Professional Documents

Culture Documents

LKSDJNFSD JKFHNSD JFGN

Uploaded by

Robin JamesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LKSDJNFSD JKFHNSD JFGN

Uploaded by

Robin JamesCopyright:

Available Formats

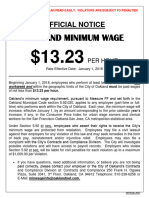

Important Information for Student Employment at UofSC

1. Upon hire, you will receive an email to your UofSC email account from I-9Advantage. The Department of Homeland

Security requires every employee working in the U.S. to complete an I-9 as proof of eligibility to work legally in the United

States. You as the employee must complete Section 1 in our automated system. You will then need to bring original

identification/employment eligibility verification documents no later than the 3rd day of work. Description of acceptable

documents can be found on the US Citizenship and Immigration Services website: https://www.uscis.gov/i-9-

central/acceptable-documents.

2. You may require a background screening, depending on your student employment role. If so, you will receive an e-mail

from HireRight that will direct you to complete on-line forms. The background invitation must be completed within 5

business days or the invitation will expire, and your department will be notified. To ensure that there is no delay in

processing your background screening provide all required information.

3. Your direct supervisor will provide the details on your work schedule, location to report, and expectations of your job.

4. UofSC presently requires all new student employees complete a Form W-4 for tax withholdings. The completed W-4 form

should be submitted to the Payroll Department at 1600 Hampton Street (7th floor) on or before the hire date, or as soon as

possible. The W-4 form and corresponding worksheet can be found on the Internal Revenue Service website:

https://www.irs.gov/pub/irs-pdf/fw4.pdf.

5. Once your effective date of employment has been reached and your hire record has been established in the HR/Payroll

system, you will be able to log in to UofSC’s Employee Self Service at hcm.ps.sc.edu. When logging in, you will use your

Network Username and password. You will be able to view your current and previous paychecks, view your tax

withholdings (W-4), and enter your direct deposit account information. It is important you log in soon after you begin

employment to ensure your direct deposit elections are ready for your first paycheck.

6. You will be paid on a pay lag. A pay lag means earnings for the first half of the month will be paid at the end of the month

and earnings for the second half of the month will be paid the following month on the 15th day. All University employees

are paid on the 15th and last day of each month. Please note, your first paycheck will be deposited into your bank account

approximately one month after you begin work.

7. If you are paid hourly, you will be paid an hourly rate for the work you perform and you are considered non-exempt under

the Fair Labor Standards Act. Your supervisor will provide the hourly rate to you for the job you were hired to perform.

a. In order to be paid on time, you must complete your timesheet in ITAMS by the timesheet deadlines. Directions

are available here. The time sheet deadlines are published by the Payroll Office and are listed by pay period along

with all the paydays for the year: https://sc.edu/about/offices_and_divisions/payroll/pay_dates/index.php.

8. If you are paid a salary, you will be paid a flat salary amount for the work you perform and you are considered exempt

under the Fair labor Standards Act. Your supervisor will provide the salary to you for the job you were hired to perform.

9. International Student Employees must complete UofSC’s Foreign National Tax Information Form:

https://sc.edu/about/offices_and_divisions/payroll/documents/forms_tax_information_form_revised71417.pdf

Completed forms can be either submitted directly to the Payroll Office or your Student Hire Representative can attach to

your hire documentation.

This acknowledges my receipt of the Affordable Care Act (ACA) Market Exchange Notice. I understand that the Notice includes

answers to the following questions which are designed to assist in my understanding of the Health Insurance Marketplace:

• What is the Health Insurance Marketplace?

• Can I save money on my health insurance premiums in the marketplace?

• Does employer health coverage affect eligibility for premium savings through the marketplace?

• How can I get more information?

I understand that I may qualify to save money and lower my monthly premium via the Health Insurance Marketplace, but only if my

employer does not offer me qualified coverage, or offers coverage that doesn't meet certain standards. Note: If you purchase a

health plan through the marketplace instead of accepting health coverage offered to you by your employer, then you may lose the

employer contribution (if any) to the employer- offered coverage. Also, this employer contribution -as well as your employee

contribution to employer- offered coverage- is often excluded from income for federal and state income tax purposes. Your

payments for coverage through the marketplace are made on an after-tax basis.

