Professional Documents

Culture Documents

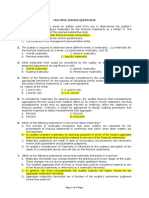

Excel Professional Services, Inc.: Discussion Questions

Uploaded by

SadAccountantOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Excel Professional Services, Inc.: Discussion Questions

Uploaded by

SadAccountantCopyright:

Available Formats

Excel Professional Services, Inc.

Management Firm of Professional Review and Training Center (PRTC)

(LUZON) Manila 87339344 * Calamba City, Laguna * Dasmariñas City, Cavite * Lipa City,

Batangas (0917) 8852769 * (VISAYAS) Bacolod City (034) 4346214 * Cebu City (032)

2537900 loc. 218 (MINDANAO) Cagayan De Oro (0917) 7081465 * Davao City (082) 2250049

AUDITING THEORY

AT.3002 – Introduction to Audit R.C.P. SOLIMAN/ K.J. UY

& Audit Standard-Setting Process MAY 2021

References:

a. Preface to the International Standards and Philippine Standards

b. PSA 200 (Revised and Redrafted), Overall Objectives of the Independent Auditor and the Conduct of an Audit

in Accordance with Philippine Standards on Auditing

DISCUSSION QUESTIONS

b. The integrity of accounting and financial records

Definition of Auditing of an entity.

c. Verification that the company’s financial reports

1. The following phrases relate to the definition of are in accordance with the standards.

auditing. Which one is incorrect? d. Compliance with government-mandated rules and

a. Auditing is a systematic process. regulations.

b. Objectively obtaining and evaluating evidence

about assertions. 6. A type of audit the purpose of which is to determine

c. Assertions about economic actions and events. whether the auditee is following specific procedures

d. Degree of correspondence between assertions and or rule

auditing standards. a. Operational audit.

b. Financial audit.

2. The single feature that most clearly distinguishes c. Compliance audit.

auditing, attestation, and assurance is the d. Management audit.

a. type of service being rendered.

b. training required to perform the service. 7. Which of the following statements is true concerning

c. scope of services. a compliance audit?

d. CPA’s approach to the service. a. Compliance audits are only performed by

government auditors.

Types of Audits b. Risks such as inherent risk, control risk, and

detection risk are not appropriate in the planning

According to Subject Matter and performance of a compliance audit.

c. Criteria normally used include laws, regulations,

3. The primary reason for a financial statement audit by or provisions of a contract or agreement.

a CPA independent of the company is to d. A report on compliance can only include negative

a. Ensure that the financial statements are free from assurance.

errors whether due to fraud or error.

b. Comply with SEC’s requirement that financial According to Auditor

statements shall be certified by a CPA.

c. Provided increased assurance to users as to the 8. Which of the following types of auditing is performed

fairness of the financial statements. most commonly by independent CPAs on a

d. Transfer the responsibility regarding the financial contractual basis?

statements from the management to the auditor. a. Internal audits

b. Government audits

4. A typical objective of an operational audit is to c. Due diligence

determine whether an entity's d. External auditing

a. Financial statements fairly present financial

position and cash flows. 9. The following statements relate to internal auditing.

b. Financial statements present fairly the results of Which of the following statements is incorrect?

operations. a. Internal audits are performed by an entity’s

c. Financial statements fairly present financial employees or by personnel contracted for that

position, results of operations, and cash flows. purpose.

d. Specific operating units are functioning efficiently b. Internal auditing has evolved into a highly

and effectively. professional activity that extends beyond the

appraisal of the efficiency and effectiveness of an

5. Operational auditing is geared towards entity’s operations.

a. Future improvements of an organization to c. Internal audit areas include providing assurance

achieve the objectives set by management. and consulting services relating to entity’s risk

Page 1 of 4 www.teamprtc.com.ph AT.3002

EXCEL PROFESSIONAL SERVICES, INC.

management, control, and governance process a. Expression of an opinion as to the fairness of the

aimed at adding value to the organization. financial statements.

d. To be effective, internal auditors should submit b. Transactions that are voluminous and complex.

their reports to the senior management. c. Remoteness of users from preparers of financial

statements.

