Professional Documents

Culture Documents

Cap Bud

Uploaded by

Gileah ZuasolaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cap Bud

Uploaded by

Gileah ZuasolaCopyright:

Available Formats

1.

Comparing Payback Period and Discounted Payback Period – Mathew Incorporated is debating using

Payback Period versus Discounted Payback Period for small dollar projects. The Information Officer has

submitted a new computer project of P15,000 cost. The cash flows will be P5,000 each year for the next

five years. The cut-off period used by Mathew Incorporated is three years. The Information Officer states

it doesn’t matter what model the company uses for the decision, it is clearly an acceptable project.

Demonstrate for the IO that the selection of the model does matter!

2. Comparing Payback Period and Discounted Payback Period – Neilsen Incorporated is switching from

Payback Period to Discounted Payback Period for small dollar projects. The cut-off period will remain at 3

years. Given the following four projects cash flows and using a 10% discount rate, which projects that

would have been accepted under Payback Period will now be rejected under Discounted Payback Period?

Project Project

Cash Flows Project One Project Two Three Four

Initial cost P10,000 P15,000 P8,000 P18,000

Year One P4,000 P7,000 P3,000 P10,000

Year Two P4,000 P5,500 P3,500 P11,000

Year Three P4,000 P4,000 P4,000 P0

3. Net Present Value – Swanson Industries has four potential projects all with an initial cost of P2,000,000.

The capital budget for the year will only allow Swanson industries to accept one of the four projects. Given

the discount rates and the future cash flows of each project, which project should they accept?

Cash Flows Project M Project N Project O Project P

Year one P500,000 P600,000 P1,000,000 P300,000

Year two P500,000 P600,000 P800,000 P500,000

Year three P500,000 P600,000 P600,000 P700,000

Year four P500,000 P600,000 P400,000 P900,000

Year five P500,000 P600,000 P200,000 P1,100,000

Discount Rate 6% 9% 15% 22%

4. Internal Rate of Return – What are the IRRs of the four projects for Swanson Industries in problem #3?

5. Net Present Value – Campbell Industries has four potential projects all with an initial cost of P1,500,000.

The capital budget for the year will only allow Swanson industries to accept one of the four projects. Given

the discount rates and the future cash flows of each project, which project should they accept?

Cash Flows Project Q Project R Project S Project T

Year one P350,000 P400,000 P700,000 P200,000

Year two P350,000 P400,000 P600,000 P400,000

Year three P350,000 P400,000 P500,000 P600,000

Year four P350,000 P400,000 P400,000 P800,000

Year five P350,000 P400,000 P300,000 P1,000,000

Discount Rate 4% 8% 13% 18%

6. Internal Rate of Return – What are the IRRs of the four projects for Swanson Industries in problem #5?

You might also like

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- An Introduction to PRINCE2: Managing and Directing Successful ProjectsFrom EverandAn Introduction to PRINCE2: Managing and Directing Successful ProjectsRating: 4.5 out of 5 stars4.5/5 (3)

- MAS01Document19 pagesMAS01andzie09876No ratings yet

- BBDocument3 pagesBBJoshua WacanganNo ratings yet

- Capital-Budgeting-Techniques 1. Gamestop Corporation Has Three Projects Under Consideration. The Cash Flows For Each of Them Are Shown in The Following Table. The Firm Has A 16% Cost of CapitalDocument6 pagesCapital-Budgeting-Techniques 1. Gamestop Corporation Has Three Projects Under Consideration. The Cash Flows For Each of Them Are Shown in The Following Table. The Firm Has A 16% Cost of CapitalEvangeline RemedilloNo ratings yet

- Non-Discounted Capital Budgeting Techniques: ExampleDocument2 pagesNon-Discounted Capital Budgeting Techniques: ExampleKristineTwo CorporalNo ratings yet

- Capital Budgeting Seatwork 2 MWFDocument1 pageCapital Budgeting Seatwork 2 MWFnelle de leonNo ratings yet

- Now Year 1 Year 2 Year 3 Year 4: Answer: The Net Present Value Is P65,984Document2 pagesNow Year 1 Year 2 Year 3 Year 4: Answer: The Net Present Value Is P65,984Unknowingly AnonymousNo ratings yet

