Professional Documents

Culture Documents

T - Test For Unequal Varinces

Uploaded by

Hardik Agarwal0 ratings0% found this document useful (0 votes)

24 views3 pagesOriginal Title

t- Test for unequal varinces

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

24 views3 pagesT - Test For Unequal Varinces

Uploaded by

Hardik AgarwalCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

t-Test: Two-Sample Assuming Unequal Variances for Silver

μ1- average opening price of Silver

μ2- average closing price of Silver

Assuming the null hypothesis i.e.

Ho: μ1=μ 2 [perception is wrong] (there is no significant difference between average

opening and closing price of silver.)

H1: μ1≠μ2 [perception is right] (there is significant difference between average opening

and closing price of silver.)

Taking confidence level= 95%, α (level of significance) = 0.05

t-Test: Two-Sample Assuming Unequal OPENING CLOSING

Variances (Rs.) (Rs.)

Mean 57961.1 58150.46667

Variance 85811964.29 83149239.95

Observations 60 60

Hypothesized Mean Difference 0

df 118

t Stat -0.112845868

P(T<=t) one-tail 0.455172254

t Critical one-tail 1.657869522

P(T<=t) two-tail 0.910344507

t Critical two-tail 1.980272249

On comparing P value with α (level of significance) we see that,

P (T <= t) two tail > α

0.91 > 0.05

Thus, accept null hypothesis and perception is wrong.

t-Test: Two-Sample Assuming Unequal Variances for Gold

μ1- average opening price of Gold

μ2- average closing price of Gold

Assuming the null hypothesis i.e.

Ho: μ1=μ 2 [perception is wrong] (there is no significant difference between average

opening and closing price of gold.)

H1: μ1≠μ2 [perception is right] (there is significant difference between average opening

and closing price of gold.)

Taking confidence level= 95%, α (level of significance) = 0.05

t-Test: Two-Sample Assuming Unequal

Variances Opening Price Closing Price

Mean 49756.38333 49816.88333

Variance 7147012.647 6945370.037

Observations 60 60

Hypothesized Mean Difference 0

df 118

t Stat -0.124835696

P(T<=t) one-tail 0.450433024

t Critical one-tail 1.657869522

P(T<=t) two-tail 0.900866049

t Critical two-tail 1.980272249

On comparing P value with α (level of significance) we see that,

P (T <= t) two tail > α

0.90 > 0.05

Thus, accept null hypothesis and perception is wrong.

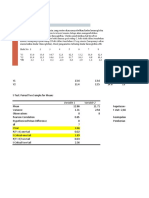

t-Test: Two-Sample Assuming Unequal Variances Open Close

Mean 2125.493333 2127.52

Variance 28507.50216 28923.63188

Observations 60 60

Hypothesized Mean Difference 0

df 118

t Stat -0.065506479

P(T<=t) one-tail 0.4739408

t Critical one-tail 1.657869522

P(T<=t) two-tail 0.9478816

t Critical two-tail 1.980272249

t-Test: Two-Sample Assuming Unequal Variances for Nifty Metal

μ1- average opening price of Gold

μ2- average closing price of Gold

Assuming the null hypothesis i.e.

Ho: μ1=μ 2 [perception is wrong] (there is no significant difference between average

opening and closing price of nifty metal.)

H1: μ1≠μ2 [perception is right] (there is significant difference between average opening

and closing price of nifty metal.)

Taking confidence level= 95%, α (level of significance) = 0.05

On comparing P value with α (level of significance) we see that,

P (T <= t) two tail > α

0.94 > 0.05

Thus, accept null hypothesis and perception is wrong.

You might also like

- T - Test For 2 Paired of MeansDocument4 pagesT - Test For 2 Paired of MeansHardik AgarwalNo ratings yet

- School of Natural Sciences: Males Fema LesDocument7 pagesSchool of Natural Sciences: Males Fema Lesangyll agaledNo ratings yet

- SPSS: Paired Samples TestDocument2 pagesSPSS: Paired Samples TestMeiraniNo ratings yet

- Tema Seminar 4Document11 pagesTema Seminar 4AniteiFlorinAlexandruNo ratings yet

- Variable 1 Variable 2Document2 pagesVariable 1 Variable 2Wahyu DewantoroNo ratings yet

