Professional Documents

Culture Documents

I. Audit Program On Fund Sourcing For COVID-19 Plans, Programs and Activities

Uploaded by

Kathleen Hare AbsinOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

I. Audit Program On Fund Sourcing For COVID-19 Plans, Programs and Activities

Uploaded by

Kathleen Hare AbsinCopyright:

Available Formats

Republic of the Philippines

COMMISSION ON AUDIT

Regional Office No. XI

OFFICE OF THE REGIONAL DIRECTOR

C.P. Garcia Highway, Buhangin Davao City

Tel. No. (082) 241-2948

I. Audit Program on Fund Sourcing for COVID-19

Plans, Programs and Activities

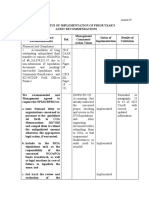

Audit Objectives Audit Procedures Criteria

A. To determine whether

there is an effective finance

planning, such as a well-

crafted Investment

Program, for DRRM and

COVID-19-related PPAs

that helps provide adequate

funding for DRR and

COVID-19-related

activities and ensures

availability of funds for

efficient disaster response

and management taking

into account the following:

a. Inclusion of all 1. Gather the following plans/ a. NDRRMC DBM and

COVID-19-related programs/ documents: DILG Joint

PPAs in the approved ➢ Annual Investment Memorandum

Annual Investment Program Circular No. 2013-1

Program/ ➢ Supplemental Investment

Supplemental Program Section 3 of

Investment Program ➢ Appropriation Ordinances Proclamation No. 929

and are funded in the ➢ Annual Budget s. 2020

Annual Budget/ ➢ Supplemental Budget

Supplemental Budget ➢ Minutes of the Local DBM Local Budget

Development Council Circular No. 124

(LDC) Meetings dated March 26, 2020

➢ LDC Resolutions

2. From the approved Annual DILG-DBM Joint

Investment Program (AIP) Memorandum

and Supplemental Investment Circular No. 2 dated

Program, identify and extract March 30, 2020

all COVID-19-related PPAs

and its corresponding

resource requirements.

3. Check if all identified

COVID-19-related PPAs in

the AIP were funded in the

approved

Annual/Supplemental Budget

of the LGU concerned. Take

note of any deficiency.

4. Compare the list of all

COVID-19 related PPAs with

those PPAs funded under the

annual/ supplemental

Republic of the Philippines

COMMISSION ON AUDIT

Regional Office No. XI

OFFICE OF THE REGIONAL DIRECTOR

C.P. Garcia Highway, Buhangin Davao City

Tel. No. (082) 241-2948

Audit Objectives Audit Procedures Criteria

budgets. Take note of any

deficiency.

5. Also, assess whether the

COVID-19-related PPAs

address the disaster response

requirement for COVID-19

emergency.

6. Verify if the proposed

projects were supported with

LDC Resolutions and

Minutes of Meetings of the

LDC. Take note of any

deficiency.

7. For those PPAs funded from

LDRRMF:

• Extract all COVID-19-

related PPAs from the

approved Annual

Investment Plan (AIP)

and Supplemental

Investment Plan those

funded from LDRRMF.

• Compare the above data

to the approved

LDRRMF Investment

Plan (LDRRMFIP) and

its revision, if any. Take

note of any deficiency.

• Identify the specific

LDRRM fund source of

these PPAs, whether

funded by the current

appropriation (including

the 30% QRF),

continuing appropriation

and previous years’

unexpended QRF and

DRRMF-MOOE. (Note:

PYs unexpended QRF

and DRRMF-MOOE

should be included in the

LDRRMFIP)

• For the PPAs funded out

of the current

appropriation, identify

whether these PPAs were

included in the approved

Annual/Supplemental

Republic of the Philippines

COMMISSION ON AUDIT

Regional Office No. XI

OFFICE OF THE REGIONAL DIRECTOR

C.P. Garcia Highway, Buhangin Davao City

Tel. No. (082) 241-2948

Audit Objectives Audit Procedures Criteria

Budgets. Check if these

budgets are supported

with Appropriation

Ordinances. Take note of

any deficiency.

• For PPAs funded out of

PYs unexpended

LDRRM fund, identify

whether these are

included in the approved

supplemental budget and

is supported with

appropriation ordinance.

Take note of any

deficiency.

8. Conduct inquiry/ interview

with the appropriate

management personnel for

the deficiencies observed and

validate the same.

9. Document results in the audit

working paper/s and take

note of deficiencies.

10. Prepare and issue Audit

Observation Memorandum

(AOM) for any deficiencies

noted.

b. Revised LDRRMFP, 1. Gather the following plans/ b. COA Circular No.

as incorporated in programs/ documents: 2012-002 dated

AIP, allocated and ➢ Local Disaster Risk September 12, 2012

presented for the year Reduction and

the: (1) lump-sum Management Plan COA Memorandum

allocation for Quick (LDRRMP) No. 2014-009 dated

Response Fund (2) ➢ Minutes of the LDRRMC August 28, 2014

allocation for disaster Meetings

prevention and ➢ LDRRMC Resolutions DBM Local Budget

mitigation, 2. With the inclusion of all Circular No. 124

preparedness, COVID-19-related PPAs in dated March 26, 2020

response, the recently issued Circulars,

rehabilitation and determine whether the DILG DBM Joint

recovery and (3) The LDRRMP was revised to Memorandum

list of projects and consider current Circular No. 02 dated

activities charged to vulnerabilities. March 30, 2020

the unexpended 3. From the LDRRMP, identify

LDRRMF of previous and prepare a list of all the

years be included the COVID-19 related PPAs

under a separate and check whether these were

caption. incorporated in the approved

Republic of the Philippines

COMMISSION ON AUDIT

Regional Office No. XI

OFFICE OF THE REGIONAL DIRECTOR

C.P. Garcia Highway, Buhangin Davao City

Tel. No. (082) 241-2948

Audit Objectives Audit Procedures Criteria

AIP and Supplemental AIP.

Take note of any deficiency.

4. Review and evaluate the

updated or revised

LDRRMFP, as incorporated

in the approved supplemental

AIP and its covering

Resolutions, considering that

LGUs are authorized to

utilize LDRRMF beyond the

30% QRF during the

existence of the state of

national emergency due to

COVID-19.

5. From the List of PPAs

prepared as identified from

the LDRRMP prepared by

the agency, verify those

PPAs that are funded by the

current appropriation,

continuing appropriation and

previous years’ unexpended

QRF and DRRMF-MOOE

6. Compare the programs

outlined in the LDRRMP

with the National DRRM

Plan if they are aligned. Take

note of updates in NDRRM

Plan, if any.

