Professional Documents

Culture Documents

Master Class Taxation - 2

Uploaded by

CRAZY SportsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Master Class Taxation - 2

Uploaded by

CRAZY SportsCopyright:

Available Formats

Principles & Practices of Taxation

MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 1

“Tax means the income-tax payable under this

Ordinance and includes any additional tax,

excess profit tax, penalty, interest, fee or other

charges leviable or payable under this

Ordinance”.

- Income Tax Ordinance, 1984

Tax Definition

“Compulsory monetary contribution to the

state’s revenue, assessed and imposed by a

Government on the activities, enjoyment,

expenditure, income, occupation, privilege,

property etc. of individuals and organizations”.

- Business Dictionary

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 2

Taxation is a main source of revenue

for the Government. In order to

accelerate economic development as

well as to ensure the defense,

administration, social welfare and

Objective of other development activities

Taxation government needs huge amount of

resources. It also reduces of

inequalities in income and wealth,

accelerates economic growth and

control of consumption and protects

local industries.

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 3

Types of Taxes:

Sources of Income to a Government

Tax

Government Donation

Loan

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 4

Types of Taxes:

Types of Taxes

Value Added

Tax (VAT)

Income Tax

Turnover Tax

Direct Tax Gift Tax Indirect Tax

Supplementary

Duty

Foreign

Travel Tax Customs Tax

Excise Duty

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 5

Income Tax at a glance

Among direct taxes, income tax is the main source of revenue. It is a

progressive tax system. Income tax is imposed based on ability to pay.

"The more a taxpayer earns the more he should pay''- is the basic

principle of charging income tax. It aims at ensuring equity and social

justice. In Bangladesh income tax is being administered under the tax

legislations named as “THE INCOME TAX ORDINANCE, 1984 (XXXVI OF

1984) and INCOME TAX RULES, 1984.”

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 6

Classification of Tax – On the basis of rate

1. Proportional Tax:

The rates remains constant regardless the size of the income.

2. Progressive Tax:

The rate of taxation increases as the taxable income increases. It is considered more equitable.

3. Regressive Tax:

The rate of taxation decreases as the taxable income increases. Opposite to Progressive.

4. Degressive Tax:

Progressive to a certain limit after which the rate becomes flat. In Bangladesh, we follow this

Degressive Tax system.

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 7

Impact and Incidence of Tax

• Person from whom government collects

Impact money in first instance.

• Person who finally bears burden of a

Incidence tax.

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 8

Canons of Taxation

Canon of Canon of Canon of Canon of

Equity Certainty Economy Convenience

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 9

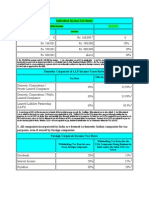

Individual Tax Rate in Bangladesh

Taxable Income Tax Rate

On First 3,00,000 0%

On Next 1,00,000 5%

On Next 3,00,000 10%

On Next 4,00,000 15%

On Next 5,00,000 20%

On Rest Amount 25%

If your income is 30,00,000 Taka, Calculate your Income tax.

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 10

Solution

Taxable Income Tax

On First 3,00,000 * 0% 0

On Next 1,00,000 * 5% 5,000

On Next 3,00,000 * 10% 30,000

On Next 4,00,000 * 15% 60,000

On Next 5,00,000 * 20% 1,00,000

On Rest 14,00,000 * 25% 3,50,000

Total Tax 5,45,000

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 11

Tax Free Limit - Individual

Tax-Payer Tax Free Limit

General People 3,00,000

Women and 65+ People 3,50,000

Disabled People 4,50,000

Freedom Fighters 4,75,000

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 12

Minimum Tax - Individual

Minimum

Area

Tax

Dhaka & Chattogram City

5,000

Corporation

Other City Corporation 4,000

Other Than City Corporation 3,000

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 13

Tax Rate - Companies

Nature of the Company Rates

1. Publicly Traded Company other than Banks, Insurance, Other financial institutions, 25%

Merchant bank, cigarette manufacturing companies and Mobile Operator companies.

2. Not Publicly Traded Company and other than Banks, Insurance, Other financial 32.5%

institutions, Merchant bank, cigarette manufacturing companies and Mobile Operator

companies.

3. For Bank, Insurance and Financial Institutions:

Publicly Traded 37.5%

Non-Publicly Traded 40%

4. For Merchant Banks 37.5%

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 14

Tax Rate - Companies

Nature of the Company Rates

5. Cigarette, bidi and tobacco manufacturing companies 45%

6. Mobile Operator companies not publicly traded 45%

7. Mobile Operator companies publicly traded (Issue minimum 10% shares through stock 40%

exchanges, IPO placement cannot be more than 5%)

8. Non-Resident Foreigner 30%

9. Co-operative societies (Registered under Co-operative societies Act 2001) 15%

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 15

Tax Rate - Companies

**If a Non-publicly traded company and Non-publicly traded mobile

operator company transfers at least 20% of its paid-up capital

through IPO, the company will get tax rebate @ 10% of the income

tax in the year of transfer.

