Professional Documents

Culture Documents

IDBI Super Top-Up Your Family's Health Protection - Draft v1

Uploaded by

Umang BhokanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IDBI Super Top-Up Your Family's Health Protection - Draft v1

Uploaded by

Umang BhokanCopyright:

Available Formats

Super Top-Up

your family’s health

protection with `15 Lacs

Base Sum Insured in

` 1,235 only#.

(Annual aggregate

deductible ` 2 Lacs)^

Max Bupa Presents Super Top-Up

plan for IDBI Bank Customers

Base Sum Insured Inpatient Care: Domiciliary Emergency Ground

of INR 15 Lacs Covered up to Hospitalization: Ambulance:

with INR 2 Lacs Base Sum Insured Covered up to INR 1000/

annual aggregate Base Sum Insured Hospitalization

deductible^

For more information, please contact

IDBI Bank branch manager

Product Name: Max Health Plus | Product UIN: MAXHLGP18130V011718

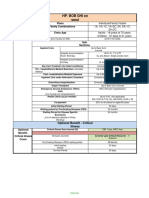

Product Structure

Policy Tenure 1 year

Entry Age (Adult - 18 yrs to 60 yrs

Child - 91 days to 21 years)

Hospitalisation Cover

Family Combination avaliable 1A, 2A, 2A+1C, 2A+2C

Base Sum Insured - INR 15 Lacs

Base Sum Insured and Deductible

Annual Aggregate Deductible - INR 2 Lacs

Sub Sections

• Nursing charges excluding private nursing charges

• Medical Practitioners’ fees, excluding any charges or fees for

Standby Services

• Medicines, drugs and consumables

• Physiotherapy, investigation and diagnostics procedures direct-

ly related to admission Up to Base Sum Insured

• Intravenous fluids, blood transfusion, injection administration

Inpatient Care

charges and /or consumables

• Operation theatre charges

• The cost of prosthetics and other devices or equipment if

Hospitalisation

implanted internally during Surgery

Cover

Hospital accommodation- Room Rent/day Single Private Room

Hospital accommodation- ICU/day Covered up to Sum Insured

Day Care Treatment Listed 536 Day Care Treatments covered up to Base Sum Insured

Pre - hospitalization Medical Expenses (including

Up to Base Sum Insured

Medical Practitioner’s consultation, diagnostics tests,

(30 days)

medicines, drugs and consumables)

Post- hospitalization Medical Expenses Up to Base Sum Insured

(including Medical Practitioner’s consultation, (60 days)

diagnostics tests, medicines, drugs and consumables)

Domiciliary Hospitalization Up to Base Sum Insured

Organ Transplant Up to Base Sum Insured

Emergency Ground Ambulance- Within India

INR 1000

(one transfer per Hospitalization)

Waiting period for Pre-Existing Diseases (PED) 24 months

Initial Waiting Period 30 days

Specific Disease waiting period 24 months

Premium Table

Base Sum Insured – INR 15 Lacs with INR 2 Lacs deductible

Family Combination 1A 2A 2A1C 2A2C

Premium (Incl of GST) INR 749 INR 1,235 INR 1,589 INR 1,939

Disclaimer: Insurance is a subject matter of solicitation. Max Bupa Health Insurance Company Limited (IRDAI Registration Number 145), ‘Max’, ‘Max Logo’, ‘Bupa’ and ‘HEARTBEAT’ logo are registered trademarks

of their respective owners and are being used by Max Bupa Health Insurance Company Limited under license. Registered office: B-1/I-2, Mohan Cooperative Industrial Estate, Mathura Road, New Delhi – 110044,

Customer Helpline: 1860-500-8888. Fax: +91 11 30902010. Website: www.maxbupa.com. CIN: U66000DL2008PLC182918. UIN: MB/SS/CA/2020-21/028. *Max Bupa indemnity plans cover COVID-19 related hospitalisation.

For more details on terms and conditions, exclusions, risk factors, waiting period and benefits, please read the sales brochure carefully before concluding a sale. Product Name: Max Health Plus | Product UIN:

MAXHLGP18130V011718 | ^Annual aggregate deductible means an amount above which your coverage will start in a policy year with this plan. IDBI Bank (Registration No. CA0135) is a corporate agent of Max Bupa Health

Insurance Company Limited and the insurance products are underwritten by Max Bupa Health Insurance Company Limited. #Illustration based on the premium calculated for 2A family combination with INR 15 Lac base

sum insured and INR 2 Lac deductible, i.e. INR 1,235 per year.

