Professional Documents

Culture Documents

Acctg 3a Financial Accounting & Reporting, Part 1

Uploaded by

vaneknekCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acctg 3a Financial Accounting & Reporting, Part 1

Uploaded by

vaneknekCopyright:

Available Formats

Vision: “Truth and Goodness in Man and for Mission: Produce, through responsive curriculum, morally upright, committed

through responsive curriculum, morally upright, committed and

all others through Education” competent graduates capable of meeting the growing human resources needs in the

profession, government, business, industry and home.

Tomas del Rosario College

City of Balanga

College Department

Course Code: Acctg 3a

Course Title: Financial Accounting & Reporting, Part 1

I. Course Description: This course introduces the nature, functions, scope and limitations of the broad field of accounting theory. It deals with the study of the theoretical accounting framework

objectives of financial statements, accounting conventions and generally accepted accounting principles, standard setting process for accounting practice, national as well as international

principles relating to the preparation and presentation of financial statements, the conditions under which they may be appropriately applied, their impact or effect on the financial statements

and the criticisms commonly leveled against them. The course covers the detailed discussion, appreciation and application of accounting principles covering the assets, financial and non-

financial. Emphasis is given on the interpretation and application of theories of accounting relating to cash, temporary investments, receivables, inventories, prepayments, long-term

investments, property, plant and equipment, intangibles and other assets, including financial statement presentation and disclosure requirements. The related internal control, ethical issues, and

management of assets are also covered. Exposure to computerized system in receivables, inventory and lapsing schedules is a requirement in this course.

II. Course Credits: 6 units

III. Course General Objectives: To be able to understand accounting for assets

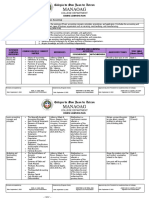

Teacher- Learner Assessment Methods/

Time Frame Topics Intended Learning Outcomes

Activities Tasks

3 hours New Conceptual Framework Understand the point of accounting and Discussion Assignment

3 hours Financial Statements who needs it Board activities Recitation

Explore the fundamental accounting Board works

principles Quizzes

Become familiar with the accounting

equation

Examine the four basic GAAP - Generally

3 hours Accepted Accounting Principles

1.5 hours Consider different forms of business

6 hours Cash and cash equivalents organization

Bank reconciliation Examine the internal control system

3 hours Proof of cash Understand bank reconciliation and related

1.5 hours journal entries

3 hours Accounts receivable Learn how to use a budget to manage cash

3 hours Notes receivable Learn how to report cash on the balance Preliminary

3 hours Loan receivable sheet Examination

3 hours Receivable financing Account for receivables and bad debts

Inventories Account for notes receivable, loans

receivables and receivable financing

Identify the costs includible as inventories

Vision: “Truth and Goodness in Man and for Mission: Produce, through responsive curriculum, morally upright, committed and

all others through Education” competent graduates capable of meeting the growing human resources needs in the

profession, government, business, industry and home.

Tomas del Rosario College

City of Balanga

1.5 hours Inventory valuation Understand inventory and periodic and Discussion Assignment

1.5 hours Biological assets perpetual inventory systems Board activities Recitation

1.5 hours Inventory estimation Become familiar with the cost of goods Board works

sold methods Quizzes

Explore inventory costing methods and

accounting principles

Understand gross profit percent and

6 hours Financial assets at fair value inventory turnover concepts

3 hours Investment in equity securities Know when and how to estimate inventory

3 hours Investment in associates Examine inventory cost flow examples

3 hours Financial asset at amortized cost Explain perpetual system

3 hours Investment property Account for different types of investments

1.5 hours Fund and other investments Midterm

6 hours Derivatives Examination

3 hours

6 hours Property, plant and equipment Understand plant assets Discussion Assignment

1.5 hours Government grant Determine the cost of plant assets Board activities Recitation

1.5 hours Borrowing costs Learn depreciation methods Board works

6 hours Land, building and machinery Understand partial year depreciation Quizzes

3 hours Depreciation Know how to change the useful life of a

3 hours Depletion plant asset

3 hours Revaluation Become familiar with the disposition of a

3 hours Impairment of assets plant asset

1.5 hours Intangible assets Explain depletion and natural resources

3 hours Specific intangible assets Explain intangible assets and amortization Final Examination

1.5 hours Research and development costs

3 hours

Prepared by: Recommending approval: Approved by:

Christine Joyce R. Berganio Jefferson Triguero Marina B. Santos, Ed. D. Mercedes G. Sanchez, Ed. D.

