Professional Documents

Culture Documents

8 Annexure VI Taxes and Duties FOR FOREIGN BIDDERS Y15SC18005

Uploaded by

Dheeraj HegdeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

8 Annexure VI Taxes and Duties FOR FOREIGN BIDDERS Y15SC18005

Uploaded by

Dheeraj HegdeCopyright:

Available Formats

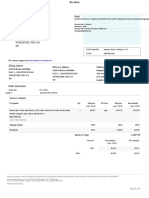

Annexure- VI-3

OIL AND NATURAL GAS CORPORATION LTD. MUMBAI HIGH ASSET

E-tender No.: Y15SC18005

Please enter values /data in yellow coloured cells only

Name of Bidder : Appendix-7-B

Price Bid (for FOREIGN BIDDERS only)

TAXES AND DUTIES

RATES OF TAXES & DUTIES CONSIDERED AND INCLUDED IN THE LUMPSUM PRICE FOR CHANGE IN LAW

Laws, Acts, Rules, regulations etc. and the tariffs thereof considered by the bidder while estimating the incidence of taxes, duties, fees, levies etc.

considered and included in the bidder’s Lumpsum price (as quoted in Appendix-7), as per relevant provisions of General Conditions of Contract to be used

for the purpose of adjustment to the contract price in the event of Change in Law in terms of clause no.43.0 of General Conditions of Contract are as

under:

Laws/Act/Rules/ Tariff Indicating

Tender Document / BEC Amount included in

Sr No Description of Item Regulations etc. Rate of Tax/Duty/

Clause Reference Lumpsum Price

Reference Fee/Levy etc

Not applicable as

1 Customs duty, if any NA

per Note 4

2 CGST

a SGST

b IGST

3 Any other tax / duty

Notes:

1. Bidders are required to ascertain themselves, the prevailing rates of GST and all other taxes and duties as applicable on the scheduled date of

submission of Price Bids and ONGC would not undertake any responsibility whatsoever in this regard. Accordingly, bidders should quote the prices, clearly

indicating the applicable rate of GST / description of service as per GST rules (under which the respective service is covered), Service Accounting Code,

alongwith all other taxes and duties applicable.

2. Bidder may suitably add other heads in terms of Change in Law clause of General Conditions of Contract.

3. Prices should be inclusive of corporate taxes as applicable and the same is not covered under the Change-in-Law provisions.

4. Custom duty is not applicable as per BEC Clause C.6.

5. The bidder should also indicate the details of imported raw material/components and its value for availing customd duty benefit, in the following tables.

Sr. No. Name of Imported Raw Material / Component Quantity of Imported

CIF value of Imported Raw Material /

Raw Material /

Component (Bidders' my also indicate the

Component

cu5rrency in which imports is made for the

purpose of information)

Signature of Authorised Signatory

Name & Designation

Place and Date

Company Seal of Bidder

You might also like

- Paypal StatementDocument11 pagesPaypal StatementZhor RealzonNo ratings yet

- 21 - Coca Cola Bottlers vs. CIRDocument24 pages21 - Coca Cola Bottlers vs. CIRJeanne CalalinNo ratings yet

- Drop Ileana Andreea Flat 1, 5 Droitwich Road Worcester, Wr3 7Lg GBDocument1 pageDrop Ileana Andreea Flat 1, 5 Droitwich Road Worcester, Wr3 7Lg GBIleana Andreea DropNo ratings yet

- Building Construction Business PlanDocument32 pagesBuilding Construction Business PlanHECTOR RODRIGUEZNo ratings yet

- Atlas Consolidated Mining Development Corporation Vs CirDocument1 pageAtlas Consolidated Mining Development Corporation Vs CirKrystel Hypa MagallanesNo ratings yet

- Taxation Bar QsDocument49 pagesTaxation Bar QsJohnKyleMendozaNo ratings yet

- The Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703From EverandThe Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703No ratings yet

- 4SCDE1920 CIV1 Delson Case Digests (Persons & Family Relations) PDFDocument254 pages4SCDE1920 CIV1 Delson Case Digests (Persons & Family Relations) PDFShanelle NapolesNo ratings yet

- Tax Evasion CHPT 1-5Document38 pagesTax Evasion CHPT 1-5KAYODE OLADIPUPO100% (4)

- China Aircraft Lease IndustryDocument26 pagesChina Aircraft Lease IndustryblueraincapitalNo ratings yet

