Professional Documents

Culture Documents

Investment and Interest Rates Questions

Uploaded by

syafiqahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investment and Interest Rates Questions

Uploaded by

syafiqahCopyright:

Available Formats

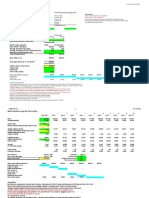

QUESTION 1

a) On 27 October 2018, Ruby Gem invested RM63,000 into an investment scheme at r% per annum

interest rate in 100 days. Through this investment, she earned an interest amount of RM1,750. Find:

i) the maturity date (3M) 4 Feb 2019

ii) the simple interest rate (r%) by using the Banker’s Rule (2M) 10%

iii) the simple amount received at the end of her investment period. (2M) RM64750

b) On 6 March 2014, RM Z was invested at a simple interest rate of 5% per annum. RM6,375 was

withdrawn on 6 March 2018 and the balance in the account was RM11,625. Calculate the value of Z.

(3M) RM15000

QUESTION 2

Fatimah received a 130-day promissory note at 8% simple interest per annum on 23 July 2018 from

Haisya. However, after 90 days, Fatimah sold the note to a bank at discount rate of 6% and received

proceeds of RM6,000. Determine:

a) the payee (1M)

b) the maturity date (3M) 30 Nov 2018

c) the maturity value (2M) RM6040.27

d) the face value (2M) RM5870.67

e) the amount of interest received by Fatimah (2M) RM129.33

QUESTION 3

Ten years ago, RMX was invested in a bank account that paid an interest rate of 7% compounded

annually. If the amount in the account today is RM15,737.21.

a) Find the value of X (3M) RM8000.00

b) If another RM4,000 is added into the same account today, find the total amount in the account after three

years. (3M) RM21178.93

c) Find the future value of RM 3,400 invested for 30 months at 6.3% compounded monthly. Calculate the

total interest earned. (5 marks) RM3978.33/ RM578.34

c) Ilham wants to make a loan of RM 7,000 for 2 years. He has two options.

Bank A charges 6% interest compounded monthly.

Bank B charges 6.5% interest compounded quarterly.

Which bank should he choose? Give your reason. (5M)

You might also like

- Pad104 Group Assignment - Introduction To Malaysian Public PolicyDocument19 pagesPad104 Group Assignment - Introduction To Malaysian Public PolicyHwang Ae Ri100% (1)

- Dec2022 Acc117 Acc106 Test 1 QDocument6 pagesDec2022 Acc117 Acc106 Test 1 Qlailanurinsyirah abdulhalimNo ratings yet

- Acc116 165 211Document6 pagesAcc116 165 211Mustaqim MustaphaNo ratings yet

- NEW TUTORIAL INSTALMENT PURCHASES - AnsSchemeDocument7 pagesNEW TUTORIAL INSTALMENT PURCHASES - AnsSchemeDiana Yunus DianaNo ratings yet

- Tax317 Group Project SSTDocument23 pagesTax317 Group Project SSTNik Syarizal Nik MahadhirNo ratings yet

- FEB 2015 Maf151 Test 1Document3 pagesFEB 2015 Maf151 Test 1Aisyah Mohd YusreNo ratings yet

- Lecture Tutorial - P, CL and CA (A)Document3 pagesLecture Tutorial - P, CL and CA (A)yym cindyy100% (1)

- Business Mathematics Tutorial Problems on Financial and Depreciation CalculationsDocument8 pagesBusiness Mathematics Tutorial Problems on Financial and Depreciation CalculationsNadya ShaminiNo ratings yet

- Eco 261 - Chapter 3Document14 pagesEco 261 - Chapter 3Izhan Abd RahimNo ratings yet

- Mat112 Sept - 2014Document7 pagesMat112 Sept - 2014Nara SakuraNo ratings yet

- Far160 (CT XXX 2022) QuestionDocument4 pagesFar160 (CT XXX 2022) QuestionFarah HusnaNo ratings yet

- CHAPTER 1 mgt162Document20 pagesCHAPTER 1 mgt162Wani HaziqahNo ratings yet

- Assignment Far 110 UitmDocument56 pagesAssignment Far 110 UitmFarah HusnaNo ratings yet

