Professional Documents

Culture Documents

Guideline To Accounts

Uploaded by

Naveen KumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Guideline To Accounts

Uploaded by

Naveen KumarCopyright:

Available Formats

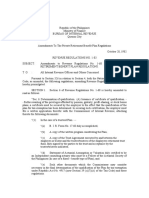

PROFIT & LOSS CLASSIFICATION & DESCRIPTION

REVENUE REV Revenue = income from normal businesss operations (excluding abnormal income and interest)

COST OF SALES VCOS Variable COS = variable costs that increase or decrease closely in proportion to revenue

FCOS Fixed COS = fixed costs that do not vary directly in proportion to revenue

DEP Depreciation = costs for which no cash was paid

EXPENSES VEXP Variable Expenses = expenses that increase or decrease closely in proportion to revenue

FEXP Fixed Expenses = expenses that do not vary directly in proportion to revenue

DA Depreciation & Amortisation = expenses for which no cash was paid

OTHER INCOME IINC Interest Income = interest from investments

AINC Other Income = abnormal income (ie. FX gains, rental income, profit from the sale of fixed assets)

OTHER EXPENSES IEXP Interest Expenses = payments for borrowings (for short term and long term debt)

TEXP Tax Expenses = profits paid to the taxation authorities

DIV Dividends = profits paid to the shareholders

ADJ Adjustments = Other adjustments to retained earnings

OEXP Other Expenses = Miscellaneous expenses

BALANCE SHEET CLASSIFICATION & DESCRIPTION

CURRENT ASSETS CASH Cash & Equivalents = cash and liquid investments which can easily be converted into cash

AR Accounts Receivable = amounts due from customers for products and services provided on credit

INV Inventory = raw materials and finished goods

WIP Work in Progress = goods and/or services that are works in process

OCA Other Current Assets = all other short-term assets (ie. prepayments)

NON-CURRENT FA Fixed Assets = the value of fixed assets (ie land, buildings, plant and equip) less accum. depreciation

ASSETS IA Intangible Assets = assets which do not have a physcial presence (ie goodwill, patents, licenses)

ONCA Investments & Other NCA = all other long-term assets (ie. shares in associated companies)

CURRENT STD Short Term Debt = includes overdrafts and interest bearing debt which is due within one year

LIABILITIES AP Accounts Payable = amounts owed to suppliers for products and services purchased on credit

TL Tax Liability = income tax that must be paid within one year

OCL Other Current Liabilities = all other short-term liabilities (including accruals and other tax liabilities)

NON-CURRENT LTD Long Term Debt = interest bearing long-term loans (more than one year)

LIABILITIES DTAX Deferred Taxes = future income taxes

ONCL Other Non-Current Liabilities = all other long-term liabilities

EQUITY RE Retained Earnings = amounts retained by the company

CE Current Earnings = current year profits retained by the company

OEQ Other Equity = all other forms of equity (ie share capital, capital reserves, minorities)

You might also like

- Accounting Cheat SheetDocument2 pagesAccounting Cheat Sheetanoushes1100% (2)

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- RevenueRegulations1 83Document4 pagesRevenueRegulations1 83Ansherina Francisco100% (1)

- CheatDocument1 pageCheatIshmo KueedNo ratings yet

- Inventory Turnover Cost of Sales / Avg Inventory High Is Effective Inv MGMT Days of Inventory On Hand (DOH) 365/inv TurnoverDocument3 pagesInventory Turnover Cost of Sales / Avg Inventory High Is Effective Inv MGMT Days of Inventory On Hand (DOH) 365/inv Turnoverjoe91bmwNo ratings yet

- Accounting Notes: List of Current AssetsDocument3 pagesAccounting Notes: List of Current Assetsfooled chimeraNo ratings yet

- SAP PM Enduser ManualDocument241 pagesSAP PM Enduser ManualNaveen KumarNo ratings yet

