Professional Documents

Culture Documents

GuideQuestions in CreditTransactions

GuideQuestions in CreditTransactions

Uploaded by

Brylle Deeiah Tumarong0 ratings0% found this document useful (0 votes)

12 views2 pagesOriginal Title

GuideQuestions_in_CreditTransactions

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views2 pagesGuideQuestions in CreditTransactions

GuideQuestions in CreditTransactions

Uploaded by

Brylle Deeiah TumarongCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

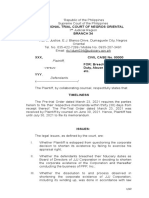

1. Compare commodatum with mutuum (Arts.

1933 & 1953 CC)

2. Distinguish consumable from non-consumable; fungible from non-fungible (Art. 418 CC)

3. Is commodatum and mutuum a consensual or real contract (Arts. 1315, 1316, 1934 CC;

BPI Investment Corp. v. Court of Appeals G.R. No. 133632, February 15, 2002)

4. Should the contract of commodatum and mutuum be in writing to be valid (Arts. 1356,

1358, & 1403 CC)

5. Compare commodatum and usufruct (Arts. 564, 1935, & 1940 CC)

6. Compare commodatum and deposit (Arts. 1933, 1937, 1962, 1965, & 1966 CC)

7. Compare commodatum and lease (Arts. 1935, 1936, 1643, 1645; Republic v. Bagtas, G.R.

No. L-17474, October 25, 1962)

8. Compare commodatum and tolerance (Arts. 537 & 1946 CC; Pujuyo v. Court of Appeals,

G.R. No. 146364, July 3, 2004)

9. Obligations of bailee (borrower) (Arts. 1939 (2), 1941, 1942 (4), 1943, 1949 CC)

10. Obligations of bailor (lender) (Arts. 1938 & 1949 CC)

11. Liability of bailee in case of loss of object (Arts. 1170, 1174, 1942 CC)

12. Extinguishment and return of object (Arts. 1939 (1), 1946, 1947, & 1948 CC)

13. Right of retention (Arts. 1944, 1951, & 1952 CC)

14. Compare mutuum (Arts. 1933 & 1953 CC) and barter (Arts. 1638 & 1954)

15. Compare mutuum and sale (Art. 1458)

16. Loan with condition (Saura Import v. Development Bank, G.R. No. L-24968, April 27,

1972)

17. What is a credit card transaction? (Pantaleon v. American Express, G.R. No. 174269,

August 25, 2010)

18. What is a savings deposit? (Arts. 12315, 1287, & 1980 CC; Gullas v. Philippine National

Bank, G.R. No. L-43191, November 13, 1935)

19. Loan with chattel mortgage. (Republic v. Grijaldo, G.R. No. L-20240, December 31, 1965)

20. Is non-payment of loan a purely civil liability? (Guingona v. City Fiscal of Manila, G.R. No.

L-60033, April 4, 1984)

21. Payment (Arts. 1249, 1250, 1955 CC; R.A. No. 8183 – An Act to Assure the Uniform Value

of Philippine Currency; Equitable PCI Bank v. Ng Shiong, G.R. No. 171545, December 19,

2007 – Extraordinary deflation)

22. Kinds of interest: a) Monetary (Art. 1956 CC; State Investment House v. Court of

Appeals, G.R. No. 90676, June 19, 1991); b) Compensatory (Arts. 1226, 1229, & 2209 CC)

and c) Compound (Arts. 1959 & 2212 CC)

23. Should stipulation of interest be in writing to be enforceable? (Arts. 1956 & 1960; De la

Paz v. L & J Development Company, G.R. No. 183360, September 8, 2014; Section 4, R.A.

No. 3765 – Truth in Lending Act) With certain exceptions (Arts. 1589, 1788, 1896, 2209,

2210, & 2211 CC)

24. What is an escalation clause? (See page 79, De Leon; Philippine Savings Bank v. Castillo;

G.R. No. 193178, May 30, 2011)

25. What is an acceleration clause? (See page 64, De Leon)

26. Exorbitant interest. Usury law suspended (Arts. 1175, 1413, 1957, & 1961; Advocates for

Truth in Lending v. Bangko Sentral Monetary Board, G.R. No. 192986, January 15, 2013;

Angel Jose Warehousing Company v. Chelda Enterprises, G.R. No. L-25704, April 24,

1968)

