Professional Documents

Culture Documents

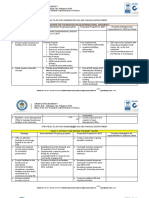

Five Major Account Groups:: A. Simple "Paper Tools"

Uploaded by

Angelica Obregon0 ratings0% found this document useful (0 votes)

16 views1 pageOriginal Title

Record keeping.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views1 pageFive Major Account Groups:: A. Simple "Paper Tools"

Uploaded by

Angelica ObregonCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Topic: Record keeping • Under accrual accounting, you measure the income

Subject: Entrepreneurship or expense when accrued. Examples are accounts

===================================== receivable and accounts payable. You would record

Record keeping important for small businesses the sales as receivable when recognized. You would

– Sole proprietor record the bills as expenses when received or

– Partnership incurred by you.

– Corporation • Companies that have inventory are supposed to use

What is Record Keeping? accrual accounting.

• Orderly and disciplined practice of storing business

records What is the Chart of Accounts?

• Ranges from simple (manila folder) to complex • Accounts examples such as cash, accounts payable,

(online electronic filing) accounts receivable, payroll, payroll taxes, long-

• Provides fast retrieval of records term loans, owner’s equity, telephone expense,

• Updated on a on-going basis utility expense, income, cost of goods

Remember – Keep good records, both business and Five major account groups:

personal 1. Assets

2. Liabilities

Why is Record Keeping Important? 3. Equity

1. Business Operations 4. Income

– Tracking details 5. Expense

– Planning

2. Legal Assets

– Contracts • Assets include both current and long term assets

– Licenses and permits • Current assets are cash, checking accounts,

– Payroll and personnel accounts receivable, and inventory

3. State and Local Taxes • Long term assets are notes receivable, tools and

equipment, land, buildings

Record Keeping Tools Liabilities

a) Simple “paper tools” • Liabilities include both short-term and long-

b) “Tickler” system term.

c) Computer systems • Short-term liabilities are defined as amounts that

d) Cloud computing are due within one year. Examples of short-term

• Accounting liabilities are accounts payable, payroll tax

• File hosting liabilities, and the portion of the long-term debt

that is owed for that year.

A. Simple “Paper Tools” • Long-term liabilities include notes payable,

• File folder bonds payable, loans.

• Hanging folder Equity

• Cabinet storage • Equity accounts represent what the owners have

• Accordion folder put into the company as well as the cumulative

B. “Tickler” System net earnings of the company.

• Use a tickler system to remind you of upcoming • Owners equity consists of both Owner’s

events such as: Contributions and Owner’s draw.

• Quarterly taxes • Retained earnings includes what the company

• License renewals has earned over the years.

• Insurance reviews and renewals Income

• Upcoming bills • You may want to set up several income accounts

• Call-backs if you have different streams of income from

C. Computer Systems different work activities.

• In addition to paper tools • The income and expense total – net earnings – is

• Takes less space than paper forwarded into the balance sheet.

• Faster and easier – Internet transmission Expense

• Many businesses and government agencies allow • You can create a number of different expense

use of Internet accounts so that you can properly track your

• Learn and grow into computer systems over time costs of your business.

• Be sure to BACK UP files daily • Some expenses are recurring on a monthly basis,

D. Cloud Computing e.g. telephone use while other expenses, such as

Use the Internet to store, manage, and process data the purchase of tools or repair of equipment will

(vs. your own personal computer). vary.

Basic Bookkeeping

CASH VS. ACCRUAL ACCOUNTING

• Most businesses start with cash accounting. You

record income and expenses as you receive or pay

out the cash.