- Chapter 4 ExamplesDocument50 pagesChapter 4 ExamplesJD FCNo ratings yet

- Chapter 4 ExamplesDocument50 pagesChapter 4 ExamplesJUAN DIEGO FALCON CHURANo ratings yet

- Uji T A. Uji T Untuk Paracetamol Dan Na DiklofenakDocument4 pagesUji T A. Uji T Untuk Paracetamol Dan Na DiklofenakDestriaNo ratings yet

- 555 Indi 2Document4 pages555 Indi 2tgrfdhfa10No ratings yet

- T - Test: Ex No: DateDocument3 pagesT - Test: Ex No: Datepecmba11No ratings yet

- Lab 8 StatDocument7 pagesLab 8 StatRacu RexNo ratings yet

- USH StatDocument3 pagesUSH StatNathan RedmondNo ratings yet

- T-Test:: Problem StatementDocument3 pagesT-Test:: Problem StatementAnanya GogoiNo ratings yet

- T TestDocument8 pagesT TestTokib TowfiqNo ratings yet

- With Treatment ControlDocument2 pagesWith Treatment ControlAnonymousNo ratings yet

- GatauDocument6 pagesGatauSalsa Nadia CleoNo ratings yet

- Assessment 3Document4 pagesAssessment 3James SwintonNo ratings yet

- Advanced Statistics: Assignment - 1bDocument5 pagesAdvanced Statistics: Assignment - 1bChirag BansalNo ratings yet

- Airtran Southwest Question: Delay in Minutes For Two Airlines Have Been Given. Does The Average Delay For Both The Airlines Differ?Document11 pagesAirtran Southwest Question: Delay in Minutes For Two Airlines Have Been Given. Does The Average Delay For Both The Airlines Differ?Jaydeep BairagiNo ratings yet

- Contoh Perhitungan T TestDocument8 pagesContoh Perhitungan T TestViviane AnnisaNo ratings yet

- Unit 5 Standard Error ClassworkDocument23 pagesUnit 5 Standard Error ClassworkfortunapartnershipNo ratings yet

- P (T T) One-Tail 0.270802066 Has Significant Difference: For XDocument4 pagesP (T T) One-Tail 0.270802066 Has Significant Difference: For XCarmela Elaco VillanuevaNo ratings yet

- DB SeriaB2014 1Document8 pagesDB SeriaB2014 1Miruna Maria MiulescuNo ratings yet

- TtestDocument1 pageTtestAhmad Sharief Bin JaylaniNo ratings yet

- Statistics JedDocument2 pagesStatistics JedDave Matthew LibiranNo ratings yet

- StatsDocument5 pagesStatsKris Anthony SyNo ratings yet

- Appendix 14 - Keller MS - AISE IMDocument14 pagesAppendix 14 - Keller MS - AISE IMPattapong WirungruangkulNo ratings yet

- Acara 7 AkbarDocument8 pagesAcara 7 AkbarRoy IrawanNo ratings yet

- Variable 1 Variable 2Document1 pageVariable 1 Variable 2JiAn GaMiNgNo ratings yet

- AnovaDocument9 pagesAnovaAlbert AguirreNo ratings yet

- Check in Activity2Document5 pagesCheck in Activity2Erika CadawanNo ratings yet

- StainferDocument6 pagesStainferMariani SinagaNo ratings yet

- Stat Task 5Document5 pagesStat Task 5jeffrey alemaniaNo ratings yet

- Latihan SoalDocument7 pagesLatihan SoalWIDYA HANDINI 1No ratings yet

- 06 TestDocument14 pages06 TestRavi ThakkarNo ratings yet

- Treatmentno Treatment Treatmentno Treatment Treatmentno TreatmentDocument2 pagesTreatmentno Treatment Treatmentno Treatment Treatmentno TreatmentDita IndahNo ratings yet

- Variable 1 Variable 2: F-Test Two-Sample For VariancesDocument4 pagesVariable 1 Variable 2: F-Test Two-Sample For Variancesrocky88No ratings yet

- Contoh Analisis Statistik (Excel)Document3 pagesContoh Analisis Statistik (Excel)Zayyan MuafiNo ratings yet