- A. Nit HeaderDocument7 pagesA. Nit HeaderAMM GSD JODHPURNo ratings yet

- GeM Bidding 3589351Document4 pagesGeM Bidding 3589351AmanNo ratings yet

- 1692788383Document2 pages1692788383TENDER AWADH GROUPNo ratings yet

- 3 General Terms and ConditionsDocument12 pages3 General Terms and ConditionsDEVI PRASAD GREENSECURENo ratings yet

- SCC PDFDocument16 pagesSCC PDFSaptarshi ChatterjeeNo ratings yet

- PCMM Acting For and On Behalf of The President of India Invites E-Tenders Against Tender No 80191199Document4 pagesPCMM Acting For and On Behalf of The President of India Invites E-Tenders Against Tender No 80191199ANILNo ratings yet

- Hindustan Shipyard Ltd - ि◌ह̢दु ◌ािनशपया ड´ ि◌ल: Commercial Division (An ISO 9001:2015 Company)Document16 pagesHindustan Shipyard Ltd - ि◌ह̢दु ◌ािनशपया ड´ ि◌ल: Commercial Division (An ISO 9001:2015 Company)satyanand chNo ratings yet

- A. Nit HeaderDocument5 pagesA. Nit HeaderAMM GSD JODHPURNo ratings yet

- Form-Ii (See Regulation 4) Postal Bill of Export - II (To Be Submitted in Duplicate)Document1 pageForm-Ii (See Regulation 4) Postal Bill of Export - II (To Be Submitted in Duplicate)mrthilagamNo ratings yet

- Bihar State Power Transmission Company LTD: Patna: Name of BidderDocument15 pagesBihar State Power Transmission Company LTD: Patna: Name of BidderDilip KumarNo ratings yet

- A. Nit HeaderDocument5 pagesA. Nit HeaderAMM GSD JODHPURNo ratings yet

- 35225370a NitDocument6 pages35225370a NitAMM GSD JODHPURNo ratings yet

- Iocl Tender No.: Bidder'S Name: RDR17P032E DATED 19.04.2017 Bidders Offer Reference: Contact Person, Contact No. & Email IDDocument11 pagesIocl Tender No.: Bidder'S Name: RDR17P032E DATED 19.04.2017 Bidders Offer Reference: Contact Person, Contact No. & Email IDAnonymous fLgaidVBhzNo ratings yet

- Vol-IiiDocument43 pagesVol-IiiSudeep ShiwakotiNo ratings yet

- NTPC Limited: Volume - IiDocument5 pagesNTPC Limited: Volume - IiIshaan LuthraNo ratings yet

- GeM Bidding 5750824Document4 pagesGeM Bidding 5750824Prem ShahiNo ratings yet

- GeM-Bidding-3088720 - Diesel GeneratorDocument4 pagesGeM-Bidding-3088720 - Diesel GeneratorLakshmana Rao NNo ratings yet

- 35225338a NitDocument6 pages35225338a NitAMM GSD JODHPURNo ratings yet

- GeM Bidding 4219786Document5 pagesGeM Bidding 4219786Dinesh KumarNo ratings yet

- GeM Bidding 3899625Document4 pagesGeM Bidding 3899625MIHIR RANJANNo ratings yet

- GeM Bidding 5052919Document5 pagesGeM Bidding 5052919Nknitin10No ratings yet

- Scope 2 Saurabh - Rampal@hplng - inDocument137 pagesScope 2 Saurabh - Rampal@hplng - inTENDER AWADH GROUPNo ratings yet

- AtcDocument21 pagesAtcgoyalcommercialcoNo ratings yet

- GeM Bidding 4188229Document4 pagesGeM Bidding 4188229Dinesh KumarNo ratings yet

- GeM Bidding 4953645Document5 pagesGeM Bidding 4953645UMESH PATILNo ratings yet

- Bid DocumentDocument4 pagesBid DocumentNITISH krNo ratings yet

- GeM Bidding 3482736Document4 pagesGeM Bidding 3482736mogijo11dffdfgdfgNo ratings yet

- viewNitPdf 4195094Document4 pagesviewNitPdf 4195094Mohit SinghNo ratings yet

- GeM Bidding 4233180Document5 pagesGeM Bidding 4233180Chehar EnterprisesNo ratings yet

- Bid DocumentDocument17 pagesBid DocumentVarun BatraNo ratings yet

- Agreed Terms & Conditions For Purchase: Annexure-IvDocument4 pagesAgreed Terms & Conditions For Purchase: Annexure-IvadihindNo ratings yet