You might also like

- Project Proposal For Hand Washing AreaDocument4 pagesProject Proposal For Hand Washing AreaAngelica Obregon90% (20)

- Project Proposal For Hand Washing AreaDocument4 pagesProject Proposal For Hand Washing AreaAngelica Obregon90% (20)

- Testy Maturalne - Klucz OdpowiedziDocument4 pagesTesty Maturalne - Klucz OdpowiedziOla Sobańtka100% (1)

- English: Quarter 3 - Module 5CDocument21 pagesEnglish: Quarter 3 - Module 5CRaisa Lima Darauay86% (7)

- FA1 NotesDocument270 pagesFA1 Notesdaneq80% (10)

- Week 1 Entrepreneurship Daily Lesson Log TemplateDocument5 pagesWeek 1 Entrepreneurship Daily Lesson Log TemplateMichelleAdanteMorong75% (8)

- Partial Samsung Voir DireDocument3 pagesPartial Samsung Voir DireMikey CampbellNo ratings yet

- Ansys Fensap-Ice ViewmericalDocument66 pagesAnsys Fensap-Ice ViewmericalEDIZONNo ratings yet

- Prime White Cement Vs IacDocument2 pagesPrime White Cement Vs IacNegou Xian TeNo ratings yet

- "A Vestigial Population"?: Perspectives On Southern Irish Protestants in The Twentieth CenturyDocument35 pages"A Vestigial Population"?: Perspectives On Southern Irish Protestants in The Twentieth CenturyBrian John SpencerNo ratings yet

- Chapter 5Document14 pagesChapter 5Joao NegreirosNo ratings yet

- Unit 29 - GeetaDocument71 pagesUnit 29 - GeetaNabiha KhanNo ratings yet

- Business MathDocument4 pagesBusiness MathPamela MarieNo ratings yet

- FA1 NotesDocument270 pagesFA1 NotesNida KhanNo ratings yet

- SSLIDES_VATEL_LSLIDES_Chap 4Document36 pagesSSLIDES_VATEL_LSLIDES_Chap 4uyenthanhtran2312No ratings yet

- Chapter 3 NotesDocument10 pagesChapter 3 NotesAyaan Ahaan Malik-WilliamsNo ratings yet

- Week 3 SlidesDocument38 pagesWeek 3 SlidesRogelio ParanNo ratings yet

- Financial AccountingDocument12 pagesFinancial AccountingValeria MaldonadoNo ratings yet

- Accounting Information Systems OverviewDocument116 pagesAccounting Information Systems OverviewMARIAN POLANCONo ratings yet

- L1-Introduction To AccountingDocument67 pagesL1-Introduction To AccountingSYAMIMI ANUARNo ratings yet

- Accounting essentialsDocument2 pagesAccounting essentialsRochelle Joy CruzNo ratings yet

- Acct 018 Chapter 4 5Document4 pagesAcct 018 Chapter 4 5rivera.roshelleNo ratings yet

- Topik 1-2Document27 pagesTopik 1-2hizikazaNo ratings yet

- Chapter 2 - Transaction Processing and ERPDocument39 pagesChapter 2 - Transaction Processing and ERPLê Thái VyNo ratings yet

- Chapter 1 AIS Overview ModuleDocument9 pagesChapter 1 AIS Overview ModuleCarmi FeceroNo ratings yet

- NOTES3Document13 pagesNOTES3Xuan HuNo ratings yet

- Computerized Accounting Options for NonprofitsDocument4 pagesComputerized Accounting Options for Nonprofitsadityakumar94No ratings yet

- Accounting Software for ManagementDocument27 pagesAccounting Software for ManagementAnonymous 1ClGHbiT0JNo ratings yet

- Essential Elements of The Definition of AccountingDocument9 pagesEssential Elements of The Definition of AccountingPamela Diane Varilla AndalNo ratings yet

- Preparing a Chart of AccountsDocument11 pagesPreparing a Chart of AccountsMarlyn LotivioNo ratings yet

- IntroductionDocument19 pagesIntroductionFabiolaNo ratings yet

- Accounting Accounting Measures Measures Processes Processes: "Language of Business" "Language of Business"Document22 pagesAccounting Accounting Measures Measures Processes Processes: "Language of Business" "Language of Business"Kate JamiloNo ratings yet

- Major Type of AccountsDocument43 pagesMajor Type of AccountsAngelica Ross de LunaNo ratings yet