10. To make the internal audit department independent, d. Investors and other users need to make

he should report directly to the a. Board of Directors. important

b. Audit committee. decisions about the company.

c. Stockholders.

d. Controller. 17. Which of the following are assertions about account

balances at the balance sheet date?

11. Governmental auditing’s scope include examinations a. Occurrence, cut-off, classification, completeness

leading to the expression of opinions on the and accuracy.

1) Fairness of financial information b. Existence, rights and obligations, completeness

2) Efficiency and economy of operations and valuation and allocation.

3) Effectiveness of operations c. Occurrence and rights and obligations,

4) Compliance completeness, classification and understandability

and accuracy and valuation.

a. 1 and 4 d. All of the above.

b. 1 only

c. 2 and 3 18. Assertions about classes of transactions and events

for the period under audit least likely include

d. 1,2,3 and 4

a. Transactions and events that have been recorded

have occurred and pertain to the entity.

12. This constitutional Commission has the power,

b. All transactions and events that should have been

authority, and duty to examine, audit, and settle all

recorded have been recorded.

accounts pertaining to the revenue and receipts of,

and expenditures or users of funds and property, c. Transactions and events have been recorded in

owned or held in trust by, or pertaining to, the the correct accounting period.

government, or any of its subdivisions, agencies, or d. All assets, liabilities and equity interests that

instrumentalities, including government-owned or should have been recorded have been recorded.

controlled corporations and recommend measures to

improve the efficiency and effectiveness of Audit Standard Setting Process

government operations.

a. Board of Accountancy International Auditing and Assurance Standards Board

b. Auditing and Assurance Standards Council (IAASB)

c. Bureau of Internal Revenue

d. Commission on Audit 19. The International Auditing and Assurance Standards

Board (IAASB) is an independent standard-setting

Audits of Historical Financial Statements body that serves the public interest by setting

highquality international standards for auditing,

13. An independent CPA is conducting an audit of the quality control, review, other assurance, and related

financial statements of Ace Corporation under PSAs. services, and by facilitating the convergence of

international and national standards.

The independent CPA is expected to

a. Express an opinion as to the fairness of Ace

Corporation's financial statements. The IAASB develops and issues, in the public interest

and under its own authority, high-quality auditing and

b. Guarantee the accuracy of the financial

assurance standards and other pronouncements for

statements of Ace Corporation.

use around the world. a. True, False

c. Make a testimonial that Ace Corporation is a good

b. False, True

choice for investment purposes.

c. True, True

d. Certify that Ace Corporation will be profitable in

the next ten (10) years. d. False, False

14. An “integrated audit”, as required by Sarbanes-Oxley IAASB Due Process and Working Procedures

Act for U.S. public companies, includes an audit of a.

The company’s internal controls. 20. A rigorous due process is followed by the IAASB in

b. The company’s financial statements. developing its pronouncements and such due process

c. The company’s compliance with its rules and is critical to ensure that the views of those affected

policies. by its standards are thoroughly considered. Which of

the following statements is incorrect regarding

d. Both a and b.

IAASB’s development of its standards?

a. A project task force is ordinarily established with

15. An audit can have a significant effect on:

the responsibility to develop a draft standard. The

a. Information risk task force develops its positions based on

b. Business risk appropriate research and consultation.

c. Interest rate b. Exposure drafts are placed on the IAASB’s

d. Inflation rate website and are widely distributed for public

comment. The exposure period is ordinarily 30

16. The underlying reasons that create demand for users days.

for reliable financial information do not include: c. The comments and suggestions received as a

result of exposure are considered at an IAASB

Page 2 of 4 www.teamprtc.com.ph AT.3002

EXCEL PROFESSIONAL SERVICES, INC.

meeting, which is open to the public, and the through the BOA for approval after which the

exposure draft is revised as appropriate. pronouncements shall be published in the Official

d. Approval of exposure drafts, re-exposure drafts, Gazette. After publication, the AASC

and final international standards is made by the pronouncement becomes operative 15 days from

affirmative vote of at least two-thirds of the publication in the Official Gazette.

