Professional Documents

Culture Documents

Periodic Versus Perpetual Inventory System

Periodic Versus Perpetual Inventory System

Uploaded by

Ahmad SafiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Periodic Versus Perpetual Inventory System

Periodic Versus Perpetual Inventory System

Uploaded by

Ahmad SafiCopyright:

Available Formats

Periodic Versus Perpetual Inventory System

Not only measurement basis and cost flow assumptions have an effect on

inventory valuation but also the way entity is managing the records will greatly

affect inventory’s value at the year end.

Typically entity uses either of the following two systems to record changes in

inventory:

1. Periodic inventory system

2. Perpetual inventory system

1 Periodic Inventory System

Under periodic system inventory records are maintained/updated in intervals

like at the end of every week or month, accountant will sit down and determine

the inventory at hand.

Under periodic inventory system, entity maintains temporary accounts like

purchases, purchases returns, sales and sales return. At the end of the period

the amounts in these temporary accounts are added to determine the amount

of inventory available for sale. Inventory still at hand is usually found by

physically counting the units. The number of units at hand are deducted from

inventory available for sale to compute cost of goods sold and hence the

formula:

CGS = Opening inventory + [Purchases – Purchases returns] – Closing

inventory

But it must be understood that purchases account and Inventory account

are two different things. If entity chooses to regularly update purchases

account it does not necessarily tell how much inventory entity holds at a

particular time. Under periodic system it is the inventory account which is

updated at intervals. Accounting of periodic inventory system will be discussed

later.

To emphasize again, physical inventory count (also called stock taking) at the

period end is mandatory under periodic system. Without such count, cost of

sales (or cost of goods sold) cannot be determined therefore, entities have to

conduct this activity at least once a year or at every period end.

2 Perpetual Inventory System

Under perpetual system, inventory record is updated on run-time basis i.e.

regularly after every transaction. As every purchase, return or sale transaction

is being recorded directly in inventory account, management will know the

amount of inventory at hand and cost of goods sold at any given point in time

as opposed to periodic inventory system where they have to wait until the end

of the period.

Under perpetual inventory system, transactions are recorded directly in

inventory account and no separate or temporary accounts like purchases

and purchases returns are maintained. Every purchase, purchase return,

sale or sales return is recorded in inventory account as and when transaction

takes place.

Difference between Perpetual and Periodic Inventory System

Perpetual Periodic

Inventory Inventory

System System

Recording Inventory Inventory

records are records are

updated updated

regularly periodically

Ending Ending

inventory is inventory is

Determinatio

determined on determined on

n of ending

the basis of the basis of

inventory

inventory physical stock

records count

Done to

Done to

confirm if units

Stock count determine cost

held are as per

of goods sold

records

High level of No control as

control as management

Control on management is unaware of

inventory knows the quantity until

quantity at the end of the

any given time period

Temporary

No temporary accounts like

accounts are purchases,

maintained. returns and

Temporary

Recording is sales are

accounts

done directly maintained

in inventory that are closed

account at the period

end.

Expensive to

Cheaper to

maintain.

maintain as it

Need

Cost requires less

dedicated

work and

trained

workforce

personnel

You might also like

- 101 Statutory Audit Interview Questions & Answers: Ca Monk'SDocument39 pages101 Statutory Audit Interview Questions & Answers: Ca Monk'SNIMESH BHATTNo ratings yet

- Accounting Grade 11 Term 3 Week 4 - 2020Document6 pagesAccounting Grade 11 Term 3 Week 4 - 2020adriana espinoza de los monteros100% (1)

- Bookkeeping Handouts (Basic Comp)Document8 pagesBookkeeping Handouts (Basic Comp)raquelNo ratings yet

- Financial Statement Analysis: Charles H. GibsonDocument22 pagesFinancial Statement Analysis: Charles H. GibsonGud BooyNo ratings yet

- Tugas Akmen Fadhliya Fauziah CH 8Document18 pagesTugas Akmen Fadhliya Fauziah CH 8FadhliyaFNo ratings yet

- Audit of Inventories (Done)Document19 pagesAudit of Inventories (Done)Hasmin Saripada AmpatuaNo ratings yet

- T.A.L.E.: Accounting Principles 1Document44 pagesT.A.L.E.: Accounting Principles 1Kevin ChandraNo ratings yet

- Unit 1Document39 pagesUnit 1Kalkidan Nigussie0% (1)