Instructor Department Chair College Dean Vice President for Academics,

Student Affairs and Extension Services

You might also like

- ACCT402 Auditing and Assurance Concepts and Application 1Document9 pagesACCT402 Auditing and Assurance Concepts and Application 1Miles SantosNo ratings yet

- Audit of Liab ModuleDocument13 pagesAudit of Liab ModuleChristine Mae Fernandez MataNo ratings yet

- BTLE 30043 Bookkeeping For Service BusinessDocument135 pagesBTLE 30043 Bookkeeping For Service Businessnicoleshi100% (1)

- Assurance Principles, Professional Ethics and Good Governance SyllabusDocument15 pagesAssurance Principles, Professional Ethics and Good Governance SyllabusGerlie0% (1)

- 30 03 2023Document11 pages30 03 2023hospetNo ratings yet

- Strategic Planning Educ204Document14 pagesStrategic Planning Educ204vaneknekNo ratings yet

- Managing Organizational Change PDFDocument13 pagesManaging Organizational Change PDFvaneknekNo ratings yet

- Acco 30013 Accounting For Special Transactions 2019Document8 pagesAcco 30013 Accounting For Special Transactions 2019Azel Ann AlibinNo ratings yet

- Issues and Problems in Educational PlanningDocument16 pagesIssues and Problems in Educational Planningvaneknek100% (3)

- Issues and Problems in Educational PlanningDocument16 pagesIssues and Problems in Educational Planningvaneknek100% (3)

- OBE Auditing SYLLABUS JRiveraDocument6 pagesOBE Auditing SYLLABUS JRiveraK-Cube MorongNo ratings yet

- Ak 01Document5 pagesAk 01djawapinNo ratings yet

- Kelompok 1 - Chapter 13 Cash Flow Estimation and Risk Analysis Rev1 - 18.30Document18 pagesKelompok 1 - Chapter 13 Cash Flow Estimation and Risk Analysis Rev1 - 18.30Afif LinofianNo ratings yet

- Financial Management Syllabus 2021-2022Document7 pagesFinancial Management Syllabus 2021-2022Marasherlyn VergaraNo ratings yet

- Tomas Del Rosario College: City of BalangaDocument2 pagesTomas Del Rosario College: City of BalangavaneknekNo ratings yet

- Acctg 12 Accounting For Governmental, Not For-Profit Entities & Specialized IndustriesDocument2 pagesAcctg 12 Accounting For Governmental, Not For-Profit Entities & Specialized IndustriesvaneknekNo ratings yet

- Audit 1 Assurance Principles Ethics & Good GovernanceDocument3 pagesAudit 1 Assurance Principles Ethics & Good GovernancevaneknekNo ratings yet

- Tomas Del Rosario College: City of BalangaDocument2 pagesTomas Del Rosario College: City of BalangavaneknekNo ratings yet

- Tomas Del Rosario College: Balanga City, Bataan DEPARTMENT: AccountancyDocument5 pagesTomas Del Rosario College: Balanga City, Bataan DEPARTMENT: AccountancyVanessa L. VinluanNo ratings yet

- Tomas Del Rosario College: City of BalangaDocument2 pagesTomas Del Rosario College: City of BalangavaneknekNo ratings yet

- Audit 2 Assurance Principles, Professional Ethics & Good GovernanceDocument5 pagesAudit 2 Assurance Principles, Professional Ethics & Good GovernancevaneknekNo ratings yet

- B ACTG123 Intermediate Accounting 1Document11 pagesB ACTG123 Intermediate Accounting 1Crizel Dario100% (1)

- 6584financial Accounting 2021Document3 pages6584financial Accounting 2021Najia SalmanNo ratings yet

- Basic Acctg - Course TitleDocument3 pagesBasic Acctg - Course TitleMerdzNo ratings yet

- Course Outline - ACTG 03ADocument6 pagesCourse Outline - ACTG 03AJASON RADAMNo ratings yet

- Instructional Plan Fundamentals of Accountancy, Business and Management 1Document2 pagesInstructional Plan Fundamentals of Accountancy, Business and Management 1SHENo ratings yet

- BSHM Accounting ObeDocument7 pagesBSHM Accounting ObeArzaga Dessa BCNo ratings yet

- Bachelor of Science in Accounting Information System: Bulacan Polytechnic CollegeDocument9 pagesBachelor of Science in Accounting Information System: Bulacan Polytechnic CollegeReena BoliverNo ratings yet

