Professional Documents

Culture Documents

FinMan FA3

FinMan FA3

Uploaded by

KHAkadsbdhsg0 ratings0% found this document useful (0 votes)

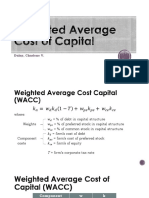

11 views1 pageThe company has $200,000 in total capital consisting of $60,000 in debt at 9% cost, $50,000 in preferred stock at 11% cost, and $90,000 in common stock at 14% cost. To calculate the weighted average cost of capital (WACC), the value of each component is divided by the total capital to obtain a weight, and the cost is multiplied by the weight to determine the weighted cost before summing to 11.75%.

Original Description:

Original Title

FinMan FA3.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe company has $200,000 in total capital consisting of $60,000 in debt at 9% cost, $50,000 in preferred stock at 11% cost, and $90,000 in common stock at 14% cost. To calculate the weighted average cost of capital (WACC), the value of each component is divided by the total capital to obtain a weight, and the cost is multiplied by the weight to determine the weighted cost before summing to 11.75%.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views1 pageFinMan FA3

FinMan FA3

Uploaded by

KHAkadsbdhsgThe company has $200,000 in total capital consisting of $60,000 in debt at 9% cost, $50,000 in preferred stock at 11% cost, and $90,000 in common stock at 14% cost. To calculate the weighted average cost of capital (WACC), the value of each component is divided by the total capital to obtain a weight, and the cost is multiplied by the weight to determine the weighted cost before summing to 11.75%.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Capital Value Cost

Component

Debt 60,000 9%

Preferred Stock 50,000 11%

Common Stock 90,000 14%

200,000

60,000

= .30 or 30%

200,000

50,000

= .25 or 25%

200,000

90,000

= .45 or 45%

200,000

Capital Value Weight Cost

Component

Debt 60,000 0.3 9% 2.70%

Preferred Stock 50,000 0.25 11% 2.75%

Common Stock 90,000 0.45 14% 6.30%

1 WACC 11.75%

200,000

Note: The table above shown that the BCD Co. has WACC of 11.75%.

You might also like

- Session 5 Topic 8 - IpackDocument3 pagesSession 5 Topic 8 - IpackHoneylyn SM AranetaNo ratings yet

- Basic CapTable - No Valuation CapDocument6 pagesBasic CapTable - No Valuation CapsonkarmanishNo ratings yet

- Bill French Case Study SolutionsDocument8 pagesBill French Case Study SolutionsMurat Kalender100% (1)

- 12 Item MCQDocument1 page12 Item MCQKHAkadsbdhsgNo ratings yet

- Task Performance I. Horizontal AnalysisDocument3 pagesTask Performance I. Horizontal AnalysisarisuNo ratings yet

- Yogesh P Assignment PDFDocument2 pagesYogesh P Assignment PDFಯೋಗೇಶ್ ಪಿNo ratings yet

- Mgac 04.24.17Document22 pagesMgac 04.24.17Ann SerratoNo ratings yet

- Memory Plus Gold For Mas5Document8 pagesMemory Plus Gold For Mas5Ashianna KimNo ratings yet

- Bin Frequency Cumulative % Bin Frequency Cumulative %Document3 pagesBin Frequency Cumulative % Bin Frequency Cumulative %Mohamed RizwanNo ratings yet

- Base Case Scenario 1 Price Increase 10% VariableDocument2 pagesBase Case Scenario 1 Price Increase 10% VariableEtoy Ka PoNo ratings yet

- Partnership Liquidation InstallmentsDocument2 pagesPartnership Liquidation InstallmentskikoNo ratings yet

- CVP SolutionDocument11 pagesCVP SolutionGmail FixNo ratings yet

- 67229bos54127 Inter P8aDocument16 pages67229bos54127 Inter P8aSANDEEP MADANNo ratings yet

- P13Document21 pagesP13Saeful AzizNo ratings yet

- Assignment Prosedur Analitis - AKSKDocument8 pagesAssignment Prosedur Analitis - AKSKAlanNo ratings yet

- Paki Check BiDocument5 pagesPaki Check BiAusan AbdullahNo ratings yet

- Ratio AnalysisDocument13 pagesRatio AnalysisElizabeth TatadNo ratings yet

- Chapter 28Document6 pagesChapter 28Shane Ivory ClaudioNo ratings yet

- DF1 601 Individual AssignmentDocument5 pagesDF1 601 Individual AssignmentIan KipropNo ratings yet

- Costing Homework SolutionsDocument97 pagesCosting Homework SolutionsKunal BhansaliNo ratings yet

- WMCC Assignment 15TH AprilDocument18 pagesWMCC Assignment 15TH AprilRamya GowdaNo ratings yet