- Unit 1: Inventories: Cost and Cost Flow AssumptionsDocument38 pagesUnit 1: Inventories: Cost and Cost Flow Assumptionsyebegashet100% (1)

- Fabm Module03 File01Document8 pagesFabm Module03 File01PREFIX THAT IS LONG - Lester LoutteNo ratings yet

- FABM1 - LAS - 9 - Nature of Transaction of A Mdsg. BusDocument8 pagesFABM1 - LAS - 9 - Nature of Transaction of A Mdsg. BusVenus Ariate100% (1)

- Accounting Principles 1: Accounting For Merchandising Operations InventoriesDocument41 pagesAccounting Principles 1: Accounting For Merchandising Operations InventoriesKevin Chandra100% (1)

- Chapter 5 Inventories and CGSDocument68 pagesChapter 5 Inventories and CGSZemene HailuNo ratings yet

- FINACCDocument3 pagesFINACCFaith Nina JauodNo ratings yet

- Finacre 2Document3 pagesFinacre 2Dwight Gabriel C. GarciaNo ratings yet

- Solve The Activity - Docx12Document3 pagesSolve The Activity - Docx12omar.chatti34No ratings yet

- Inventroy ValnDocument18 pagesInventroy ValnDrpranav SaraswatNo ratings yet

- CH08Document26 pagesCH08Will TrầnNo ratings yet

- CH 08Document54 pagesCH 08Jessie jorgeNo ratings yet

- Periodic Inventory SystemDocument1 pagePeriodic Inventory SystemJotaro KujoNo ratings yet

- Module 5 - Audit of InventoriesDocument23 pagesModule 5 - Audit of InventoriesIvan LandaosNo ratings yet

- Inventory ControlDocument11 pagesInventory Controlshamlee ramtekeNo ratings yet

- Finmar Invty Cash Receivables Management PDFDocument18 pagesFinmar Invty Cash Receivables Management PDFJoshua CabinasNo ratings yet

- Inventory Management PDFDocument6 pagesInventory Management PDFa0mittal7No ratings yet

- Submitted By: Submitted To: TopicDocument6 pagesSubmitted By: Submitted To: TopicNavsNo ratings yet

- Inventory Valuation SystemDocument54 pagesInventory Valuation Systemone formanyNo ratings yet

- Unit 1: Inventories ValuationDocument38 pagesUnit 1: Inventories ValuationNesru SirajNo ratings yet

- InventoriesDocument8 pagesInventoriesangel ciiiNo ratings yet

- CH 8 - AnswerDocument58 pagesCH 8 - Answer金沛霓No ratings yet

- Periodic VS Perpetual Inventory SystemDocument3 pagesPeriodic VS Perpetual Inventory SystemBea chuaNo ratings yet

- Maria QamarDocument7 pagesMaria QamarMaria QamarNo ratings yet

- Invent A RioDocument1 pageInvent A Riofelipe sotoNo ratings yet

- Materials Inventory ControlDocument14 pagesMaterials Inventory ControlAsal Islam100% (1)

- Inventory Cost: Perpetual Vs Periodic Inventory SystemDocument5 pagesInventory Cost: Perpetual Vs Periodic Inventory SystemsagortemenosNo ratings yet

- Q4, Fabm1Document9 pagesQ4, Fabm1consuelomariasofiatNo ratings yet

- Om 4Document36 pagesOm 4Charles MedallaNo ratings yet

- Chapter 6 - Reporting and Analyzing InventoryDocument13 pagesChapter 6 - Reporting and Analyzing InventoryCông Hoàng ĐìnhNo ratings yet

- Chapter 3. Inventory ControlDocument7 pagesChapter 3. Inventory ControlSahil DixitNo ratings yet

- SCM - Module 5Document10 pagesSCM - Module 5May AlmendraNo ratings yet

- Inventory ManagementDocument8 pagesInventory ManagementMike Padilla IINo ratings yet

- 11 Material ManagementDocument2 pages11 Material ManagementIlah Marie DignosNo ratings yet

- Inventory ManagementDocument4 pagesInventory ManagementAnna DerNo ratings yet

- MidtermDocument7 pagesMidtermOscar awardsNo ratings yet

- Inventory Valuation 20.4.21Document22 pagesInventory Valuation 20.4.21Rushabh BeloskarNo ratings yet

- Merchandising BusimessDocument1 pageMerchandising Busimessruth san joseNo ratings yet