7. Assess the PPAs charged

against the LDRRMF if it

addresses the disaster

response requirements of

COVID-19 emergency. Take

note of any deficiency.

8. Check whether the

LDRRMO furnished the

Office of the Civil Defense

and DILG-LGOO with

copies of the LDRRMFP.

9. Conduct inquiry/ interview

with the appropriate

management personnel for

the deficiencies observed and

validate the same.

11. Document results in the audit

working paper and take note

of deficiencies.

Republic of the Philippines

COMMISSION ON AUDIT

Regional Office No. XI

OFFICE OF THE REGIONAL DIRECTOR

C.P. Garcia Highway, Buhangin Davao City

Tel. No. (082) 241-2948

Audit Objectives Audit Procedures Criteria

12. Prepare and issue Audit

Observation Memorandum

(AOM) for any deficiencies

noted.

Republic of the Philippines

COMMISSION ON AUDIT

Regional Office No. XI

OFFICE OF THE REGIONAL DIRECTOR

C.P. Garcia Highway, Buhangin Davao City

Tel. No. (082) 241-2948

I. Audit Program on Fund Sourcing for COVID-19

Plans, Programs and Activities

Audit Objectives Audit Procedures Criteria

B. To determine

whether appropriate

and adequate

financial support was

provided to

implement the

COVID-19 Plans,

Programs and

Activities

considering the

following guidelines:

a. Use of 20% 1. Obtain the following plans/ programs/ a. Budget

Development documents: Operations

Fund for ➢ PDP and PIP for CY 2017 – 2022 Manual for

COVID-19- (downloadable from NEDA website) Local

related expenses ➢ Local Development Plan (LDP) Government

including the ➢ Annual Investment Program (AIP) Units- 2016

continuing ➢ Supplemental AIP for COVID 19 PPAs Edition

appropriations ➢ Minutes of the Local Development

from previous Council's (LDCs) Meetings DBM Local

years’ ➢ LDC Resolutions Budget

2. Determine the amount of the mandatory 20% Circular No.

Development Fund from the estimated/ 124 dated

budgeted share from the Internal Revenue March 26,

Allotment (IRA), as reflected in the Statement 2020

of Receipts as presented in the

Annual/Supplemental Budgets. Then, compare DILG DBM

the computed amount with the total amount of Joint

20% development projects funded under the Memorandum

Annual/ Supplemental Budgets. Take note of Circular No.

any deficiency. 01 dated

3. From the approved Annual Investment March 27,

Program (AIP), identify and extract all 2020

COVID-19-related PPAs and its corresponding

resource requirements. In case the COVID-19-

related expenses are not among those included Section 321 of

in the approved AIP, the local development the Local

council shall prepare a supplemental Government

investment program for the purpose, approved Code

by the local sanggunian.

4. Check if all identified COVID-19-related Section 323 of

PPAs in the AIP were funded in the approved the Local

Annual/Supplemental Budget of the LGU Government

concerned. Take note of any deficiency. Code.

5. In the event that the LGUs opt to realign their

Republic of the Philippines

COMMISSION ON AUDIT

Regional Office No. XI

OFFICE OF THE REGIONAL DIRECTOR

C.P. Garcia Highway, Buhangin Davao City

Tel. No. (082) 241-2948

Audit Objectives Audit Procedures Criteria

existing PPAs under the 20% DF, including Article 417 of

the continuing appropriations from previous its IRR of the

years’ 20% DF for COVID-19-related Local

expenses, determine whether changes in their Government

respective annual budgets were through the Code.

following:

a. Changes in annual budgets through Section 336 of

supplemental budgets in accordance with the Local

Section 321 of the Code and Article 417 Government

of its IRR, as amended by AO No. 47, s. Code and

1993:

a.1 Determine the funding source/s of the Article 454

agency by gathering and analyzing the (b) of its IRR

following documents under each of the Local

circumstances: Government

(a) Funds actually available: Code.

✓ Certified Statement of

Additional Realized Income

by the Local Treasurer and

Local Accountant

✓ Certification of Savings

certified by the Local

Treasurer and Local

Accountant

(b) New revenue measure/s:

✓ Certified Statement of Income

from New Revenue Measure/s

✓ Copy of duly enacted

ordinance which impose new

local taxes, charges, fees,

fines, or penalties or which

raises existing local taxes,

charges, fees, fines and

penalties signed by the Local

Treasurer and Local

Accountant.

✓ Copy of official

communication stating that

the LGU is a recipient of new

or higher remittances,

contributions, subsidies or

grants in aid from the

National Government or from

government corporations and

private entities signed by the

Local Treasurer and Local

Accountant

(c) In times of Natural Calamity

Republic of the Philippines

COMMISSION ON AUDIT

Regional Office No. XI

OFFICE OF THE REGIONAL DIRECTOR

C.P. Garcia Highway, Buhangin Davao City

Tel. No. (082) 241-2948

Audit Objectives Audit Procedures Criteria

✓ Certificate of Source of Funds

Available for Appropriations

as certified under oath jointly

by the Local Treasurer and

Local Accountant and attested

to by the LCE.

✓ The Appropriation Ordinance

shall clearly indicate the

sources of funds available, the

items of appropriations

affected; and the reasons for

the change.

a.2 In addition, check if the following

documents with the required

signatories were submitted together

with the Appropriation Ordinance:

✓ Supplemental AIP, if any, signed

by the Local Planning and

Development Officer, Local

Budget Officer and Local Chief

Executive

✓ Sanggunian Resolution approving

the Supplemental AIP signed by

the Secretary to the Local

Sanggunian and Presiding Officer

✓ Veto message, if any, signed by

the Local Chief Executive and

✓ Sanggunian’s action on veto, if

any, signed by the Secretary to the

Local Sanggunian and Presiding

Officer

a.3 Conduct inquiry/ interview with the

appropriate management personnel

regarding the reasons for the

deficiencies observed.

b. Use of savings and augmentation in

accordance with Section 336 of the Local

Government Code and Article 454 (b) of

its IRR:

b.1 Check if the LCE or the Presiding

Officer of the Sanggunian concerned

is authorized by ordinance (enacted by

Sanggunian) to use savings and

augment items in the approved

Annual Budget.

b.2 Assess whether the authority granted

covers the augmentation of any item

in the approved Annual Budget, which

Republic of the Philippines

COMMISSION ON AUDIT

Regional Office No. XI

OFFICE OF THE REGIONAL DIRECTOR

C.P. Garcia Highway, Buhangin Davao City

Tel. No. (082) 241-2948

Audit Objectives Audit Procedures Criteria

upon implementation or subsequent

evaluation of needed resources is

determined to be deficient.

b.3 Check whether the amount to augment

the deficient item of appropriation is

sourced from savings. In Article

454(b)(1) of the IRR of the Local

Government Code defines savings as

referring to portions or balances of

any programmed appropriation free

from any obligation or encumbrance,

still available after the satisfactory

completion or the unavoidable

discontinuance or abandonment of the

work, activity or purpose for which

the appropriation is authorized, or

arising from unpaid compensation and

related costs pertaining to vacant

positions and leaves of absences

without pay.

b.4 Conduct inquiry/ interview with the

appropriate management personnel

regarding the reasons for the

deficiencies observed.