27. Courts can equitably reduce exorbitant interest (Macalinao v. Bank of Philippine Islands,

G.R. No. 175490, September 17, 2009; Medel v. Court of Appeals, G.R. No. 131622,

November 27, 1988; Fausto v. Multi Agri-Forest, G.R. No. 213939, October 12, 2016)

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Resolution 3 and 4 Concurring To The AppointmentDocument4 pagesResolution 3 and 4 Concurring To The AppointmentBrylle Deeiah Tumarong100% (2)

- List of Lease Instruments - A 78 2017Document5 pagesList of Lease Instruments - A 78 2017Maldives Islands100% (2)

- An Outline of The Insurance CodeDocument6 pagesAn Outline of The Insurance CodeBrylle Deeiah TumarongNo ratings yet

- RESOLUTION 1 and 2 For Appointment of Secretary and TreasurerDocument6 pagesRESOLUTION 1 and 2 For Appointment of Secretary and TreasurerBrylle Deeiah Tumarong100% (2)

- Business Math Reviewer ShortDocument12 pagesBusiness Math Reviewer ShortJames Earl AbainzaNo ratings yet

- Credit Card Transaction FlowDocument7 pagesCredit Card Transaction Flowranjith123456No ratings yet

- Internet BankingDocument67 pagesInternet BankingRaj Kumar0% (2)

- 1569658110042Document8 pages1569658110042ShubhamGuptaNo ratings yet

- 2021 LAW On SUFFRAGE Assignment (Revised)Document3 pages2021 LAW On SUFFRAGE Assignment (Revised)Brylle Deeiah TumarongNo ratings yet

- Memorandandum Breach CaseDocument62 pagesMemorandandum Breach CaseBrylle Deeiah TumarongNo ratings yet

- Letter For PNPDocument3 pagesLetter For PNPBrylle Deeiah Tumarong100% (1)

- List of Kkdat MembersDocument1 pageList of Kkdat MembersBrylle Deeiah TumarongNo ratings yet

- List of Kkdat MembersDocument1 pageList of Kkdat MembersBrylle Deeiah TumarongNo ratings yet

- Guidelines For Law Firms or Government Offices Supervising Apprentices From Silliman University - College of LawDocument3 pagesGuidelines For Law Firms or Government Offices Supervising Apprentices From Silliman University - College of LawBrylle Deeiah TumarongNo ratings yet

- Aydap 2019Document1 pageAydap 2019Brylle Deeiah TumarongNo ratings yet

- Gercio VS SunlifeDocument4 pagesGercio VS SunlifeBrylle Deeiah TumarongNo ratings yet

- SPL All CasesDocument15 pagesSPL All CasesBrylle Deeiah TumarongNo ratings yet

- Three BricklayersDocument2 pagesThree BricklayersBrylle Deeiah TumarongNo ratings yet

- RIATF7-MEID Resolution No. 31, S. 2020 PDFDocument3 pagesRIATF7-MEID Resolution No. 31, S. 2020 PDFBrylle Deeiah TumarongNo ratings yet

- Siquijor Provincial: Task Force Covid-19Document8 pagesSiquijor Provincial: Task Force Covid-19Brylle Deeiah TumarongNo ratings yet

- Monitoring Good Practices Report Volume4 - Web Version PDFDocument52 pagesMonitoring Good Practices Report Volume4 - Web Version PDFBrylle Deeiah TumarongNo ratings yet

- Memorandum Reiteration of Iatf Guidelines PDFDocument3 pagesMemorandum Reiteration of Iatf Guidelines PDFBrylle Deeiah TumarongNo ratings yet

- Qualifications of Every PositionDocument3 pagesQualifications of Every PositionBrylle Deeiah TumarongNo ratings yet

- RA 9262 - BoadoDocument12 pagesRA 9262 - BoadoBrylle Deeiah TumarongNo ratings yet

- Republic VS GuzmanDocument2 pagesRepublic VS GuzmanBrylle Deeiah TumarongNo ratings yet

- Division 1Document1 pageDivision 1Brylle Deeiah TumarongNo ratings yet

- Program: Siquijor Province Task Force Covid-19 Planning WorkshopDocument1 pageProgram: Siquijor Province Task Force Covid-19 Planning WorkshopBrylle Deeiah TumarongNo ratings yet

- Safer, Adaptive and Disaster Resilient Filipino Communities Towards Sustainable DevelopmentDocument14 pagesSafer, Adaptive and Disaster Resilient Filipino Communities Towards Sustainable DevelopmentBrylle Deeiah TumarongNo ratings yet