- DFM 15 SolutionDocument17 pagesDFM 15 SolutionAbhinav JainNo ratings yet

- Debt LevelDocument3 pagesDebt Levelsultan altamashNo ratings yet

- Exercise 6.2Document3 pagesExercise 6.2Lester MojadoNo ratings yet

- Mayes 8e CH11 SolutionsDocument22 pagesMayes 8e CH11 SolutionsRamez AhmedNo ratings yet

- 19-11-02 Cost of Debt ProblemDocument2 pages19-11-02 Cost of Debt ProblemNdaru PuspitahatiNo ratings yet

- Extra Material On CFDocument127 pagesExtra Material On CFPanosMavrNo ratings yet

- Soal 1 (Kontribusi Asset Netto) : Uraian PT - Wayang PT - Gatot PT - KacaDocument13 pagesSoal 1 (Kontribusi Asset Netto) : Uraian PT - Wayang PT - Gatot PT - KacaegiNo ratings yet

- Net Present Value Calculator V1.0Document1 pageNet Present Value Calculator V1.0EyeoSkyNo ratings yet

- Topic 7 Capital Structure & Dividend ImputationDocument53 pagesTopic 7 Capital Structure & Dividend Imputationsir bookkeeperNo ratings yet

- Jean CalixtroooDocument16 pagesJean CalixtroooJerome MontoyaNo ratings yet

- Charlene DulayDocument19 pagesCharlene DulayJerome MontoyaNo ratings yet

- CdosDocument26 pagesCdosapi-3742111No ratings yet

- Osjdioahfnlk, MNLKJLDocument10 pagesOsjdioahfnlk, MNLKJLAlex NievaNo ratings yet

- SAPMDocument7 pagesSAPMrakeshkakaniNo ratings yet

- Equity Share of 100 EachDocument2 pagesEquity Share of 100 EachKrushikesh PatilNo ratings yet

- Capm QuestionsDocument6 pagesCapm QuestionsyenNo ratings yet

- Quiz1 Problem SolutionDocument2 pagesQuiz1 Problem SolutionVee YaNo ratings yet

- Loan Yearly Revenue Operating Profit Return On Assets Distribute Al As Dividends Other Invest ReturnDocument3 pagesLoan Yearly Revenue Operating Profit Return On Assets Distribute Al As Dividends Other Invest ReturnPath GargNo ratings yet

- Stock DividendsDocument3 pagesStock DividendsBella CynthiaNo ratings yet

- 157 635652264260446926 Practice ManagerialDocument13 pages157 635652264260446926 Practice Manageriallisa lheneNo ratings yet

- Desiree Smith - Assignment 6 2Document4 pagesDesiree Smith - Assignment 6 2Des SmithNo ratings yet

- Professional Excel Training (MD - Shohel)Document15 pagesProfessional Excel Training (MD - Shohel)Shohel MiahNo ratings yet

- 03 Elms Activity 1Document1 page03 Elms Activity 1Sol LunaNo ratings yet

- CPA Review School of The Philippines ManilaDocument4 pagesCPA Review School of The Philippines ManilaSophia PerezNo ratings yet

- AssignmentDocument40 pagesAssignmentnoeljrpajaresNo ratings yet

- Financing Decisions 10-12Document48 pagesFinancing Decisions 10-12Rajat ShrinetNo ratings yet

- Joint CostsDocument9 pagesJoint CostsChiragNo ratings yet

- Sol Pre-Test 1Document3 pagesSol Pre-Test 1Scarlet DragonNo ratings yet

- Problem Set 5: Capital StructureDocument3 pagesProblem Set 5: Capital StructureGautam PatilNo ratings yet

- Practice Q (Capital Budgeting)Document12 pagesPractice Q (Capital Budgeting)Divyam GargNo ratings yet

- Quiz 1 Answers and Solutions (Partnership Formation and Operation)Document6 pagesQuiz 1 Answers and Solutions (Partnership Formation and Operation)cpacpacpaNo ratings yet

- Chapter 9 Multiple ChoicesDocument5 pagesChapter 9 Multiple Choicesshiroe raabuNo ratings yet

- Tugas AKL1Document4 pagesTugas AKL1Yandra Febriyanti0% (1)

- BUSN 625 Week 5 Chapter 14 ProblemsDocument2 pagesBUSN 625 Week 5 Chapter 14 ProblemsKristin DavisNo ratings yet

- Cart-2 + Production Unit FinalDocument4 pagesCart-2 + Production Unit Finalman789840No ratings yet

- Cost Concepts and CVP AnalysisDocument7 pagesCost Concepts and CVP AnalysisLara Lewis AchillesNo ratings yet