- Hak Clothing Assignment Far110Document44 pagesHak Clothing Assignment Far1101ANurul AnisNo ratings yet

- Munchys CompanyDocument18 pagesMunchys Company2023414494No ratings yet

- Chapter 2 - Bank Negara Malaysia (BNM)Document44 pagesChapter 2 - Bank Negara Malaysia (BNM)Nur HazirahNo ratings yet

- Eco162 Assignment Group ReportDocument7 pagesEco162 Assignment Group ReportAmirah MaisarahNo ratings yet

- Bbaw2103 Financial AccountingDocument15 pagesBbaw2103 Financial AccountingSimon RajNo ratings yet

- MALAYSIA TOURISM PROMOTION STRATEGIESDocument7 pagesMALAYSIA TOURISM PROMOTION STRATEGIESmeeyaNo ratings yet

- Eco - 162 - Teaching - Materials - Topic 1 - 3Document53 pagesEco - 162 - Teaching - Materials - Topic 1 - 3Atiqah RazakNo ratings yet

- Elc231 Mid Sem Test June2020 Set1 PDFDocument6 pagesElc231 Mid Sem Test June2020 Set1 PDFNURUL AIN IZZATI BINTI MUHAMAD ZAILAN SOVILINUSNo ratings yet

- Trade and Cash Discount MAT112Document2 pagesTrade and Cash Discount MAT112syafiqahNo ratings yet

- Mind Maps MGT 162 (Chapter 1-5)Document4 pagesMind Maps MGT 162 (Chapter 1-5)Mohamad Norul Haziq Muzaffar Alfian100% (1)

- Chapter 2 Mgt162Document15 pagesChapter 2 Mgt162Farahain MasriNo ratings yet

- Elc 231 Evaluative Commentary - Pair 5Document8 pagesElc 231 Evaluative Commentary - Pair 5Nurul Adira FaziraNo ratings yet

- ECO211Document11 pagesECO211Mia KulalNo ratings yet

- D FAR110 Test Jun 2022 QuestionDocument6 pagesD FAR110 Test Jun 2022 QuestionNADIYATUL AMIRAH AHMAD NAZMINo ratings yet

- MUET: Short Essay (Sample)Document1 pageMUET: Short Essay (Sample)Syahirah SharumNo ratings yet

- ACCOUNTING SIMULATION REPORTDocument50 pagesACCOUNTING SIMULATION REPORTNUR NAJIBAH BINTI MOHAMAD SHAHRINNo ratings yet

- Acc117 Test 2 July 2022 - Tapah BRS SSDocument3 pagesAcc117 Test 2 July 2022 - Tapah BRS SSNajmuddin AzuddinNo ratings yet

- Fin420 540Document11 pagesFin420 540Zam Zul0% (1)

- Inflation Only ECO120Document7 pagesInflation Only ECO120Nxnx Celup100% (1)

- Tutorial 11 Preparation of Financial Statements (Q)Document6 pagesTutorial 11 Preparation of Financial Statements (Q)lious liiNo ratings yet

- Ayamas Group Objectives, Profile & CSRDocument14 pagesAyamas Group Objectives, Profile & CSRMizie MohdNo ratings yet

- Template Final Report Fpa210 - AnisahDocument83 pagesTemplate Final Report Fpa210 - AnisahZetty JamalNo ratings yet

- Chapter 1 211Document13 pagesChapter 1 211Nazirul SafwatNo ratings yet

- Short Term Decision Making: Management Accounting & ControlDocument36 pagesShort Term Decision Making: Management Accounting & ControlNur Hidayatul ShafiqahNo ratings yet

- Tutorial 6 QDocument5 pagesTutorial 6 Qmei tanNo ratings yet

- MGT162 - 4 Organizing Jan 2016Document69 pagesMGT162 - 4 Organizing Jan 2016Shah Reall100% (2)

- Topic 2: Basic Accounting ConceptsDocument38 pagesTopic 2: Basic Accounting ConceptsShanti GunaNo ratings yet