- Non-Discounted Capital Budgeting TechniquesDocument4 pagesNon-Discounted Capital Budgeting TechniquesLloyd ReglosNo ratings yet

- Basic Methods For Making Economy StudiesDocument4 pagesBasic Methods For Making Economy StudiesJubillee MagsinoNo ratings yet

- Investment Appraisal TutorialDocument6 pagesInvestment Appraisal TutorialQin Yi NgNo ratings yet

- 4 Capital Budgeting - DTI UP PDFDocument35 pages4 Capital Budgeting - DTI UP PDFEarthAngel OrganicsNo ratings yet

- Endterm ExamDocument6 pagesEndterm ExamMasTer PanDaNo ratings yet

- Cap Budg QuestionsDocument6 pagesCap Budg QuestionsSikandar AsifNo ratings yet

- Capital Budgeting LectureDocument3 pagesCapital Budgeting Lectureamormi2702No ratings yet

- 2.0 Years 2.6 Years 213,745 34.9% 1.4Document5 pages2.0 Years 2.6 Years 213,745 34.9% 1.4YameteKudasaiNo ratings yet

- ESENECO (7) Basic Methods For Making Economy StudiesDocument17 pagesESENECO (7) Basic Methods For Making Economy StudiesNicole ReyesNo ratings yet

- Capital BudgetingDocument4 pagesCapital BudgetingYaj CruzadaNo ratings yet

- PDF Intermediate Accounting Volume 3 ValixDocument4 pagesPDF Intermediate Accounting Volume 3 ValixJosh Cruz CosNo ratings yet

- Qtouto 1492176702 1Document4 pagesQtouto 1492176702 1Christy AngkouwNo ratings yet

- Capital Budgeting Quiz 1: Multiple ChoiceDocument7 pagesCapital Budgeting Quiz 1: Multiple ChoiceMark Jesus Aristo100% (1)

- Operating Cash InflowDocument11 pagesOperating Cash InflowQuiroann NalzNo ratings yet

- Project Selection MethodDocument42 pagesProject Selection Methodjeon100% (1)

- Engineering EconomyDocument2 pagesEngineering EconomyMichelle MariposaNo ratings yet

- TVM Applications To Investment and Comparison of AlternativesDocument7 pagesTVM Applications To Investment and Comparison of Alternativessab x btsNo ratings yet

- Answers To Warm-Up Exercises: AnswerDocument21 pagesAnswers To Warm-Up Exercises: AnswerMeyzla Ativa HuslikNo ratings yet

- Semifinal Part2Document5 pagesSemifinal Part2emilobaromanivNo ratings yet

- Acc14 Exercise Capital-BudgetingDocument3 pagesAcc14 Exercise Capital-BudgetingyeezzzzNo ratings yet

- MAS Part II Illustrative Examples (Capital Budgeting)Document2 pagesMAS Part II Illustrative Examples (Capital Budgeting)Princess SalvadorNo ratings yet

- Capital Budgeting ExercisesDocument4 pagesCapital Budgeting ExercisescrissilleNo ratings yet

- Question 1Document6 pagesQuestion 1Ibrahim SameerNo ratings yet

- CVDocument1 pageCVJPNo ratings yet

- Capital BudgetingDocument23 pagesCapital BudgetingNoelJr. Allanaraiz100% (4)

- Acc 223 CB PS1 2021 QDocument8 pagesAcc 223 CB PS1 2021 QAeyjay ManangaranNo ratings yet

- Problem SetDocument1 pageProblem SetJoy DimaanoNo ratings yet

- Tugas Individu I MKB Capital BudgetingDocument4 pagesTugas Individu I MKB Capital BudgetingAndryo RachmatNo ratings yet

- ACTIVITY 5 CBE Module 4Document5 pagesACTIVITY 5 CBE Module 4Christian John Resabal BiolNo ratings yet

- Exercises Capital BudgetingDocument3 pagesExercises Capital BudgetingSwap WerdNo ratings yet

- Chapter 4 Capital Budgeting Techniques 2021 - Practice ProblemsDocument20 pagesChapter 4 Capital Budgeting Techniques 2021 - Practice ProblemsAkshat SinghNo ratings yet