- Faculty of Commerce and Management: Course: Bba Iii Sem. Subject: Financial ManagementDocument7 pagesFaculty of Commerce and Management: Course: Bba Iii Sem. Subject: Financial ManagementSuyash RoyNo ratings yet

- Chapter 19 Borrowing CostDocument7 pagesChapter 19 Borrowing CostKiminosunoo LelNo ratings yet

- Elite, S.A. de C.V.: Balance GeneralDocument6 pagesElite, S.A. de C.V.: Balance GeneralGuadalupe e ZamoraNo ratings yet

- Banana Frit OohDocument34 pagesBanana Frit OohKHAkadsbdhsgNo ratings yet

- Preparation of Statement of Financial PositionDocument6 pagesPreparation of Statement of Financial PositionKHAkadsbdhsgNo ratings yet

- Introduction To Information Systems AuditDocument1 pageIntroduction To Information Systems AuditKHAkadsbdhsgNo ratings yet

- Estate Tax Return: - Taxpayer InformationDocument2 pagesEstate Tax Return: - Taxpayer InformationKHAkadsbdhsgNo ratings yet

- Cost of Goods Sold BudgetDocument1 pageCost of Goods Sold BudgetKHAkadsbdhsgNo ratings yet

- Total Cash Receipts 157,558Document2 pagesTotal Cash Receipts 157,558KHAkadsbdhsgNo ratings yet

- Calculation of Cash Receipt Expected in OctoberDocument2 pagesCalculation of Cash Receipt Expected in OctoberKHAkadsbdhsgNo ratings yet

- Cash Disbursements On Accounts PayableDocument1 pageCash Disbursements On Accounts PayableKHAkadsbdhsgNo ratings yet

- Direct Materials Purchases BudgetDocument1 pageDirect Materials Purchases BudgetKHAkadsbdhsgNo ratings yet

- Total Direct Labor Cost 1,051,200 984,000 1,206,000 3,241,200Document1 pageTotal Direct Labor Cost 1,051,200 984,000 1,206,000 3,241,200KHAkadsbdhsgNo ratings yet

- CMC, LTD.: Last Name First Name Salary Years Job Title BonusDocument1 pageCMC, LTD.: Last Name First Name Salary Years Job Title BonusKHAkadsbdhsgNo ratings yet

- 3.3 Exercise Key AnswerDocument2 pages3.3 Exercise Key AnswerKHAkadsbdhsgNo ratings yet

- Setting Transfer Prices - Market Price vs. Full CostDocument1 pageSetting Transfer Prices - Market Price vs. Full CostKHAkadsbdhsgNo ratings yet

- Incremental Profit/Loss 1,000 10,000,000Document2 pagesIncremental Profit/Loss 1,000 10,000,000KHAkadsbdhsgNo ratings yet

- 3.1 Exercise Key AnswerDocument1 page3.1 Exercise Key AnswerKHAkadsbdhsgNo ratings yet

- Self-Study Practice 2-Decision Match-Accept or Reject A Special Order - ManguraliDocument2 pagesSelf-Study Practice 2-Decision Match-Accept or Reject A Special Order - ManguraliKHAkadsbdhsgNo ratings yet

- Drills - Keep or DropDocument4 pagesDrills - Keep or DropKHAkadsbdhsgNo ratings yet

- How Is It Going? Sell or Process FurtherDocument2 pagesHow Is It Going? Sell or Process FurtherKHAkadsbdhsg100% (1)

- Incremental Analysis Problems 111320Document4 pagesIncremental Analysis Problems 111320KHAkadsbdhsgNo ratings yet

- Basic Income Tax and ITR FilingDocument1 pageBasic Income Tax and ITR FilingKHAkadsbdhsgNo ratings yet

- Requirement 1:: Sales Cost of Goods Sold) Cost of Goods Sold X 100 X 100 X 100Document1 pageRequirement 1:: Sales Cost of Goods Sold) Cost of Goods Sold X 100 X 100 X 100KHAkadsbdhsgNo ratings yet

- Topic 1: Financial Manager (3 Fundamental Questions)Document8 pagesTopic 1: Financial Manager (3 Fundamental Questions)KHAkadsbdhsg100% (1)

- Intacc2 - Assignment 3Document4 pagesIntacc2 - Assignment 3KHAkadsbdhsgNo ratings yet

- Buslare FA2Document2 pagesBuslare FA2KHAkadsbdhsgNo ratings yet

- Fringe Benefit TaxDocument1 pageFringe Benefit TaxKHAkadsbdhsgNo ratings yet

- BasketballDocument5 pagesBasketballKHAkadsbdhsgNo ratings yet