Professional Documents

Culture Documents

Don Shurley: This Analysis and Commentary Is Not Affiliated With The University of Georgia

Uploaded by

Morgan IngramOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Don Shurley: This Analysis and Commentary Is Not Affiliated With The University of Georgia

Uploaded by

Morgan IngramCopyright:

Available Formats

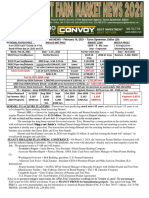

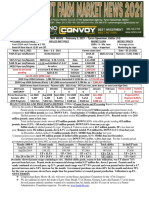

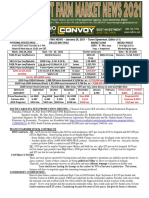

Friday—October 16, 2020

Cotton is pushing toward 70 cents, presenting pricing and risk management opportunities for growers

that I’m sure most of us never thought we would see for this crop. It’s decision time. If not priced

already, this move certainly seems a good opportunity to get going or add to previous sales.

December futures closed just short of 70 cents today (69.92)—gaining 2.28 cents for the week and,

so far, over 4 cents this month. Prices are now the highest in 8 months. Prices have increased this

week due to expected losses from Hurricane Delta, a “spillover effect” from strengthening corn and

soybean prices, and “technical considerations”. There have also been reports of possible damage to

the India crop—a major US export competitor.

Hurricane Delta made landfall on October 9th. The impacts of Delta are not yet known. This week’s

USDA crop conditions report as of October 11 showed 30% of the US crop in poor to very poor condition

compared to 27% for the prior week. It is likely that the October 11 numbers did not yet fully reflect

the impact of Delta so we will see what the numbers look like as of October 18.

This week’s export report is not a good one.

Sales for the week ending October 8th were

120,200 bales—down 42% from the prior week.

Sales to China were only 26,700 bales—the

lowest week thus far in the marketing year.

Shipments were 211,500 bales—up 30% from

the prior week and good to see after 2 previous

weeks of decline. Shipments to China were

145,800 bales or 69% of the total.

The largest shipment destinations were China,

Vietnam, and Mexico. When the sales and

shipments numbers to China appear weak, we’ll

look at other important destinations like

Vietnam, Turkey, Bangladesh, Mexico, and

Indonesia. Use in those countries could work to

offset any weakness in the China numbers. A

news media report I saw this week mentioned increased yarn business in Vietnam where that yarn

could eventually be shipped to destinations in China.

The market (Dec futures) has strengthened this week. The damage from Delta in unknown and it is

yet to be determined if a move to 70 cents is justified. What we do know is that USDA’s October

estimate was a surprise and higher than most thought it should be and now we’ve had Delta. A further

reduced US crop is likely.

December advancing further and pushing 70 cents today, in the face of a weak export report, is

evidence that something positive is going on. There are concerns of harvest delays and in next week’s

crop conditions report on Monday, we’ll see if conditions fall due to further evidence of the impacts

from Delta. This move to near 70 may be at risk of a correction down but price has support at 67.

Don Shurley

Marketing and Policy Analyst

Cotton Economist- Retired / Professor Emeritus of Cotton Economics

University of Georgia- Tifton Campus

*****This analysis and commentary is not affiliated with the University of Georgia*****

You might also like

- Don Shurley: This Analysis and Commentary Is Not Affiliated With The University of GeorgiaDocument1 pageDon Shurley: This Analysis and Commentary Is Not Affiliated With The University of GeorgiaMorgan IngramNo ratings yet

- Cotton Marketing NewsDocument2 pagesCotton Marketing NewsBrittany EtheridgeNo ratings yet

- 2 CMN12142020Document1 page2 CMN12142020Morgan IngramNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsMorgan IngramNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsMorgan IngramNo ratings yet

- Cotton Weekly 10 Oct 22Document4 pagesCotton Weekly 10 Oct 22Vamsi Krishna KonaNo ratings yet

- Cotton Weekly 8 Nov 22Document3 pagesCotton Weekly 8 Nov 22Vamsi Krishna KonaNo ratings yet

- Cotton Marketing NewsDocument2 pagesCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsMorgan IngramNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsMorgan IngramNo ratings yet

- Market Perspectives: July 16, 2020Document16 pagesMarket Perspectives: July 16, 2020Katya Vasquez QuezadaNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Weekly 1 Nov 22Document3 pagesCotton Weekly 1 Nov 22Vamsi Krishna KonaNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsMorgan IngramNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsMorgan IngramNo ratings yet

