Professional Documents

Culture Documents

Concept & Extent of Inheritance: General Principles

Uploaded by

fergie1trinidadOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Concept & Extent of Inheritance: General Principles

Uploaded by

fergie1trinidadCopyright:

Available Formats

GENERAL PRINCIPLES

CONCEPT & EXTENT OF INHERITANCE

Any property accruing since the death of the decedent is not part of the

inheritance although it pertains to the heir because it is not transmitted

by death but acquired by the heir by virtue of the right of accession.

TRANSMISSIBILITY OF RIGHTS

ART. 1311 NCC – GR: rights and obligations arising from contracts are

binding upon the heirs. UNLESS: they are not transmissible by their

nature, or by stipulation or by provision of law.

In the case at bar, the subject matter of the contract is a lease, which is a property right. The

death of a party does not excuse nonperformance of a contract which involves a property

right, and the rights and obligations thereunder pass to the personal representatives of the

deceased. Similarly, nonperformance is not excused by the death of the party when the

other party has a property interest in the subject matter of the contract. DKC Holdings v. CA,

G.R. No. 118248. April 5, 2000

ART 1311 NCC – The heir is NOT liable beyond the value of the property

he received from the decedent.

ACQUISITION OF RIGHTS UPON DEATH OF THE DECEDENT

LEGACIES OF CREDIT AND REMISSION are valid only in the amount due

and outstanding at the death of the testator (ART 935 NCC), and the

fruits accruing after that instant are deemed to pertain to the legatee

(ART. 948 NCC)

Law in force at the time of the death of the decedent

The heirs’ (including devisee/legatee) right to the property of the

deceased become vested without need for them to be declared heirs

nor court adjudication. At the precise moment of death, the heirs (do

not include devisee/legatee) become owners of the estate pro indiviso

and become absolute owners of their undivided aliquot share until

partition and distribution. Thus the rights of the State to collect

inheritance/estate tax accrues at the moment of death notwithstanding

the postponement of actual possession.

Possession of hereditary property is transmitted without interruption at

the moment of the decedent death in case the inheritance is accepted.

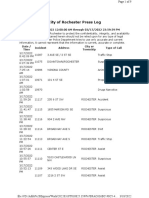

PERIOD OF ABSENCE FOR PURPOSE OF OPENING SUCCESSION

ORDINARY ABSENCE: QUALIFIED ABSENCE:

ART 390 (2) ART 391

10 yrs – if a person 4 yrs

being unknown whether

or not he still lives

PERIOD

5 yrs – if he disappeared

after the age of 75

1. last of the period of 1. on the very day of the

absence required by law occurrence of the event

from which is presumed

2. no news – from the

date of disappearance 2. if the date cannot be

RECKONING PERIOD fixed, the court

3. if there is news – determines the middle

from the time referred of the period in which

to by the news or the the event could have

time when the news happened

was sent

You might also like

- Notes On SuccessionDocument239 pagesNotes On Successiontoypatz94% (18)

- Assignment Brief - Globalisation and Corporate GovernanceDocument4 pagesAssignment Brief - Globalisation and Corporate GovernancemaneeshaNo ratings yet

- Test Questions Chapter 5Document14 pagesTest Questions Chapter 5Sandra100% (1)

- Succession Review DraftDocument9 pagesSuccession Review DraftCzar Ian Agbayani100% (1)

- Yee SuccessionDocument34 pagesYee SuccessionAto Teja100% (1)

- Succession Tolentino NotesDocument30 pagesSuccession Tolentino NotesJeffrey L. Ontangco100% (2)

- Art 774-782Document6 pagesArt 774-782ferdzky100% (3)

- Succession Reviewer - ProvisionsDocument60 pagesSuccession Reviewer - ProvisionsAnne Secretbox100% (4)

- Succession Reviwer AtoDocument35 pagesSuccession Reviwer AtoAto TejaNo ratings yet

- Purely Personal Rights Are Extinguished by DeathDocument7 pagesPurely Personal Rights Are Extinguished by DeathAnonymous yKFZKlqPfTNo ratings yet

- Philippine Law On Succession - My ReviewerDocument8 pagesPhilippine Law On Succession - My ReviewerCorina Jane AntigaNo ratings yet

- Succession Midterms ReviewerDocument19 pagesSuccession Midterms ReviewerToffLombos-Lamug100% (1)

