Professional Documents

Culture Documents

Let's Check: Name: Jerah Y. Torrejos Subject: ACP311 (29600)

Let's Check: Name: Jerah Y. Torrejos Subject: ACP311 (29600)

Uploaded by

irahQOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Let's Check: Name: Jerah Y. Torrejos Subject: ACP311 (29600)

Let's Check: Name: Jerah Y. Torrejos Subject: ACP311 (29600)

Uploaded by

irahQCopyright:

Available Formats

Name: Jerah Y.

Torrejos

Subject: ACP311 (29600)

Let's Check

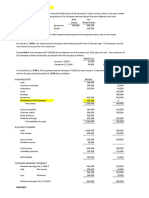

Ex. 1 C.

Ex. 2

The amount that should be recorded as Jordan, Capital should be 55,000 because the

computer was sold immediately after the formation of the partnership which represents

the fair market value of the asset.

Ex. 3 Rodman, Capital 40,000 40,000

Will, Capital 80,000 2/3 80,000

BJ, Capital - 1/3 60,000

120,000 180000

Therefore, Jordan should contribute 60,000 cash to have 1/3 interest in the partnership.

Ex. 4 Ewing, Capital Barkley

60% 40%

300,000 70,000

90,000

-40,000

120,000

300,000 300,000

120,000 80,000 200,000

420,000 500,000

Therefore, Barkley should contribute additional 80,000 cash.

Ex. 5 BONUS METHOD

Magic, Capital 100,000 92,000

Kareem, Capital 84,000 8,000 92,000

184,000 184,000

Therefore, Kareem's identifiable assets are still debited for 84,000 pesos because

under the Bonus method the capital will increase not the identifiable asset.

Entry would be: Magic, Capital 8,000

Kareem, Capital 8,000

Ex. 6 BONUS METHOD

Kg, Capital 140,000 140,000

Paul, Capital 220,000 -60,000 160,000

Ray, Capital - -

TCC=TAC 300,000

300,000/3= 100,000

Therefore, the capital balance of Ray under Bonus method is 100,000.

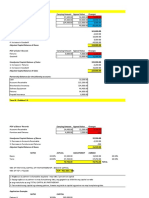

Ex. 7

Tim, Capital 50,000 25,000 75,000

Tony, Capital 80,000 80,000

Manu, Capital 25,000 60,000 85,000

240,000

The question did not give the interest ratio of the partners, only the profit ratio. The

capital of Tim, Tony, and Manu are 75,000, 80,000, and 85,000 respectively.

You might also like

- Sol. Man. - Chapter 11 - Partnership FormationDocument12 pagesSol. Man. - Chapter 11 - Partnership Formationpehik100% (2)

- Week 3 - Honda Element CaseDocument1 pageWeek 3 - Honda Element CaseAnna100% (1)

- Syllabus ACP 312 Accounting For Business CombinationsDocument9 pagesSyllabus ACP 312 Accounting For Business CombinationsirahQNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Get Rich with Dividends: A Proven System for Earning Double-Digit ReturnsFrom EverandGet Rich with Dividends: A Proven System for Earning Double-Digit ReturnsNo ratings yet

- CH 3 SolutionsDocument37 pagesCH 3 SolutionsRavneet BalNo ratings yet

- The Value of Communication During A Crisis: Insights From Strategic Communication ResearchDocument8 pagesThe Value of Communication During A Crisis: Insights From Strategic Communication Research조현민No ratings yet

- ParCor Chapter3 BuenaventuraDocument19 pagesParCor Chapter3 BuenaventuraAnonn100% (3)

- 6 - Pat & Sat Co. - PALACIODocument7 pages6 - Pat & Sat Co. - PALACIOPinky DaisiesNo ratings yet

- StudyDocument10 pagesStudyirahQNo ratings yet

- Tata SteelDocument41 pagesTata SteelSanjana GuptaNo ratings yet

- Bangladesh Case StudyDocument3 pagesBangladesh Case StudyRupama Joshi100% (1)

