Professional Documents

Culture Documents

Quiz1 Problem Solution

Uploaded by

Vee YaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quiz1 Problem Solution

Uploaded by

Vee YaCopyright:

Available Formats

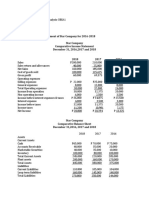

ABC Company

Comparative Income Statement

For the year ended December 31

HORIZONTAL ANALYSIS Percentage

2022 2021 Peso Change Change

Revenue 120,000.00 100,000.00 20,000.00 20.00%

Cost of Sales 60,000.00 50,000.00 10,000.00 20.00%

Gross Profit 60,000.00 50,000.00 10,000.00 20.00%

Rent Expense 5,500.00 5,000.00 500.00 10.00%

Depreciation Expense 3,600.00 2,500.00 1,100.00 44.00%

Salaries Expense 5,400.00 3,000.00 2,400.00 80.00%

Utilities Expense 2,500.00 1,500.00 1,000.00 66.67%

Net profit before interest and tax 43,000.00 38,000.00 5,000.00 13.16%

Interest Expense 5,400.00 3,000.00 2,400.00 80.00%

Income Tax 6,000.00 5,000.00 1,000.00 20.00%

Net profit after interest and tax 31,600.00 30,000.00 1,600.00 5.33%

ABC Company

Comparative Income Statement

For the year ended December 31

VERTICAL ANALYSIS 2022 2021 2022 2021

Revenue 120,000.00 100,000.00 100.00% 100.00%

Cost of Sales 60,000.00 50,000.00 50.00% 50.00%

Gross Profit 60,000.00 50,000.00 50.00% 50.00%

Rent Expense 5,500.00 5,000.00 4.58% 5.00%

Depreciation Expense 3,600.00 2,500.00 3.00% 2.50%

Salaries Expense 5,400.00 3,000.00 4.50% 3.00%

Utilities Expense 2,500.00 1,500.00 2.08% 1.50%

Net profit before interest and tax 43,000.00 38,000.00 35.83% 38.00%

Interest Expense 5,400.00 3,000.00 4.50% 3.00%

Income Tax 6,000.00 5,000.00 5.00% 5.00%

Net profit after interest and tax 31,600.00 30,000.00 26.33% 30.00%

ABC Company

Comparative Balance Sheet

For the year ended December 31

HORIZONTAL ANALYSIS 2022 2021 Percentage

Peso Change Change

Assets

Current Assets 110,000.00 90,000.00 20,000.00 22.22%

Cash 30,000.00 20,000.00 10,000.00 50.00%

Accounts Receivable 40,000.00 35,000.00 5,000.00 14.29%

Inventory

Non-current assets

Property Plant and Equipment 50,000.00 40,000.00 10,000.00 25.00%

Land 20,000.00 15,000.00 5,000.00 33.33%

Total Assets 250,000.00 200,000.00 50,000.00 25.00%

Liabilities

Current Liabilities

Accounts Payable 75,000.00 60,000.00 15,000.00 25.00%

Unearned Revenue 25,000.00 10,000.00 15,000.00 150.00%

Non-current Liabilities

Bank Loan 50,000.00 40,000.00 10,000.00 25.00%

Total Liabilities 150,000.00 110,000.00 40,000.00 36.36%

Stockholders' Equity

Share capital 80,000.00 75,000.00 5,000.00 6.67%

Retained Earnings 20,000.00 15,000.00 5,000.00 33.33%

Total Equity 100,000.00 90,000.00 10,000.00 11.11%

ABC Company

Comparative Balance Sheet

For the year ended December 31

VERTICAL ANALYSIS 2022 2021 2022 2021

Assets

Current Assets 110,000.00 90,000.00 44.00% 45.00%

Cash 30,000.00 20,000.00 12.00% 10.00%

Accounts Receivable 40,000.00 35,000.00 16.00% 17.50%

Inventory

Non-current assets

Property Plant and Equipment 50,000.00 40,000.00 20.00% 20.00%

Land 20,000.00 15,000.00 8.00% 7.50%

Total Assets 250,000.00 200,000.00 100.00% 100.00%

Liabilities

Current Liabilities

Accounts Payable 75,000.00 60,000.00 30.00% 30.00%

Unearned Revenue 25,000.00 10,000.00 10.00% 5.00%

Non-current Liabilities

Bank Loan 50,000.00 40,000.00 20.00% 20.00%

Total Liabilities 150,000.00 110,000.00 60.00% 55.00%

Stockholders' Equity

Share capital 80,000.00 75,000.00 32.00% 37.50%

Retained Earnings 20,000.00 15,000.00 8.00% 7.50%

Total Equity 100,000.00 90,000.00 40.00% 45.00%

You might also like

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- Horizontal and Vertical ActivityDocument4 pagesHorizontal and Vertical ActivityKarlla ManalastasNo ratings yet