IAASB members.

Engagement Standards and Practice Statements

Auditing and Assurance Standards Council (AASC)

23. Which of the following standards are to be applied, as

21. The Auditing and Assurance Standards Council appropriate, in the audits of historical financial

(AASC) is the body authorized to establish and information?

a.

a.

a.

DO-IT-YOURSELF (DIY) DRILL a.

promulgate generally accepted auditing standards Philippine Standards on Assurance Engagements

(GAAS) in the Philippines. (PSAE)

b. Philippine Standards on Auditing

At present, AASC pronouncements are mainly c. Philippine Standards on Review Engagements

adopted from the standards and practice statements d. Philippine Standards on Related Services

issued by the International Auditing and Assurance

Standards Board (IAASB). a. True, False

24. Philippine Standards on Quality Control (PSQCs) are

b. False, True

to be applied to

c. True, True

a. Assurance engagements only.

d. False, False

b. Review Engagements only.

c. Compilation and agreed-upon engagements only.

22. Which of the following statements about AASC and its

d. All services that fall under AASC’s engagement

working procedures is incorrect?

standards.

a. The AASC’s Standards contain basic principles and

essential procedures together with related

25. These statements are issued by the AASC to provide

guidance in the form of explanatory and other

interpretative guidance and practical assistance to

material, including appendices.

auditors in the implementation of PSAs and to

b. Exposure draft of proposed Philippine Standard or

promote good practice.

Practice Statements are widely distributed to

a. Philippine Auditing Practice Statements (PAPS)

interested organizations and persons for

comment, the period of which is generally not b. Philippine Review Engagement Practice

shorter than 90 days. Statements (PREPS)

c. Issuance of exposure drafts requires approval by c. Philippine Assurance Engagement

a majority of the members of the Council; Practice

issuance of final Philippine Standards and Practice Statements (PAEPS)

Statements, as well as interpretations, requires d. Philippine Related Services Practice Statements

approval of at least ten members. (PRSPS)

d. Each final Philippine Standard and Practice

Statement, as well as interpretations, if deemed

appropriate, shall be submitted to the PRC - now do the DIY drill –

c. A measure of management performance in

1. Auditing involves both a(an): meeting organizational goals.

a. Documentation process and an evaluation d. Aid to the independent auditor, who is conducting

process. the examination of the financial statements.

b. Evaluation process and a reporting process.

c. Investigative process and a reporting process. 4. An audit which is undertaken in order to determine

d. Documentation process and a reporting process. whether the auditee is following specific procedures

or rules laid down by some higher authority is

2. Which of the following types of audit is performed in classified as a(n)

order to determine whether an entity’s financial a. audit of financial statements.

statements are fairly stated, in all material respects, b. compliance audit.

in conformity with the generally accepted accounting c. operational audit.

principles? d. production audit.

a. Operational audit

b. Financial statement audit 5. Internal auditing relates to an

c. Compliance audit a. Audit which is performed by professional

d. Performance audit practitioner as an independent contractor

b. Audit which is incidentally concerned with the

3. A primary purpose of an operational audit is to detection and prevention of fraud

provide a. A means of assurance that internal c. Audit wherein the auditor should be independent

accounting controls are functioning as planned. of management both in fact and in mental

b. The results of internal examination of financial attitude

and accounting matters to a company’s top level d. Audit which serves the needs of management

management.

Page 3 of 4 www.teamprtc.com.ph AT.3002

EXCEL PROFESSIONAL SERVICES, INC.

