Professional Documents

Culture Documents

Volume of Earning Assets

Volume of Earning Assets

Uploaded by

Joele shOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Volume of Earning Assets

Volume of Earning Assets

Uploaded by

Joele shCopyright:

Available Formats

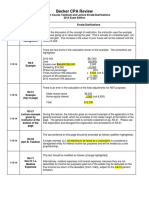

Volume of earning assets= EA/TA

Yield on earning assets=interest income/TA

Composition=$amount of asset i/EA

A. Volume of earning assets

We calculated first the total earning assets and then divided them by the total assets to get the

volume in each 2013 and 2014.

2013 2014

volume of EA= EA/TA 93.4% 93%

Table 6: volume of EA

As we can see in the above table, the volume of earning assets decreased from 2013 to 2014.

Therefore the decrease of AU, ROA and ROE in 2014 depends on the volume of earning assets.

B. Yield on earning assets

2013 2014

yield on earning assets=interest income/earning assets 5.47% 5.50%

Table 7: yield on EA

As we can see in the above table, the yield increased from 2013 to 2014. Therefore, despite the

decrease in the volume on earning asset they were able to generate more interest income in 2014

due to higher interest rate.

These two ratios pushed the interest income ratio by only 0.001%.

C. Composition and mix

Column1 Column2 Column3 Column1 Column2

2013 2013 2014 2014

asseti/TA comp and asseti/TA comp and

mix mix

government debt securities 0.0128693 0.013580

0.18 98 0.18 172

You might also like

- IFM11 Solution To Ch09 P11 Build A ModelDocument18 pagesIFM11 Solution To Ch09 P11 Build A ModelDiana SorianoNo ratings yet

- Case Finland and NokiaDocument25 pagesCase Finland and NokiaJoele shNo ratings yet

- Case Finland and NokiaDocument25 pagesCase Finland and NokiaJoele shNo ratings yet

- I. Assets Utilization: ROA TR/TA (Assets Utilization) - Total Expense/TA (Expense Ratio) - Taxes/TA (Tax Ratio)Document2 pagesI. Assets Utilization: ROA TR/TA (Assets Utilization) - Total Expense/TA (Expense Ratio) - Taxes/TA (Tax Ratio)Joele shNo ratings yet

- Column1 Column2 Column3 Column1 Column 2Document3 pagesColumn1 Column2 Column3 Column1 Column 2Joele shNo ratings yet

- 2013 2014 Interest Expense/TaDocument2 pages2013 2014 Interest Expense/TaJoele shNo ratings yet

- Baf BafDocument6 pagesBaf BafJoele shNo ratings yet

- Dupont AnalysisDocument5 pagesDupont AnalysisNoraminah IsmailNo ratings yet

- University of Swabi: Group Leader:-Awais Ali (02) Group Members: - Waqas Ali (05) Sohail IqbalDocument23 pagesUniversity of Swabi: Group Leader:-Awais Ali (02) Group Members: - Waqas Ali (05) Sohail IqbalFarhan IsrarNo ratings yet

- Vertical Analysis FinalDocument8 pagesVertical Analysis FinalLiya JahanNo ratings yet

- Non Tax Revenue ReceiptDocument7 pagesNon Tax Revenue ReceiptGadadhar PandeyNo ratings yet

- Analysis For Dalmia Bharat LTD: Capital StructureDocument4 pagesAnalysis For Dalmia Bharat LTD: Capital Structurejaiminspatel127No ratings yet

- Finanicial Analysis ThomscookDocument45 pagesFinanicial Analysis ThomscookAnonymous 5quBUnmvm1No ratings yet

- Ass1 AuditDocument10 pagesAss1 AuditMoinNo ratings yet

- Days Sales Outstanding: Introduction To Business Finance Assignment No 1Document10 pagesDays Sales Outstanding: Introduction To Business Finance Assignment No 1Varisha AlamNo ratings yet

- Financial Ratio Analysis of Dabur India LTDDocument11 pagesFinancial Ratio Analysis of Dabur India LTDHarshit DalmiaNo ratings yet