- Solution Manual-Module 1: Acc 311 - Acctg For Special Transactions and Business CombinationsDocument11 pagesSolution Manual-Module 1: Acc 311 - Acctg For Special Transactions and Business CombinationsJoy SantosNo ratings yet

- A 1. FormationDocument3 pagesA 1. Formationmartinfaith958No ratings yet

- Problem 20-23Document5 pagesProblem 20-23Teresa Pantallano DivinagraciaNo ratings yet

- Assignment 1Document8 pagesAssignment 1Bianca LizardoNo ratings yet

- Intangibles Assignment - Valix 2017Document3 pagesIntangibles Assignment - Valix 2017Shinny Jewel VingnoNo ratings yet

- Problems Partnership FormationDocument11 pagesProblems Partnership FormationJunaly PanagaNo ratings yet

- Sogradiel - Final ExamDocument17 pagesSogradiel - Final ExamRIZLE SOGRADIELNo ratings yet

- 5 - Assign - Pad & Sad Co.Document2 pages5 - Assign - Pad & Sad Co.Pinky DaisiesNo ratings yet

- UntitledDocument7 pagesUntitledKhyell PayasNo ratings yet

- Paw and Saw DownstreamDocument3 pagesPaw and Saw DownstreamLorie Roncal JimenezNo ratings yet

- Problems Partnership Dissolution and LiquidationDocument5 pagesProblems Partnership Dissolution and LiquidationNick ivan AlvaresNo ratings yet

- Semi Final AccountingDocument8 pagesSemi Final AccountingSherryl DumagpiNo ratings yet

- PPS DissolutionDocument13 pagesPPS DissolutionAireen Shelvie BermudezNo ratings yet

- Alomia - Ae 112 Midterm Sa1 SolutionDocument9 pagesAlomia - Ae 112 Midterm Sa1 SolutionRica Ann RoxasNo ratings yet

- Quiz # 3 - Partnership Dissolution Answer KeyDocument5 pagesQuiz # 3 - Partnership Dissolution Answer KeyCamille Francisco AgustinNo ratings yet

- Accounting 3 4 Module 3aDocument2 pagesAccounting 3 4 Module 3aMnriMinaNo ratings yet

- Suggested AnswersDocument18 pagesSuggested AnswersEl YangNo ratings yet

- Acc2 CH11Document6 pagesAcc2 CH11Leah CalataNo ratings yet

- Fabm OutputsDocument3 pagesFabm OutputsElaine Joyce GarciaNo ratings yet

- Chapter2aa1sol 2012 PDFDocument18 pagesChapter2aa1sol 2012 PDFMatt David Kenneth ReyesNo ratings yet

- LiquidationDocument18 pagesLiquidationSamaica MontemayorNo ratings yet

- PDF Chapter 2 Sol Man BAYSA 2008Document18 pagesPDF Chapter 2 Sol Man BAYSA 2008michNo ratings yet

- Deathwithdrawalretirement of A PartnersDocument12 pagesDeathwithdrawalretirement of A PartnersALYZA ANGELA ORNEDONo ratings yet

- ParCor Chapter3 Part2 BuenaventuraDocument17 pagesParCor Chapter3 Part2 BuenaventuraAnonn100% (4)

- Acccob1 Online Quiz 3 - Solution Guide (Part Iii)Document3 pagesAcccob1 Online Quiz 3 - Solution Guide (Part Iii)Abe Miguel BullecerNo ratings yet

- Case 1: Purhase of Interest - Goodwill To Old PartnersDocument12 pagesCase 1: Purhase of Interest - Goodwill To Old PartnersAEDRIAN LEE DERECHONo ratings yet

- Sol. Man. - Chapter 11 - Partnership FormationDocument12 pagesSol. Man. - Chapter 11 - Partnership FormationpehikNo ratings yet

- Chapter4 MC Pt2Document12 pagesChapter4 MC Pt2Anonn100% (1)

