Professional Documents

Culture Documents

Module 4 - Capital Financing

Uploaded by

Aron H OcampoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 4 - Capital Financing

Uploaded by

Aron H OcampoCopyright:

Available Formats

Chapter 4.

CAPITAL FINANCING

©2017 Batangas State University

1

Introduction

Business run on money. Capital is more the just money. Capital financing

refers to methods you use to raise money in launching your business. Your

business can have several types of capital such as financial, human and

even natural capital.

Financial capital keep your business running. After you start earning a

profit, some of your capital comes from your revenues. If your business

starting small or you have deep pockets, you may be able to survive with

your own resources.

In this chapter, we were able to determine the types of business

organization, the types of bonds and its application.

2 ©2017 Batangas State University

Learning Objectives

• Explain the advantages and

disadvantages of different types

of business organizations

• Discuss the classification of

bonds

3 ©2017 Batangas State University

Financing

Equity and Borrowed Capital

Equity capital or ownership funds are those supplied

and used by the owners of an enterprise in the

expectation that a profit will be earned.

Borrowed funds or capital are those supplied by

others on which a fixed rate of interest must be paid

and the debt must be repaid at a specific time.

4 ©2017 Batangas State University

Types of Business Organizations

A. Individual Ownership

The individual ownership or sole proprietorship is the

simplest form of business organization, wherein a

person uses his or her own capital to establish a

business and is the sole owner.

5 ©2017 Batangas State University

Types of Business Organizations

Advantages of the Individual Ownership

1. It is easy to organize.

2. The owner has full control of the enterprise.

3. The owner is entitled to whatever benefits and

profits that accrue from the business.

4. It is easy to dissolve.

6 ©2017 Batangas State University

Types of Business Organizations

Disadvantages of the Individual Ownership

1. The amount of equity capital which can be

accumulated is limited.

2. The organization ceases upon the death of the

owner.

3. It is difficult to obtain borrowed capital, owing to

the uncertainty

4. The liability of the owner for his debts is unlimited.

7 ©2017 Batangas State University

Types of Business Organizations

B. The Partnership

A partnership is an association of two or more

persons for the purpose of engaging in a business for

profit.

8 ©2017 Batangas State University

Types of Business Organizations

Advantages of the Partnership

1. More capital may be obtained by the partners pooling their

resources together.

2. It is bound by few legal requirements as to its accounts,

procedures, tax forms and other items of operation.

3. Dissolution of the partnership may take place at any time by

more agreement of partners.

4. It provides an easy method whereby two or more persons of

differing talents may enter into business, each carrying those

burdens that he can best handle.

9 ©2017 Batangas State University

Types of Business Organizations

Disadvantages of the Partnership

1. The amount of capital that can be accumulated is definitely

limited.

2. The life of the partnership is determined by the life of the

individual partners. When any partner dies, the partnership

automatically ends.

3. There may be serious disagreement among the individual

partners.

4. Each partners is liable for the debts of the partnership.

10 ©2017 Batangas State University

Types of Business Organizations

C. The Corporation

A corporation is a distinct legal entity, separate from the

individuals who own it, and which can engage in almost any

type of business transaction in which a real person could

occupy himself or herself.

11 ©2017 Batangas State University

Types of Business Organizations

Advantages of the Corporation

1. It enjoys perpetual life without regard to any change in the

person of its owners, the stockholders.

2. The stockholders of the corporation are not liable for the

debts of the corporation.

3. It is relatively easier to obtain large amount of money for

expansion, due to its perpetual life.

4. The ownership in the corporation is readily transferred.

5. Authority is easily delegated by the hiring of managers.

12 ©2017 Batangas State University

Types of Business Organizations

Disadvantages of the Corporation

1. The activities of a corporation are limited to those stated in

its charter.

2. It is relatively complicated in formation and administration.

3. There is a greater degree of governmental control as

compared to other types of business organizations.

13 ©2017 Batangas State University

Source of Capital for Business Organization

Capitalization of a Corporation

The capital of a corporation is acquired through the sale of

stock. There are two principal types of capital stock: common

stock and preferred stock.