- Project 03Document7 pagesProject 03John McCollyNo ratings yet

- Q1: Is There Any Relationship On The Cat Performance With Reference To Their Academic PerformanceDocument9 pagesQ1: Is There Any Relationship On The Cat Performance With Reference To Their Academic PerformanceDeepesh NishadNo ratings yet

- Variable 1 Variable 2Document2 pagesVariable 1 Variable 2Gwyn Irish AbanadorNo ratings yet

- CH 10Document12 pagesCH 10aqillahNo ratings yet

- Milk Bidding Wars: Data Driven Decision Making - Case Study 3Document4 pagesMilk Bidding Wars: Data Driven Decision Making - Case Study 3Alex NicholsonNo ratings yet

- Milk Bidding Wars: Data Driven Decision Making - Case Study 3Document4 pagesMilk Bidding Wars: Data Driven Decision Making - Case Study 3Alex NicholsonNo ratings yet

- T-Test: Two-Sample Assuming Unequal Variances: Variabl E1 Variab Le2Document10 pagesT-Test: Two-Sample Assuming Unequal Variances: Variabl E1 Variab Le2RadHika GaNdotraNo ratings yet

- RefractionDocument4 pagesRefractionVictor LadefogedNo ratings yet

- Exercises and Examples For CM 4Document11 pagesExercises and Examples For CM 4Anthony OrataNo ratings yet

- BS Assignment 2: σ given, z−test, H HDocument28 pagesBS Assignment 2: σ given, z−test, H HNiharika AnandNo ratings yet

- Current Mins New MinsDocument2 pagesCurrent Mins New MinsKaran TrivediNo ratings yet

- ExercisesDocument35 pagesExercises045005No ratings yet

- Final Exam in StatsDocument6 pagesFinal Exam in StatsPrincess MirandaNo ratings yet

- Final Exam in StatsDocument6 pagesFinal Exam in StatsPrincess MirandaNo ratings yet

- Laboratory Exercise 3Document9 pagesLaboratory Exercise 3alia fauniNo ratings yet

- Regular Student Working StudentDocument14 pagesRegular Student Working StudentErika BuenaNo ratings yet

- Book 1Document3 pagesBook 1darshak_sangani4005No ratings yet

- Chapter 3Document12 pagesChapter 3jestoni langgidoNo ratings yet

- Essay Test MASDocument18 pagesEssay Test MASNguyen Cam Tu (K15 HL)No ratings yet

- q2 Group 5 (15) SolvedDocument7 pagesq2 Group 5 (15) SolvedMehrijaNo ratings yet

- Variable 1 Variable 2: T-Test: Paired Two Sample For MeansDocument4 pagesVariable 1 Variable 2: T-Test: Paired Two Sample For MeanskhulafaurrasidinNo ratings yet

- Unstoppable Franchise Trends: Defying The PandemicDocument3 pagesUnstoppable Franchise Trends: Defying The PandemicHardik AgarwalNo ratings yet

- Annual Report 2019 20 - tcm1255 552013 - 1 - en PDFDocument118 pagesAnnual Report 2019 20 - tcm1255 552013 - 1 - en PDFAnjali SoniNo ratings yet

- Annual Report 2019 20 - tcm1255 552013 - 1 - en PDFDocument118 pagesAnnual Report 2019 20 - tcm1255 552013 - 1 - en PDFAnjali SoniNo ratings yet

- D1e5cethics & Corporate GovernanceDocument18 pagesD1e5cethics & Corporate GovernanceHardik AgarwalNo ratings yet

- 72b99indian Consumer MarketsDocument2 pages72b99indian Consumer MarketsHardik AgarwalNo ratings yet

- Get Stock Market Updates From Telegram App: Https://T.Me/KittuswealthjourneyDocument23 pagesGet Stock Market Updates From Telegram App: Https://T.Me/KittuswealthjourneyHardik Agarwal0% (1)

- D58bcdifference Between Ethics and ValuesDocument4 pagesD58bcdifference Between Ethics and ValuesHardik AgarwalNo ratings yet

- Ba 1 D 4 UtilitarianismDocument3 pagesBa 1 D 4 UtilitarianismHardik AgarwalNo ratings yet

- Difference Between Ethics and ValuesDocument4 pagesDifference Between Ethics and ValuesHardik AgarwalNo ratings yet

- Ethics & Corporate GovernanceDocument18 pagesEthics & Corporate GovernanceHardik AgarwalNo ratings yet