- Bidding Document: IFB No.: NCB/MM/G.05-079/080Document105 pagesBidding Document: IFB No.: NCB/MM/G.05-079/080Sunil GhimireNo ratings yet

- viewNitPdf 4336101Document6 pagesviewNitPdf 4336101mthmethodsengineeringNo ratings yet

- ATC 6 Buyerkurukshetra1Document47 pagesATC 6 Buyerkurukshetra1TENDER AWADH GROUPNo ratings yet

- GeM Bidding 4588198Document5 pagesGeM Bidding 4588198Rohit KumarNo ratings yet

- GeM Bidding 4604338Document5 pagesGeM Bidding 4604338Abhi SharmaNo ratings yet

- GeM Bidding 2848096Document3 pagesGeM Bidding 2848096Tarun MondalNo ratings yet

- GeM Bidding 5398208Document5 pagesGeM Bidding 5398208Rupesh GhatoleNo ratings yet

- GeM Bidding 4882317Document4 pagesGeM Bidding 4882317hussainarwa98No ratings yet

- GeM Bidding 3768184Document4 pagesGeM Bidding 3768184Kartik RajputNo ratings yet

- PCMM Acting For and On Behalf of The President of India Invites E-Tenders Against Tender No 80191205Document5 pagesPCMM Acting For and On Behalf of The President of India Invites E-Tenders Against Tender No 80191205ANILNo ratings yet

- GeM Bidding 5203379Document6 pagesGeM Bidding 5203379assgxNo ratings yet

- GeM-Bidding-2580918 Word Format AnnexuresDocument38 pagesGeM-Bidding-2580918 Word Format AnnexuresYogesh SinghNo ratings yet

- GeM Bidding 4907325Document7 pagesGeM Bidding 4907325Hemanth KumarNo ratings yet

- GeM Bidding 5667902Document5 pagesGeM Bidding 5667902Mayank KhandelwalNo ratings yet

- GeM Bidding 4042546Document5 pagesGeM Bidding 4042546Plant-Tech Hot TappingNo ratings yet

- A. Nit HeaderDocument5 pagesA. Nit HeaderAMM GSD JODHPURNo ratings yet

- viewNitPdf 4309803Document4 pagesviewNitPdf 4309803Rahul MannaNo ratings yet

- XI XII PBG 9 MprpumDocument4 pagesXI XII PBG 9 MprpuminfoNo ratings yet

- Nwrtendercondition0207 Compressed1Document49 pagesNwrtendercondition0207 Compressed1NeelNo ratings yet

- GeM Bidding 4291322Document8 pagesGeM Bidding 4291322Punya Prateek Nath SharmaNo ratings yet

- GeM Bidding 4561388Document8 pagesGeM Bidding 4561388Rohit KumarNo ratings yet

- GeM Bidding 5548833Document7 pagesGeM Bidding 5548833DHEERAJ JAINNo ratings yet

- ATC 6 Buyerkurukshetra1Document48 pagesATC 6 Buyerkurukshetra1TENDER AWADH GROUPNo ratings yet

- 4-GST Special Commercial Terms and Conditions RevisedDocument7 pages4-GST Special Commercial Terms and Conditions Revisedvishal.nithamNo ratings yet

- Bhopal TenderDocument3 pagesBhopal TenderDharmesh ShethNo ratings yet

- GeM Bidding 2923646Document4 pagesGeM Bidding 2923646Sulvine CharlieNo ratings yet

- Ii) Iii) : Are Hereby Invited Through E-Tendering Mode On Behalf of The President of India byDocument16 pagesIi) Iii) : Are Hereby Invited Through E-Tendering Mode On Behalf of The President of India byDheeraj HegdeNo ratings yet

- DAE E-Tenders - Public Tenders - Offline Tenders - Online Tenders - Department of Atomic EnergyDocument4 pagesDAE E-Tenders - Public Tenders - Offline Tenders - Online Tenders - Department of Atomic EnergyDheeraj HegdeNo ratings yet

- Tender DocumentDocument97 pagesTender DocumentDheeraj HegdeNo ratings yet

- Annexure To Tender No: DPS/MRPU/IGCAR/CAP/9542 Description of The ItemsDocument4 pagesAnnexure To Tender No: DPS/MRPU/IGCAR/CAP/9542 Description of The ItemsDheeraj HegdeNo ratings yet

- Project Under ExecutionDocument1 pageProject Under ExecutionDheeraj HegdeNo ratings yet

