Professional Documents

Culture Documents

ACACC102A Assessment2 S1 2014 ExamAnswerBook PDF

Uploaded by

fernandarvOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACACC102A Assessment2 S1 2014 ExamAnswerBook PDF

Uploaded by

fernandarvCopyright:

Available Formats

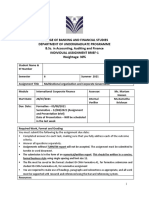

Student name:

Student ID

Campus:

Associate Degree of Accounting

Subject number: ACACC102A

Subject name: Accounting Foundations II

Semester 1, 2014

Time allowed 1 hour plus 5 minutes reading time

General instructions Marks

Write your answers using black or blue pen Total marks: 50 (scaled to 15%)

Write your name and campus at the top of Section 1: 5 Marks

each page 5 x multiple choice questions

Section 2: 30 Marks

3 x Short answer theory questions

Section 3: 5 Marks

1 x Practical question

Section 4: 10 Marks

1 x 3 part practical question

Examination aids permitted as indicated

Standard Bilingual Technical Programmable Non-

dictionaries dictionaries dictionaries calculators programmable

calculators

Yes Yes No No Yes

Other examination aids permitted

None

© TAFE NSW – Higher Education Semester 1, 2014 Page | 1

ACACC102A Accounting Foundations II

ACACC102A Accounting Foundations II

Assessment Event 2 – Mid-Semester Exam

ANSWER BOOKLET

QUESTION 1

Multiple Choice - Answer all the questions. 1 Mark each

Please select the correct answer by putting a colouring in the relevant letter:

EXAMPLE

PLACE YOUR ANSWER BELOW

© TAFE NSW – Higher Education Semester 1, 2014 Page | 2

ACACC102A Accounting Foundations II

QUESTION 2

A) The textbook discusses two types of inventory systems. In your own words, identify

and advise the main differences between the two methods. (5 marks each)

Method 1:

© TAFE NSW – Higher Education Semester 1, 2014 Page | 3

ACACC102A Accounting Foundations II

QUESTION 2

A) The textbook discusses two types of inventory systems. In your own words, identify

and advise the main differences between the two methods. (5 marks each)

Method 2:

© TAFE NSW – Higher Education Semester 1, 2014 Page | 4

ACACC102A Accounting Foundations II

QUESTION 2

B) Accounts receivable should be recorded in terms of their future economic benefits

(their gross amount less an allowance for expected bad debts). Two methods may be

used to record the actual amount outstanding and the fair value of the accounts

receivable. Distinguish between each of these methods and provide an example of

the accounting procedure for each (general journal entry). (5 marks each)

(i) Method 1

Example:

$ $

© TAFE NSW – Higher Education Semester 1, 2014 Page | 5

ACACC102A Accounting Foundations II

QUESTION 2

B) Accounts receivable should be recorded in terms of their future economic benefits

(their gross amount less an allowance for expected bad debts). Two methods may be

used to record the actual amount outstanding and the fair value of the accounts

receivable. Distinguish between each of these methods and provide an example of

the accounting procedure for each (general journal entry). (5 marks each)

(ii) Method 2

Example:

$ $

© TAFE NSW – Higher Education Semester 1, 2014 Page | 6

ACACC102A Accounting Foundations II

QUESTION 2

B) In your own words define ‘the residual value of an asset’ under IAS16/AASB116. (10

marks)

© TAFE NSW – Higher Education Semester 1, 2014 Page | 7

ACACC102A Accounting Foundations II

QUESTION 3

Jack Jones, CFO of Austral Blinds Ltd, has asked you, as the accountant, to prepare the

general journal entry to increase the allowance for doubtful debts from 1% to 1.25% of the

closing Accounts Receivable value for the period. An extract of the trial balance of the

company as at 30th June 2014 shows:

Accounts Receivable $792,581

Allowance Doubtful Debts $ 6,843

Jack has also advised that Fred Rose Kitchens P/L is to be written off as a bad debt in this

financial year. The balance of Fred Rose’s account is $2,200

REQUIRED:

Using the allowance for doubtful debts method you are required to show the adjusting

general journal entry required. (Whole dollars only).

