Professional Documents

Culture Documents

Sample 4 Soalan Test PDF

Uploaded by

Emmy LizaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sample 4 Soalan Test PDF

Uploaded by

Emmy LizaCopyright:

Available Formats

CONFIDENTIAL 1 AC/SAMPLE/FAR110

UNIVERSITI TEKNOLOGI MARA

SAMPLE 4

COURSE : FINANCIAL ACCOUNTING 1

COURSE CODE : FAR110

EXAMINATION : SAMPLE

TIME : 1 HOUR 30 MINUTES

INSTRUCTIONS TO CANDIDATES

1. This question paper consists of four (4) sections.

2. Answer ALL questions in the Answer Booklet. Start each answer on a new page.

3. Do not bring any material into the examination room unless permission is given by the

invigilator.

4. Please check to make sure that this test pack consists of :

i) the Question Paper

ii) an Answer Booklet – provided by the Faculty

DO NOT TURN THIS PAGE UNTIL YOU ARE TOLD TO DO SO

This examination paper consists of 5 printed pages

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 2 AC/SAMPLE/FAR110

SECTION A

Part 1: MULTIPLE CHOICE QUESTIONS

This part consists of five (5) multiple-choice questions. Choose the most suitable

answer.

1. The economic resources of a business that are expected to provide future benefits to

the business are referred to as

A. owner’s equity

B. expenses

C. liabilities

D. assets

(1 mark)

2. Which of the following is NOT the purpose of accounting?

A. To provide financial information to the users.

B. To be used as a tool for performance evaluation.

C. To increase wealth of the users.

D. To assist management in controlling the business.

(1 mark)

3. The two (2) items that represent the decrease in owner’s equity are:

A. Capital and revenues

B. Revenues and expenses

C. Drawings and expenses

D. Capital and drawings

(1 mark)

4. Which of the following types of business organizations provides its owner with the

advantage of a limited legal liability in cases of insolvency?

A. Sole-proprietorship only

B. Partnership only

C. Company only

D. Sole-proprietorship and partnership only

(1 mark)

5 The following account balance are classified as assets EXCEPT

A. bank overdraft

B. fixed deposit

C. patents & trademarks

D. loan to an employee

(1 mark)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 3 AC/SAMPLE/FAR110

Part 2:

Hassan is the owner of a business dealing in sports equipment. He prepares the accounts of

the business on the assumption that the business will continue in operation for the

foreseeable future and he ensures that all his business transactions are recorded in terms of

Ringgit Malaysia (RM).

Required:

a. Identify TWO (2) accounting concepts applied in the above scenario.

(2 marks)

b. Explain the accounting concepts identified in (a) above.

(3 marks)

(Total: 10 marks)

SECTION B

Ali Baba decides to open a cleaning and laundry service near the PFI Campus of UiTM that

will operate as a sole proprietorship business.

Transactions:

(1) Ali Baba invests RM30,000 in cash to start a cleaning and laundry business on

January 1.

(2) Purchased equipment for RM20,000 paying RM5,000 in cash and the remainder will

be paid by installment of RM1,000 per month.

(3) Purchased supplies (detergent and fabric softener) for RM1,400 cash.

(4) Paid RM300 for advertising in the local newspaper.

(5) Cash receipts from customers for cleaning and laundry services amounted to

RM2,400.

(6) Purchased supplies (detergent and fabric softener) on account from ABC Sdn Bhd

amounted to RM2,000.

(7) Billed the Local Football Team RM1,000 for cleaning and laundry services.

(8) Paid RM500 to ABC Sdn Bhd for the purchased of supplies in Transaction 6.

(9) Ali Baba withdrew RM1,000 from the business for his living expenses.

The business uses the periodic inventory system to record the supplies.

Required:

Show the effects of the above transactions on the accounting equation using the following

format.

Example:

January 1: Received cash RM400 for the rental income.

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 4 AC/SAMPLE/FAR110

Date Assets = Liabilities + Owner’s Equity

Capital - Drawings + Revenue - Expenses

Jan1 + 400 +400

(Total: 10 marks)

SECTION C

DEF Enterprise, is a business selling books and stationeries owned by Daud Emir bin Fadli.