- Tomas Del Rosario College: City of BalangaDocument5 pagesTomas Del Rosario College: City of BalangaVanessa L. VinluanNo ratings yet

- Jose Rizal Memorial State University: College of Business AdministrationDocument4 pagesJose Rizal Memorial State University: College of Business AdministrationJermebie LabadlabadNo ratings yet

- Syllabus: I. Course InformationDocument5 pagesSyllabus: I. Course InformationLorisa CenizaNo ratings yet

- San Beda College Alabang: College of Arts and Sciences (Name of The) DepartmentDocument4 pagesSan Beda College Alabang: College of Arts and Sciences (Name of The) DepartmentKhristian Joshua G. JuradoNo ratings yet

- ACCTG 208 Rev 2022 Acctg Govt Not For Profit OrgDocument8 pagesACCTG 208 Rev 2022 Acctg Govt Not For Profit OrgRoschelle MiguelNo ratings yet

- Tomas Del Rosario College: City of Balanga Curricular Program: AccountancyDocument12 pagesTomas Del Rosario College: City of Balanga Curricular Program: AccountancyVanessa L. VinluanNo ratings yet

- Manaoag: Colegio de San Juan de LetranDocument10 pagesManaoag: Colegio de San Juan de LetranFlordeliza HalogNo ratings yet

- ProgramDocument54 pagesProgramManeet SinghNo ratings yet

- Tomas Del Rosario College: Syllabus in Management 11Document5 pagesTomas Del Rosario College: Syllabus in Management 11vaneknekNo ratings yet

- Financial Accounting OverviewDocument2 pagesFinancial Accounting OverviewTharineesh MNo ratings yet

- Course Outline - Bsa 101 - Fundamentals of Acctng 1 - RBMDocument7 pagesCourse Outline - Bsa 101 - Fundamentals of Acctng 1 - RBMRoselyn Mangaron SagcalNo ratings yet

- Course Plan - Business FinanceDocument7 pagesCourse Plan - Business FinanceYannah HidalgoNo ratings yet

- Intermediate Financial Accounting 2 FIX (2023)Document5 pagesIntermediate Financial Accounting 2 FIX (2023)dimazNo ratings yet

- M. Mendoza - Aud03-Syllabus (Sy 2021-2022)Document9 pagesM. Mendoza - Aud03-Syllabus (Sy 2021-2022)Mark Domingo MendozaNo ratings yet

- University of The Philippines Baguio: Institute of Management Bs Management EconomicsDocument7 pagesUniversity of The Philippines Baguio: Institute of Management Bs Management EconomicsConradoNo ratings yet

- PDF Conceptual Framework and Accounting Standard Syllabus DDDocument11 pagesPDF Conceptual Framework and Accounting Standard Syllabus DDMariya BhavesNo ratings yet

- ACTG309 Assurance Principles Prof Ethics Good Gov 2019 2020Document10 pagesACTG309 Assurance Principles Prof Ethics Good Gov 2019 2020Palos DoseNo ratings yet

- Syll - Basic FinanceDocument5 pagesSyll - Basic FinancevaneknekNo ratings yet

- Financial Accounting Theory and Reporting IDocument16 pagesFinancial Accounting Theory and Reporting IKendrick PajarinNo ratings yet

- Accountant (GS-510) Competency Model: (Note: This Competency Model Framework Allows For The Development of ADocument21 pagesAccountant (GS-510) Competency Model: (Note: This Competency Model Framework Allows For The Development of AArief KurniawanNo ratings yet

- Tomas Del Rosario College: City of BalangaDocument2 pagesTomas Del Rosario College: City of BalangavaneknekNo ratings yet

- Tax Law Review SyllabusDocument4 pagesTax Law Review SyllabusjustinebetteNo ratings yet

- Corporate AccountingDocument10 pagesCorporate AccountingSHREY SANGAL 1823164No ratings yet

- Law III Syllabus 2015-16Document15 pagesLaw III Syllabus 2015-16Reygie P. LopezNo ratings yet

- Fabm 1 SS 11 Q3 0402Document7 pagesFabm 1 SS 11 Q3 0402zedtalaveraNo ratings yet

- Types of Major AccountsDocument3 pagesTypes of Major AccountsSHIERY MAE FALCONITINNo ratings yet

- Acctg 1 Syllabus JmaoDocument7 pagesAcctg 1 Syllabus JmaoHanis MeeNo ratings yet

- Introduction of Financial ManagementDocument22 pagesIntroduction of Financial Managementhaarsh23No ratings yet