6. Internal auditors may perform all of the following d. Each of these is a cause of information risk.

types of audits except

a. Operational audits 13. Which of the following statements does not properly

b. Compliance audits describe a limitation of an audit?

c. Computer system audits a. Many audit conclusions are made on the basis of

d. All of the above may be performed by internal examining all available evidence.

auditors b. Some evidence supporting peso representations

in the financial statements must be obtained by

7. Government auditing often extends beyond oral or written representation of management.

examination leading to the expressions of opinion on c. Human weakness, such as fatigue and

the fairness of financial presentation and includes carelessness, can cause auditors to overlook

audits of efficiency, effectiveness and a. Internal pertinent evidence or cause them to make the

control wrong conclusions.

b. Accuracy d. Judgment is used throughout

c. Evaluation the audit

d. Compliance engagement.

8. Which of the following is not among the functions of 14. Which of the following standards are to be applied to

the audit committee? compilation engagements, engagements to apply

a. Review the external auditor’s overall audit plan agreed-upon procedures to information, and other

b. Meet regularly with the Chief Audit Executive of related services engagements as specified by the

the internal audit activity AASC?

c. Evaluate results of internal and external audits a. PSRSs

d. Set the strategic direction of the company and b. PSAs

supervise its day-to-day operations c. PSAEs

d. PSREs

9. The independent auditor’s opinion helps establish the

credibility of the financial statements. 15. Philippine Standards on Assurance Engagements

(PSAEs) are to be applied in

The independent auditor’s opinion is an assurance as a. Assurance engagements dealing with subject

to the efficiency or effectiveness with which matters other than historical financial information.

management has conducted the affairs of the entity. b. Compilation engagements and agreements to

a. The first statement is false, the second statement apply agreed-upon procedures to information.

is true c. The audit or review of historical financial

b. The first statement is true, the second statement information.

is true d. Assurance engagements dealing with historical

c. The first statement is false, the second statement financial information.

is false

d. The first statement is true, the second statement - end of AT.3002 -

is false

10. Which of the following statements is an example of an

assertion made by management in an entity's

financial statements?

a. The financial statements were prepared in an

unbiased manner.

b. All information requested by the auditor has been

provided by management.

c. The scope of the auditors' investigation was not

limited in any way by management.

d. Reported inventory balances reflect all related

transactions for the period.

11. Accuracy and valuation assertions about presentation

and disclosure means

a. Disclosed events, transactions, and other matters

have occurred and pertain to entity.

b. All disclosures that should have been included in

the financial statements have been included.

c. Financial information is appropriately presented

and described, and disclosures are clearly

expressed.

d. Financial and other information are disclosed

fairly

and at appropriate amounts.

12. Which of the following is a cause of information risk?

a. Voluminous data.

b. Biases and motives of the provider of information.

c. Remoteness of the provider of the information.

Page 4 of 4 www.teamprtc.com.ph AT.3002

You might also like

- Since 1977: Preliminary Audit ActivitiesDocument7 pagesSince 1977: Preliminary Audit ActivitiesYukiNo ratings yet

- PSA 230 (RED) "Audit Documentation": (Effectivity Date: December 15, 2009)Document20 pagesPSA 230 (RED) "Audit Documentation": (Effectivity Date: December 15, 2009)Christine NicoleNo ratings yet

- Nfjpia Nmbe Far 2017 AnsDocument9 pagesNfjpia Nmbe Far 2017 AnsSamieeNo ratings yet

- Quiz BeeDocument15 pagesQuiz BeeRudolf Christian Oliveras UgmaNo ratings yet

- Aud2 CashDocument6 pagesAud2 CashMaryJoyBernalesNo ratings yet

- At MCQ Salogsacol Auditing Theory Multiple ChoiceDocument32 pagesAt MCQ Salogsacol Auditing Theory Multiple ChoiceJannaviel MirandillaNo ratings yet

- Excel Professional Services, Inc.: Discussion QuestionsDocument7 pagesExcel Professional Services, Inc.: Discussion QuestionskæsiiiNo ratings yet