- Commercial AccountingDocument16 pagesCommercial AccountingAaditya Pandey AmritNo ratings yet

- NOTESDocument11 pagesNOTESXuan HuNo ratings yet

- Fabm 4THDocument3 pagesFabm 4THDrahneel MarasiganNo ratings yet

- The Revenue Cycle: Group 1Document43 pagesThe Revenue Cycle: Group 1Ratih PratiwiNo ratings yet

- Transaction Processing in The AISDocument20 pagesTransaction Processing in The AISChristlyn Joy BaralNo ratings yet

- Unit 1: Chapter 1: Role and Purpose of AccountingDocument8 pagesUnit 1: Chapter 1: Role and Purpose of AccountingXuan HuNo ratings yet

- Day1 TrainingDocument23 pagesDay1 TrainingAeron PamplonaNo ratings yet

- Chapter 1 Agr323Document32 pagesChapter 1 Agr3232024530911No ratings yet

- 7 Elements of FS-specific AccountsDocument28 pages7 Elements of FS-specific Accountsivygem saanNo ratings yet

- Nature of Business and AccountingDocument3 pagesNature of Business and AccountingHailey LegaspiNo ratings yet

- CompileDocument15 pagesCompileSantos, Carla MayNo ratings yet

- Chapter 2-3Document7 pagesChapter 2-3...No ratings yet

- Chapter 2 - Recording Business TransactionsDocument6 pagesChapter 2 - Recording Business TransactionsHa Phuoc HauNo ratings yet

- Oracle R12 OVERVIEWDocument67 pagesOracle R12 OVERVIEWJulio FerrazNo ratings yet

- Manage Working Capital EffectivelyDocument27 pagesManage Working Capital EffectivelyRitik KumarNo ratings yet

- Chapter 1-Introduction To Cost Accounting: Commissions (SEC)Document5 pagesChapter 1-Introduction To Cost Accounting: Commissions (SEC)Jenefer DianoNo ratings yet

- B064 Nikhil NDocument2 pagesB064 Nikhil NVarun RNo ratings yet

- Session 2Document27 pagesSession 2I don't knowNo ratings yet

- activity-2082Document15 pagesactivity-2082Joie Cyra Gumban PlatonNo ratings yet

- Account TitlesDocument6 pagesAccount TitlesKristine JayNo ratings yet

- 1.8 Overview of Trnsaction Processing and ERP SystemsDocument24 pages1.8 Overview of Trnsaction Processing and ERP SystemsHabtamu mamoNo ratings yet

- Five Major Types of AccountsDocument17 pagesFive Major Types of AccountsCharmie Flor CuetoNo ratings yet

- Basic Concepts of Financial Accounting ExplainedDocument42 pagesBasic Concepts of Financial Accounting ExplainedKavitha Kavi KaviNo ratings yet

- M 12 - 13 Expenditure CycleDocument50 pagesM 12 - 13 Expenditure CycleJevan MarcelNo ratings yet

- Intro, Accounting Conecpts and EquationDocument30 pagesIntro, Accounting Conecpts and EquationPraween BimsaraNo ratings yet

- Accountancy PPT 1Document22 pagesAccountancy PPT 1sakshamNo ratings yet

- Unit IvDocument44 pagesUnit IvLiamia Labos MabandosNo ratings yet

- Financial Decision Making Tools: Financial Statements: Presented By: Dr. Anthony Ly B. Dagang Anthony - Dagang@lccdo - Edu.phDocument31 pagesFinancial Decision Making Tools: Financial Statements: Presented By: Dr. Anthony Ly B. Dagang Anthony - Dagang@lccdo - Edu.phmila dacarNo ratings yet

- Basic Concepts of Financial Accounting EditedDocument42 pagesBasic Concepts of Financial Accounting EditedKavitha Kavi KaviNo ratings yet

- Introducing Financial Statements and Transaction AnalysisDocument64 pagesIntroducing Financial Statements and Transaction AnalysisHazim AbualolaNo ratings yet

- Part 6.a - AccountingDocument38 pagesPart 6.a - AccountingzhengcunzhangNo ratings yet