- Financial Projections TemplateDocument17 pagesFinancial Projections Templatedeepscribd100% (1)

- MN Srinivasan & K Kannan Principles of Insurance Law, 10 EdDocument1,668 pagesMN Srinivasan & K Kannan Principles of Insurance Law, 10 EdDrishti Agarwal100% (1)

- Lock Box in SAP ARDocument4 pagesLock Box in SAP ARNaveen KumarNo ratings yet

- Types of Major AccountsDocument27 pagesTypes of Major AccountsLala dela Cruz - FetizananNo ratings yet

- Presented Below Is The Trial Balance of Vivaldi Spa at December 31, 2019Document2 pagesPresented Below Is The Trial Balance of Vivaldi Spa at December 31, 2019SalsabiilaNo ratings yet

- SD AssignmentDocument14 pagesSD AssignmentNaveen Kumar100% (1)

- Standard Operating Procedure (SOP) For eNPSDocument22 pagesStandard Operating Procedure (SOP) For eNPSahan verma100% (1)

- Types of Major Accounts: An Account Is The Basic Storage of Information in AccountingDocument15 pagesTypes of Major Accounts: An Account Is The Basic Storage of Information in AccountingGab GamboaNo ratings yet

- MM Weekend NewDocument19 pagesMM Weekend NewNaveen KumarNo ratings yet

- FAR Preweek Lecture (B42)Document14 pagesFAR Preweek Lecture (B42)Ciarie Mae Salgado50% (4)

- Fs Cashflows Nov 20211Document21 pagesFs Cashflows Nov 20211MikhailNo ratings yet

- Total Current AssetsDocument1 pageTotal Current AssetsMarthana WilsonNo ratings yet

- Vocabulario Valuation 1Document1 pageVocabulario Valuation 1Vitória GilNo ratings yet

- Principles AccountingDocument3 pagesPrinciples Accountingphamtra241998No ratings yet

- Ananta-02 - Mengenal Laporan Keuangan, Pajak, Dan Free Cash FlowDocument40 pagesAnanta-02 - Mengenal Laporan Keuangan, Pajak, Dan Free Cash FlowKania SyahraNo ratings yet

- 132 QbalshtDocument1 page132 QbalshtAri BaagiiNo ratings yet

- A212 - Topic 2 - Slides (Part I)Document24 pagesA212 - Topic 2 - Slides (Part I)Teo ShengNo ratings yet

- Major AccountsDocument54 pagesMajor AccountsJhana ValdezNo ratings yet

- Projected Balance SheetDocument1 pageProjected Balance SheetshobuzfeniNo ratings yet

- IAS Changes2Document3 pagesIAS Changes2johnny458No ratings yet

- Balance Sheet - ComparativeDocument1 pageBalance Sheet - ComparativeRene SalinasNo ratings yet

- Categories: Net Property and EquipmentDocument4 pagesCategories: Net Property and EquipmentthrowawayyyNo ratings yet

- FOFch 03Document23 pagesFOFch 03ferahNo ratings yet

- Finance Cebu Pacific Annual Balance SheetDocument3 pagesFinance Cebu Pacific Annual Balance Sheetraymorecaliboso3No ratings yet

- Chap-2 Quản trị tài chínhDocument12 pagesChap-2 Quản trị tài chínhQuế Anh TrươngNo ratings yet

- Fsa FinalDocument8 pagesFsa Finalasifrahi143No ratings yet

- The Three Financial Statements:: Profit and Loss (P&L)Document7 pagesThe Three Financial Statements:: Profit and Loss (P&L)Bruno DomingosNo ratings yet

- Disaggregate ListDocument2 pagesDisaggregate ListSara CooperNo ratings yet

- Fabm Module 3 PowerpointDocument70 pagesFabm Module 3 PowerpointCharlene Mae BorromeoNo ratings yet