- ReSA B46 AUD Final PB Exam Questions Answers Solutions 1Document16 pagesReSA B46 AUD Final PB Exam Questions Answers Solutions 1John Gabriel RafaelNo ratings yet

- Auditing and Assurance: Specialized Industries - Aviation Sector Examination ReviewerDocument9 pagesAuditing and Assurance: Specialized Industries - Aviation Sector Examination ReviewerHannah SyNo ratings yet

- Auditing Risks of Material MisstatementsDocument6 pagesAuditing Risks of Material MisstatementsDenny June CraususNo ratings yet

- Sol Manchapter 5 Corporate Liquidation Reorganizationacctg For Special Transactions PDF FreeDocument15 pagesSol Manchapter 5 Corporate Liquidation Reorganizationacctg For Special Transactions PDF FreeJane GavinoNo ratings yet

- Session 3 AUDITING AND ASSURANCE PRINCIPLESDocument29 pagesSession 3 AUDITING AND ASSURANCE PRINCIPLESagent2100No ratings yet

- CPD TRAINING CENTER FINAL PREBOARD EXAMSDocument5 pagesCPD TRAINING CENTER FINAL PREBOARD EXAMSRandy PaderesNo ratings yet

- CH 07Document24 pagesCH 07xxxxxxxxxNo ratings yet

- Ac-Aud 3Document10 pagesAc-Aud 3Mark Anthony TibuleNo ratings yet

- Auditing Theory Test BankDocument7 pagesAuditing Theory Test BankjaysonNo ratings yet

- QuizDocument13 pagesQuizPearl Morni AlbanoNo ratings yet

- Completing the Audit ReportsDocument66 pagesCompleting the Audit ReportsDieter LudwigNo ratings yet

- Gramling 9e Auditing Solman Audit SamplingDocument29 pagesGramling 9e Auditing Solman Audit Samplingkimjoonmyeon22100% (1)

- CPALEDocument1 pageCPALERalph Clarence NicodemusNo ratings yet

- Auditing Theory - MockDocument10 pagesAuditing Theory - MockCarlo CristobalNo ratings yet

- QUIZ 2 Airline IndustryDocument4 pagesQUIZ 2 Airline IndustrySia DLSLNo ratings yet

- Chapter 1-CFAS: I. AccountingDocument6 pagesChapter 1-CFAS: I. AccountingDale Jose GarchitorenaNo ratings yet

- Ap 9004-IntangiblesDocument5 pagesAp 9004-IntangiblesSirNo ratings yet

- Auditing and Assurance Principles Final Exam Set ADocument11 pagesAuditing and Assurance Principles Final Exam Set APotato CommissionerNo ratings yet

- DocxDocument9 pagesDocxKez MaxNo ratings yet

- ACT1205 - Module 3 - Audit of InvestmentsDocument6 pagesACT1205 - Module 3 - Audit of InvestmentsIo AyaNo ratings yet

- National Mock Board Examination 2017 Auditing: A. Consolidated Net Profit After Tax Attributable To ParentDocument13 pagesNational Mock Board Examination 2017 Auditing: A. Consolidated Net Profit After Tax Attributable To ParentKez MaxNo ratings yet

- CORRECTING FINANCIAL STATEMENT ERRORSDocument56 pagesCORRECTING FINANCIAL STATEMENT ERRORSKimberly Pilapil MaragañasNo ratings yet

- Quiz Results: Week 12: Conceptual Framework: Expenses Quizzer 2Document31 pagesQuiz Results: Week 12: Conceptual Framework: Expenses Quizzer 2marie aniceteNo ratings yet

- Practical Accounting 1: I ExamcoverageDocument12 pagesPractical Accounting 1: I ExamcoverageCharry Ramos0% (2)

- Multiple Choice Questions: Finance and Investment CycleDocument19 pagesMultiple Choice Questions: Finance and Investment Cyclemacmac29No ratings yet