- AE23 Capital BudgetingDocument4 pagesAE23 Capital BudgetingCheska AgrabioNo ratings yet

- Self Practice Cost AccountingDocument17 pagesSelf Practice Cost AccountingLara Alyssa GarboNo ratings yet

- FinalsSW2 Capital-BudgetingDocument6 pagesFinalsSW2 Capital-BudgetingJona Francisco0% (1)

- Acc 223 CB PS3 QDocument8 pagesAcc 223 CB PS3 QAeyjay ManangaranNo ratings yet

- Engineering EconomicsDocument17 pagesEngineering EconomicsIan BondocNo ratings yet

- Management Advisory ServicesDocument28 pagesManagement Advisory ServicesAnnaliza DonqueNo ratings yet

- Tutorial Sheet For Engineering EconomicsDocument12 pagesTutorial Sheet For Engineering EconomicsTinashe ChikariNo ratings yet

- Operating Cash InflowDocument11 pagesOperating Cash InflowRarajNo ratings yet

- Investment Decision QuestionsDocument44 pagesInvestment Decision QuestionsAkash JhaNo ratings yet

- Capital Budgeting ProblemsDocument4 pagesCapital Budgeting ProblemsLiana Monica Lopez0% (1)

- Payback Period QuestionsDocument2 pagesPayback Period Questionspareekrishika34No ratings yet

- Practice Questions May 2018Document11 pagesPractice Questions May 2018Minnie.NNo ratings yet

- Activity - Capital Investment AnalysisDocument5 pagesActivity - Capital Investment AnalysisKATHRYN CLAUDETTE RESENTENo ratings yet

- Chapter 10 SolutionsDocument21 pagesChapter 10 SolutionsFranco Ambunan Regino75% (8)

- Project Appraisal - Investment Appraisal - 2023Document40 pagesProject Appraisal - Investment Appraisal - 2023ThaboNo ratings yet

- Iacademy Basicfin: Basic Finance and Financial Management Final RequirementDocument5 pagesIacademy Basicfin: Basic Finance and Financial Management Final RequirementClarisse AlimotNo ratings yet

- WC Management Sample ProblemsDocument2 pagesWC Management Sample ProblemsGreys Maddawat MasulaNo ratings yet

- Operating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16From EverandOperating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16No ratings yet

- Managing Successful Projects with PRINCE2 2009 EditionFrom EverandManaging Successful Projects with PRINCE2 2009 EditionRating: 4 out of 5 stars4/5 (3)

- Lessons in Corporate Finance: A Case Studies Approach to Financial Tools, Financial Policies, and ValuationFrom EverandLessons in Corporate Finance: A Case Studies Approach to Financial Tools, Financial Policies, and ValuationNo ratings yet

- Pacific Private Sector Development Initiative: A Decade of Reform: Annual Progress Report 2015-2016From EverandPacific Private Sector Development Initiative: A Decade of Reform: Annual Progress Report 2015-2016No ratings yet

- 4 Percentage TaxDocument25 pages4 Percentage TaxGileah ZuasolaNo ratings yet

- 3 - 2 - Nano WorldDocument35 pages3 - 2 - Nano WorldMelody YayongNo ratings yet

- CHAPTER24. Forming An Opinion and Reporting On Financial StatementsDocument2 pagesCHAPTER24. Forming An Opinion and Reporting On Financial StatementsGileah ZuasolaNo ratings yet

- 3 - 1 - Climate ChangeDocument46 pages3 - 1 - Climate ChangeGileah ZuasolaNo ratings yet

- 5 EXCISE - and DOCS STAMP TAXDocument17 pages5 EXCISE - and DOCS STAMP TAXGileah ZuasolaNo ratings yet

- Multiple Choice Questions in Tax Review Jan 5Document1 pageMultiple Choice Questions in Tax Review Jan 5Gileah ZuasolaNo ratings yet

- 1estate Tax Part LectureDocument51 pages1estate Tax Part LectureGileah ZuasolaNo ratings yet

