Professional Documents

Culture Documents

Sample Debt Letter 3 Request A Reduced Settlement

Sample Debt Letter 3 Request A Reduced Settlement

Uploaded by

Raviteja ChOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sample Debt Letter 3 Request A Reduced Settlement

Sample Debt Letter 3 Request A Reduced Settlement

Uploaded by

Raviteja ChCopyright:

Available Formats

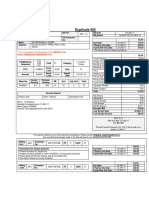

Debt > Debt Settlements > Sample Letters > Letter 3

Sample Debt Letter 3

Request a Reduced Settlement

Date

Name of contact, Name of company

Address

City, ST Zip

Re: Account of [name account is under]; Account No. [insert account number]

Dear _________:

This letter is to follow-up on the telephone conversation we had on [date] wherein I advised you of my dire

financial condition. As I told you on the phone, I have recently become disabled, and my current monthly

income has been reduced to such a low amount that it barely covers my rent and basic necessities of life.

Because my health problems are permanent and I have nothing of value to sell and no money in savings,

there is no way I will be able to pay my debts in full. For this reason, I am trying to avoid filing bankruptcy

by contacting all of my unsecured creditors and asking them to accept a reduced amount as payment in

full.

My monthly net income in the form of a disability payment is $_____________ , and my basic living

expenses are as follows:

Rent

Insurance

Utilities

Food

Total $_____________________

As you can see, this leaves me $__________ each month to pay all of my unsecured creditors, who

consist of the following:

Creditor Total Amount Due Average Monthly Payment

X Credit Card $[total amount due] $[avg. monthly payment]

Y Credit Card $[total amount due] $[avg. monthly payment]

Z Credit Card $[total amount due] $[avg. monthly payment]

Totals $___________ $____________

I am proposing a settlement of 30 percent of the total amount owed as payment in full for this debt to your

company, as well as the other two listed above. Thirty percent of $[total amount due] is $____________,

which I am requesting be paid back to you in the form of a payment each month in the amount of

$____________ for the next [number of months] months.

Please contact me as soon as possible and advise me whether or not this settlement is agreeable to you.

I want to do everything I can to avoid filing bankruptcy and am hoping I can work out some sort of

settlement with my creditors. Thank you for your attention to this matter.

Sincerely,

Your name

Complete contact information

Dear Sir,

This is Kumaraguru was having ICICI bank credit card in the year 2005. Card no :

[protected].

There was a credit outstanding of only 4000/- premium amount in this card when i

stopped using this card. Even when i paid my monthly minimum dues, i was fined in the

next month bill during that time. I have not paid and the case transferred to CIBIL. Now

a person from ICICI bank called me and asked for settlement for this card.

When i am trying to customer care centre, i could not get in with them using this card

number as the IVR saying the entry is invalid. I tried maximum number of times. I have

received a letter from Chennai Ambattur ICIC bank saying that letter is settlement only

and not mentioned anywhere as FULL and FINAL settlement letter.

I was worrying if anyone from ICICI bank trying to cheat me. Pls advise how to handle

this.

regards/guru

You might also like

- Letter Request-Metrobank-Credit Card Debt RestructuringDocument1 pageLetter Request-Metrobank-Credit Card Debt RestructuringGrasya Albano100% (7)

- Credit Card Late Payment Removal LetterDocument1 pageCredit Card Late Payment Removal LetterElcana Mathieu80% (5)

- Application AmexDocument8 pagesApplication AmexAkash HimuNo ratings yet

- Hybrid Script 8-8-23Document17 pagesHybrid Script 8-8-23Andrés FlórezNo ratings yet

- Bank Loan Application LetterDocument8 pagesBank Loan Application LetterSantosh Shrestha100% (1)

- Payments User Guide - English (2006)Document39 pagesPayments User Guide - English (2006)Gláucia CarvalhoNo ratings yet