- Effects of Recession in US, On Indian Economy: "When Uncle Sam Sneezes, The World Catches A Cold"Document6 pagesEffects of Recession in US, On Indian Economy: "When Uncle Sam Sneezes, The World Catches A Cold"qwerwqadfNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Weekly 13 Sep 22Document5 pagesCotton Weekly 13 Sep 22Vamsi Krishna KonaNo ratings yet

- Corn Bear ArgumentDocument11 pagesCorn Bear ArgumentPellucidigmNo ratings yet

- PEANUT MARKETING NEWS - October 5, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - October 5, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- August 2021 Peanut Market ReportDocument5 pagesAugust 2021 Peanut Market ReportAhmedFatehyAbdelsalam100% (1)

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Where's Our Food Supply Chains and Food Insecurity DC Press Briefing May 2020Document7 pagesWhere's Our Food Supply Chains and Food Insecurity DC Press Briefing May 2020National Press FoundationNo ratings yet

- Focus On Ag (12-12-22)Document3 pagesFocus On Ag (12-12-22)FluenceMediaNo ratings yet

- Santelli: $4 Gas, $150 Oil Coming This Summer..Document9 pagesSantelli: $4 Gas, $150 Oil Coming This Summer..Albert L. PeiaNo ratings yet

- Jeremy Zwinger President: 757 Main Street Colusa, CA 95932 (530) 933-7277Document54 pagesJeremy Zwinger President: 757 Main Street Colusa, CA 95932 (530) 933-7277Panda Panda TranNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsMorgan IngramNo ratings yet

- Focus On Ag (8-30-21)Document2 pagesFocus On Ag (8-30-21)FluenceMediaNo ratings yet

- Connecting The Dots - The USA and Global RecessionsDocument2 pagesConnecting The Dots - The USA and Global RecessionsChinmay PanhaleNo ratings yet

- Weekly WatchlistDocument5 pagesWeekly WatchlistFabian Rojas ToroNo ratings yet

- Weekly Commodity Review - 7 - 11 May 2012Document1 pageWeekly Commodity Review - 7 - 11 May 2012gordjuNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- The Sauer ReportDocument29 pagesThe Sauer ReportSampada DeoNo ratings yet

- May 2021 Money LetterDocument26 pagesMay 2021 Money LetterSoren K. GroupNo ratings yet

- Focus On Ag: Written by Kent Thiesse Farm Management Analyst and Senior Vice President, Minnstar BankDocument2 pagesFocus On Ag: Written by Kent Thiesse Farm Management Analyst and Senior Vice President, Minnstar BankFluenceMediaNo ratings yet

- DTN Cotton Closing: Cotton Ends Flat To Higher: Cotton Modules Lined Up in A Gin Yard. ©debra L FergusonDocument2 pagesDTN Cotton Closing: Cotton Ends Flat To Higher: Cotton Modules Lined Up in A Gin Yard. ©debra L Fergusonanon_960619631No ratings yet

- QSL Market Update 08.09.14Document1 pageQSL Market Update 08.09.14Carla KeithNo ratings yet

- 1st JuneDocument8 pages1st JuneJohn HowellNo ratings yet

- Fed Chief Bernanke Wins 2nd Term in Closest Vote (AP) : Kurt Nimmo - The Senate Will Reappoint BernankeDocument11 pagesFed Chief Bernanke Wins 2nd Term in Closest Vote (AP) : Kurt Nimmo - The Senate Will Reappoint BernankeAlbert L. PeiaNo ratings yet

- Good News Is Bad News Once Again As Stronger Employment Growth Spooks MarketsDocument12 pagesGood News Is Bad News Once Again As Stronger Employment Growth Spooks Marketsjjy1234No ratings yet

- ING Think Commodities Are Buoyant But Supply Concerns Still A WorryDocument5 pagesING Think Commodities Are Buoyant But Supply Concerns Still A Worrydbr trackdNo ratings yet

- 20th Feb.,2014 Daily ORYZA Exclusive Rice News by Riceplus MagazineDocument15 pages20th Feb.,2014 Daily ORYZA Exclusive Rice News by Riceplus MagazineBrittany MaxwellNo ratings yet

- CMN08242020Document1 pageCMN08242020Morgan IngramNo ratings yet

- Recent Recession Business: Presentation By:-Anmol Behal (Jalandhar)Document29 pagesRecent Recession Business: Presentation By:-Anmol Behal (Jalandhar)damy_sunnerNo ratings yet

- INFORMATION BITE 10th May 08Document4 pagesINFORMATION BITE 10th May 08information.biteNo ratings yet

- PEANUT MARKETING NEWS - September 25, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - September 25, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Economics Report On U S Trade DeficitDocument3 pagesEconomics Report On U S Trade Deficitapi-221530271No ratings yet