The following were account balances of DEF Enterprise as at 31 December 2014:

RM

Bank 28,950

Office Equipment 21,000

Stock of books and stationeries 30,500

Accounts receivable/Debtor: APlus Tuition Centre 8,000

Accounts payable/Creditor: Sasbadi Sdn Bhd 10,500

Capital ?

The following transactions occurred during the month of January 2015:

Jan 1 Returned books purchased from Sasbadi Sdn Bhd costing RM500 due to wrong

edition.

2 Purchased stationeries from Q Stationers Sdn Bhd on credit for RM8,500.

8 Sold books and stationeries for cash RM3,300.

10 Received a cheque of RM7,840 from APlus Tuition Center, having deducted RM160

cash discount.

14 Settled amount owed by cheque to Sasbadi Sdn Bhd and granted a 2% cash

discount.

20 Paid utilities bill by cash RM715.

23 Daud Emir took stationery worth RM250 for office used.

25 Paid Q Stationers RM3,000 by cheque.

The business uses the periodic inventory system to record the books and stationeries.

Required:

a. Prepare the three (3) column general ledger to record the above balances and

transactions.

b. Prepare a trial balance as at 31 Jan 2015.

(Total: 20 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 5 AC/SAMPLE/FAR110

SECTION D

On 31 Dec 2014, XYZ Trading has identified the following errors in its relevant ledger

accounts:

i. The general expense amounting to RM1,500 paid by cash had been

completely omitted in the journal and ledger.

ii. Received cash of RM720 from Ina for settlement of her account was debited

to cash and credited to Ani.

iii. A debit posting to accounts receivable for RM500 was omitted.

iv. A payment of accounts payable for RM1,600 was debited to cash and

credited to accounts payable.

v. The purchase of equipment on account for RM1,700 was recorded as a debit

to Repair Expense and a credit to Accounts Payable for RM1,700.

Required:

a. Identify the type of errors made in the books of XYZ Trading for the month of

December 2014 and indicate whether the trial balance will balance or the trial

balance is not balance for each of the errors above.

(5 marks)

b. Prepare the correcting entry (if any) that should be made in the general journal for

the above errors.

(5 marks)

(Total: 10 marks)

END OF QUESTION PAPER

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

You might also like

- Eco 162 Microeconomics PDFDocument22 pagesEco 162 Microeconomics PDFjungkook wifeNo ratings yet

- Dec2022 Acc117 Acc106 Test 1 QDocument6 pagesDec2022 Acc117 Acc106 Test 1 Qlailanurinsyirah abdulhalimNo ratings yet

- Tutorial 6 QDocument5 pagesTutorial 6 Qmei tanNo ratings yet

- Ais160 GProject Mac-Aug 2020Document3 pagesAis160 GProject Mac-Aug 2020Ahmad Arief0% (1)

- Img 0004Document4 pagesImg 0004velavanNo ratings yet

- Sta104 Tutorial 1Document3 pagesSta104 Tutorial 1Ahmad Aiman Hakimi bin Mohd Saifoul ZamzuriNo ratings yet

- Business Mathematics Tutorial Problems on Financial and Depreciation CalculationsDocument8 pagesBusiness Mathematics Tutorial Problems on Financial and Depreciation CalculationsNadya ShaminiNo ratings yet

- Eco 415 Apr07Document5 pagesEco 415 Apr07myraNo ratings yet

- Group Project Far670 7e VS MynewsDocument33 pagesGroup Project Far670 7e VS MynewsNurul Nadia MuhamadNo ratings yet

- The Effect of Different Quantities of Water Intake On Urine OutputDocument2 pagesThe Effect of Different Quantities of Water Intake On Urine OutputCikgu A. Kamil33% (3)

- BDEK1103 Introductory Microeconomics - Smay19 (Rs & MREP) PDFDocument227 pagesBDEK1103 Introductory Microeconomics - Smay19 (Rs & MREP) PDFAbu Hassan Anis AzuraNo ratings yet

