Professional Documents

Culture Documents

Tutorial 2 (2) 1 (D) PDF

Tutorial 2 (2) 1 (D) PDF

Uploaded by

Shan Jeef0 ratings0% found this document useful (0 votes)

27 views1 pageOriginal Title

Tutorial 2 (2) 1 (d).pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

27 views1 pageTutorial 2 (2) 1 (D) PDF

Tutorial 2 (2) 1 (D) PDF

Uploaded by

Shan JeefCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

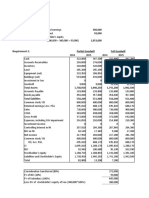

BBFT3014/BBFT3013 ADVANCED TAXATION

APPENDIX A

T2: Suggested answer to Question 1(d)

MyCo. Sdn. Bhd. (MCSB) (Pioneer Status, Production date: 1.11.2019)

The rate of abatement of statutory income is 70%

Tax Computation:

Year of Assessment 2019 2020 2021 2022 2023 2024 #

RM'000 RM'000 RM'000 RM'000 RM'000 RM'000

Pre-pioneer business

Adjusted income 0

Less: IBA & CA 0

Statutory income 0

Pioneer business (PB)

Adjusted income 0 3,000 6,000 10,000 15,000

Less: IBA & CA 0 3,000 6,000 9,500 200

Statutory income (SI) 0 0 0 500 14,800

Less: Abated statutory income (70% of SI) 0 0 0 350 10,360

Deemed total income (30% of SI) 0 0 0 150 4,440

FD interest from local bank 0 80 80 80 80 80

Single tier dividend - Para. 12B, Sch. 6 Exempt Exempt Exempt Exempt Exempt Exempt

Rental from shophouse in KL 100 100 100 100 100 100

Aggregate income (AI) (Biz & Non-Biz) 100 180 180 180 180 180

Less: Current year business loss 100 0 0 0 0 0

App. cash donation (rest. to 10% AI) 10 18 18 18 18 18

Cash donation to Govt. - 200 200 - - -

Total income 0 0 0 162 162 162

Deemed total income (30% of SI from PB) 0 0 0 150 4,440

Chargeable income 0 0 0 162 312 4,602

Total chargeable income in the period for YA 2020 to YA 2024 5,076

Tax exempt account (Pioneer status)

Balance b/f 0 0 0 0 150

70% of statutory income 0 0 0 350 10,360

0 0 0 350 10,510

Less: Pioneer losses b/f 0 0 0 200 0

Balance c/f 0 0 0 150 10,510

Pre-pioneer & Pioneer business

Industrial building allowance (IBA) & capital allowance (CA) - TAX DEPRECIATION

Balance b/f - 5,500 10,000 10,500 8,000 -

Claimed in current year 5,500 4,500 3,500 3,500 1,500 200

Amount available 5,500 10,000 13,500 14,000 9,500 200

Less: Utilisation / Untilised - - 3,000 6,000 9,500 200

Balance c/f 5,500 10,000 10,500 8,000 - -

Pioneer business loss

Balance b/f 0 200 200 200 0

Business loss 200 0 0 0 0

200 200 200 200 0

Less: Utilisation 0 0 0 200 0

Balance c/f 200 200 200 0 0

Pre-pioneer business loss b/f & c/f 200* 200 200 200 200 200

* (RM300K - RM100)

You might also like

- Ratio Analysis WorksheetDocument5 pagesRatio Analysis WorksheetAnish AroraNo ratings yet

- Practice Question On Group AccountsDocument12 pagesPractice Question On Group Accountsemerald75% (4)

- Tutorial 1Document7 pagesTutorial 1Shan JeefNo ratings yet

- 40-People Vs BaluyotDocument4 pages40-People Vs BaluyotLexter CruzNo ratings yet

- Special Power of Attorney-Blank To SellDocument2 pagesSpecial Power of Attorney-Blank To SellJenny T ManzoNo ratings yet

- Tutorial 2 (3) 3 (E)Document2 pagesTutorial 2 (3) 3 (E)Shan JeefNo ratings yet

- T2 Ans. (PS & ITA)Document8 pagesT2 Ans. (PS & ITA)KY LawNo ratings yet

- T2 Revised Ans. (PS & ITA)Document8 pagesT2 Revised Ans. (PS & ITA)alvinmono.718No ratings yet