- Special Proceedings ReviewerDocument11 pagesSpecial Proceedings Reviewerabogada1226No ratings yet

- Succesion NotesDocument128 pagesSuccesion Notesahsiri22No ratings yet

- Succession Reviewer - Lectures (4th Year)Document53 pagesSuccession Reviewer - Lectures (4th Year)Ramon Miguel Rodriguez100% (3)

- (Tolentino) Notes On Succession PDFDocument30 pages(Tolentino) Notes On Succession PDFJenny100% (3)

- Reviewer On SuccessionDocument20 pagesReviewer On SuccessionChelsea GarciaNo ratings yet

- Succession - NotesDocument83 pagesSuccession - NotesBhenz Bryle TomilapNo ratings yet

- Judicial Declaration Is Not Required and Courts Are With Out Authority To Do The SameDocument10 pagesJudicial Declaration Is Not Required and Courts Are With Out Authority To Do The SameApril AnielNo ratings yet

- Notes On SuccessionDocument239 pagesNotes On SuccessionCindy-chan Delfin0% (1)

- Civil Code-Succession Notes/Remarks/ReferenceDocument14 pagesCivil Code-Succession Notes/Remarks/ReferencemvgeNo ratings yet

- Wills & Succession 4 Year Review Class St. Thomas More School of LawDocument228 pagesWills & Succession 4 Year Review Class St. Thomas More School of LawgniyNo ratings yet

- Chapter 1-General Provisions: Title Iv-SuccessionDocument22 pagesChapter 1-General Provisions: Title Iv-Successiondolf lincolnNo ratings yet

- SPecPro CodalDocument30 pagesSPecPro CodalKathrine Marie AbquinaNo ratings yet

- Succession by Dean NavarroDocument14 pagesSuccession by Dean NavarroAljay Labuga100% (2)

- Lecture of Judge Antonio C LubaoDocument138 pagesLecture of Judge Antonio C LubaoCh YmnNo ratings yet

- Notes in Succession LanzarroteDocument6 pagesNotes in Succession LanzarroteRom0% (1)

- Notes On SuccessionDocument118 pagesNotes On SuccessionWhere Did Macky Gallego100% (3)

- 3 Succession ReadyDocument25 pages3 Succession ReadyBrian DuelaNo ratings yet

- Oblicon (Prescription)Document25 pagesOblicon (Prescription)Ange Buenaventura Salazar100% (1)

- Rights and Obligations Arising From Contract Are, As A Rule, BindingDocument36 pagesRights and Obligations Arising From Contract Are, As A Rule, BindingCarl Mitchell Guevara100% (1)

- DefinitionDocument3 pagesDefinitionMPLNo ratings yet

- Notes On SuccessionDocument237 pagesNotes On SuccessionkeithnavaltaNo ratings yet

- Specpro NotesDocument34 pagesSpecpro NotesGracey Sagario Dela TorreNo ratings yet

- Summary Settlement of EstatesDocument10 pagesSummary Settlement of EstatesJames Ibrahim AlihNo ratings yet

- Inter Vivos or Mortis Causa. Succession Inter Vivos Is Ordinary Donation. Succession MortisDocument23 pagesInter Vivos or Mortis Causa. Succession Inter Vivos Is Ordinary Donation. Succession MortisTrudgeOnNo ratings yet

- Succession 1 2Document11 pagesSuccession 1 2Andrea TalledoNo ratings yet

- Taxation II NotesDocument16 pagesTaxation II NotesVASQUEZ, RHODORA ADRALESNo ratings yet

- Chapter 1 General Provisions PDFDocument12 pagesChapter 1 General Provisions PDFRafael Francesco GonzalesNo ratings yet

- Rule 91-109 NotesDocument6 pagesRule 91-109 NotesJames Ibrahim AlihNo ratings yet

- RTB Taxation II ReviewerDocument59 pagesRTB Taxation II Reviewerdiazadie100% (1)

- 02 - Estate TaxesDocument27 pages02 - Estate TaxesShiela MeiNo ratings yet

- Wills and SuccessionDocument50 pagesWills and SuccessionJan VelascoNo ratings yet

- Spec Pro NotesDocument7 pagesSpec Pro NotesJake Zhan Capanas AdrianoNo ratings yet

- Reviewer WillsDocument14 pagesReviewer WillsAjean Tuazon-CruzNo ratings yet

- Chapter 13 - Succession and Estate TaxDocument7 pagesChapter 13 - Succession and Estate TaxCamila MolinaNo ratings yet