ROBIN JAMES

I (print legal name) ____________________________________ certify that I have received and read the aforementioned Important

10/07/2019

Information for Student Employment at UofSC on (today’s date) ______________________.

Student Employee Signature ____________________________________

You might also like

- Sample Hire Letter For Temporary Worker - Effective September 18, 2020Document3 pagesSample Hire Letter For Temporary Worker - Effective September 18, 2020Sakib AhmedNo ratings yet

- External Candidates Not On Grant FundingDocument5 pagesExternal Candidates Not On Grant FundingNew Top Music VideosNo ratings yet

- JLTDocument21 pagesJLTSurendiran DhayalarajanNo ratings yet

- E Verify FaqsDocument4 pagesE Verify FaqsMuhammad Aulia RahmanNo ratings yet

- 10 Steps To HiringDocument4 pages10 Steps To HiringjasoniohNo ratings yet

- TahaDocument3 pagesTahataharNo ratings yet

- Missouri UI Online Claims Filing - After I FileDocument7 pagesMissouri UI Online Claims Filing - After I FileTom JoadNo ratings yet

- Completing The Form I9Document1 pageCompleting The Form I9ashwini arulrajhanNo ratings yet

- E-Verify Frequently Asked Questions (Faqs)Document4 pagesE-Verify Frequently Asked Questions (Faqs)Muhammad Mazharul IslamNo ratings yet

- Information SheetDocument5 pagesInformation SheetShrishNo ratings yet

- Payroll Basics 2015 2016Document6 pagesPayroll Basics 2015 2016Markandeya ChitturiNo ratings yet

- NM Self/Participant Direction Employee Employment PacketDocument34 pagesNM Self/Participant Direction Employee Employment PacketShellyJacksonNo ratings yet

- 99 SCHDocument3 pages99 SCHMarcus WilsonNo ratings yet

- Unemployment Insurance Faqs Regarding Covid-19:: UpdateDocument11 pagesUnemployment Insurance Faqs Regarding Covid-19:: UpdatenwytgNo ratings yet

- Beacon O - S A: Frequently Asked QuestionsDocument8 pagesBeacon O - S A: Frequently Asked QuestionsRowell JaoNo ratings yet

- Employers Guide CurrentDocument62 pagesEmployers Guide Currentglamom100% (3)

- Casual Appointments - Eait Faculty & Schools: Modules (Copy of Mytraining Report On Blackboard)Document8 pagesCasual Appointments - Eait Faculty & Schools: Modules (Copy of Mytraining Report On Blackboard)ukyo0801No ratings yet

- Opt Training 2015 001Document4 pagesOpt Training 2015 001gajjalavivekNo ratings yet

- Wage and Student Hiring ProcessingDocument2 pagesWage and Student Hiring Processingayotech08_762989644No ratings yet

- NSSA RegistrationDocument10 pagesNSSA RegistrationTawanda Tatenda HerbertNo ratings yet

- United States Office of Personnel Management The Federal Government's Human Resources AgencyDocument9 pagesUnited States Office of Personnel Management The Federal Government's Human Resources AgencyFilozófus ÖnjelöltNo ratings yet

- Employer's Report of Injury/disease (Form 7) : Reference Guide For EmployersDocument35 pagesEmployer's Report of Injury/disease (Form 7) : Reference Guide For Employersarafat albadriNo ratings yet

- Sample Letter of Offer Project AssistantDocument5 pagesSample Letter of Offer Project AssistantSam MuelNo ratings yet

- Contract Librarian Appointment Template 06 21 08Document2 pagesContract Librarian Appointment Template 06 21 08Winniejanes nyabokeNo ratings yet

- UIF Maternity Benefits: Everything You Need to KnowDocument5 pagesUIF Maternity Benefits: Everything You Need to KnowJa DabNo ratings yet

- Sample Letter of Offer Project AssistantDocument5 pagesSample Letter of Offer Project AssistantAjaya DhakalNo ratings yet