6. Evaluate whether COVID-19-related PPAs

and expenses are among the allowable

expenses to be charged against the 20% DF as

provided under DILG-DBM JMC No. 1 dated

March 27, 2020.

7. Document results in the audit working paper

and take note of deficiencies.

8. Prepare and issue Audit Observation

Memorandum (AOM) for any deficiencies

noted.

b. Realignment 1. Secure a copy of the Annual Budget/ Section 8(b) and

and Supplemental Budget of the barangay and 20(c) of the IRR of

augmentation of determine the budget allocated for SK Fund RA No. 10742

SK budgets to in accordance with the adopted Annual

provide funds Barangay Youth Investment Program Sec 336 of

for PPAs related (ABYIP) together with the covering SK RA 7160

to COVID-19 Resolution.

2. If there are changes in the SK fund done Article 454

through Supplemental Budget/s, assess the (b) of IRR of

following conditions and requirements: Local

i. When supported by funds actually Government

available as certified by the SK Code

treasurer; and

Republic of the Philippines

COMMISSION ON AUDIT

Regional Office No. XI

OFFICE OF THE REGIONAL DIRECTOR

C.P. Garcia Highway, Buhangin Davao City

Tel. No. (082) 241-2948

Audit Objectives Audit Procedures Criteria

ii. If covered by new resources. COA Circular

3. Anent the use of savings to augment any item No. 2020-003

in the approved AB, determine if the dated January

following conditions and requirements were 28, 2020

observed by the SKs:

➢ The SK chairperson is authorized to use DILG

savings and augment items in the Memorandum

approved AB through a resolution passed Circular

by the SK (Note: the authority is in a 2020-074

form of resolution since the SK does not dated April

have the legislative power to enact an 14, 2020

ordinance)

➢ The authority granted to the SK

chairperson covers the augmentation of

any item in the approved AB, which

upon implementation or subsequent

evaluation of needed resources is

determined to be deficient pursuant to

Article 454 (b)(2) of the IRR of RA 7160

➢ The amount to augment the deficient item

of the budget must be sourced from

savings

➢ The item/s of budget to be augmented and

that from which the savings will be

derived are within the same expense class

in the approved AB of the SK

4. If the SKs opt to realign and augment their

respective budgets to provide necessary funds

for COVID-19, assess whether the PPAs were

related and aligned to COVID-19 measures

and in accordance with the adopted ABYIP.

5. Conduct inquiry/ interview with the

appropriate management personnel regarding

the reasons for the deficiencies observed.

6. Document results in the audit working paper

and take note of deficiencies.

7. Prepare and issue Audit Observation

Memorandum (AOM) for any deficiencies

noted.

c. Use of Peace 1. Secure a copy of the resolution creating the b. DILG

and Order POC of the province/city/municipality. Memorandum

Council funds 2. Verify if there is a Local Task Force Against Circular No.

for COVID-19- COVID-19 created by the agency for the 2020-079 dated

related PPSAs purpose of addressing the COVID-19 issues May 01, 2020

and concerns. Secure a copy of the POC

Resolution constituting the Task Force. DILG

3. Secure copies of the proposals made by the Memorandum

Task Force for inclusion in the Peace and Circular No.

Republic of the Philippines

COMMISSION ON AUDIT

Regional Office No. XI

OFFICE OF THE REGIONAL DIRECTOR

C.P. Garcia Highway, Buhangin Davao City

Tel. No. (082) 241-2948

Audit Objectives Audit Procedures Criteria

Order and Public Safety (POPS) plan of the 2019-143 dated

agency. Prepare a list of the programs, August 27,

projects, services, and activities (PPSAs) 2019 (Re:

proposed. Omnibus

4. Check whether there is a POC Resolution Guidelines for

passed which contained guidelines on the Peace and

realignment of funds for COVID-19 related Order

PPSAs. Councils)

5. From the prepared List of PPSAs proposed by

the Task Force, verify if these were

incorporated in the POPS plan and

appropriately funded in the

annual/supplemental budget.

6. Conduct inquiry/ interview with the

appropriate management personnel regarding

the reasons for the deficiencies observed.

7. Document results in the audit working paper

and take note of deficiencies.

8. Prepare and issue Audit Observation

Memorandum (AOM) for any deficiencies

noted.

d. Creation of a 1. Confirm the released allocations for the c. DBM Local

Special Account beneficiary Provinces through the Notice of Budget

in the General Advices to Debit Account issued by the BTr. Circular No.

Fund for 126 dated April

Bayanihan 2. Determine if the special account in the General 13, 2020

Grant equivalent Fund (SAGF) for the BGP was created

to the one half through the following: DILG-DBM

(1/2) of the one- a. An ordinance by the provincial sanggunian JMC No. 2

month FY 2020 b. Done by the provincial sanggunian dated March

IRA share for through inclusion in the pertinent 30, 2020

Provinces appropriation ordinance authorizing a

supplemental budget covering the BGP. Section 313 of

RA 7160

3. Determine whether the LDC prepared a

supplemental investment program for the

purpose, approved by the local sanggunian.

4. Based on the Supplemental Investment

Program, identify and prepare a list of the

COVID-19 related PPAs. Check if the

proposed PPAs were supported with LDC

Resolutions and Minutes of Meetings of the

LDC. Take note of any deficiency.

5. Assess whether the said PPAs in the

Supplemental Investment Program are in

relation/connection to the operation of

Republic of the Philippines

COMMISSION ON AUDIT

Regional Office No. XI

OFFICE OF THE REGIONAL DIRECTOR

C.P. Garcia Highway, Buhangin Davao City

Tel. No. (082) 241-2948

Audit Objectives Audit Procedures Criteria

provincial, district and other local hospitals

operated by the provincial government and

maintenance of duly established provincial

checkpoints related to COVID-19. Evaluate

whether these COVID-19-related PPAs and

expenses are among the allowable expenses to

be charged against the Bayanihan Grant in

accordance with LBC No. 126 dated April 13,

2020. Take note of any deficiency.

6. Also, check if the proposed projects were

supported with LDC Resolutions and Minutes

of Meetings of the LDC. Take note of any

deficiency.