14 ©2017 Batangas State University

Source of Capital for Business Organization

Common Stock

Common stock represents ordinary ownership without special guarantees of

return. Common stockholders have certain legal rights, among which are the

following:

1. Vote at stockholder's meeting.

2. Elect directors and delegates to them power to conduct the affairs of the

business.

3. Sell or dissolve the corporation.

4. Make and amend the by laws of the corporation.

5. Subject to government approval, amend, or change the charter or capital

structure.

6. Participate in the profits.

7. Inspect the books of the corporation.

15 ©2017 Batangas State University

Source of Capital for Business Organization

Preferred Stock

Preferred stock are guaranteed a define dividend on their

stocks. In case the corporation is dissolved, the assets must

be used to satisfy the claims of the preferred stockholders

before those of the holders of the common stock. Preferred

stockholders usually have the right to vote in meetings, but

not always.

16 ©2017 Batangas State University

Financing with Bonds

A bond is a certificate of indebtness of a corporation usually for a

period not less than ten years and guaranteed by a mortgage on certain

assets of the corporation or its subsidiaries. Bonds are issued when

there is need for more capital such as for expansion of the plant or the

services rendered by the corporation.

The face or par value of a bond is the amount stated on the bond.

When the face value has been repaid, the bond is said to have been

retired or redeemed. The bond rate is the interest rate quoted on the

bond.

17 ©2017 Batangas State University

Financing with Bonds

Classification of Bonds

1. Registered bonds. The name of the owner of this bond is

recorded on the record books of the corporation and interest

payments are sent to the owner periodically without any action

on his part.

2. Coupon Bonds. Coupon bond have coupon attached to the

bond for each interest payment that will come due during the

life of the bond. The owner of the bond can collect the interest

due by surrendering the coupon to the offices of the corporation

or at specified banks.

18 ©2017 Batangas State University

Financing with Bonds

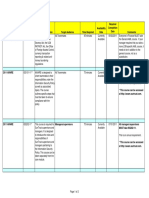

Methods of Bond Retirement

1. The corporation may issue another set of bonds equal to the

amount of bonds due for redemption.

2. The corporation may set up a sinking fund into which

periodic deposits of equal amount are made. The accumulated

amount in the sinking fund is equal to the amount needed to

retire the bonds at the time they are due.

19 ©2017 Batangas State University

Financing with Bonds

Methods of Bond Retirement

20 ©2017 Batangas State University

Financing with Bonds

Examples

21 ©2017 Batangas State University

Financing with Bonds

22 ©2017 Batangas State University

Financing with Bonds

23 ©2017 Batangas State University

Financing with Bonds

24 ©2017 Batangas State University

Financing with Bonds

25 ©2017 Batangas State University

Financing with Bonds

26 ©2017 Batangas State University

Chapter Test

27 ©2017 Batangas State University

You might also like

- 02 Handout 1Document6 pages02 Handout 1Rey Visitacion MolinaNo ratings yet

- Chapter 4 Business Plan EntitiesDocument18 pagesChapter 4 Business Plan EntitieszulieyanaNo ratings yet

- LLC: A Complete Guide To Limited Liability Companies And Setting Up Your Own LLCFrom EverandLLC: A Complete Guide To Limited Liability Companies And Setting Up Your Own LLCNo ratings yet

- Finance and Budgetting DestinyDocument9 pagesFinance and Budgetting DestinyEdeh chikamma DestinyNo ratings yet

- Sources of Long and Short Term FinanceDocument23 pagesSources of Long and Short Term FinanceNishant TutejaNo ratings yet

- Unit - 3Document22 pagesUnit - 3naveennanni988No ratings yet

- Financial ManagementDocument12 pagesFinancial ManagementRohit GoyalNo ratings yet

- DocumentDocument3 pagesDocumentShariine BestreNo ratings yet

- Meaning of Financial Management: (A) To Ensure Availability of Sufficient Funds at Reasonable Cost (Liquidity)Document10 pagesMeaning of Financial Management: (A) To Ensure Availability of Sufficient Funds at Reasonable Cost (Liquidity)Rana AhmedNo ratings yet