- Home Construction Sinks, Building Permits DownDocument30 pagesHome Construction Sinks, Building Permits DownAlbert L. PeiaNo ratings yet

- FICC Times 26 July 2013Document4 pagesFICC Times 26 July 2013Melissa MillerNo ratings yet

- 2014 October 17 Weekly Report UpdateDocument4 pages2014 October 17 Weekly Report UpdateAnthony WrightNo ratings yet

- Trading Log 1Document9 pagesTrading Log 1Kristin KingNo ratings yet

- LPL Compliance Tracking #1-05063010Document8 pagesLPL Compliance Tracking #1-05063010Clay Ulman, CFP®No ratings yet

- Testing My Uploads....Document5 pagesTesting My Uploads....ajaxmaster12No ratings yet

- So What Is A Recession?Document7 pagesSo What Is A Recession?silverlookzNo ratings yet

- Senate Hearing, 109TH Congress - Agriculture, Rural Development, and Related Agencies Appropriations For Fiscal Year 2007Document229 pagesSenate Hearing, 109TH Congress - Agriculture, Rural Development, and Related Agencies Appropriations For Fiscal Year 2007Scribd Government DocsNo ratings yet

- Daily Agri Report Sep 10Document8 pagesDaily Agri Report Sep 10Angel BrokingNo ratings yet

- The Pensford Letter - 1.9.12Document7 pagesThe Pensford Letter - 1.9.12Pensford FinancialNo ratings yet

- This Could Give Farmers Information On The Plans by The New AdministrationDocument1 pageThis Could Give Farmers Information On The Plans by The New AdministrationMorgan IngramNo ratings yet

- Market Loan Weekly Prices: Shelled MKT PriceDocument1 pageMarket Loan Weekly Prices: Shelled MKT PriceMorgan IngramNo ratings yet

- AL CropProgress February2021Document1 pageAL CropProgress February2021Morgan IngramNo ratings yet

- FL CropProgress February2021Document1 pageFL CropProgress February2021Morgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Broiler Hatchery 09-02-20Document2 pagesBroiler Hatchery 09-02-20Morgan IngramNo ratings yet

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 87.3%Document1 pageExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 87.3%Morgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Peanut Marketing News - February 19, 2021 - Tyron Spearman, EditorDocument1 pagePeanut Marketing News - February 19, 2021 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- YieldDocument1 pageYieldMorgan IngramNo ratings yet

- Market Loan Weekly Prices: Shelled MKT PriceDocument1 pageMarket Loan Weekly Prices: Shelled MKT PriceMorgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Broiler Hatchery 02-17-21Document2 pagesBroiler Hatchery 02-17-21Morgan IngramNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsMorgan IngramNo ratings yet

- Market Loan Weekly Prices: Shelled MKT PriceDocument1 pageMarket Loan Weekly Prices: Shelled MKT PriceMorgan IngramNo ratings yet

- Shelled MKT Price: Market Loan Weekly PricesDocument1 pageShelled MKT Price: Market Loan Weekly PricesMorgan IngramNo ratings yet

- Cit 0221Document4 pagesCit 0221Morgan IngramNo ratings yet

- Broiler Hatchery 09-02-20Document2 pagesBroiler Hatchery 09-02-20Morgan IngramNo ratings yet

- AgendaDocument1 pageAgendaMorgan IngramNo ratings yet

- To Sign Up.: State Insured Acres Insured Liability ($) Total Premium ($) Total Indemnity ($) Loss RatioDocument1 pageTo Sign Up.: State Insured Acres Insured Liability ($) Total Premium ($) Total Indemnity ($) Loss RatioMorgan IngramNo ratings yet

- Cheryla Davis@usda GovDocument1 pageCheryla Davis@usda GovMorgan IngramNo ratings yet

- Broiler Hatchery 09-02-20Document2 pagesBroiler Hatchery 09-02-20Morgan IngramNo ratings yet

- FL CropProgress January2021Document1 pageFL CropProgress January2021Morgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Peanut Marketing News - January 25, 2021 - Tyron Spearman, EditorDocument1 pagePeanut Marketing News - January 25, 2021 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Market Loan Weekly Prices: Shelled MKT PriceDocument1 pageMarket Loan Weekly Prices: Shelled MKT PriceMorgan IngramNo ratings yet

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 67.4%Document1 pageExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 67.4%Morgan IngramNo ratings yet

- Peanut Marketing News - January 22, 2021 - Tyron Spearman, EditorDocument1 pagePeanut Marketing News - January 22, 2021 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Vip Service ContractDocument2 pagesVip Service ContractJames Lucas MooreNo ratings yet

- Optimized Production TechnologyDocument2 pagesOptimized Production TechnologyanurajNo ratings yet