7. Conduct inquiry/ interview with the

appropriate management personnel regarding

the reasons for the deficiencies observed.

8. Document results in the audit working paper

and take note of deficiencies.

9. Prepare and issue Audit Observation

Memorandum (AOM) for any deficiencies

noted.

e. Creation of a 1. Confirm the released allocations for the e. DBM Local

Special Account beneficiary Provinces through the Notice of Budget

in the General Advices to Debit Account issued by the BTr. Circular No.

Fund for 125 dated April

Bayanihan 2. Determine if the special account in the General 07, 2020

Grant equivalent Fund (SAGF) for the BGCM was created

to the one- through the following: DILG-DBM

month FY 2020 a. An ordinance by the local sanggunian JMC No. 2

IRA share for b. Done by the local sanggunian through dated March

Cities and inclusion in the pertinent appropriation 30, 2020

Municipalities. ordinance authorizing a supplemental

budget covering the BGP. Section 313 of

RA 7160

3. Determine whether the LDC prepared a

supplemental investment program for the

purpose, approved by the local sanggunian.

4. Based on the Supplemental Investment

Program, identify and prepare a list of the

COVID-19 related PPAs. Check if the

proposed PPAs were supported with LDC

Resolutions and Minutes of Meetings of the

LDC. Take note of any deficiency.

Republic of the Philippines

COMMISSION ON AUDIT

Regional Office No. XI

OFFICE OF THE REGIONAL DIRECTOR

C.P. Garcia Highway, Buhangin Davao City

Tel. No. (082) 241-2948

Audit Objectives Audit Procedures Criteria

5. Assess whether the said PPAs in the

Supplemental Investment Program are in

relation/connection to enhancing the capacities

of the cities/municipalities in immediately

responding to the COVID-19 emergency.

Evaluate whether these COVID-19-related

PPAs and expenses are among the allowable

expenses to be charged against the Bayanihan

Grant in accordance with LBC No. 125 dated

April 13, 2020. Take note of any deficiency.

6. Also, check if the proposed projects were

supported with LDC Resolutions and Minutes

of Meetings of the LDC. Take note of any

deficiency.

7. Conduct inquiry/ interview with the

appropriate management personnel regarding

the reasons for the deficiencies observed.

8. Document results in the audit working paper

and take note of deficiencies.

9. Prepare and issue Audit Observation

Memorandum (AOM) for any deficiencies

noted.

f. Funds received 1. Determine if said funds were treated as a special f. COA Circular

from other trust liability account in the Trust Fund books. No. 2012-002

LGUs and other dated

sources 2. Secure a copy of MOA, if any. September 12,

2012

3. Conduct inquiry/ interview with the appropriate

management personnel regarding the reasons

for the deficiencies observed.

4. Document results in the audit working paper

and take note of deficiencies.

5. Prepare and issue Audit Observation

Memorandum (AOM) for any deficiencies

noted.

Republic of the Philippines

COMMISSION ON AUDIT

Regional Office No. XI

OFFICE OF THE REGIONAL DIRECTOR

C.P. Garcia Highway, Buhangin Davao City

Tel. No. (082) 241-2948

I. Audit Program on Fund Sourcing for COVID-19

Plans, Programs and Activities

Audit Objectives Audit Procedures Criteria

C. To determine 1. In case of cash donations received from foreign • COA Circular

whether cash and or local sources, check/ verify/ confirm whether: No. 2012-002

in-kind a. The LCE is duly authorized by the dated

aids/donations sanggunian in a resolution to accept cash September 12,

from local or donations from local or foreign sources. 2012

foreign sources, b. Receipt of the funds is acknowledged

if any, were

through the issuance of Official Receipt and • COA Circular

properly No. 2014-002

deposited with the AGDB. For NGAs, a

received, date April 15,

recorded and separate bank account is maintained for

2014

accounted in disaster funds while for LGUs, the receipts

accordance with are deposited to their Trust Fund bank

the guidelines account.

prescribed under ➢ For cash donations: • COA

COA Circular • Donations through electronic receipts Memorandum

No. 2012-002 or records as proof of receipt, in lieu No. 2014-009

dated September of traditional official receipts, is dated August

12, 2012, COA compliant with the requirements 28, 2014

Circular No. provided that the electronic tracking

2014-002 dated • COA Circular

platform can provide a minimum

April 15, 2014, No. 2020-009

COA data content to reflect the transaction dated April 21,

Memorandum such as but not limited to the 2020

No. 2014-009 following: (i) date of receipt of the

dated August 28, donation; (ii) name of the donor; (iii)

2014 and COA nature of donation; (iv) amount or

Circular No. volume of the donation; (v) the

2020-009 dated reference number, if applicable, and

April 21, 2020 (vi) specific purpose of donation.

• If made directly to recipient agency’s

bank account, the credit memo or

bank statement shall serve as proof

of receipt.

• Transferred electronically to an

electronic wallet (e.g. Landbank

IAccess, Gcash, Peso Net, Insta Pay),

the transaction reference will be the

basis of proof and recording.

➢ For foreign currency cash donations, the

amount is converted to local currency

using the current exchange rate at the

date of receipt

➢ The amount directly deposited by the

Republic of the Philippines

COMMISSION ON AUDIT

Regional Office No. XI

OFFICE OF THE REGIONAL DIRECTOR

C.P. Garcia Highway, Buhangin Davao City

Tel. No. (082) 241-2948

Audit Objectives Audit Procedures Criteria

donor to the agency bank account shall

be taken up in the books by the

Accounting Unit based on the bank credit

memo.

c. There are copies of MOA or other agreement

with the donors, if any. Review the MOA and

check whether the agreements were properly

carried out. Take note of any deficiencies.

d. Entered in Cash Receipts Record or

Cashbook by the designated Collecting

Officer.

e. Separate Report of Collections and Deposits

(RCD) for shall be prepared daily by the

designated Collecting Officer and submitted

to the Accounting Unit for recording in the

Cash Receipts Journal (CRJ) as Trust

Liabilities.

f. The Budget Unit shall be furnished copies of

the RCD, JEV and credit memo as bases in

the preparation of the Registry of Cash

Donations and Utilization (RCDU). The

RCDU shall be maintained per donor per

purpose and updated regularly by the Budget

Unit.

g. Subsidiary Ledger for Trust Liabilities-

DRRMF for cash donations received

amounting to P100,000 and above per donor

per purpose while those below P100,000

shall be booked as “Various Donors” per

purpose.

h. For cash donations without specific purpose,

funds shall be used for purposes provided in

the RA No. 11469 also known as “Bayanihan

to Heal As One Act”, Proclamation No. 929,

executive orders and other pertinent

issuances treated on COVID-19 PPAs.

i. Conduct inquiry/ interview with the

appropriate management personnel for the

deficiencies observed and validate the same.

j. Document results of the audit working paper

and take note of deficiencies.

k. Prepare and issue Audit Observation

Memorandum (AOM) for any deficiencies

noted.