- Screenshot 2019-10-16 at 1.26.55 AMDocument2 pagesScreenshot 2019-10-16 at 1.26.55 AMSantiva ReddingNo ratings yet

- Michigan Employer AdvisorDocument5 pagesMichigan Employer AdvisorMichigan News100% (1)

- UIF Maternity Benefits: Everything You Need to KnowDocument4 pagesUIF Maternity Benefits: Everything You Need to Knowdiane terolNo ratings yet

- FAQs For Ex-EmployeesDocument6 pagesFAQs For Ex-Employeeskiran chavdaNo ratings yet

- Ethiopian Payroll AccountingDocument16 pagesEthiopian Payroll AccountingRashzi Peace PoyNo ratings yet

- Federal Employees' Group Life Insurance Program (FEGLI) Life Insurance Open Season GuidanceDocument9 pagesFederal Employees' Group Life Insurance Program (FEGLI) Life Insurance Open Season GuidanceFedSmith Inc.No ratings yet

- Umbrella FAQDocument7 pagesUmbrella FAQKusuma NandiniNo ratings yet

- Sample Letter of Offer Project AssistantDocument5 pagesSample Letter of Offer Project AssistantSatish VengatesanNo ratings yet

- H-1B Handbook GuideDocument7 pagesH-1B Handbook GuidebennitoNo ratings yet

- How to Apply for a Social Security Number as an International StudentDocument7 pagesHow to Apply for a Social Security Number as an International StudentJabeerNo ratings yet

- Sample Project or Program Assistant Offer LetterDocument5 pagesSample Project or Program Assistant Offer LetterRemya R. KumarNo ratings yet

- 1.7 H.R Policies: 1.7.1 Talent ManagementDocument9 pages1.7 H.R Policies: 1.7.1 Talent Managementaditi thakurNo ratings yet

- Instructions For Form 941: (Rev. January 2013)Document10 pagesInstructions For Form 941: (Rev. January 2013)alanngu93No ratings yet

- Employment contract and compensationDocument9 pagesEmployment contract and compensationYolly DiazNo ratings yet

- Frequently Asked Questions During The Coronavirus Emergency: Self-Employed NJ WorkersDocument2 pagesFrequently Asked Questions During The Coronavirus Emergency: Self-Employed NJ Workersdavid rockNo ratings yet

- FORM & Documents Required at The Time of JoiningDocument3 pagesFORM & Documents Required at The Time of JoiningSiddhant SinghNo ratings yet

- STEM OPT InstructionsDocument7 pagesSTEM OPT InstructionshusktechNo ratings yet

- OPT Application ChecklistDocument3 pagesOPT Application ChecklistA ZHOUNo ratings yet

- Annexure - Iv Information Sheet Name: Candidate ID:: 1. Role and Competency Based OrganizationDocument3 pagesAnnexure - Iv Information Sheet Name: Candidate ID:: 1. Role and Competency Based OrganizationdfsdfNo ratings yet

- F-1 Opt: Rules and Regulations For Optional Practical TrainingDocument29 pagesF-1 Opt: Rules and Regulations For Optional Practical TrainingThomas VargheseNo ratings yet

- Optional Practical Training NewDocument4 pagesOptional Practical Training Newthro999No ratings yet

- Employment-Based Immigration Guidelines: U.S. Immigration GuideDocument4 pagesEmployment-Based Immigration Guidelines: U.S. Immigration GuideJuan OspinaNo ratings yet

- Quickbooks Payroll Qs Section 3Document7 pagesQuickbooks Payroll Qs Section 3Noorullah0% (1)

- Payroll Accounting 2013 Bieg 23rd Edition Solutions ManualDocument31 pagesPayroll Accounting 2013 Bieg 23rd Edition Solutions ManualBrittanyMorrismxgo100% (39)

- A Guide To Terms and Conditions: Advanced Learning LoanDocument16 pagesA Guide To Terms and Conditions: Advanced Learning LoanAnca BodianNo ratings yet

- Employment Verification Form: The Department of Early Education and Care Subsidized Child CareDocument6 pagesEmployment Verification Form: The Department of Early Education and Care Subsidized Child CareJessica PotratzNo ratings yet

