Professional Documents

Culture Documents

Abstract and Key Words

Uploaded by

kuselvOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Abstract and Key Words

Uploaded by

kuselvCopyright:

Available Formats

xii

ABSTRACT AND KEY WORDS

Abstract

There has been tremendous growth in the demand for housing.

Consequently, the requirements of housing finance increased considerably.

Now, housing loan segment has become more competitive due to the entry of

new institutions into the industry. Because of intense competition, the players

in the sector have to become more customer oriented. They must provide

quality services to their customers and ensure that customers are satisfied

with their experience. Hence, the study on housing finance services assumes

great significance.

The study was mainly intended to assess and analyse the level of

awareness, perception and satisfaction of borrowers as to the housing finance

services of HDFC and LICHFL, the former representing the private sector and

the latter the proxy of public sector housing finance institution. The 630 home

loan beneficiaries (HDFC-360 and LICHFL-270) from the three zones in the

state of Kerala compose the sample of the study. Then, two districts, having

the highest growth rate in terms of per capita income from each zone, were

selected and from each district, 60 customers of HDFC and 45 customers of

LICHFL were selected by observing simple random sampling technique

xiii

The results of the analysis reveals that the two selected HFIs

differentiate themselves in framing policies and taking efforts to influence the

level of both awareness and perception of their borrowers on many aspects of

their products. When LICHFL pursued a more customer centred policy by

keeping greater information efficiency, its rival HDFC placed greater thrust on

earning factor by focusing its operating efficiency especially on sanctioning

and disbursement of loan with in limited time.

In terms of the level of satisfaction of borrowers with the loan products

rendered by their HFIs, the position of LICHFL in the mind of its borrowers is

much higher than that occupied by its rival in their customer’s mind. Such

difference in satisfaction level happened mainly due to the difference in the

gap between the borrower expectations and performance perceived by them.

However, borrower attributes did not contribute much to such difference.

The main limitation of the study is that it deals with the most qualitative

aspect of human behaviour, ‘satisfaction’, which cannot be exactly quantified.

Key words

Housing finance, Housing stock, Housing loan products, Housing

finance institutions, Borrower awareness, Borrower perception, Borrower

satisfaction, Borrower attributes, Residential mortgage backed securitisation,

Reverse mortgage loan, On-line approval, Non performing assets.

You might also like

- (218040592003) Saurabh CPDocument26 pages(218040592003) Saurabh CPNitish MarthakNo ratings yet

- A Navigator Study On Responsible Lending For India'Document6 pagesA Navigator Study On Responsible Lending For India'Ni007ckNo ratings yet

- Assignment On Housing Development Finance Corporation LTDDocument27 pagesAssignment On Housing Development Finance Corporation LTDShubhra Agarwal100% (2)

- Investing Customer Base of HSBC Bank An AnalysisDocument51 pagesInvesting Customer Base of HSBC Bank An AnalysisHusnain A AliNo ratings yet

- Home LoanDocument10 pagesHome LoanStudent Placement CoordinatorNo ratings yet

- Project Report: Banking IntroductionDocument4 pagesProject Report: Banking IntroductionKumar PreetamNo ratings yet

- Conceptpaper BDODocument3 pagesConceptpaper BDOgkzunigaNo ratings yet

- Customer Satisfaction: A Comparative Analysis of Public and Private Sector Banks in IndiaDocument8 pagesCustomer Satisfaction: A Comparative Analysis of Public and Private Sector Banks in IndiaShanawaz ArifNo ratings yet

- International Journal of Information Technology and Knowledge ManagementDocument6 pagesInternational Journal of Information Technology and Knowledge Managementrakeshkmr1186No ratings yet

- Research Paper On Home LoanDocument4 pagesResearch Paper On Home Loanafeaaawci100% (1)

- Consumer FinanceDocument23 pagesConsumer Financeching_pong100% (1)

- EXECUTIVE SUMMARY GenerlDocument36 pagesEXECUTIVE SUMMARY GenerlTusharJoshiNo ratings yet

- Patel Vipul (097520592058) Patel Nisit (097520592054)Document23 pagesPatel Vipul (097520592058) Patel Nisit (097520592054)Vipul PatelNo ratings yet

- Banking Risk DistributionDocument5 pagesBanking Risk DistributionPrashant RatnpandeyNo ratings yet

- Literature Review of HDFC Home LoanDocument8 pagesLiterature Review of HDFC Home Loanafmzuiffugjdff100% (1)

- ReportDocument13 pagesReportshubham rathiNo ratings yet

- Assignment 3 Part ADocument6 pagesAssignment 3 Part AALEN AUGUSTINENo ratings yet

- Introduction To Home LoansDocument7 pagesIntroduction To Home LoansMohmmedKhayyumNo ratings yet