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 16

Surcharge Rate

Net Asset Surcharge Rate Minimum Surcharge

1. Net Asset up to 3 crore 0% 0

2. Net Asset 3 Crore – 5 Crore or 10% 3,000

- More than one Motor Car (private car, jeep, micro) or

- House of more than 8000 sq. feet in any city corporation area

3. Net Asset 5 Crore – 10 Crore 15% 3,000

4. Net Asset 10 Crore – 15 Crore 20% 5,000

5. Net Asset 15 Crore – 20 Crore 25% 5,000

6. Net Asset more than 20 Crore – 50 Crore 30% 5,000

7. Net Asset more than 50 Crore, then

- 0.1% on Net Asset OR 30% on Tax Liability, Higher one

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 17

Calculate Tax Liability

Mrs. Tanzila has earned 30,00,000 taka during the

latest income year. She has shown 21 Crore BDT Net

Asset in the Balance Sheet. What will be her Tax

Liability?

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 18

Solution

Taxable Income Tax

On First 3,50,000 * 0% 0

On Next 1,00,000 * 5% 5,000

On Next 3,00,000 * 10% 30,000

On Next 4,00,000 * 15% 60,000

On Next 5,00,000 * 20% 1,00,000

On Rest 13,50,000 * 25% 3,37,500

Total Tax 5,32,500

Surcharge 30% on 5,32,500 1,59,750

Total Tax Liability 6,92,250

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 19

Calculate Tax Liability

Mrs. Tanzila has earned 3,00,000 taka during the

latest income year. She has shown 21 Crore BDT Net

Asset in the Balance Sheet. What will be her Tax

Liability?

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 20

Income Year

❑The period beginning with the date of setting up of a business and ending with the thirtieth

day of June following the date of setting up of such business;

❑The period beginning with the date on which a source of income newly comes into existence

and ending with the thirtieth day of June following the date on which such new source comes

into existence;

❑The period beginning with the first day of July and ending with the date of discontinuance of

the business or dissolution of the unincorporated body or liquidation of the company, as the

case may be;

❑The period beginning with the first day of July and ending with the date of retirement or

death of a participant of the unincorporated body;

❑The period immediately following the date of retirement, or death, of a participant of the

unincorporated body and ending with the date of retirement, or death, of another participant

or the thirtieth day of June following the date of the retirement, or death, as the case may be;

❑In the case of banks, insurance companies or financial institution the period of twelve months

commencing from the first day of January of the relevant year; or

❑In any other case the period of twelve months commencing from the first day of July of the

relevant year.

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 21

Assessment Year

Assessment year means the period of twelve months commencing on

the first day of July every year; and includes any such period which is

deemed, under the provisions of this ordinance, to be assessment year

in respect of any income for any period.

Computation of Tax Liability, Tax exemption and tax credit facilities are

computed on the basis of Assessment Year.

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 22

Accounting year ends on Income year Assessment year

30.06.2007

30.09.2007

31.12.2007 /

31.03.2008

31.07.2008

Find out the Income & Assessment Year

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 23

Solution

Accounting year ends on Income year Assessment year

30.06.2007 2006- 07 2007- 08

30.09.2007 2007- 08 2008- 09

31.12.2007 2007- 08 2008- 09

31.03.2008 2007- 08 2008- 09

31.07.2008 2008- 09 2009- 10

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 24

Find out the Assessment Year

Income year Assessment year

01.01.08 to 31.12.08

01.03.08 to 31.12.08

01.08.08 to 31.07.09

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 25

Solution

Income year Assessment year

01.01.08 to 31.12.08 2009 - 2010

01.03.08 to 31.12.08 2009 -2010

01.08.08 to 31.07.09 2010 - 2011

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 26

Assessee

Assessee means a person by whom any tax or other sum of money is payable under this

Ordinance, and includes -

a) every person in respect of whom any proceeding under this Ordinance has been taken for

the assessment of his income or the income of any other person in respect of which he is

assessable, or of the amount of refund due to him or to such other person;

b) every person who is required to file a return under section 75,section 89 or section 91;

c) every person who desires to be assessed and submits his return of income under this

Ordinance; and

d) every person who is deemed to be an Assessee, or an Assessee in default, under any

provision of this Ordinance;

Exemption : Local government are not taxable entity (Six schedule part A para 3).