- 3 VatDocument95 pages3 VatGileah ZuasolaNo ratings yet

- What Is CrystallizationDocument2 pagesWhat Is CrystallizationGileah ZuasolaNo ratings yet

- Estate Tax - Exercises On Allowable Deduction and Taxable Net EstateDocument5 pagesEstate Tax - Exercises On Allowable Deduction and Taxable Net EstateGileah ZuasolaNo ratings yet

- Chapter2 Nature..Document3 pagesChapter2 Nature..Gileah ZuasolaNo ratings yet

- 3 How Science Is Applied in TechnDocument21 pages3 How Science Is Applied in TechnGileah ZuasolaNo ratings yet

- Estate Tax - Exercises On Allowable Deduction and Taxable Net EstateDocument5 pagesEstate Tax - Exercises On Allowable Deduction and Taxable Net EstateGileah ZuasolaNo ratings yet

- Claire ResearchDocument4 pagesClaire ResearchGileah ZuasolaNo ratings yet

- Estate Tax Exercises On Gross EstateDocument5 pagesEstate Tax Exercises On Gross EstateGileah ZuasolaNo ratings yet

- Resolution Numbered 55, Series of 2014: Introduced by All Members of The Sangguniang BarangayDocument6 pagesResolution Numbered 55, Series of 2014: Introduced by All Members of The Sangguniang BarangayGileah ZuasolaNo ratings yet

- 10e 09 Chap Student WorkbookDocument22 pages10e 09 Chap Student WorkbookMSUIITNo ratings yet

- Facts About VoleyballDocument10 pagesFacts About VoleyballGileah ZuasolaNo ratings yet

- Oblicon SorianoDocument349 pagesOblicon Sorianofantasigh100% (5)

- 3 How Science Is Applied in TechnDocument21 pages3 How Science Is Applied in TechnGileah ZuasolaNo ratings yet

- Chapter 2 Accounting For Materials: Review SummaryDocument15 pagesChapter 2 Accounting For Materials: Review SummaryGileah ZuasolaNo ratings yet

- A Critique Paper On The Philippine DevelDocument5 pagesA Critique Paper On The Philippine DevelGiuseppe Carlo LaranangNo ratings yet

- ECON 200. Introduction To Microeconomics Homework 3 Part I Name: - (Multiple Choice)Document12 pagesECON 200. Introduction To Microeconomics Homework 3 Part I Name: - (Multiple Choice)Ifrah AtifNo ratings yet

- Emotional & Intellectual Well-Being (1) 8.46.20 PMDocument18 pagesEmotional & Intellectual Well-Being (1) 8.46.20 PMGileah Ymalay ZuasolaNo ratings yet

- Hersley FinalDocument2 pagesHersley FinalGileah Ymalay ZuasolaNo ratings yet

- Taxation MCQDocument6 pagesTaxation MCQJade Palma Salingay100% (8)

- Practical Accounting 1Document3 pagesPractical Accounting 1Angelo Otañes GasatanNo ratings yet

- Module 28 - Employee Benefits: Iasc Foundation: Training Material For The Ifrs For SmesDocument76 pagesModule 28 - Employee Benefits: Iasc Foundation: Training Material For The Ifrs For SmesKhayla Mitch LoyNo ratings yet

- Chapter 20 - Monitoring and Controlling Firm Performance and FunctioningDocument7 pagesChapter 20 - Monitoring and Controlling Firm Performance and FunctioningGileah ZuasolaNo ratings yet

- Scope and Meaning of Accounting 1: Accounting and Its Relationship To Shareholder Value and Business StructureDocument4 pagesScope and Meaning of Accounting 1: Accounting and Its Relationship To Shareholder Value and Business StructurepebinscribdNo ratings yet

- Brand ManagementDocument11 pagesBrand ManagementSreemathiNo ratings yet

- FS Analysis FormulasDocument2 pagesFS Analysis FormulasMaryrose SumulongNo ratings yet

- Course Outline (Akshat)Document7 pagesCourse Outline (Akshat)Saritha RajNo ratings yet

- Fluxo 02Document2 pagesFluxo 02GAME CRAFT vitorNo ratings yet

- Discounted Cash Flow Valuation SlidesDocument260 pagesDiscounted Cash Flow Valuation Slidesgambino03100% (2)