- BonusLetters Expanded Edition 19Document36 pagesBonusLetters Expanded Edition 19jack mehoff100% (6)

- Goodwill Letter Mortgage Late PaymentDocument2 pagesGoodwill Letter Mortgage Late Paymentgabby macaNo ratings yet

- (Company Name) Is Willing To Work With Me On Erasing This Mark From My Credit Reports. I HaveDocument2 pages(Company Name) Is Willing To Work With Me On Erasing This Mark From My Credit Reports. I Havegabby macaNo ratings yet

- Credit Card LetterDocument2 pagesCredit Card Letterbjo10No ratings yet

- International Finance Case Solution Chapter 13Document3 pagesInternational Finance Case Solution Chapter 13Al-Imran Bin Khodadad100% (1)

- KPMG Basel IIDocument34 pagesKPMG Basel IIkenpty0% (1)

- Market Timing Sin A LittleDocument16 pagesMarket Timing Sin A LittlehaginileNo ratings yet

- Hardship LetterDocument2 pagesHardship Letterjuanpolicarpio420No ratings yet

- Credit - Repair - What Is A Goodwill Letter - TemplateDocument1 pageCredit - Repair - What Is A Goodwill Letter - TemplateCarol BerzatNo ratings yet

- Sample LetterDocument1 pageSample Letterjuanpolicarpio420No ratings yet

- Write A Letter To The Bank Requesting Him For A Time Duration For The Payment of The Monthly InstallmentsDocument2 pagesWrite A Letter To The Bank Requesting Him For A Time Duration For The Payment of The Monthly InstallmentsrrameshsmitNo ratings yet

- Reminder and Collection LetterDocument3 pagesReminder and Collection Lettermihaela0709No ratings yet

- Sample Letter To A Creditor Requesting A Reduced Monthly PaymentDocument1 pageSample Letter To A Creditor Requesting A Reduced Monthly PaymentRakesh JoshiNo ratings yet

- Judgment Proof Sample LettersDocument3 pagesJudgment Proof Sample Letterstina100% (1)

- Goodwill Template LetterDocument1 pageGoodwill Template LetterMichael DavisNo ratings yet

- Salary Stretch Application Form2 1Document2 pagesSalary Stretch Application Form2 1Gilbert MendozaNo ratings yet

- Safe GoodwillLetters123Document4 pagesSafe GoodwillLetters123gabby macaNo ratings yet

- Introduction EbcDocument5 pagesIntroduction EbckmkesavanNo ratings yet

- Customer Information Sheet: Primary Account HolderDocument7 pagesCustomer Information Sheet: Primary Account HolderJayakumarNo ratings yet

- Template - Intimation To LenderDocument1 pageTemplate - Intimation To Lenderadvocate572No ratings yet

- Sample Request Letter For Waiving Credit Card FeesDocument2 pagesSample Request Letter For Waiving Credit Card FeesWræn ŸåpNo ratings yet

- Credit Card LostDocument2 pagesCredit Card LostAzmyNo ratings yet

- Intimation Letter - DMIDocument1 pageIntimation Letter - DMIAditya PathaniaNo ratings yet

- Credit Repair KitDocument9 pagesCredit Repair KitChristine Skiba0% (1)

- Credit Card WaiverDocument1 pageCredit Card WaiverphuaboonguanNo ratings yet

- Ample Eminder Etter: Master Card VisaDocument3 pagesAmple Eminder Etter: Master Card VisaBherllyne JumillaNo ratings yet

- Credit LetterDocument33 pagesCredit LetterMeralu pagueNo ratings yet

- Deposit Account Opening Form: Vijaya BankDocument3 pagesDeposit Account Opening Form: Vijaya Bankamitagar42No ratings yet

- Mandate Form For Electronic Transfer of Claim / Refund Payments To Bajaj Allianz General Insurance Company LTDDocument1 pageMandate Form For Electronic Transfer of Claim / Refund Payments To Bajaj Allianz General Insurance Company LTDSwarup GadeNo ratings yet