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 27

Classification of Assessee - Person

"Person" includes-

✓an individual, a firm, an association of persons and

✓Hindu undivided family, Trust, a local authority, a company and

every other artificial juridical person;

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 28

Classification of Assessee- Residence

1. Resident 2. Non-Resident

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 29

Residential Status Determination

"Resident", in respect of any income year, means -

✓an individual who has been in Bangladesh –

i) for a period of, or for periods amounting in all to, 182 days or more in that year; or

ii) for a period of, or periods amounting in all to, 90 days or more in that year having

previously been in Bangladesh for a period of, or periods amounting in all to, 365 days or

more during four years preceding that year;

✓a Hindu undivided family, firm or other association of persons, the control and management of

whose affairs is situated wholly or partly in Bangladesh in that year; and

✓a Bangladeshi company or any other company the control and management of whose affairs is

situated wholly in Bangladesh in that year;

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 30

Effects of Residential Status

Non-

Particulars Status of Income Resident

Resident

Income Received, Accrued or

deemed to be accrued in Bangladeshi Income Taxable Taxable

Bangladesh

Income Accrued or arose Non-

Foreign Income Taxable

outside Bangladesh Taxable

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 31

Mr. Uzzal, an Indian citizen, stayed in Bangladesh

from 1st August, 2009 to 31st December, 2009 and

left for London. What will be his residential status in

the income year 2009-10?

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 32

Mr. Uzzal is a non-resident since his stay

in Bangladesh during income year 2009-10

is [31 +30+31 +30+31] = 153 days which is

less than required 182 days.

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 33

❑If total income of any individual other than female

taxpayers, senior male taxpayers of 65 years and above,

retarded taxpayers and war wounded gazetted freedom

fighter during the income year exceeds Tk 3,00,000/-.

❑If total income of any female taxpayer, senior male taxpayer

of 65 years and above during the income year exceeds Tk

Who should 3,50,000/-.

submit Income ❑If total income of any Physically handicapped taxpayers

Tax Return? during the income year exceeds TK. 4,50,000.

❑If total income of any gazetted war-wounded freedom

fighter taxpayer during the income year exceeds Tk.

4,75.000/-.

❑If any person was assessed for tax during any of the 3 years

immediately preceding the income year.

❑ A person who lives in any city corporation/ paurashava/

divisional HQ/district HQ and owns motor car/owns

membership of a club registered under VAT Law.

❑If any person runs a business or profession having trade license

and operates a bank account.

❑Any professional registered as a doctor, lawyer, income tax

practitioner, Chartered Accountant, Cost & Management

Who should submit Accountant, Engineer, Architect and Surveyor etc.

Income Tax Return ❑Member of a Chamber of Commerce and Industries or a trade

(Cont’d) Association.

❑Any person who participates in a tender.

❑Candidate for Paurashava, City Corporation, Upazilla or

Parliament elections.

❑Any company registered under the Company Act, 1913 or

1994.

❑Any Non-government organization (NGO) registered with NGO

Affairs Bureau

‘Tax Day’ Means-

1. For an Individual – The 30th Day of November

When to submit following the end of the income year.

assessment 2. For a Company – The 15th day of the seventh

month following the end of the income year

[or the 15th day of September following the end of

the income year where the said 15th day falls

before the 15th day of September]

Year end Tax Day Explanation

Company

th th th

31.12.2018 15 September 2019 15 day of 7 month falls before the 15 day of September

th th th

31.03.2019 15 October 2019 15 day of 7 month falls after the 15 day of September

th th th

30.06.2019 15 January 2020 15 day of 7 month falls after the 15 day of September

th th th

31.07.2019 15 February 2020 15 day of 7 month falls after the 15 day of September

th th th

30.09.2019 15 September 2020 15 day of 7 month falls before the 15 day of September

th th th

31.12.2019 15 September 2020 15 day of 7 month falls before the 15 day of September

th

Other Than Company (30 November following the income year. In every case Income year ends on 30 June for Other than

Company)

2017-18 30 November 2018 As Income Year ended on 30 June 2018 here.

2018-19 30 November 2019 As Income Year ended on 30 June 2019 here.

31.12.2019 30 November 2020 As Income Year ended on 30 June 2020 here.

When to submit assessment (Illustration)

8/26/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 37

When to submit assessment (Illustration)

Accounting Year Prevailing

Income Year Assessment Year Tax Day

End Rate

30 June 2019

Finance Act

(Other than Bank,

2019

insurance and 2018-19 2019-20 15 January 2020

(Rate of AY:

financial

2019-20)

Institutions)

31 December 2019 Finance Act

(Bank, insurance 15 September 2020

2019 2020-21

and financial 2020 (Rate of AY:

Institutions 2020-21)

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 38

Minimum Tax – Company [82(C)]

Classes of Assessee Rate of Minimum Tax

Manufacturer of Cigarette, bidi,

chewing tobacco, smokeless

1% of the gross receipts

tobacco or any other tobacco

products

Mobile phone operator 2% of the gross receipts

Any other cases 0.60% of the gross receipts

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 39

Problem – 82 (C)

X limited is a private limited company registered in

Bangladesh involved in manufacturing cigarette.