- AEC10 - Introduction To Transfer TaxDocument21 pagesAEC10 - Introduction To Transfer TaxDarrel Sapinoso100% (1)

- Succession: San Beda College of LawDocument33 pagesSuccession: San Beda College of LawByme DahanNo ratings yet

- Wills Succession Habana NotesDocument59 pagesWills Succession Habana NotesAnonymous G7UOnJRyNo ratings yet

- Inheritance Law - Civil Code (Introduction)Document25 pagesInheritance Law - Civil Code (Introduction)spenzha.daffaNo ratings yet

- Transfer and Business TaxationDocument3 pagesTransfer and Business TaxationMarie Shell OrdanielNo ratings yet

- I. General Principles A. Definition and Concept of SuccessionDocument14 pagesI. General Principles A. Definition and Concept of SuccessionEarl TheFingerroll ReyesNo ratings yet

- Pre Bar Review 2017 SuccessionDocument102 pagesPre Bar Review 2017 SuccessionYollaine GaliasNo ratings yet

- Bustax Quiz 1 ReviewerDocument10 pagesBustax Quiz 1 ReviewerEleina Bea BernardoNo ratings yet

- Notes On Succession PDFDocument237 pagesNotes On Succession PDFcjoy omaoengNo ratings yet

- Succession in A NutshellDocument113 pagesSuccession in A NutshellMarkKevinAtendidoVidarNo ratings yet

- Joy Wills NotesDocument76 pagesJoy Wills NotesMichael Vincent BautistaNo ratings yet

- WillDocument19 pagesWillMd. Mahbubul KarimNo ratings yet

- Rule 73 Sec 2-4Document10 pagesRule 73 Sec 2-4joy dayagNo ratings yet

- Wiils RevocationDocument3 pagesWiils RevocationLyka Lim PascuaNo ratings yet

- The Science of Happiness: ‘Discovering the Secrets of a Joyful and Fulfilling Life’From EverandThe Science of Happiness: ‘Discovering the Secrets of a Joyful and Fulfilling Life’No ratings yet

- FINE and 2. Bond To Keep The Peace (Art 25)Document2 pagesFINE and 2. Bond To Keep The Peace (Art 25)fergie1trinidadNo ratings yet

- American V InsuranceDocument2 pagesAmerican V Insurancefergie1trinidadNo ratings yet

- Tipon and Rabago For Plaintiff-Appellant. Elviro L. Peralta For Defendants-AppelleesDocument2 pagesTipon and Rabago For Plaintiff-Appellant. Elviro L. Peralta For Defendants-Appelleesfergie1trinidadNo ratings yet

- Pre-trial-Brief-Practicum (EDITED Acdg To Paper Use)Document4 pagesPre-trial-Brief-Practicum (EDITED Acdg To Paper Use)fergie1trinidadNo ratings yet

- G.R. No. L-28476 January 31, 1968 ALEJANDRO REYES, Petitioner, Anatalio Reyes and Commission On Elections, Respondents. Fernando, J.Document3 pagesG.R. No. L-28476 January 31, 1968 ALEJANDRO REYES, Petitioner, Anatalio Reyes and Commission On Elections, Respondents. Fernando, J.fergie1trinidadNo ratings yet

- Office of The Punong BarangayDocument4 pagesOffice of The Punong Barangayfergie1trinidad100% (1)

- Beneficial Title.: Cumulative Voting Is A Matter of Right Granted by Law To Stockholder of Stock Corporation ToDocument22 pagesBeneficial Title.: Cumulative Voting Is A Matter of Right Granted by Law To Stockholder of Stock Corporation Tofergie1trinidadNo ratings yet

- SRC Reading MaterialDocument6 pagesSRC Reading Materialfergie1trinidadNo ratings yet

- Business Permit and Licensing DivisionDocument4 pagesBusiness Permit and Licensing Divisionfergie1trinidadNo ratings yet

- Involuntary Dissolution Until Foreign Corporation (December 10 & 12 Meetings)Document8 pagesInvoluntary Dissolution Until Foreign Corporation (December 10 & 12 Meetings)fergie1trinidadNo ratings yet

- Office: of The SecretaryDocument5 pagesOffice: of The Secretaryfergie1trinidadNo ratings yet