Republic of the Philippines

COMMISSION ON AUDIT

Regional Office No. XI

OFFICE OF THE REGIONAL DIRECTOR

C.P. Garcia Highway, Buhangin Davao City

Tel. No. (082) 241-2948

Audit Objectives Audit Procedures Criteria

2. In case of in-kind donations received from

foreign or local sources, the LCE for LGUs must

be duly authorized in a sanggunian resolution to

accept in-kind donations. The donee/ agencies

must prepare the following:

• The recording of donations in kind before

repacking and distribution is put on hold

during the quarantine. Acknowledgement

of the donations-in-kind and accounting of

distribution and balances by the recipient

agencies will suffice during this period.

• Verify if the recipient agencies prepared

the Summary/ List of Donations Received,

Distributed and Balance and submitted

within ten (10) working days after the end

of the quarantine, or if the quarantine

exceeds three (3) months, within ten (10)

working days after the end of each quarter

supported with:

• Acknowledgement receipts of the

donations in-kind

• Proof of receipt by and distribution

to the beneficiaries, not necessarily

in the required form; and

• Inventory of remaining

undistributed items, if any.

• Analyze the Summary/ List of Donations

Received, Distributed and Balance if there

are deficiencies noted.

• Check whether the remaining donations

were properly costed and recorded in the

books or in the registries.

• For donations in-kind, an electronically

produced acknowledgement receipt or

similar document automatically generated

by the system shall also be accepted.

• Conduct inquiry/ interview with the

appropriate management personnel for the

deficiencies observed and validate the

same.

• Document results in the audit working

paper and take note of deficiencies.

• Prepare and issue Audit Observation

Memorandum (AOM) for any deficiencies

Republic of the Philippines

COMMISSION ON AUDIT

Regional Office No. XI

OFFICE OF THE REGIONAL DIRECTOR

C.P. Garcia Highway, Buhangin Davao City

Tel. No. (082) 241-2948

Audit Objectives Audit Procedures Criteria

noted.

Republic of the Philippines

COMMISSION ON AUDIT

Regional Office No. XI

OFFICE OF THE REGIONAL DIRECTOR

C.P. Garcia Highway, Buhangin Davao City

Tel. No. (082) 241-2948

I. Audit Program on Fund Sourcing for COVID-19

Plans, Programs and Activities

Audit Objectives Audit Procedures Criteria

D. To determine whether 1. Check if the funding source • Administrative Order

funding source for the is available for the grant of No. 28 dated April 6,

Special Risk Allowance COVID-19 Special Risk 2020

(for NGAs) is charged Allowance:

against the available ➢ For personnel occupying • Item No. 6 of DBM

released allotments after all regular, contractual, BC No. 2020-2 dated

authorized mandatory casual or part-time April 7, 2020

expenses have been paid positions in NGAs, the

first. amount required for the

grant is charged against

the available released PS

allotments provided that

all authorized mandatory

expenses shall have been

paid first.

➢ For COS/ JO workers,

the amount required for

the grant is charged

against the available

released MOOE

allotments provided that

all authorized mandatory

expenses shall have been

paid first.

2. In case of insufficient PS or

MOOE allotments, check

whether the agency

submitted to the DBM a

Special Budget Request duly

supported by a list of entitled

personnel with the

corresponding amounts

required. The DBM shall

release funds chargeable

against the available

appropriations that may be

indentified pursuant to the

pertinent provision of RA

No. 11469, without need of

further approval from the

Office of the President.

3. Secure a copy of the funds

Republic of the Philippines

COMMISSION ON AUDIT

Regional Office No. XI

OFFICE OF THE REGIONAL DIRECTOR

C.P. Garcia Highway, Buhangin Davao City

Tel. No. (082) 241-2948

Audit Objectives Audit Procedures Criteria

released by DBM which may

be in the form of SARO.

4. Conduct inquiry/ interview

with the appropriate

management personnel for

the deficiencies and validate

the same.

5. Document results in the audit

working paper and take note

of deficiencies

6. Prepare and issue Audit

Observation Memorandum

(AOM) for any deficiencies

Republic of the Philippines

COMMISSION ON AUDIT

Regional Office No. XI

OFFICE OF THE REGIONAL DIRECTOR

C.P. Garcia Highway, Buhangin Davao City

Tel. No. (082) 241-2948

I. Audit Program on Fund Sourcing for COVID-19

Plans, Programs and Activities

Audit Objectives Audit Procedures Criteria

E. To determine whether 1. Check if the funding source • Administrative Order

funding source for the is available for the grant of No. 28 dated April 6,

Special Risk Allowance COVID-19 Special Risk 2020

(for GOCCs) is charged Allowance: • DBM BC No. 2020-2

against their approved ➢ The amount required is dated April 7, 2020

corporate operating charged against the

budgets for FY 2020. respective approved

corporate operating

budgets for FY 2020. If

insufficient, the amount

authorized may grant the

same at a lower but

uniform rate for all

qualified personnel.

2. Conduct inquiry/ interview

with the appropriate

management personnel for

the deficiencies observed and

validate the same.

3. Document results in the audit

working paper and take note

of deficiencies.