$ $

© TAFE NSW – Higher Education Semester 1, 2014 Page | 8

ACACC102A Accounting Foundations II

QUESTION 4

Vietnam Pty Ltd purchased a truck for cash for $52,000 plus 10% GST on January 1, 2010. At

the time of purchase it was estimated that the useful life of the vehicle would be 100,000

kilometres and it was expected that it would travel that distance over four years. At the end

of four years of useful life it was calculated that the truck could be sold for $12,000. The

accounting period for Vietnam Pty Ltd is the financial year.

The actual distance covered by the truck was as follows:

Year ending 30 June:

2010 10,000 kilometres

2011 25,000 kilometres

2012 30,000 kilometres

2013 22,000 kilometres

2014 8,000 kilometres

REQUIRED:

a) Calculate depreciation for the years ending 30th June 2010 to 30 June 2014 using the

units of production method. (4 marks)

Workings:

Calculation worksheet:

Year ended 30 June $

© TAFE NSW – Higher Education Semester 1, 2014 Page | 9

ACACC102A Accounting Foundations II

b) Prepare general journal entries to record the purchase of the truck and depreciation,

using the straight-line method, for the period 1 January 2010 to 30 June 2012 (4 marks)

c) Prepare an extract from the balance sheet for the vehicle as at 30 June 2012 using the

straight-line method of depreciation. (2 marks)

© TAFE NSW – Higher Education Semester 1, 2014 Page | 10

You might also like

- BACC116 Financial Accounting 1 - S2 2015Document8 pagesBACC116 Financial Accounting 1 - S2 2015Melody AhNo ratings yet

- ACC201 PA - UEH-ISB - S1 2019 - Unit Guide - Sent To LecturerDocument9 pagesACC201 PA - UEH-ISB - S1 2019 - Unit Guide - Sent To LecturerHa TranNo ratings yet

- ACC201 - Principles of Accounting - Trimester 1 2021Document10 pagesACC201 - Principles of Accounting - Trimester 1 2021Hoàng Võ Như QuỳnhNo ratings yet

- Associate Degree of Accounting: Examination Question BookletDocument11 pagesAssociate Degree of Accounting: Examination Question BookletfernandarvNo ratings yet

- DCP Financial AccountingDocument9 pagesDCP Financial AccountingIntekhab AslamNo ratings yet

- University of The Commonwealth Caribbean School of Business & ManagementDocument13 pagesUniversity of The Commonwealth Caribbean School of Business & ManagementBeyonce SmithNo ratings yet

- ACC201 - Principles of Accounting - Trimester 1 2021-2022 Updated 15.09.2021Document18 pagesACC201 - Principles of Accounting - Trimester 1 2021-2022 Updated 15.09.2021Khuê Phạm100% (1)

- ACCT 3102 - Assignment 1Document3 pagesACCT 3102 - Assignment 1Iqtidar KhanNo ratings yet

- Intermediate Financial Accounting IntroductionDocument14 pagesIntermediate Financial Accounting Introductionyicunz8No ratings yet

- Open University of Mauritius Module Specification Sheet-Accounting Fundamentals, Oubs002111Document3 pagesOpen University of Mauritius Module Specification Sheet-Accounting Fundamentals, Oubs002111Shik Isha BhuroseeNo ratings yet

- SyllabusDocument12 pagesSyllabusAndrew WatsonNo ratings yet

- Paper 2-ACCT3044 - MidSemDocument3 pagesPaper 2-ACCT3044 - MidSemsharnette.daley22No ratings yet

- Global Management and Politics Financial Reporting and Performance Measurement Prof. Jonathan BerkovitchDocument4 pagesGlobal Management and Politics Financial Reporting and Performance Measurement Prof. Jonathan BerkovitchFanny BozziNo ratings yet