- DC2020 0049 Reiteration of DM2020 0072 Interim Guidelines For 2019 nCoV ARD Response in Hospitals and Other Health Facilities PDFDocument31 pagesDC2020 0049 Reiteration of DM2020 0072 Interim Guidelines For 2019 nCoV ARD Response in Hospitals and Other Health Facilities PDFfergie1trinidadNo ratings yet

- Wills in GeneralDocument2 pagesWills in Generalfergie1trinidadNo ratings yet

- Question PDFDocument4 pagesQuestion PDFSo LazyNo ratings yet

- Guest". Comes From The Word "Hospice", An Old FrenchDocument20 pagesGuest". Comes From The Word "Hospice", An Old FrenchAudrey RNo ratings yet

- Extempo TopicsDocument2 pagesExtempo TopicsBianca MistalNo ratings yet

- Verbs Describing Thought and Knowledge: VocabularyDocument8 pagesVerbs Describing Thought and Knowledge: Vocabularyney canalesNo ratings yet

- Weekly Editorial Vocabulary Magazine by Nimisha Mam 15th To 20thDocument15 pagesWeekly Editorial Vocabulary Magazine by Nimisha Mam 15th To 20thShikha ShuklaNo ratings yet

- 392 2016 Commercial Registration and Licensing Council of MinistersDocument34 pages392 2016 Commercial Registration and Licensing Council of MinistersPeter MuigaiNo ratings yet

- Public Notice For The Recruitment of Clerks On Adhoc Basis Dated 17-11-2021Document2 pagesPublic Notice For The Recruitment of Clerks On Adhoc Basis Dated 17-11-2021Gouri AroraNo ratings yet

- Eric BirlingDocument13 pagesEric BirlingSankarshan DahiyaNo ratings yet

- Fisher V Bell - Find RatioDocument4 pagesFisher V Bell - Find RatioChinonso ChinanzaNo ratings yet

- Values Education, Self-Awareness and Good Governance PDFDocument15 pagesValues Education, Self-Awareness and Good Governance PDFChristian Jay Lagadan Subaste100% (1)

- First Flight MCQSDocument47 pagesFirst Flight MCQSABCNo ratings yet

- Internet Ethics of Adolescents-Understanding Demographic DifferencesDocument8 pagesInternet Ethics of Adolescents-Understanding Demographic DifferencestimNo ratings yet

- LawDocument1 pageLawRhap SodyNo ratings yet

- Classical Philosopher: PlutarchDocument30 pagesClassical Philosopher: PlutarchShiela Marie ManoguidNo ratings yet

- SHANATADocument3 pagesSHANATAcca 2016No ratings yet

- Rhetorical AppealsDocument13 pagesRhetorical AppealsChloe HuaNo ratings yet

- Dev Lec 1 Chapter 1Document28 pagesDev Lec 1 Chapter 1وائل مصطفى0% (1)

- Ethics in ResearchDocument32 pagesEthics in ResearchmariamNo ratings yet

- Cultural IgnoranceDocument2 pagesCultural IgnoranceNicole AnngelaNo ratings yet

- 1 - Knowledge of Law As A Business AssetDocument19 pages1 - Knowledge of Law As A Business AssetHoney JamesNo ratings yet

- Your Habit Formation ChecklistDocument4 pagesYour Habit Formation Checklistsafa bin tazNo ratings yet

- Deed of DonationDocument3 pagesDeed of DonationDenver GamlosenNo ratings yet

- Group 2 - Ethics FinallllDocument9 pagesGroup 2 - Ethics FinallllRivera MarianelNo ratings yet

- RPD Daily Incident Report 3/17/22Document9 pagesRPD Daily Incident Report 3/17/22inforumdocsNo ratings yet

- 071973C-G00-CS-2200-16 Cover Letter BIDDERSDocument3 pages071973C-G00-CS-2200-16 Cover Letter BIDDERSSanju TkNo ratings yet

- Moral and Non-Moral Standards in The PhilippinesDocument7 pagesMoral and Non-Moral Standards in The PhilippinesNeil Harbee AquaticsNo ratings yet

- AC3193 ZB Final For UoLDocument8 pagesAC3193 ZB Final For UoLRigged RiggedNo ratings yet

- Shrimoyee Ghosh. "Not Worth The Paper It's Written On' Stamp Paper Documents and The Life of Law in IndiaDocument27 pagesShrimoyee Ghosh. "Not Worth The Paper It's Written On' Stamp Paper Documents and The Life of Law in IndiaRitesh Raj100% (1)