- Finance PointersDocument8 pagesFinance PointersMgrace arendaknNo ratings yet

- UCU 104 Lesson 6Document19 pagesUCU 104 Lesson 6Matt HeavenNo ratings yet

- Chapter 4 Legal Issues For EntrepreneurshipDocument24 pagesChapter 4 Legal Issues For EntrepreneurshipKariuki CharlesNo ratings yet

- Corporate Law I AssignmentDocument11 pagesCorporate Law I AssignmentSaurabh YadavNo ratings yet

- Worksheet - Business Ethics12 Week 1Document5 pagesWorksheet - Business Ethics12 Week 1RanielJohn GutierrezNo ratings yet

- 5FC004 - John Budha Magar - 2054155Document12 pages5FC004 - John Budha Magar - 2054155Saim KhanNo ratings yet

- Mcom Final Internship BankDocument13 pagesMcom Final Internship BankRahul D LekshmanNo ratings yet

- Entrepreneurship MGT-3103: BS (Chemistry) - 2 SemesterDocument11 pagesEntrepreneurship MGT-3103: BS (Chemistry) - 2 SemesterLectures On-lineNo ratings yet

- Las in Org MGT Week4Document9 pagesLas in Org MGT Week4sarah fojasNo ratings yet

- Business - Associations - by - Ssozi RajjabuDocument82 pagesBusiness - Associations - by - Ssozi RajjabuNAYIGA DEMITNo ratings yet

- CH 02 - Business, Trade - Commecer AkDocument13 pagesCH 02 - Business, Trade - Commecer AkArundhoti MukherjeeNo ratings yet

- Business Finance Reviewer 1Document12 pagesBusiness Finance Reviewer 1John Delf GabrielNo ratings yet

- La Salette of Roxas College IncDocument4 pagesLa Salette of Roxas College IncThe PsychoNo ratings yet

- Chapter Five Forms of Business Organizations Expected Learning OutcomesDocument33 pagesChapter Five Forms of Business Organizations Expected Learning OutcomesAlvin KoechNo ratings yet

- Topic Five-Forms of Business OrganizationsDocument33 pagesTopic Five-Forms of Business OrganizationsAlvin KoechNo ratings yet

- 4 Form of OrganisationDocument35 pages4 Form of OrganisationSeiya KapahiNo ratings yet

- Principles Tools ND TechniuesDocument3 pagesPrinciples Tools ND TechniuesMonica Bechayda RosalesNo ratings yet

- Asses The Various Methods Through Which Organization Access Funding and When To Use Different Types of FundingDocument11 pagesAsses The Various Methods Through Which Organization Access Funding and When To Use Different Types of FundingAhmad Sheikh100% (1)

- Law On Partnership Lecture NotesDocument27 pagesLaw On Partnership Lecture NotesJoanne Gonzales JuntillaNo ratings yet

- Financing of Entrepreneurial VentureDocument19 pagesFinancing of Entrepreneurial VentureKshitiz RawalNo ratings yet

- ME-Module-10-Organization-of-Firms StudentsDocument8 pagesME-Module-10-Organization-of-Firms StudentsAngelica PallarcaNo ratings yet

- 07 Capital FinancingDocument19 pages07 Capital FinancingMitch TechsNo ratings yet

- Chapter 4 and 5 Forms of Business Org., Types of Business Org.Document33 pagesChapter 4 and 5 Forms of Business Org., Types of Business Org.Ian SumastreNo ratings yet

- CH 02 - Business, Trade - Commecer AkDocument17 pagesCH 02 - Business, Trade - Commecer AkArundhoti MukherjeeNo ratings yet

- Debt or Equity FinancingDocument17 pagesDebt or Equity Financingrachanase70% (1)

- Financial Statements and Decision Making: Cornerstones of Financial Accounting, Second Canadian EditionDocument62 pagesFinancial Statements and Decision Making: Cornerstones of Financial Accounting, Second Canadian Edition时家欣No ratings yet

- Mechanisms For Financing New Cooperatives 2Document24 pagesMechanisms For Financing New Cooperatives 2Edleen Agarao-BulanNo ratings yet