- Chapter 8-Types of Major AccountsDocument2 pagesChapter 8-Types of Major AccountsRichael Ann Delubio ZapantaNo ratings yet

- Econeng1 Jan10thDocument14 pagesEconeng1 Jan10thArjan David AlquintoNo ratings yet

- Inbound 2270504447012932442Document6 pagesInbound 2270504447012932442jaksksNo ratings yet

- EntrepreneurshipHandout Week 5Document6 pagesEntrepreneurshipHandout Week 5Pio GuiretNo ratings yet

- 2020 Plans and AccomplishmentDocument5 pages2020 Plans and AccomplishmentAngelica ObregonNo ratings yet

- Course Code EntrepDocument3 pagesCourse Code EntrepAngelica ObregonNo ratings yet

- Recitation MidtermsDocument2 pagesRecitation MidtermsAngelica ObregonNo ratings yet

- Course Syllabus Entrep (Revised)Document12 pagesCourse Syllabus Entrep (Revised)Angelica Obregon100% (1)

- Course Code EntrepDocument3 pagesCourse Code EntrepAngelica ObregonNo ratings yet

- Closing Message: Office of The Vice President - Administration & FinanceDocument2 pagesClosing Message: Office of The Vice President - Administration & FinanceAngelica ObregonNo ratings yet

- Handout 1Document2 pagesHandout 1Angelica ObregonNo ratings yet

- Importance of keeping accurate business recordsDocument2 pagesImportance of keeping accurate business recordsDavid EdemNo ratings yet

- Introductory SpeechDocument1 pageIntroductory SpeechAngelica ObregonNo ratings yet

- How to Start a Small Business Guide with 10 Steps for Finding a Business IdeaDocument2 pagesHow to Start a Small Business Guide with 10 Steps for Finding a Business IdeaAngelica ObregonNo ratings yet

- Handout 3Document2 pagesHandout 3Angelica ObregonNo ratings yet

- Samar State University Sanitizing Footbath ProjectDocument2 pagesSamar State University Sanitizing Footbath ProjectAngelica ObregonNo ratings yet

- Strategy in Catbalogan City", Issued On September 23, 2020 Due To The Continued Increased ofDocument1 pageStrategy in Catbalogan City", Issued On September 23, 2020 Due To The Continued Increased ofAngelica ObregonNo ratings yet

- Emergency Fund WorksheetDocument1 pageEmergency Fund Worksheetms_lezahNo ratings yet

- Emergency Fund WorksheetDocument1 pageEmergency Fund Worksheetms_lezahNo ratings yet

- Emergency Fund WorksheetDocument1 pageEmergency Fund Worksheetms_lezahNo ratings yet

- Project Proposal For Janitorial SuppliesDocument2 pagesProject Proposal For Janitorial SuppliesAngelica ObregonNo ratings yet

- Policy Guidelines For Post CovidDocument2 pagesPolicy Guidelines For Post CovidAngelica ObregonNo ratings yet

- The World Is Facing Its Greatest Enemy YetDocument1 pageThe World Is Facing Its Greatest Enemy YetAngelica ObregonNo ratings yet

- Strategy in Catbalogan City", Issued On September 23, 2020 Due To The Continued Increased ofDocument1 pageStrategy in Catbalogan City", Issued On September 23, 2020 Due To The Continued Increased ofAngelica ObregonNo ratings yet

- Closing MessageDocument2 pagesClosing MessageAngelica ObregonNo ratings yet

- Week 2 Political IdeologiesDocument10 pagesWeek 2 Political IdeologiesAngelica Obregon0% (2)

- Project Proposal For Toilet / Comfort Room Accessories: Office of The Vice President - Administration & FinanceDocument1 pageProject Proposal For Toilet / Comfort Room Accessories: Office of The Vice President - Administration & FinanceAngelica ObregonNo ratings yet

- People power revolution and 1987 Philippine ConstitutionDocument2 pagesPeople power revolution and 1987 Philippine ConstitutionAngelica Obregon100% (12)