- Top 10 Things You Should Know - . .: About The Reemployment Assistance System When Filing Your ClaimDocument2 pagesTop 10 Things You Should Know - . .: About The Reemployment Assistance System When Filing Your ClaimPatrick PadgettNo ratings yet

- Bancassurance FAQs for EFU Life InsuranceDocument7 pagesBancassurance FAQs for EFU Life InsuranceAzeem AnwarNo ratings yet

- What Unitedhealth Group Offers You: Automatic Enrollment Makes It SimpleDocument3 pagesWhat Unitedhealth Group Offers You: Automatic Enrollment Makes It SimpleHendrik SauterNo ratings yet

- Local Notices v8 9-20-2018Document13 pagesLocal Notices v8 9-20-2018Katherine EcheverriaNo ratings yet

- Project Trainee Appointment Letter TemplateDocument4 pagesProject Trainee Appointment Letter TemplateGovind MaheshwariNo ratings yet

- Implementation of The E-Verify Requirement at The University of Nebraska-Lincoln BackgroundDocument2 pagesImplementation of The E-Verify Requirement at The University of Nebraska-Lincoln BackgroundTrầnQuangNo ratings yet

- Maximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryFrom EverandMaximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryNo ratings yet

- Sample Position DescriptionDocument1 pageSample Position DescriptionRobin JamesNo ratings yet

- Robin James Invoice for Medical SuppliesDocument2 pagesRobin James Invoice for Medical SuppliesRobin JamesNo ratings yet

- SGWFLVJDNDocument1 pageSGWFLVJDNRobin JamesNo ratings yet

- Quiz 1 PDFDocument1 pageQuiz 1 PDFRobin JamesNo ratings yet

- Sample Position DescriptionDocument1 pageSample Position DescriptionRobin JamesNo ratings yet

- Finite-Element Method Simulations of Guided THz WavesDocument17 pagesFinite-Element Method Simulations of Guided THz WavesRobin JamesNo ratings yet

- Finite Element Modeling and Simulation of Ultrasonic Guided Wave Propagation Using Frequency Response AnalysisDocument5 pagesFinite Element Modeling and Simulation of Ultrasonic Guided Wave Propagation Using Frequency Response AnalysisRobin JamesNo ratings yet

- Efficient finite element modelling of ultrasound waves in elastic mediaDocument218 pagesEfficient finite element modelling of ultrasound waves in elastic mediaSutanwi LahiriNo ratings yet

- Decomposition of Fundamental Lamb Wave Modes in Complex Metal Structures Using COMSOLDocument8 pagesDecomposition of Fundamental Lamb Wave Modes in Complex Metal Structures Using COMSOLMohammad HarbNo ratings yet

- Presentation 1Document9 pagesPresentation 1Robin JamesNo ratings yet

- Impact Damage Detection in Composite Plates Using Acoustic Emission Signal Signature IdentificationDocument18 pagesImpact Damage Detection in Composite Plates Using Acoustic Emission Signal Signature IdentificationRobin JamesNo ratings yet

- Robin James Invoice for Medical SuppliesDocument2 pagesRobin James Invoice for Medical SuppliesRobin JamesNo ratings yet

- IRF Proposal V1Document2 pagesIRF Proposal V1Robin JamesNo ratings yet

- Gand MR DamhaskjnsDocument6 pagesGand MR DamhaskjnsRobin JamesNo ratings yet

- Presentation 1 MJHBKJHNDocument9 pagesPresentation 1 MJHBKJHNRobin JamesNo ratings yet

- Specimen Q-6-B - 6 MM - 15J - 2.61kg - No Delamination ObservedDocument5 pagesSpecimen Q-6-B - 6 MM - 15J - 2.61kg - No Delamination ObservedRobin JamesNo ratings yet

- Eddy Current Modeling in Composite Materials: Piers O V NDocument5 pagesEddy Current Modeling in Composite Materials: Piers O V NRobin JamesNo ratings yet

- Reviewer 2 CommentsDocument1 pageReviewer 2 CommentsRobin JamesNo ratings yet

- Corporate Finance Assignment One (20%)Document5 pagesCorporate Finance Assignment One (20%)Linh BuiNo ratings yet