- Orgman W4 PDFDocument6 pagesOrgman W4 PDFCent BNo ratings yet

- Manajemen Keuangan Lanjutan - Tugas Minggu 1Document7 pagesManajemen Keuangan Lanjutan - Tugas Minggu 1NadiaNo ratings yet

- 7.1. Source of Project FinanceDocument7 pages7.1. Source of Project FinanceTemesgenNo ratings yet

- Bus. Finance 2. Final 2.Document9 pagesBus. Finance 2. Final 2.Gia PorqueriñoNo ratings yet

- Ethel Business FinanceDocument8 pagesEthel Business FinancePatrick ChibabulaNo ratings yet

- Company Law Assignment: Topic: Formation of A Joint Stock Company Submitted ToDocument14 pagesCompany Law Assignment: Topic: Formation of A Joint Stock Company Submitted ToRishabh RastogiNo ratings yet

- BE 121 - Week 6-7 - ULO ADocument8 pagesBE 121 - Week 6-7 - ULO ALovely Jean LopezNo ratings yet

- Company Law 2013Document191 pagesCompany Law 2013Vetri Velan100% (1)

- Aditi Vyas 2nd Sem FM ProjectDocument14 pagesAditi Vyas 2nd Sem FM ProjectVipul SolankiNo ratings yet

- Corporate Finance and Project 2Document10 pagesCorporate Finance and Project 2Legal CorpusNo ratings yet

- Chapter-5 (JSC)Document8 pagesChapter-5 (JSC)Abdirahman BoonNo ratings yet

- BFN Note CombineDocument50 pagesBFN Note CombineTimilehin GbengaNo ratings yet

- Fundamental of FinanceDocument195 pagesFundamental of FinanceMillad MusaniNo ratings yet

- UNIT-1: Corporate Finance & Its ScopeDocument7 pagesUNIT-1: Corporate Finance & Its ScopeTanya MalviyaNo ratings yet

- Principles, Tools, and TechniquesDocument12 pagesPrinciples, Tools, and TechniquesLaz FaxNo ratings yet

- Applied Economics Module Week 5Document5 pagesApplied Economics Module Week 5Billy Joe100% (1)

- Form of Business OrganizationDocument7 pagesForm of Business OrganizationpyulovincentNo ratings yet

- Concept of Capital StructureDocument22 pagesConcept of Capital StructurefatimamominNo ratings yet

- MBA 806 Corporate Finance 01 and 02Document22 pagesMBA 806 Corporate Finance 01 and 02ALPASLAN TOKERNo ratings yet

- Canadian Entrepreneurship & Small Business Management: Balderson and MombourquetteDocument37 pagesCanadian Entrepreneurship & Small Business Management: Balderson and MombourquetteRishab JoshiNo ratings yet

- Business Studies Notes F2Document188 pagesBusiness Studies Notes F2Joe KamashNo ratings yet

- Impact of Capital Structure On Banking ProfitabilityDocument9 pagesImpact of Capital Structure On Banking Profitabilityclelia jaymezNo ratings yet

- Renewable Energy - The FactsDocument257 pagesRenewable Energy - The FactsManuel Adrio GonzálezNo ratings yet

- TIDAL TECHNOLOGIES (Formatted)Document8 pagesTIDAL TECHNOLOGIES (Formatted)Aron H OcampoNo ratings yet

- Iloilo A bs3 04 Hydo RoadmapDocument22 pagesIloilo A bs3 04 Hydo RoadmapAron H OcampoNo ratings yet

- DownloadDocument15 pagesDownloadAron H OcampoNo ratings yet

- Sridhar Viamajala, Bryon S. Donohoe, Stephen R. Decker (Auth.), Om v. Singh, Steven P. Harvey (Eds.) - Sustainable Biotechnology - Sources of Renewable Energy-Springer Netherlands (2010)Document333 pagesSridhar Viamajala, Bryon S. Donohoe, Stephen R. Decker (Auth.), Om v. Singh, Steven P. Harvey (Eds.) - Sustainable Biotechnology - Sources of Renewable Energy-Springer Netherlands (2010)Aron H OcampoNo ratings yet