- Quiz P3Document2 pagesQuiz P3JEP Walwal100% (1)

- Aud ThEORY - 2nd PreboardDocument11 pagesAud ThEORY - 2nd PreboardKim Cristian MaañoNo ratings yet

- E/o C V/M: (A1) (A2) (A3) (A4) A6) (A7)Document17 pagesE/o C V/M: (A1) (A2) (A3) (A4) A6) (A7)Krisha Lei SanchezNo ratings yet

- Chapter 05 - Audit Evidence and DocumentationDocument44 pagesChapter 05 - Audit Evidence and DocumentationALLIA LOPEZNo ratings yet

- ACCO 30043: Quiz Number 1 (Introduction To Assurance and Audit Services)Document16 pagesACCO 30043: Quiz Number 1 (Introduction To Assurance and Audit Services)pat lanceNo ratings yet

- Department of Accountancy: Page - 1Document17 pagesDepartment of Accountancy: Page - 1NoroNo ratings yet

- Whittington Audit Chapter 17 Solutions ManualDocument16 pagesWhittington Audit Chapter 17 Solutions ManualIam AbdiwaliNo ratings yet

- The New Code of Ethics For CPA S by Atty Eranio Punsalan PDFDocument9 pagesThe New Code of Ethics For CPA S by Atty Eranio Punsalan PDFsamuel debebeNo ratings yet

- Prelim Set ADocument13 pagesPrelim Set AJanine LerumNo ratings yet

- PDF Resa b44 Aud Final PB With Answer - Compress PDFDocument21 pagesPDF Resa b44 Aud Final PB With Answer - Compress PDFVianney Claire RabeNo ratings yet

- Auditing and Assurance Principles Pre-Test ReviewDocument9 pagesAuditing and Assurance Principles Pre-Test ReviewKryzzel Anne JonNo ratings yet

- Generally Accepted Auditing StandardsDocument29 pagesGenerally Accepted Auditing StandardsCarlito B. BancilNo ratings yet

- Auditing ProcessDocument11 pagesAuditing ProcessJuliana ChengNo ratings yet

- Karkits Corporation PDFDocument4 pagesKarkits Corporation PDFRachel LeachonNo ratings yet

- Introduction to Assurance, Auditing and Related ServicesDocument4 pagesIntroduction to Assurance, Auditing and Related ServicesmymyNo ratings yet

- CW6 - MaterialityDocument3 pagesCW6 - MaterialityBeybi JayNo ratings yet

- PSA 220 Quality Control For Historical Info SummaryDocument6 pagesPSA 220 Quality Control For Historical Info SummaryAbraham ChinNo ratings yet

- This Study Resource Was: Profit Loss Profit LossDocument9 pagesThis Study Resource Was: Profit Loss Profit LossrogealynNo ratings yet

- Auditing Multiple ChoicesDocument8 pagesAuditing Multiple ChoicesyzaNo ratings yet

- Auditing Theory 250 Questions 2 With Answers 1Document40 pagesAuditing Theory 250 Questions 2 With Answers 1Hafsha MangandogNo ratings yet

- Chapter 19 AnsDocument10 pagesChapter 19 AnsDave ManaloNo ratings yet

- BanksDocument58 pagesBanksgraceNo ratings yet

- RDC Review School Accountancy Audit QuizDocument16 pagesRDC Review School Accountancy Audit QuizKIM RAGANo ratings yet

- Compilation Review Agreed-Upon ProceduresDocument11 pagesCompilation Review Agreed-Upon ProceduresJulrick Cubio EgbusNo ratings yet

- CHAPTER 1 Auditing-Theory-MCQs-by-Salosagcol-with-answers 1Document2 pagesCHAPTER 1 Auditing-Theory-MCQs-by-Salosagcol-with-answers 1MichNo ratings yet