- Demand Letter For Payment of Outstanding DebtDocument2 pagesDemand Letter For Payment of Outstanding Debtf8trbwh6nr100% (1)

- TO Head - Credicards Icici Creditcard Division Kind Attn. MR - Subrat Pani Dear Sir, Ref:: My Credit Card NoDocument1 pageTO Head - Credicards Icici Creditcard Division Kind Attn. MR - Subrat Pani Dear Sir, Ref:: My Credit Card Noayaskant751001No ratings yet

- CFPB Students Sample-LetterDocument3 pagesCFPB Students Sample-LetterMihaela StavilaNo ratings yet

- Letter To CreditorsDocument1 pageLetter To Creditorsjuanpolicarpio420No ratings yet

- Forb EdservDocument1 pageForb Edserv1rayshaunNo ratings yet

- EFT ApplicationDocument1 pageEFT Applicationrob_crowell_1No ratings yet

- YesbankDocument2 pagesYesbankshantibhushan.saleNo ratings yet

- MR Umar Mansha Chief Executive OfficerDocument2 pagesMR Umar Mansha Chief Executive Officeraveros12No ratings yet

- Goodwill Letter TemplateDocument1 pageGoodwill Letter TemplateReandino, Shannen Rose LNo ratings yet

- Accounts Receivable Call ScriptsDocument3 pagesAccounts Receivable Call Scriptsrajeshselvam002No ratings yet

- PDFDocument20 pagesPDFdhandapani seemanNo ratings yet

- Salary Transfer LetterDocument1 pageSalary Transfer LetterMinesh MistryNo ratings yet

- Eto Na Talaga XDDocument3 pagesEto Na Talaga XDy3nkieNo ratings yet

- Jelen Accounting Services Inc: Recurring Payment Authorization FormDocument1 pageJelen Accounting Services Inc: Recurring Payment Authorization FormjhonNo ratings yet

- Sample Letter To Landlord To Request Rent Relief or Payment PlanDocument3 pagesSample Letter To Landlord To Request Rent Relief or Payment PlanS P JaladharanNo ratings yet

- Mail Merge (Word)Document1 pageMail Merge (Word)Jezza G. PlangNo ratings yet

- Freeze Interest LetterDocument1 pageFreeze Interest Letterjuanpolicarpio420No ratings yet

- Auto Debit Instruction HDFC Bank CCDocument1 pageAuto Debit Instruction HDFC Bank CCNihar KNo ratings yet

- 650 and Beyond DIY Credit Repair: “Where We Care To RepairFrom Everand650 and Beyond DIY Credit Repair: “Where We Care To RepairNo ratings yet

- Goodwill MessagesDocument4 pagesGoodwill Messagesmoeed-ali-167750% (2)

- Collection Letters Format - SamplesDocument5 pagesCollection Letters Format - Samplesusless018No ratings yet

- Debit CardDocument1 pageDebit CardRavi Kumar KadivetiNo ratings yet

- Sample Hardship Letter 3Document1 pageSample Hardship Letter 3donsira123No ratings yet

- Settlement LetterDocument2 pagesSettlement LetterRitisha BiswasNo ratings yet

- Bcbs - HCSC IllinoisDocument2 pagesBcbs - HCSC IllinoisShirley Pigott MDNo ratings yet

- Recurring Deposit Closure LetterDocument1 pageRecurring Deposit Closure Lettervidhyaa101170% (10)

- A Letter Requesting Payment: By: Arib Muhammady Fikri Islami Risky SetyawanDocument35 pagesA Letter Requesting Payment: By: Arib Muhammady Fikri Islami Risky Setyawanuser100% (2)

- Pedro Cooper: 3588 Plymouth #258, Ann Arbor, MI 48105 248-509-4811 Plcooper@umich - EduDocument1 pagePedro Cooper: 3588 Plymouth #258, Ann Arbor, MI 48105 248-509-4811 Plcooper@umich - EduPedro CooperNo ratings yet