- Ijesrt: International Journal of Engineering Sciences & Research TechnologyDocument19 pagesIjesrt: International Journal of Engineering Sciences & Research TechnologyAron H OcampoNo ratings yet

- MODULE 3. Kinetics of ParticlesDocument40 pagesMODULE 3. Kinetics of ParticlesAron H OcampoNo ratings yet

- Recent Advances in CFD For Wind and Tidal Offshore Turbines: Esteban Ferrer Adeline Montlaur EditorsDocument151 pagesRecent Advances in CFD For Wind and Tidal Offshore Turbines: Esteban Ferrer Adeline Montlaur EditorsAron H OcampoNo ratings yet

- A Review On Design and Flow Simulation in An Axial Flow Hydro TurbineDocument3 pagesA Review On Design and Flow Simulation in An Axial Flow Hydro TurbineAron H OcampoNo ratings yet

- MODULE 1. Introduction To DynamicsDocument12 pagesMODULE 1. Introduction To DynamicsAron H Ocampo100% (1)

- Module 5 - EVALUATION OF SINGLE PROJECTDocument28 pagesModule 5 - EVALUATION OF SINGLE PROJECTAron H OcampoNo ratings yet

- RRL Research MethodsDocument3 pagesRRL Research MethodsAron H OcampoNo ratings yet

- A Review On Design and Flow Simulation in An Axial Flow Hydro TurbineDocument3 pagesA Review On Design and Flow Simulation in An Axial Flow Hydro TurbineAron H OcampoNo ratings yet

- MODULE 2. Kinematics of ParticlesDocument24 pagesMODULE 2. Kinematics of ParticlesAron H OcampoNo ratings yet

- Y (X) 30 - 898+41. 344 X 15 - 855 X ,: 1. 15 Times 10Document2 pagesY (X) 30 - 898+41. 344 X 15 - 855 X ,: 1. 15 Times 10Aron H OcampoNo ratings yet

- Coconut Oil: Chemistry, Production and Its Applications - A ReviewDocument14 pagesCoconut Oil: Chemistry, Production and Its Applications - A Reviewdebasish senNo ratings yet

- Newtons Difference Interpolation PDFDocument5 pagesNewtons Difference Interpolation PDFAron H OcampoNo ratings yet

- Thermodynamics: Conservation of EnergyDocument38 pagesThermodynamics: Conservation of EnergyAron H OcampoNo ratings yet

- Europes Ambition For Biofuels in Aviation - A STR PDFDocument9 pagesEuropes Ambition For Biofuels in Aviation - A STR PDFAron H OcampoNo ratings yet

- Processes 08 00158 v2 PDFDocument24 pagesProcesses 08 00158 v2 PDFAron H OcampoNo ratings yet

- Quiz No 3Document1 pageQuiz No 3Aron H OcampoNo ratings yet

- Quiz No 3Document1 pageQuiz No 3Aron H OcampoNo ratings yet

- Basic ResearchDocument6 pagesBasic ResearchAron H OcampoNo ratings yet

- Thermo 1 Lecture 2Document56 pagesThermo 1 Lecture 2Aron H OcampoNo ratings yet

- QUIZ 3. Biomes: Instructions. Answer The Questions Below Each Answer Should Be at Least 50Document1 pageQUIZ 3. Biomes: Instructions. Answer The Questions Below Each Answer Should Be at Least 50Aron H OcampoNo ratings yet

- 1Document1 page1Aron H OcampoNo ratings yet

- ADADADDocument1 pageADADADAron H OcampoNo ratings yet

- IJIRSTV2I11139Document9 pagesIJIRSTV2I11139AathiNo ratings yet

- Goodyear AnalysisDocument2 pagesGoodyear AnalysisSakshi ShardaNo ratings yet

- Finance Compliance Training Calendar - Current v1Document2 pagesFinance Compliance Training Calendar - Current v1shilpan9166No ratings yet

- Uco BankDocument9 pagesUco BankPuja Sahay0% (1)

- TSC Wealth DeclarationDocument4 pagesTSC Wealth DeclarationMutai Kiprotich100% (2)