- MFRS110 Events of Malaysian CompaniesDocument34 pagesMFRS110 Events of Malaysian CompaniesMeena SyadaNo ratings yet

- Group Project Far670 7e VS MynewsDocument33 pagesGroup Project Far670 7e VS MynewsNurul Nadia MuhamadNo ratings yet

- Mkt243 Chapter 8Document13 pagesMkt243 Chapter 8Bibi Shafiqah Akbar ShahNo ratings yet

- MKT243 Mind MapDocument1 pageMKT243 Mind MapNurul IzzahNo ratings yet

- Usage of Smartphones Among UiTM StudentsDocument2 pagesUsage of Smartphones Among UiTM StudentsAzyan Farhana Adham100% (1)

- FOR SCIENCE LAB EXPERIMENTDocument35 pagesFOR SCIENCE LAB EXPERIMENTNoredah Jamiaan50% (2)

- New Edit Acc 3Document16 pagesNew Edit Acc 3MUAZ IZZUDDIN ZAMSARINo ratings yet

- STA104-written Repot ExampleDocument20 pagesSTA104-written Repot ExampleYaya annNo ratings yet

- Group Assignment: Bibliographic Citations Due DateDocument2 pagesGroup Assignment: Bibliographic Citations Due DateEvie IzzatiNo ratings yet

- Controlling Material Structure for Desired PropertiesDocument3 pagesControlling Material Structure for Desired PropertiesNorazilah YunusNo ratings yet

- Nota Pengantar Statistik Bab 2Document49 pagesNota Pengantar Statistik Bab 2s12617880% (5)

- Ais205 June 23Document7 pagesAis205 June 23ediza adha0% (1)

- MFRS 116 - PpeDocument26 pagesMFRS 116 - Ppeizzati zafirahNo ratings yet

- Haji K Trading SIEP ReportDocument13 pagesHaji K Trading SIEP ReportfathinNo ratings yet

- COMMUNICATION BARRIERS AND OVERCOMING THEMDocument12 pagesCOMMUNICATION BARRIERS AND OVERCOMING THEMYusznoorryta100% (1)

- Fin 242 FullDocument5 pagesFin 242 FullIzzaty AffrinaNo ratings yet

- FELDA Fraud InvestigationDocument9 pagesFELDA Fraud Investigationfahfuhfeh fuhfahfehNo ratings yet

- Law of Contract Analysis of Pot SaleDocument3 pagesLaw of Contract Analysis of Pot Salefardeen khanNo ratings yet

- UTM Final Assessment Questions AnswersDocument6 pagesUTM Final Assessment Questions AnswersINTAN NOOR AMIRA ROSDINo ratings yet

- MAT037 Assignment 2 Questions and FormulasDocument4 pagesMAT037 Assignment 2 Questions and FormulasAdriana RoslyNo ratings yet

- Assignment ACC106Document8 pagesAssignment ACC106syafiqahNo ratings yet

- ACC106 Assignment AccountDocument5 pagesACC106 Assignment AccountsyafiqahNo ratings yet

- Acc TransactionsDocument2 pagesAcc TransactionssyafiqahNo ratings yet

- Trade and Cash Discount MAT112Document2 pagesTrade and Cash Discount MAT112syafiqahNo ratings yet

- Chapter 6 Designing Global Supply Chain NetworksDocument22 pagesChapter 6 Designing Global Supply Chain NetworksRashadafaneh100% (1)

- Sunsystems - 6.4.x Financials AdministrationDocument400 pagesSunsystems - 6.4.x Financials Administrationeverboqaileh mohNo ratings yet

- Solution To E4-8&10Document4 pagesSolution To E4-8&10Adam100% (1)

- 10 Short Term Bank Loans and Other S-T FinancingDocument33 pages10 Short Term Bank Loans and Other S-T FinancingMohammad DwidarNo ratings yet

- Nuru Ethiopia Final Audit Report 2019Document22 pagesNuru Ethiopia Final Audit Report 2019Elias Abubeker AhmedNo ratings yet