4. Prepare and issue Audit

Observation Memorandum

(AOM) for any deficiencies

Republic of the Philippines

COMMISSION ON AUDIT

Regional Office No. XI

OFFICE OF THE REGIONAL DIRECTOR

C.P. Garcia Highway, Buhangin Davao City

Tel. No. (082) 241-2948

I. Audit Program on Fund Sourcing for COVID-19

Plans, Programs and Activities

Audit Objectives Audit Procedures Criteria

F. To determine 1. Determine whether there is available • Administrative

whether there is budget for the grant of COVID-19 Special Order No. 28 dated

available budget Risk Allowance (SRA) subject to the April 6, 2020

for the grant of following conditions: • DBM BC No. 2020-

Special Risk 2 dated April 7,

Allowance (for a. In the case of regular/ contractual/ 2020

LGUs) subject to casual personnel, determine the PS • Budget Operations

(1) PS limitation of limitation: Manual for Local

LGU budgets, (b) ➢ Compare the PS limitation and Government Units-

available total Annual PS Budget, net of 2016 Edition

allotments and waived items. PS limitation is the

conditions set on amount equivalent to 45% of the

DBM BC No. total income from regular sources

2020-2 dated April earned in the next preceding fiscal

7, 2020, chargeable year for 1st to 3rd class provinces/

against the FY cities/ municipalities, or 55% for

2020 local lower class LGUs, including

government funds. barangays. Total PS costs refers

to: (i) salaries of existing regular

personnel; (ii) statutory and

contractual obligations (ECIP,

HIC, Pag-Ibig, RLIP, RG and TL

Benefits); and (iii) Authorized

allowances/ benefits.

➢ Secure a copy of the review action

by the DBM RO in the form of a

letter, while that of the

Sangguniang Panlalawigan in the

form of a Resolution. This is to

validate compliance of the agency

to the budgetary requirement and

general limitations.

➢ Secure a copy of the LGUs

computation on the allowable PS

level.

➢ Analyze the results:

• If the Total Annual PS

Budget, net of waived items,

is less than the PS Limitation,

then the LGU may still

provide for additional PS

costs to the extent of the

difference between the said

amounts.

Republic of the Philippines

COMMISSION ON AUDIT

Regional Office No. XI

OFFICE OF THE REGIONAL DIRECTOR

C.P. Garcia Highway, Buhangin Davao City

Tel. No. (082) 241-2948

Audit Objectives Audit Procedures Criteria

• If the Total Annual PS Budget

is equal to or greater than the

PS Limitation, then the LGU

can no longer provide for

additional or new PS costs.

b. In the case of COS/JO workers and

BHWs, determine available MOOE

allotments.

c. Should there be insufficient funds to

fully cover the COVID-19 SRA, a

lower but uniform rate is granted for

all qualified personnel.

• If a lower rate is granted, secure a

copy of the computation or

payroll to determine uniformity of

rate granted.

d. Ensure that the conditions set in Item

4.0 of DBM BC No. 202-2 are met in

the grant of COVID-19 SRA

(equivalent to a maximum of 25% of

monthly basic salary/pay/honorarium),

to wit:

• The PHWs provide critical and

urgent services to respond to the

public health emergency during

the implementation of the

Enhanced Community Quarantine

(ECQ).

• The PHWs are either (a) civilian

employees occupying regular,

contractual or casual positions, on

full-time or part-time basis; or (b)

Workers engaged thru contract of

service (COS) or job order (JO),

including Barangay Health

Workers (BHWs) regardless of

nature of engagement, provided

that the COS/JO workers and

BHWs concerned are assigned to

hospitals and other healthcare

facilities.

• The PHWs physically report for

work at their respective

offices/work stations on the

prescribed official working hours,

as authorized by the head of

agency/office during the period of

the implementation of the ECQ

Republic of the Philippines

COMMISSION ON AUDIT

Regional Office No. XI

OFFICE OF THE REGIONAL DIRECTOR

C.P. Garcia Highway, Buhangin Davao City

Tel. No. (082) 241-2948

Audit Objectives Audit Procedures Criteria

measures.

• The grant of COVID-19 SRA

shall be pro-rated based on the no.

of days that PHWs concerned

physically report for work during

the period of ECQ in their

respective places of assignment,

reckoned not earlier than March

17, 2020, as follows;

No. of Days

Percentage

Physically

of the

Reporting for

Incentive

Work

3 to 7 25%

8 to 12 50%

13 to 17 75%

18 or more 100%

• The COVID-19 SRA of personnel

hired on part-time basis in one or

more agencies shall be in direct

proportion to the services

rendered, provided that the total

COVID-19 SRA received from all

sources shall not exceed 25% of

the monthly salary//pay.

• The COVID-19 SRA of an

employee on detail to another

government agency shall be

granted by the parent agency.

• A compulsory retiree, on service

extension, may be granted the

COVID-19 SRA, subject to the

pertinent conditions and

guidelines under the Circular.

2. Conduct inquiry/ interview with the

appropriate management personnel for the

deficiencies observed and validate the

same.

3. Document results in the audit working

paper and take note of deficiencies.

4. Prepare and issue Audit Observation

Memorandum (AOM) for any deficiencies

noted.

You might also like

- AP-Budget UtilizationDocument13 pagesAP-Budget UtilizationRosemarie VeluzNo ratings yet

- FY 2020 Fund Release UTRMC FINAL WebsiteDocument35 pagesFY 2020 Fund Release UTRMC FINAL WebsitemgallegoNo ratings yet

- Revised Audit Program - 20% DF Step by Step ProcessDocument8 pagesRevised Audit Program - 20% DF Step by Step ProcessEi Mi SanNo ratings yet

- Presentation On The PIP Updating Guidelines PDFDocument48 pagesPresentation On The PIP Updating Guidelines PDFNiel Edar Balleza100% (1)

- 02 Proc Planning & Monitoring.09162016Document43 pages02 Proc Planning & Monitoring.09162016Shiela May NocedaNo ratings yet

- MFRG - Guidelines - CY 2023 AIPDocument22 pagesMFRG - Guidelines - CY 2023 AIPJames Domini Lopez LabianoNo ratings yet

- AP - Gender and DevelopmentDocument7 pagesAP - Gender and DevelopmentRosemarie VeluzNo ratings yet

- 2109204730policy Initiatives - NABARD-2021-22Document28 pages2109204730policy Initiatives - NABARD-2021-22Soumya UttamNo ratings yet

- FY 2020 Fund ReleaseDocument36 pagesFY 2020 Fund ReleaseMichael LacsamanaNo ratings yet

- Audit Findings and Management Responses 2021Document23 pagesAudit Findings and Management Responses 2021ABINo ratings yet

- Audit Program 20 Infra Const Roads BridgesDocument13 pagesAudit Program 20 Infra Const Roads BridgesAehruj Blet100% (2)

- 15b Strategic Plan GCF 2024 2027 Criteria and Planned Allocations Targeted Results GCF b37 Inf17Document8 pages15b Strategic Plan GCF 2024 2027 Criteria and Planned Allocations Targeted Results GCF b37 Inf17Bouran Awad HassanNo ratings yet