- The Difference Between Home Loans and Educational Loans in HDFC BankDocument60 pagesThe Difference Between Home Loans and Educational Loans in HDFC BankRajesh BathulaNo ratings yet

- HDFC BankDocument87 pagesHDFC BankDeepak DixitNo ratings yet

- Pengaruh Kualitas Pelayanan Terhadap Loyalitas Nasabah Dengan Kepuasan Dan Kepercayaan Nasabah Sebagai Variabel InterveningDocument14 pagesPengaruh Kualitas Pelayanan Terhadap Loyalitas Nasabah Dengan Kepuasan Dan Kepercayaan Nasabah Sebagai Variabel InterveningBagastiyo Danar NinditoNo ratings yet

- Study On Vehicle Loan Disbursement ProceDocument11 pagesStudy On Vehicle Loan Disbursement ProceSandesh UdhaneNo ratings yet

- Customer Satisfaction: A Comparative Analysis of Public and Private Sector Banks in IndiaDocument8 pagesCustomer Satisfaction: A Comparative Analysis of Public and Private Sector Banks in IndiaShashwat VaidyaNo ratings yet

- Micro Finance For Housing (Final)Document142 pagesMicro Finance For Housing (Final)Sampanna ParhiNo ratings yet

- Project On PNBDocument62 pagesProject On PNBAakash KhuranaNo ratings yet

- Customers Satisfaction in Public and Private Sector Banks in India A Comparative Study PDFDocument8 pagesCustomers Satisfaction in Public and Private Sector Banks in India A Comparative Study PDFchandra sekar genjiNo ratings yet

- SSRN CustomerservicesincoopbanksDocument28 pagesSSRN CustomerservicesincoopbanksPriyanshu RatandhariyaNo ratings yet

- Literature Review On Loan RecoveryDocument7 pagesLiterature Review On Loan Recoveryc5m07hh9No ratings yet

- Ancillary Services Provided by BankersDocument17 pagesAncillary Services Provided by BankersLogan Davis100% (2)

- Study On Vehicle Loan Disbursement ProceDocument11 pagesStudy On Vehicle Loan Disbursement ProceRuby PrajapatiNo ratings yet

- Consumer Financing in PakistanDocument17 pagesConsumer Financing in PakistanSamia100% (10)

- Analysis of Icici BankDocument7 pagesAnalysis of Icici BankAnkur MathurNo ratings yet

- Ishu Main File2Document73 pagesIshu Main File2ishan chughNo ratings yet

- An Analytical Study On Home Loan: TitleDocument9 pagesAn Analytical Study On Home Loan: TitleomkarNo ratings yet

- BCG Digital Lending Report Tcm21 197622Document48 pagesBCG Digital Lending Report Tcm21 197622Krishna Chaitanya KothapalliNo ratings yet

- Idbi Final ProjectDocument59 pagesIdbi Final ProjectNitin Agarwal100% (1)

- Credit Appraisal System of Commercial Vehicle Loans.Document43 pagesCredit Appraisal System of Commercial Vehicle Loans.Pravin Kolpe92% (12)

- Literature Review of Customer Satisfaction in Banking SectorDocument4 pagesLiterature Review of Customer Satisfaction in Banking Sectorc5sq1b48No ratings yet

- Literature ReviewDocument10 pagesLiterature Reviewridhiarora2378% (9)

- Assessment of Customer's Satisfaction in HDFC (An Empirical Study in Lucknow City)Document10 pagesAssessment of Customer's Satisfaction in HDFC (An Empirical Study in Lucknow City)Anonymous CwJeBCAXpNo ratings yet

- 2 9 123 487 PDFDocument4 pages2 9 123 487 PDFAnandu MadhusudhaNo ratings yet

- Breaking Barriers - Micro Mortgage Analytics - EditedDocument9 pagesBreaking Barriers - Micro Mortgage Analytics - EditedVivek Sisodia100% (1)

- Customer Satisfaction of Landbank of The Philippines and Banco de Oro in Terms of Car Loan Services in Surigao CityDocument16 pagesCustomer Satisfaction of Landbank of The Philippines and Banco de Oro in Terms of Car Loan Services in Surigao CityLindy Lou YamiloNo ratings yet

- Different Types of DepositsDocument25 pagesDifferent Types of DepositsMohamad SayeedNo ratings yet

- Awareness and Satisfaction Level of Financial Products Offered by ICICI Bank and HDFC BankDocument13 pagesAwareness and Satisfaction Level of Financial Products Offered by ICICI Bank and HDFC BankPankaj AhujaNo ratings yet