- Bizcom Problem 3-2Document1 pageBizcom Problem 3-2kate trishaNo ratings yet

- DissolutionDocument11 pagesDissolutionJay Mark Marcial JosolNo ratings yet

- Assignment in Partnership DissolutionDocument4 pagesAssignment in Partnership DissolutionLalaine Keendra GonzagaNo ratings yet

- Date Particulars: in The Books of XYZ JournalDocument38 pagesDate Particulars: in The Books of XYZ JournalAnanya ChoudharyNo ratings yet

- Seatwork Problem 1Document11 pagesSeatwork Problem 1Zihr EllerycNo ratings yet

- Chapter 15Document12 pagesChapter 15Nikki GarciaNo ratings yet

- Module 5 - With SolutionsDocument21 pagesModule 5 - With SolutionsSeulgi KangNo ratings yet

- Ast-Chapter 1 p3, p5, p6Document8 pagesAst-Chapter 1 p3, p5, p6Geminah BellenNo ratings yet

- 01 Act 1Document1 page01 Act 1dimayugadesiree5No ratings yet

- Module 5 - With SolutionsDocument12 pagesModule 5 - With SolutionsStella MarieNo ratings yet

- Problems AnswerDocument5 pagesProblems AnswerNABO IRISHA DIANNENo ratings yet

- CH 12 Excel (Students)Document9 pagesCH 12 Excel (Students)Daniela VelezNo ratings yet

- Partnership FormationDocument5 pagesPartnership FormationIce Voltaire Buban GuiangNo ratings yet

- Assigment 1Document3 pagesAssigment 1Muhd Zulhusni MusaNo ratings yet

- Chapter 6Document7 pagesChapter 6Its meh SushiNo ratings yet

- Ans Key Inst Liq4Document7 pagesAns Key Inst Liq4Garp BarrocaNo ratings yet

- Solution of Assignment Eco-04 Case: Mike (The Plumber) - A True StoryDocument5 pagesSolution of Assignment Eco-04 Case: Mike (The Plumber) - A True StoryYusuf HusseinNo ratings yet

- JV ZZZZDocument32 pagesJV ZZZZPaula VillarubiaNo ratings yet

- Accounting ActivityDocument3 pagesAccounting ActivityKae Abegail GarciaNo ratings yet

- Batch 1 - Lecture 1 - Partnership Formation - Part 3Document4 pagesBatch 1 - Lecture 1 - Partnership Formation - Part 3VILLANUEVA Monica ThereseNo ratings yet

- Class Project - SolvedDocument8 pagesClass Project - SolvedMarcoNo ratings yet

- Asset AcquisitionDocument3 pagesAsset AcquisitionMerliza JusayanNo ratings yet

- Parcor ExplanationDocument5 pagesParcor ExplanationjulionocheadjeNo ratings yet

- Discussion Problems and Solutions On Module 3, Part 1Document28 pagesDiscussion Problems and Solutions On Module 3, Part 1AJ Biagan MoraNo ratings yet

- Name: Fe C. Leyros Bsa 2 Acctg TTH 3:00-4:30 PM Solutions: Problem 1Document7 pagesName: Fe C. Leyros Bsa 2 Acctg TTH 3:00-4:30 PM Solutions: Problem 1AlexNo ratings yet

- NOTESDocument53 pagesNOTESirahQNo ratings yet

- Let's Check: Jerah Y. TorrejosDocument2 pagesLet's Check: Jerah Y. TorrejosirahQNo ratings yet

- Home Office Books Branch Office BooksDocument3 pagesHome Office Books Branch Office BooksirahQNo ratings yet

- A Reflection Paper On Panagtapok Online: Alumni Meeting Beyond BoundariesDocument1 pageA Reflection Paper On Panagtapok Online: Alumni Meeting Beyond BoundariesirahQNo ratings yet

- Jerah Y. Torrejos: Home Office Books Branch Office BooksDocument2 pagesJerah Y. Torrejos: Home Office Books Branch Office BooksirahQNo ratings yet