- Chapter 4 Solutions Time Value of MoneyDocument16 pagesChapter 4 Solutions Time Value of MoneyHạng VũNo ratings yet

- This Study Resource Was: UP Junior Philippine Institute of Accountants Education and Research CommitteeDocument7 pagesThis Study Resource Was: UP Junior Philippine Institute of Accountants Education and Research CommitteeGervinBulataoNo ratings yet

- A.P.S Iapm Unit 4Document21 pagesA.P.S Iapm Unit 4Mamata ThakuraiNo ratings yet

- Damodaran ValuationDocument99 pagesDamodaran Valuationmarklen100% (1)

- 1 Mathematics (Gr.9) T1 W1 & 2 Lesson PlanDocument41 pages1 Mathematics (Gr.9) T1 W1 & 2 Lesson PlanZawolfNo ratings yet

- Chapter 3 Foreign Exchange Exposure & Risk ManagementDocument50 pagesChapter 3 Foreign Exchange Exposure & Risk Managementvaibhavrs22.pumbaNo ratings yet

- Basic Principles of Managerial EconomicsDocument12 pagesBasic Principles of Managerial Economicsभारद्धाज पवनNo ratings yet

- Comparing Investment Rates and Calculating Present ValuesDocument36 pagesComparing Investment Rates and Calculating Present ValuesMark Smith100% (1)

- Chapter 1 - Fundamental Financial Management Concepts (Student's Copy)Document23 pagesChapter 1 - Fundamental Financial Management Concepts (Student's Copy)Julie Mae Caling MalitNo ratings yet

- 3chapter Three FM ExtDocument19 pages3chapter Three FM ExtTIZITAW MASRESHANo ratings yet

- Sir. Shabir Ahmad Tariq Aziz: Supervised byDocument52 pagesSir. Shabir Ahmad Tariq Aziz: Supervised byMohib Ullah YousafzaiNo ratings yet

- Notes Payable and Debt Restructuring EssentialsDocument39 pagesNotes Payable and Debt Restructuring EssentialsJoshua Cabinas100% (1)

- Tetley Brand Valuation Spreadsheets Blank 2022 23Document2 pagesTetley Brand Valuation Spreadsheets Blank 2022 23Kanika SubbaNo ratings yet

- Year Project A Project B: Total PV NPVDocument19 pagesYear Project A Project B: Total PV NPVChin EENo ratings yet

- Chapter-16 Company AccountsDocument23 pagesChapter-16 Company AccountsAmruta JadhavNo ratings yet

- Jmfl-Policybazaar Ic 161121Document31 pagesJmfl-Policybazaar Ic 161121Santosh RoutNo ratings yet

- Maximizing Shareholder Wealth Key to Financial ManagementDocument28 pagesMaximizing Shareholder Wealth Key to Financial ManagementDnyan JadhavNo ratings yet

- Corporate Finance Academic Year 2011-2012 TutorialsDocument21 pagesCorporate Finance Academic Year 2011-2012 TutorialsSander Levert100% (1)

- Valuation and Rates of Return: Powerpoint Presentation Prepared by Michel Paquet, SaitDocument41 pagesValuation and Rates of Return: Powerpoint Presentation Prepared by Michel Paquet, SaitArundhati SinhaNo ratings yet

- FIN303 Exam-Type Questions For Midterm 2Document10 pagesFIN303 Exam-Type Questions For Midterm 2bi2345No ratings yet

- Tools of Working CapitalDocument34 pagesTools of Working CapitalShiva Prasad33% (3)

- Basics PDFDocument19 pagesBasics PDFGriffith GohNo ratings yet

- FRM ErrataDocument6 pagesFRM Erratapeieng0409No ratings yet

- IA Terminal Output 1Document8 pagesIA Terminal Output 1Jannefah Irish Saglayan100% (1)

- CPAR-CHAPTER 17 INVESTMENTS TRUE-FALSE AND MULTIPLE CHOICE QUESTIONSDocument38 pagesCPAR-CHAPTER 17 INVESTMENTS TRUE-FALSE AND MULTIPLE CHOICE QUESTIONSRhedeline LugodNo ratings yet