Professional Documents

Culture Documents

B) 1. Detroit Has A Higher NPV 2. The Net Cash Flow Is The Same For Both 3

Uploaded by

Aryan Madan0 ratings0% found this document useful (0 votes)

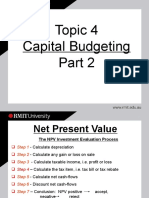

8 views3 pages1) Net present value (NPV) calculates the total discounted net cash flow of an investment minus the initial cost.

2) The document provides an example NPV calculation for a project with an initial cost of $850,000 and net cash flows of $240,000, $300,000, $350,000 and $350,000 over four years.

3) The calculated NPV for this project is $706,200, indicating it should be accepted since the NPV is positive.

Original Description:

Original Title

business 18 aug

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) Net present value (NPV) calculates the total discounted net cash flow of an investment minus the initial cost.

2) The document provides an example NPV calculation for a project with an initial cost of $850,000 and net cash flows of $240,000, $300,000, $350,000 and $350,000 over four years.

3) The calculated NPV for this project is $706,200, indicating it should be accepted since the NPV is positive.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views3 pagesB) 1. Detroit Has A Higher NPV 2. The Net Cash Flow Is The Same For Both 3

Uploaded by

Aryan Madan1) Net present value (NPV) calculates the total discounted net cash flow of an investment minus the initial cost.

2) The document provides an example NPV calculation for a project with an initial cost of $850,000 and net cash flows of $240,000, $300,000, $350,000 and $350,000 over four years.

3) The calculated NPV for this project is $706,200, indicating it should be accepted since the NPV is positive.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

b)

1. Detroit has a higher NPV

2. The net cash flow is the same for both

3.

1) Net present value is a value that calculates the total discounted net cash flow

minus the initial cost of an investment project.

2)

Year Net Cash Discoun Present

Flow t Factor Value

0 (850000)

1 240000 0.88 211200

2 300000 0.76 228000

3 350000 0.67 234500

4 350000 0.59 206500

Sum of present value- 211200+228000+234500+206500= 880200

Sum of net cash flow- 174000

NPV- 880200-174000= 706200

You might also like

- Cash+flow+estimation (14-1759)Document9 pagesCash+flow+estimation (14-1759)M shahjamal QureshiNo ratings yet

- Valuing Capital Investment ProjectsDocument16 pagesValuing Capital Investment ProjectsMetta AprilianaNo ratings yet

- Group 2 - Answers To QuestionsDocument2 pagesGroup 2 - Answers To QuestionsJr Roque100% (4)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Cash Flow Brigham SolutionDocument14 pagesCash Flow Brigham SolutionShahid Mehmood100% (4)

- Digital Electronics For Engineering and Diploma CoursesFrom EverandDigital Electronics For Engineering and Diploma CoursesNo ratings yet

- Break even Analysis Feasibility Study - Chapter 12 - مهمDocument11 pagesBreak even Analysis Feasibility Study - Chapter 12 - مهمwskrebNo ratings yet

- Calculations For Report 1 (Capital Budgeting) : Payback Period For Project ADocument5 pagesCalculations For Report 1 (Capital Budgeting) : Payback Period For Project ArubsrayliNo ratings yet

- Week 2 (Chapter 8) : Making Capital Investment DecisionsDocument30 pagesWeek 2 (Chapter 8) : Making Capital Investment Decisionsmaria akshathaNo ratings yet

- PC10 - Investment CriteriaDocument15 pagesPC10 - Investment CriteriaSyed InshanuzzamanNo ratings yet

- Benito Juhantyo Wibbowo 1714422056 NPVDocument6 pagesBenito Juhantyo Wibbowo 1714422056 NPVBenito JuhantyoNo ratings yet

- 3.3 Cashflow Estimation and Risk Analysis Data Tables, Goal Seek and Scenario Analysis ExcerciseDocument11 pages3.3 Cashflow Estimation and Risk Analysis Data Tables, Goal Seek and Scenario Analysis ExcerciseRaghavendra NaduvinamaniNo ratings yet

- Chap 05Document4 pagesChap 05Farooq HaiderNo ratings yet

- Accounting ExamDocument6 pagesAccounting Examgenn katherine gadunNo ratings yet

- Chapter 11 Mini Case: Cash Flow EstimationDocument60 pagesChapter 11 Mini Case: Cash Flow EstimationafiNo ratings yet

- FINA 3330 - Notes CH 9Document2 pagesFINA 3330 - Notes CH 9fische100% (1)

- DCF - QuestionsDocument7 pagesDCF - Questionsanon_747753998No ratings yet

- Lecture Notes Topic 4 Part 2Document34 pagesLecture Notes Topic 4 Part 2sir bookkeeperNo ratings yet

- Project ManagementDocument10 pagesProject ManagementcleousNo ratings yet

- Investment Decision - Techniques.Document4 pagesInvestment Decision - Techniques.Ashutosh AgrawalNo ratings yet