- RA 9262 and RA 7610Document2 pagesRA 9262 and RA 7610Brylle Deeiah TumarongNo ratings yet

- Literature Review On Credit CardsDocument3 pagesLiterature Review On Credit CardsAkshay singhNo ratings yet

- Zing Corp Prepares Monthly Bank Reconciliations As Part of ItsDocument2 pagesZing Corp Prepares Monthly Bank Reconciliations As Part of ItsCharlotteNo ratings yet

- Corporate Salary Account Report For HDFC BankDocument42 pagesCorporate Salary Account Report For HDFC BankShubhranshu SumanNo ratings yet

- Bfi Questions FinalDocument4 pagesBfi Questions FinalChristian RellonNo ratings yet

- Jcsgo Christian Academy: Senior High School DepartmentDocument4 pagesJcsgo Christian Academy: Senior High School DepartmentFredinel Malsi ArellanoNo ratings yet

- NBFCs and Transition From OL Model To FL ModelDocument5 pagesNBFCs and Transition From OL Model To FL Modelshashwat joshiNo ratings yet

- Tybbi 100 Mark Project List 2011 (Sem V)Document2 pagesTybbi 100 Mark Project List 2011 (Sem V)Shubhra Dutta56% (18)

- Registered Office: Plot No.C-27, 'G' Block, Bandra Kurla Complex, Bandra (E), Mumbai, Maharashtra 400051Document2 pagesRegistered Office: Plot No.C-27, 'G' Block, Bandra Kurla Complex, Bandra (E), Mumbai, Maharashtra 400051KiranNo ratings yet

- Name: Amita Satish: My Debt Free LifeDocument3 pagesName: Amita Satish: My Debt Free LifeAmitaNo ratings yet

- PhonePe Statement Feb2024 Mar2024Document13 pagesPhonePe Statement Feb2024 Mar2024Xyz AvmcNo ratings yet

- Bank List NACH ECS Direct DebitDocument52 pagesBank List NACH ECS Direct DebitSantosh BillaNo ratings yet

- Booking Confirmation & Reservation Form: Please Fill Out Needed Details in AsteriskDocument2 pagesBooking Confirmation & Reservation Form: Please Fill Out Needed Details in AsteriskEmy SalvadorNo ratings yet

- Crystal Reports - GST O&MDocument1 pageCrystal Reports - GST O&Mgaurav_kumar477No ratings yet

- Tugas Pelatihan 2Document27 pagesTugas Pelatihan 2Danang RamadhanNo ratings yet

- Instructions: (2) Make Amortization Schedule For 3 YearsDocument2 pagesInstructions: (2) Make Amortization Schedule For 3 YearsPatar ElmausNo ratings yet

- FMI Important QuestionDocument3 pagesFMI Important Question848 Anirudh ChaudheriNo ratings yet

- Following Transactions of Ramesh, Delhi For April, 2019 Are Given Below. Journalise ThemDocument1 pageFollowing Transactions of Ramesh, Delhi For April, 2019 Are Given Below. Journalise ThemAgape Sol'nsNo ratings yet

- Phenomenon Consultants: E/503, Borsali Apt Khanpur, Ahmedabad-380001 PH: 079-25600269Document2 pagesPhenomenon Consultants: E/503, Borsali Apt Khanpur, Ahmedabad-380001 PH: 079-25600269Murli MenonNo ratings yet

- Agriculture Loan.1Document2 pagesAgriculture Loan.1babu41652107No ratings yet

- Bank Guarantee: B. Com. (Hons.) Sem. II Banking Operations ManagementDocument8 pagesBank Guarantee: B. Com. (Hons.) Sem. II Banking Operations ManagementRajesh KumarNo ratings yet

- Date Mm/dd/yyyy Name of Customer Bank Check # AmountDocument2 pagesDate Mm/dd/yyyy Name of Customer Bank Check # AmountDerick DalisayNo ratings yet

- (Revisi 16 November 2020) : CNP (Southern Pump) Price ListDocument99 pages(Revisi 16 November 2020) : CNP (Southern Pump) Price Listkalimosodo 010% (1)

- Santander's Acquisition of Abbey: Banking Across BordersDocument29 pagesSantander's Acquisition of Abbey: Banking Across BordersJawad FarisiNo ratings yet

- Commercials: Sr. No. TXN Mode Services Type Vle ShareDocument2 pagesCommercials: Sr. No. TXN Mode Services Type Vle ShareSHASHI KANTNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument6 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancePerala SrikanthNo ratings yet