- Appropriations Dividend To Shareholders of Parent CompanyDocument30 pagesAppropriations Dividend To Shareholders of Parent Companyavinashtiwari201745No ratings yet

- Format of Financial StatementsDocument2 pagesFormat of Financial StatementsnellyNo ratings yet

- Activos No CorrientesDocument2 pagesActivos No CorrientesDaniel AstudilloNo ratings yet

- 2 140201115744 Phpapp01Document20 pages2 140201115744 Phpapp01Tannu GuptaNo ratings yet

- Cash FlowDocument1 pageCash Flowbunso2012No ratings yet

- Vertical Analysis For Att and VerizonDocument4 pagesVertical Analysis For Att and Verizonapi-299644289No ratings yet

- Fiche FRADocument2 pagesFiche FRAZaineb Mora SadikNo ratings yet

- Titan Shoppers Stop Ratio Analysis - 2014Document25 pagesTitan Shoppers Stop Ratio Analysis - 2014Jigyasu PritNo ratings yet

- Format of Cash Flow StatementDocument5 pagesFormat of Cash Flow Statementilyas2sapNo ratings yet

- Balance SheetDocument1 pageBalance SheetAjith KumarNo ratings yet

- Balance Sheet SurvivorsDocument3 pagesBalance Sheet SurvivorsRehab MorganNo ratings yet

- Miracle Workers FinalDocument73 pagesMiracle Workers FinalKeith RosalesNo ratings yet

- Group2 FRADocument22 pagesGroup2 FRAKaran TripathiNo ratings yet

- Understanding Financial Statements, Taxes, and Cash Flows: Income Statement Balance Sheet Taxes Free Cash Flow (FCF)Document11 pagesUnderstanding Financial Statements, Taxes, and Cash Flows: Income Statement Balance Sheet Taxes Free Cash Flow (FCF)Rejean Dela CruzNo ratings yet

- Balance SheetDocument1 pageBalance Sheetapi-300132327No ratings yet

- Statement of Cash FlowsDocument7 pagesStatement of Cash FlowsratihNo ratings yet

- MGMT 200 NotesDocument11 pagesMGMT 200 NotesCaroline CareyNo ratings yet

- Major AccountsDocument24 pagesMajor AccountscelestinaNo ratings yet

- Profit and Loss AccountDocument2 pagesProfit and Loss Accountjohn paulNo ratings yet

- Study Unit 1 FAC1601Document18 pagesStudy Unit 1 FAC1601andreqwNo ratings yet

- Cash Flow Before Changes in Working Capital: Sopl Profit From OperationsDocument1 pageCash Flow Before Changes in Working Capital: Sopl Profit From Operationstylee97No ratings yet

- Group 4 Symphony FinalDocument10 pagesGroup 4 Symphony FinalSachin RajgorNo ratings yet

- Glossary 3Document3 pagesGlossary 3bobblytasticNo ratings yet

- PrefaceDocument2 pagesPrefaceAfsal ParakkalNo ratings yet

- Bangladesh Commerce Bank Limited: Balance Sheet As at 31 December 2008Document4 pagesBangladesh Commerce Bank Limited: Balance Sheet As at 31 December 2008nurul000No ratings yet

- Cash Flow Cheat SheetsDocument2 pagesCash Flow Cheat SheetsSarah SafiraNo ratings yet

- Hand Outs AccountingDocument5 pagesHand Outs AccountingFinance TutorNo ratings yet

- Accounting Classification & Accounting EquationDocument25 pagesAccounting Classification & Accounting EquationMadadib 08No ratings yet

- AccountingDocument1 pageAccountingniranjanisnairNo ratings yet

- Free Basic Short Financial Accounting - 2f20dc43 314d 49bf A7e8 F398e2c49e3dDocument32 pagesFree Basic Short Financial Accounting - 2f20dc43 314d 49bf A7e8 F398e2c49e3dCareer and TechnologyNo ratings yet