- PREFACEDocument1 pagePREFACEbhaktasika2004No ratings yet

- Bibah Nurhabibah 38 48 Pengaruh Kualitas Produk Tabungan Wadiah Terhadap Loyalitas Nasabah Di BTPN Syariah Cabang Wisma PurwakartaDocument11 pagesBibah Nurhabibah 38 48 Pengaruh Kualitas Produk Tabungan Wadiah Terhadap Loyalitas Nasabah Di BTPN Syariah Cabang Wisma PurwakartaNusa JaksaraNo ratings yet

- Mba Project AxiesDocument55 pagesMba Project Axiespavan kumarNo ratings yet

- Home Loan - Hdfc&Icici BankDocument65 pagesHome Loan - Hdfc&Icici BankSahil SethiNo ratings yet

- Kotak FinalDocument46 pagesKotak FinalRahul FaliyaNo ratings yet

- Research Papers On Bank Loans in IndiaDocument7 pagesResearch Papers On Bank Loans in Indiaofahxdcnd100% (1)

- Housing Finance ChallangesDocument4 pagesHousing Finance Challangesbotmaking20No ratings yet

- Home Loan Research PapersDocument6 pagesHome Loan Research Papersgz7vhnpe100% (1)

- Service Quality Perceptions: A Case Study of Banking ServicesDocument19 pagesService Quality Perceptions: A Case Study of Banking ServicesLaurent GelyNo ratings yet

- Comparative Analysis of Home Loan in UTI BankDocument95 pagesComparative Analysis of Home Loan in UTI BankMitesh SonegaraNo ratings yet

- Issues and Challenges of Consumer Financing in PakistanDocument3 pagesIssues and Challenges of Consumer Financing in PakistanMohsin JuttNo ratings yet

- Navigating Unrealistic Budget Expectations: A Guide for New EntrepreneursFrom EverandNavigating Unrealistic Budget Expectations: A Guide for New EntrepreneursNo ratings yet

- Derivatives IIDocument1 pageDerivatives IIkuselvNo ratings yet

- AormDocument2 pagesAormkuselvNo ratings yet

- Two Marks Slip Test For AcctsDocument1 pageTwo Marks Slip Test For AcctskuselvNo ratings yet

- Unit IVDocument14 pagesUnit IVkuselvNo ratings yet

- Marketing Management Notes For All 5 Units - 6Document6 pagesMarketing Management Notes For All 5 Units - 6kuselvNo ratings yet

- Unit IDocument10 pagesUnit IkuselvNo ratings yet

- Unit IIIDocument9 pagesUnit IIIkuselvNo ratings yet

- Spectrum 2020 - 21Document2 pagesSpectrum 2020 - 21kuselvNo ratings yet

- Chapter 6-1Document14 pagesChapter 6-1kuselvNo ratings yet

- 10 - Appendix-2Document18 pages10 - Appendix-2kuselvNo ratings yet

- 17 - Chapter 7Document37 pages17 - Chapter 7kuselvNo ratings yet

- 1.1. Introduction To Supply Chain and LogisticsDocument13 pages1.1. Introduction To Supply Chain and LogisticskuselvNo ratings yet

- 20 AppendixDocument8 pages20 AppendixkuselvNo ratings yet

- 18 - Chapter 8 PDFDocument43 pages18 - Chapter 8 PDFkuselvNo ratings yet

- APPENDIXDocument1 pageAPPENDIXkuselvNo ratings yet

- Rental Agreement Sample and All You Need To Know Google DocsDocument5 pagesRental Agreement Sample and All You Need To Know Google DocsArvind KumarNo ratings yet

- Appendix QuestionnaireDocument6 pagesAppendix QuestionnairekuselvNo ratings yet

- Chapter 2Document19 pagesChapter 2kuselvNo ratings yet

- Chapter 1Document25 pagesChapter 1kuselvNo ratings yet

- PramilaDocument6 pagesPramilakuselvNo ratings yet

- Factors To Consider in ProductDocument1 pageFactors To Consider in ProductkuselvNo ratings yet

- MSC M Van Der Wal PDFDocument102 pagesMSC M Van Der Wal PDFkuselvNo ratings yet

- Assessment of Construction Management Techniques in The Nigeria Construction IndustryDocument55 pagesAssessment of Construction Management Techniques in The Nigeria Construction Industrykuselv0% (1)

- Aravind Complted 007Document117 pagesAravind Complted 007kuselvNo ratings yet

- Honda CityDocument1 pageHonda CitykuselvNo ratings yet

- The Role of Government in Supporting EntrepreneurshipDocument1 pageThe Role of Government in Supporting EntrepreneurshipkuselvNo ratings yet

- Banking and Indian Financialt200813 PDFDocument425 pagesBanking and Indian Financialt200813 PDFsimmi33No ratings yet

- Marketing Management Notes For All 5 Units - 32 PDFDocument1 pageMarketing Management Notes For All 5 Units - 32 PDFkuselvNo ratings yet

- Claudio Ferrari - University of Genova, ItalyDocument19 pagesClaudio Ferrari - University of Genova, ItalykuselvNo ratings yet