- Knowledge Process OutsourcingDocument48 pagesKnowledge Process OutsourcingCalmguy ChaituNo ratings yet

- Kuvempu University: Department of Post-Graduate Studies and Research in CommerceDocument79 pagesKuvempu University: Department of Post-Graduate Studies and Research in CommercePragathi PraNo ratings yet

- Intermediate Financial Accounting I: Intangible AssetsDocument46 pagesIntermediate Financial Accounting I: Intangible AssetsAurell Joseph MoralesNo ratings yet

- Actuarial Education & Certification Around The WorldDocument20 pagesActuarial Education & Certification Around The WorldLudovic PirlNo ratings yet

- Framework For Business Analysis and Valuation Using Financial StatementsDocument9 pagesFramework For Business Analysis and Valuation Using Financial StatementsDikaGustianaNo ratings yet

- Wachovia Securities DatabookDocument44 pagesWachovia Securities DatabookanshulsahibNo ratings yet

- Company Valuation MethodsDocument20 pagesCompany Valuation MethodsKlaus LaurNo ratings yet

- DOT - ATRAM Philippine Sustainable Development & Growth Fund - Dec 2020Document16 pagesDOT - ATRAM Philippine Sustainable Development & Growth Fund - Dec 2020Jayr LegaspiNo ratings yet

- Gibson Chapter 11 Expanded Analysis (Editted)Document35 pagesGibson Chapter 11 Expanded Analysis (Editted)Ali UmerNo ratings yet

- Swot Analysis On Reit (Ireland)Document3 pagesSwot Analysis On Reit (Ireland)Aniket Ahire100% (1)

- Chapter 8 - Bond Valuation and RiskDocument32 pagesChapter 8 - Bond Valuation and RiskJenniferNo ratings yet

- Ysch Oolg Ist.c Om: Principles of Accounts General ObjectivesDocument6 pagesYsch Oolg Ist.c Om: Principles of Accounts General ObjectivesGabriel UdokangNo ratings yet

- Dreamforce - Project Management For Admins V 1Document22 pagesDreamforce - Project Management For Admins V 1PattyNo ratings yet

- ICDS - 2 InventoryDocument21 pagesICDS - 2 Inventorykavita.m.yadavNo ratings yet

- Weekly Commentary BlackRockDocument6 pagesWeekly Commentary BlackRockelvisgonzalesarceNo ratings yet

- Audit YE 2013Document29 pagesAudit YE 2013Beverly TranNo ratings yet

- 1562 SPTOTO RHB-OSK 2023-02-23 BUY 1.75 SportsTotoStillaYielderDespiteToughTimesStayBUY 2041388072Document8 pages1562 SPTOTO RHB-OSK 2023-02-23 BUY 1.75 SportsTotoStillaYielderDespiteToughTimesStayBUY 2041388072Lim Chau LongNo ratings yet

- Required Returns and The Cost of Capital Required Returns and The Cost of CapitalDocument51 pagesRequired Returns and The Cost of Capital Required Returns and The Cost of Capitalarslan shahNo ratings yet

- HeptalysisDocument36 pagesHeptalysisbodhi_bgNo ratings yet

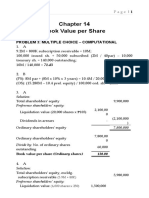

- Sol. Man. Chapter 14 Bvps 2021Document6 pagesSol. Man. Chapter 14 Bvps 2021Nikky Bless LeonarNo ratings yet

- Business Process Master List For CODocument24 pagesBusiness Process Master List For COlionelkenethNo ratings yet

- 1Q21 Profit in Line With Estimates: SM Investments CorporationDocument8 pages1Q21 Profit in Line With Estimates: SM Investments CorporationJajahinaNo ratings yet

- Securities Analysis & Portfolio Management IntroDocument50 pagesSecurities Analysis & Portfolio Management IntrogirishNo ratings yet

- Fundamentals of Investments Valuation and Management 7th Edition Jordan Solutions Manual 1Document36 pagesFundamentals of Investments Valuation and Management 7th Edition Jordan Solutions Manual 1sarahhilldemjafxpon100% (31)