- Accounting For Managers-SyllabusDocument2 pagesAccounting For Managers-SyllabusBibek BasnetNo ratings yet

- Dr. Gloria D. Lacson Foundation Colleges, IncDocument5 pagesDr. Gloria D. Lacson Foundation Colleges, IncMa. Liza MagatNo ratings yet

- FAR 3 Intermediate Accounting I SyllabusDocument8 pagesFAR 3 Intermediate Accounting I SyllabusABMAYALADANO ,ErvinNo ratings yet

- Entrep Q2 Week7Document4 pagesEntrep Q2 Week7Naj CumlaNo ratings yet

- ASM SOC B. Com. (Hons.) Course Syllabus 2019-22Document99 pagesASM SOC B. Com. (Hons.) Course Syllabus 2019-22Rajdeep Kumar RautNo ratings yet

- Module 1 Overview of Government AccountingDocument3 pagesModule 1 Overview of Government Accountingleyn sanburgNo ratings yet

- Nptel: Managerial Accounting - Video CourseDocument3 pagesNptel: Managerial Accounting - Video CourseNajlaNo ratings yet

- Course Ouline Financial InstitutionsDocument5 pagesCourse Ouline Financial InstitutionsSherif ElSheemyNo ratings yet

- Rps Teori Akuntansi EnglishDocument11 pagesRps Teori Akuntansi EnglishRismayantiNo ratings yet

- Course DetailDocument3 pagesCourse DetailNajlaNo ratings yet

- FM StaffingDocument17 pagesFM StaffingvaneknekNo ratings yet

- Empowerment Malibiran MichaelDocument15 pagesEmpowerment Malibiran MichaelvaneknekNo ratings yet

- Managing Change: Prepared By: Mrs. Melba J. MendiolaDocument11 pagesManaging Change: Prepared By: Mrs. Melba J. MendiolavaneknekNo ratings yet

- The Need For Effective Manager DevelopmentDocument23 pagesThe Need For Effective Manager DevelopmentvaneknekNo ratings yet

- The Social System Executive BehaviorDocument10 pagesThe Social System Executive BehaviorvaneknekNo ratings yet

- The Need For Effective Manager DevelopmentDocument23 pagesThe Need For Effective Manager DevelopmentvaneknekNo ratings yet

- Conflict Resolution Mental Health Law and Stress ManagementDocument46 pagesConflict Resolution Mental Health Law and Stress ManagementvaneknekNo ratings yet

- Types of LeadershipDocument14 pagesTypes of LeadershipvaneknekNo ratings yet

- Concepts of Change: By: Jamaica ManaloDocument11 pagesConcepts of Change: By: Jamaica ManalovaneknekNo ratings yet

- Ways in Overcoming BarriersDocument10 pagesWays in Overcoming BarriersvaneknekNo ratings yet

- The Need For Effective Manager DevelopmentDocument23 pagesThe Need For Effective Manager DevelopmentvaneknekNo ratings yet

- Problems and Issues Confronting Educational InstitutionDocument34 pagesProblems and Issues Confronting Educational InstitutionvaneknekNo ratings yet

- Session Guide Approaches To Educational Planning Educ 204Document5 pagesSession Guide Approaches To Educational Planning Educ 204vaneknekNo ratings yet

- The Need For Effective Manager DevelopmentDocument11 pagesThe Need For Effective Manager DevelopmentvaneknekNo ratings yet

- Educ 200 Types of Classes of Interviews Christine Sismaet PDFDocument20 pagesEduc 200 Types of Classes of Interviews Christine Sismaet PDFvaneknekNo ratings yet

- Purposes and Types of GraphsDocument7 pagesPurposes and Types of GraphsvaneknekNo ratings yet

- Interpretation and Summary Ongmelody B. PDFDocument21 pagesInterpretation and Summary Ongmelody B. PDFvaneknekNo ratings yet

- ManagingEducConflicts Part1TRIGUERODocument8 pagesManagingEducConflicts Part1TRIGUEROvaneknekNo ratings yet

- The Need For Effective Manager DevelopmentDocument23 pagesThe Need For Effective Manager DevelopmentvaneknekNo ratings yet

- Empowerment Malibiran MichaelDocument15 pagesEmpowerment Malibiran MichaelvaneknekNo ratings yet

- Barriers To Effective Planning TRAJANO ABEGAIL T.Document7 pagesBarriers To Effective Planning TRAJANO ABEGAIL T.vaneknekNo ratings yet