- Arthur's First Day (Case Studies) - StaffingDocument2 pagesArthur's First Day (Case Studies) - StaffingSis LavenderNo ratings yet

- A181 Tutorial 2Document9 pagesA181 Tutorial 2Fatin Nur Aina Mohd Radzi33% (3)

- Pyq Acc 116Document7 pagesPyq Acc 116HaniraMhmdNo ratings yet

- Proposal csc264 Group Assingment 1 - CompressDocument22 pagesProposal csc264 Group Assingment 1 - CompressIsyraf AzriNo ratings yet

- Resume For SPM LeaversDocument2 pagesResume For SPM LeaversSharvin NallathambyNo ratings yet

- Acc106 Feb2021 Question Set 1Document15 pagesAcc106 Feb2021 Question Set 1Fara husna0% (1)

- Mind Maps MGT 162 (Chapter 1-5)Document4 pagesMind Maps MGT 162 (Chapter 1-5)Mohamad Norul Haziq Muzaffar Alfian100% (1)

- Munchys CompanyDocument18 pagesMunchys Company2023414494No ratings yet

- CSC134 (Past Year)Document7 pagesCSC134 (Past Year)muhammad haziqNo ratings yet

- Fin420 540Document11 pagesFin420 540Zam Zul0% (1)

- Lala Trading's Profit & Loss, Assets & Equity for 2018Document27 pagesLala Trading's Profit & Loss, Assets & Equity for 2018ummi sabrina100% (1)

- Investment and Interest Rates QuestionsDocument1 pageInvestment and Interest Rates Questionssyafiqah0% (1)

- Farm Fresh Group Assignment Analyzes Inventory ValuationDocument25 pagesFarm Fresh Group Assignment Analyzes Inventory ValuationWOO YOKE MEINo ratings yet

- Individual Assignment: Visualization 1Document5 pagesIndividual Assignment: Visualization 1Muhd FakhrullahNo ratings yet

- Question 4 JULY2020 MAF251Document5 pagesQuestion 4 JULY2020 MAF251Tengku Ed Tengku ANo ratings yet

- Solution Far410 Jun 2019Document9 pagesSolution Far410 Jun 2019Nabilah NorddinNo ratings yet

- Topic 2: Basic Accounting ConceptsDocument38 pagesTopic 2: Basic Accounting ConceptsShanti GunaNo ratings yet

- FOR SCIENCE LAB EXPERIMENTDocument35 pagesFOR SCIENCE LAB EXPERIMENTNoredah Jamiaan50% (2)

- Tutorial 11 Preparation of Financial Statements (Q)Document6 pagesTutorial 11 Preparation of Financial Statements (Q)lious liiNo ratings yet

- Partnership Accounting RecordsDocument17 pagesPartnership Accounting RecordsHaroon Khan100% (1)

- ZULKEPLI & CO Industrial Training ReportDocument66 pagesZULKEPLI & CO Industrial Training ReportJannah AhmadNo ratings yet

- MFRS 116 - PpeDocument26 pagesMFRS 116 - Ppeizzati zafirahNo ratings yet

- Tuisyen BiDocument134 pagesTuisyen BiwanieNo ratings yet

- Ayamas Group Objectives, Profile & CSRDocument14 pagesAyamas Group Objectives, Profile & CSRMizie MohdNo ratings yet

- MKT243 Marketing Portfolio ReportDocument17 pagesMKT243 Marketing Portfolio ReportIzlyn IzlyanaNo ratings yet

- FEB 2015 Maf151 Test 1Document3 pagesFEB 2015 Maf151 Test 1Aisyah Mohd YusreNo ratings yet

- Elc 231 Evaluative Commentary - Pair 5Document8 pagesElc 231 Evaluative Commentary - Pair 5Nurul Adira FaziraNo ratings yet

- TMC451 Sample - Skema JWPDocument2 pagesTMC451 Sample - Skema JWPraihana abdulkarimNo ratings yet

- Far160 (CT XXX 2022) QuestionDocument4 pagesFar160 (CT XXX 2022) QuestionFarah HusnaNo ratings yet