- Presentation 4 - Cost & Management Accounting - March 10, 209 - 3pm To 6pmDocument45 pagesPresentation 4 - Cost & Management Accounting - March 10, 209 - 3pm To 6pmBhunesh KumarNo ratings yet

- Accounting Merchandising and TitlesDocument2 pagesAccounting Merchandising and TitlesCAMILLE LOPEZNo ratings yet

- A. Theory of ConstraintsDocument3 pagesA. Theory of ConstraintsSyed Shahid SheraziNo ratings yet

- InventoryDocument20 pagesInventoryE.D.J33% (3)

- Accounting For Merchandising Business: Learning OutcomesDocument22 pagesAccounting For Merchandising Business: Learning Outcomeslemon100% (1)

- Weeklysummary7group ADocument8 pagesWeeklysummary7group AOlivio CampanerNo ratings yet

- Unit 15Document17 pagesUnit 15Pavan Kumar MRNo ratings yet

- Cost Accounting MicroDocument12 pagesCost Accounting MicroSwadil GhoshinoNo ratings yet

- 4.1 Audit of Inventories and Cost of SalesDocument2 pages4.1 Audit of Inventories and Cost of SalesNavsNo ratings yet

- Merchandise Inventory PDFDocument14 pagesMerchandise Inventory PDFLutfi MualifNo ratings yet

- Accounting For Merchandising Business: Learning OutcomesDocument15 pagesAccounting For Merchandising Business: Learning OutcomesJuan Dela Cruz100% (1)

- 64f5815692c86b6cb7d7fe2c-1693811417-Inventory Powerpoint 2Document8 pages64f5815692c86b6cb7d7fe2c-1693811417-Inventory Powerpoint 2kenneth LiwagonNo ratings yet

- Stocktaking and Inventory Measurement As A Means To Improve Profitability - Susan RandallDocument11 pagesStocktaking and Inventory Measurement As A Means To Improve Profitability - Susan RandallDani BatallasNo ratings yet

- Inventory Periodic PerpitualDocument15 pagesInventory Periodic PerpitualnigusNo ratings yet

- Periodic Inventory PDFDocument33 pagesPeriodic Inventory PDF48pgcw62kkNo ratings yet

- AEC 4204-Agribusiness Management: Lecture 8: Agricultural Enterprise Selection and ManagementDocument26 pagesAEC 4204-Agribusiness Management: Lecture 8: Agricultural Enterprise Selection and ManagementRogers Soyekwo KingNo ratings yet

- Compare and Contrast Perpetual Versus Periodic Inventory SystemsDocument7 pagesCompare and Contrast Perpetual Versus Periodic Inventory SystemsjimNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- Report 2Document47 pagesReport 2Ahmad SafiNo ratings yet

- SM Paper For BDocument3 pagesSM Paper For BAhmad SafiNo ratings yet

- POM HandoutsDocument739 pagesPOM HandoutsAhmad SafiNo ratings yet

- Company Law - by Luqman BaigDocument16 pagesCompany Law - by Luqman BaigAhmad SafiNo ratings yet

- Organizational Behavior Project: 2: Purpose of The ProjectDocument10 pagesOrganizational Behavior Project: 2: Purpose of The ProjectAhmad SafiNo ratings yet

- Playing The Long Game: 1: TeslaDocument3 pagesPlaying The Long Game: 1: TeslaAhmad SafiNo ratings yet

- Swot Analysis of PTCLDocument5 pagesSwot Analysis of PTCLAhmad SafiNo ratings yet

- Product Proposal Ahmad AliDocument3 pagesProduct Proposal Ahmad AliAhmad SafiNo ratings yet

- Who Moved My Cheese Summary by Ahmad Ali Bba 7th Reg 04151713016Document2 pagesWho Moved My Cheese Summary by Ahmad Ali Bba 7th Reg 04151713016Ahmad SafiNo ratings yet

- Product Proposal: Submitted byDocument4 pagesProduct Proposal: Submitted byAhmad SafiNo ratings yet

- Apple and Samsung Patent WarsDocument2 pagesApple and Samsung Patent WarsAhmad SafiNo ratings yet

- Research Project of Fundamental of FinanceDocument9 pagesResearch Project of Fundamental of FinanceAhmad SafiNo ratings yet

- AFS Assignment by DawoodDocument20 pagesAFS Assignment by DawoodAhmad SafiNo ratings yet

- Asma KareemiDocument40 pagesAsma KareemiAhmad SafiNo ratings yet

- Ahmad Ali-Space Matrix AnalysisDocument9 pagesAhmad Ali-Space Matrix AnalysisAhmad SafiNo ratings yet