- Equity Research Analysis ShashankDocument24 pagesEquity Research Analysis ShashankVineet Pratap SinghNo ratings yet

- Context of The Organization Clause 4.1-4.2Document4 pagesContext of The Organization Clause 4.1-4.2Vincent TorenoNo ratings yet

- InsuransDocument5 pagesInsuransrimbunan redupNo ratings yet

- Project Report 2 Akshit Dube Idbi Federal Life InsuranceDocument17 pagesProject Report 2 Akshit Dube Idbi Federal Life InsuranceAkshit DubeNo ratings yet

- Business Strategy and Development Canadian 2nd Edition Bissonette Test BankDocument33 pagesBusiness Strategy and Development Canadian 2nd Edition Bissonette Test Bankariannenhannv0nwk100% (32)

- Michael Fagan Slides RMC Asia 2015Document20 pagesMichael Fagan Slides RMC Asia 2015chuff6675No ratings yet

- International Economics - Practice Test BankDocument11 pagesInternational Economics - Practice Test Bankhoanganh2808.2003No ratings yet

- 2 General-Journal-and-LedgersDocument51 pages2 General-Journal-and-LedgershilarytevesNo ratings yet

- Sethcano Resume July2020Document1 pageSethcano Resume July2020api-500085811No ratings yet

- (C) Modern Foods - Disinvestment and After: Introduction: Background NoteDocument3 pages(C) Modern Foods - Disinvestment and After: Introduction: Background NoteChandan KokaneNo ratings yet

- Types of Retail LocationDocument21 pagesTypes of Retail LocationDinesh Kataria67% (3)

- Module 1: Statement Of: Financial Position (SFP)Document20 pagesModule 1: Statement Of: Financial Position (SFP)Alyssa Nikki VersozaNo ratings yet

- A Project On The Spinning Industry of India: BY Deepak Luniya Roll No: 290Document45 pagesA Project On The Spinning Industry of India: BY Deepak Luniya Roll No: 290deepakluniyaNo ratings yet

- Market FailureDocument4 pagesMarket FailureJojo LeongNo ratings yet

- ISO 9001 AwarenessDocument1 pageISO 9001 AwarenessAnand Chavan Projects-QualityNo ratings yet

- Artificial Intelligence and Customer ExperienceDocument10 pagesArtificial Intelligence and Customer ExperienceDiyo LoryNo ratings yet

- PatanjaliDocument19 pagesPatanjaliAmit MishraNo ratings yet

- Economics and Markets For Wealth Management Ed2Document706 pagesEconomics and Markets For Wealth Management Ed2a.aljohani.1991100% (1)

- Maintain Quality Customer/guest Service: D1.HCS - CL6.03 D2.TRM - CL9.12 D1.HML - CL10.07 D1.HRM - CL9.06 Trainee ManualDocument80 pagesMaintain Quality Customer/guest Service: D1.HCS - CL6.03 D2.TRM - CL9.12 D1.HML - CL10.07 D1.HRM - CL9.06 Trainee Manualjames reidNo ratings yet

- Quality Risk Management (QRM) in Pharmaceutical Industry PDFDocument9 pagesQuality Risk Management (QRM) in Pharmaceutical Industry PDFАнна ОрлеоглоNo ratings yet

- Cópia de Teste StatusDocument130 pagesCópia de Teste StatusHigor PoloNo ratings yet

- Balance SHeet ApproachDocument14 pagesBalance SHeet ApproachMac TinhNo ratings yet

- Proposal - Business Plan Ikan BawalDocument30 pagesProposal - Business Plan Ikan BawalSaskia Putri zaniaNo ratings yet

- Making Case of Integrative Negotiation and Decision Making PDFDocument15 pagesMaking Case of Integrative Negotiation and Decision Making PDFFezi Afesina Haidir100% (1)

- t2sch125 08e 1Document4 pagest2sch125 08e 1denisgalNo ratings yet

- Carter Cleaning CompanyDocument19 pagesCarter Cleaning Companys65597No ratings yet