- Law485 Jan 2012Document4 pagesLaw485 Jan 2012Khairul Ridzuan Bin Malik0% (1)

- Kos Pelaksanaan Projek RM Jumlah Perbelanjaan Aset Bukan SemasaDocument5 pagesKos Pelaksanaan Projek RM Jumlah Perbelanjaan Aset Bukan SemasaNoor IrnawatiNo ratings yet

- Individual Assignment MKT 558 Ahmad HaikalDocument11 pagesIndividual Assignment MKT 558 Ahmad HaikalAhmad HaikalNo ratings yet

- Megan Media Company PresentationDocument13 pagesMegan Media Company PresentationNuruljannatulSyahiraNo ratings yet

- MarketingDocument2 pagesMarketingfatin aqilahNo ratings yet

- Assignment/ TugasanDocument9 pagesAssignment/ TugasanatiNo ratings yet

- Peka Report Experiment 4.8 Effects of Acid and Alkali On LatexDocument2 pagesPeka Report Experiment 4.8 Effects of Acid and Alkali On LatexHOOI PHING CHANNo ratings yet

- Paper 2 Section CDocument11 pagesPaper 2 Section CAnonymous MuCuTGd1aoNo ratings yet

- ECO211Document11 pagesECO211Mia KulalNo ratings yet

- Assignment May21 BDKM2103 Introductory Marketing CommunicationDocument10 pagesAssignment May21 BDKM2103 Introductory Marketing CommunicationSOBANAH A/P CHANDRAN STUDENTNo ratings yet

- Biography of Tan Sri Syed Mokhtar AlDocument2 pagesBiography of Tan Sri Syed Mokhtar AlNora MazminNo ratings yet

- Sqqs1013 Elementary Statistics (Group A) SECOND SEMESTER SESSION 2019/2020 (A192)Document13 pagesSqqs1013 Elementary Statistics (Group A) SECOND SEMESTER SESSION 2019/2020 (A192)Liew Chi ChiengNo ratings yet

- Family's Financial Planning RecommendationsDocument10 pagesFamily's Financial Planning RecommendationsMUHAMMAD NUR IMAN NOR AZLI100% (1)

- Elc501 Ak Jun2020 Online - Sub Set 1 (B)Document9 pagesElc501 Ak Jun2020 Online - Sub Set 1 (B)chaNo ratings yet

- Acc117 Test 2 July 2022 - Tapah BRS SSDocument3 pagesAcc117 Test 2 July 2022 - Tapah BRS SSNajmuddin AzuddinNo ratings yet

- Comment Test 2Document6 pagesComment Test 2AirasNo ratings yet

- D FAR110 Test Dec 2021 QuestionDocument6 pagesD FAR110 Test Dec 2021 QuestionNADIYATUL AMIRAH AHMAD NAZMINo ratings yet

- CT Far110 Apr2019 QuestionDocument5 pagesCT Far110 Apr2019 QuestionNurul HudaNo ratings yet

- D FAR110 Test Jun 2022 QuestionDocument6 pagesD FAR110 Test Jun 2022 QuestionNADIYATUL AMIRAH AHMAD NAZMINo ratings yet

- Far110 (Q) Sep 2014 MelDocument12 pagesFar110 (Q) Sep 2014 MelAlieyaaNo ratings yet

- Section BDocument2 pagesSection BEmmy LizaNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Codes Quiz Assignment Test FAR110 ECO162 MGT162Document2 pagesCodes Quiz Assignment Test FAR110 ECO162 MGT162Emmy LizaNo ratings yet

- Soalan Matematik 1Document6 pagesSoalan Matematik 1Emmy LizaNo ratings yet

- The Beggar's Opera by Gay, John, 1685-1732Document50 pagesThe Beggar's Opera by Gay, John, 1685-1732Gutenberg.orgNo ratings yet

- CB4 BBC Interviews EXTRA UnitDocument1 pageCB4 BBC Interviews EXTRA UnitCristianNo ratings yet

- A Report On Kantajew MandirDocument21 pagesA Report On Kantajew MandirMariam Nazia 1831388030No ratings yet