- Hand Washing PDFDocument5 pagesHand Washing PDFMichelle Copones LlanesNo ratings yet

- Week 3 Political Ideologies and CommunitiesDocument7 pagesWeek 3 Political Ideologies and CommunitiesAngelica Obregon100% (2)

- Pepsi Vs Municipality of TanauanDocument7 pagesPepsi Vs Municipality of TanauanKenmar NoganNo ratings yet

- Notes On Business Law - SecuritiesDocument8 pagesNotes On Business Law - SecuritiesNovelyn DuyoganNo ratings yet

- Nursing License Suspended Dumm 3Document5 pagesNursing License Suspended Dumm 3Kristin NelsonNo ratings yet

- Bank account transactions and financial recordsDocument5 pagesBank account transactions and financial recordsSyaza AisyahNo ratings yet

- Astm A 384 A384mDocument3 pagesAstm A 384 A384medwinbadajosNo ratings yet

- SIP On TaxationDocument59 pagesSIP On Taxationprajwal shramaNo ratings yet

- OSHMM DA 01 - Maintenance of Safety and Operational EquipmentDocument2 pagesOSHMM DA 01 - Maintenance of Safety and Operational EquipmentIoannis FinaruNo ratings yet

- Bus Driver CV TemplateDocument2 pagesBus Driver CV Templatecucucucucu72No ratings yet

- Bankersway editorial vocabulary PDF provides concise definitionsDocument134 pagesBankersway editorial vocabulary PDF provides concise definitionsSeth Rollins100% (1)

- DR. JOSE RIZAL Is A Unique Example of A Many-Splendored Genius Who Became The Greatest Hero of TheDocument2 pagesDR. JOSE RIZAL Is A Unique Example of A Many-Splendored Genius Who Became The Greatest Hero of TheDianneJeeDagasdasNo ratings yet

- Ideologies' Advantages and DisadvantagesDocument1 pageIdeologies' Advantages and DisadvantagesKamil DumpNo ratings yet

- S1-17 18 PDFDocument1 pageS1-17 18 PDFganeshp_eeeNo ratings yet

- TGP Reply Brief Hitting Back at John Doe Argument in Epstein CaseDocument28 pagesTGP Reply Brief Hitting Back at John Doe Argument in Epstein CaseJim Hoft100% (1)

- Rizal's Friends and AlliesDocument5 pagesRizal's Friends and AlliesSean HooeksNo ratings yet

- MBA514 Final ReportDocument12 pagesMBA514 Final ReportSaima AkterNo ratings yet

- The Chinese Revolution in 1949 Refers To The Final Stage of FightingDocument2 pagesThe Chinese Revolution in 1949 Refers To The Final Stage of FightingRemya MarimuthuNo ratings yet

- Gyekye Kwame-The Unexamined LifeDocument44 pagesGyekye Kwame-The Unexamined LifeDarling Jonathan WallaceNo ratings yet

- The Electric Field of A Plane Polarized Electromagnetic Wave in Free Space at Timeâ T 0 Is Given by An ExpressionDocument3 pagesThe Electric Field of A Plane Polarized Electromagnetic Wave in Free Space at Timeâ T 0 Is Given by An ExpressionAshutosh PathakNo ratings yet

- Ledesma v. Municipality of IloiloDocument2 pagesLedesma v. Municipality of IloilokathrynmaydevezaNo ratings yet

- Evid Digest Feb12Document7 pagesEvid Digest Feb12Alfonso DimlaNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)satvikNo ratings yet

- Macalintal vs. ComelecDocument1 pageMacalintal vs. ComelecRJ TurnoNo ratings yet

- Cincinnati ARPA Allocations As of May 19, 2021Document1 pageCincinnati ARPA Allocations As of May 19, 2021WVXU NewsNo ratings yet

- (JFM) (PC) Pulu v. Evans Et Al - Document No. 4Document2 pages(JFM) (PC) Pulu v. Evans Et Al - Document No. 4Justia.comNo ratings yet