- Allied Food Products: A Case StudyDocument18 pagesAllied Food Products: A Case StudyMikey MadRatNo ratings yet

- Module 4 - Home Work SolutionDocument3 pagesModule 4 - Home Work Solutionntkt0408No ratings yet

- FM11 CH 11 Mini CaseDocument16 pagesFM11 CH 11 Mini CaseDora VidevaNo ratings yet

- Discussion:: 1. Explain How Capital Budgeting Can Impact On A Firm's Competitiveness 2Document4 pagesDiscussion:: 1. Explain How Capital Budgeting Can Impact On A Firm's Competitiveness 2Nishika KaranNo ratings yet

- Chapter 46 Investment AppraisalDocument4 pagesChapter 46 Investment AppraisalAbdur RafayNo ratings yet

- Lecfor12 19 20Document8 pagesLecfor12 19 20Laong laanNo ratings yet

- Engg. Economics ProjectDocument13 pagesEngg. Economics ProjectkawtharNo ratings yet

- Final Mock1 - AnswerDocument7 pagesFinal Mock1 - AnswerK58 Hà Phương LinhNo ratings yet

- Evaluating TechniquesDocument13 pagesEvaluating TechniquesMario YyyyNo ratings yet

- Use The Following Information To Answer Items 5 - 7Document4 pagesUse The Following Information To Answer Items 5 - 7acctg2012No ratings yet

- Final Discussion Part 2Document3 pagesFinal Discussion Part 2Yaga KanggaNo ratings yet

- CH 13Document6 pagesCH 13Agung PrabowoNo ratings yet

- Questions and Problems 5Document3 pagesQuestions and Problems 5Pepe Céspedes PeregrinaNo ratings yet

- Chapter 13 - Risk Analysis and Project Evaluating: Financial Management TaskDocument11 pagesChapter 13 - Risk Analysis and Project Evaluating: Financial Management TaskFaradibaNo ratings yet

- Financial Decision Making: Module Code: UMADFJ-15-MDocument9 pagesFinancial Decision Making: Module Code: UMADFJ-15-MFaraz BakhshNo ratings yet

- Kunci Tugas 9aDocument19 pagesKunci Tugas 9aKhoirun NisaaNo ratings yet

- Quiz 3Document14 pagesQuiz 3K L YEONo ratings yet

- Chapter 12. Tool Kit For Cash Flow Estimation and Risk AnalysisDocument4 pagesChapter 12. Tool Kit For Cash Flow Estimation and Risk AnalysisHerlambang PrayogaNo ratings yet

- Investment Outlays: Long-Term AssetsDocument12 pagesInvestment Outlays: Long-Term AssetsRimpy SondhNo ratings yet

- Ia T18 AnsDocument3 pagesIa T18 Ansckwai0603No ratings yet

- Isna Wirda Lutfiyah - 17 - 4-17Document10 pagesIsna Wirda Lutfiyah - 17 - 4-17DewaSatriaNo ratings yet

- Constructing A Capital Budget: File C5-241 August 2013 WWW - Extension.iastate - Edu/agdmDocument5 pagesConstructing A Capital Budget: File C5-241 August 2013 WWW - Extension.iastate - Edu/agdmBhavesh MaruNo ratings yet

- PaybackDocument3 pagesPaybackMd. Masudur Rahman MasumNo ratings yet

- Week 5 TutorialDocument8 pagesWeek 5 TutorialRenee WongNo ratings yet

- Project and Risk AnalysisDocument2 pagesProject and Risk AnalysisvipukNo ratings yet

- UTS AKM Novan TiwangDocument5 pagesUTS AKM Novan TiwangRigel RotinsuluNo ratings yet

- Solutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment DecisionsDocument12 pagesSolutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment Decisionshung TranNo ratings yet

- BBF 321Document10 pagesBBF 321sipanjegivenNo ratings yet

- UntitledDocument22 pagesUntitledWild PlatycodonNo ratings yet

- Unit 4 Lecture Activity 1 Depreciation Methods SolutionDocument5 pagesUnit 4 Lecture Activity 1 Depreciation Methods SolutionMisu NguyenNo ratings yet

- Tugas Kelompok Akuntansi Ke 4Document10 pagesTugas Kelompok Akuntansi Ke 4grup apa iniNo ratings yet

- Session - 048Document9 pagesSession - 048Abcdef GhNo ratings yet

- Profitability AnalysisDocument24 pagesProfitability AnalysisAnonymous 1P14SXhUNo ratings yet

- FIN Home Assigment AnswersDocument5 pagesFIN Home Assigment AnswersIkra MemonNo ratings yet

- Busn 233 CH 08Document101 pagesBusn 233 CH 08Pramod VasudevNo ratings yet

- CH 11 - CF Estimation Mini Case Sols Excel 14edDocument36 pagesCH 11 - CF Estimation Mini Case Sols Excel 14edأثير مخوNo ratings yet

- Ch11 ShowDocument63 pagesCh11 ShowMahmoud AbdullahNo ratings yet