- Tsinghua UG English-Taught Courses Syllabi (Fall 2010)Document80 pagesTsinghua UG English-Taught Courses Syllabi (Fall 2010)An WoNo ratings yet

- Ccconline Course Syllabus: Ourse NformationDocument9 pagesCcconline Course Syllabus: Ourse NformationHafiz Abdul BasitNo ratings yet

- Acca FR Financial ReportingDocument40 pagesAcca FR Financial ReportingK58 Nguyễn Hương GiangNo ratings yet

- SOW Form 5 POA Term 2 2020 2021Document9 pagesSOW Form 5 POA Term 2 2020 2021Peta-Gay Brown-JohnsonNo ratings yet

- Acct1111c 2019T1Document4 pagesAcct1111c 2019T1Fuk FukNo ratings yet

- Acc201 Pa Ueh-Isb s1 2021 Unit GuideDocument11 pagesAcc201 Pa Ueh-Isb s1 2021 Unit Guideduy blaNo ratings yet

- Bangalore University Jnanabharathi, Bengaluru-560056 (According To NEP - 2020 Regulations) Syllabus of 2nd SemesterDocument13 pagesBangalore University Jnanabharathi, Bengaluru-560056 (According To NEP - 2020 Regulations) Syllabus of 2nd SemesterParimalaNo ratings yet

- Advanced Financial Accounting II, Spring 2021Document7 pagesAdvanced Financial Accounting II, Spring 2021Shehab HassanNo ratings yet

- Associate Degree of Accounting: Examination Question BookletDocument11 pagesAssociate Degree of Accounting: Examination Question BookletfernandarvNo ratings yet

- Syllabus Aku 3302 - Auditing 2Document6 pagesSyllabus Aku 3302 - Auditing 2Depi YikwaNo ratings yet

- Answer Mock PPR 2 Econs PDFDocument14 pagesAnswer Mock PPR 2 Econs PDFHamiz AizuddinNo ratings yet

- BFW 2401 Assignment QuestionDocument3 pagesBFW 2401 Assignment QuestionhongeuNo ratings yet

- Cambridge Assessment International Education: Business 9609/33 October/November 2017Document13 pagesCambridge Assessment International Education: Business 9609/33 October/November 2017Saad RebelNo ratings yet

- 1.1 What Is Financial Accounting and How Does It Fit Within The Professional Stage?Document20 pages1.1 What Is Financial Accounting and How Does It Fit Within The Professional Stage?nitu mdNo ratings yet

- IFRS - ManualDocument4 pagesIFRS - ManualLawin HassanNo ratings yet

- Jaipuria Institute of Management PGDM Trimester Ii Academic Year 2019-20Document9 pagesJaipuria Institute of Management PGDM Trimester Ii Academic Year 2019-20Sanjana SinghNo ratings yet

- 2021 MSHS Exam - SolutionsDocument25 pages2021 MSHS Exam - Solutionscharlie.young2No ratings yet

- Aqa 2121 Accn3 W MS Jan 12Document14 pagesAqa 2121 Accn3 W MS Jan 12zahid_mahmood3811No ratings yet

- Solved Manaual of Fundamentals of FinanceDocument14 pagesSolved Manaual of Fundamentals of Financemansoor mahmoodNo ratings yet

- Assignment HBET4703 English For Specific Purposes September 2022 Semester - Specific InstructionsDocument12 pagesAssignment HBET4703 English For Specific Purposes September 2022 Semester - Specific InstructionsAhmad ikhwan MataliNo ratings yet

- WRlEb Assignment BriefDocument9 pagesWRlEb Assignment BriefLoice WanjalaNo ratings yet

- Assignment 2 ACCT101 - StudentsDocument3 pagesAssignment 2 ACCT101 - StudentsHaitham Erejah0% (1)