During the assessment year 2019-20, its total assessed

income is Taka 15,00,000 consisting net operating

income of Taka 12,50,000 Taka and interest income of

Taka 2,50,000. If sales revenue/turnover is Taka

2,00,00,000 and income tax rate is 35%, calculate

income tax liability.

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 40

Solution

Income tax @ regular rate: 15,00,000 * 35% = 5,25,000

Gross Receipts of the company: (2,00,00,000+2,50,000) = 2,02,50,000 Taka

Minimum Tax amount: (2,02,50,000*1%) = 2,02,500 Taka

Since regular tax is greater than the minimum tax, the tax liability will be 5,25,00

Taka.

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 41

Problem – 82 (C)

Y Ltd is a Private Limited Co. registered in Bangladesh involved in mobile

operating business. During the income year 2019-20, its-

Net Operating Income (loss) – (Taka 4,50,000)

Interest Income - Taka 2,50,000

Total Assessed income (loss) - (Taka 2,00,000)

Sales revenue was Taka 2,00,00,000. Income tax rate is 35%. Calculate income

tax liability.

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 42

Solution

Income Tax @ regular rate: zero since there is net loss

Gross Receipts of the company: (2,00,00,000+2,50,000) = 2,02,50,000 Taka

Minimum Tax amount: (2,02,50,000*0.60%) = 1,21,500 Taka

Since, Minimum tax is greater than regular tax, the tax liability will be 1,21,500

taka.

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 43

DO IT – 82 (C)

Y Ltd is a Public Limited Co. registered in Bangladesh involved in mobile operating business

(Not listed in the stock exchange). During the income year 2018-19, its-

◦ Net Operating Income (loss) – (Taka 4,50,000)

◦ Interest Income - Taka 2,50,000

◦ Total Assessed income (loss) - (Taka 2,00,000)

Sales revenue was Taka 2,00,00,000. Income tax rate is applicable as per law. Calculate income

tax liability.

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 44

DO IT – 82 (C)

X Limited is a Public Limited Company registered in Bangladesh

involved in manufacturing chips (Listed in the Stock Exchange).

During the assessment year 2018-19, its net operating income was

1,250,000 and interest income was 250,000. If sales revenue is

20,000,000 and income tax rate is applicable as per law, Calculate

income tax liability.

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 45

Tax Rebate on CSR Expenditure

In order to avail 10% tax rebate on CSR related expenditures, an organization has to fulfil the

following conditions.

- Maximum limit of CSR expenditure on which rebate will be allowed will be 20% of the total

income of the company or 12 crore whichever is lower.

- It should pay salary and wages to its employees regularly and if it is a manufacturing unit, it

must have waste treatment plant or ETP.

- The firm must pay the relevant taxes like income tax, VAT et. And loan instalment on a regular

basis.

- It can only contribute to government approved organizations.

- Must submit relevant documents to the DCT regarding the expenditure.

- Must comply with Bangladesh Labor Law 2006. - Payment must be paid through Bank.

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 46

Problem - CSR

X private limited company has presented the following information:

Total expenditure on CSR activities – Taka 1 crore

Net income as per audited income statement – Taka 10 crore

Corporate tax rate – 35%

Calculate the net tax liability.

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 47

Solution

Total income for assessment purpose: (10+1) = 11 crore

Gross tax liability on regular rate: 11 crore * 35% = 3.85 crore

Maximum limit of CSR expenditure on which rebate will be allowed@

- 20% of the total income (11 crore * 20%) =2.2 crore

- Or, 12 crore, whichever is lower.

Since company’s actual CSR expense is 1 crore which is less than 2.2 crore, it will get 10% rebate

on CSR expenditure of 1 crore.

Therefore 10% CSR rebate (1 crore * 10%) = 10 lac

Net tax liability: (Gross tax – 10% CSR rebate) = (3.85 crore – 0.1 crore) = 3.75 crore

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 48

DO IT – CSR

Halal Public limited company (Not listed with stock exchange), has presented the

following information:

Total expenditure on CSR activities – Taka 2.5 crore

Net income as per audited income statement – Taka 10 crore

Corporate tax rate – at applicable rate

Calculate the net tax liability.

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 49

Classification of Income

• Are not included in the

Non-Assessable computation of total income.

Income • Sixth Schedule, Part A

• Tax Free Income

Assessable • Tax Credit Income/Inv. Allowance

Income • Tax Payable Income

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 50

Tax Free Income

1. Included in the determination of total income.

2. Applied Tax rate applicable.

3. Tax Rebate on Average rate on such income.

Average Tax Rate (Total Tax / Total income)*100

Rebate on Tax Free Income Total Tax Free Income * Average Rate

Tax Free Income are:

1. Income from Partnership firm if tax has already been paid by the firm.

2. Income from Association of persons on which tax has already been paid by the association.

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 51

Tax Free Income

Total Taxable income is 5,00,000 Taka out of which tax-free income is 50,000 Taka.

