNo ratings yet

- Port Er's Nat Iona L Dia Mon D Co Mpe Titiv Ea Dva Ntag Eof Natio NS'Document45 pagesPort Er's Nat Iona L Dia Mon D Co Mpe Titiv Ea Dva Ntag Eof Natio NS'Soha KhanNo ratings yet

- Checklist For T&C of Chemical Fire Suppression SystemDocument2 pagesChecklist For T&C of Chemical Fire Suppression Systembeho2000No ratings yet

- TUTO 4 PU Sol PDFDocument21 pagesTUTO 4 PU Sol PDFVievie Le BluewberrietrufflesNo ratings yet

- How To Install Blue PrismDocument2 pagesHow To Install Blue PrismRanjith NarayanNo ratings yet

- Installation Instruction: Q/fit Piping On Base MachineDocument11 pagesInstallation Instruction: Q/fit Piping On Base MachineJULY VIVIANA HUESO VEGANo ratings yet

- 3 Kinds of de Facto Government:: CharacteristicsDocument10 pages3 Kinds of de Facto Government:: CharacteristicsAbigael SeverinoNo ratings yet

- Equipment Sheet: Cable Laying VesselDocument2 pagesEquipment Sheet: Cable Laying Vesselsitu brestNo ratings yet

- SSRN Id983401Document43 pagesSSRN Id983401LeilaNo ratings yet

- CV (Muhammad Irfan Khan)Document3 pagesCV (Muhammad Irfan Khan)Niazi_sabNo ratings yet

- Navigating The Digital Age PDFDocument369 pagesNavigating The Digital Age PDFSteve GilsonNo ratings yet

- Discharging A ClientDocument6 pagesDischarging A ClientNorman Batalla Juruena, DHCM, PhD, RNNo ratings yet

- Conduct CardsDocument9 pagesConduct Cardsapi-248309459No ratings yet

- PRINCIPLES OF MANAGEMENT Model Questions - ADocument4 pagesPRINCIPLES OF MANAGEMENT Model Questions - ALionel MintsaNo ratings yet

- Kalokal Barangay Highway HillsDocument35 pagesKalokal Barangay Highway HillsDixie MirandaNo ratings yet

- Automatic Transfer Switch (ATS) : I. History and BackgroundDocument3 pagesAutomatic Transfer Switch (ATS) : I. History and BackgroundJon Lorde BolivarNo ratings yet

- The Role of Molecular Testing in The Differential Diagnosis of Salivary Gland CarcinomasDocument17 pagesThe Role of Molecular Testing in The Differential Diagnosis of Salivary Gland CarcinomasMariela Judith UCNo ratings yet

- OT Lawsuit CPDDocument20 pagesOT Lawsuit CPDDan LehrNo ratings yet

- The 2012 FedEx Ketchum Social Business StudyDocument40 pagesThe 2012 FedEx Ketchum Social Business StudyEric PrenenNo ratings yet

- Data Protection Act (DPA)Document14 pagesData Protection Act (DPA)Crypto SavageNo ratings yet

- C-TECC Principles Guide TECC EducationDocument4 pagesC-TECC Principles Guide TECC EducationDavid Sepulveda MirandaNo ratings yet

- Wiz107sr User Manual en v1.0Document29 pagesWiz107sr User Manual en v1.0Pauli Correa ArriagadaNo ratings yet

- NHBC Standards 2011 Bre SD 1 SRCDocument5 pagesNHBC Standards 2011 Bre SD 1 SRCSuresh RaoNo ratings yet

- Appendix 2 Overview On HRM Defintions Contribution and Avenues For Future ResearchDocument6 pagesAppendix 2 Overview On HRM Defintions Contribution and Avenues For Future ResearchBarun Kumar SinghNo ratings yet

- The Sssessential List of Microsoft Outlook Keyboard ShortcutsDocument3 pagesThe Sssessential List of Microsoft Outlook Keyboard Shortcutsabidaliabid1No ratings yet