- ACC1701X Course OutlineDocument9 pagesACC1701X Course Outlinekhoo zitingNo ratings yet

- Unit Guide - Corporate FinanceDocument10 pagesUnit Guide - Corporate FinanceAn Pham ThuyNo ratings yet

- 1110-04 LectureDocument49 pages1110-04 LectureKasendereNo ratings yet

- 2022 Syllabus Guide - RBA10x2Document5 pages2022 Syllabus Guide - RBA10x2ChulumancoNo ratings yet

- IG Economics Paper 2 Exemplar ResponsesDocument38 pagesIG Economics Paper 2 Exemplar ResponsesAnjana FernandoNo ratings yet

- Grade 12 Caps Amendments: National Curriculum Statements (NCS)Document185 pagesGrade 12 Caps Amendments: National Curriculum Statements (NCS)Timon JohnNo ratings yet

- Course Information Summer Semester 2019/2020Document4 pagesCourse Information Summer Semester 2019/2020mmNo ratings yet

- Syllabus - FSA - Fall 2020 - Section 004Document7 pagesSyllabus - FSA - Fall 2020 - Section 004RanjeetaTiwariNo ratings yet

- Accounting 300A: Intermediate AccountingDocument5 pagesAccounting 300A: Intermediate AccountingpeachyNo ratings yet

- Financial Accounting PDFDocument684 pagesFinancial Accounting PDFImtiaz Rashid91% (11)

- Intermediate Financial Accounting I (ACCT2012)Document19 pagesIntermediate Financial Accounting I (ACCT2012)AlfieNo ratings yet

- Syllabus Aku 3302 - Auditing 2Document6 pagesSyllabus Aku 3302 - Auditing 2alfianaNo ratings yet

- ACCT5170 Syllabus - 2023Document7 pagesACCT5170 Syllabus - 2023bafsvideo4No ratings yet

- Mat102 - Statistics For Business - S2-2019Document14 pagesMat102 - Statistics For Business - S2-2019The FacesNo ratings yet

- 21-4-TM1 Pts-Institutional AssessmentDocument18 pages21-4-TM1 Pts-Institutional Assessmentbob guintoNo ratings yet

- ACCT 2015 Mona WJC 2022 Course OutlineDocument10 pagesACCT 2015 Mona WJC 2022 Course OutlineChristina StephensonNo ratings yet

- Talal - ICF - ASSIGNMENT - SUMMER 2021Document8 pagesTalal - ICF - ASSIGNMENT - SUMMER 2021Tuba AkbarNo ratings yet

- RPS Akuntansi Menengah IIDocument18 pagesRPS Akuntansi Menengah IIAnyaaNo ratings yet

- The Course Plan Of:: The Instructor: Dr. Rabie EidDocument3 pagesThe Course Plan Of:: The Instructor: Dr. Rabie EidAA BB MMNo ratings yet

- Learner Work File 230071 V1Document13 pagesLearner Work File 230071 V1palmalynchwatersNo ratings yet

- HTTPSWWW Education Gov zaPortals0DocumentsPublicationsANNEXURE20A-Gr201120ACCOUNTING2020EXAMINATION20GUIDELINES PDDocument12 pagesHTTPSWWW Education Gov zaPortals0DocumentsPublicationsANNEXURE20A-Gr201120ACCOUNTING2020EXAMINATION20GUIDELINES PDbmtnrcmzqyNo ratings yet

- Acc 35 Managerial Accounting Course Syllabus: Finance & Accounting Department, J. Gokongwei School of ManagementDocument4 pagesAcc 35 Managerial Accounting Course Syllabus: Finance & Accounting Department, J. Gokongwei School of ManagementyaneeNo ratings yet

- Luai Abu Rajab: Course SyllabusDocument3 pagesLuai Abu Rajab: Course SyllabusJudeNo ratings yet

- ECON314 Nwu-Jun2022Document17 pagesECON314 Nwu-Jun2022Mmabatho MosesiNo ratings yet