- Dividends Session6 8Document21 pagesDividends Session6 8Vibhuti AnandNo ratings yet

- Chart of Accounts ExplanationDocument9 pagesChart of Accounts Explanationellapot89No ratings yet

- Loan and Security AgreementDocument52 pagesLoan and Security Agreementbefaj44984No ratings yet

- 2 Nominal and Effective Interest Rate 2015Document11 pages2 Nominal and Effective Interest Rate 2015Muhammad SaepudinNo ratings yet

- BDW AffidavitDocument82 pagesBDW AffidavitkatiaNo ratings yet

- Account Details: Invoice/Statement DateDocument3 pagesAccount Details: Invoice/Statement DateThanh GiangNo ratings yet

- WhitepaperDocument5 pagesWhitepaperyudiNo ratings yet

- Sahaj AePs - Retailer ModuleDocument21 pagesSahaj AePs - Retailer Modulemonishmansoori72No ratings yet

- Chapter - Ii Review of Literature: Personal Debt Management: A Study Related To Urban Household's Debt Servicing BurdenDocument20 pagesChapter - Ii Review of Literature: Personal Debt Management: A Study Related To Urban Household's Debt Servicing BurdenSakshi BathlaNo ratings yet

- InvoiceDocument1 pageInvoicemanojkmorwal07No ratings yet

- Unit 1 - Introduction To Accounting: Annual Financial StatementsDocument2 pagesUnit 1 - Introduction To Accounting: Annual Financial StatementsMayte DeliyoreNo ratings yet

- FWDS Detailed ExampleDocument4 pagesFWDS Detailed ExampleZacks MchenyenyaNo ratings yet

- Posting General Journal Entries (J58)Document6 pagesPosting General Journal Entries (J58)waqar anwarNo ratings yet

- ACBDocument64 pagesACBPrakash GowdaNo ratings yet

- 01.20 Government BusinessDocument48 pages01.20 Government Businessmevrick_guyNo ratings yet

- Accounting ManualDocument38 pagesAccounting ManualyasirkarimNo ratings yet

- Investment Analysis & Portfolio ManagementDocument22 pagesInvestment Analysis & Portfolio ManagementJyoti YadavNo ratings yet

- Capital Market: Financial Market Debt Equity SecuritiesDocument33 pagesCapital Market: Financial Market Debt Equity SecuritiesRohit JainNo ratings yet

- Assets Liabilities Date Cash + Accounts Receivable + Equipment Accounts PayableDocument11 pagesAssets Liabilities Date Cash + Accounts Receivable + Equipment Accounts PayableAadit AggarwalNo ratings yet

- Affidavit NOEL KENNEDY On and For The Record - DUKES Colin Naylor CEO.Document65 pagesAffidavit NOEL KENNEDY On and For The Record - DUKES Colin Naylor CEO.MarkMadMunki100% (1)

- A Study of Roots IndustryDocument49 pagesA Study of Roots Industrygowthamven100% (4)

- Duplicate Bill: For Any Queries On This Bill Please Contact MSEDCL CallDocument1 pageDuplicate Bill: For Any Queries On This Bill Please Contact MSEDCL CallNarendra VermaNo ratings yet

- FILE 20231105 224350 KIỂM-TRA-T6Document60 pagesFILE 20231105 224350 KIỂM-TRA-T6vanpth20404cNo ratings yet

- Research Paper by Naresh Kachori, Roll No.22Document15 pagesResearch Paper by Naresh Kachori, Roll No.2222Naresh KachoriNo ratings yet

- Ib Economics Study Guide MacroDocument43 pagesIb Economics Study Guide Macroapi-196719233No ratings yet

- 2017-11-20 Tier 2 5 Register of SponsorsDocument1,911 pages2017-11-20 Tier 2 5 Register of SponsorsManisha BotNo ratings yet