Taxable Income Tax

On First 3,00,000 * 0% 0

On Next 1,00,000 * 5% 5,000

On Next 1,00,000 * 10% 10,000

Total Tax 15,000

Less: Rebate on Tax Free Income (1500)

Tax Liability 13,500

Average Tax Rate (15,000 / 5,00,000)*100 = 3%

Rebate on Tax Free Income 50,000 * 3% = 1500

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 52

Tax Credit Income / Investment Allowance

1. Included in the determination of total income.

2. Applied Applicable Tax Rate. Sixth Schedule,

3. Calculate Actual Investment Amount. Part B

4. Calculate Eligible Amount.

(Lesser one: Actual Investment or 25% of Total Income or 1,50,00,000).

5. Apply Investment Allowance Rate on Eligible Amount. (Next Slide)

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 53

Tax Credit Income / Investment Allowance

Total Income Amount of Credit/Rebate

Total Income: Up to 10,00,000 1. 15% of the eligible amount

Total Income: 10,00,000 – 30,00,000 1. 15% of the first 2,50,000 Taka of the eligible

amount.

2. 12% of the rest eligible amount.

Total Income: More than 30,00,000 1. 15% of the first 2,50,000 Taka of the eligible

amount.

2. 12% of the next 5,00,000 Taka of the eligible

amount.

3. 10% of the rest eligible amount.

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 54

Eligible Amount (Base for charging Tax Credit rate)

Lesser of:

Actual Investment

25% of Total Income

1,50,00,000 Taka

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 55

Actual Investment

Investment described in Sixth Schedule, Part B. Read it from Chapter 5.

Such As:

1. Life Insurance premium: Maximum 10% of the Policy Value.

2. Contribution to Provident Fund: Full Amount.

3. Contribution to DPS: Maximum 60,000 Taka.

4. Investment in Computer/Laptop: 50,000 / 1,00,000

5. Donation to Zakat Fund, Charitable Hospitable etc.

6. Investment in Share market, Government Treasury Bond etc.

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 56

If your income is 30,00,000 Taka

and your actual investment

Problem:

Sixth Schedule, according to Sixth Schedule, Part

Part B B is 4,00,000 Taka, Calculate your

Income tax.

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 57

Solution

Income Tax on Regular Rate:

Taxable Income Tax

On First 3,00,000 * 0% 0

On Next 1,00,000 * 5% 5,000

On Next 3,00,000 * 10% 30,000

On Next 4,00,000 * 15% 60,000

On Next 5,00,000 * 20% 1,00,000

On Rest 14,00,000 * 25% 3,50,000

Total Tax 5,45,000

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 58

Solution

Eligible base for Investment Allowance Calculation:

Lesser of:

Actual Investment = 4,00,000

25% of Total Income = 7,50,000

1,50,00,000 Taka

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 59

Solution

Slab Selection

Total Income Amount of Credit/Rebate

Total Income: Up to 10,00,000 1. 15% of the eligible amount

Total Income: 10,00,000 – 1. 15% of the first 2,50,000 Taka of the eligible

30,00,000 amount.

2. 12% of the rest eligible amount.

Total Income: More than 30,00,000 1. 15% of the first 2,50,000 Taka of the eligible

amount.

2. 12% of the next 5,00,000 Taka of the eligible

amount.

3. 10% of the rest eligible amount.

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 60

Solution

Taxable Income Tax

On First 3,00,000 * 0% 0

Investment Allowance On Next 1,00,000 * 5% 5,000

On Next 3,00,000 * 10% 30,000

2,50,000 * 15% = 37,500 On Next 4,00,000 * 15% 60,000

1,50,000 * 12% = 18,000

On Next 5,00,000 * 20% 1,00,000

Total: 55,500

On Rest 14,00,000 * 25% 3,50,000

Total Tax 5,45,000

Less: Investment Allowance (55,500)

Tax Liability 4,89,500

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 61

DO IT

Tanzila has earned 30,00,000 taka during the latest

income year. She has shown 21 Crore BDT Net Asset

in the Balance Sheet and 5,00,000 taka as Actual

investment according to Sixth Schedule, Part B.

What will be her Tax Liability?

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 62

Sixth Schedule, Part A: Tax Exemption

Particulars Total Amount Exemption Taxable Amount

Basic Salary 5,00,000 - 5,00,000

Bonus 2,00,000 - 2,00,000

House Allowance 3,00,000 3,00,000 0

Medical Allowance 50,000 50,000 0

Book Allowance 10,000 10,000 0

Conveyance Allowance 20,000 20,000 0

Total 10,80,000 3,80,000 7,00,000

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 63

Tax Payable Income

Total Tax + Surcharge – Investment Allowance

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 64

Chapter 6: Income from Salary

Section 20:

❑Periodical Payment made for work to an employee from an employer for the services rendered

to him.