- Subject Guide: Code: ACETH201A Title: Professional Ethics Accounting Course: Associate Degree of AccountingDocument32 pagesSubject Guide: Code: ACETH201A Title: Professional Ethics Accounting Course: Associate Degree of AccountingfernandarvNo ratings yet

- Subject Guide: Code: ACINT201A Title: Accounting Internship Course: Associate Degree of AccountingDocument44 pagesSubject Guide: Code: ACINT201A Title: Accounting Internship Course: Associate Degree of AccountingfernandarvNo ratings yet

- ACC240 - All Topics PDFDocument75 pagesACC240 - All Topics PDFfernandarvNo ratings yet

- ACCG340: Auditing and Assurance ServicesDocument10 pagesACCG340: Auditing and Assurance ServicesfernandarvNo ratings yet

- Associate Degree of Accounting: Examination Question BookletDocument11 pagesAssociate Degree of Accounting: Examination Question BookletfernandarvNo ratings yet

- AIS Lecture 9 Notes S1 2016 (V1) - CH 13 On GL Fin Report Cycle-StudentDocument20 pagesAIS Lecture 9 Notes S1 2016 (V1) - CH 13 On GL Fin Report Cycle-StudentfernandarvNo ratings yet

- Boundless CompassionDocument20 pagesBoundless CompassionfernandarvNo ratings yet

- ACACC102A Accounting Foundations II Assessment Event 2 - Mid-Semester Exam - QUESTIONSDocument3 pagesACACC102A Accounting Foundations II Assessment Event 2 - Mid-Semester Exam - QUESTIONSfernandarvNo ratings yet

- ACACC102A Assessment2 - S2 - 2014 - ExamAnswerBook PDFDocument5 pagesACACC102A Assessment2 - S2 - 2014 - ExamAnswerBook PDFfernandarvNo ratings yet

- ACACC102A Assessment2 S1 2014 ExamAnswerBook PDFDocument10 pagesACACC102A Assessment2 S1 2014 ExamAnswerBook PDFfernandarvNo ratings yet

- Exam Timetable Ourimbah 2016 Sem 1Document2 pagesExam Timetable Ourimbah 2016 Sem 1fernandarv100% (1)

- ACACC102A Assessment2 - S2 - 2014 - ExamAnswerBook PDFDocument5 pagesACACC102A Assessment2 - S2 - 2014 - ExamAnswerBook PDFfernandarvNo ratings yet

- BUSL 301 - Corporations Law: Comparison of Business OrganisationsDocument19 pagesBUSL 301 - Corporations Law: Comparison of Business OrganisationsfernandarvNo ratings yet

- Week 10 - ch20 - Solutions To Tutorial QuestionsDocument2 pagesWeek 10 - ch20 - Solutions To Tutorial QuestionsfernandarvNo ratings yet

- Westpac DraftDocument8 pagesWestpac DraftfernandarvNo ratings yet

- Gloria Steinem - If Men Could Menstruate PDFDocument2 pagesGloria Steinem - If Men Could Menstruate PDFfernandarvNo ratings yet

- Greetings and PartingsDocument4 pagesGreetings and Partingspriyo cirebonNo ratings yet

- 18c Effective Telephone CommunicationDocument78 pages18c Effective Telephone CommunicationJan Cleo Cerdiña QuijanoNo ratings yet

- Bangladesh PoliceDocument17 pagesBangladesh PoliceCpsMinhazulIslamNo ratings yet

- 6-GFM Series: Main Applications DimensionsDocument2 pages6-GFM Series: Main Applications Dimensionsleslie azabacheNo ratings yet

- FAC1502 Bank Reconcilliation NotesDocument22 pagesFAC1502 Bank Reconcilliation NotesMichelle Foord0% (1)

- Fuzzy Based Techniques For Handling Missing ValuesDocument6 pagesFuzzy Based Techniques For Handling Missing ValuesFarid Ali MousaNo ratings yet