- National Foods by Saqib LiaqatDocument14 pagesNational Foods by Saqib LiaqatAhmad SafiNo ratings yet

- AFS Assignment by Rimsha KhalidDocument14 pagesAFS Assignment by Rimsha KhalidAhmad SafiNo ratings yet

- Bit Coin Pros and Cons: Bitcoin Price Is Quite VolatileDocument3 pagesBit Coin Pros and Cons: Bitcoin Price Is Quite VolatileAhmad SafiNo ratings yet

- Aspect of Organizational CultureDocument2 pagesAspect of Organizational CultureAhmad SafiNo ratings yet

- SCM Mid PaperDocument1 pageSCM Mid PaperAhmad SafiNo ratings yet

- Principles of Accounting IIDocument175 pagesPrinciples of Accounting IIsamuel debebe95% (22)

- Cost Acctg. II Joint Product QUIZ Answer Key PDFDocument3 pagesCost Acctg. II Joint Product QUIZ Answer Key PDFCheliah Mae ImperialNo ratings yet

- Trading AccountDocument3 pagesTrading AccountRirin GhariniNo ratings yet

- Management AccountingDocument108 pagesManagement AccountingBATUL ABBAS DEVASWALANo ratings yet

- AC1025 Commentary 2019 PDFDocument55 pagesAC1025 Commentary 2019 PDFNghia Tuan Nghia100% (1)

- Essay Survey Test About COVID 19Document10 pagesEssay Survey Test About COVID 19Miharu KimNo ratings yet

- Chapter 3 Accounting For Merchandising OperationsDocument10 pagesChapter 3 Accounting For Merchandising OperationsSKY StationeryNo ratings yet

- HBL Final ReportDocument31 pagesHBL Final ReportAamir KhanNo ratings yet

- This Study Resource Was: Tugas Personal 2 Week 7/ Sesi 11Document5 pagesThis Study Resource Was: Tugas Personal 2 Week 7/ Sesi 11Jimmi Tamba100% (1)

- Inventory 1Document8 pagesInventory 1Ren AikawaNo ratings yet

- FOFA RatiosDocument11 pagesFOFA RatiosShilpa RajuNo ratings yet

- Chap 004Document9 pagesChap 004dbjnNo ratings yet

- Mas 9403 Standard Costs and Variance AnalysisDocument21 pagesMas 9403 Standard Costs and Variance AnalysisBanna SplitNo ratings yet

- Introduction To Management AccountingDocument33 pagesIntroduction To Management Accountinghemanth20032001No ratings yet

- Sec C - Cost Behavior and Cost ObjectsDocument11 pagesSec C - Cost Behavior and Cost ObjectsDao Mai PhuongNo ratings yet

- Financial StatementsDocument2 pagesFinancial StatementsMaria Teresa VillamayorNo ratings yet

- Capslet: Capsulized Self - Learning Empowerment ToolkitDocument15 pagesCapslet: Capsulized Self - Learning Empowerment Toolkitun knownNo ratings yet

- CosoldatedDocument11 pagesCosoldatedShafiqNo ratings yet

- Test SamplesDocument18 pagesTest SamplesDen NgNo ratings yet

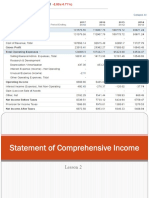

- Lesson 2 Statement of Comprehensive IncomeDocument23 pagesLesson 2 Statement of Comprehensive IncomePaulette Sarno80% (5)

- Guide To Retail Math Key FormulasDocument1 pageGuide To Retail Math Key FormulasJitender BhardwajNo ratings yet

- Module 5.2 - Sample ExercisesDocument8 pagesModule 5.2 - Sample ExercisesJaimell LimNo ratings yet

- Chapter # 5 Financial RatiosDocument30 pagesChapter # 5 Financial RatiosRooh Ullah KhanNo ratings yet

- InventoriesDocument64 pagesInventoriesJoey WassigNo ratings yet

- Chapter 003: Product Costing and Cost Accumulation in A Batch Production EnvironmentDocument54 pagesChapter 003: Product Costing and Cost Accumulation in A Batch Production EnvironmentNia BranzuelaNo ratings yet

- Thor Power Tool Co. v. Commissioner, 439 U.S. 522 (1979)Document25 pagesThor Power Tool Co. v. Commissioner, 439 U.S. 522 (1979)Scribd Government DocsNo ratings yet