- Appsc Aee Mains 2019 Electrical Engineering Paper III 1fcbb2c9Document12 pagesAppsc Aee Mains 2019 Electrical Engineering Paper III 1fcbb2c9SURYA PRAKASHNo ratings yet

- Video ObservationDocument8 pagesVideo Observationapi-532202065No ratings yet

- 20 Ijrerd-C153Document9 pages20 Ijrerd-C153Akmaruddin Bin JofriNo ratings yet

- AnkitKumar InternshalaResume PDFDocument2 pagesAnkitKumar InternshalaResume PDFkusha010No ratings yet

- Gender and Patriarchy: Crisis, Negotiation and Development of Identity in Mahesh Dattani'S Selected PlaysDocument6 pagesGender and Patriarchy: Crisis, Negotiation and Development of Identity in Mahesh Dattani'S Selected Playsতন্ময়No ratings yet

- EQUIP9-Operations-Use Case ChallengeDocument6 pagesEQUIP9-Operations-Use Case ChallengeTushar ChaudhariNo ratings yet

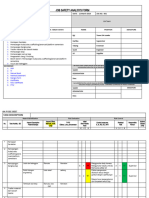

- JSA FormDocument4 pagesJSA Formfinjho839No ratings yet

- SSC 211 ED Activity 4.1Document4 pagesSSC 211 ED Activity 4.1bernard bulloNo ratings yet

- CMS156Document64 pagesCMS156Andres RaymondNo ratings yet

- July 2014Document56 pagesJuly 2014Gas, Oil & Mining Contractor MagazineNo ratings yet

- Glory in The Cross - Holy Thursday - Schutte PDFDocument1 pageGlory in The Cross - Holy Thursday - Schutte PDFsharon0murphyNo ratings yet

- Buku BaruDocument51 pagesBuku BaruFirdaus HoNo ratings yet

- Skills Check Extra 2ADocument1 pageSkills Check Extra 2AVishmi JayawardeneNo ratings yet

- A-Z Survival Items Post SHTFDocument28 pagesA-Z Survival Items Post SHTFekott100% (1)

- Comparison of Multi-Coil and Diaphragm Spring ClutchesDocument3 pagesComparison of Multi-Coil and Diaphragm Spring Clutchesmasb_994077No ratings yet

- Python Programming Laboratory Manual & Record: Assistant Professor Maya Group of Colleges DehradunDocument32 pagesPython Programming Laboratory Manual & Record: Assistant Professor Maya Group of Colleges DehradunKingsterz gamingNo ratings yet

- Description About Moon: Earth SatelliteDocument6 pagesDescription About Moon: Earth SatellitePurva KhatriNo ratings yet

- B1 Editable End-of-Year TestDocument6 pagesB1 Editable End-of-Year TestSyahira Mayadi50% (2)

- Information Security Master PlanDocument6 pagesInformation Security Master PlanMarubadi Rudra Shylesh Kumar100% (2)

- Supreme Court Case Analysis-Team ProjectDocument5 pagesSupreme Court Case Analysis-Team ProjectJasmineA.RomeroNo ratings yet

- 1.nursing As A ProfessionDocument148 pages1.nursing As A ProfessionveralynnpNo ratings yet

- Brochure - Actiwhite PWLS 9860.02012013Document12 pagesBrochure - Actiwhite PWLS 9860.02012013J C Torres FormalabNo ratings yet

- Module 17 Building and Enhancing New Literacies Across The Curriculum BADARANDocument10 pagesModule 17 Building and Enhancing New Literacies Across The Curriculum BADARANLance AustriaNo ratings yet

- 8A L31 Phiếu BTDocument7 pages8A L31 Phiếu BTviennhuNo ratings yet

- CA Level 2Document50 pagesCA Level 2Cikya ComelNo ratings yet

- Evaluating Websites A Checklist - JOHN CARLO G. GAERLANDocument3 pagesEvaluating Websites A Checklist - JOHN CARLO G. GAERLANMarvin CincoNo ratings yet

- A List of 142 Adjectives To Learn For Success in The TOEFLDocument4 pagesA List of 142 Adjectives To Learn For Success in The TOEFLchintyaNo ratings yet

- Lenovo S340-15iwl Compal LA-H101P SchematicDocument53 pagesLenovo S340-15iwl Compal LA-H101P SchematicYetawa Guaviare100% (4)

- James KlotzDocument2 pagesJames KlotzMargaret ElwellNo ratings yet

- Service Manual: NISSAN Automobile Genuine AM/FM Radio 6-Disc CD Changer/ Cassette DeckDocument26 pagesService Manual: NISSAN Automobile Genuine AM/FM Radio 6-Disc CD Changer/ Cassette DeckEduardo Reis100% (1)