- Tri-Star Company Financial Statement AnalysisDocument10 pagesTri-Star Company Financial Statement AnalysisJuliana Angela VillanuevaNo ratings yet

- ABC Corporation's 2019 Financial Statement AnalysisDocument15 pagesABC Corporation's 2019 Financial Statement AnalysisHallasgo, Elymar SorianoNo ratings yet

- Sotalbo, Norhie Anne O. 3BSA-2Document11 pagesSotalbo, Norhie Anne O. 3BSA-2Acads PurpsNo ratings yet

- Financial AnalysisDocument8 pagesFinancial AnalysisMaxine Lois PagaraganNo ratings yet

- 2020 Expenses: What SUP, Inc. Income Statement For The Year EndedDocument5 pages2020 Expenses: What SUP, Inc. Income Statement For The Year EndedRi BNo ratings yet

- Final Req VCMDocument8 pagesFinal Req VCMMaxine Lois PagaraganNo ratings yet

- Horizontal and Vertical AnalysisDocument4 pagesHorizontal and Vertical AnalysisJasmine ActaNo ratings yet

- V - Common SizeDocument2 pagesV - Common SizeKyriye OngilavNo ratings yet

- DVM Enterprises Financial Statements AnalysisDocument6 pagesDVM Enterprises Financial Statements AnalysisNicole AlexandraNo ratings yet

- Act 2 Answer KeyDocument8 pagesAct 2 Answer KeyDianne PañoNo ratings yet

- Name: - Yr. and SectionDocument4 pagesName: - Yr. and SectionClarisse AlimotNo ratings yet

- Task Performance I. Horizontal AnalysisDocument3 pagesTask Performance I. Horizontal AnalysisarisuNo ratings yet

- AF Ch. 4 - Analysis FS - ExcelDocument9 pagesAF Ch. 4 - Analysis FS - ExcelAlfiandriAdinNo ratings yet

- FS Analysis - Illustration (Lomenario, Anna Marie, S.)Document14 pagesFS Analysis - Illustration (Lomenario, Anna Marie, S.)Anna LomenarioNo ratings yet

- Activity-1 Unit 2 Financial Analysis 3BSA-1Document2 pagesActivity-1 Unit 2 Financial Analysis 3BSA-1JonellNo ratings yet

- Laurenz R. Patawe - Activity 1PART2 PDFDocument2 pagesLaurenz R. Patawe - Activity 1PART2 PDFJonellNo ratings yet

- 5,655.00 Additional Investment Needed/financingDocument23 pages5,655.00 Additional Investment Needed/financingMPCINo ratings yet

- Ratio and Trend Analysis (FC)Document26 pagesRatio and Trend Analysis (FC)Cindelyn LibodlibodNo ratings yet

- Three Statement Model 14-07-2021 (F3)Document16 pagesThree Statement Model 14-07-2021 (F3)Vaibhav BorateNo ratings yet

- Statement AnalysisDocument4 pagesStatement AnalysisrameelNo ratings yet

- Bank ManagementDocument14 pagesBank ManagementAreeba MalikNo ratings yet

- Basic Finance I.Z.Y.X Comparative Income StatementDocument3 pagesBasic Finance I.Z.Y.X Comparative Income StatementKazia PerinoNo ratings yet

- Mart Manalo Tax Calculator for 1M IncomeDocument2 pagesMart Manalo Tax Calculator for 1M IncomeMart ManaloNo ratings yet

- Financial StatementDocument36 pagesFinancial StatementJigoku ShojuNo ratings yet

- FIN 325-3-2 Final Project Milestone Two Vertical and Horizontal Analysis Saeed Algarni Facebook IDocument9 pagesFIN 325-3-2 Final Project Milestone Two Vertical and Horizontal Analysis Saeed Algarni Facebook IAlison JcNo ratings yet

- 5-Year Income Projection for Access-so-realDocument2 pages5-Year Income Projection for Access-so-realKamille SumaoangNo ratings yet

- Financial Statement Analysis of Jenny CompanyDocument5 pagesFinancial Statement Analysis of Jenny CompanyAshley Rouge Capati QuirozNo ratings yet

- PT XYZ Financial Analysis ReportDocument8 pagesPT XYZ Financial Analysis ReportAlanNo ratings yet

- Financial Statement Analysis: by Ghanendrafago Mba, M PhilDocument19 pagesFinancial Statement Analysis: by Ghanendrafago Mba, M Philits4krishna3776No ratings yet

- Current Year Base Year Base Year X 100Document4 pagesCurrent Year Base Year Base Year X 100Kathlyn TajadaNo ratings yet