- Data Latihan AnovaDocument15 pagesData Latihan AnovaNuraini MeinaNo ratings yet

- Question BankDocument1 pageQuestion BankSayantan PalNo ratings yet

- Diff PDFDocument4 pagesDiff PDFpcg20013793No ratings yet

- Statis PrakDocument6 pagesStatis PrakZaharaaNo ratings yet

- Unit-8 IGNOU STATISTICSDocument15 pagesUnit-8 IGNOU STATISTICSCarbidemanNo ratings yet

- 14 Panel Data ModelsDocument31 pages14 Panel Data ModelsDavid AyalaNo ratings yet

- Chapter 8 - : ForecastingDocument43 pagesChapter 8 - : ForecastingArchit SomaniNo ratings yet

- Risks: Predicting Motor Insurance Claims Using Telematics Data-Xgboost Versus Logistic RegressionDocument16 pagesRisks: Predicting Motor Insurance Claims Using Telematics Data-Xgboost Versus Logistic RegressionvijayambaNo ratings yet

- EKONOMETRIKADocument8 pagesEKONOMETRIKANorenza Awaliya Putri SumbariNo ratings yet

- ArticleText 93587 2 10 202104111Document25 pagesArticleText 93587 2 10 202104111Sam LugoNo ratings yet

- Statistic 2Document8 pagesStatistic 2Kok Wen KaiNo ratings yet

- R Tutorial For STAT 350 For Computer Assignment 9a: ExampleDocument4 pagesR Tutorial For STAT 350 For Computer Assignment 9a: ExamplexhbegqrddgzmtvxnchNo ratings yet

- Notes5 PDFDocument11 pagesNotes5 PDFsashumaruNo ratings yet

- Hypothesis LECTUREDocument75 pagesHypothesis LECTUREStarNo ratings yet

- Estimation 2Document20 pagesEstimation 2Bryan BarcelonaNo ratings yet

- TSTA602 NA Exam Answer Booklet 2022 Term 5Document11 pagesTSTA602 NA Exam Answer Booklet 2022 Term 5Syeda IrumNo ratings yet

- Conditional and Singular Normal DistributionDocument5 pagesConditional and Singular Normal DistributionOmNo ratings yet

- DSC4821 2022 Assignment 04 Solutions PDFDocument11 pagesDSC4821 2022 Assignment 04 Solutions PDFKeshi AngelNo ratings yet

- (2006 PPT) Quantum Fisher InformationDocument36 pages(2006 PPT) Quantum Fisher InformationJunaid RehmanNo ratings yet

- Random Variables CH2 MuqaibelDocument62 pagesRandom Variables CH2 MuqaibelbamlakadereNo ratings yet

- ISYE 6420 SyllabusDocument1 pageISYE 6420 SyllabusYasin Çagatay GültekinNo ratings yet

- QEM-1004 Basic Statistics For Process ControlDocument6 pagesQEM-1004 Basic Statistics For Process Controlakhil kvNo ratings yet

- Isom 351 WelthwrhgDocument74 pagesIsom 351 WelthwrhgYijia QianNo ratings yet

- GATE Online Coaching Classes: Digital CommunicationsDocument64 pagesGATE Online Coaching Classes: Digital CommunicationsMMhammed AlrowailyNo ratings yet

- Probability & Statistics New 1Document3 pagesProbability & Statistics New 1amrit403No ratings yet

- Reporting SEM Results in APADocument5 pagesReporting SEM Results in APAORLANDO CHAMORRONo ratings yet

- (Brajendra C. Sutradhar) Longitudinal Categorical Data Analysis (PDF) (ZZZZZ)Document387 pages(Brajendra C. Sutradhar) Longitudinal Categorical Data Analysis (PDF) (ZZZZZ)Tchakounte NjodaNo ratings yet

- 25-27 Statistical Reasoning-Probablistic Model-Naive Bayes ClassifierDocument35 pages25-27 Statistical Reasoning-Probablistic Model-Naive Bayes ClassifierDaniel LivingstonNo ratings yet

- 8 - 29 NotesDocument2 pages8 - 29 NotesEthan Shea-StultzNo ratings yet

- 5.1. Testing HypothesisDocument34 pages5.1. Testing Hypothesisnica pidlaoanNo ratings yet