- Unit II Analysis and Interpretation of Financial Statements Vertical Balance Sheet Balance Sheet As On 31/3/2022 Liabilities Rs. Assets RsDocument9 pagesUnit II Analysis and Interpretation of Financial Statements Vertical Balance Sheet Balance Sheet As On 31/3/2022 Liabilities Rs. Assets RsKirti RawatNo ratings yet

- Addmrpt 1 36561 36562Document5 pagesAddmrpt 1 36561 36562Anonymous ZGcs7MwsLNo ratings yet

- Zinc Payment Letter 04.12.2022Document3 pagesZinc Payment Letter 04.12.2022SHASHIKIRAN SNo ratings yet

- Entrep DLP 1Document3 pagesEntrep DLP 1Gevelyn BautistaNo ratings yet

- Ted Talk ScriptDocument3 pagesTed Talk Scriptapi-709046578No ratings yet

- Lesson Plan Preparing Financial StatementsDocument4 pagesLesson Plan Preparing Financial StatementsIssa TimNo ratings yet

- Listado Codigo Unico Otros Estados - Mzo162014Document6,391 pagesListado Codigo Unico Otros Estados - Mzo162014Alex CalderonNo ratings yet

- PSME Constitution and Bylaws 2017 FinalDocument13 pagesPSME Constitution and Bylaws 2017 FinalPsmeorgph PhilNo ratings yet

- Larrys Bicycle Shop - Annual Financial Statements - Original HardcodedDocument4 pagesLarrys Bicycle Shop - Annual Financial Statements - Original HardcodedLarry MaiNo ratings yet

- 5 Company Law IIDocument4 pages5 Company Law IIVani ChoudharyNo ratings yet

- Ex01 - Cost Behavior - Cost-Volume-Profit Analysis XDocument18 pagesEx01 - Cost Behavior - Cost-Volume-Profit Analysis Xhanie lalaNo ratings yet

- Wal-Mart Activity System MapDocument1 pageWal-Mart Activity System MapWan Wan HushNo ratings yet

- Depreciation Expense Cost - Salvage Value / Useful LifeDocument2 pagesDepreciation Expense Cost - Salvage Value / Useful LifeGarp BarrocaNo ratings yet

- Bidding AnnouncementDocument1 pageBidding AnnouncementCoeur FragileNo ratings yet

- Proposal On Banking & InstrumentDocument29 pagesProposal On Banking & InstrumentSwati WalandeNo ratings yet

- Education: ProfileDocument14 pagesEducation: ProfileRizky NafandyNo ratings yet

- SPEECH RECOGNITION SYSTEM FinalDocument16 pagesSPEECH RECOGNITION SYSTEM FinalMard GeerNo ratings yet

- SPP Doc 205-Post-Construction ServicesDocument10 pagesSPP Doc 205-Post-Construction ServicesKyle AradoNo ratings yet

- Epp-He 6Document41 pagesEpp-He 6Daisy L. TorresNo ratings yet

- Business Activities and Registration ActDocument11 pagesBusiness Activities and Registration Actdaudi edward nkwabiNo ratings yet

- Technopreneurship - Creativity and InnovationDocument68 pagesTechnopreneurship - Creativity and InnovationCamilogs100% (1)

- This Spreadsheet Supports STUDENT Analysis of The Case "Transportation and Consolidation at Elevalt LTD." (UVA-OM-1490)Document7 pagesThis Spreadsheet Supports STUDENT Analysis of The Case "Transportation and Consolidation at Elevalt LTD." (UVA-OM-1490)rakeshNo ratings yet

- Senior Solution Architect in Amazon CV Samle - KickresumeDocument4 pagesSenior Solution Architect in Amazon CV Samle - KickresumeIndra SarNo ratings yet

- Basic Occupational Safety and HealthDocument6 pagesBasic Occupational Safety and HealthRonnick De La TongaNo ratings yet

- Industry 4.0 Developments Towards The Fourth Industrial RevolutionDocument69 pagesIndustry 4.0 Developments Towards The Fourth Industrial RevolutionAna RotaruNo ratings yet

- Corporate Governance: Punjab National BankDocument16 pagesCorporate Governance: Punjab National BankTejas D HusukaleNo ratings yet

- Vdoc - Pub Handbook of Industrial Engineering Technology and Operations Management Third EditionDocument2,798 pagesVdoc - Pub Handbook of Industrial Engineering Technology and Operations Management Third EditionGilberto Giner Alvídrez100% (1)

- Corporate Law of Malaysia: Statutory Meetings in Malaysia CompaniesDocument14 pagesCorporate Law of Malaysia: Statutory Meetings in Malaysia CompaniesJitha RithaNo ratings yet