- 342210210082022INAPL6SB22120820221409Document7 pages342210210082022INAPL6SB22120820221409INTERWORLD PACIFIC CONTAINER LINENo ratings yet

- Course Project Specifications: (Type Topic Here)Document3 pagesCourse Project Specifications: (Type Topic Here)Igiboy FloresNo ratings yet

- Time Value of MoneyDocument21 pagesTime Value of MoneyKadita MageNo ratings yet

- Module 7 - Managing InventoryDocument28 pagesModule 7 - Managing InventoryMuhammad FaisalNo ratings yet

- Fare Comparision - ReportDocument6 pagesFare Comparision - ReportMohammed Saber Ibrahim Ramadan ITL World KSANo ratings yet

- Unit-III Time Study (Work Measurement) Time Study: DefinitionsDocument15 pagesUnit-III Time Study (Work Measurement) Time Study: DefinitionsAbhishek AruaNo ratings yet

- Internship Report On Capital Structure of Islamic Bank LimitedDocument47 pagesInternship Report On Capital Structure of Islamic Bank LimitedFahimNo ratings yet

- ANS - 17A - Apr2012 (AR 2011)Document488 pagesANS - 17A - Apr2012 (AR 2011)cuonghienNo ratings yet

- College Accounting A Career Approach 13th Edition Scott Solutions ManualDocument35 pagesCollege Accounting A Career Approach 13th Edition Scott Solutions ManualCalvinMataazscm100% (16)

- Logistical Challenges of Warehousing and TransportingDocument5 pagesLogistical Challenges of Warehousing and Transportingiamcheryl2098No ratings yet

- Take Home Activity 3Document6 pagesTake Home Activity 3Justine CruzNo ratings yet

- Unit 3: Reading BankDocument2 pagesUnit 3: Reading Bankhanngoclt7No ratings yet

- Chapter 1 Mcqs On Income Tax Rates and Basic Concept of Income TaxDocument27 pagesChapter 1 Mcqs On Income Tax Rates and Basic Concept of Income TaxSatheesh KannaNo ratings yet

- MEDICI IFR 2020 ReportDocument125 pagesMEDICI IFR 2020 ReportAtul YadavNo ratings yet

- Pran RFL ReportDocument17 pagesPran RFL ReportAnita Khan33% (3)

- Banking and FinancialDocument8 pagesBanking and FinancialBaby PinkNo ratings yet

- Economic OrganizationDocument2 pagesEconomic OrganizationKeneth NagumNo ratings yet

- Home Office and Branch Accounting Special ProceduresDocument17 pagesHome Office and Branch Accounting Special ProceduresOrnica BalesNo ratings yet

- Entrepreneurship Quarter 2 Module 9 Forecasting RevenuesDocument19 pagesEntrepreneurship Quarter 2 Module 9 Forecasting Revenuesrichard reyesNo ratings yet

- HagoBuy - The Best Taobao Agent Help You Shop, Shipping From China - Weidian Agent1688agent - Cross-Border E-Commerce For WholesaDocument1 pageHagoBuy - The Best Taobao Agent Help You Shop, Shipping From China - Weidian Agent1688agent - Cross-Border E-Commerce For WholesasimionrobertNo ratings yet

- Cambridge O Level: Economics 2281/12Document12 pagesCambridge O Level: Economics 2281/12Jack KowmanNo ratings yet

- Quant Checklist 382 by Aashish Arora For Bank Exams 2023Document111 pagesQuant Checklist 382 by Aashish Arora For Bank Exams 2023ritikraj569No ratings yet

- What Is Lean Six Sigma & How Does It Work - Part 2 - 3 - THE QHSE GROUPDocument7 pagesWhat Is Lean Six Sigma & How Does It Work - Part 2 - 3 - THE QHSE GROUPAna SilvaNo ratings yet

- Chapter 11 322-330Document9 pagesChapter 11 322-330Anthon AqNo ratings yet

- Gamuda AR2016Document356 pagesGamuda AR2016UstazFaizalAriffinOriginalNo ratings yet

- Chapter 2 PDFDocument11 pagesChapter 2 PDFTú NguyễnNo ratings yet