- SAI-LGAS MDLSGDDocument6 pagesSAI-LGAS MDLSGDlovellev.ev3No ratings yet

- 02 Proc Planning & Monitoring.09162016Document31 pages02 Proc Planning & Monitoring.09162016Em FernandezNo ratings yet

- Circular Letter No 2023 7 Dated May 17 2023Document11 pagesCircular Letter No 2023 7 Dated May 17 2023Abe Salvador SalvosaNo ratings yet

- CONCEPTUAL FRAMEWORK HandoutDocument6 pagesCONCEPTUAL FRAMEWORK HandoutRuby RomeroNo ratings yet

- Budgeting: V0.2 December 2022Document16 pagesBudgeting: V0.2 December 2022SARFRAZ AHMED BhuttoNo ratings yet

- Guidelines in The Updating of Tier 1 and Formulation of Tier 2Document12 pagesGuidelines in The Updating of Tier 1 and Formulation of Tier 2Yev ChenkovNo ratings yet

- Catarman Executive Summary 2021Document8 pagesCatarman Executive Summary 2021DarrellNo ratings yet

- PFMAT Budgeting - Framework - BOM - 2016 For PresentattionDocument33 pagesPFMAT Budgeting - Framework - BOM - 2016 For PresentattionJ Andrea Jaca100% (1)

- Toolkit Part 2 Local Plan Content Oct 2019 - 2Document20 pagesToolkit Part 2 Local Plan Content Oct 2019 - 2mertNo ratings yet

- Procurement Planning & MonitoringDocument43 pagesProcurement Planning & Monitoringfraniel sauraNo ratings yet

- CDP-Course-4Document64 pagesCDP-Course-4Keith Clarence BunaganNo ratings yet

- Annex H Status of Implementation of PYs Audit Recommendations 2019Document7 pagesAnnex H Status of Implementation of PYs Audit Recommendations 2019LA AkutNo ratings yet

- BRRP-Brief Presentation - RNR April 2021Document26 pagesBRRP-Brief Presentation - RNR April 2021Salps Quituar Jr.No ratings yet

- Financial Reporting and Auditing in Sovereign Operations: Technical Guidance NoteFrom EverandFinancial Reporting and Auditing in Sovereign Operations: Technical Guidance NoteNo ratings yet

- Procurement Planning & Monitoring (MADPAT)Document73 pagesProcurement Planning & Monitoring (MADPAT)Diane100% (2)

- tr22 1Document23 pagestr22 1Trung PhanNo ratings yet

- Panaji SAAP - GOADocument69 pagesPanaji SAAP - GOAJames RodrickNo ratings yet

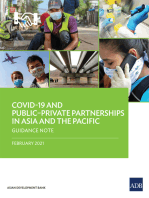

- COVID-19 and Public–Private Partnerships in Asia and the Pacific: Guidance NoteFrom EverandCOVID-19 and Public–Private Partnerships in Asia and the Pacific: Guidance NoteNo ratings yet

- Barangay Procurment 2018 NRMDocument65 pagesBarangay Procurment 2018 NRMCristine S. DayaoNo ratings yet

- LDIP POWERPOINT SaDocument10 pagesLDIP POWERPOINT SaJEnny RojoNo ratings yet

- AGNPO The Budget ProcessDocument33 pagesAGNPO The Budget ProcessJassyNo ratings yet

- English FPO Scheme Guidelines FINAL - 0 - LTDocument7 pagesEnglish FPO Scheme Guidelines FINAL - 0 - LTJayverdhan TiwariNo ratings yet

- Procurement Planning & MonitoringDocument55 pagesProcurement Planning & Monitoringjilllliyj100% (1)

- Non-Government Budget Investment Financing (PINA)Document8 pagesNon-Government Budget Investment Financing (PINA)Adri UsmanNo ratings yet

- PIP 2023 2028 Chapter 9 As of March 22 2023Document6 pagesPIP 2023 2028 Chapter 9 As of March 22 2023Alex LucasNo ratings yet

- ACCA - Chapter 1-4Document5 pagesACCA - Chapter 1-4Bianca Alexa SacabonNo ratings yet

- Annex I. The Updated PIMA Questionnaire: A. Planning Sustainable Levels of Public InvestmentDocument8 pagesAnnex I. The Updated PIMA Questionnaire: A. Planning Sustainable Levels of Public Investmentcoolvimal1156No ratings yet

- A Governance Framework for Climate Relevant Public Investment ManagementFrom EverandA Governance Framework for Climate Relevant Public Investment ManagementNo ratings yet

- DILG MC 2023-063 Revised Omnibus Guidelins in The M&E of ALGU-LGSFDocument18 pagesDILG MC 2023-063 Revised Omnibus Guidelins in The M&E of ALGU-LGSFTrisha Marie DogupNo ratings yet

- Gov Act Reviewer (Punzalan)Document13 pagesGov Act Reviewer (Punzalan)Kenneth WilburNo ratings yet

- World Bank Paris Alignment Method For Program For ResultsDocument17 pagesWorld Bank Paris Alignment Method For Program For ResultsshintiyaNo ratings yet

- Corporate Budget Memorandum No 46 Dated January 18 2024Document69 pagesCorporate Budget Memorandum No 46 Dated January 18 2024jmdagingNo ratings yet

- Department of Budget and Management: Republic of The PhilippinesDocument5 pagesDepartment of Budget and Management: Republic of The PhilippinesgbenjielizonNo ratings yet

- Busines Mirror, Feb. 27, 2019, As Enrolled Copy of 19 Budget Bill Pends DBM Chief Inks 20 Budget Call PDFDocument1 pageBusines Mirror, Feb. 27, 2019, As Enrolled Copy of 19 Budget Bill Pends DBM Chief Inks 20 Budget Call PDFpribhor2No ratings yet

- Advanced Accounting 12th Edition Fischer Solutions Manual Full Chapter PDFDocument26 pagesAdvanced Accounting 12th Edition Fischer Solutions Manual Full Chapter PDFanwalteru32x100% (16)

- Advanced Accounting 12th Edition Fischer Solutions ManualDocument5 pagesAdvanced Accounting 12th Edition Fischer Solutions Manualbacksideanywheremrifn100% (29)

- Status of Implementation of Prior Years' Audit Recommendations 13Document14 pagesStatus of Implementation of Prior Years' Audit Recommendations 13Angel BacaniNo ratings yet

- Procurement Planning - & Budget LinkageDocument28 pagesProcurement Planning - & Budget LinkageBea Therese VillanuevaNo ratings yet