- Figures and Illustrations - Financial RatiosDocument19 pagesFigures and Illustrations - Financial RatioscamillaNo ratings yet

- Vertical Analysis Base Denominator Company ADocument6 pagesVertical Analysis Base Denominator Company AYesha SibayanNo ratings yet

- Financial StatementDocument4 pagesFinancial StatementLizlee LaluanNo ratings yet

- 511skin Financial Projections - Sheet1 3Document1 page511skin Financial Projections - Sheet1 3mercyinifielateNo ratings yet

- Jacen Co.: Comparative Balance SheetDocument4 pagesJacen Co.: Comparative Balance Sheetnina pascualNo ratings yet

- Rack Draft - 01.08-2021Document42 pagesRack Draft - 01.08-2021Rashan Jida ReshanNo ratings yet

- FinancialsDocument6 pagesFinancialsharshithamandalapuNo ratings yet

- Capital BudgetingDocument20 pagesCapital BudgetingAngelo VilladoresNo ratings yet

- Engaging Activity 1 Financial AnalysisDocument3 pagesEngaging Activity 1 Financial AnalysisCatherineNo ratings yet

- Changing Monthly Loan Payment CalculatorDocument10 pagesChanging Monthly Loan Payment Calculatorarushi duttNo ratings yet

- Gross Profit For The Year 2021-2023Document6 pagesGross Profit For The Year 2021-2023Beverly DatuNo ratings yet

- Exide Industries Ltd. Financial Model and ProjectionsDocument55 pagesExide Industries Ltd. Financial Model and ProjectionsSALONI JaiswalNo ratings yet

- Session 2 Income Statement FC Exercise - QuestionDocument2 pagesSession 2 Income Statement FC Exercise - Questionnhutminh2706No ratings yet

- Technopreneurship PPT Presentation Group 1Document57 pagesTechnopreneurship PPT Presentation Group 1Mia ElizabethNo ratings yet

- Mooc FinanzasDocument2 pagesMooc FinanzasAlvaro LainezNo ratings yet

- Comparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018Document5 pagesComparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018JonellNo ratings yet

- 99 A Benzeer Tanha Funfin FinalsDocument7 pages99 A Benzeer Tanha Funfin FinalsBenzeer TanhaNo ratings yet

- Acc105 Depreciation1-1Document6 pagesAcc105 Depreciation1-1Christie SabidorNo ratings yet

- Local Media2551384955216348707Document4 pagesLocal Media2551384955216348707alinashane obleaNo ratings yet

- Balance Sheet Accounts: Total AssetsDocument4 pagesBalance Sheet Accounts: Total AssetsJing SagittariusNo ratings yet

- Activities 11&12Document6 pagesActivities 11&12MPCINo ratings yet

- Trend AnalysisDocument1 pageTrend Analysisapi-385117572No ratings yet

- Projected Income StatementDocument8 pagesProjected Income Statementdebate ddNo ratings yet

- W2020 ACC100 Financial Statement AnalysisDocument5 pagesW2020 ACC100 Financial Statement AnalysisMahmoud ZizoNo ratings yet

- Managerial Finance AssingmentDocument9 pagesManagerial Finance AssingmentEf AtNo ratings yet

- YubarajDocument4 pagesYubarajYubraj ThapaNo ratings yet

- Ishika GuptaDocument5 pagesIshika GuptaGarvit JainNo ratings yet

- Asynchronous Statement of Financial Position XYZ CompanyDocument5 pagesAsynchronous Statement of Financial Position XYZ CompanyDiana Fernandez MagnoNo ratings yet

- Topic ScriptDocument2 pagesTopic ScriptVee YaNo ratings yet

- Code of Ethics For IT ProfessionalsDocument2 pagesCode of Ethics For IT ProfessionalsManelle TulodNo ratings yet

- Business LogicDocument12 pagesBusiness LogicVee YaNo ratings yet

- De Minimis Benefits (PINGAD)Document4 pagesDe Minimis Benefits (PINGAD)Vee YaNo ratings yet

- Flashcards (Chapter 2)Document2 pagesFlashcards (Chapter 2)Vee YaNo ratings yet

- Understanding Cybercrime and Online Sexual Exploitation of ChildrenDocument3 pagesUnderstanding Cybercrime and Online Sexual Exploitation of ChildrenVee YaNo ratings yet

- Request for Accounting Analyst PositionDocument5 pagesRequest for Accounting Analyst PositionVee YaNo ratings yet

- Timeline of The Moro WarsDocument4 pagesTimeline of The Moro WarsVee YaNo ratings yet

- Activity ParadigmDocument4 pagesActivity ParadigmVee YaNo ratings yet

- CAC - Separating Mixed CostDocument4 pagesCAC - Separating Mixed CostVee YaNo ratings yet