Product Name: Max Health Plus | Product UIN: MAXHLGP18130V011718

You might also like

- Niva HSL Mediclaim Ghi Gpa Ss v3Document2 pagesNiva HSL Mediclaim Ghi Gpa Ss v3bradburywillsNo ratings yet

- MR.L Rishi Naidu: Mata Santoshi Ward Jagdalpur Distt - Mobile No: XXXXXX7797Document4 pagesMR.L Rishi Naidu: Mata Santoshi Ward Jagdalpur Distt - Mobile No: XXXXXX7797AkashNachraniNo ratings yet

- Corona Kavach STAR One PagerDocument1 pageCorona Kavach STAR One PagerRajat GuptaNo ratings yet

- Corona Kavach - One Pager - Version 1.0 - July - 2020 PDFDocument1 pageCorona Kavach - One Pager - Version 1.0 - July - 2020 PDFRanjeeta BhanjNo ratings yet

- Health Insurance That Works For YouDocument5 pagesHealth Insurance That Works For YouTrinetra AgarwalNo ratings yet

- PolicyDocument10 pagesPolicyKalyaniNo ratings yet

- Comprehensive insurance policy featuresDocument1 pageComprehensive insurance policy featuresvamsiklNo ratings yet

- Health PulseDocument2 pagesHealth PulseAcma Renu SinghaniaNo ratings yet

- Health - Pulse Single SheeterDocument2 pagesHealth - Pulse Single SheeterAnupam JainNo ratings yet

- 1 Health ProtectorDocument1 page1 Health ProtectorKhairul RafiziNo ratings yet

- AIA Platinum Health Protection CoverageDocument8 pagesAIA Platinum Health Protection CoverageHihiNo ratings yet

- Axis Freedom Plan - RACDocument5 pagesAxis Freedom Plan - RACUday TiwariNo ratings yet

- Premier Medic PartnerDocument2 pagesPremier Medic PartnerHihiNo ratings yet

- Benefit Manual - Aecom IndiaDocument32 pagesBenefit Manual - Aecom IndiaAnil PuvadaNo ratings yet

- Medical continuity options for Bupa insuranceDocument11 pagesMedical continuity options for Bupa insuranceSudhakar JayNo ratings yet

- SuperSHIP - Smart Super Health Insurance PolicyDocument28 pagesSuperSHIP - Smart Super Health Insurance PolicyNitin GuptaNo ratings yet

- Aia Platinum Health BrochureDocument8 pagesAia Platinum Health BrochureRaymond AngNo ratings yet

- Niva Axis CASA SS v8Document2 pagesNiva Axis CASA SS v8jar070888No ratings yet

- Health Companion Health Insurance Plan - Health CompanionDocument2 pagesHealth Companion Health Insurance Plan - Health CompanionANAND MLNo ratings yet

- Revised HS360 ICICI Lombard Health Insurance PlanDocument29 pagesRevised HS360 ICICI Lombard Health Insurance PlanrbitrackerNo ratings yet

- Super Top Up - 211130 - 094009Document3 pagesSuper Top Up - 211130 - 094009Venkatesh SharmaNo ratings yet

- Medical Insurance BenifitsDocument13 pagesMedical Insurance BenifitsdhineshNo ratings yet

- Bandhan Bank Health Plus Portability 050723Document2 pagesBandhan Bank Health Plus Portability 050723goelrajivgNo ratings yet

- BARODAHEALTHDocument1 pageBARODAHEALTHSejal KumariNo ratings yet

- N MP Brochure NewDocument4 pagesN MP Brochure Newraj27385No ratings yet

- Mr. Tapaswani MargarajDocument3 pagesMr. Tapaswani MargarajAkashNachraniNo ratings yet

- Star Comprehensive Insurance Policy - One Pager - Version - 1.1 - (June) - 21Document1 pageStar Comprehensive Insurance Policy - One Pager - Version - 1.1 - (June) - 21Viki for gmail GmailNo ratings yet

- Smartcare Optimum Plus BrochureDocument12 pagesSmartcare Optimum Plus BrochureMeng Seng EngNo ratings yet

- Home Healthcare PlanDocument6 pagesHome Healthcare PlanAhmedNo ratings yet

- Mrs. Manjushree NayakDocument3 pagesMrs. Manjushree NayakAkashNachraniNo ratings yet

- BandhanDocument31 pagesBandhanCNo ratings yet

- Overseas Visitors BasicDocument4 pagesOverseas Visitors BasicMarco NgNo ratings yet