- T3 Ans. (RA)Document6 pagesT3 Ans. (RA)KY LawNo ratings yet

- Example1 - Investment IncentiveDocument6 pagesExample1 - Investment IncentiveRaudhatun Nisa'No ratings yet

- Solution Illustrative Example PSDocument1 pageSolution Illustrative Example PSsharifah nurshahira sakinaNo ratings yet

- SS Tutorial 3 Sample ExamDocument4 pagesSS Tutorial 3 Sample ExamFeahRafeah KikiNo ratings yet

- Exercises On Implementation of DCF ApproachDocument10 pagesExercises On Implementation of DCF ApproachVincenzoPizzulliNo ratings yet

- SBM Errata Sheet 2020 - 080920Document11 pagesSBM Errata Sheet 2020 - 080920Hamza AliNo ratings yet

- Ratio Analysis Numericals Including Reverse RatiosDocument6 pagesRatio Analysis Numericals Including Reverse RatiosFunny ManNo ratings yet

- Chapters ExcelDocument121 pagesChapters ExcelRohan VermaNo ratings yet

- 2015 - Question 2 ANSWERDocument1 page2015 - Question 2 ANSWERTan TaylorNo ratings yet

- Common Size Statement AnalysisDocument2 pagesCommon Size Statement AnalysisRevati ShindeNo ratings yet

- Exhibit 3.1 Balance Sheet of Horizon Limited As at March 31, 20x1Document102 pagesExhibit 3.1 Balance Sheet of Horizon Limited As at March 31, 20x1Vasudev lahotiNo ratings yet

- Fund Flow StatementDocument41 pagesFund Flow StatementMahima SinghNo ratings yet

- SS Mid-Term Test Tax517 July 2022 Student VersionDocument6 pagesSS Mid-Term Test Tax517 July 2022 Student VersionFeahRafeah KikiNo ratings yet

- SS June 2022Document1 pageSS June 2022ALIESYA FARHANA ALI HUSSAIN GHAZALINo ratings yet

- R2.TAXM - .L Solution CMA June 2021 Exam.Document8 pagesR2.TAXM - .L Solution CMA June 2021 Exam.Pavel DhakaNo ratings yet

- Activity 13 May 2023 Key To CorrectionDocument1 pageActivity 13 May 2023 Key To CorrectionJohn Paul MagbitangNo ratings yet

- Anwar Group of IndustriesDocument1 pageAnwar Group of IndustriesMoment RevealersNo ratings yet

- Aminah Quiz Answer Done by Abdullah Narejo-The Great.Document10 pagesAminah Quiz Answer Done by Abdullah Narejo-The Great.Abdullah NarejoNo ratings yet

- 1 BTAXREV Week 2 Income TaxationDocument48 pages1 BTAXREV Week 2 Income TaxationgatotkaNo ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- ATX T1 Ans. To Q3 (CBAT)Document1 pageATX T1 Ans. To Q3 (CBAT)alvinmono.718No ratings yet

- Analyzing Financial StatementDocument17 pagesAnalyzing Financial StatementkaoriimagiNo ratings yet

- Cash Flow 05 With Answers Just Give SolutionsDocument21 pagesCash Flow 05 With Answers Just Give SolutionsEdi wow WowNo ratings yet

- Individual Chargeable Income (Section 4a To 4d) Tax Computation FormatDocument1 pageIndividual Chargeable Income (Section 4a To 4d) Tax Computation FormatHaananth SubramaniamNo ratings yet

- R2. TAX (M.L) Solution CMA May-2023 ExamDocument5 pagesR2. TAX (M.L) Solution CMA May-2023 ExamSharif MahmudNo ratings yet

- Taxation of CompaniesDocument10 pagesTaxation of CompaniesnikhilramaneNo ratings yet

- Illustration 1Document9 pagesIllustration 1Thanos The titanNo ratings yet

- Special Allowable Itemized DeductionsDocument13 pagesSpecial Allowable Itemized DeductionsSandia EspejoNo ratings yet

- Bank of India Fund BasedDocument33 pagesBank of India Fund Basedhariram v choudharyNo ratings yet

- Class Discussion On Ratios 28022023Document2 pagesClass Discussion On Ratios 28022023lil telNo ratings yet

- Submitted Status:: Sales Tax Credit Gross Value Taxable Value Sales TaxDocument4 pagesSubmitted Status:: Sales Tax Credit Gross Value Taxable Value Sales TaxaizazbarkiNo ratings yet