- Types of Classes of Interview Steps and Pointers, What To AvoidDocument20 pagesTypes of Classes of Interview Steps and Pointers, What To AvoidvaneknekNo ratings yet

- Problems and Issues Confronting Educational InstitutionDocument34 pagesProblems and Issues Confronting Educational InstitutionvaneknekNo ratings yet

- Managing Change: Prepared By: Mrs. Melba J. MendiolaDocument11 pagesManaging Change: Prepared By: Mrs. Melba J. MendiolavaneknekNo ratings yet

- Barriers To Effective Planning TRAJANO ABEGAIL T.Document7 pagesBarriers To Effective Planning TRAJANO ABEGAIL T.vaneknekNo ratings yet

- FM StaffingDocument17 pagesFM StaffingvaneknekNo ratings yet

- Radission Hotel Annual Report 2077 78Document174 pagesRadission Hotel Annual Report 2077 78Deepak BishwasNo ratings yet

- Acca Cat MCQDocument50 pagesAcca Cat MCQferosNo ratings yet

- Trade PlanDocument6 pagesTrade PlanFazri Ashari RomadhonNo ratings yet

- Ifr PRC Banks in Loan Trading Plea Sept19Document3 pagesIfr PRC Banks in Loan Trading Plea Sept19tracy.jiang0908No ratings yet

- PARAGMILK StockReport 20230828 1022Document12 pagesPARAGMILK StockReport 20230828 1022Chetan ChouguleNo ratings yet

- Intermediate Accounting II - Chapter 10 Study GuideDocument13 pagesIntermediate Accounting II - Chapter 10 Study GuideCoco Tucker100% (4)

- NYU Foundations of Finance Homework1Document2 pagesNYU Foundations of Finance Homework13nvwangNo ratings yet

- Yohanes TampubolonDocument8 pagesYohanes TampubolonTOT BandungNo ratings yet

- Gray Company S Financial Statements Showed Income Before Income Taxes ofDocument1 pageGray Company S Financial Statements Showed Income Before Income Taxes ofFreelance WorkerNo ratings yet

- Program Overview BicDocument9 pagesProgram Overview BicPraveenaNo ratings yet

- Management Accounting Versus Financial Accounting.: Takele - Fufa@aau - Edu.et...... orDocument6 pagesManagement Accounting Versus Financial Accounting.: Takele - Fufa@aau - Edu.et...... orDeselagn TefariNo ratings yet

- Using Financial Accounting Information The Alternative To Debits and Credits 10th Edition Porter Solutions ManualDocument19 pagesUsing Financial Accounting Information The Alternative To Debits and Credits 10th Edition Porter Solutions Manualleonardedanah7lkhe100% (27)

- Chapter 6 - DepreciationDocument22 pagesChapter 6 - DepreciationUpendra ReddyNo ratings yet

- Chapter 2 Financial Intermediaries and Other ParticipantsDocument45 pagesChapter 2 Financial Intermediaries and Other ParticipantsWill De OcampoNo ratings yet

- Quiz 1 - ACPRE3 - 03.01.22Document4 pagesQuiz 1 - ACPRE3 - 03.01.22Cristal CristobalNo ratings yet

- MaytasdraftDocument386 pagesMaytasdraftSaket PachisiaNo ratings yet

- Fabm2 Q1mod2 Statement of Comprehensive Income Frances Beraquit Bgo v1Document26 pagesFabm2 Q1mod2 Statement of Comprehensive Income Frances Beraquit Bgo v1Monina Durana LegaspiNo ratings yet

- FAR.2639 - Accounting Changes and ErrorsDocument24 pagesFAR.2639 - Accounting Changes and Errorslijeh312No ratings yet

- Ceo Summit 2019 ProgramDocument4 pagesCeo Summit 2019 ProgramChris AnnNo ratings yet

- NPV MCQ'sDocument14 pagesNPV MCQ'sJames MartinNo ratings yet

- Unit 6Document42 pagesUnit 6yebegashetNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Risk-Coverage Risks: Chapter - 9 Insurance ClaimsDocument24 pagesRisk-Coverage Risks: Chapter - 9 Insurance Claimss2sNo ratings yet

- A Review of The Accounting CycleDocument44 pagesA Review of The Accounting CycleBelle PenneNo ratings yet

- Dec 2005 - Qns Mod BDocument12 pagesDec 2005 - Qns Mod BHubbak Khan100% (1)

- Mergers and Acquisitions REVDocument18 pagesMergers and Acquisitions REVhizelaryaNo ratings yet