❑Any pay or wages

❑Any annuity, pension or gratuity

❑Any fees, commission, allowance, perquisites

❑Any advance of salary

❑Any leave encashment

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 65

Points to be remembered

1. Employer-Employee Relationship

2. If there is no such relationship, income will be shown under ‘income from other sources’.

3. Employment can be part time of full time.

4. In case of multiple employers, all the income should be merged as salary income.

5. Pension received by an assessee from his former employer is Salary income but if it received

by his family member after his death, it will be ‘income from other sources’.

6. Salary of a Minister of Government is Salary income, but Salary of a MP is income from other

sources.

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 66

Perquisite

Includes:

❑Insurance Premium borne by the employer

❑House for free or at concession

❑Entertainment

❑Conveyance Allowance

❑Car for personal use

❑House servant, gardener etc.

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 67

Please open your book and go through 6.4

(149 Page, Chapter 6)

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 68

Basic Salary

6000-200-10000

26/08/2020 MOHAMMED MOIN UDDIN REZA, ASSISTANT PROFESSOR, BUP 69

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Chapter 1 5 Slides Master Class TaxationDocument64 pagesChapter 1 5 Slides Master Class TaxationMohammad GalibNo ratings yet

- Laws and Practices of Income TaxDocument34 pagesLaws and Practices of Income TaxNibir RahmanNo ratings yet

- Chapter 5 - Corporate Income TaxDocument25 pagesChapter 5 - Corporate Income Taxtkldiablo1211No ratings yet

- Notes For Diploma SLSP HighlightedDocument75 pagesNotes For Diploma SLSP HighlightedsameehaashrafaliNo ratings yet

- Income Tax - Income Tax Guide 2023, Latest NewsDocument34 pagesIncome Tax - Income Tax Guide 2023, Latest NewsnandiniNo ratings yet

- History of Taxation in India: CA Mohit PunethaDocument161 pagesHistory of Taxation in India: CA Mohit PunethaAnurag KandariNo ratings yet

- Adobe Scan Oct 11, 2023Document9 pagesAdobe Scan Oct 11, 2023Amir HamzaNo ratings yet

- IJCRT2312064Document19 pagesIJCRT2312064shreyshaw21No ratings yet

- Taxjournal July 2020Document60 pagesTaxjournal July 2020Venkatesh PrabhuNo ratings yet

- GST (Unit 1)Document19 pagesGST (Unit 1)bcomh2103012No ratings yet

- Taxation-Reforms PRESENTATIONDocument17 pagesTaxation-Reforms PRESENTATIONRaman KumarNo ratings yet

- Kenya Finance Bill 2020Document36 pagesKenya Finance Bill 2020Life NoanneNo ratings yet

- Directors' Manual 2012Document54 pagesDirectors' Manual 2012harshagarwal5No ratings yet

- GST (4) - 1Document73 pagesGST (4) - 1प्रेम हेNo ratings yet

- Income Tax in India - Eligibility, Tax Slabs, New Regime, Sections & MoreDocument13 pagesIncome Tax in India - Eligibility, Tax Slabs, New Regime, Sections & MoreSIDDHESHNo ratings yet

- Resource Collection Model of The GovernmentDocument18 pagesResource Collection Model of The GovernmentSarita BhandariNo ratings yet

- Useme eu+-+North+Macedonia+report PDFDocument4 pagesUseme eu+-+North+Macedonia+report PDFGoran PavlovskiNo ratings yet

- Malaysia: Taxation of International ExecutivesDocument23 pagesMalaysia: Taxation of International ExecutivesPeng LimNo ratings yet

- Income Tax AccountingDocument24 pagesIncome Tax AccountingSYED WAFI100% (1)

- Tax & Taxation of BangladeshDocument31 pagesTax & Taxation of BangladeshAl JamiNo ratings yet

- 3106AFE - Chapter1 - Introduction To ATODocument31 pages3106AFE - Chapter1 - Introduction To ATOTong TianNo ratings yet

- Tax Structure and Basic ConceptsDocument64 pagesTax Structure and Basic Conceptstushar_shetti100% (1)

- Taxation MBADocument903 pagesTaxation MBAkeyurNo ratings yet

- Sep Final ReportDocument14 pagesSep Final ReportDanial ShadNo ratings yet

- 58 Corporate Individual Income Tax RatesDocument3 pages58 Corporate Individual Income Tax RatesKhalid QuadriNo ratings yet