- Value in Lacs Sme-Service InputDocument27 pagesValue in Lacs Sme-Service InputSugandha MadhokNo ratings yet

- PM 9.30 PM NewDocument17 pagesPM 9.30 PM NewNaveen KumarNo ratings yet

- SAP MM Course Content and Timelines - Advance Level (Package 2)Document18 pagesSAP MM Course Content and Timelines - Advance Level (Package 2)Naveen KumarNo ratings yet

- STO - Solution Document - V3Document8 pagesSTO - Solution Document - V3Naveen KumarNo ratings yet

- STO - User Manual - V1Document10 pagesSTO - User Manual - V1Naveen KumarNo ratings yet

- Newsletter - Pre-KG (Nov-Dec 2023) - 05 - 2024 - 14 - 07 - 55Document6 pagesNewsletter - Pre-KG (Nov-Dec 2023) - 05 - 2024 - 14 - 07 - 55Naveen KumarNo ratings yet

- MM 10am NewDocument21 pagesMM 10am NewNaveen KumarNo ratings yet

- Discovery Form SDDocument6 pagesDiscovery Form SDNaveen KumarNo ratings yet

- Sap PP 5.30Document17 pagesSap PP 5.30Naveen KumarNo ratings yet

- MM 9.30am NewDocument19 pagesMM 9.30am NewNaveen KumarNo ratings yet

- Sap PM Course ContentDocument4 pagesSap PM Course ContentNaveen KumarNo ratings yet

- PDF PM Test Scripts Full Aahg 1600 - CompressDocument78 pagesPDF PM Test Scripts Full Aahg 1600 - CompressNaveen KumarNo ratings yet

- S4 PP PDFDocument2 pagesS4 PP PDFNaveen KumarNo ratings yet

- Spare Flow PDFDocument2 pagesSpare Flow PDFNaveen KumarNo ratings yet

- CO Custom Content PDFDocument2 pagesCO Custom Content PDFNaveen KumarNo ratings yet

- FICO Corporate TrainerDocument5 pagesFICO Corporate TrainerNaveen KumarNo ratings yet

- 1 Wiremesh 2.5mm 2.5mm 5mm 2 Wiremesh 3mm 3mm 10mm 3 MTO Product These Fields Required in Product Master To Differentiate The Products 4 5 Mesh WireDocument16 pages1 Wiremesh 2.5mm 2.5mm 5mm 2 Wiremesh 3mm 3mm 10mm 3 MTO Product These Fields Required in Product Master To Differentiate The Products 4 5 Mesh WireNaveen KumarNo ratings yet

- Ds Netsuite CPQ PDFDocument2 pagesDs Netsuite CPQ PDFNaveen KumarNo ratings yet

- Mesh-Wire 1 Pre-Assy Cramping Straigtening: Routing Description Operations/OperationDocument5 pagesMesh-Wire 1 Pre-Assy Cramping Straigtening: Routing Description Operations/OperationNaveen KumarNo ratings yet

- S4 Hana MM 1809bbbDocument1 pageS4 Hana MM 1809bbbNaveen KumarNo ratings yet

- Rework in Manufacturing - SAP BlogsDocument7 pagesRework in Manufacturing - SAP BlogsNaveen KumarNo ratings yet

- HSPL Fi 06 House Bank v1.0Document18 pagesHSPL Fi 06 House Bank v1.0Naveen KumarNo ratings yet

- SAP COPA-configurationDocument177 pagesSAP COPA-configurationNaveen Kumar100% (1)

- Special Procurement TypesDocument109 pagesSpecial Procurement TypesNaveen KumarNo ratings yet

- ValueFirst Enterprise Mobility Solution PresentationDocument19 pagesValueFirst Enterprise Mobility Solution PresentationNaveen KumarNo ratings yet

- Chapter 12Document38 pagesChapter 12Lê Bảo DuyNo ratings yet

- Problem 1-3: Jhazreel Mae Biasura Bsa 2BDocument9 pagesProblem 1-3: Jhazreel Mae Biasura Bsa 2BJhazreel BiasuraNo ratings yet