- Afar 03 Partnership DissolutionDocument2 pagesAfar 03 Partnership DissolutionJohn Laurence LoplopNo ratings yet

- How About Measuring IntrapreneurshipDocument19 pagesHow About Measuring Intrapreneurshipyohana wijayaNo ratings yet

- Courses Given in English at Seoul Campus07-2Document86 pagesCourses Given in English at Seoul Campus07-2A.N.M. neyaz MorshedNo ratings yet

- FEE STRUCTURE 2012 v1.0Document2 pagesFEE STRUCTURE 2012 v1.0HaslindaNo ratings yet

- A Study On Women in Manufacturing in EthiopiaDocument180 pagesA Study On Women in Manufacturing in EthiopiaAbebe TekaNo ratings yet

- Ujian Tengah Semester English For Islamic EcoonomicsDocument3 pagesUjian Tengah Semester English For Islamic EcoonomicsASUS AsusNo ratings yet

- Return of InvestmentDocument5 pagesReturn of InvestmentPakar Kuda LautNo ratings yet

- What Is Social Media ManagementDocument5 pagesWhat Is Social Media ManagementAnalia WriterNo ratings yet

- Quarter 1 Module 3Document12 pagesQuarter 1 Module 3Billy JoeNo ratings yet

- Process Mapping Design of Supply Chain Management of NikeDocument14 pagesProcess Mapping Design of Supply Chain Management of NikePayal Bansal0% (2)

- SWOT Analysis of Michelin With USPDocument2 pagesSWOT Analysis of Michelin With USPReymond LovendinoNo ratings yet

- Sabzar Ahmad Peerzadah DR Sabiya Mufti DR Nazir Ah Nazir - EUIjADocument7 pagesSabzar Ahmad Peerzadah DR Sabiya Mufti DR Nazir Ah Nazir - EUIjARahul GurjarNo ratings yet

- Make in India 2Document7 pagesMake in India 2Hcs OnlineNo ratings yet

- Job Allocation, ScheduleDocument12 pagesJob Allocation, ScheduleCaperberryNo ratings yet

- History of derivatives from ancient times to modern marketsDocument15 pagesHistory of derivatives from ancient times to modern marketsUyên NguyễnNo ratings yet

- Rev 1Document1 pageRev 1Jessa BeloyNo ratings yet

- Finance Budget 2023Document4 pagesFinance Budget 2023SakshamNo ratings yet

- Asymmetric and Non-Linear Exchange Rate EffectDocument34 pagesAsymmetric and Non-Linear Exchange Rate EffectGennaro D'AngeloNo ratings yet

- Question/Answers: Chapter 1: Geography To Commercial GeographyDocument4 pagesQuestion/Answers: Chapter 1: Geography To Commercial GeographyAisha Ashraf100% (2)

- Old SchemeDocument4 pagesOld SchemeUTTAM AGRAWALNo ratings yet

- Contract DocumentDocument49 pagesContract DocumentEngineeri TadiyosNo ratings yet

- Tutorial 6 - TRMDocument9 pagesTutorial 6 - TRMHằngg ĐỗNo ratings yet

- Managing Human Resources, 4th Edition Chapters 1 - 17Document49 pagesManaging Human Resources, 4th Edition Chapters 1 - 17Aamir Akber Ali67% (3)

- Chapter 7-١Document27 pagesChapter 7-١zkNo ratings yet

- ManagementSpansandLayers - Booz and Co PDFDocument8 pagesManagementSpansandLayers - Booz and Co PDFMukul JainNo ratings yet

- Engineering Management - Chapter - 9 PDFDocument2 pagesEngineering Management - Chapter - 9 PDFdaniel zapardielNo ratings yet

- Akshay Finance PRJCTDocument38 pagesAkshay Finance PRJCTsamarthadhkariNo ratings yet

- Krispy Kreme Doughnuts ProjectDocument18 pagesKrispy Kreme Doughnuts ProjectSushant MandalNo ratings yet

- Mid TermDocument6 pagesMid Termapi-263262077No ratings yet