- Airplane NotesDocument1 pageAirplane NotesEmma Mariz GarciaNo ratings yet

- A. B. C. D. A. B. C. D.: ANSWER: Review Prior-Year Audit Documentation and The Permanent File For The ClientDocument7 pagesA. B. C. D. A. B. C. D.: ANSWER: Review Prior-Year Audit Documentation and The Permanent File For The ClientRenNo ratings yet

- Jose Rizal University: College Ob Business Administration and AccountancyDocument2 pagesJose Rizal University: College Ob Business Administration and AccountancyLorielyn AgoncilloNo ratings yet

- Group 2 Sec 1 Taco LabDocument159 pagesGroup 2 Sec 1 Taco LabSadAccountant100% (1)

- Sushilog Ac503Document251 pagesSushilog Ac503SadAccountant100% (1)

- Little Portable Desk LampDocument17 pagesLittle Portable Desk LampSadAccountantNo ratings yet

- Pizza Bomb Feasib CompiledDocument235 pagesPizza Bomb Feasib CompiledSadAccountant100% (3)

- Prof. Ryan C. Roque, CPA, MBADocument109 pagesProf. Ryan C. Roque, CPA, MBASadAccountantNo ratings yet

- At.3009-Internal Control ConsiderationsDocument9 pagesAt.3009-Internal Control ConsiderationsSadAccountant100% (1)

- At.3008 Understanding The Entity and Its EnvironmentDocument6 pagesAt.3008 Understanding The Entity and Its EnvironmentSadAccountant100% (1)

- Final Paper November22Document123 pagesFinal Paper November22SadAccountantNo ratings yet

- At.3004-Nature and Type of Audit EvidenceDocument6 pagesAt.3004-Nature and Type of Audit EvidenceSadAccountantNo ratings yet

- DavidDocument17 pagesDavidFiera ChueraNo ratings yet

- Excel Professional Services, Inc.: Discussion QuestionsDocument5 pagesExcel Professional Services, Inc.: Discussion QuestionsSadAccountantNo ratings yet

- At.3006-Planning An Audit of Financial StatementsDocument5 pagesAt.3006-Planning An Audit of Financial StatementsSadAccountantNo ratings yet

- Excel Professional Services, Inc.: Discussion QuestionsDocument4 pagesExcel Professional Services, Inc.: Discussion QuestionsSadAccountantNo ratings yet

- At.3001 Assurance Engagements Other Services of A PractitionerDocument4 pagesAt.3001 Assurance Engagements Other Services of A PractitionerSadAccountantNo ratings yet

- David sm11 Basic 03Document20 pagesDavid sm11 Basic 03JAPNo ratings yet

- Management Strategic David Sm11 Chapter 2 Vission and Mission AnalysisDocument15 pagesManagement Strategic David Sm11 Chapter 2 Vission and Mission AnalysisAna ElbrachtNo ratings yet

- Viana SwotDocument2 pagesViana SwotSadAccountantNo ratings yet

- CH 1 Nature of StramanDocument17 pagesCH 1 Nature of StramanSadAccountantNo ratings yet

- Assignment Fundamentals of Book - Keeping & AccountingDocument19 pagesAssignment Fundamentals of Book - Keeping & AccountingmailonvikasNo ratings yet

- Sample Reflective SummaryDocument3 pagesSample Reflective SummaryRicksen TamNo ratings yet

- History of Anglo Saxon Literature English Assignment NUML National University of Modern LanguagesDocument15 pagesHistory of Anglo Saxon Literature English Assignment NUML National University of Modern LanguagesMaanNo ratings yet

- Nursing Care PlanDocument12 pagesNursing Care Planzsazsageorge86% (21)

- Task 1 Junio 30-Julio 3Document5 pagesTask 1 Junio 30-Julio 3brilli mirandaNo ratings yet

- Crime Trend CompletedDocument15 pagesCrime Trend CompletedLENARD LAGASINo ratings yet

- Biography: Rex NettlefordDocument1 pageBiography: Rex NettlefordYohan_NNo ratings yet