- GST NotesDocument62 pagesGST NotesSHANKAR GUDDADNo ratings yet

- Presenting: Direct Tax - Trends in IndiaDocument27 pagesPresenting: Direct Tax - Trends in IndiatusharNo ratings yet

- Vietnam Tax Legal HandbookDocument52 pagesVietnam Tax Legal HandbookaNo ratings yet

- Cost Accounting and File TransferDocument31 pagesCost Accounting and File TransferBappy PaulNo ratings yet

- Handbook of Profession Tax E-ServicesDocument55 pagesHandbook of Profession Tax E-ServicesRajendra D AdsulNo ratings yet

- IDT Notes June - OrganizedDocument200 pagesIDT Notes June - Organizedmightybanana121No ratings yet

- SGV and Co Presentation On TRAIN LawDocument48 pagesSGV and Co Presentation On TRAIN LawPortCalls100% (8)

- Tax Invoice / Credit Note: Simply Set Up Autopay To Effortlessly Pay For Your BillsDocument4 pagesTax Invoice / Credit Note: Simply Set Up Autopay To Effortlessly Pay For Your BillsVisnu SankarNo ratings yet

- MAURITIUS-Taxation Guide 2022Document22 pagesMAURITIUS-Taxation Guide 2022Dani ShaNo ratings yet

- Etisalat Bill - November 2020 PDFDocument5 pagesEtisalat Bill - November 2020 PDFVinoth RajahNo ratings yet

- TAX Holidays & MAT For IT: Presentation BriefDocument12 pagesTAX Holidays & MAT For IT: Presentation BriefmuruganandammNo ratings yet

- Recent Tax and Expenditure Reforms in IndiaDocument18 pagesRecent Tax and Expenditure Reforms in IndiaSatyam KanwarNo ratings yet

- Assigment BBTX4203 - Percukaian Ii - by ZakibaseriDocument11 pagesAssigment BBTX4203 - Percukaian Ii - by ZakibaseriMUHAMMAD ZAKI BIN BASERI STUDENTNo ratings yet

- Inv1729020937 PDFDocument17 pagesInv1729020937 PDFShyam BKNo ratings yet

- Module 3 Types of Income Taxpayers and Tax ComputationsDocument10 pagesModule 3 Types of Income Taxpayers and Tax ComputationsCris Martin IloNo ratings yet

- On MAT and AMT WRO0533356 - FinalDocument25 pagesOn MAT and AMT WRO0533356 - FinalOffensive SeriesNo ratings yet

- Direct Taxes Code BookletDocument50 pagesDirect Taxes Code BookletprasadmandreNo ratings yet

- CITN On Taxes Oil & GasDocument91 pagesCITN On Taxes Oil & GasEfosaUwaifoNo ratings yet

- Provision of Train Law UpdatedDocument91 pagesProvision of Train Law UpdatedAldrich De VeraNo ratings yet

- CBDT Issued Revised TDS Rate Chart As Applicable For F.Y. 2020-21 W.E.F May 14, 2020 - A2Z Taxcorp LLPDocument11 pagesCBDT Issued Revised TDS Rate Chart As Applicable For F.Y. 2020-21 W.E.F May 14, 2020 - A2Z Taxcorp LLPpriserve acc4No ratings yet

- I Dont Pay My Taxes (Im The Most Wanted From The IRS)Document16 pagesI Dont Pay My Taxes (Im The Most Wanted From The IRS)Adam AnwarNo ratings yet

- Direct & Indirect Tax Structure in India-FinalDocument23 pagesDirect & Indirect Tax Structure in India-FinalJivaansha SinhaNo ratings yet

- Final-Requirement (Actcy 12S2)Document26 pagesFinal-Requirement (Actcy 12S2)Ralph Carlo SumaculubNo ratings yet

- Tax Reform For Acceleration and Inclusion (TRAIN)Document187 pagesTax Reform For Acceleration and Inclusion (TRAIN)Janna GunioNo ratings yet

- KSA VAT Rate Increase Webinar PresentationDocument24 pagesKSA VAT Rate Increase Webinar PresentationAhmedNo ratings yet

- Ms Word Project WorkDocument70 pagesMs Word Project WorkRamesh RatlavathNo ratings yet

- BCOM 1 Direct Tax System Income Tax1Document34 pagesBCOM 1 Direct Tax System Income Tax1Sumitra SethyNo ratings yet

- SAM Co - Union Budget 2023Document39 pagesSAM Co - Union Budget 2023shwetaNo ratings yet

- Subject: Taxation Laws I: Satya Prakash (Don)Document10 pagesSubject: Taxation Laws I: Satya Prakash (Don)ABHINAV DEWALIYANo ratings yet

- Train LawDocument25 pagesTrain LawMariel Mangalino BautistaNo ratings yet

- Unit 1 Introduction To Goods and Services TaxDocument10 pagesUnit 1 Introduction To Goods and Services TaxDikshitha MNo ratings yet