- EstateDocument8 pagesEstateLyka RoguelNo ratings yet

- Model Solution: Page 1 of 6Document6 pagesModel Solution: Page 1 of 6ShuvonathNo ratings yet

- Confidential: Infosys 29-08-2016 JUN 9 R Anvesh Banda 0 Designation Software EngineerDocument1 pageConfidential: Infosys 29-08-2016 JUN 9 R Anvesh Banda 0 Designation Software EngineerAbdul Nayeem100% (1)

- Answer Tax317 Scheme July 2022Document10 pagesAnswer Tax317 Scheme July 2022Kirei RoseNo ratings yet

- SB FM 2 Practical Sem 5Document39 pagesSB FM 2 Practical Sem 5Sohan KhaterNo ratings yet

- Tax ReportDocument5 pagesTax ReportHanna Lyn BaliscoNo ratings yet

- Income Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollDocument2 pagesIncome Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollShiva098No ratings yet

- Exhibit 3.1 Balance Sheet of Horizon Limited As at March 31, 20x1Document121 pagesExhibit 3.1 Balance Sheet of Horizon Limited As at March 31, 20x1DrSwati BhargavaNo ratings yet

- CFS Case Set 1 2022Document28 pagesCFS Case Set 1 2022HimanshuNo ratings yet

- Cash Flow Statement ProblemDocument2 pagesCash Flow Statement Problemapi-3842194100% (2)

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument7 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaSARAVANAN PNo ratings yet

- Acc106 Assignment 2 Tie Beauty Enterprise FinalDocument15 pagesAcc106 Assignment 2 Tie Beauty Enterprise Finalnur anisNo ratings yet

- Sales Tax Return Sept 10Document6 pagesSales Tax Return Sept 10Raheel BaigNo ratings yet

- Cash Flow Master Question With SolutionDocument6 pagesCash Flow Master Question With Solutionft2vny7nytNo ratings yet

- Assessment of Companies (Solution) : Solution 1 M/s John Morris IncDocument8 pagesAssessment of Companies (Solution) : Solution 1 M/s John Morris IncIQBALNo ratings yet

- Solution Aman BHDDocument4 pagesSolution Aman BHDIZZAH ATHIRAH MOHD SALIMINo ratings yet

- AFA ESE 2022 SolutionsDocument8 pagesAFA ESE 2022 Solutionssebastian mlingwaNo ratings yet

- Wca CaseDocument8 pagesWca CaseAum RaoNo ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument8 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaGeetanjali BarejaNo ratings yet

- Intercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Document31 pagesIntercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Abegail LibreaNo ratings yet

- Hifa NurafwaDocument8 pagesHifa Nurafwa20197 Elisa Nurhayati AhmadNo ratings yet

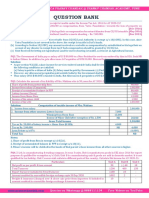

- Question Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneDocument4 pagesQuestion Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneSimran MeherNo ratings yet

- 11.08.2020 - F7 - Interpretation of FS - Sept Dec 2019 ExamDocument12 pages11.08.2020 - F7 - Interpretation of FS - Sept Dec 2019 ExamAliNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Tutorial 2 (1) Q1 - Q4Document8 pagesTutorial 2 (1) Q1 - Q4Shan JeefNo ratings yet

- Tutorial 3 (1) Q1,2,4,5Document9 pagesTutorial 3 (1) Q1,2,4,5Shan JeefNo ratings yet

- Tutorial 2 (3) 3 (E)Document2 pagesTutorial 2 (3) 3 (E)Shan JeefNo ratings yet

- Tutorial 3 (1) Q1,2,4,5Document9 pagesTutorial 3 (1) Q1,2,4,5Shan JeefNo ratings yet

- Tutorial 2 (1) Q1 - Q4Document8 pagesTutorial 2 (1) Q1 - Q4Shan JeefNo ratings yet

- Fire Feat Daddy Shaq Verse 1Document4 pagesFire Feat Daddy Shaq Verse 1Shan JeefNo ratings yet

- CALTEX (PHILIPPINES), INC., Petitioner, vs. The Intermediate Appellate Court and Asia PACIFIC AIRWAYS, INC., RespondentsDocument5 pagesCALTEX (PHILIPPINES), INC., Petitioner, vs. The Intermediate Appellate Court and Asia PACIFIC AIRWAYS, INC., RespondentspatrickNo ratings yet