- HonorDishonorProcess - Victoria Joy-1 PDFDocument126 pagesHonorDishonorProcess - Victoria Joy-1 PDFarjay1266100% (3)

- MOW Procurement Management Plan - TemplateDocument7 pagesMOW Procurement Management Plan - TemplateDeepak RajanNo ratings yet

- Batt ChargerDocument2 pagesBatt Chargerdjoko witjaksonoNo ratings yet

- Teaching Vocabulary Through TPR Method ToDocument41 pagesTeaching Vocabulary Through TPR Method ToAan Safwandi100% (3)

- Danbury BrochureDocument24 pagesDanbury BrochureQuique MartinNo ratings yet

- V14 EngDocument8 pagesV14 EngJamil PavonNo ratings yet

- Summarised Maths Notes (Neilab Osman)Document37 pagesSummarised Maths Notes (Neilab Osman)dubravko_akmacicNo ratings yet

- Audio Narration SINGLE Slide: Google Form in The Discussion ForumDocument2 pagesAudio Narration SINGLE Slide: Google Form in The Discussion Forumfast sayanNo ratings yet

- Temenos Brochure - FormpipeDocument5 pagesTemenos Brochure - FormpipeDanial OngNo ratings yet

- Bai Tap Bo TroDocument6 pagesBai Tap Bo TroKhiết TrangNo ratings yet

- TLM4ALL@1 Number System (EM)Document32 pagesTLM4ALL@1 Number System (EM)jkc collegeNo ratings yet

- Top-Down DesignDocument18 pagesTop-Down DesignNguyễn Duy ThôngNo ratings yet

- Malabsorption and Elimination DisordersDocument120 pagesMalabsorption and Elimination DisordersBeBs jai SelasorNo ratings yet

- MINTZBERGDocument32 pagesMINTZBERGgeezee10004464100% (2)

- Document 25Document455 pagesDocument 25Pcnhs SalNo ratings yet

- Transformers Obj Questions PDFDocument8 pagesTransformers Obj Questions PDFphaniputta100% (2)

- Reprocessing Guide: Shaver Handpiece TrayDocument198 pagesReprocessing Guide: Shaver Handpiece TrayAnne Stephany ZambranoNo ratings yet

- Coffee TestDocument6 pagesCoffee TestAmit Satyen RaviNo ratings yet

- M.Sc. Agriculture (Agronomy)Document23 pagesM.Sc. Agriculture (Agronomy)Abhishek MauryaNo ratings yet

- JMPRTraininga I5545e PDFDocument500 pagesJMPRTraininga I5545e PDFmvptoxNo ratings yet

- Financial ManagementDocument2 pagesFinancial ManagementSanna KazmiNo ratings yet

- Heather Bianco 2016 Resume Revised PDFDocument3 pagesHeather Bianco 2016 Resume Revised PDFapi-316610725No ratings yet

- European Journal of Internal MedicineDocument4 pagesEuropean Journal of Internal Medicinesamer battatNo ratings yet

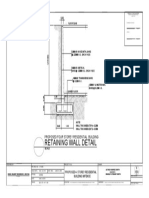

- Retaining Wall DetailsDocument1 pageRetaining Wall DetailsWilbert ReuyanNo ratings yet

- NST 021 Orientation SASDocument5 pagesNST 021 Orientation SASLady Mae AguilarNo ratings yet

- Engr2227 Apr03Document10 pagesEngr2227 Apr03Mohamed AlqaisiNo ratings yet

- BTEC International Level 3 IT Pearson Set Assignment Unit 11 Cyber SecurityDocument8 pagesBTEC International Level 3 IT Pearson Set Assignment Unit 11 Cyber SecurityGergana Stamenova100% (1)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesFrom EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesRating: 5 out of 5 stars5/5 (4)

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)From EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Rating: 4.5 out of 5 stars4.5/5 (24)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementFrom EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementRating: 4.5 out of 5 stars4.5/5 (20)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageFrom EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageRating: 4.5 out of 5 stars4.5/5 (109)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)