- GNL GMC Benefit Manual 2021-22Document10 pagesGNL GMC Benefit Manual 2021-22nkr2294No ratings yet

- Employee Benefit Manual - C&W Group - 2022-23Document34 pagesEmployee Benefit Manual - C&W Group - 2022-23Shubham GargNo ratings yet

- Focus On The Ingwe Option: Momentumhealth - Co.zaDocument7 pagesFocus On The Ingwe Option: Momentumhealth - Co.zaRoe Wekwa NyembaNo ratings yet

- Category 3_TOB 2Document7 pagesCategory 3_TOB 2Krishna PrasathNo ratings yet

- Reassurance at Every Step: Keeps Giving You More!Document2 pagesReassurance at Every Step: Keeps Giving You More!ajayup48No ratings yet

- N PMP BrochureDocument6 pagesN PMP BrochureManojit SarkarNo ratings yet

- Benefits ManualDocument12 pagesBenefits ManualPramod ApugolNo ratings yet

- SENIOR FIRST_0 Co Payment_BrDocument2 pagesSENIOR FIRST_0 Co Payment_BriamshonalidixitNo ratings yet

- Reports Webdocs T1049 Terex India - Benefits Manual-2021Document38 pagesReports Webdocs T1049 Terex India - Benefits Manual-2021mzaidpervezNo ratings yet

- Bupa International Plan - Table of BenefitsDocument10 pagesBupa International Plan - Table of BenefitsIrene LyeNo ratings yet

- 2024 SMT SOB - Gold PlanDocument5 pages2024 SMT SOB - Gold Planmaluyajake88No ratings yet

- GSH Zcard Proof2Document2 pagesGSH Zcard Proof2RyanNo ratings yet

- IDA Edelweiss Gallagher Final 25yrsDocument5 pagesIDA Edelweiss Gallagher Final 25yrsShital KiranNo ratings yet

- Dnirc Silk Road Plan ADocument4 pagesDnirc Silk Road Plan AMoksh SharmaNo ratings yet

- Niva - SENIOR FIRST - SS - v3Document2 pagesNiva - SENIOR FIRST - SS - v3scrikanth03565No ratings yet

- ManipalCigna Super Top Up Prospectus Key HighlightsDocument9 pagesManipalCigna Super Top Up Prospectus Key HighlightsVyshak SamakNo ratings yet

- Group Health Insurance ..Document9 pagesGroup Health Insurance ..Amrita PatraNo ratings yet

- IDA Edelweiss Gallagher 2Document5 pagesIDA Edelweiss Gallagher 2KANPUR DENTALS & IMPLANT CENTRENo ratings yet

- Table of Benefits-Oasis Investment2Document18 pagesTable of Benefits-Oasis Investment2ppdeepakNo ratings yet

- Health Insurance StudyDocument9 pagesHealth Insurance StudyKiran BathiniNo ratings yet

- S. NO. Title Description: Group Health (Floater) InsuranceDocument4 pagesS. NO. Title Description: Group Health (Floater) Insurancejay rawatNo ratings yet

- Sbi General'S Arogya Plus Policy: Assure Your Health For A Fixed PremiumDocument9 pagesSbi General'S Arogya Plus Policy: Assure Your Health For A Fixed Premiumdinesh banaNo ratings yet

- Reassurance at Every Step: Keeps Giving You More!Document8 pagesReassurance at Every Step: Keeps Giving You More!hiteshmohakar15No ratings yet

- HyBasic Plans Proposal - 2021CDocument3 pagesHyBasic Plans Proposal - 2021CRotimi Shitta-BeyNo ratings yet

- Category B Emirates Insurance PDFDocument5 pagesCategory B Emirates Insurance PDFDonald HamiltonNo ratings yet

- Group Mediclaim Policy BenefitsDocument19 pagesGroup Mediclaim Policy BenefitsJitendra BhatewaraNo ratings yet

- The Best Laid Plans of Dogs and Vets: Transform Your Veterinary Practice Through Pet Health Care PlansFrom EverandThe Best Laid Plans of Dogs and Vets: Transform Your Veterinary Practice Through Pet Health Care PlansNo ratings yet

- About APY PDFDocument2 pagesAbout APY PDFrajikul islamNo ratings yet

- Apy Chart PDFDocument1 pageApy Chart PDFUmang BhokanNo ratings yet

- Introducti On Our Segments: Commodity CurrencypcgDocument8 pagesIntroducti On Our Segments: Commodity CurrencypcgUmang BhokanNo ratings yet