- Information For Producers of Emergency Fittings Acc. To Iec 60598 2 22Document10 pagesInformation For Producers of Emergency Fittings Acc. To Iec 60598 2 22mohammed imran pashaNo ratings yet

- Evolution of Human Resource ManagementDocument13 pagesEvolution of Human Resource Managementmsk_1407No ratings yet

- WS Soln 2 6A RationalFunctionsDocument6 pagesWS Soln 2 6A RationalFunctionsSiddhant ShahNo ratings yet

- Automotive Workshop Practice 1 Report - AlignmentDocument8 pagesAutomotive Workshop Practice 1 Report - AlignmentIhsan Yusoff Ihsan0% (1)

- Satyam GargDocument2 pagesSatyam GargSatyam GargNo ratings yet

- Competency Training Capability IECEx 20160609Document4 pagesCompetency Training Capability IECEx 20160609AhmadNo ratings yet

- 4 5827923419810760428Document250 pages4 5827923419810760428T M Santhosh KumarNo ratings yet

- ReDocument3 pagesReSyahid FarhanNo ratings yet

- Skott Marsi Art Basel Sponsorship DeckDocument11 pagesSkott Marsi Art Basel Sponsorship DeckANTHONY JACQUETTENo ratings yet

- 01 04 2018Document55 pages01 04 2018sagarNo ratings yet

- Certified Tester AI Testing Overview of Syllabus: International Software Testing Qualifications BoardDocument18 pagesCertified Tester AI Testing Overview of Syllabus: International Software Testing Qualifications BoardEzio Auditore da FirenzeNo ratings yet

- 2 - Civil Liberties Union Vs Executive SecretaryDocument3 pages2 - Civil Liberties Union Vs Executive SecretaryTew BaquialNo ratings yet

- Masonry: Department of EducationDocument6 pagesMasonry: Department of EducationFatima AdilNo ratings yet

- Multiple Linear Regression: Diagnostics: Statistics 203: Introduction To Regression and Analysis of VarianceDocument16 pagesMultiple Linear Regression: Diagnostics: Statistics 203: Introduction To Regression and Analysis of VariancecesardakoNo ratings yet

- Wheel Loader Manual Agrison PDFDocument138 pagesWheel Loader Manual Agrison PDFTravisReign Dicang02No ratings yet

- GTA Liberty City Stories CheatsDocument6 pagesGTA Liberty City Stories CheatsHubbak KhanNo ratings yet

- Newcastle University Dissertation Cover PageDocument5 pagesNewcastle University Dissertation Cover PageThesisPaperHelpUK100% (1)

- Safety Data Sheet: Armohib Ci-28Document21 pagesSafety Data Sheet: Armohib Ci-28SJHEIK AbdullahNo ratings yet

- Laser Pointing StabilityDocument5 pagesLaser Pointing Stabilitymehdi810No ratings yet

- CW 3 - Non-Profit Making Organisation Sekolah Harapan Bangsa ACADEMIC YEAR 2020/2021Document3 pagesCW 3 - Non-Profit Making Organisation Sekolah Harapan Bangsa ACADEMIC YEAR 2020/2021Adrian WensenNo ratings yet

- VDO Gauge - VL Hourmeter 12 - 24Document2 pagesVDO Gauge - VL Hourmeter 12 - 24HanNo ratings yet

- The Object-Z Specification Language: Software Verification Research Centre University of QueenslandDocument155 pagesThe Object-Z Specification Language: Software Verification Research Centre University of QueenslandJulian Garcia TalanconNo ratings yet

- Local Training Companies DBDocument8 pagesLocal Training Companies DBMohammad MuhannaNo ratings yet

- Intelligent Traffic Signal Control System Using Embedded SystemDocument11 pagesIntelligent Traffic Signal Control System Using Embedded SystemAlexander DeckerNo ratings yet