- 4Ps of LifebuoyDocument5 pages4Ps of LifebuoyApurva Saini100% (1)

- Borang Pemarkahan RIMUP (Dazanak Tavantang)Document11 pagesBorang Pemarkahan RIMUP (Dazanak Tavantang)ELLYE ORNELLA SULIMAN MoeNo ratings yet

- The Zwolftonspiel of Josef Matthias Hauer: John RDocument36 pagesThe Zwolftonspiel of Josef Matthias Hauer: John RMax Kühn100% (1)

- l2 Unit 8 Statement of Aims Blank 2023 Templa 1Document8 pagesl2 Unit 8 Statement of Aims Blank 2023 Templa 1api-631701024No ratings yet

- Tone - 5 - Plagal 1 - 4 Aug - 6ap - 6 Matt - ParalyticDocument6 pagesTone - 5 - Plagal 1 - 4 Aug - 6ap - 6 Matt - ParalyticMarguerite PaizisNo ratings yet

- The Lack of Sports Facilities Leads To Unhealthy LIfestyle Among StudentsReportDocument22 pagesThe Lack of Sports Facilities Leads To Unhealthy LIfestyle Among StudentsReportans100% (3)

- Mock Trial Plaintiff ClosingDocument3 pagesMock Trial Plaintiff ClosingDan CohenNo ratings yet

- Philippines Supreme Court rules on robbery and double homicide caseDocument13 pagesPhilippines Supreme Court rules on robbery and double homicide caseNadzlah BandilaNo ratings yet

- Demerit System PointsDocument87 pagesDemerit System PointsBusinessTech25% (4)

- Rufino Luna, Et - Al V CA, Et - Al (G.R. No. 100374-75)Document3 pagesRufino Luna, Et - Al V CA, Et - Al (G.R. No. 100374-75)Alainah ChuaNo ratings yet

- Draft Law Regarding Matrimonial Regimes Family Donations and Successions PDFDocument56 pagesDraft Law Regarding Matrimonial Regimes Family Donations and Successions PDFMugaboNo ratings yet

- FEA Buckling AnalysisDocument7 pagesFEA Buckling AnalysisRabee Shammas100% (1)

- Arihant Sample PaperDocument8 pagesArihant Sample PaperKhali GangueNo ratings yet

- Scada/Ems/Dms: Electric Utilities Networks & MarketsDocument12 pagesScada/Ems/Dms: Electric Utilities Networks & MarketsdoquocdangNo ratings yet

- Bundling and Best FitDocument41 pagesBundling and Best FitJeena JnNo ratings yet

- Travels of RizalDocument13 pagesTravels of Rizaljjofgg100% (1)

- Deglobalization of GlobalizationDocument20 pagesDeglobalization of GlobalizationAbdullah FarhadNo ratings yet

- Caring in Nursing: Four AspectsDocument47 pagesCaring in Nursing: Four AspectsAnuchithra RadhakrishnanNo ratings yet

- MOC 20487B: Developing Windows Azure and Web Services Course OverviewDocument9 pagesMOC 20487B: Developing Windows Azure and Web Services Course OverviewMichaelsnpNo ratings yet

- Roman Epicurean'ism - Natural Law and HomosexualityDocument21 pagesRoman Epicurean'ism - Natural Law and HomosexualityPapa Giorgio100% (1)

- Chemical Reaction Engineering II Note 1Document49 pagesChemical Reaction Engineering II Note 1Asasira IradNo ratings yet

- Costa, António Pedro, Luís Paulo Reis, António Moreira. 2019. (Advances in Intelligent Systems and Computing 861) Computer Supported Qualitative Research - New Trends On Qualitative Research-SpringerDocument330 pagesCosta, António Pedro, Luís Paulo Reis, António Moreira. 2019. (Advances in Intelligent Systems and Computing 861) Computer Supported Qualitative Research - New Trends On Qualitative Research-SpringerClarisse ReinfildNo ratings yet