- MCXDocument2 pagesMCXUmang BhokanNo ratings yet

- Icon Book PresentationDocument22 pagesIcon Book PresentationUmang BhokanNo ratings yet

- Algorithmic TradingDocument13 pagesAlgorithmic TradingUmang Bhokan100% (1)

- A - Measures of Central TendencyDocument7 pagesA - Measures of Central TendencyFarrukh AhmedNo ratings yet

- Kumar Birla Gets All of Pantaloons ChainDocument5 pagesKumar Birla Gets All of Pantaloons ChainUmang BhokanNo ratings yet

- STABILITY GUIDANCE PROTOCOLDocument10 pagesSTABILITY GUIDANCE PROTOCOLManish shankarpure100% (1)

- Rainier-Andal A11-02 GT6Document1 pageRainier-Andal A11-02 GT6Rosalie AndalNo ratings yet

- DRAFT Formwork Falsework COPDocument46 pagesDRAFT Formwork Falsework COPicehorizon88No ratings yet

- Ecl SW Iso45001Document92 pagesEcl SW Iso45001Meghanath LalemmaNo ratings yet

- Admission LetterDocument4 pagesAdmission LetterYasir KNNo ratings yet

- Module 1Document26 pagesModule 1priya malikNo ratings yet

- Power of Play An Evidence BaseDocument64 pagesPower of Play An Evidence BaseIsaiNo ratings yet

- Retinol in CosmeticsDocument204 pagesRetinol in CosmeticsMarrauNo ratings yet

- Company - : Country Website Point of Contact(s)Document6 pagesCompany - : Country Website Point of Contact(s)Karan TrivediNo ratings yet

- AQA Statement of Dramatic Intent 2024 FilledDocument3 pagesAQA Statement of Dramatic Intent 2024 Filledtedjackson608No ratings yet

- Research Paper On Noise PollutionDocument8 pagesResearch Paper On Noise Pollutionhmpquasif100% (1)

- Safe carriage of dangerous goods by airDocument2 pagesSafe carriage of dangerous goods by airNuran Dursunoğlu100% (1)

- Intrusion Detection System Method StatementDocument30 pagesIntrusion Detection System Method StatementNideesh RobertNo ratings yet

- Bihar Jharkhand Lab ScrapDocument27 pagesBihar Jharkhand Lab ScrapOFC accountNo ratings yet

- Handling Compressed Gas CylindersDocument103 pagesHandling Compressed Gas CylinderstorolsoNo ratings yet

- Anaphy SGD HeartDocument1 pageAnaphy SGD HeartbrylleNo ratings yet

- Admission HospitalDocument7 pagesAdmission HospitalYuhuuNo ratings yet

- Implementing programs and projects for disaster risk managementDocument58 pagesImplementing programs and projects for disaster risk managementImtiaze Shafin RehadNo ratings yet

- The Baltimore SunDocument21 pagesThe Baltimore SunАгент ГусьNo ratings yet

- Behavioral Perspective On Mental Health and IllnessDocument12 pagesBehavioral Perspective On Mental Health and IllnessMonisha LakshminarayananNo ratings yet

- Post Test-Module 5 H.O.P.E 12Document1 pagePost Test-Module 5 H.O.P.E 12Kirby BrizNo ratings yet

- Veterinary EctoparasitesDocument8 pagesVeterinary Ectoparasitesc3891446100% (1)

- GyroGear Marketing Brief v1.4Document4 pagesGyroGear Marketing Brief v1.4vcvccccNo ratings yet

- Exerciții Pe TEXT 2Document27 pagesExerciții Pe TEXT 2Balanean TatianaNo ratings yet

- 5th Grade Reading Comprehension Worksheets - Fifth Grade Week 4Document2 pages5th Grade Reading Comprehension Worksheets - Fifth Grade Week 4Julius CesarNo ratings yet

- Malignant Self LoveDocument7 pagesMalignant Self LoveMarjoryStewartBaxterNo ratings yet

- Checklist Using Nasopharengeal and Oropharengeal SuctioningDocument4 pagesChecklist Using Nasopharengeal and Oropharengeal SuctioningKristine Louise JavierNo ratings yet

- Types of Dementia Symptoms Causes TreatmentsDocument6 pagesTypes of Dementia Symptoms Causes TreatmentsRatnaPrasadNalamNo ratings yet

- Project ConceptDocument11 pagesProject Conceptokware brianNo ratings yet

- CABITA REVISION SHEETS FOR 3e 2020Document100 pagesCABITA REVISION SHEETS FOR 3e 2020Momi OrpheyNo ratings yet