- Trade Terms Cheat SheetDocument1 pageTrade Terms Cheat SheetDmitry GrozoubinskiNo ratings yet

- Revenue Regulation 19 of 1986 PDFDocument7 pagesRevenue Regulation 19 of 1986 PDFRaymart SalamidaNo ratings yet

- Group 1 ReportDocument11 pagesGroup 1 ReportDawn Rei DangkiwNo ratings yet

- Fire Code Art8Document3 pagesFire Code Art8patitay036817No ratings yet

- Module 5. Common Vat Rules On Sale of Goods, Properties and Services - Monthly Declarations and Quarterly Returns Lesson 1-VAT and Tax PeriodsDocument1 pageModule 5. Common Vat Rules On Sale of Goods, Properties and Services - Monthly Declarations and Quarterly Returns Lesson 1-VAT and Tax PeriodsRachelle Mae NagalesNo ratings yet

- Rome Regulation 1 & 2Document15 pagesRome Regulation 1 & 2Shubhanshu YadavNo ratings yet

- MCQpublicDocument16 pagesMCQpublicShalini Singh IPSANo ratings yet

- OBLICON Notes 2Document8 pagesOBLICON Notes 2Rachel RiveraNo ratings yet

- Difference Between High Court and Supreme CourtDocument2 pagesDifference Between High Court and Supreme CourtNirmal DeepakNo ratings yet

- Click Here To View Your Aliyah Benefits at A GlanceDocument1 pageClick Here To View Your Aliyah Benefits at A GlanceAyelen FlintNo ratings yet

- Welfare Schemes For Senior CitizensDocument2 pagesWelfare Schemes For Senior CitizensVishal SinghNo ratings yet

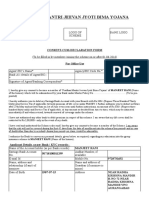

- Pradhan Mantri Jeevan Jyoti Bima Yojana: Print By: 1ASY4213Document2 pagesPradhan Mantri Jeevan Jyoti Bima Yojana: Print By: 1ASY4213Urvashi Sandeep VermaNo ratings yet

- Blake LawsuitDocument25 pagesBlake LawsuitWXYZ-TV Channel 7 DetroitNo ratings yet

- Segregation of FunctionsDocument2 pagesSegregation of FunctionsHelarie RoaringNo ratings yet

- Case Comment National Kamgar Union V. Kran Rader PVT - LTD & OthersDocument9 pagesCase Comment National Kamgar Union V. Kran Rader PVT - LTD & OthersVinod Thomas EfiNo ratings yet

- PO Comprehensive MotorcycleDocument3 pagesPO Comprehensive Motorcyclelloyd_yongNo ratings yet

- 13 - List of Roads Pursuant To EO 113 PDFDocument24 pages13 - List of Roads Pursuant To EO 113 PDFDexter Domingo Vengua100% (2)

- Law Enforcement or Security ManagementDocument2 pagesLaw Enforcement or Security Managementapi-78950964No ratings yet

- Andrej Plenković - Google SearchDocument1 pageAndrej Plenković - Google Searchucboss72No ratings yet

- Elepano Zenaida Syllabus of A 2021 Mcle Lecture On Pretrial andDocument37 pagesElepano Zenaida Syllabus of A 2021 Mcle Lecture On Pretrial and'Naif Sampaco PimpingNo ratings yet

- Reserva Troncal Cases SuccessionDocument35 pagesReserva Troncal Cases SuccessionpaympmnpNo ratings yet

- Tour Contract Receipt / Tax Invoice: Print HomeDocument1 pageTour Contract Receipt / Tax Invoice: Print HomeFarmer MNo ratings yet

- Form - 2 (Nomination Paper)Document4 pagesForm - 2 (Nomination Paper)Suvodip EtcNo ratings yet

- Sro 42Document8 pagesSro 42zainallliNo ratings yet

- AdvanceMe Inc v. RapidPay LLC - Document No. 310Document50 pagesAdvanceMe Inc v. RapidPay LLC - Document No. 310Justia.comNo ratings yet

- Addendum To Interim Guidelines On Student Government Elections For The School Year 2021 2022 Under New NormalDocument6 pagesAddendum To Interim Guidelines On Student Government Elections For The School Year 2021 2022 Under New NormalMamaanun PSNo ratings yet

- Affidavit of Undertaking For PromotionDocument3 pagesAffidavit of Undertaking For PromotionML PascuaNo ratings yet