- Financial Analysis Evaluation Guidance NoteDocument64 pagesFinancial Analysis Evaluation Guidance NoteSELCIYA ROSELINENo ratings yet

- Dilg Memocircular 202024 - Ea86676b0c PDFDocument154 pagesDilg Memocircular 202024 - Ea86676b0c PDFRonnie EdecNo ratings yet

- Yeager CPA - Govt AccountingDocument73 pagesYeager CPA - Govt AccountingShouvik NagNo ratings yet

- PimaDocument1 pagePimaShafiqulHasanNo ratings yet

- Session 6 - Other Matters (IFP Monitoring)Document14 pagesSession 6 - Other Matters (IFP Monitoring)marinette vasoNo ratings yet

- Local GAD Planning and Budgeting - JMC 2013Document72 pagesLocal GAD Planning and Budgeting - JMC 2013Rhejo OrioqueNo ratings yet

- En Special Series On Covid 19 Budgeting in A Crisis Guidance On Preparing The 2021 BudgetDocument10 pagesEn Special Series On Covid 19 Budgeting in A Crisis Guidance On Preparing The 2021 BudgetJessalyn DaneNo ratings yet

- Session I - Planning & Investment ProgrammingDocument41 pagesSession I - Planning & Investment ProgrammingKristine Jane AguirreNo ratings yet

- Operational Guidelines For NBFCsDocument34 pagesOperational Guidelines For NBFCssakshigulati2508No ratings yet

- Erb Final - Zambia Refit GuidelinesDocument32 pagesErb Final - Zambia Refit GuidelinesGoodman HereNo ratings yet

- Office of The Regional Director: List of Criteria in The Audit of COVID-19 FundsDocument6 pagesOffice of The Regional Director: List of Criteria in The Audit of COVID-19 FundsKathleen Hare AbsinNo ratings yet

- A. Biological Assets: Living Plant or AnimalDocument19 pagesA. Biological Assets: Living Plant or AnimalKathleen Hare AbsinNo ratings yet

- Investment, Prperty, Plant and Equiment and Biological AssetDocument86 pagesInvestment, Prperty, Plant and Equiment and Biological AssetKathleen Hare AbsinNo ratings yet

- Manual On The Financial Management of BarangaysDocument41 pagesManual On The Financial Management of BarangaysKathleen Hare AbsinNo ratings yet

- Design and Fabrication Multi Spindle Drilling MachineDocument4 pagesDesign and Fabrication Multi Spindle Drilling MachineEditor IJTSRDNo ratings yet

- Introduction To Industrial Technology Midterm ReviewerDocument7 pagesIntroduction To Industrial Technology Midterm ReviewerRenz Moyo ManzanillaNo ratings yet

- RECEIPTDocument2 pagesRECEIPTsavan anvekarNo ratings yet

- Notice For FeeDocument1 pageNotice For FeeAnkesh Kumar SrivastavaNo ratings yet

- MA Economics PI A19Document7 pagesMA Economics PI A19Muhammad SajjadNo ratings yet

- Activity-Based Costing System Advantages and Disadvantages: SSRN Electronic Journal July 2004Document13 pagesActivity-Based Costing System Advantages and Disadvantages: SSRN Electronic Journal July 2004hardeep waliaNo ratings yet

- OMNI 7000 Installation and ConfigurationDocument188 pagesOMNI 7000 Installation and Configurationfowl nguyen100% (1)

- Design of Jigs and Fixtures 2 MarksDocument16 pagesDesign of Jigs and Fixtures 2 MarksParamasivam Veerappan100% (1)

- G.R. No. 154486Document3 pagesG.R. No. 154486Mila MovidaNo ratings yet

- Company Name Industry Vertical Salutation First Name Designation AddressDocument14 pagesCompany Name Industry Vertical Salutation First Name Designation Addressinfo for businessNo ratings yet

- Hodson-Sullivan - Corporate PowerDocument7 pagesHodson-Sullivan - Corporate PowerNikolina PalicNo ratings yet

- Revenue AdministrationDocument3 pagesRevenue AdministrationMontasir BalambagNo ratings yet

- Maru Batting CentreDocument6 pagesMaru Batting CentreTanya GargNo ratings yet

- Table of Specification (Tos) : Borbon National High SchoolDocument1 pageTable of Specification (Tos) : Borbon National High SchoolJonel RuleNo ratings yet

- Somaliland Vision 2030Document20 pagesSomaliland Vision 2030Mohamed AliNo ratings yet

- KEY TO CONTROLLED WRITING Powerpoint. HCDHDocument21 pagesKEY TO CONTROLLED WRITING Powerpoint. HCDHTran LeNo ratings yet

- Reliance Industries AGM: Here Are Key Takeaways From Mukesh Ambani's SpeechDocument4 pagesReliance Industries AGM: Here Are Key Takeaways From Mukesh Ambani's SpeechSamil MusthafaNo ratings yet

- Finalchapter 23Document7 pagesFinalchapter 23Jud Rossette ArcebesNo ratings yet

- Ec 1 PDFDocument12 pagesEc 1 PDFAnum RajputNo ratings yet

- Report Errors in The PDF - FDocument277 pagesReport Errors in The PDF - FsocejoNo ratings yet

- Project Charter Template-CERSDocument10 pagesProject Charter Template-CERSAyesha KholaNo ratings yet

- Santuyo, Et Al. v. Remerco 260-261Document2 pagesSantuyo, Et Al. v. Remerco 260-261Thea Dela Cruz CapunponNo ratings yet

- MT Chains Evolution - AUG'22Document16 pagesMT Chains Evolution - AUG'22Xuan Loc Mai100% (1)

- Scott Beach ResumeDocument4 pagesScott Beach Resumebeach1311No ratings yet

- Alternative Dispute Resolutions: Case DigestDocument107 pagesAlternative Dispute Resolutions: Case DigestCristy C. Bangayan100% (2)

- Far - Team PRTC 1stpb May 2023Document8 pagesFar - Team PRTC 1stpb May 2023Alexander IgotNo ratings yet

- Safety 4.0: Updating Safety For Industry 4.0Document5 pagesSafety 4.0: Updating Safety For Industry 4.0Osama ShaalanNo ratings yet

- Yib 09 4800090967 ZVC01 00001 0000 06Document3 pagesYib 09 4800090967 ZVC01 00001 0000 06Anil Krishna JangitiNo ratings yet

- Monthly Attendance Report Template FormatDocument5 pagesMonthly Attendance Report Template FormatNina Jasmin Suing-VitugNo ratings yet

- Bill FormDocument2 pagesBill FormMukesh Singh GravitaNo ratings yet