- A.Vital Criteria For Acceptance of BidsDocument5 pagesA.Vital Criteria For Acceptance of BidsDheeraj HegdeNo ratings yet

- Un Price Bid Format Annexure VIIDocument1 pageUn Price Bid Format Annexure VIIDheeraj HegdeNo ratings yet

- Un Price Bid Format Annexure VIIDocument1 pageUn Price Bid Format Annexure VIIDheeraj HegdeNo ratings yet

- Technical Specification Annexure IIIDocument5 pagesTechnical Specification Annexure IIIDheeraj HegdeNo ratings yet

- 8 Annexure VI Taxes and Duties FOR FOREIGN BIDDERS Y15SC18005Document2 pages8 Annexure VI Taxes and Duties FOR FOREIGN BIDDERS Y15SC18005Dheeraj HegdeNo ratings yet

- 9 UnPrice Bid Enclosure A Calculation of Local Content Y15SC18005Document2 pages9 UnPrice Bid Enclosure A Calculation of Local Content Y15SC18005Dheeraj HegdeNo ratings yet

- 9 Annexure V Material FOR FOREIGN BIDDERS Y15SC18005Document5 pages9 Annexure V Material FOR FOREIGN BIDDERS Y15SC18005Dheeraj HegdeNo ratings yet

- Investor Presentation (Company Update)Document43 pagesInvestor Presentation (Company Update)Shyam SunderNo ratings yet

- METRO India METRO Wholesale HyderabadDocument32 pagesMETRO India METRO Wholesale HyderabadKrishna KothaNo ratings yet

- KH Tax Guide To Taxation in Cambodia 2020Document30 pagesKH Tax Guide To Taxation in Cambodia 2020Lee XingNo ratings yet

- G.R. No 183505 Cir Vs SM Prime HoldingsDocument11 pagesG.R. No 183505 Cir Vs SM Prime HoldingsRenChaNo ratings yet

- Spectrochem Chemindex 2016 17Document122 pagesSpectrochem Chemindex 2016 17Nivedita Dube0% (1)

- Meaning and Scope of Supply Under GSTDocument5 pagesMeaning and Scope of Supply Under GSTGirish kNo ratings yet

- Airports Authority of India: Aai Office ComplexDocument52 pagesAirports Authority of India: Aai Office ComplexanupamkhannaNo ratings yet

- BIR RMC No. 62-2005Document15 pagesBIR RMC No. 62-2005dencave1No ratings yet

- All Level Two Coc QuestionsDocument15 pagesAll Level Two Coc Questionsabelu habite neriNo ratings yet

- 1 - 117 - Scheme of Assistance For ESDM Units Under Electronics Policy (2016-21) - GujaratDocument40 pages1 - 117 - Scheme of Assistance For ESDM Units Under Electronics Policy (2016-21) - GujaratAmitNo ratings yet

- CCDC 3Document35 pagesCCDC 3Raj SalviNo ratings yet

- April 18 2014Document48 pagesApril 18 2014fijitimescanadaNo ratings yet

- SER65xx ManualDocument145 pagesSER65xx ManualenoobyarNo ratings yet

- Part 1 - Total of 33Pts: San Beda University College of Law Taxation2 Final ExaminationDocument4 pagesPart 1 - Total of 33Pts: San Beda University College of Law Taxation2 Final ExaminationBrigette DomingoNo ratings yet

- Curriculum Vitae of Ralph G. Recto (As of January 19, 2024)Document7 pagesCurriculum Vitae of Ralph G. Recto (As of January 19, 2024)Ralph RectoNo ratings yet

- Summary For Customer Account Number (CAN) 133568798-5: Electric BillDocument2 pagesSummary For Customer Account Number (CAN) 133568798-5: Electric BillDenice MapayeNo ratings yet

- GST Amendment For May 23Document29 pagesGST Amendment For May 23Tushar MittalNo ratings yet

- Chapter 2 Ratio and Proportion (Business Application) )Document7 pagesChapter 2 Ratio and Proportion (Business Application) )Rinna Lynn FraniNo ratings yet

- MyobDocument52 pagesMyobRedwanur RahmanNo ratings yet

- Instructions & Commentary For: Standard Form of Contract For Architect's ServicesDocument65 pagesInstructions & Commentary For: Standard Form of Contract For Architect's ServicesliamdrbrownNo ratings yet

- A Critical Review of The Tax Structure of BangladeshDocument4 pagesA Critical Review of The Tax Structure of BangladeshSumaiya IslamNo ratings yet