- Faisal Spinning Mills Limited: Ratio AnalysisDocument11 pagesFaisal Spinning Mills Limited: Ratio Analysisaitzaz ahmedNo ratings yet

- Current Ratio Year LiabilitiesDocument14 pagesCurrent Ratio Year LiabilitiesVaibhavSonawaneNo ratings yet

- Cia 3Document10 pagesCia 3Yashvi JainNo ratings yet

- Income Statement: 1. Income: NestleDocument8 pagesIncome Statement: 1. Income: NestleAkshay ThampiNo ratings yet

- Profitability: Comparison of Current Year Performance (Fiscal Year 2011)Document3 pagesProfitability: Comparison of Current Year Performance (Fiscal Year 2011)Edward K. QuachNo ratings yet

- Ratio Analysis PPT 94Document5 pagesRatio Analysis PPT 94Sanjana PottipallyNo ratings yet

- Current RatioDocument1 pageCurrent RatioRoseRedyassebovaNo ratings yet

- Inventories With Lower Cost, Without Sacrificing Its QualityDocument4 pagesInventories With Lower Cost, Without Sacrificing Its QualityMark Lyndon YmataNo ratings yet

- Liquidity Ratios: Current RatioDocument19 pagesLiquidity Ratios: Current RatiovarunNo ratings yet

- Descriptive FindingsDocument8 pagesDescriptive FindingsValdi NadhifNo ratings yet

- Profitability Ratios: Return On Asset (ROA)Document11 pagesProfitability Ratios: Return On Asset (ROA)Saddam Hossain EmonNo ratings yet

- 2014 Reg TextDocument2 pages2014 Reg Textxhitechx1No ratings yet

- Profitability Ratios: PDS Tech, Inc. Financial AnalysisDocument3 pagesProfitability Ratios: PDS Tech, Inc. Financial AnalysisMichael JohnsonNo ratings yet

- Ratios Interpretation of Maruti Suzuki Current RatioDocument5 pagesRatios Interpretation of Maruti Suzuki Current RatioShubham Rathi Jaipuria JaipurNo ratings yet

- Accm506 Ca1Document10 pagesAccm506 Ca1Shay ShayNo ratings yet

- Financial Analysis AppleDocument10 pagesFinancial Analysis AppleEléa LeconteNo ratings yet

- Af314 Group Assignment 2020 2021Document11 pagesAf314 Group Assignment 2020 2021HugsNo ratings yet

- Snisbury's Ratio AnalysisDocument8 pagesSnisbury's Ratio Analysis99 Nazmul AlamNo ratings yet

- IRS Data On 2014 Tax FilersDocument362 pagesIRS Data On 2014 Tax FilersStephen LoiaconiNo ratings yet

- Balochistan Glass LimitedDocument9 pagesBalochistan Glass Limitedarifking29No ratings yet

- Handouts Vertical and Horizontal AnalysisDocument2 pagesHandouts Vertical and Horizontal AnalysisCindy KibosNo ratings yet

- Table 2.1 Samsung Debt Ratio Annual Report 2012-2016 (Measured in Thousand USD)Document6 pagesTable 2.1 Samsung Debt Ratio Annual Report 2012-2016 (Measured in Thousand USD)Intan IntongNo ratings yet

- Profitability Ratio: A. Net Profit MarginDocument6 pagesProfitability Ratio: A. Net Profit MarginCamille Andrea CorteroNo ratings yet

- Financial Analysis of Indigo Airlines From Lender's PerspectiveDocument12 pagesFinancial Analysis of Indigo Airlines From Lender's PerspectiveAnil Kumar Reddy100% (1)

- Comparative Analysis of BATA INDIA LTDDocument4 pagesComparative Analysis of BATA INDIA LTDBhakti BhadraNo ratings yet

- Financial Report: in Partial Fulfillment of The Requirements in GE 14 (Technical Writing)Document6 pagesFinancial Report: in Partial Fulfillment of The Requirements in GE 14 (Technical Writing)Airon Keith AlongNo ratings yet