- NEw IC 38 SummaryDocument80 pagesNEw IC 38 SummaryMadhup tarsolia100% (2)

- (UPDATED) BCC Semifinalist GuidebookDocument4 pages(UPDATED) BCC Semifinalist GuidebookYohanes StefanusNo ratings yet

- Questionnaire RAAM GroupDocument7 pagesQuestionnaire RAAM GroupVinayak ChaturvediNo ratings yet

- An Argument For The Eastern Origins of CatharismDocument22 pagesAn Argument For The Eastern Origins of CatharismDiana Bernal ColonioNo ratings yet

- Au L 1637113412 Poem Analysis of Matilda by Hilaire Belloc - Ver - 2Document5 pagesAu L 1637113412 Poem Analysis of Matilda by Hilaire Belloc - Ver - 2Manha abdellahNo ratings yet

- Salem Steel PlantDocument69 pagesSalem Steel PlantKavuthu Mathi100% (2)

- bài tập unit 4Document5 pagesbài tập unit 4Hiền PhạmNo ratings yet

- NAME: - Grade Level: 12 Q:2 - Lesson: 1Document2 pagesNAME: - Grade Level: 12 Q:2 - Lesson: 1neschee leeNo ratings yet

- Lesson 4 Jobs and Occupations PDFDocument2 pagesLesson 4 Jobs and Occupations PDFronaldoNo ratings yet

- USA2Document2 pagesUSA2Helena TrầnNo ratings yet

- Tanzania Catholic Directory 2019Document391 pagesTanzania Catholic Directory 2019Peter Temu50% (2)

- "Remembering The Past": ConsciousnessDocument2 pages"Remembering The Past": Consciousnessnona jean ydulzuraNo ratings yet

- An Inscribed Nabataean Bronze Object DedDocument15 pagesAn Inscribed Nabataean Bronze Object Dedejc1717No ratings yet

- Mary I Fact File and Activities SampleDocument7 pagesMary I Fact File and Activities SamplenaomiNo ratings yet

- Letter From Canute FranksonDocument2 pagesLetter From Canute FranksonAbraham Lincoln Brigade ArchiveNo ratings yet

- What Is Gratitude and What Is Its Role in Positive PsychologyDocument19 pagesWhat Is Gratitude and What Is Its Role in Positive Psychologyakraam ullah100% (1)

- CLEARING CLAIMS IN SAP PAYROLLDocument24 pagesCLEARING CLAIMS IN SAP PAYROLLsrikanthyh1979100% (2)

- CustomAccountStatement22 12 2019 PDFDocument10 pagesCustomAccountStatement22 12 2019 PDFHR MathanloganNo ratings yet

- 'SangCup Business Plan Pota-Ca Empanada (Grp. 3 ABM 211)Document56 pages'SangCup Business Plan Pota-Ca Empanada (Grp. 3 ABM 211)jsemlpz0% (1)

- Microeconomics 20th Edition Mcconnell Test BankDocument25 pagesMicroeconomics 20th Edition Mcconnell Test BankMeganAguilarkpjrz100% (56)

- TNB Electricity System Voltages, Frequencies, Earthing Systems and Supply OptionsDocument4 pagesTNB Electricity System Voltages, Frequencies, Earthing Systems and Supply OptionsSaiful RizamNo ratings yet

- Production Operation Management Final Project Bata Shoes CompanyDocument10 pagesProduction Operation Management Final Project Bata Shoes CompanyrazaNo ratings yet

- What Is The Thesis of Federalist Paper 78Document6 pagesWhat Is The Thesis of Federalist Paper 78tonyastrongheartanchorage100% (2)

- Henry VIII, Act of Supremacy (1534) by Caroline BarrioDocument4 pagesHenry VIII, Act of Supremacy (1534) by Caroline BarriocarolbjcaNo ratings yet

- JBIMS Strategic MGMT Srini BMN Exam Paper Nov 2022Document4 pagesJBIMS Strategic MGMT Srini BMN Exam Paper Nov 2022nikupadhyay25No ratings yet

- ELSS V/s SCSS For A Retired InvestorDocument13 pagesELSS V/s SCSS For A Retired InvestorMayuri SonawaneNo ratings yet

- Black Violet Pink 3D Company Internal Deck Business PresentationDocument16 pagesBlack Violet Pink 3D Company Internal Deck Business Presentationakumar09944No ratings yet

- 2009-05-28Document40 pages2009-05-28Southern Maryland OnlineNo ratings yet

- From Vision To Reality: GebizDocument10 pagesFrom Vision To Reality: Gebizmaneesh5100% (1)

- Co-creator Rights in Archival DescriptionDocument7 pagesCo-creator Rights in Archival Descriptioncinnamonbun1No ratings yet