- Salient Features: Company-Confidential 26.02.2010Document9 pagesSalient Features: Company-Confidential 26.02.2010Coolvishal AgnihotriNo ratings yet

- Session 26 - Income TaxDocument23 pagesSession 26 - Income TaxUnnati RawatNo ratings yet

- Various Means of Gathering Audit EvidenceDocument14 pagesVarious Means of Gathering Audit EvidenceCRAZY SportsNo ratings yet

- Mid AFA-II 2020Document2 pagesMid AFA-II 2020CRAZY SportsNo ratings yet

- Mid PDFDocument8 pagesMid PDFCRAZY SportsNo ratings yet

- CB312 Ch3Document40 pagesCB312 Ch3CRAZY SportsNo ratings yet

- Last Mock SadmanDocument16 pagesLast Mock SadmanCRAZY SportsNo ratings yet

- TA6 Safeguard Measures (F)Document39 pagesTA6 Safeguard Measures (F)Heather Brennan100% (1)

- Accounting DefinitionsDocument30 pagesAccounting DefinitionsSTEVEN TULANo ratings yet

- SMC Financial Statements 2012Document104 pagesSMC Financial Statements 2012Christian D. OrbeNo ratings yet

- Chapter Two Relevant Information and Decision Making: 5.1 The Role of Accounting in Special DecisionsDocument11 pagesChapter Two Relevant Information and Decision Making: 5.1 The Role of Accounting in Special DecisionsshimelisNo ratings yet

- HDFCDocument10 pagesHDFCNishant ThakkarNo ratings yet

- Form No. Mgt-9 Extract of Annual Return: Annexure-VIIDocument10 pagesForm No. Mgt-9 Extract of Annual Return: Annexure-VIIAbhishekNo ratings yet

- Trial Balance Print Screen Amin DianaDocument1 pageTrial Balance Print Screen Amin DianaFitria NingrumNo ratings yet

- Acc 252 Practice ExamDocument5 pagesAcc 252 Practice ExamEmy ManiyarNo ratings yet

- Production N Cost AnalysisDocument71 pagesProduction N Cost AnalysisAnubhav PatelNo ratings yet

- LCCI Level I (Book-Keeping) : Course OutlineDocument5 pagesLCCI Level I (Book-Keeping) : Course OutlineGergana DraganovaNo ratings yet

- MicroRate Technical GuideDocument64 pagesMicroRate Technical GuideGiancarlo CamperiNo ratings yet

- Federalism - ArgumentDocument4 pagesFederalism - ArgumentSapere Aude100% (1)

- Salary Slip 286Document10 pagesSalary Slip 286Saurabh GawadeNo ratings yet

- Dangote Cement PLC NGSE DANGCEM Financials SegmentsDocument6 pagesDangote Cement PLC NGSE DANGCEM Financials SegmentsDavid HundeyinNo ratings yet

- Title: Individual Report On Tesco PLC: Module: International FinanceDocument38 pagesTitle: Individual Report On Tesco PLC: Module: International Financeomotola52paseNo ratings yet

- Marginal CostingDocument25 pagesMarginal Costingangshumanbrahmachari6No ratings yet

- Paul Gay 216 Hermosa El PasoDocument15 pagesPaul Gay 216 Hermosa El PasoanonNo ratings yet

- Inverse Floater Valuation ParametersDocument20 pagesInverse Floater Valuation ParametersNishant KumarNo ratings yet

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document12 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali50% (2)

- AKPK 1 Cash Flow Managment PDFDocument24 pagesAKPK 1 Cash Flow Managment PDFEthanNo ratings yet

- Solutions Chapter 8 - 2d EditionDocument29 pagesSolutions Chapter 8 - 2d Editionafsdasdf3qf4341f4asDNo ratings yet

- Marginal Costing For Decision Making & CVP Analysis - BudgetingDocument15 pagesMarginal Costing For Decision Making & CVP Analysis - BudgetingSravya MagantiNo ratings yet

- CPA Financial Accounting SyllabusDocument11 pagesCPA Financial Accounting SyllabusKasujja AidenNo ratings yet

- Land Bank Vs DumlaoDocument2 pagesLand Bank Vs DumlaoTrek Alojado100% (2)

- Financial Planning Business PlanDocument32 pagesFinancial Planning Business PlanGetto PangandoyonNo ratings yet

- Financial Statement AnalysisDocument98 pagesFinancial Statement AnalysisDrRitesh PatelNo ratings yet

- Summer Project ReportDocument55 pagesSummer Project ReportsunilpratihariNo ratings yet

- Financial ManagementDocument48 pagesFinancial Managementalokthakur100% (1)

- Session 1 Stratagic MGTDocument22 pagesSession 1 Stratagic MGTNathan MontgomeryNo ratings yet