- Analysis Gemini & NTCDocument2 pagesAnalysis Gemini & NTCAnand RahmanNo ratings yet

- ProjectDocument9 pagesProjectShaheen ShaikNo ratings yet

- TFSource ROEEPSDocument8 pagesTFSource ROEEPScreacion impresionesNo ratings yet

- Putu Calista Gitta KalyanaDocument10 pagesPutu Calista Gitta KalyanaPutu Calista GittaNo ratings yet

- BankmedDocument6 pagesBankmedJoele shNo ratings yet

- Written Assignment Week 1Document6 pagesWritten Assignment Week 1MaylynNo ratings yet

- Analysis & Interpretation of Data RatioDocument28 pagesAnalysis & Interpretation of Data RatiomallathiNo ratings yet

- GAIL 2015 Financial Ratio AnalysisDocument8 pagesGAIL 2015 Financial Ratio AnalysisVarun PatelNo ratings yet

- Leverage Analysis: Analysis For DCM Shriram LTDDocument3 pagesLeverage Analysis: Analysis For DCM Shriram LTDiamatanuNo ratings yet

- Financial Analysis P&GDocument10 pagesFinancial Analysis P&Gsayko88No ratings yet

- Cairn India Financial InfoDocument4 pagesCairn India Financial Infohirenchavla93No ratings yet

- Analysis of Financial StatementsDocument48 pagesAnalysis of Financial StatementsNguyễn Thùy LinhNo ratings yet

- Item Description The CompanyDocument4 pagesItem Description The Companyheidrian dagamiNo ratings yet

- PatilDocument11 pagesPatilMayur BadheNo ratings yet

- Fin 254 - Project: Company Name: Meghna Cement Mills LimitedDocument18 pagesFin 254 - Project: Company Name: Meghna Cement Mills LimitedAniruddha RantuNo ratings yet

- Case Study FM Group 1Document4 pagesCase Study FM Group 1Ini IchiiiNo ratings yet

- Abbott Laboratories (ABT)Document8 pagesAbbott Laboratories (ABT)Riffat Al ImamNo ratings yet

- Profitability RatiosDocument48 pagesProfitability RatiosMohan RajNo ratings yet

- F3Document2 pagesF3Kimberly PadlanNo ratings yet

- Viii. Growth RatiosDocument2 pagesViii. Growth RatiosJoele shNo ratings yet

- 1-Computer Ethics For Computer Professionals: 1.1 - The ACM Code of ConductDocument2 pages1-Computer Ethics For Computer Professionals: 1.1 - The ACM Code of ConductJoele shNo ratings yet

- Collective LearningDocument1 pageCollective LearningJoele shNo ratings yet

- OperatingDocument2 pagesOperatingJoele shNo ratings yet

- 1.1.1-Code of Conduct For Institute For Certification of Computing ProfessionalsDocument2 pages1.1.1-Code of Conduct For Institute For Certification of Computing ProfessionalsJoele shNo ratings yet

- FinancialDocument1 pageFinancialJoele shNo ratings yet

- Interest Rate RiskDocument2 pagesInterest Rate RiskJoele shNo ratings yet

- B-Preparation For Future Losses PLL/ Total Loans&leases: Year 2010 2011 2012Document2 pagesB-Preparation For Future Losses PLL/ Total Loans&leases: Year 2010 2011 2012Joele shNo ratings yet

- Expense ControlDocument1 pageExpense ControlJoele shNo ratings yet

- Ratio Analysis:: Year 2010 2011 2012Document2 pagesRatio Analysis:: Year 2010 2011 2012Joele shNo ratings yet

- Tax RatioDocument1 pageTax RatioJoele shNo ratings yet

- Non-Int exp/TA Depends On: Each item/TA2013 Each item/TA2014Document1 pageNon-Int exp/TA Depends On: Each item/TA2013 Each item/TA2014Joele shNo ratings yet

- ThirdDocument1 pageThirdJoele shNo ratings yet