- AGI Exam 1 With Answers - EnglishDocument13 pagesAGI Exam 1 With Answers - EnglishBaskar SayeeNo ratings yet

- Inheritance EssayDocument2 pagesInheritance EssaySanm SidhuNo ratings yet

- Final Departmental Examination: College of Accountancy and FinanceDocument11 pagesFinal Departmental Examination: College of Accountancy and FinancecmaeNo ratings yet

- Annuity: Meanings and TypesDocument34 pagesAnnuity: Meanings and TypesDevyansh GuptaNo ratings yet

- Bus MathDocument3 pagesBus MathSVTKhsiaNo ratings yet

- As 1538 ProceededDocument1 pageAs 1538 ProceededYassi CurtisNo ratings yet

- Related Literature and Studies 2Document29 pagesRelated Literature and Studies 2Yawi Abdul KarimNo ratings yet

- Taxation Law Question Bank BALLBDocument49 pagesTaxation Law Question Bank BALLBaazamrazamaqsoodiNo ratings yet

- MACP Salient Featues DOPDocument11 pagesMACP Salient Featues DOPPNVITALKUMARNo ratings yet

- Uganda NSSF Annual Report 2020Document246 pagesUganda NSSF Annual Report 2020jadwongscribdNo ratings yet

- Acp - Acc417 Case Study 1Document6 pagesAcp - Acc417 Case Study 1Faker MejiaNo ratings yet

- Long-Term Disability Insurance: Benefits: PurposeDocument7 pagesLong-Term Disability Insurance: Benefits: Purpose1990sukhbirNo ratings yet

- Incom Tax Proclamation EnglishDocument65 pagesIncom Tax Proclamation EnglishNegash JaferNo ratings yet

- Employees Provident Fund Organization: Emp Code: CompanyDocument2 pagesEmployees Provident Fund Organization: Emp Code: CompanyAmit RuikarNo ratings yet

- Sure Start Maternity Grant: From The Social FundDocument11 pagesSure Start Maternity Grant: From The Social FundKenya GrigoreNo ratings yet

- Nikhil Parthsarthi, Batch XIV,, Sem 5, Labour Law 2Document16 pagesNikhil Parthsarthi, Batch XIV,, Sem 5, Labour Law 224. Rashi -Kaveri-KavilashNo ratings yet

- Mdtny19699780000010116 2023Document2 pagesMdtny19699780000010116 2023vedniwasNo ratings yet

- Will Baby Boomers Bankrupt Social SecurityDocument2 pagesWill Baby Boomers Bankrupt Social SecurityFirdaNo ratings yet

- Activity #2-Employee BenefitsDocument5 pagesActivity #2-Employee BenefitsJamaica DavidNo ratings yet

- Accounting For Insurance Contracts Deferred Tax and Earnings Per ShareDocument2 pagesAccounting For Insurance Contracts Deferred Tax and Earnings Per ShareJanine CamachoNo ratings yet

- Acfrogbcb Ms Bu63bgir6a5mzr9iunb2pmzmexmabj 4hj36l0uezc6ewccy1tpcyr7sdn9yzbhtgdvs Eijelsp9pl6tcu7blolcdeipfsa16k 71fyzopeexfd Ewfe3camrxoo Gjz9f BaxDocument1 pageAcfrogbcb Ms Bu63bgir6a5mzr9iunb2pmzmexmabj 4hj36l0uezc6ewccy1tpcyr7sdn9yzbhtgdvs Eijelsp9pl6tcu7blolcdeipfsa16k 71fyzopeexfd Ewfe3camrxoo Gjz9f BaxHarpreetNo ratings yet

- ACE PP11MSTP1 ExamDocument18 pagesACE PP11MSTP1 Examgrayce limNo ratings yet